Archive

Global semicon mid-year review: Chip market revival or blip on stats radar screen?

A recent report from Future Horizons suggests an 18 percent growth for the chip market in Q2-2009! So, is this a sign of the chip market recovery or a mere blip on the statistics radar screen?

It is both, said, Malcolm Penn, chairman, founder and CEO of Future Horizons, and counselled that: “The fourth quarter market collapse was far too steep — a severe over-reaction to last year’s gross financial uncertainty — culminating with the Lehman Brothers collapse in September. The first quarter saw this stabilise with the second quarter restocking, but there are other positive factors also in play.”

Examining a bit further, here’s what he further revealed. One, the memory market is seeing some signs of slow recovery. He said, “This has already started DDR3 driven!” Likewise, companies are also in the process of revising their forecasts. The reason, Penn contended, being, “The maths has changed dramatically since Jan 2009!”

According to him, factors now leading to conditions looking up in H2 2009, include the normal seasonal demand — from a tight inventory base — and tightening capacity. There is also a clear indication of the correction phase to rebalance over-depleted inventories having started. “This is what’s driving Q2’s high unit, and therefore, sales growth,” he contended.

Firms advised to stop seeing and waiting!

This isn’t all! Penn further counselled firms who are still in a wait-and-see mode to ‘stop seeing and waiting’! Next, fabs are also looking to maximize their returns. For one, they have stopped over-investing.

Do we have enough stats from others to back up what’s been happening in the global semiconductor industry? Perhaps, yes!

IC Insights stands out

First, look at IC Insights! It has stood out by pointing out in early July that H2-09 is likely to usher in strong seasonal strength for electronic system sales, a period of IC inventory replenishment, which began in 2Q09, and positive worldwide GDP growth.

IC Insights has predicted global IC market to grow +18 percent; IC foundry sales to grow +43 percent; and semiconductor capital spending to grow +28 percent in H2-09.

DDR3 driving memory recovery? Flat NAND?

Elsewhere, Converge Market Insights said that according to major DRAM manufacturers, DDR3 demand has been on the rise over the last two months and supply is limited.

This is quite in line with Future Horizons contention that there is a DDR3 driven memory recovery, albeit slow. It would be interesting to see how Q3-09 plays out.

As for NAND, according to DRAMeXchange, the NAND market may continue to show the tug-of-war status in July due to dissimilar positive and negative market factors perceived and expected by both sides. As a result, NAND Flash contract prices are likely to somewhat soften or stay flat in the short term.

Semicon equipment market to decline 52 percent in 2009!

According to SEMI, it projects 2009 semiconductor equipment sales to reach $14.14 billion as per the mid-year edition of the SEMI Capital Equipment Forecast, released by SEMI at the annual SEMICON West exposition.

The forecast indicates that, following a 31 percent market decline in 2008, the equipment market will decline another 52 percent in 2009, but will experience a rebound with annual growth of about 47 percent in 2010.

EDA cause for concern

The EDA industry still remains a cause for concern. The EDA Consortium’s Market Statistics Service (MSS) announced that the EDA industry revenue for Q1 2009 declined 10.7 percent to $1,192.1 million, compared to $1,334.2 million in Q1 2008, driven primarily by an accounting shift at one major EDA company. The four-quarter moving average declined 11.3 percent.

If you look at the last five quarters, the EDA industry has really been having it rough. Here are the numbers over the last five quarters, as per the Consortium:

* The EDA industry revenue for Q1 2008 declined 1.2 percent to $1,350.7 million compared to $1,366.8 million in Q1 2007.

* The industry revenue for Q2 2008 declined 3.7 percent to $1,357.4 million compared to $1,408.8 million in Q2 2007.

* The industry revenue for Q3 2008 declined 10.9 percent to $1,258.6 million compared to $1,412.1 million in Q3 2007.

* The industry revenue for Q4 2008 declined 17.7 percent to $1,318.7 million, compared to $1,602.7 million in Q4 2007.

Therefore, at the end of the day, what do you have? For now, the early recovery signs are more of a blip on the stats radar screen and there’s still some way to go and work to be done before the global semiconductor industry can clearly proclaim full recovery!

Before I close, a word about the Indian semiconductor industry. Perhaps, it needs to start moving a bit faster and quicker than it is doing presently. Borrowing a line from Malcolm Penn, the Indian semiconductor industry surely needs to “stop waiting and watching.”

I will be in conversation next with iSuppli on the chip and electronics industry forecasts. Keep watching this space, friends.

Reports of memory market recovery greatly exaggerated: iSuppli

EL SEGUNDO, USA: Concerned about their image as they face the specter of bankruptcy, many memory chip suppliers are attempting to paint a more optimistic picture of the business by talking up a potential market recovery.

However, while overall memory chip prices are expected to stabilize during the remaining quarters of 2009, iSuppli Corp. believes a true recovery in demand and profitability is not imminent.

