Archive

Round-up 2010: Best of electronics, telecom and technology

Year 2010 has been a good year for the global electronics industry, rather, the technology industry, coming right after a couple of years of recession. Well, it is time to look back on 2010 and see the good, bad and ugly sides, if any, of electronics, telecom and technology.

Presenting my list of top posts for 2010 from these three segments.

ELECTRONICS

Electronics for energy efficient powertrain

Photonics rocks in India @ APW 2010, Cochin!

Plastic Logic’s QUE proReader looks to mean business!

Growing Indian power electronics market provides host of opportunities

Philips focuses on how interoperability, content sharing drive CE devices!

Is this a war of tablets, or Apple OS vs. Google Android?

India needs to become major hardware player!

Roundup of day 2 @ Electronica India 2010

Strategic roadmap for electronics enabling energy efficient usage: Venkat Rajaraman, Su-Kam

NI stresses on innovation, launches LabVIEW 2010!

What’s Farnell (element14) up to? And, semicon equipment bubble burst? Whoa!!

Bluetooth set as short range wireless standard for smart energy!

View 3D TV, without glasses, today!

Indian medical electronics equipment industry to grow at 17 percent CAGR over next five years: ISA

Top 10 electronics industry trends for 2011

TELECOMMUNICATIONS

LTE will see larger deployments, higher volumes than WiMAX!

LTE should benefit from WiMAX beachhead!

Context-aware traffic mediation software could help telcos manage data tsunami: Openwave

Mobile WiMAX deployment and migration/upgrade strategies

Upgrade to WiMAX 2 uncertain as TD-LTE gains in momentum!

Tejas celebrates 10 years with new products for 3G/BWA backhaul

Focus on gyroscopes for mobile phone apps: Yole

Bluetooth low energy should contribute to WSN via remote monitoring

INSIDE Contactless unveils SecuRead NFC solution for mobile handset market

How are femtocells enhancing CDMA networks?

Top 10 telecom industry trends for 2011

TECHNOLOGY

Symantec’s Internet threat security report on India has few surprises!

Epic — first ever web browser for India, from India!

Norton cybercrime report: Time to take back your Internet from cybercriminals!

NComputing bets big on desktop virtualization

Brocade launches VDX switches for virtualized, cloud-optimized data centers

It isn’t an easy job tracking so many different segments! 🙂 I will try and do better than this next year!

Best wishes for a very, very happy and prosperous 2011! 🙂

More 'fabless IC billionaires' in 2010, says IC Insights! Is India listening?

Brilliant! There’s no other word to describe the first part of this headline!

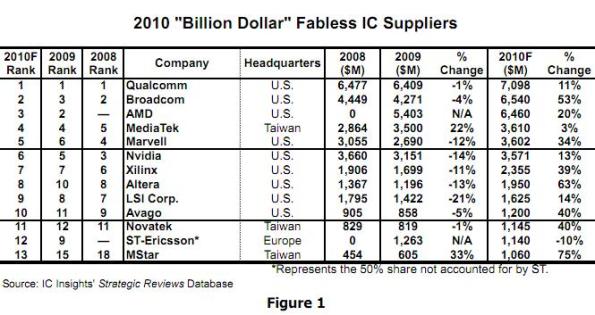

As per IC Insights’ forecast of 2010 billion-dollar fabless IC suppliers, excerpted from a ranking of top 50 fabless IC suppliers in its ‘ 2011 edition of The McClean Report’, as many as 13 fabless IC suppliers are tipped to cross the $1-billion mark in sales in 2010! As per IC Insights, this is a significant step up — from 10 companies in 2009 and eight in 2008.

Just sit back and admire this table. There are nine firms from the US — Qualcomm, Broadcom, AMD, Marvell, Nvidia, Xilinx, Altera, LSI and Avago, three from Taiwan — MediaTek, Novatek and MStar, while ST-Ericsson is Europe’s lone representation in this stellar list.

In this august club of IC billionaires, no surprises, but Qualcomm retains the top place for the third consecutive year. Broadcom moves up a place. AMD should become the world’s third largest player.

