Archive

Embedded Vision Alliance (EVA) is born!

The Embedded Vision Alliance is born! Over 15 leading technology companies, including some really big names in semiconductors, have come together in Oakland, USA, to ‘ speed the adoption of computer vision capabilities in electronic products’.

BDTI, Xilinx, and IMS Research initiated the Embedded Vision Alliance (EVA) and are being joined by Analog Devices, Apical, Avnet Electronics Marketing, CEVA, CogniVue, Freescale, National Instruments, NVIDIA, Texas Instruments, Tokyo Electron Device, MathWorks, Ximea, and XMOS as founding members.

According to a release, the ability of machines to see and understand their environments—what we call “embedded vision”—promises to transform the electronics industry with products that are more intelligent and aware of their environments, and to create significant new markets for electronic equipment and components.

This new consortium, called the Embedded Vision Alliance, will enable the proliferation of embedded vision technology by providing design engineers with information, practical know-how, and industry standards.

While the participants in this Alliance need to be congratulated for their foresight, one wonders what took them so long!

Also, I do not see any Indian company in the list, although, the embedded systems and software industry here is quite large. Names, such as Ittiam, Tata Elxsi, etc., should be part of this Alliance, but they are absent, as of now!

Now, the EVA’s commitment is to vision technology and enabling customers to develop the industry’s most innovative hardware, development tools and software to make vision application development easier. One of the founders has commented that embedded vision will be used on automobiles to prevent accidents and to security cameras to prevent crimes. Should this happen, embedded vision will surely proliferate across a multitude of markets! We are all waiting really patiently for such days!

No real fun being at DAC or ESC! Seriously!!

The 48th Design Automation Conference (DAC) kicks off in about a month’s time in San Diego, California, USA. I have been flooded with invites. There’s also an Embedded Systems Conference starting tomorrow, in San Jose. However, I will give both of the events a miss! Why? Simply because of one fact! The EDA industry has stopped surprising me! And, so has the embedded systems industry!!

I an very well aware of the changing and ‘challenging’ trends in the global semiconductor industry. I should also add that I do have at least some knowledge of the global EDA industry in 2010 and its expectations for 2011.

I am aware of the fact that product lifecycle management involves reducing the time-to-market cycles for new product introduction. Industry folks have, time and again, apprised me of the fact that there is a need to bridge the gap between software and hardware – and growing the IT and VLSI industries.

Cadence, for instance, will share a new technology that addresses some of the toughest challenges detailed in the EDA360 vision at ESC 2011. For how long will the challenges be met? Synopsys seems to be raking in the dollars, year after year. Mentor, despite its ‘current issues’, has been doing fairly well. So, what’s new over here?

In embedded, it is very well known globally, that India is an emerging leader. Otherwise, there is hardly any electronics or semiconductor related manufacturing happening in India, despite the best efforts of the ISA.

So, why isn’t all of this being viewed as industry growth? Maybe, you have all the answers! I will only try to sound more optimistic, without creating additional pain!

Almost all of the new techniques and technologies to be announced at either conference, will or already have made their way to India. Or, the companies using them are not allowed to speak about them, at best!

SFO – India's leading ODM player!

Thanks to Soni Saran Singh, executive director, NMTronics India Pvt Ltd, I was able to attend a ‘Global Supplier Meet’ at The NeST Group, Kochi, who’s flagship company, SFO Technologies is India’s number 1 ODM player.

I first heard of the NeST group when I was last in Kochi, covering the Photonics event organized by Cochin University of Science & Technology. Today, I had a full introduction! The NeST group started operations in 1991. Now, it is a $220 million dollar company, and well, India’s premier ODM player!

More later 😉

Top 10 Indian embedded companies!

It has been over two years since I wrote the piece — Top 10 embedded companies in India! It has been the most read, and by far, the most commented. Now, it is time to do a review, or, more suitably, a recap!

