Archive

Turnaround finally in global mobile phone market?

Late this week, there were three reports on the global mobile phone market!

First, IDC, which says that the mobile phone market had turned a corner in Q3, and more gains are likely in Q4-2009.

Then, ABI Research pointed out that the outlook for mobile phones continue to improve — with 291.1 million mobile handsets shipped in Q3-2009 — a contraction of 6.5 percent.

Finally, Strategy Analytics also reported that global mobile handset shipments fell 4 percent year-over-year, to reach 291 million units in Q3 2009.

One other interesting aspect — while the top five vendors — Nokia, Samsung, LG, Sony Ericsson and Motorola — either held on or lost a small amount of their market share, Apple has increased its share to 2.5 percent — a figure common with both ABI Research and Strategy Analytics.

Well, all of this can only be good news for the global technology industry as well as the global mobile phone market — both of whom have had to face the wrath of probably the longest ever recession! Perhaps, it is also a good news for the mobile phone semiconductor market as well!

Top trends in cyber crimes you need to watch out for!

Here’s part two of my conversation with Gaurav Kanwal, Country Sales Manager – India, Consumer Products & Solutions, Symantec. Here, we discussed trends in cyber crimes, how users can protect themselves against malware, phishing and other attacks, and some India based statistics.

Top trends in cyber crimes

What are the trends that Symantec has been seeing in cyber crimes today? Are any new trends appearing?

According to Kanwal, today’s online thieves will stop at nothing to steal anything you’ve got: your money, your identity, even your good name. Their methods are getting more devious and sophisticated every day. Cyber criminals then sell the information on the online black market. Some trends that Symantec has recently witnessed include:

Explosion of malware variants: Significant changes in the threat landscape over the last few years have dramatically altered the distribution profile for new malware. Today, instead of a single malware strain infecting millions of machines, it is much more common to see many millions of malware strains, each targeting a handful of machines.

Advanced Web Threats: Threats are becoming increasingly sneaky and complex. New scams, such as drive-by downloads, or exploits that come from seemingly legitimate sites, can be almost impossible for the average user to detect. Before the user knows it, malicious content has been downloaded onto their computer.

Social Networks: Online social networking continues to rise in popularity due to the numerous opportunities it provides. Social networking also provides phishers with a lot more bait than they used to have. Threats can come from all sorts of avenues within a networking site. Games, links and notifications are easy starting points for phishers. As society picks up one end of the social networking stick, it inevitably picks up the security problems on the other end.

Rising Spam Levels: We may not want it, but it still keeps coming. In October 2009, about 90 percent of all email messages were spam. The overall amount does fluctuate, but on average, the levels of spam have primarily risen rather than fallen. Big headlines almost always lead to more spam, and major headlines from 2009, such as the death of Michael Jackson, the H1N1 flu outbreak and the Diwali festival are examples of this. Furthermore, according to a recent Symantec report, spam and phishing information was the 2nd most requested item on the cyber mafia’s underground economy.

Malvertisements and scareware: Cybercriminals have figured out how to deceive people by presenting counterfeit messages. Examples of this include malicious advertisements or “malvertisments,” which redirect people to malicious sites, or “scareware,” which parade as antivirus scanners and scare people into thinking that their computer is infected when that’s not the case.

To encourage users to install rogue software, cybercriminals place website ads that prey on users’ fears of security threats. These ads typically include false claims such as “If this ad is flashing, your computer may be at risk or infected,” urging the user to follow a link to scan their computer or get software to remove the threat.

According to a recent Symantec study, 93 percent of software installations for the top 50 rogue security software scams were intentionally downloaded by the user.

As of June 2009, Symantec has detected more than 250 distinct rogue security software programs. To make matters worse, some rogue software installs malicious code that puts users at risk of attack from additional threats.

Symantec's Norton 2010 products use cloud based intelligence

Recently, Symantec brought a completely unique approach to online security with Norton 2010. The Norton Internet Security 2010 and Norton AntiVirus 2010 leverage a new model of security, codenamed Quorum, to attain unmatched detection of new malware and advance far beyond traditional signature and behaviour-based detection.