Broadcom at 53 percent, Marvell at 34 percent, Xilinx at 39 percent, Altera at 63 percent, Avago and Novatek at 40 percent each are top performers. However, MStar of Taiwan steals the show with an estimated 75 percent growth in 2010.

Qualcomm, Nvidia and LSI have performed well, especially the last two – coming pff a difficult 2009. Taiwan’s MediaTek has seen the biggest slip — down to 3 percent in 2010 from 22 percent in 2009.

There is no representation from Japan in the fabless IC billionaires club. IC Insights has indicated that the fabless/foundry hasn’t caught on in Japan and is unlikely to do so in the near future. However, Taiwan and China based firms should sooner or later find their way into this club.

I will now come to India! Read more…

What's Farnell (element14) up to? And, semicon equipment bubble burst? Whoa!!

I’ve received two interesting reports today. One, from Premier Farnell on a name change and another from The Information Network on the troubles of the semicon equipment industry.

First, Premier Farnell plc announced the launch of a new, market leading customer proposition in Asia offering a significantly expanded inventory of products relevant to electronic design engineers, next-day delivery in Asia Pacific and an enhanced range of services, under the name element14.

I have not quite understood this move!

I wonder how is this going to help Farnell! It has had element14 for so long now. Hey, I even provided Farnell feedback on the element14 website back in July 2009 (in Bangalore), and even discussed with its executives in Singapore when they sought further queries on the feedbacks provided by me.

What’s Farnell (or element14) really up to?

At least, I don’t see any newness in Farnell’s element14 release. Unless, there’s a move to dilute the Farnell brand itself, which is and will be really strange!

I for one felt element14 was (and is) doing magnificiently as a standalone entity, and has done a great job in building a community of design engineers around itself.

The release also says that the Group’s businesses located in Australia, China, India, Malaysia, Singapore and New Zealand will be known as element14 and will offer customers and suppliers a multi-channel, multi-currency, multi-language way to source their product needs, quickly and easily.

So, I checked Farnell’s India site. Now, the India website of Farnell is confusing me. There’s a message on the site that says ‘Farnell Electronics (India) Pvt Ltd name change in progress’.

Where is the need to call Farnell by its original name in the UK, and why rename it elsewhere, especially in Asia? Is it that the brand name is not well known across Asia? What’s wrong in the first place with having two separate standalone and successful identities such as Farnell and element14?

It would be prudent on Farnell’s part to maintain element14 as the community it has been originally meant to be. For instance, why call Farnell India as element14 India all of a sudden?

I hope to hear from my friend, Ravi Pagar at Farnell soon, hopefully, in the morning. Have sent him the query. Name change or not, best wishes to element14/Farnell in its future endeavors.

Semicon equipment industry bubble burst?

Now to the second one! I also received an interesting report from The Information Network — where it says that the global semiconductor equipment industry bubble has burst!

It has also made interesting use of an analogy around “The Emperor’s New Clothes,” a short tale by Hans Christian Andersen and the global semiconductor industry.

The report has set me off thinking. Just how can the global semiconductor industry afford to not overlook repeated warnings? This is peculiar! What could be the repercussions of a deteriorating semiconductor industry? The Information Network also mentioned industry pushouts. How will these benefit the industry in the long run?

I hope to speak with Dr. Castellano regarding the study and get some replies on my queries.

What’s very interesting is a prediction made at the end of this report. The Information Network says that firms such as AMAT, AMD, APD, ASML, AVZA, CAJ, FJTSY.PK, HPQ, INTC, MU, NVLS, OMG, TOELF.PK, TOSBF.PK and other IC, equipment, and material suppliers have or will be announcing their results soon. “Nearly all will point to a slowing in the next quarter in their releases and conference calls. It will get worst in the following quarter!”

Wow! That will be significant! Hey folks, I’m going to watch all of these firms very closely as they annouce their quarterly results. Suggest, you do the same.

Roundup of day 2 @ Electronica India 2010

Aqtronics is targeting nine segments — wireless, automotive, embedded, LED lighting, telecom, industrial, power, identification and IT enterprise. It has signed up Atheros, which has five SBO segments — Wi-Fi, Ethernet, powerline communications, GPS and PON. Aqtronics has used LEDs to light up its entire booth at the show.

