Archive

Overview of emerging power management opportunities

The conference participants were:

* Stephan Ohr, panel moderator and research director, Analog and Power Semiconductors, Gartner Inc.

* John Pigott, Freescale fellow, and analog IC guru and designer, Freescale Semiconductor.

* Ralf J. Muenster, director strategy and business development, National Semiconductor.

* Wayne Chen, VP for Technology and Operations, Triune Systems.

* Lou N. Hutter, SVP and GM, Analog Foundry Business Unit, Dongbu HiTek Semiconductor.

Gartner’s Ohr started by indicating Gartner’s position on power management products. The standard analog ICs were a $15.2 billion market globally in 2009. Voltage regulators made up $7,394 billion, amplifiers $2,675 billion, data converters $2,567 billion, other analog $1,331 billion, and interface ICs $1,198 billion, respectively.

Voltage regulators – power management ICs accounted for 48.8 percent of the analog market. Voltage regulators continue to show strongest growth, growing at a CAGR of 11.1 percent for the period 2009-2014.

Power management ICs forecast

The global revenue forecast for power management ICs by market segment is as follows:

Military and aerospace: This is likely to grow at a CAGR of 3.2 percent during 2009-14.

Industrial/medical: This is likely to grow from $1,118 million in 2009 to $1,779 million in 2014, at a CAGR of 9.7 percent.

Automotive: This is likely to grow from $415 million in 2009 to $622 million in 2014, at a CAGR of 8.4 percent.

Communications: This is likely to grow from $529 million in 2009 to $988 million in 2014, at a CAGR of 13.3 percent.

Wireless: This is likely to grow from $1,353 million in 2009 to $2,149 million in 2014, at a CAGR of 9.7 percent.

Storage: This is likely to grow at a CAGR of 13.3 percent during 2009-14.

Computing: This is likely to grow from $2,114 million in 2009 to $4,013 million in 2014, at a CAGR of 13.7 percent.

Consumer: This is likely to grow from $1,627 million in 2009 to $2,564 million in 2014, at a CAGR of 9.5 percent.

Server and wired communications remain the biggest drivers.

Emergence of BCD technology

Lou Hutter from Dongbu HiTek discussed the technology considerations for emerging power management markets. He focused on the emergence of BCD (Bipolar/CMOS/DMOS) technology.

There are multiple benefits of BCD technology. These include integration of bipolar, CMOS, and DMOS components. It enables the integration of logic, analog control, and power on same die. It also enables high-and low-voltage, and high-and low-power functions on same die. BCD further enables reduced chip count, and improves reliability through fewer package interconnects. It also enables reduced BOM costs.

Emerging markets, such as automotive, solar and energy harvesting, stand to benefit from BCD. Dongbu is offering the 0.18um platform, which boasts of IP portability and more. Dongbu is offering the BD180LV-30V power process (Epi), to be followed by the BD180LV-30V power process (Non-Epi) in 3Q10, the BD180X 40-60V power process in 4Q10, and finally, the HP180 precision analog in 2Q11.

Hutter explained the BD180LV-30V Optimized Power and BD180X – 60V Optimized Power processes. Optional modules in Dongbu Hitek’s BCD technology include Schottky Diode, thick Cu, PLDMOS, NVM, low power CMOS, low noise CMOS, respectively. Read more…

Freescale intros MPC830x PowerQUICC II Pro portfolio

Sunil Kaul, product marketing manager, Networking and Multimedia Group, Freescale, said that the MPC830x portfolio extends the e300 core-based PowerQUICC II Pro architecture into cost competitive networking and industrial applications with increased performance per price/power.

Freescale announced the following portfolio:

MPC8306/S – 133 to 266 MHz: The MPC8306 integrates QUICC Engine, CAN, USB, SDHC and IEEE 1588 support ideal for industrial control, factory automation and test/measurement equipment.