First, who are the top 10 (Indian) embedded systems and software companies in India? My list, in no particular order, would read something like this:

1. Ittiam

2. Sasken

3. CMC

4. C-DAC

5. L&T EmSyS

6. ProcSys

7. eInfochips

8. Mistral

9. iWave Systems/Global Edge

10. Vayavya Labs

There are several firms in Pune and Hyderabad, who probably deserve a name. There may be some folks may not agree with this list, but I would go with these, for now. The next change could be two years down the road!

Some may even question the presence of CMC and C-DAC in this list. However, CMC has well over 30+ years of extensive experience in providing consulting, design and development services and testing services in real-time systems.

C-DAC has capabilities in high-performance computing as well as grid computing. It also has unit focusing on professional electronics, including embedded and VLSI products.

Ittiam and Sasken remain in the top 5 category. ProcSys is a new entrant, besides iWave, Global Edge and Vayavya Labs.

Now, may I know if you have any doubts, as well as moves, additions and/or changes (MAC)? 😉

Is the Indian semicon industry losing the plot?

Every time I see a new electronics or related segment being talked about in India — be it medical electronics/healthcare, RFID and smart cards, or for that matter, telecom, why do I get this feeling that the Indian semicon industry is slowly losing the plot? One hopes not!

The Indian technology industry is talking about practically everything, except semiconductors. Yes, I know we have a great pool of designers who work in the MNCs. Also, there are plenty of Indian design services companies doing excellent work (for others?). India’s strength in embedded is folk lore. Despite all of this, we are, where we were a few years ago!

Back in 2007, I’d done a story on how there were very remote chances of having a fab in India. Back then, some industry folks expressed optimism that the fab story was not dead! However, that story is well and truly dead and buried, as of now! Today, no one wants to talk about a fab — fine, then!

Let’s do a reality check on India’s semiconductor score-card!

So far, India has not even managed to have a small foundry, forget about having a fab! Nor has the Indian industry managed to develop, nurture and build many (or any?) fabless companies of note. Can you tell me how many Indian fabless semicon companies have come up in the past five years? How many globally known Indian semicon product start-ups are there in our country for that matter? Okay, how many Indian semicon product start-ups are there in our country?

For that matter, how many ATMP units have come up in India? I do recall some industry folks mention in the past that there will be some ATMP units happening. Where are they? Okay, who, in India, is even trying to develop IP libraries?

Even if there is some success in building electronic product companes — that is and will be limited success! Neither is there any evidence of cutting-edge R&D being done in India. Please do not mix this up with the work being done by the Indian arms of the various MNCs.

Why, I don’t even think that the industry-academia partnership has developed substantially, leave alone mature!

If medical electronics, or some other related area, were to go on and succeed in the near future, it would be counted as a success for the Indian electronics industry, and not for the Indian semicon industry! Even if this did happen and it was counted as a ‘semicon success, can anyone make a guess as to how many of the chips going into such devices would be actually made in India – by Indian firms?

I had mentioned back in Feb. 2009 that “Can the Indian semicon industry dream big? (And even buy Qimonda?)! To refresh your memory, there was a large 300mm fab up for sale in Dresden, Germany. Well, even that never happened, or well, the Indian industry did not think it to be of much importance!

Back in August 2009, there was news about Texas Instruments (TI) placing a bid of $172.5 million for buying Qimonda’s 300mm production tools from its closed DRAM fab. While this highlighted TI’s focus on building the world’s first 300mm analog fab, I can’t stop wondering: what would have happened had an Indian investor actually bought Qimonda’s fab!

Perhaps, it would be better for the Indian semicon industry to stick to its globally known strengths of providing excellent semiconductor design services and embedded design services. At least, there will be clear direction in these areas.

Of course, there exist huge opportunities in all of the areas (or gaps) that I’ve touched upon.

7 principles for bridging hardware and firmware divide: Gary Stringham

Embedded designers, are you having problems with the firwarre (embedded software) running on your hardware? For instance, do you wish to reduce chip respins? Or, would you like to improve on the hardware and firmware integration?