Commenting on the industry trend, Ranga Prasad said there were visible signs of good pick up and growth for the last two quarters in India. Concerns remain on the lead times of inventory. Hopefully, this problem should get over by Q4 in India and Q1 2011 in the US.

My next stop was at Khanna Traders & Engineers, which has entered into a tie up with Japan’s Nihon for lead free solder. S.K. Khanna, managing director, said it is a patented product in 23 countries. It has already captured 60 percent market share in Europe and the United States, and has been previously running in over 40 countries across over 4,000 machines. This is said to be the only lead free solder with no silver coating.

It was a pleasure meeting Ms Kumud Tyagi, vice president, Bergen Associates. Quite rare to see a lady in a leadership position in an electronics outfit in India!

Bergen Associates has entered into a new partnership with Assemblon for pick and place machines. The company now has the complete SMT line of solutions for customers.

Bergen Associates is offering adhesives from Panacol — meant for most industries, such as semiconductors, electronics and automotive. It is also showcasing the laser direct structuring (LDI) technology on special 3D parts from LPKF Laser & Electronics AG, Germany, as well.

TransTechnology Pte Ltd is pretty buoyant on India — quite evident from the line-up of products on display. Christopher J. Fussner, president, said the company is offering the YS-24 from Yamaha. TransTechnology is also displaying the X3 Ekra screen printer — an entry level inline model. Another one is the Asymtek SL-940/941 conformal coating machines. The 940 is an inline machine while the 941 is a batch type machine.

Maxim SMT is showcasing the SPI-350 solder paste inspection system from CyberOptics, USA. This is said to be one of the fastest and most accurate machines around. It is also displaying the QX500 AOI machine, also from CyberOptics.

Some other highlights from day 2 at Electronica India 2010 include:

* Leaptech is displaying the Omron AOI machine with color highlighting technology as well as an axial component insertion machine from Sciencgo, China. It is also showcasing the M6ex mounting center from i-Pulse of Japan, a Yamaha group company.

* Schott Glass India Pvt Ltd is displaying electronic housings or packages for electronic components. Schott specializes in glass-to-metal seals, and also develops ceramic-to-metal seals. It is offering housings for quartz as well. Schott’s hybrid/microelectronic packages can be used for space, defence and telecom applications.

You can read all of these and more at tomorrow’s Electronica India 2010 and Productronica India 2010 Show Floor Daily, published by Debasish Choudhury for Global SMT & Packaging magazine, and compiled by yours truly.

A nice chat with Ashok Chandak of NXP Semiconductors on the status of electronics manufacturing in India was a great way to round off my day! I shall be writing about this interaction later.

That’s it from me from this year’s show floor. Hope to be back next year, God willing! Cheers!!

P.S.: You can download all the three show dailies from the show here. BTW, my name went missing from the show daily on Day 2. In fact, the lead story of day 2, featuring Ananth Kumar, has been written by me, as were all of the compiled news. It is an honest error on part of Global SMT & Packaging! 🙂 Enjoy reading!

India needs to become major hardware player!

“Bangalore should become the hardware capital of India,” according to Ananth Kumar, MP and former Union minister of Urban Development. Bangalore should not only be known as the software capital and silicon valley of India. “That should be the main aim of Electronica India 2010 expo.”

“India also needs hardware parks, besides software parks,” he added. India needs hardware parks that should be more like multiplexes. He mentioned that taxation regime in Karnataka was also blocking development of electronics hardware. Hardware should also enjoy the taxation benefits that hardware enjoys, he stressed. “We should be the major exporters of hardware.”

There are several highlights from day one of Electronica India 2010. I hope you get a chance to pick up the show daily being produced by yours truly on behalf of the Global SMT & Packaging magazine, thanks to my good friend and ex-colleague Debashish Chowdhury.

Some of the highlights are:

I also met a supplier who has an e-bike. Need to catch up with him sometime soon!

