Archive

Semicon to grow 12pc in 2008: Future Horizons

If there is going to be a global economic recession, the chip industry (but not all companies) is in the best shape possible to weather the ensuing storm!

According to Malcom Penn, CEO, Future Horizons, we are dealing with a semiconductor industry in ‘deep trauma.’ He was delivering the company’s forecast at the recently held International Electronics Forum (IEF) 2008 in Dubai, predicting a 12 percent growth this year despite signs of a wobbling US economy.

According to Malcom Penn, CEO, Future Horizons, we are dealing with a semiconductor industry in ‘deep trauma.’ He was delivering the company’s forecast at the recently held International Electronics Forum (IEF) 2008 in Dubai, predicting a 12 percent growth this year despite signs of a wobbling US economy.

Is there a need to get back to the industry basics? “Semiconductors are a peculiar business; the only sane strategy is to bet the company regularly,” once remarked Dr Gordon Moore.

Penn noted that the current industry status is somewhat confused and uncertain. Short-term issues are dominating the agenda.

Longer-term structural trends are unclear. The traditional IDMs are currently going through a mid-life ‘new business model’ identity crisis, and the start-ups are struggling to even reach critical mass! And all of this has been happening amidst intense economic uncertainty

“Now is the time for strong nerves and determination,” Penn said. According to him, the underlying industry fundamentals are sound and there is no end in sight to the ‘make-lunch-or-be-lunch’ ethos.

The emerging economies like India and China have so far been less affected by the financial market’s turbulence. In fact, the emerging and developing economies were shifting the global growth dynamics.

Chip industry in best possible shape

A forecast health warning is: IF the global economy collapses, it will take the chip market with it. However, Future Horizons feels that if there is going to be a global economic recession, the chip industry (but not all companies) is in the best shape possible to weather the ensuing storm.

The ASPs are an enigma wrapped up in riddle. The course of ASPs (like love) never runs smooth. Wobbles happen! ASPs are also the perennial (and least understood) industry wild card. ASPs are generally driven by new IC designs, and that takes time (sometimes three to four years). Post-2001, value recovery lost one generation (130nm impact). The ASP recovery ‘wobbled’ in 2007 (memory and MPU price wars). Barring a recession, Future Horizons forecasts that ASPs will recover in 2008 (it has already started).

12 percent growth likely

Future Horizons’ 2008 forecast summary and assumptions (as of May 2008) are — ‘12 percent’ growth — ’10 percent’ units / ‘2 percent’ ASP. There may be no global economic recession, although US/UK/Eurozone might wobble — which they are! No significant inventory correction will probably take place, but there are always Q4>Q1 adjustments, and there’s nothing special about that either.

There could be lower fab capacity expansion due to 2007/2008 capex slowdown, which is inevitable and irreversible. There is also a possibility of a more stable memory price erosion — which means, back to the learning vs. bleeding curve, and prices have since hardened. If the global economy holds, the 2H-08 growth will likely be strong. This, if the capacity, ASP and units are all pulling together, which is said to be happening.

Therefore, Penn feels it is too early to call for a (major) downward revision. Q1 08 was a lot stronger than conventional wisdom feared.

“That’s the rational analysis, but semiconductors aren’t rational. It could just as easily be another single digit growth year,” Penn added.

Danger signs to watch out for

So, what are the danger signs one should watch out for? These would be capacity — it is hard to see how this can spoil 2008, provided unit growth holds up, but there is a need to watch capex. Another factor is demand — the current IC unit demand is sustainable provided the economy holds up, so there is a need to watch the inventory.

Next comes the economy! The current outlook continues to be uncertain with risks all on the downside. ASPs are the key to recovery, but always the first line of defence. ASPs could still derail 2008, but the trends are encouraging.

What’s driving the market?

In semiconductor 7.0 — or the 7th decade of the transistor revolution, the same things, as always, are driving the market. These are: technology, legislation — energy saving/conservation and structural — the relentless analog to digital conversion. All of these are combining to do what the chip industry does best — enabling something that was previously impossible. Penn contends, “This industry has nowhere near run out of steam!”

New applications continue to drive the market, with automotive, industrial and medical, mobile phones, and PCs and servers, dominating. The PC market is dominating, but going nowhere fast. Mobile phones have become more interesting, but have conflicting priorities. The challenges are: how to protect the existing cost structure and subscriber base and how to add useful and affordable value-add services! Evidently, “chipset suppliers love the high end, market loves the low end.”

There is definitely an increasing automotive semiconductor content. A solid annual growth has been prediced (CAGR 2006-11) for vehicles — 5.5 percent, systems — 11.5 percent, and semiconductors — 13.3 percent. Some other new areas are motor control and energy, as well as lighting and photovoltaic, besides medical electronics. Robotics is yet another interesting area.

Key industry issues

It is clear that more chips per wafer equals less cost per chip and more transistors per die equals more functionality. Several billion transistors gives phenomenal design flexibility as well. Considering total ICs and MOS ICs, in the MOS capacity build out by technology node, there has been no change in volume ramp profile despite the hype.

As for the evolution of the technology node, definitely, 45nm is a revolutionary step from 65nm. In all likelihood, 32nm will be a natural evolutionary. However, Penn cautioned that 22nm would be another ‘difficult’ transition!