MPC8306S: It features the QUICC Engine (HDLC/TDM, 10/100) and USB targeting networking equipment such as low-end base station line cards and branch access gateways.

MPC8309 – 266 to 400 MHz: Richly featured with QUICC Engine, CAN, USB, SDHC, PCI and IEEE 1588 support for networking, industrial control, factory automation and test/measurement equipment.

Target applications for the MPC830x include:

Kumar Hebbalalu, product development manager, NMG/CSP, Freescale, added that the complete design has been done out of Freescale India.The MPC830x communications processor portfolio was designed at Freescale’s India Design Center using advanced SoC design methodologies and techniques to achieve quick cycle times from product definition to silicon qualification. He added: “We have a large R&D team here. We are leveraging the ODC support we have in India.” Read more…

Providing 'real solutions' will be next challenge for IC suppliers

Increasing complexity means that the OEMs are now relying heavily on the IC suppliers for system-level support and software development. Also, connected intelligence, which is really blurring the traditional market boundaries. This requires system-level expertise combined with the knowledge of multiple market technologies.

There is also a great need for innovation teamwork, which would require focusing on the entire product value chain — starting from definition and design on to software and support. Delivering ‘real solutions’ would involve wrapping the ecosystems around OEM application expertise to create value through differentiation.

ST/Freescale intro 32-bit MCUs for safety critical applications

Early this month, STMicroelectronics and Freescale Semiconductor introduced a new dual-core microcontroller (MCU) family aimed at functional safety applications for car electronics.

These 32-bit devices help engineers address the challenge of applying sophisticated safety concepts to comply with current and future safety standards. The dual-core MCU family also includes features that help engineers focus on application design and simplify the challenges of safety concept development and certification.

Based on the industry-leading 32-bit Power Architecture technology, the dual-core MCU family, part-numbered SPC56EL at ST and MPC564xL at Freescale, is ideal for a wide range of automotive safety applications including electric power steering for improved vehicle efficiency, active suspension for improved dynamics and ride performance, anti-lock braking systems and radar for adaptive cruise control.

Freescale/STMicroelectronics JDP

The Freescale/STMicroelectronics joint development program (JDP) is headquartered in Munich, Germany, and jointly managed by ST and Freescale.

The JDP is accelerating innovation and development of products for the automotive market. The JDP is developing 32-bit Power Architecture MCUs manufactured on 90nm technology for an array of automotive applications: a) powertrain, b) body, c) chassis and safety, and d) instrument cluster.

STMicroelectronics’ SK Yue, said: “We are developing 32-bit MCUs based on 90nm Power Architecture technology. One unique feature — it allows customer to use dual core or single core operation. The objective of this MCU is to help customers simplify design and to also reduce the overall system cost.

On the JDP, he added: “We will have more products coming out over a period of time. This JDP is targeted toward automotive products.”

Commenting on the automotive market today, he said that from June onward, the industry has been witnessing a gradual sign of recovery coming in the automotive market.

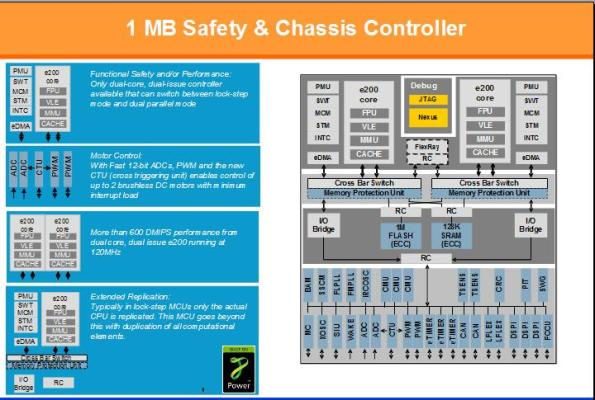

1 MB safety and chassis controller -- 32-bit MCU courtesy Freescale/STMicroelectronics joint development program (JDP)

Automotive market challenges

There has been an increasing integration and system complexity. These include:

* Increasing electrification of the vehicle (replacing traditional mechanical systems).