It was also great to catch up with Bhupinder Singh and Sunali Agarwaal of MMI India, Anil Kumar of IPCA, as well as Ranga Prasad of Aqtronics, and several other folks, who, up until now, were merely friends over email or telephone.

More later, time permitting!

Solar PV likely showstopper at electronica India 2010 and productronica India 2010

For those interested, since its debut in 2009, this show has been split into two sections – productronica India — devoted to production technologies, SMT and EMS/contract manufacturers, PCB, solar and PV, laser, etc., and electronica India – focused on components, semiconductors, assemblies, LEDs and materials.This year, there are going to be three added attractions or special exhibit areas, namely:

* Solar pavilion.

* LED pavilion.

* Laser pavilion.

Solar PV main attraction

A report on the ‘Solar PV Industry 2010: Contemporary Scenario and Emerging Trends’ released by the India Semiconductor Association (ISA) with the support of the Office of the Principal Scientific Advisor (PSA), lays out the strengths and challenges of the Indian solar PV market:

* Even though the industry operates at a smaller scale as compared to other solar PV producing nations, production in India is very cost effective as compared to global standards.

* With Government initiatives such as the SIPS scheme and JN-NSM in place to promote application of solar PV in domestic market, the Indian solar PV industry is likely to gain further edge over other solar PV producing nations.

* There is no manufacturing base in India for the basic raw material, that is, silicon wafers.

* Over the last five years, China has emerged as the largest producer of solar cells in the world. The country currently has about 2,500 MW of production capacity for solar PV as compared to India’s 400 MW. Taiwan, with annual capacity of 800 MW, is also emerging as a major threat to the Indian industry.

* Price reduction is another major challenge for the industry as this would have greatly impact the future growth of the market.

The recently concluded Solarcon India 2010 threw up several interesting points as well. Industry observers agreed that the timely implementation of phase 1 of the historic Jawaharlal Nehru National Solar Mission (JN-NSM) is going to be critical for the success of this Mission.

The MNRE stressed on the need to develop an indigenous solar PV manufacturing capacity in solar, and build a service infrastructure. Strong emphasis is also being placed on R&D, and quite rightly. Notably, the Indian government is working toward tackling issues involved with project financing as well.

All the right steps and noises are currently being taken and made in the Indian solar PV industry. If these weren’t enough, the TÜV Rheinland recently opened South Asia’s largest PV testing lab in Bangalore!

This year, an exhibitor forum on PV and solar will also take place at the Solar PV pavilion during electronica India 2010 and productronica India 2010.

Read more…

Has India done enough in the past to boost electronics hardware manufacturing?

I had mixed feelings on reading a press release on the recommendations from the Task Force set up by the Ministry of Communications & IT, Government of India in August 2009 to suggest measures to stimulate the growth of IT, ITeS and electronics hardware manufacturing in the country. However, I was quite surprised to see a news suggesting an amendment of the Indian semiconductor policy!

First, the Task Force’s recommendations. I’ll only focus on the electronics manufacturing bit! For electronics system design and manufacturing — it suggests the following:

* Establishing a ‘National Electronics Mission’ -– a nodal agency for the electronics Industry within DIT and with direct interface to the Prime Minister’s Office (PMO). The nodal agency would help in the synchronized functioning of the Industry through effective coordination across Ministries and Government Departments in the Centre and the States and would enhance the ease of doing business.

* Nurturing established electronics manufacturing clusters and develop them into centres of excellence, while encouraging new ones.

Isn’t this old wine in new bottles? Also, have we really done enough in the past to even boost electronics hardware manufacturing in the country? If yes, then where are the mini Hsinchus and Shenzhens within India? Even N. Vittal had said something similar (such as developing mini Hong Kongs and Singapores) some years ago!

India already has an Electronics Hardware Technology Park (EHTP) scheme. The business of establishing key electronics manufacturing clusters and developing them into centres of excellence — while encouraging new ones — should have been taken care of much, much earlier! By much. much earlier — at least 10-15 years ago!

By the time the Task Force’s recommendations are acted upon, a year or two more would have easily passed! That stretches the manufacturing gap even further!