There is no doubt that 65nm will be tomorrow’s leading-edge workhorse, having the same basic Si gate/SiO2/MOSFET structure. Nevertheless, 45nm will herald a totally different structure — metal gate/high-k/thin FET/deep trench design, etc. Also, 45nm will herald a new way of system design.

Is fabless right?

Is Fablite a valid option? While there is nothing wrong with being fabless, people are just not sure whether the best starting point is being an IDM. Teamwork has to be perfectly orchestrated as competition is tough.

As for the market share dynamics, the top 10 companies (IDMs) have been losing share. Fabless share has been growing, but it is still relatively small.

Coming to the realities of the foundry market, TSMC’s lead is now unassailable. Were it an IDM, it would be No. 2, challenging Intel and passing Samsung. Moving more into design looks inevitable.

Finally, execution, and not technology, is everything! Execution has and will continue to make the difference. Applications (software) will play the role of the key differentiator as well, and it has value. Design is the means to an end, and not the end.

From the chip industry’s perspective, the electronics market was traditionally Japan, North America and Western Europe. It now encompasses the entire Asian rim, China, Eastern Europe and India. Far from maturing, the chip industry itself is still in its volatile, high-growth phase, with at least a further 20 years of strong growth in prospect. Penn said, “The underlying growth drivers for chips has never been better.”

Back to basics

We started with the need to get

back to industry basics. We end in the same way! Stick to basics like:

* Don’t invest in low cost areas just because they are cheap — they have a habit of becoming high cost tomorrow, plus the hidden extras.

* Don’t make outsourcing decisions just because they are easy — especially if there’s no way back.

* Don’t make strategic cut-backs just to trim the bottom line — some decisions, e.g., R&D, take a long time to impact, then it’s too late.

* Stop looking for high volume/high value market niches — they don’t exist, need to learn how to compete

* Do show strong leadership

* Do have a long-term plan and stick with it — even if it negatively impacts ‘the next quarter’ balance sheet

* Do show a commitment and determination to succeed

* Do stay focused and resistant to external meddling

* Do execute ruthlessly — this is the key competitive differentiator)

* Do … just do it with passion — it’s the passion that makes the difference

NAND Q108 sales falls 15.8 percent

There’s a nice report today by DRAMeXchange on the state of the NAND Flash market. It is reproduced here.

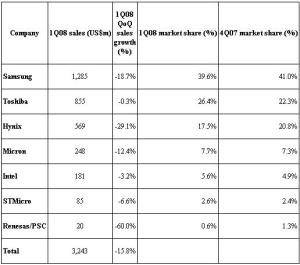

Impacted by effect of the US sub-prime mortgage loan and a slow season, oversupply of NAND Flash worsened in 1Q08. NAND Flash ASP fell about 35 percent compared to 4Q07. Although the overall bit shipment grew about 30 percent compared to 4Q07, the total 1Q08 sales of branded NAND Flash makers fell 15.8 percent QoQ to US$3.24bn.

Ranked by the overall 1Q08 sales, Samsung continues to lead. The top five NAND Flash branded makers shared 96.8 percent of the whole market share in 1Q08.

Ranked by the overall 1Q08 sales, Samsung continues to lead. The top five NAND Flash branded makers shared 96.8 percent of the whole market share in 1Q08.

Although the NAND Flash market share by sales for Samsung in 1Q08 fell to roughly 39.6 percent compared to 4Q07, Samsung continues to be the leader in branded market.

Despite the increase proportion of 51nm node production, affected by the deep decline in NAND Flash price, 1Q08 sales fell 18.7 percent QoQ to US$1.28bn.

NAND Flash market share by sales for Toshiba rose to 26.4 percent compared to 4Q07 and continued to be in the second place among the branded NAND Flash makers.

Due to Toshiba’s successful increase in 56nm node production, it was able to resist the effect of the NAND Flash price decline. However, 1Q08 sales were flat compared to 4Q07 at US$855m.

The 1Q08 market share by sales for Hynix fell to 17.5 percent, though it continued to stay at the number three spot among branded NAND Flash makers. As Hynix lowered its NAND Flash production, 1Q08 bit shipment increased only 9 percent QoQ. However, due to the fall of NAND Flash ASP at 39 percent QoQ, 1Q08 sales for Hynix fell to US$569m, or a decline of 29.1 percent QoQ.

With the ramp up of 50nm node, Micron and Intel continued to see steady growth in a bit shipment in 1Q08. However, impacted by the large decline in NAND Flash price, their 1Q08 sales fell compared to 4Q07. Micron and Intel 1Q08 sales were US$248m and US$181m, respectively, with a market share of 7.7 percent and 5.6 percent, each.

As STMicroelectronics primarily produces NAND Flash for cell phone applications, revenue for 1Q08 was not as severely impacted by the price decline. Revenue for STMicro in 1Q08 fell slightly to US$85m, or a slight decline of 6.6 percent compared to 4Q07. The 1Q08 market share by sales was 2.6 percent.

Since Renesas continued to reduce its AG-AND Flash production in 1Q08, Renesas/PSC camp sales fell roughly 60 percent compared to 4Q07 with a market share of 0.6 percent.