* Mounting costs pressure leading to integration of more functionality in a single ECU.

* Subsequent increase in use of high-performance sensor systems has driven increased MCU performance needs.

There are also increasing safety expectations. Automotive system manufacturers need to guarantee the IEC61508 (SIL3) and ISO26262 (ASILD) system-safety capability. Also, a move from passive to active safety is increasing the number of safety functions distributed in many ECUs.

Finally, there is a continued demand for quality — in form of zero defects, by which, a 10x quality improvement is expected.

MCU family addresses market challenges

The MCU family offers exceptional integration and performance. These include: high-end 32-bit dual-issue Power Architecture cores, combined with comprehensive peripheral set in 90nm non-volatile-memory technology. It also provides a cost effective solution by reducing board size, chip count and logistics/support costs.

It also solves functional safety. The Functional Safety architecture has been specifically designed to support IEC61508 (SIL3) and ISO26262 (ASILD) safety standards. The architecture provides redundancy checking of all computational elements to help endure the operation of safety related tasks. The unique, dual mode of operation allows customers to choose how best to address their safety requirements without compromising on performance.

The MCU also offers best-in-class quality. It is design for quality, aiming for zero defects. The test and manufacture have been aligned to lifetime warranty needs.

The MCU family addresses the challenges of applying sophisticated safety concepts to meet future safety standards. Yue added, “There are two safety standards — we are following those guidelines.” These are the IEC61508 (SIL3) and ISO26262 (ASILD) system-safety capabilities.

The automotive industry is also targeting for zero defects. “Therefore, all suppliers in tier 1 and 2 need to come up with stringent manuyfaturing and testing process that ensures zero defects,” he said.

32-bit dual-issue, dual-core MCU family

Finally, why dual core? Yue said that the MCU helps customers to achieve to achieve safety and motor control. Hence, dual core will definitely help deliver results.

“In many automotive applications, especially in safety-related applications, we want to have redundancy for safety. In the lock-step mode, two cores run the same task simultaneously, and results are then compared to each other in every computation. If the results are not matched, it indicates that there are some problems.”

This MCU family definitely simplifies design. It uses a flexible, configurable architecture that addresses both lock-step and dual parallel operation modes on a single dual-core chip. Next, it complies with safety standards.

A redundant architecture provides a compelling solution for real-time applications that require compliance with the IEC61508 SIL3 and ISO26262 ASIL-D safety standards. It also lowers the systems cost.

Dual-core architecture reduces the need for component duplication at the system level, and lowers overall system costs.

Top 20 semicon rankings Q2-09 — TSMC climbs up, AMD slips down!

Very interesting, isn’t it? And I am not surprised! TSMC deserves to move up the top 20 semiconductor companies rankings!! It seems that AMD especially needs to really get its act together.

First, to the rankings. Recently, IC Insights released the list of the top 20 semiconductor sales leaders during Q2-09.![]() Source: IC Insights

Source: IC Insights

In this list, there are four fabless semiconductor companies — Qualcomm, Broadcom, MediaTek and Nvidia in the top 20, and one foundry — TSMC, perhaps, emphasizing the growing influence of TSMC as well as the fabless semiconductor companies.

AMD slips! Again?

I had written a couple of posts some time back on AMD and Intel, where the former had commented on the EC ruling on Intel, and also how both were at each other’s throats, and had asked the question — how will all of this help the market?

Well, one hopes that AMD will come back very much stronger in the next quarter, despite its uninspiring guidance for 3Q09, saying that it expects its sales to be “up slightly” from 2Q09.

TSMC, Hynix, MediaTek shine

Coming back to the table, the clear movers are TSMC, and no surprises there, as well as Hynix and MediaTek. In fact, with a little better Q3 performance, TSMC could well move up to the third position, overtaking both Texas Instruments and Toshiba.