These and several related queries were answered by Gary Stringham, founder and president of Gary Stringham and Associates, LLC, USA, in an interactive session organized by the Bangalore Chamber of Industry and Commerce (BCIC), in co-operation with the US Commercial Service, Bangalore, and in association with the India Semiconductor Association (ISA).

Here are the seven principles that Stringham highlighted during his session. These principles should be of great interest to designers of embedded systems in India, and elsewhere. These are:

1. Collaborate on design.

I will add some more stuff for each one of these points, time permitting.

Round-up 2009: Best of EDA, embedded systems and software, design trends

Friends, the next installment in this series on the round-up of 2009 lists my top posts across three specific fields that are very important within the semiconductor industry — electronic design automation (EDA), embedded systems and software, and some design trends. Here you go!

EDA

Synopsys on Discovery 2009, VCS2009 and CustomSIM

State of global semicon industry: Hanns Windele, Mentor

New routing tool likely to cover upcoming MCMM challenges: Hanns Windele, Mentor

Cadence’s focus — systems, low power, enterprise verification, mixed signal and advanced nodes

Zebu-Server — Enterprise-type emulator from EVE

State of the global EDA industry: Dr. Pradip Dutta, Synopsys

Mentor’s Wally Rhines on global EDA industry and challenges

Mentor’s Wally Rhines on EDA industry — II

Cadence’s Lip-Bu Tan on global semicon, EDA and Indian semicon industry

Indian EDA thought leaders can exploit opportunities from tech disruption!

EMBEDDED SYSTEMS & SOFTWARE

Top 10 embedded companies in India — By the way, this happens to be the most read article of the year!

NI LabView solves embedded and multicore problems!

Intel’s retail POS kiosk provides unique shopping experience

ISA Vision Summit 2009: Growing influence of embedded software on hardware world

MCUs are now shaping the embedded world!

Embedded electronics: Trends and opportunities in India!

Growth drivers for embedded electronics in India

DESIGN TRENDS

Microcontrollers unplugged! How to choose an MCU

Xilinx rolls out ISE Design Suite 11 for targeted design platforms!

TI’s 14-bit ADC unites speed and efficiency

ST/Freescale intro 32-bit MCUs for safety critical applications

Again, I am certain to have missed out some posts that you may have liked. If yes, please do point out. Also, it is not possible for me to select the top 10 articles for the year. If anyone of you can, I’d be very delighted.

My best wishes to you, your families and loved ones for a happy and prosperous 2010.

P.S.: The next two round-ups will be on solar photovoltaics and semiconductors. These will be added tomorrow, before I disappear for the year! 😉

Growth drivers for embedded electronics in India

The strength of India’s embedded systems and software industry is well known globally. Naturally, interest is extremely high in this area.

Keeping that in mind, the India Semiconductor Association (ISA), recently organized a conference on “Embedded Electronics: Trends and opportunities in India”, during the BangaloreIT.biz event.

Speaking on the global electronics systems design and manufacturing ecosystem, BV Naidu, chairman, ISA, estimated the global electronics industry at $1.75 trillion for 2009, and projected to reach $2 trillion in 2014. The annual growth rate has been 3 percent for 2004-09.

India lags behind in (electronics) numbers!

India’s story is starkly revealed in its numbers. While the electronics industry is the key to national growth, India is extremely small in this segment. Taking telecom/electronics hardware production as a share of GDP, China has a GDP share of 12.7 percent, while India only has 1.7 percent share.

Even smaller countries, such as Korea — 15.1 percent, Taiwan — 15.5 percent, and Israel — 23.6 percent, respectively, have much higher GDPs. The share of USA is 5.4 percent, Japan — 4.5 percent, and Germany — 8.3 percent, respectively.

India’s domestic production, excluding imports, is $10.8 billion during 2009. Consumption reached $45 billion in FY09 and the demand is likely to reach $125 billion in FY 2014. The expected domestic demand will likely grow 22 percent from 2009-2020, reaching $400 billion by 2020. Exports reached $4.4 billion in FY09, and it is likely to reach $15 billion in FY14 and $80 billion in FY20, growing at 31 percent.