After a 14.3 percent sequential decline in global revenue in the first quarter DRAM and NAND flash, the market for these products will grow throughout the rest of the year. Combined DRAM and NAND revenue will rise by 3.6 percent in the second quarter, and surge by 21.9 percent and 17.5 percent in the third and fourth quarters respectively.

“While this growth may spur some optimism among memory suppliers, the oversupply situation will continue to be acute,” said Nam Hyung Kim, director and chief analyst for memory ICs and storage at iSuppli.

“For example shipments of DRAM in the equivalent of the 1Gbit density will exceeded demand by an average of 14 percent during the first three quarters of 2009. This will prevent a strong price recovery, which will be required to achieve profitability for most memory suppliers.”

Painful oversupply

Due to a long-lasting glut of DRAM, the imbalance between supply and demand is too great for this market to recover to profitability any time soon.

“Even if all of the Taiwanese DRAM suppliers idled all their fabs, which equates to 25 percent of global DRAM megabit production, the market would remain in a state of oversupply,” Kim said. “This illustrates that the current oversupply is much more severe than many suppliers believe—or hope.”

Besides cutting capacity, which suppliers have already been doing, they presently have few options other than waiting for a fundamental demand recovery. iSuppli believes that another round of production cuts will take place in the second quarter, which will positively impact suppliers’ balance sheets late this year or early in 2010 at the earliest.

DRAM prices now amount to only one-third-level of Taiwanese suppliers’ cash costs. Unless prices increase by more than 200 percent, cash losses will persist for these Taiwanese suppliers.

While average megabit pricing for DRAM will rise during every quarter of 2009, it will not be even remotely enough to allow suppliers to generate profits in this industry. The industry needs a dramatic price recovery of a few hundred percentage points to make any kind of impact.

iSuppli is maintaining its “negative” rating of near-term market conditions for DRAM suppliers.

Confusing picture in NAND

The picture is a little more complicated in the NAND flash memory market.

Pricing for NAND since January has been better than iSuppli had expected. However, iSuppli believes this doesn’t signal a real market recovery.

Most NAND flash makers are continuing to lose money. The leading supplier, Samsung Electronics Co. Ltd., seems to be enjoying the current NAND price rally as prices have almost reached the company’s break-even costs. However, all the other NAND suppliers still are losing money.

“While the NAND market in the past has been able to achieve strong growth and solid pricing solely based on orders from Apple Computer Inc. for its popular iPod and iPhone products, this situation is not likely to recur in the future,” Kim said. “Even if Apple’s order surge, and it books most of Samsung’s capacity, it would require a commensurate increase in demand to other suppliers to generate a fundamental recovery in demand.”

However, iSuppli has not detected any substantial increase in orders from Apple to other suppliers. Furthermore, Apple’s orders, according to press reports, are not sufficient to positively impact the market as a whole.

It doesn’t make sense for major NAND suppliers Toshiba Corp. and Hynix Semiconductor Inc. to further decrease their production if there is a real fundamental market recovery. This means supply will continue to exceed demand and pricing will not rise enough to allow the NAND market as a whole to achieve profitability.

The NAND flash market is in a better situation than DRAM at least. However, the market remains challenging because fundamental demand conditions in the consumer electronics market have not improved due to the global recession.

One of the reasons why the price rally occurred is that inventory levels have been reduced in the channel and re-stocking activity has been progressing. Overall, memory suppliers will begin to announce their earnings shortly and iSuppli will remain cautious about the NAND flash market until we detect solid evidence, not just speculation, of a recovery.

iSuppli is remaining cautious about the near term rating of NAND market, holding its negative view for now, before considering upgrading it to neutral.

“Production cuts undoubtedly will have a positive impact on the market in the future. However, it’s too early for to celebrate. iSuppli believes the surge in optimism is premature. Supplier must be rational and watch the current market conditions carefully to avoid jumping to conclusions too quickly,” Kim concluded.

Top NAND suppliers of the world: DRAMeXchange

DRAMeXchange has recently released its rankings for the top NAND suppliers of the world. I am producing bits of that report here, for the benefit of those interested in NAND and the memory market.

Be aware, that this segment has been hit particularly bad. We have heard of Qimonda’s problems, as well as Spansion’s. They are trying to battle it out, gamefully, and best wishes to them.

The global semiconductor industry needs the flash memory segment to recover, and fast, to bring the health back in the industry, as well as the missing buzz!

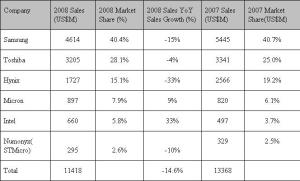

Getting back to DRAMeXchange’s report, NAND Flash brand companies released their total revenue of 2008. Samsung’s annual revenue was $4.614 billion and it gained 40.4 percent market share, to maintain the number 1. position.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

Hynix’s annual revenue was $1.727 billion, with 15.1 percent market share. Though it stayed at the number 3 position, its market share declined 4.1 percent, compared to 2007.