Let me ask one question: how well is India known globally for its local telecom manufacturing companies, or, even hardware manufacturing companies? Why am I asking this question? Well, when the National Telecom Policy was announced back in 1994. Many would recall there were a lot of astronomical bids — especially the ones from Himachal Futuristic. What many overlook is the fact that the period actually presented a brilliant opportunity before India to become a leader in telecom and electronics hardware manufacturing! However, that hasn’t and never quite happened!

The Indian electronic components story is more or less the same! India’s electronic components and accessories ecosystem industry is currently moderate. It used to be 15 percent and has now grown to 35 percent. This should be grown even further! Are we backing the electronic components segment enough?

What sort of guidance or hand holding will be provided to those firms who look to develop India-based product companies? For that matter, how many great software products have been conceptualized, designed and developed in India that are worth mentioning?

Further, an interesting fact brought up time and again within the Indian industry is the requirement of a robust entrepreneurial spirit, and the need for much more sources of funding for semiconductor product companies. Who all are helping the Indian semicon startups?

And then, there’s this news that suggests amending the existing Indian semiconductor policy! It is sheer bad luck that silicon IC fabs haven’t happened in India, as yet! Although HSMC and SemIndia started off with good intentions, things got sidetracked due to various reasons. Now, solar PV has attracted several players. It was also part of the semicon policy, isn’t it? So, where is the question of amending the policy?

Yes, there is definitely a need to develop strong entrepreneurial spirit within the country and encourage local product development, rather than remain contented with a services-oriented mindset and industry.

Last July, during the ISA Excite, there was an announcement that Karnataka would have its semicon policy soon. It hasn’t happened yet, but I hope it will!

Nevertheless, here’s what I wrote last year on what India brings to the semicon world (and Japan), as I attempted to answer this question from a friend:

What are India’s strengths?

The clear strengths of the Indian semiconductor industry are embedded and design services! We are NOT YET into product development, but one sincerely hopes that it gathers pace.

The market drivers in India are mobile phone services, IT services/BPO, automobiles and IT hardware. India is also very strong in design tools, system architecture and VLSI design, has quite strong IP protection laws, and is reasonably strong in concept/innovation in semiconductors.

Testing and packaging are in a nascent stage. India will certainly have more of ATMP facilities. Nearly every single semicon giant has an India presence! That should indicate the amount of interest the outside world has on India. In fact, I am told, some key decisions are now made out of the Bangalore based outfits!

I had also suggested a 10-point program for the Karnataka semicon policy — in another blog post — on June 29, 2008. The points were:

1. A long-term semiconductor policy running 20-25 years or so.

2. Core team of top Indian leaders from Indian firms and MNCs, as well as technology institutes in Karnataka to oversee policy implementation.

3. Incentives such as government support, including stake in investments, and tax holidays.

4. Strong infrastructure availability and management.

5. Focus on having solar/PV fabs in the state.

6. Consider having 150/180/200mm fabs that tackle local problems via indigenous applications.

7. Develop companies in the assembly testing, verification and packaging (ATMP) space.

8. Attract companies in fields such as RFID, to address local problems and develop local applications.

9. Pursue companies in PDP, OLED/LED space to set up manufacturing units.

10. Promote and set up more fabless units.

There should be some steps to create specific zones for setting up such units — for fabs, fabless, ATMP, manufacturing, etc., all spread equally across the state.

Well, can’t all of this be extended across the country, rather than Karnataka alone? It sure can! What wasn’t done earlier, should be done now. Better late than never!

There’s also a lack of funding for certain semicon and hardware manufacturing areas/projects. This is another aspect that needs to be looked into.

As I’ve mentioned time and again to some friends within the Indian semiconductor industry and solar /PV industry — the semicon policy (earlier), and the National Solar Mission (now), are meant to help you guys! It is up to you — the industry folks — to make things happen! If you don’t, who will?

I am sure that the Task Force’s recommendations are very well thought out and quite robust. I don’t have the luxury of reading a copy, barring the release, and so there’s nothing for me to add. Best wishes to the Indian electronics hardware manufacturing industry and may it succeed greatly in future.