I managed to catch up with Gaurav Kanwal, Country Sales Manager – India, Consumer Products & Solutions, Symantec, to find out more about this release. Of course, Symantec was kind enough to share a copy of the software.

I managed to catch up with Gaurav Kanwal, Country Sales Manager – India, Consumer Products & Solutions, Symantec, to find out more about this release. Of course, Symantec was kind enough to share a copy of the software.

Norton 2010 products and their unique approach

Cybercrime has surpassed illegal drug trafficking as a criminal money maker. Cybercriminals use phony emails, fake websites and online ads to steal everything you’ve got. Your money, your identity, even your reputation.

To do that, cybercriminals are furiously writing and then rewriting new and unique pieces of malware, hoping to stay under the radar of threat signatures for as long as possible. Symantec security researchers see more than 200 million attacks on average every month, the vast majority of which are never-seen-before threats and delivered via the web.

Kanwal said: “The reality is, the signature approach and other traditional methods of security are not keeping pace with the sheer number of these threats being created by online criminals. Traditional security solutions are obsolete today.

“The faster, safer and smarter Norton 2010 is anything but traditional. Norton 2010 harnesses the power of millions of users united against cybercrime and gives consumers the power to ‘deny’ digital dangers and ‘allow’ a safe online experience.

“Norton 2010 achieves this by leveraging a new and unique model of reputation-based security, codenamed Quorum, to attain unmatched detection of new malware and advance far beyond traditional signature and behaviour-based detection.

“In short, the code name Quorum takes the greatest weapon cyber criminals have in their arsenal – their ability to generate unique pieces of malware at an alarming rate – and turns that very weapon against them.”

The other key and unique feature in the Norton 2010 products is the Norton Insight family of technologies, which uses extensive online intelligence systems to proactively protect the PC and keep users informed of the security and performance impact of files and applications that they encounter in their everyday online experience. The suite consists of:

Norton Download Insight – Uses extensive online intelligence systems leveraging reputation to proactively protect your PC. Analyses and reports on the safety of new files and applications before users install and run them.

Norton System Insight – Provides features and easy-to-understand system information to help keep PCs performing at top speed. Automatic and on-demand application optimisation rejuvenates application performance. Provides a view of recent events on the computer, providing the information required to research and analyze PC issues. Performance graphs help pinpoint what’s causing a computer to slow down.

Norton Threat Insight – Provides details on threats that have been detected on your PC – including useful information on where it came from (the URL) and when it was initially encountered.

Norton Insight Network – Leverages a cloud-based approach unique to Symantec. Based on the technology codenamed Quorum, it takes cloud-based security beyond traditional blacklists and whitelists. It uses a statistical analysis of file attributes based on billions of scans on millions of computers to identify the trust level of a file. This way Norton can identify files to be trustworthy or untrustworthy that would otherwise fall into the grey area of the unknown with only traditional security methods.

Additional key technologies:

SONAR 2 – Sophisticated second-generation behavioural security technology that detects entirely new threats based on their suspicious actions, without the need for traditional fingerprints. Leverages data from the reputation cloud, firewall, network communications (IPS), and file attributes such as location on the PC, origin information, etc., to decide when to detect a program as a threat.

New Antispam (Norton Internet Security only) – Powerful Enterprise-grade spam blocking engine helps keep you clear of unwanted email and safe from email-based scams and infections. 20 percent more effective than the previous engine and requires no training.

Norton Safe Web (Norton Internet Security only) – Website rating service that annotates Google, Yahoo! and Bing.com search results with site safety ratings to warn users about sites that may pose a danger to them. It also includes ecommerce safety ratings to help users make safer online shopping decisions.

OnlineFamily.Norton (Norton Internet Security only) – Norton Internet Security 2010 users can opt to try a subscription to OnlineFamily.Norton, a new Web-based service that keeps parents in the loop on their kids online lives and fosters communication about what’s appropriate and inappropriate behaviour on the Internet. Read more…

Chip industry epitaph — "It's A Lovely Day Tomorrow”: Semicon update Sep. ’09

Here are the excerpts from the Global Semiconductor Monthly Report, September 2009, provided by Malcolm Penn, chairman, founder and CEO of Future Horizons. There are a lot of charts associated with this report. Those interested to know more about this report should contact Future Horizons.