Micron’s annual revenue was $897 million. It had a 7.9 percent market share, which enjoyed a 1.8 percent increase when compared to 2007. Micron was number 4. Intel was at number 5. Its annual revenue was $660 million with 5.8 percent market share, which increased 2.1 percent, compared to 2007.

Numonyx’s (STMicro) 2008 annual revenue was $295 million. It was at number 6 position with the market share of 2.6 percent, which remained the same as 2007.

According to DRAMeXchange, the 4Q08 total revenue of worldwide NAND Flash brand companies was $2.227 billion, which dropped 19.3 percent from $2.761 billion in 3Q08. Under the continuing impact of global recession and the influence of declining worldwide consumer confidence, the 4Q08 revenue of NAND Flash brand companies showed signs of decreasing.

The overall demand and expenditure for consumer electronics declined. Although bit growth in 4Q08 increased 18 percent QoQ, the overall average selling price (ASP) dropped 32 percent QoQ, says DRAMeXchange. A big thanks to DRAMeXchange.

Global semiconductor industry could well see revival in 2010?

“Let’s start from the very beginning! A very good place to start!!”

Hope you all remember this lovely song sung by Julie Andrews in The Sound of Music!! So, what’s the connection?

Right! Last week, I blogged about how the global semiconductor industry is likely to drop by 28 percent in 2009, while the Indian industry should grow by 13.4 percent during the same period, and that, we should not get carried away by these statistics!

A moment to ponder: isn’t this drop of 28 percent too high for the global semicon industry? Or, is the situation really that bad? So, let’s start from the very beginning, and go straight to the source — Malcolm Penn!

Revival likely by 2010?  Here’s what Malcolm Penn, CEO and founder of Future Horizons, had to say: “Fraid not! It could even be lower, but remember that this is a year on year number. It is based on the following assumptions: Q4-08 down 22.5 percent vs. Q3-08; Q1-09 down 20 percent vs Q4-08; Q2 down 2 percent vs Q1; and Q3 up 12 percent vs Q2, and Q4 up 3 percent vs Q3! And, if this pattern runs true, 2010 will be up 28 percent vs 2009!”

Here’s what Malcolm Penn, CEO and founder of Future Horizons, had to say: “Fraid not! It could even be lower, but remember that this is a year on year number. It is based on the following assumptions: Q4-08 down 22.5 percent vs. Q3-08; Q1-09 down 20 percent vs Q4-08; Q2 down 2 percent vs Q1; and Q3 up 12 percent vs Q2, and Q4 up 3 percent vs Q3! And, if this pattern runs true, 2010 will be up 28 percent vs 2009!”

Voila! The global semiconductor industry could well be in for a major revival next year itself! Why, even Bill McClean, president of IC Insights, took a more optimistic look at the state of the industry in light of the current global economic situation at the recently concluded SEMI ISS 2009 conference!!

Continues Penn, “The actual Q4 results (released this Sunday) were down 24.2 percent, slightly worse than our estimate.”

How to get the buzz back in semicon?

It has been said that the current situation the global semiconductor industry finds itself in was fueled by greed and short-term business goals. So, who were the culprits? Weren’t they warned earlier?

Adds Penn: “It was more complex that that! The woeful state-of-the-world economy was a consequence of debt, greed and irresponsibility; political self interests and short-term business goals, aided and abetted by compliant governments; ineffective regulators; imprudent institutions; incompetent management; irrational self delusion and vested self-interests! No one is blameless for this crisis! Concerns were raised, but the human nature is often irrational, and the ‘easy option’ always the one of choice.”

So true! Perhaps, the ‘easy option’ factor seems to be affecting the Indian semiconductor industry as well, but more of that later!

The key issue today is: what needs to be done to get the buzz back in the global semiconductor industry? The answer probably lies in the following: in the short-term, it involves rebuilding the industry confidence, and in longer term, it involves a radical return to ‘old fashioned’ business and political values.

On another note, I was curious to know how the EDA segment is doing? Penn said, “No better, no worse than normal, technology marches on, new designs accelerate in a downturn.”

Tricky memory!

Memory is another segment that’s been hit hard. In fact, the other day, someone asked me why Qimonda’s story was so important!

Another could not understand what Spansion really did, and why it had announced this January 15 that the company was exploring strategic alternatives for a sale or a merger! Doesn’t matter! Memory is a very tricky business, and semiconductors is the mother of all such tricky businesses! Perhaps, isn’t that why they once said in jest: “Real men have fabs!” Anyhow!

Coming back to memory, when can the industry expect some recovery in NAND? More importantly, will the various government interventions help? Qimonda also recently petitioned for the opening of the insolvency proceedings.

Penn is clear: “NAND will recover when the excess capacity abates, and that will take several more quarters. The government intervention won’t help, rather the opposite, and it will exacerbate the excess capacity issue.”

Fab spends to move up only by Q1-2010

Earlier, Penn predicted a recovery in 2010 with the resumption of growth in Q3 2009. What will make this happen? He says, “A recovering world GDP growth, plus a return in business confidence.”