The trade imbalance is projected to increase to $323 billion by 2020 as the imports of electronic products are likely to increase to 16 percent of the GDP. As a result, it is important for some Indian companies to play a major role.

It has the potential to leapfrog!

There exists a tremendous potential for India to leapfrog technologies and lead. Potential exists in several areas such as wireless, smart meters (AMI), LEDs, green energy/energy efficiency, affordable devices/telemedicine, digital classrooms/virtual classrooms for education, digitization in terms of electronic society/unique ID/TV, radio, etc., integrated surveillance systems, and low-cost zero emission cars.

Touching on the VLSI/electronics ecosystem, Bangalore itself is home to over 90 companies in VLSI and embedded. However, most of these are arms of MNCs. High-tech manufacturing does not exist, as yet. However, the solar PV industry has been attractive recently, and high-tech manufacturing is likely to grow there. The silicon fab, however, may take some more time.

Within the Indian electronic system design industry, there are companies such as Ittiam, SemIndia, etc., who focus on made in India and made for India. Naidu called upon the government to encourage the domestic manufacturing and systems companies.

In this respect, the electronic components and accessories ecosystem industry is currently moderate. It used to be 15 percent and has now grown to 35 percent. That means, 35 percent of the costs of production can be sourced and managed using components from India.

India has managed to attract some EMS companies, especially to Sriperumbudur, an industrial town in the Kanchipuram district, Tamil Nadu. However, low end products are being developed, or rather, work that is at the low end of the value chain is being done. That needs to change! Here, embedded software can play a key role.

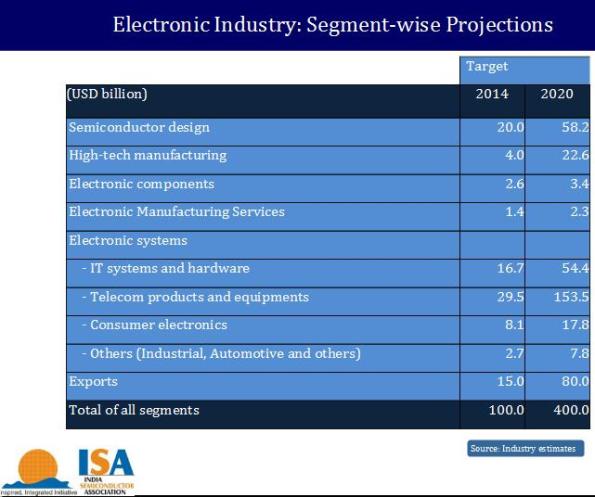

Segment-wise projections for the Indian electronics industry. Source: India Semiconductor Association (ISA)

“Our local markets should provide opportunities for the local companies. Access to global markets will help us grow,” he added. He presented segment-wise projections for the Indian electronics industry up to 2020 (see table). Read more…

Embedded electronics: Trends and opportunities in India!

I know this particular topic and headline is going to get lots of page views. However, I’ve something better in mind to tell all of you, especially those having an interest in embedded systems and software in India.

The headline is actually the theme of the India Semiconductor Association’s (ISA) E3 conference, which will be held during the forthcoming BangaloreIT.biz event next week!

What’s in store? Probably lots!

In the opening session, industry thought leaders from Ittiam Systems and SemIndia will be setting the tone on design and manufacturing perspective. The second session is actually a panel discussion — to be moderated by S. Janakiraman, President and Group CEO, Product Engineering Services, MindTree. The panelists are from KPIT Cummins, National Semiconductor, Wipro and Delphi. It should be interesting!

I will add some more thoughts on the trends and opportunities in the Indian embedded systems and software industry, although, I’ve mentioned those quite a few times in the past!

India’s strength in embedded

India’s strength in embedded is two-fold — embedded design – in both hadware and software. Also India’s manufacturing demand for electronic products is growing at 13 percent CAGR as per ISA-F&S report 2008.