July’s WSTS results showed the industry recovery is continuing to gain momentum, with total semiconductor growth down 9.6 percent versus July 2008, up from minus 25.8 percent in June 2009. This is in line with our negative 14 percent year-on-year growth rate for the whole of 2009 and our 12 percent sequential third quarter growth projection.

Indeed, these forecasts are now virtually in the bag, only a further economic meltdown of Lehman’s Brothers proportion can now derail the chip market recovery. Not that this is out of the question, given so few lessons have yet been learned and little has culturally changed in the banking and financial sectors, but at least for now the chip market recovery is in full swing.

In short, there is more upside potential to our forecasts than downside risks; it’s going to be a really lovely day tomorrow.

Let the good times roll … tomorrow’s been a long time coming!

There have been wild fluctuations when looked at on an individual monthly basis meaning no single month’s data is a good indicator of the underlying trends. Each month is thus just another peg in the ground, especially during a period of rapidly changing conditions.

Whilst June’s minus 25.8 percent year-on-year growth looked much closer to our original minus 28 percent forecast for the year, rather than the minus 14 percent, we reforecast last month, this graph is backward looking and does not take into account (a) the prospective second-half-year rebound and (b) the fact we will be measuring future 12:12 growth rates against a dynamic whereby the 2009 numbers are trending up whereas the 2008 numbers were trending down, amplifying the impact of the 2009 positive monthly trends. As demonstrated by July’s results, we can now expect to see this number to trend upwards for the rest of 2009, albeit with continuing acute month-on-month fluctuations.

As can be seen, there is very little sensitivity now to the 2009 outcome, with 2009’s market coming in at around $ 215 billion.

Mathematically, a $215 billion 2009 chip market would result in a market the same size as it was in 2004, a five-year CAGR of 0.2 percent. An ideal number for the short sighted to drive nail a in the chip market ‘told you growth is over’ coffin. To mis-quote Jerry Sanders III … “Nuts”. CAGRs are notoriously flawed and should all come with ‘Numbers Can Seriously Damage Your Health’ warning. Depending on your start and finish point, you can derive any growth number you want. As shown in Figure E4, CAGRs for the industry over successive five-year periods from 1999 to 2010 vary dramatically, from 0.2 percent to 12.7 percent. Caveat Emptor.

As with all industry statistics, numbers need to be interpreted very carefully indeed, especially in an industry where the supply-side dynamics are driven by long (five year) design and investment decisions and the demand-side works on lead-times measured in months.

The reality is there is no substitute for a long-term plan with clear CEO vision and direction. History has shown sound industries are built around visionaries and leaders; falling foul only when greed and the pen pushers take control. As with life, even good businesses grow old and eventually loose momentum, giving way to the new upstarts vying for control of their chosen patch. It is never easy, however, to hand over the reins and growing old gracefully is difficult to achieve.

Even more difficult is reviving an aged organisation to compete against the new status quo. As history has shown over and over again, it is impossible to turn a company around once it has allowed itself to become ‘old’, where ‘old’ is much more an attitude of mind than physical age.

No amount of product pruning or reorganisation can downsize or rejuvenate a time-expired organisation. Better by far not to have allowed the firm to stagnate in the first place, which again points back to vision, leadership and a clear, well-executed long-term strategy. Loose sight of the direction and/or sacrifice tomorrow for today and you loose control of the company.

Despite conventional wisdom, there are more than enough chip market opportunities to fuel significant growth over the next many years, so long as you have the courage to ride the chip market ups and downs. In the words of Irving Berlin, and a song that could well have been the anthem of the chip industry …the only clear message is “It’s A Lovely Day Tomorrow”.

“It’s a lovely day tomorrow, tomorrow is a lovely day, Come and feast your tear-dimmed eyes on tomorrow’s clear blue skies, If today your heart is weary, if every little thing looks gray, Just forget your troubles and learn to say, tomorrow is a lovely day.”

More information will be added later!