However, those keen on fabs, do not expect the fab spends to look up any time soon! In fact, Penn estimates fab spends to start moving north not until Q1-2010 at the earliest.

The Chinese impact!

Interestingly, China is set to see negative growth of 5.8 percent during 2009. It will be worth noting how much of this this impact the global semiconductor industry.

Point one, compared to a global semicon fall of 28 percent in 2009, Penn considers a fall in China’s semicon fortunes of 5.8 percent to be ‘darned sight better!’ So, China should still be a high growth market (relatively speaking).

And India?

Like I mentioned earlier, the Indian semiconductor industry is perhaps getting affected by the ‘easy option.’ Design services continue to do well, hopefully, but when it comes to real semiconductor product companies, those are far and few.

And, I haven’t seen any real activity in the recent past that could tell me more such initiatives are in the pipeline. Nor do I think there are many attempts to even incubate such companies. On the contrary, there’s a mad rush toward solar!

No harm there! Solar is great for India and the need of the hour. However, India should not forget its semiconductor priorities as well! Indian simply cannot bank on chip design services and solar gains, and then proclaim that it has a very successful semiconductor industry! Real action is still quite far away.

I think, India needs to rethink its semiconductor strategy! It cannot survive on chip design alone.

“When you know the notes to sing, you can sing most anything,” concludes the song from The Sound of Music!

So, is the Indian semiconductor industry hitting the right notes? That’s going to be my next blog post, friends.

Reviewing global/Indian semicon industry in 2008 — top posts

Greetings, dear readers and friends, in the new year. May you all have all the success and prosperity in 2009!

An eventful year in semiconductors has passed by us. For me, personally, it has been a tremendous 2008, ending with Electronics Weekly of UK selecting my blog (Pradeep Chakraborty’s Blog) as the world’s best in the Electronic Hardware category.

An eventful year in semiconductors has passed by us. For me, personally, it has been a tremendous 2008, ending with Electronics Weekly of UK selecting my blog (Pradeep Chakraborty’s Blog) as the world’s best in the Electronic Hardware category.

Lot of people have asked me since, how it feels to be a world champion! Well, I do feel elated! However, one point, more of the congratulatory notes have come from overseas, than from India. Perhaps, it is an apt indicator of how semiconductors is perceived in India — though, I may be wrong.

Friends have also asked me how I’ve managed to blog on such a difficult subject sitting in India. Simply put: It has not been easy!

First, I’m just a simple person, and not some brand name. Second, my blog does not represent any large, well known media house, or a big brand semiconductor magazine. Hence, maintaining a semicon blog, with the help of contacts from all over the world has been tough, at times. Why, some folks, with whom I wished to speak with, never even responded to my emails and requests. Quite understandable!

Third, I’ve only managed to blog, when I have the time, unlike many other great bloggers who post regularly (or daily)! Fourth, there have been several instances, where my location has been my weak point. I was unable to blog on several instances simply because I had no way of reaching people whom I wished to speak with, while sitting in India. And, as I said, I did get cold snubs on several instances! 🙂 As a result, I could not present my views at specific instances, even though I dearly wanted to!

However, the unconditional and loving support and encouragement of my family, friends, well wishers, industry leaders and loyal readers such as you have helped overcome all of these deficiencies. It is only because of these people that I’ve managed to come this far! I hope each one of you continues to have faith in me. I shall try my best to provide you with the best information (hopefully) the global semiconductor industry has to offer.

To start off the new year, may I present, what I feel, are the top blog posts on semiconductors during 2008, as a review for the past year.

Being indisposed at the start of 2008, I only managed to pick up speed from April onward. As the year progressed, the Indian fab story with SemIndia started worsening, before finally disappearing, even as fabless India held on sttong, as did the fortunes of the global semiconductor industry, which incidentally, did look quite good till September last year.

I have arranged the blog posts, from January to December 2008, so they will present a better picture of how 2008 behaved! These posts are set in no particular order or preference, otherwise. Some of you may have your own favorites, so kindly let me know, in case those haven’t made the list.

JAN 2008

Power awareness critical for chip designers

LabVIEW 8.5 delivers power of multicore processors

MAR 2008

NXP India achieves RF CMOS in single chip

VLSI as a career in India

Using ‘semicon’ simulation for drug discovery

APR 2008

New camps promise exciting times ahead in memory market

Indian design services to hit $10.96bn by 2010

Staying ahead of clock a habit at Magma!

MAY 2008

Dubai — an emerging silicon oasis

Developers, go parallel, or perish, says Intel

Think AND not OR; Altera first @ 40nm FPGAs

Top 10 global semicon predictions — where are we today

Semicon to grow 12pc in 2008

India’s growing might in global semicon

JUN 2008

10-point program for Karnataka semicon policy

Has the Indian silicon wafer fab story gone astray?

Semicon half year over, what next now?