Design of embedded systems and software

India is emerging as the chip design center for most global companies. There are three types of embedded activities currently happening in India. These are:

* Embedded products designed, developed and manufactured by Indian companies for local markets or for exports — such as local product companies.

* Design projects executed by Indian design services companies for global companies — such as Wipro, KPIT, etc.

* Transnational R&D companies functional in India, who are doing captive design projects for parent companies from India. — Delphi, Cisco, Intel, etc.

Verticals of growth

Coming to manufacturing part, this growth is happening across five-six verticals:

* IT and office automation (OA) — where desktops and laptops are the growth drivers.

* The second area is telecom — wireless infrastructure for GSM and CDMA; also mobile phone manufacturing is emerging as a big segment.

* Next comes consumer electronics, which is driven by STBs, MP3 playerrs, TV and audio systems, etc.

* In industrial electroncis — it is being driven by UPS, energy meters, etc.

* In automotive — we have over 7 million two-wheelers being manufactured in India. The electronic content within them is growing.

* Another opportunity is in medical electronics, smart cards — now with the national ID project as well as metros coming in, and also e-passports.

* Even defence and aerospace are growing areas.

Trends and opportunities in India

The emerging trends are in security surveillance, solar energy, and LED lighting.

* Surveillance — video and security surveillance are gaining strongly.

* Solar — basically, along with solar panels, you will need MPPT charge controllers as well as solar inverters. These will fuel growth.

* LED lighting — meant to replace kerosene lamps with LED, as well as street LED lighting and auto LED lighting, along with lanterns.

On the software side, India has more of software than hardware engineers. The reason being, In India, more work based on developing applications, programming of MCUs, device driver development, etc. are majorly happening here.

Hence, embedded software is a bigger element of the Indian industry.

Freescale's Rich Beyer on semicon and industry trends

Rich Beyer, chairman and CEO, Freescale Semiconductor

Since we met last year, the industry has experienced the greatest economic challenges in generations that had an unprecedented global impact, and no region has been immune from its effects.

From a global perspective, the markets are stabilizing, and we hope that the worst is over. However, in order to compete effectively, businesses will need to become more efficient and more agile, at least for the next few years.

One of the core purposes of this FTF is to demonstrate our efforts and progress in providing you with the best possible solutions to help develop products and systems that enable your companies to win.

On networking

In networking, multicore processors are essential to delivering the industry-leading levels of integration, performance and energy-efficiency required for next-generation communications systems.

To enable rapid prototyping for our microcontrollers, we have introduced the Freescale Tower System, a modular development platform with reconfigurable hardware that enables developers to mix and match MCU and peripheral boards to save both money and months of development time through rapid prototyping and tool re-use. Read more…

Random Posts

Tag Cloud

3G 32nm AMD ARM China chip design DRAM DRAMeXchange EDA EDA tools embedded design embedded systems and software fabless fabs FPGAs Freescale Future Horizons global semiconductor industry global semiconductor market Hynix IC Insights India Indian semiconductor industry Indian solar/PV industry India Semiconductor Association India semiconductor market Intel iSuppli low-power design Malcolm Penn memory market mobile phones NAND Qimonda S. Janakiraman Samsung SEMI Semicon Semiconductors solar solar/PV solar cells Synopsys Taiwan TICategories