Look at the last column — the 2Q09/1Q09 percentage change — TSMC has grown by a whopping 93 percent! One other thing! TSMC is reportedly eyeing business opportunities in solar photovoltaics and LEDs in a bid to diversify its revenue channels. Should these happen, expect TSMC to move up higher!

The closest to TSMC in terms of growth are Hynix at 40 percent and Qualcomm at 36 percent, respectively. MediaTek, another impressive mover, grew by 20 percent. Of course, there is Samsung as well, with 29 percent growth.

ST, Micron, Nvidia and NXP have done well too! According to IC Insights, Nvidia replaced Fujitsu in the Q2-09 top 20 rankings. And that brings us to the shakers or those who fared poorly.

Fujitsu, AMD, Freescale slide!

I’ve already touched upon AMD. Fujitsu cited flash memory and automotive device sales to have suffered immensely this quarter. However, it hopes Q3 will be better and said that customer demand was picking up. So, it could well be back in the Top 20 during Q3.

Yet another slip was in store for Freescale. It slipped from 16th position in 2008 to 18th position during Q1-09, and slid further to 20th position in Q2-09. Perhaps, overdependance on automotives has been its undoing.

An interesting statistic from IC Insights — Fujitsu, with -9 percent and Freescale, with -2 percent growth, were the only two top-20 companies from Q1-09 to register a 2Q09/1Q09 sales decline!

Wonderful industry guidance

It is heartening to see 19 of the 20 companies registering positive growth this quarter. It won’t be improper here to commend IC Insights on its wonderful industry guidance!

In an IC Insights study from late December 2008, it was very vocal in advising firms to adopt a quarterly outlook! It also forecast a significant rebound in the IC market beginning in the third quarter of the year!

IC Insights also stood out by pointing out in early July that H2-09 is likely to usher in strong seasonal strength for electronic system sales, a period of IC inventory replenishment, which began in 2Q09, and positive worldwide GDP growth.

IC Insights had marked 4Q08 as the beginning of the downturn/collapse and Q1-09 as the bottom of the cycle. This quarter (Q2) has largely been a replenishment phase for the inventories. Going by that count, Q3 could well see a true seasonal increase in demand. IC Insights also said that during Q4-09, market growth will mirror the health of the worldwide economy and electronic system sales.

There is light, after all, at the end of the tunnel! Wonder why are the industry folks continue to tell each other — we still aren’t having a good time! Maybe, it is time for them to shed their pessimism and from holding back on investments, and move on to show steely optimism, and indulge in really aggressive buying and selling! After all, work and progress will happen ONLY if you work!!

ISA Vision Summit 2009: Indian design influence, ideas to volume

This post is slightly delayed given the fact that I’ve been travelling! Here it is: Session 2 of Day 1, ISA Vision Summit 2009!!

The still quite young, Indian semiconductor industry has come a long way! Making his opening remarks during the session: Indian Design Influence, Ideas to Volume, Jaswinder Ahuja, Corporate Vice President & MD, Cadence Design Systems India, and chairman, pointed out that earlier, it used to be ‘made by the world, FOR India.’ However, globalization of design has now put India on the world semiconductor map. Today, it is ‘made by the world, IN India.’

The picture here shows Ahuja making a point, while Freescale’s Ganesh Guruswamy, TI’s Dr. Bobby Mitra and Intel’s Praveen Vishakantaiah are all attention.

The picture here shows Ahuja making a point, while Freescale’s Ganesh Guruswamy, TI’s Dr. Bobby Mitra and Intel’s Praveen Vishakantaiah are all attention.

The electronics systems production is clearly moving eastward. Even though the chip fabs may not happen in India, systems manufacturing is certainly happening. The emerging markets today offer a $5 trillion opportunity. However, the transformative challenge is: how to marry low cost, good quality, sustainability and profitability simultaneously!