EDA as DNA of growth

JUL 2008

Semicon is no longer business as usual!

Cadence C-to-Silicon Compiler eliminates barriers to HLS adoption

Practical to take solar/PV route: Dr. Atre, Applied

AUG 2008

What India brings to the table for semicon world! And, for Japan

NAND update: Market likely to recover in H2-09

E Ink on every smart surface!

RVCE unveils Garuda super fuel-efficient car

Indian fab policy gets 12 proposals; solar dominates

SEP 2008

90pc fab investments for 300mm capacity: SEMI

Synopsys’ Dr Chi-Foon Chan on India, low power design and solar

Magma’s YieldManager could make solar ‘rock’!

Motion sensors driving MEMS growt

BV Naidu quits SemIndia; what now of Indian fab story?

OCT 2008

Top 20 global solar photovoltaic companies

IDF Taiwan: Father of the Atom an Indian!

TI Beagle Board for Indian open source developers and hobbyists

Cadence’s Virtuoso vs. Synopsys’ Galaxy Custom Designer!

Synopsys’ Galaxy Custom Designer tackles analog mixed signal (AMS) challenges

Solar, semi rocking in India; global semi recovery in 2010?

No fabs? So?? Fabless India shines brightly!!

NOV 2008

AMD’s roadmap 2009 provides lots of answers… now, to deliver!

Embedded computing — 15mn devices not so far away!

FPGAs have adopted Moore’s Law more closely!

DEC 2008

My blog is the world’s best!

Semicon outlook 2009: Global market could be down 7pc or more

Altera on FPGAs outlook for 2009

Solar sunburn likely in 2009? India, are you listening

Outlook for solar photovoltaics in 2009!

I found it difficult to select the Top 10 posts. If any one of you can draw up such a list, it’d be great!

Memory market to witness another negative sales growth in 2009

This is a continuation from my previous blog on the outlook for the global semiconductor industry, and iSuppli’s ranking of the Top 20 global semiconductor companies.

Thanks to Jon Cassell at iSuppli, I also got into a conversation with Nam Hyung Kim, Director & Chief Analyst, iSuppli. Kim touched upon the outlook for DRAM and the memory market as a whole.

Thanks to Jon Cassell at iSuppli, I also got into a conversation with Nam Hyung Kim, Director & Chief Analyst, iSuppli. Kim touched upon the outlook for DRAM and the memory market as a whole.

Further analyzing iSuppli’s top 20 rankings, among the leading memory makers, Hynix has performed the worst. On this aspect, Kim says that DRAM sales is likely to decline by 20 percent in 2008. Thus, Hynix’s performance is not far from overall challenging status considering it also scaled NAND flash business back dramatically.

On another note, Qimonda is also among the strugglers, and there have been whispers about its possible bankruptcy. However, iSuppli did not comment on this topic.

So, how much longer will it take before the memory market can come out of its current woes? Kim adds: “The memory industry inevitably will experience another negative sales growth in 2009. However, the rate of sales decline will be much lower than that of 2008.

“The year 2009 will be the third year of the memory market downturn. Therefore, supply growth reduction will take place fast, resulting in lower price drop compared to 2008.”

Finally, what’s the way forward for DRAM, NOR and SRAM? Kim asserts that iSuppli expect the following sales growth in 2009 (preliminary):

* DRAM: single digit percentage sales decline; and

* NAND, NOR, SRAM will experience mid to high teens sales decline.

What can the global semicon industry do to get back its money-making touch!

It is very well known that the global semiconductor industry has had a year full of turmoil. The ongoing global financial has been not been of any help either.

The key question: Has the semiconductor industry really lost its money making touch?

According to iSuppli, facing dwindling profits, fewer opportunities to expand by taking market share from competitors and a shrinking roster of star performers, the semiconductor industry has entered a period of lowered expectations and diminishing options, forcing chip suppliers to rethink their basic strategies for success.

Thanks to Jon Cassell at iSuppli, I caught up with Derek Lidow, president and CEO, of iSuppli, to find out more about why the global semiconductor industry has become less forgiving. He has offered a range of suggestions for the global semiconductor industry to adopt and follow. The beauty of the advice lies in its simplicity, and I hope the industry is reading!

Thanks to Jon Cassell at iSuppli, I caught up with Derek Lidow, president and CEO, of iSuppli, to find out more about why the global semiconductor industry has become less forgiving. He has offered a range of suggestions for the global semiconductor industry to adopt and follow. The beauty of the advice lies in its simplicity, and I hope the industry is reading!

Facing dwindling profits and fewer opportunities to expand by taking market share from competitors and a shrinking roster of star performer, how difficult is the market today?

According to Derek Lidow, at the moment, the makers of electronics have started slamming on the brakes as they have decided that the financial turmoil will effect Christmas spending.

In this scenario, what strategies should the players: a) fabs; b) NAND; c) DRAM; d) materials devise, to ensure some turnaround?

Lidow says that the fab players should consolidate fabs to make them more efficient.