- 22nm

- 32nm

- 3G

- 3G spectrum

- 40nm

- 450mm

- 45nm

- 4G

- 65nm

- 802.11n

- 90nm

- A.Raja

- Aart De Geus

- Abhi Talwalkar

- Accellera

- Accenture

- access control

- Agilent

- Altera

- Aluminum electrolytic capacitors

- AMD

- AMS

- Analog Devices

- analog ICs

- analog mixed signal

- analog/RF

- analog/RF competency center

- Anand Chandrasekher

- Anil Gupta

- Ankush Oberai

- Apple

- Apple TV

- Applied Materials

- AqTronics

- ARIB

- ARM

- Asia

- Asiaworld Expo

- ASICs

- ASML

- ASPs

- ASSPs

- ASUS

- Atom

- Atom processor

- AUSPI

- automotive

- automotive electronics

- Bali

- bandwidth costs

- Bangalore

- Bangalore Nano 2007

- Bangalore serial blasts of July 25

- Bangkok

- Barack Obama

- Beagle Board

- Beceem

- Beijing Olympics

- Belliappa Kuttanna

- biometrics

- BIPV

- Blackberry

- Blade.org

- bloggers

- Blogging

- blogs

- board design

- Bosch Sensortec

- Brazil

- Brent Przybus

- Broadband

- Broadcom

- building integrated photovoltaics

- BV Naidu

- C++

- C-DoT

- C-to-Silicon Compiler

- Cadence

- Calpella

- carrier Ethernet

- CDG

- CDMA

- CDMA Development Group

- CDMA2000

- CDNLive

- CEA

- CEATEC

- cell phones

- Cellworks

- Charlie Hartley

- Chartered Semiconductor

- Chelsio

- Chi-Foon Chan

- Chimera

- China

- China Mobile

- China Sourcing Fair

- China Telecom

- China's IC industry

- China/Hong Kong

- Chinese semiconductor industry

- chip design

- chip designers

- Chip fabs

- chip industry

- chip makers

- chip market

- chip suppliers

- chips

- Christian Gregor Dieseldorff

- CIOL

- CIOs

- Cir-Q-Tech

- cloud computing

- CMOS

- CMOS camera modules

- CMP

- co-verification tools

- COAI

- communications

- components

- COMPUTEX

- Computex Taipei

- computing

- connectors

- consumer electronics

- Converge Market Insights

- convergence

- converter solution

- Core i7 processor

- Corporate Social Responsibility

- Cosmic Circuits

- Cowans LRA model

- CPF

- CPLD

- CPM

- cross-license dispute

- cross-licensing

- crystalline solar

- CSF

- CSR

- Cuil

- CustomSim

- CWG

- Cyclone III LS

- Cypress

- Cypress Semiconductor

- DAB

- DAB radios

- Dale Ford

- data center energy measurement

- Datang

- DAVIC

- DECT

- Deloitte

- Delphi FormFactor

- Denali

- Department of IT

- Derek Lidow

- design challenges

- design services

- design services in India

- design tools

- designers

- developers

- Dexcel Electronics Designs

- DFM

- DFT

- Diachi

- digital cameras

- digital factory

- digital president

- digital still cameras

- Digitimes

- DISCO

- Discovery 2009

- disk drive controllers

- display driver ICs

- display drivers

- displays

- DisplaySearch

- DLNA

- DLP

- Dr Farooq Abdullah

- Dr Gordon Moore

- Dr. Ashok Das

- Dr. Bobby Mitra

- Dr. Chi Foon-Chan

- Dr. Ganesh Natarajan

- Dr. Henning Wicht

- Dr. J. Gururaja

- Dr. Li Shi-he

- Dr. Madhusudan V. Atre

- Dr. Rajiv Jain

- Dr. Robert N. Castellano

- DRAM

- DRAM industry

- DRAM manufacturers

- DRAM market

- DRAMeXchange

- DRC/LVS

- driver ICs

- drug discovery

- DSOA

- DSPs

- DTG

- DTH

- DTV

- Dubai

- Dubai Circuit Design

- Durga Puja

- E Ink

- e-book semiconductors

- E-books

- e-passports

- ebooks

- EC

- EC ruling

- ECG-on-a-Chip

- Eclypse

- EDA

- EDA Consortium

- EDA industry

- EDA products

- EDA tools

- EDGE

- EEPROMs

- eInfochips

- Elcoteq

- Elections 2009

- electronic components

- electronic design engineers

- Electronic Design Trends

- electronic designers

- electronic equipment

- electronic paper display

- electronics

- electronics components

- Electronics Hardware

- Electronics industry

- electronics products