AqTronics-Mouser eye growth opportunities for components distribution in India!

Bangalore based AqTronics Technologies Pvt Ltd is an innovator in the distribution and marketing of semiconductors, passives, interconnects, electro-mechanical, IT and enterprise products. It is a focused demand creation distributor for India markets.

According to Ranga Prasad, business development manager, AqTronics, the company desires to be a part of the technology supply chain for customers in India.

According to Ranga Prasad, business development manager, AqTronics, the company desires to be a part of the technology supply chain for customers in India.

He said: “We would like to bring the latest technologies to India and provide an exemplary standard of quality service through superior product marketing, outstanding technical solution support, in-depth inventory, professional selling procedures and the most reliable operational systems in distribution.”

AqTronics to distribute Mouser’s components in India

AqTronics recently entered into an agreement with Mouser Electronics Inc., a leading global distributor of electronic components.

Under the agreement, AqTronics will distribute Mouser’s electronics components in India. All of Mouser’s components are available through AqTronics through INR (Indian Rupees) and USD (US dollars) with Modvat refund.

Mouser Electronics is one of the fastest growing global catalog and web based distributors in the electronics industry. The company is focused on the rapid introduction of newest products, leading edge technologies, and world class customer service.

It is specially focused on design engineers and buyers demanding small to medium quantities of the latest products. Hence, Mouser provides customer-focused distribution.

Mouser is also an authorized distributor for over 390 industry leading manufacturers. With a new catalog every six months, it ensures that the newest products are added and the end-of-life products removed from the print catalog. Mouser’s website features over a million products for easy purchase in USD, INR and with Modvat refund through AqTronics.

USP of AqTronics-Mouser relationship

Ranga Prasad says: “AqTronics’ focus is demand creation distribution. This calls for supporting customers on the complete product development life cycle (PDLC).”

Mouser Electronics will help AqTronics will support customers for — functional engineering, embedded development tool selection, bread board to engineering BOM, prototyping with small quantities, and NPI or pilot production – broken pack (Non MoQ, non MoV).

Components distribution and India advantage

Estimating the global components distribution market, according to Mouser, the semiconductor markets globally are estimated to be $1.2 trillion.

The Indian market share in percentage terms is said to be lesser than 2 percent of the world TAM (total available market). According to the companies, this calls for tremendous growth opportunities for components distribution in the Indian market.

Naturally, the India advantage comes into play!

India, with the second largest population in the world, and a huge talent pool of engineers, is a promising market. Especially, in the R&D activities, there are a lot of technology companies in major cities such as Bangalore, Chennai, etc.

Mouser will focus and continue to put an effort into developing this market. Mouser is very excited about the growth in the Indian market and the opportunity to bring its world class product line card to the region.

AqTronics’ strategies to tap Indian market with Mouser

AqTronics and Mouser have aggressive plans for the Indian market.

According to Ranga Prasad: “Mouser will re-inforce resources in India by increasing its presence through partners, e-marketing through the Internet, e-magazines and appropriate search engines. Mouser’s focus is on bringing the ‘newest parts for the newest designs’, and ensuring that the engineering community is best served with all of the latest parts.

“To support this, AqTronics, and also Mouser, will update their website daily with new parts and components from over 390 major manufacturers. There will also also be a fully updated catalog in India every six months.”

Warehouse in pipeline

Entering India in the electronic components space also calls for having a dedicated warehouse at some point of time. Since customer support is one of Mouser’s strength, the company is serious in its approach toward India, and will provide its best services for after sales support.

Putting appropriate resource to support customers is Mouser’s belief. Therefore, it will not neglect the needs of adding a warehouse wherever and whenever required. It also partners with FEDEX for international operations and has a three-day shipping from Texas, USA, to its customer base in the region.

Companies represented by AqTronics

AqTronics represents the following companies:

Mouser Electronics: Catalogue sales distribution.

Digi International: Leaders in device networking and M2M.

SST: Serial/parallel Flash, NAN drive (solid-state drive), 8051 microcontrollers.