Both the NAND players and DRAM players should push out capacity expansion plans. Makers of devices should make variations of the existing products that customer would like to have, and don’t turn down opportunities to lock in orders for specials.

If semiconductors have actually lost their money-making touch, it is really an alarming sign. However, Lidow advises that the semiconductor business is maturing and every industry, as it matures, must undergo transitions.

Leaders can’t ignore looming changes

“Often, these transitions come as a surprise and many companies go through hard times,” he says. “Semiconductor companies don’t have to go through the turmoil of the steel or automotive industries if it doesn’t want to. The leaders of the industry just can’t ignore the looming changes.”

Is there a way that semiconductor companies break out of the current market dynamics to outperform the industry?

Lidow suggests the semiconductor companies should STOP doing things that they are not good at! He adds: “Each company will have to follow a recipe that eliminates where they are mediocre and focuses on where they add real value. Next, they should change their business models so that semiconductor technology is the tool, not the objective.”

According to him, designing more total systems with system-level chips built around proprietary Intellectual Property (IP) should be enough.

He says: “The electronics industry is $1.5 trillion dollars in size, and the semiconductor industry is $270 billion in size. There is a lot more value to capture. However, the value is more complex to unlock and requires as much or more software expertise as it does semiconductor expertise. They have to get married together to succeed in developing proprietary IP.”

Areas to outspend rivals

As for the areas where companies can massively outspending rivals in areas of products and manufacturing, these would be leading edge wafer foundries, memory chips, and the most complex system-on-chips (SoCs).

Why won’t this massive outspend simply to maintain technical and scale dominances in competitive market segments be risky?

Lidow says you can only use this strategy if you know you can outspend your rival! “We see the problems of a spending race in the memory market where many companies are trying to keep up with Samsung’s massive investments and it is hurting everyone,” he points out.

iSuppli has also advised adopting a scalable acquisition process that would allow a semiconductor company to grow by buying other companies or selected parts of companies.

Lidow says: “I think the point of my article was that there haven’t been any success stories to date. So, this strategy is unproven, but very tantalizing, considering the state of the maturing industry.”

On possible Samsung-SanDisk deal; AMD's fab-lite path

Last week, the global semiconductor industry has been hearing and reading about two big speculative stories:

a) A possible acquisition of SanDisk by Samsung, and

b) A possible chance of AMD taking the fab-lite route.

First on Samsung’s buyout (possible) of SanDisk! There have been rumors of a possibility of Samsung acquiring SanDisk. While it is still a possibility, it also leads to several interesting questions!

Should this deal happen, what will be the possible implications for the memory market? Will this also lead to a possible easing off on the pricing pressures on the memory supply chain? And well, what happens to the Toshiba-SanDisk alliance?

A couple of weeks back, iSuppli, had highlighted how Micron had managed to buck the weak NAND market conditions, and was closing the gap with Hynix in Q2, and that NAND recovery was likely only by H2-2009.

I managed to catch up again Nam Hyung Kim, Director & Chief Analyst, iSuppli Corp., and quizzed him on the possible acquisition of SanDisk by Samsung.

A caution: Remember, all of this is merely based on speculation!

On the possibility of Samsung’s takeover of SanDisk, he says: “Samsung at least said that they consider it. Thus, it is a possible deal. But who knows!”

Kim is more forthright on the implications for the memory market, should this deal happen, and I tend to agree with him.

Consolidation inevitable; no impact on prices

The chief analyst quips: “The NAND flash market is still premature and there are too many players in flash cards, USB Flash drives, SSD, etc. The industry consolidation should be inevitable in future.”

So, will this possible buyout at least ease some pricing pressures on memory supply chain? “I don’t expect this deal to impact the prices. Prices will depend on suppliers’ capacity plans. In the memory industry, the consolidation has never impacted the prices in a long run. (maybe, just a short-term impact). As you know, Micron acquired Lexar a few years ago, but no impact,” he adds.

Is there any possibility of SanDisk delaying its production ramps and investments at two of its fabs? And, what will happen should it do so?

Nam says: “SanDisk has already said that they would delay its investment and capacity plan given difficult market condition. This is a positive sign to the market as we expect slower supply growth than expected in future. However, in a long run, consolidation won’t impact the market up and down.”

Negative impact likely for Toshiba?

Lastly, what happens to the SanDisk-Toshiba alliance, should the Samsung buyout of SanDisk does happen?

Nam adds: “It is negative to Toshiba. The company [Toshiba] not only loses its technology partner, but also loses its investment partner. It should be burden for Toshiba to keep investing themselves to grow its business.”

Well, in SEMI’s Fab Forecast Report, there is mention of how Toshiba and SanDisk are among the big spenders in fabs, in Japan. Considering that Japanese semiconductor manufacturers are more cautious, it would be interesting to see how this deal, should it happen, affects the Toshiba-SanDisk alliance.

Now, AMD goes fab-lite?