- electronics supply chain

- Electronics Weekly

- Electrophoretic Display

- element14

- Elpida

- embedded

- embedded applications

- embedded computing

- embedded design

- embedded designers

- embedded devices

- embedded Internet

- Embedded Internet devices

- embedded jobs

- embedded Linux

- embedded processor

- embedded software

- embedded systems

- embedded systems and software

- EmSys

- emulator

- Encounter

- Encounter Digital Implementation

- energy

- energy efficiency

- Enterprise

- enterprise technologies

- enterprise verification

- Enterprises

- epaper

- EPD

- Epson Toyocom

- EPSRC

- ESL

- Ethernet

- EU

- Europartners

- European Commission

- EV-DO Rev. A

- EVE

- Extreme Networks

- fab capacities

- fab policy

- fab spends

- Fab-Lite

- FabCity

- fabless

- fabless companies

- Fabless Semiconductor Association

- fabs

- Fabtech

- Farnell

- FDSOI

- femtocells

- First Solar

- fixed-mobile convergence

- flash memory

- flexible displays

- flexible substrates

- Flextronics

- FMC

- FOMA

- Forward Concepts

- foundries

- foundry semiconductor market

- FPDs

- FPGA

- FPGA Central

- FPGA design

- FPGA design software

- FPGA market

- FPGA Seek

- FPGAs

- France

- Freescale

- Freescale Technology Forum

- Frost

- FTF 2008

- Fujicon

- Fujitsu

- Fukuoka

- Fully Depleted Silicon On Insulator

- Future Horizons

- G1

- Galaxy Custom Designer

- Gartner

- Garuda

- Gary Shapiro

- GateRocket

- GE Healthcare

- Germany

- Gigabyte

- GK Pramod

- global chip market

- global DRAM market

- global EDA industry

- global MEMS market

- global semiconductor industry

- global semiconductor inventory

- global semiconductor manufacturing industry. global semiconductor industry

- Global semiconductor manufacturing utilization

- global semiconductor market

- Global silicon photonics market

- global solar industry

- Global Sources

- global telecom industry

- GlobalFoundries

- Google phone

- Gordon Moore

- GPS

- graphical programming

- graphical system design

- green data centers

- green electronics

- GSA

- GSM

- Gurdas Kamat

- Hanns Windele

- HardCopy IV ASICs

- hardware

- hardware policy

- hardware/software co-verification

- hardware/software co-verification solutions

- Harriet Green

- Harshad Deshpande

- HDDs

- HDMI

- healthcare

- High-definition

- high-K gate dielectric

- high-K metal gates

- high-level synthesis

- Hitachi

- HKMG

- HLS

- Hokoriku

- Hon Hai

- HSMC

- HSPA

- HTC

- Huawei

- hybrid car

- Hynix

- i-mode phones

- i-phones

- IBM

- IBM Research Labs

- IC ASPs

- IC industry

- IC Insights

- IC market

- IC Validator

- ICICI Ventures

- ICs

- IDC

- Idea Cellular

- IDF

- IDF Taiwan

- IDM

- iDTV

- IEF 2009

- IIM-Bangalore

- IISc. Bangalore

- IIT Bombay

- IIT Kharagpur

- IIT Madras

- IIT-Kanpur

- iMac

- IMS

- IMT

- InCyte Chip Estimator

- India

- India Inc.

- India Semiconductor Association

- India semiconductor market

- India's first plug-in hybrid car

- Indian 3G policy

- Indian aerospace and defense markets

- Indian branded memory market

- Indian EDA industry

- Indian electronics industry

- Indian embedded industry

- Indian fab story

- Indian IT industry

- Indian semicon policy

- Indian semiconductor industry

- Indian solar industry

- Indian solar/PV industry

- Indian telecom

- Indian telecom industry

- Indrion

- industrial segments

- Infineon

- Infineon Asiaworld Expo

- Infosys

- Ingo Guertler

- innovators

- InnovLite

- Inoueki

- integrated access devices

- Intel

- Intel Atom processor

- Intel Core 2 Duo

- Intel Developer Forum

- intelligent video surveillance system

- International Electronics Forum (IEF)