Fantastic opportunity for investing in technology

Praveen Vishakantaiah, President, Intel, added that India has a fantastic opportunity ahead for investing in technology. He cited Intel’s examples, such as: products designed in India for global market — Intel Xeon 7400 processor; designed in India for India and emerging markets — Classmate PC, which was prototyped in India; and designed in India and customized for the local market — PoS retail kiosk solution.

Internal factors related to volume development include: unique market needs, designing for reliability, enabling customers — standard globally but varied in India. External factors include: access to customers — which can be challenging in a varied market such as India, access to employable talent, predictable supply chain, robust infrastructure — digital infrastructure should scale simultaneously with design and development, and proactive policies and regulations.

According to Vishakantaiah, there is a need for a call to action and seize opportunities. This means, capitalizing on opportunities for local and global product designs, increase the impact and build end-to-end competencies, and to continue to move up the value chain. There is a need to address the internal factors. This would enable increasing the quality of products and extend local products into global markets. There is also a need to focus on the enabling the local market for global product companies.

As far as the external factors are concerned, there is a need to be proactive to remove barriers. There is a need to also encourage research, faculty development and new curriculum. India also needs to build energy efficient power, logistics and manufacturing capabilities, and also reduce e-waste and think green for all product designs.

Downturn creates huge opportunities

Ganesh Guruswamy, Director and Country Manager, Freescale Semiconductor India, remarked that even the deepest downturns can create huge opportunities for companies and countries. “Continuing to innovate during the downturn is important,” he added. It is therefore, time for India to step up, put the right innovations in place and grow.

He stressed upon several custom solutions for emerging markets, such as two-wheelers, which dominate, e-bikes, which are said to be the future, LED lamps, power inverters, irrigation pumpset powered by solar, smart energy meters, and solar/PV base station and carrier based equipment for telecom.

Medical tourism is an emerging focus area for India, as it is growing by 30 percent each year. Medical tourism is likely to bring $1-2 billion to India by 2012. In this context, Guruswamy highlighted Freescale’s ECG-on-a-chip solution. According to him, the way forward would involve moving away from a design mindset to a product mindset!

Don’t be dwarfed by glamorous industries!

Dr Bobby Mitra, MD, Texas Instruments India, said that India is witnessing a change in its semiconductors agenda — from R&D to R&D + market growth. If followed properly, it can become a game changing agenda. “India has nearly 2,000 OEMs designing electronics products. That’s the untapped potential,” he said.

Most of the customers are smaller companies — the proverbial long tail. They know semiconductors and electronics very well. Such companies need to be measured by the firebrand innovation going on at those places.

Dr. Mitra said: “The products have to be the right kind of products. If they are complex, it is incidental.” He cited defense and aerospace as very strong spaces, while industrial is also an equally strong opportunity area. “We should not be dwarfed by glamorous industries,” he cautioned.

In the near term, the Indian semiconductor industry needs to develop two new stripes. These are: a high degree of customer centricity so it can be brought into the R&D engineer’s minds, and have an application mindset — India is very good in design work; it now needs to develop applications in the current context.

Dr. Mitra also called upon having research as an agenda for the industry. This can be done in areas that would assume importance in future. “By working with customers, we can make products more intelligent, by adding electronics and semiconductors,” he advised. “All of us have a key role to play in this transformation.”

SMEs, in particular, have a major role to play. Intel’s Vishakantaiah said that MNCs would need to mentor and coach such companies. Freescale’s Guruswamy added that MNCs can either help them grow or buy them out.

Dr. Mitra advised that even if customers didn’t provide business, it would pay to remain close to them. He also referred to TI’s Beagle Board, an open and low-cost platform, which enables development of applications. However, he advised the industry to be realistic about mass customization.

Consumer MEMS shine amid gloom: iSuppli

I was fortunate enough to attend a webinar on MEMS organized recently by iSuppli. The webinar looked at the growth potential of this segment, especially during the downturn, as well as some top MEMS suppliers.