Rising opportunities in India’s solar PV space

SEMI India, in association with Intersolar India and partner organizations India Semiconductor Association (ISA) and Fab City, organizing SOLARCON India 2009, today held an interactive panel discussion titled, ”Rising opportunities for Solar/PV in India”.

The participants were: Sathya Prasad, president, SEMI India, BP Acharya, CMD APIIC, Sankar Rao, MD, Titan Energy Systems, SSN Prasad, VP, Solar Semiconductors, and Seshagiri Rao, India Sales Head, Oerlikon.

Abundant solar radiation in India!

According to Sathya Prasad, president, SEMI India, India is abundantly endowed with solar radiation — > 300 sunny days a year and 5 trillion kWh of solar energy per year available across the land mass. “Even 0.5 percent of India’s land mass generating solar electricity can meet the entire power needs of the country in the year 2030,” he said.

India PV end market – opportunities

Several opportunities exist in the India PV end market, such as:

* Basic lighting and electrification of rural homes.

* Irrigation pump sets.

* Power backup for cellular base stations.

* Urban applications.

* Solar power plants

Indian PV manufacturing background

India has a long history of solar/PV activity. CEL and BHEL have been around from the 1970s. Pioneering R&D work has also been done. The Indian space program was one of the early drivers. A few private companies have been in operation for ~two decades.

There has been a rising production capacity in India. This is extending from module to cell manufacturing. Also, the industry is now getting into downstream opportunities.

India PV end market – opportunities in urban applications.

Today, most of the output is in exports (~70 percent).

India solar capacity targets

* Satisfy large solar local market (generation capacity)

— A few hundred MW Today

— 1000 MW by 2013

— 6000 – 7000 MW by 2017

— 20,000 MW by 2020

— 100,000 / 200,000 by 2030/2050, respectively

* Solar manufacturing capacity targets

— A few hundred MW Today

— 1000MW-1500 MW by 2012 / 2013

— 4000MW-5000 MW by 2017

Why is local solar/PV manufacturing important?

* Benefits of manufacturing locally in India

— Ability to scale production to meet end-demand

— Cost reduction

— Quality/reliability enhancements for local conditions

— Customization of end solutions targeted for India market

* Build competitive advantage in the long-term

* Employment creation (~100,000 over next 10 yrs)

Solar/PV manufacturing in India

* Govt recognition of potential of solar/PV

— Targets of 20,000 MW by 2020

* State government initiatives: Example: FabCity initiative

* Rising interest from Industry for solar/PV

— Integrated PV/solar manufacturing park

* India can provide a competitive manufacturing base for PV (cells, modules and solutions)

— Well established industrial base

— Industrial manpower available (PV training needed)

Solar farms, India an emerging leader Read more…

Excerpts from Future Horizons' International Electronics Forum 2009 @ Geneva

Here are excerpts of some key presentations made on day 1 at the recently held International Electronics Forum 2009 (IEF 2009), in Geneva, Switzerland, from Sept. 30-Oct. 2, which was held under the auspices of the Geneva Chancellerie D’Etat & Istitut Carnot CEA LETI. I hope to be presenting full reports as well.

May I also take this opportunity to thank Malcolm Penn, chairman and CEO, Future Horizons, as well as Gemma Fabian.

“Powering Out Of Recession With Innovation”’ — Maria Marced, President, Europe, TSMC

Maria Marced emphasised both investment and collaboration as a way forward for the semiconductor industry to recover from this recession. Based on the fact that every known recession has been followed by a strong recovery in demand the Taiwanese wafer foundry TSMC is expected to increase its earlier projected dollar investment plans substantially. Its new manufacturing GigaFab (Fab12-Phase4) will eventually be able to supply 150,000 wafers per month.

It will also being investing in people and will be adding 30 percent more R&D engineers to its existing 1200 worldwide and will also be adding 15 percent to its existing design technology engineers.

Maria stressed that it is innovation in our products and continued R&D that will improve semiconductor company margins. R&D costs and time-to-market can be reduced by processing equipment suppliers, IDMs and fabless companies collaborating with foundries for future success in finer geometries. TSMC has already announced that it has set up a development laboratory in a partnership with IMEC of Louvain, Belgium.