ISSI: Synchronous SRAM, DDR-II, asynchronous SRAM, DRAM, automotive and industrial versions.

Fujistu: Thermal printers, interface boards, touch panels, Bluetooth modules.

Upek: Capacitive type -– large area, swipe sensors, controllers, RSA tokens.

Ember: Zigbee chipsets.

ORing: Ethernet switches.

Sarantel: GPS Geo Helix antennae.

iWatt: AC/DC ICs, DC/DC ICs, Advance power solutions

Tysso: Magnetic swipe readers, keyboards, bar code readers/scanners, POS systems.

Everlight: LED lighting solutions.

MPS: Monolithic power systems — regulators, low drop regulators, battery, chargers/protection, transformer based power supplies.

Narda Batteries: Batteries for telecom, UPS, power, solar energy, emergency lighting and power systems, mobile communications, radio, railways.

Taking on competition

India is also home to leading electronic components and distributors, such as Farnell. Contending with such stiff competition is key on the agenda.

Ranga Prasad adds: “In addition to the strategies mentioned earlier, we would like to re-inforce and strengthen our relationships with the universities’ research teams, and ensure that the engineers are aware of Mouser’s services and support when they are still in the universities.

“Mouser’s focus is driven by ensuring that the latest components are always available. Its stock profile is focused on electronic components, and not on other peripheral ranges.”

Farnell banking big on India

Farnell Electronics, a part of the Premier Farnell group of companies, recently established its sales presence in Pune, as part of its phased rollout plan, post the launch of the company in June 2008.

Headquartered in Bangalore, the company has already established seven other branch offices in cities, including Bangalore, Coimbatore, Ahmedabad, Chennai, Hyderabad, New Delhi and Mumbai, and, plans to set up another branch in Kolkata.

Headquartered in Bangalore, the company has already established seven other branch offices in cities, including Bangalore, Coimbatore, Ahmedabad, Chennai, Hyderabad, New Delhi and Mumbai, and, plans to set up another branch in Kolkata.

Harriet Green, CEO, said, “We have put up a new India Web site, which has over 450,000 products. Our site also supports live chat. We also have eight call centers. Our support is largely for the SMEs. We are a publicly filed company in India.” The company has over 2 million customers worldwide.

On Farnell, she further added: “We have a great supply chain ecosystem for our customers. This is total care for customers. As an example, we stock all of TI’s 40,000+ products. We take a Web order every 8 seconds. We are extending this investment in India.”

Ravi Pagar, Director, Farnell Electronics, added that users are able to search on the Indian Web site for components and products by part numbers.

The company has two technology centers, one in China and another in Bangalore, India. According to Green, Farnell’s goal is to achieve $1 billion for the Indian market.

She added: “We have already invested Rs. 200 million in the purchase of Hynetics, besides hiring people and on infrastructure. We will spend another Rs 200 million on branches, warehousing, etc.”

Complying with RoHS, REACH and WEEE

With so much of focus nowadays on green electronics, it is natural for Farnell to be one of the leading proponents. Green said, “Our components are REACH, RoHS and WEEE compliant.”

She added: “Unfortunately, the lead content in Bangalore is quite high. We will also work with the environmental agencies here and work on resolving this problem.”

Farnell is said to be the only components distributor in China, which is stocking products that are RoHS compliant. “We give a guarantee on our invoice that our products are RoHS, REACH and WEE compliant. In China, each province has zones where electronics products are dumped,” she said.

According to her, all major components manufacturers were now becoming environment compliant. “The supply chain is more now in balance as the electronics environment is maturing.”

Speaking on partnerships, she noted: “We are exclusive partners with Altera in Asia. We also have a special partnership with TI. We have over 4,500 authorized partnerships globally, with companies in semiconductors, passives, electromechanical, connectors, wires, screens, ICs, repairs, power, displays, flexible substrates, optos, etc.”

Pagar added: “Sony Ericsson is setting up a design center in Chennai. We are partners globally, and they wanted to replicate that in India. We have a similar kind of relationship with GM.”

Highlighting the fact that India has a great design industry, he felt that if more distributors like Farnell were to enter India, it would only go on to help the country.