According to Jeremie Bouchaud, director & principal analyst, both consumer and mobile MEMS supply has been exploding. The overall MEMS market is likely to grow from $1 billion in 2006 to $2.5 billion in 2012! There will be strong acceleration due to growth of cell phones — a hotbed for MEMS, he said.

According to Jeremie Bouchaud, director & principal analyst, both consumer and mobile MEMS supply has been exploding. The overall MEMS market is likely to grow from $1 billion in 2006 to $2.5 billion in 2012! There will be strong acceleration due to growth of cell phones — a hotbed for MEMS, he said.

However, the share of MEMS for rear projection TV is vanishing. A market worth $300 million in 2006 is slowly disappearing, and will, in fact, disappear by 2012. Among other growth areas, personal navigation devices (PNDs) and remote controllers will also see growth.

Consumer and mobile market by MEMS device

The main segments include accelerometers, as well as gyroscopes, RF MEMS switches and capacitors, microphones, etc. The penetration of MEMS devices in CE products is said to increase quite fast.

MEMS growth in cell phones will be faster. It will grow from 3 percent in 2007 to 10 percent in 2008. All of the new, best selling smartphones, such as the iPhone, Nokia N95 and N96, Samsung Omnia, HTC Diamond, Google G1, Blackberry Storm, new Palm OS, etc., have accelerometers. A number of mid range phones also have accelerometers, eg. Sony Ericsson’s models.

MEMS usage is also growing in gaming. From 1998-2005, there was technology push with limited success. However, in 2006, Nintendo showed the way with its Wii, as did the Sony PS3. Microsoft did not enter this field back then!

Interestingly, 2006-08, motion sensing unveiled new, untapped target groups for gaming — the so called casual gamers. In Xmas 2008, Microsoft also embraced motion sensors with accessories. Hence, the penetration of motion sensors has really improved. The next third generation platform will include accelerometers and gyroscopes.

Top 15 MEMS suppliers

The key question: who all are shipping these products? According to iSuppli,The top 15 MEMS suppleirs for CE and mobile phones are: STMicroelectronics, Texas Instruments, Avago Technologies, Knowles, Analog Devices, Murata, Kionix, Epson Toyocom, Invensense, Panasonic, Bosch Sensortec, Freescale, Hokoriku, VTI and Memsic.

Some other companies to watch are:

Accelerometers and gyroscopes: Qualtre, Oki, Wacon, Alps, Virtus, Ricoh.

Pressure sensors: Intersema (MEAS), Metrodyne.

Microphones: Infineon, Wolfson, Memstech, Yamaha, Omron, Panasonic, MEMSensing, AAC, Goertek.

Pico-projectors and other MEMS displays: Microvision, Nippon Signal, Samsung, Konica Minolta, Scanlight, Qualcomm, Pixtronix, Unipixel

RF MEMS switches and capacitors: Wispry, Epcos, RFMD, Baolab.

MEMS oscillators: SiTime, Discera, NXP, Seiko, Intel.

BAW filters: Triquint, Skyworks, MEMS Solutions.

MEMS actuators for autofocus and zoom: Simpel, Sony.

Micro-fuel cells: Angstrom, Tekion, Medis.

It is understood well that not all of these companies will be successful. However, they all need to be monitored carefully.

Commenting on cell phones as a hotbed for inertial and magnetic sensors, Dr. Richard Dixon, senior analyst MEMS, iSuppli, said that the market for accelerometers, gyroscopes and magnetometers is in cell phones. This market will reach $730 million in 2012. Gyroscopes are not in the market yet, and are likely to enter by 2010. The total growth rate is very fast. In units, the annual growth rate is said to be 97 percent.

Interestingly, Apple has contributed significantly to growth of MEMS. The iPhone had a great application. Other vendors followed suite with a ‘me too” strategy. Apple also had sustainable business model with downloads on the Apple Store. The chicken and egg issue of price was solved. Also, with the iPhone, there was a free field test of motion sensing based applications.