There were some questions about possible overcapacity as some plants in China were coming on line, but Maria thought differently as TSMC was already running at 90-95 percent of capacity today. There even could be a shortage of processed wafers in 2010.

“Feeding The World’s Insatiable Appetite For Memory – New Technologies, New Markets, New Applications” — Brian Harrison, President & CEO, Numonyx

Brian Harrison of Numonyx, a memory company jointly owned by STMicroelectronics and Intel, made a robust case for its latest technology Phase-Change Memory (PCM). Describing the history of non-volatile memory Brian showed its dramatic growth driven by both a continuously reduced cost-per-bit and new applications that needed its ability to support firmware that could be updated ‘down the wire’ or ‘across radio networks’.

The industries’ most recent entrant, PCM, is claimed to be a disruptive technology that will enable the next wave of innovation. In the right application it will replace both DRAM and flash memories — replacing these because of either speed, size, retention reliability or lower energy or a combination of all virtues.

Numonyx is already sampling 128Mbit 90nm product and has cost reduction 45nm process in development that is aimed at 1Gbit products. Samsung is also working on products in this field. The two companies are collaborating on package and interface standards.

“Agile Customer Support-Models For ‘More Moore” — Jean-Marc Chery, Executive VP & CTO, STMicroelectronics

Finer and finer geometries are still possible and there seems no immediate end, to the progress of process development. Jean-Marc needs a variety of processes to cater for broad application markets, that include automotive, industrial, medical and radio, so STMicroelectronics needs to maintain leads in low-power CMOS, smart power, analogue, discretes and MEMs markets.

To maintain this present agile supply chain and fund future development the company believes in growth in its own fabs in Crolles, Agrate, Tours and Catania, which gives it a key competitive differentiator. It then leverages these internal resources to deliver its business units the best price and foundry-like supply by using multiple sources.

As an example, STMicroelectronics joins European development programmes and works closely with laboratories such as CEA/LETI and other European institutes and universities. It is also involved in process development with the International Semiconductor Development Alliance (ISDA) which involves AMD, Chartered Semiconductor, IBM, Infineon, NEC, Samsung, and Toshiba. A 28nm CMOS process is being developed, which will be ready for volume production in 2010 at four sites.

What matters to Jean-Marc is keeping the ability to produce silicon subsystems for its chosen markets and this can be done either on-chip or by using 3-D integration techniques, such as stacking RF chips on top of digital CMOS within a single package. He finds these technologies important to keep in-house rather than going to an open-market foundry, although he does not rule out joint manufacturing plants with ISDA members. Read more…

ST/Freescale intro 32-bit MCUs for safety critical applications

Early this month, STMicroelectronics and Freescale Semiconductor introduced a new dual-core microcontroller (MCU) family aimed at functional safety applications for car electronics.

These 32-bit devices help engineers address the challenge of applying sophisticated safety concepts to comply with current and future safety standards. The dual-core MCU family also includes features that help engineers focus on application design and simplify the challenges of safety concept development and certification.

Based on the industry-leading 32-bit Power Architecture technology, the dual-core MCU family, part-numbered SPC56EL at ST and MPC564xL at Freescale, is ideal for a wide range of automotive safety applications including electric power steering for improved vehicle efficiency, active suspension for improved dynamics and ride performance, anti-lock braking systems and radar for adaptive cruise control.

Freescale/STMicroelectronics JDP

The Freescale/STMicroelectronics joint development program (JDP) is headquartered in Munich, Germany, and jointly managed by ST and Freescale.

The JDP is accelerating innovation and development of products for the automotive market. The JDP is developing 32-bit Power Architecture MCUs manufactured on 90nm technology for an array of automotive applications: a) powertrain, b) body, c) chassis and safety, and d) instrument cluster.

STMicroelectronics’ SK Yue, said: “We are developing 32-bit MCUs based on 90nm Power Architecture technology. One unique feature — it allows customer to use dual core or single core operation. The objective of this MCU is to help customers simplify design and to also reduce the overall system cost.

On the JDP, he added: “We will have more products coming out over a period of time. This JDP is targeted toward automotive products.”