While on fabs, this brings me to the other big story of last week — of AMD going the fab-lite route, possibly!

Magma’s Rajeev Madhavan had commented some time back that fab-lite is actually good for EDA. It means more design productivity. Leading firms such as TI, NVIDIA, Broadcom, etc., are Magma’s customers.

Late last year, Anil Gupta, MD, India Operations, ARM, had also commented on some other firms going fab-lite! Gupta pointed out Infineon, NXP, etc., had announced Fab-Lite strategies. Even Texas Instruments was moving to a Fab-Lite strategy. “IDMs are going to be the fabless units of today and tomorrow,” he added.

So much for those who’ve taken the fab-lite route, and industry endorsements.

On the fab-lite subject, iSuppli’s Kim will not speculate whether AMD would actually break up into into two entities: design and manufacturing, and also prefers to wait and watch.

How does fab-lite actually benefit? He comments: “Fab-lite has not been working well in the memory industry, which requires very tight control. It works, IF two companies (an IDM and a foundry) work very closely. For example, the industry leader, Samsung, produces all of the memory alone without any foundry relationship.”

Watch this space, folks!

Semicon to grow 4-8pc in 2008; ASPs trending up

It has really been a tumultuous year for semiconductors, which has held up very well, despite the memory market turmoils, so far.

Just a day ago, Future Horizons reported on the June sales for semiconductors. According to Malcolm Penn, chairman and CEO, June’s WSTS results brought both good and bad news! The good news being that the recovery momentum strengthened, with Q2 sales up 3 percent on Q1.

Just a day ago, Future Horizons reported on the June sales for semiconductors. According to Malcolm Penn, chairman and CEO, June’s WSTS results brought both good and bad news! The good news being that the recovery momentum strengthened, with Q2 sales up 3 percent on Q1.

He says, “This was significantly better than even we dared to predict in last month’s Report, despite the fact we raised eyebrows and disbelief by suggesting a 2.3 percent quarter on quarter growth.”

The bad news was the Jan-May YTD WSTS numbers for standard logic (and thus, the total ICs and total SC) were revised downwards by a sizeable US$1.4 billion, a restatement that will knock 2 percentage points off the 2008 year on year growth number!

What were the reasons for the recovery momentum to have strengthened, with Q2 sales up 3 percent on Q1? Penn adds: “The first half year sales were much stronger than everyone (except us) believed. It has depresses, only by memories.”

Also, the Jan-May YTD WSTS numbers for standard logic (and total ICs and total SC) were revised downward by a sizeable US$1.4 billion. Why did this happen? It is interesting to note that one company mis-reported its sales for Jan-May and corrected this reporting error in June.

Penn adds: “This often happens, but not before at this magnitude. Individual company details are secret, so we do not know who the culprit was or how the ‘error’ happened.”

Forecast revised to 4-8 percent

Future Horizons further says in its report that the downward revision in standard logic numbers would knock 2 percentage points off the 2008 year on year growth number. On quizzing, Penn agrees: “Yes, our ‘revised’ forecast range is 4-8 percent. We are currently still erring on the high side of this range. More important though is the market momentum.”

Memory has been a constant problem this year. iSuppli has mentioned in an earlier report that NAND recovery will be likely in H2-2009.

DRAMeXchange, in another report today, indicates a new record low for DDR 1Gb. Even Penn agrees that recovery is definitely not in sight. When do we actually get to see some recovery? He adds: “There is still over capacity, however, Q3 is typically the strongest demand quarter.”

Still on memory, does Future Horizons forsee Hynix bouncing back? Penn says: “They did; in 2000-02, they were on the verge of bankruptcy. Now, they are fitter and financially strong.”

ASPs were trending up earlier, and the status quo is maintained. “ASPs are still trending up, slowly, but surely. We will be commenting more on this in September’s report,” he adds.

Fab spends trending down

Just a few days ago, a SEMI analyst highlighted the chief reasons for decline in fab spends. Christian Gregor Dieseldorff, Senior Manager of Fab Information and Analysis at SEMI, said: “Given the weaker economic conditions globally, coupled with higher energy and commodity prices and the financial crisis, the overall outlook for semiconductor growth in 2008 is for low-single digit growth in both revenues and units. As such, device makers have responded by cutting back their capital spending and pushing out fab projects or putting them on hold.”

On the status with fab spends, Penn agrees, “Those are still trending down, and will continue to do so for at least the next three quarters.”

Solar not much help

There have been lot of investments happening in solar/PV. One may imagine that all of this would be helping the global semiconductor industry. So, is the spend in solar/PV really helping the industry? Penn disagrees, saying this only helps the equipment guys.

One last query, and this is regarding the smaller IDMs, ‘fab-lite’ IDMs, and fabless semiconductor companies. Are they growing at below average? Penn concludes: “They are mostly not. The fabless firms outgrew the market 2x in the first half of 2008.”

Perhaps, here also lies a message for India!! One hopes that India does not get too carried away by all those investments in solar/PV, and focuses more on the semicon side. Semicon in India, does need concrete planning, after all!