Major suppliers of accelerometers for cell phones today, include STMicroelectronics, Bosch Sensortec, Analog Devices, Hokuriku, Kionix, MEMSIC, Freescale, Oki. Of these, ST has really been very impressive, while Bosch saw impressive growth in 2008. MEMSIC dropped share in 2008.

Navigation in cell phones next big thing

According to Dixon, navigation in mobile phones is the next big thing. Leading navigation markets by platform are: mobile phone navigation, smartphone navigation, PNDs, car aftermarket and car OEM in-dash, respectively. By 2010, the mobile phone/smartphone navigation segment will account for over 60 percent of the market.

Similarly, magnetic sensors will take off in 2009 for e-Compass. There has been penetration of magnetometers in GPS phones. They have been around since 2003 in Japanese phones. These rather esoteric applications and also had technical issues.

There were successful implementations in 2008 for navigation. Eg., the G1 Street View, and the Nokia 6210. Also, 3D compass in combination with 3D accelerometers.

The leading suppliers in this space today, include AKM, Honeywell, Yamaha, Aichi Steel. In the R&D segment, the leading players are said to be Alps, Omron, Memsic, Oki, ST, Freescale, Demodulation. Growth will be steep from 2009 onward, and take off from 2010 up to 2012.

Another growth are is the multi-sensor packages and IMUs (Inertial Measurement Unit) for navigation. Today, we have six-axis e-compass combining magnetic sensors and accelerometers. In future, there will be IMU for LBS and indoor navigation also using gyroscopes.

The issue with gyroscopes is of: performance, price, size, power consumption and no availability of three-axis. Companies that need to be watched in this space are said to be Invensense, ST, Bosch Sensortec, Qualtre, Oki, Virtus.

Other opportunity areas

Later, Jeremie Bouchaud highlighted two other opportunity areas.

MEMS microphone market presents a major opportunity. It will reach close to $400 million by 2012. In 2008, already 325 million units were selling in cell phones and laptops. Leading players in this segment are said to be Knowles, Akustica, Infineon, Sonion, Memstech, AAC. Knowles has over 90 percent of the market share.

MEMS pico projectors is another growth area. Companies have made lot of progress in this segment. The pico projectors come in various varieties.

In the MEMS scanner based segment, the R&D is led by firms such as Microvison, Konica, Minolta, Scanlight, Nippon, Signal, Symbol. These solutions came first as stand alone projectors. Later, it will come on cell phones. The best opportunity is said to be at the module level.

Another sub-segnent is the DLP based projectors. First it will be in form of a pico-projector, later, followed by usage in cell phones.

Bouchaud advised watching out for non-MEMS alternatives, such as Light Blue Optics,

3M and Logic Wireless.

Coping with commoditization and price erosion

The ASP of MEMS devices for CE and mobile phones is dropping at -13 percent per year. So, what are the ways to get profitable?

To be profitable, there is a need to achieve economies of scale by combining consumer and automotive. Also, there is a need to

move wafer size to 8-inch. Next, there is a need for externalizing to foundries. ADI and TSMC have already showed the way. Now, USMC, Tower, Dongbu, Magnachip, Omron, etc., are following.

Innovation, in terms of packaging and 3D integration, test, multi-sensor packages, is another way for making profits. There is an opportunity for the equipment suppliers as well.

Consumer MEMS is currently glowing as a light in today’s dark times! It is said to grow from $1 billiom in 2006 to $2.5 billion in 2012, with 19 percent CAGR. This optimistic forecast has already started. Accelerometers are present in 10 percent of cell phones in 2008 as against 3 percent in 2007.

There exist a number of opportunities. Small companies can be successful, eg. Kionix and Invensense. There are still opportunities for newcomers. These can be large companies, fabless startups, foundries, software companies, equipment suppliers, etc. Consumer MEMS is an extremely dynamic market, having fast design cycles.