Commenting on the automotive market today, he said that from June onward, the industry has been witnessing a gradual sign of recovery coming in the automotive market.

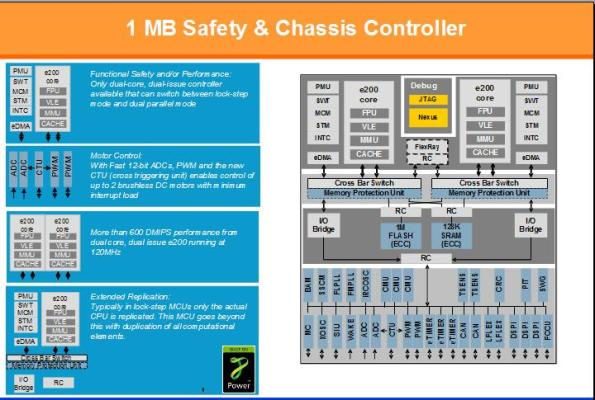

1 MB safety and chassis controller -- 32-bit MCU courtesy Freescale/STMicroelectronics joint development program (JDP)

Automotive market challenges

There has been an increasing integration and system complexity. These include:

* Increasing electrification of the vehicle (replacing traditional mechanical systems).

* Mounting costs pressure leading to integration of more functionality in a single ECU.

* Subsequent increase in use of high-performance sensor systems has driven increased MCU performance needs.

There are also increasing safety expectations. Automotive system manufacturers need to guarantee the IEC61508 (SIL3) and ISO26262 (ASILD) system-safety capability. Also, a move from passive to active safety is increasing the number of safety functions distributed in many ECUs.

Finally, there is a continued demand for quality — in form of zero defects, by which, a 10x quality improvement is expected.

MCU family addresses market challenges

The MCU family offers exceptional integration and performance. These include: high-end 32-bit dual-issue Power Architecture cores, combined with comprehensive peripheral set in 90nm non-volatile-memory technology. It also provides a cost effective solution by reducing board size, chip count and logistics/support costs.

It also solves functional safety. The Functional Safety architecture has been specifically designed to support IEC61508 (SIL3) and ISO26262 (ASILD) safety standards. The architecture provides redundancy checking of all computational elements to help endure the operation of safety related tasks. The unique, dual mode of operation allows customers to choose how best to address their safety requirements without compromising on performance.

The MCU also offers best-in-class quality. It is design for quality, aiming for zero defects. The test and manufacture have been aligned to lifetime warranty needs.

The MCU family addresses the challenges of applying sophisticated safety concepts to meet future safety standards. Yue added, “There are two safety standards — we are following those guidelines.” These are the IEC61508 (SIL3) and ISO26262 (ASILD) system-safety capabilities.

The automotive industry is also targeting for zero defects. “Therefore, all suppliers in tier 1 and 2 need to come up with stringent manuyfaturing and testing process that ensures zero defects,” he said.

32-bit dual-issue, dual-core MCU family

Finally, why dual core? Yue said that the MCU helps customers to achieve to achieve safety and motor control. Hence, dual core will definitely help deliver results.

“In many automotive applications, especially in safety-related applications, we want to have redundancy for safety. In the lock-step mode, two cores run the same task simultaneously, and results are then compared to each other in every computation. If the results are not matched, it indicates that there are some problems.”

This MCU family definitely simplifies design. It uses a flexible, configurable architecture that addresses both lock-step and dual parallel operation modes on a single dual-core chip. Next, it complies with safety standards.

A redundant architecture provides a compelling solution for real-time applications that require compliance with the IEC61508 SIL3 and ISO26262 ASIL-D safety standards. It also lowers the systems cost.

Dual-core architecture reduces the need for component duplication at the system level, and lowers overall system costs.

Top 5 high growth markets driving (semicon?) recovery, and top 10 hot and emerging technology platforms

Today, I received two wonderful reports — one, highlighting the top 5 high growth markets driving (semiconductor) recovery, and two, the top 10 hot and emerging technology platforms well poised to profoundly impact manifold sectors across the globe while offering potential high RoI for investors!