NAND update: Market likely to recover in H2-09

iSuppli’s recently published a report on the current NAND market conditions, which highlighted that Micron had managed to buck the weak NAND market conditions, and was actually closing the gap with Hynix in Q2 2008.

To find out more about the global NAND Flash market scenario, I managed to discuss the health of the NAND market conditions, performance of certain companies, and the possible impact of SSDs on the NAND market, in depth with Nam Hyung Kim, Director & Chief Analyst, Memory, for the market research firm, iSuppli Corp., El Segundo, Calif., USA.

To find out more about the global NAND Flash market scenario, I managed to discuss the health of the NAND market conditions, performance of certain companies, and the possible impact of SSDs on the NAND market, in depth with Nam Hyung Kim, Director & Chief Analyst, Memory, for the market research firm, iSuppli Corp., El Segundo, Calif., USA.

I would also like to thank Jonathan Cassell, Editorial Director and Manager, Public Relations, iSuppli, for helping me out a lot! Without his assistance, this would not have been possible! Many thanks.

Now on to iSuppli and the NAND update. First up, NAND continues to be weak. How much longer, before we can see some sort of recovery?

Nam Hyung Kim says that the NAND market conditions will depend on the suppliers’ manufacturing capacity plans and on the global economy. The health of the NAND flash market is largely determined by consumer spending, since more than 85 percent of demand for the memory is generated by consumer-electronics-type products like digital still cameras, mobile handsets and flash storage devices.

“Market conditions won’t improve much this quarter. However, iSuppli Corp. does expect NAND prices to stabilize to some degree during the fourth quarter due to a slowdown in certain suppliers’ capacity expansion plans. A major recovery is expected in the second half of 2009,” he says.

So, what’s the reason for Micron to have done better in a weak market scenario?

According to Kim, Micron is doing well based on market share and sales growth—but not in terms of profitability. Micron has been expanding its market share by ramping up production aggressively. The company joined the flash market later than its competitors and is trying to catch up. In the memory world, a supplier needs to have critical scale. Without scale, the company won’t be competitive. Thus, Micron is increasing its scale—i.e., its volume—to be more like the size of the top-three suppliers at this moment.

If Micron has been aggressive, why haven’t the others? Possibly, the others could have also planned or migrate to 34nm! However, except for Samsung, all of the suppliers are losing money in their NAND businesses now.

“Each supplier has a different product mix and strategy, so being aggressive during tough times is not a suitable approach for certain firms. Others also plan to migrate their process to sub 40 nanometers. However, Micron will be the first one that produces 34nm products this year,” adds Kim.

iSuppli has now cut its 2008 NAND annual flash revenue growth forecast from 9 percent to virtually zero. When the slowdown had already been predicted during the end of last year, what was the need to cut predictions?

Kim agrees that this is indeed the second cut this year. “We cut our forecast early this year to 9 percent, which was a dramatic reduction from the more than 20 percent growth forecast previously. I believe, we were the first research firm that cut the market growth dramatically this year, followed by other research firms.

“The NAND flash market is relatively new and has lots of growth potential. However, oversupply issues, along with weak consumer spending, prompted us to cut the growth outlook further this time.”

Coming to the subject of solid-state drives, what are the chances of SSDs in helping with a turnaround in the NAND market? Or, are they (SSDs) hyped?

“I should not say SSDs (solid-state drives) are overhyped,” adds Kim. “There are lots of issues that the industry must overcome when bringing SSD technology to the real world. Hard disk drives (HDDs) have been used in PCs for more than 30 years, so the movement to SSD technology won’t be very rapid.”

iSuppli had predicted that SSDs would not impact the market this year or next year. The real prime time for SSD adoption will be in 2010. There are many optimization problems associated with SSDs, which is typical at an early stage in the technology industry. By 2011, iSuppli believes SSDs will be the number one NAND flash market driver in terms of dollar value.

iSuppli also believes that the global NAND flash per-megabit average selling price (ASP) will decline by about 60 percent in 2008, compared to its previous forecast of a 56 percent decline. On quizzing, he says, “As mentioned, the NAND flash market, even in third-quarter, holiday season, won’t have a turn around, which brings the ASP down to the 60 percent level.”

When NAND is taken out of the equation, how does the semiconductor industry look like? iSuppli believes that the 2009 global semiconductor market growth will be higher than that of this year. The semiconductor market is also cyclical, so it will be impacted by global GDP growth this year.

Finally, how does the research firm forsee Nymonyx (there was an article saying it will conquer NAND Flash)?

According to Kim, Numonyx is still a major NOR flash supplier with limited NAND flash market share. Unlike Intel, Numonyx’s focus is on mobile applications. Its joint-venture partner, Hynix, is scaling down its NAND flash production at this time and is focusing on DRAM production.

iSuppli doesn’t expect Numonyx to be a formidable competitor in the NAND flash memory market during the near term.