First, semiconductors! Semico Research has come up with a report that highlights the top 5 high growth segments driving growth and recovery in the semiconductor segment. For the record, 2009 is likely to see the global semiconductor industry decline by 12.5 percent. The top 5 segments according to Semico Research are:

* Netbooks

* Portable navigation devices (PNDs)

* Digital TVs

* DVD recorders

* Video game consoles

Hey, there really seems to be a lot of light at the end of the tunnel for the consumer electronics industry!

On netbooks, I think Intel needs to be given most, if not, all of the credit. Here’s what iSuppli has to say in its fast facts for Intel’s Q3 results:

* Intel also capitalized on the continued rise in demand for netbook PCs. The company dominates the netbook microprocessor market with its Atom chip. iSuppli predicts global netbook shipments will rise to 22.2 million units in 2009, up 68.5 percent from 13.2 million in 2008.

* While Atom represents only a small share of Intel’s total revenue, its profitability is disproportionately high. “Netbook microprocessors are a high-margin product because they utlilize old technology,” said Matthew Wilkins, principal analyst, compute platforms, for iSuppli. “The Atom is based on the old Pentium M microprocessor and uses a mature manufacturing process. Because of this, Intel is getting very high yields and an extremely high margin on the Atom.”

On PNDs, SatNav has recently introduced a Bluetooth enabled multifunction PND. Also, In-Stat reports that the worldwide unit shipments for PNDs will reach approximately 56 million units in 2012.

However, iSuppli has just sent out a story to me, saying that PNDs have now entered a period of slowing growth, spurring companies throughout the supply chain to re-evaluate their business models. Interesting!

As for digital TVs, according to DisplaySearch, developed markets are starting 2009 with strong growth and emerging markets are transitioning from CRT to LCD TVs faster than expected. However, plasma (PDP) TV is expected to fall about 2 percent Y/Y to 14.1 million in 2009 after strong 28 percent growth in 2008. As per iSuppli, OLED-TV revenue will likely rise by a factor of 240 by 2015—but still remain a niche. Let’s see!

DisplaySearch’s total global TV forecast is 200.4 million units in 2009, down 3 percent Y/Y, the first decline in total shipments in recent memory as the global recession and rising unemployment continue to take a toll on demand. However, the slowdown will be temporary as the worldwide economy emerges from recession and new markets enter the initial stages of the flat panel and digital TV transition.

Among DVDs, Samsung has introduced its first internal Blu-ray disc combo drive with BD-R and 8X BD-ROM read speed. Also, Flex-DVD is the latest technology in the DVD replication industry. This single layer format has the same capacity of a DVD-5 (4.7GB for standard size and 1.1GB for 3″ Mini DVD), but is half the thickness of the standard DVD.

Video game consoles — I find it quite interesting! It has been reported that the only products to see a decline in unit shipments in the second quarter were handheld video games, video game consoles, etc. Watch this market segment!

Now, to the top 10 hot and emerging technologies! According to a report from Frost & Sullivan, these are:

* Nanomaterials

* Flexible electronics

* Advanced batteries and energy storage

* Smart materials

* Green IT

* CIGS solar

* 3D integration

* Autonomous systems

* White biotech

* Lasers

Flex-DVD, above, is a great example of flexible electronics. Green IT — although a much abused term, it has certainly been on the top of the charts for quite some time now. Battery technologies and energy storage — yes, certainly. There are rightful places for CIGS solar — a point also made by Dr. Robert Castellano of The Information Network — and smart materials, as well as lasers and white biotech.

Well, what do you think folks? Do you agree with these top 5 and top 10 lists?

Cowan's LRA model's global semiconductor sales forecast

Continuing with my coverage of the fortunes of the global semiconductor industry, here’s the global semiconductor industry sales forecasts, by Mike Cowan. Here, I’d like to acknowledge Mike for sharing his findings and thank him for his continuous tracking of the semiconductor industry.

The presently updated global S/C sales forecast estimates are based upon the recently published August 2009 actual sales numbers released by the WSTS (posted on their website on Oct 6 (http://www.wsts.org/public/files/bbhist-23.xls).

The table details the latest, updated forecast numbers covering the next six quarters, that is, from 3Q09 through 4Q10, respectively, as well as for the full years of 2009 and 2010.

As the table shows, the latest forecast updates for years 2009 and 2010 chip sales forecast estimates both increased by +1.5 percent to $208.5 billion and $225.4 billion, respectively, compared to last month’s sales forecast estimates of $205.4 billion and $222.1 billion, respectively.

The updated 2009 and 2010 chip sales forecast estimates correspond to yr-o-yr sales growth forecast estimates of -16.1 percent and +8.1 percent, respectively, which represent a continuing improvement compared to last month’s sales growth prediction of -17.4 percent for 2009, but maintaining the status quo for 2010 at +8.1 percent.

Latest quarterly sales and year-on-year sales growth forecast estimates -- Cowan LRA model.

Sources: Actuals => WSTS; Forecasts => Cowan LRA Forecasting Model (Oct 2009)

It should be highlighted that the actual cumulative YTD (through August) sales number of $133.82 billion represents a YTD sales decline of 21.3 percent relative to last year’s August actual cumulative YTD sales of $170.12 billion.

Therefore, the latest model run projects an improvement in 2009’s full year’s sales growth estimate (of -16.1 percent) relative to August’s 2009 actual cumulative YTD sales growth decline (of 21.3 percent).

Remember that the model is dynamic, that is, is recalculated each month as the year plays out; therefore today’s latest, updated full year sales growth prediction will not sit still but will evolve over the coming months.

Additionally, the model also projects a sales forecast estimate for next month, namely for September, 2009. Thus September’s (actual) sales forecast estimate is projected to be $21.15 billion, which corresponds to a 3MMA sales forecast estimate of $19.68 billion as normally published by the SIA. Read more…

Semi Solar caters to requirements of semicon, solar industries!

One of the ‘guilty’ pleasures of blogging is that I’ve managed to make a whole lot of friends from all over the world. It is amazing to see how much of interest folks have on India, and especially on the Indian semiconductor and the Indian solar/PV industry.

Well, one such gentleman, who I recently got acquainted with over cyberspace is Mohan Chandra, president, Semi Solar Technologies, from Merrimack, NH, USA.

Mohan’s first query to me was: “Saw your blog, which came through my Linkedin messages. How does India plan to get onto 20 GW of solar power by 2020 without support from the silicon materials industry (viz. polysilicon through to wafers)?”

Interesting! As far as I’m aware, efforts are on to build an ecosystem here in India, so this bit would surely get addressed, if it already hasn’t!

Now, being in India, it is not easy for me to get in touch with companies based in the US, especially those in the solar photovoltaics field. Therefore, I also asked Mohan to brief me a bit about Semi Solar Technologies.

According to Mohan, he started Semi Solar technologies as a consulting company to cater to the requirements around the world in the semiconductor regime, as well as the photovoltaic industry.

“The idea was to see how best to push new and better technology through to different companies operating around the world rather than to build plants, equipment, run turnkey operations or to take up manufacturing ourselves. Things have changed considerably since we first started (which was just a little over two years ago!!

“Since the requirement of our clients have been to lean on us to put up plants and to design and build equipment. In the photovoltaic industry, we have the technology to take it from metallurgical grade silicon to silicon solar cells and modules for our clients.

“This will mean the technology to manufacture hyper pure raw material, polysilicon and then to take it through crystal growing, wafering and cell manufacture. We therefore advise how to build integrated plants or just parts of the PV plant. Very few such teams are available around the world.”

Semi Solar tries to get out in the field and if a company already exists, it attempts to see how best to introduce technology to improve the production and lower the product cost, or if it a new plant, then it would implement as many new technologies as possible to get out low cost material.

As per Mohan, Semi Solar has now put together a team of physicists, chemists, chemical, electrical, electronic, software and controls engineers. Within the team, it has more than 25 patents with many in the works mostly in the silicon area.

He added: “The coming years, we will see many of this kind of activities because of the large PV projection. So, it is one that will be slowly be taken out of the hands of the few controlling manufacturers and will become more or less a small to medium business operation with severe competition.” An interesting observation, that!