- Internet

- Internet radio stations

- Internet radios

- intranets

- Invensense

- IP creation

- IP re-use

- iPad

- iPDK

- iPhone

- iPhone 3G

- iPod

- IPs

- IPSec

- IPTV

- ISA

- ISA Excite

- ISA Vision Summit 2009

- ISE Design Suite 11

- ISI Calcutta

- Israel

- Istanbul

- iSuppli

- IT

- IT processes

- IT/OA

- Ittiam

- Ittiam Systems

- ITU

- ITU Telecom Asia

- iTV

- IVSS

- James Reinders

- Japan

- Japan chip industry

- Japan's microelectronics industry

- Jaswinder Ahuja

- Jayamahal

- Jayaram Pillai

- Jérémie Bouchaud

- JEM

- Jennifer Lo

- JETRO

- JMCC

- JNCASR

- Jobs in FPGAs and CPLDs

- Jon Cassell

- Jonney Shih

- Jordan Plofsky

- Joseph Sawicki

- K. Subramanya

- Karnataka

- KCR

- Kexin

- Khasim Syed Mohammed

- Kionix

- Kirk Skaugen

- Kishor Patil

- Klaus Maler

- Knowles

- Kochi

- Kodiak Networks

- Korea

- Korea Electronics Show

- KPIT Cummins

- KUKA

- Kyushu

- LabView

- LabView 8.6

- Lanco Solar

- Lara Chamness

- LAS-CDMA

- last mile problem

- Laurin Publishing

- LCD

- LCD monitor panels

- LCD monitors

- LCD panels

- LCD TVs

- LCDs

- LED driver ICs

- LED lighting devices

- LED lights

- LEDs

- Lexmark

- LG

- LG Telecom

- life sciences

- LinkAir

- Linux

- lithography

- Lo Wu

- logic IC market

- logic synthesis

- low power

- low-cost handsets

- low-power design

- LSI Corp.

- LSI Logic

- LTE

- LUT

- Mac OS

- Magma Design Automation

- Malcolm Penn

- malware

- Man Yue

- Manoj Gandhi

- manufacturing hub

- Marco Principato

- Market for key system semiconductors

- Marnello

- material devices

- McAfee

- MCMM

- MCUs

- MEAS

- Measurement Specialties

- Mediacart

- MediaTek

- mega fabs

- MelZoo

- memory

- memory fabs

- memory market

- MEMS

- MEMS accelerometers

- MEMS devices

- MEMS foundries

- MEMS gyroscopes

- MEMS industry

- MEMS oscillators

- MEMS sensors

- Memsic

- Mentor Graphics

- Messe Munchen

- metro area networks

- MHEG-5

- Michael J. Fister

- micro fuel cells

- microcontrollers

- Micron

- Micronics Japan

- microprocessors

- Microsoft

- MIDs

- MII

- MIII

- Mike Cowan

- Mike Splinter

- military

- military market

- Min-Sun Moon

- Minalogic

- mini fabs

- Ministry of Communication and IT

- mixed signal

- ML-PCBs

- MNRE

- Mobile

- Mobile application operating systems

- mobile broadband

- mobile computing

- mobile CPUs

- mobile devices

- mobile handheld devices

- mobile handsets

- mobile Internet

- mobile Internet devices

- mobile phone semiconductor market

- mobile phones

- mobile TV

- mobile VAS

- Mobile WiMAX

- Mobility

- Moblin

- modeling and photomask correction

- monitor panels

- Monolithic Power Systems

- monster fabs

- Moore’s Law

- Moorestown

- MosChip

- Moser Baer

- Moshe Handelsman

- Motorola

- Mouser

- MP3 players

- MPUs

- multi-core platforms

- multi-cores

- multicore programming

- multilayer PCBs

- Mumbaikars

- Munich

- Murata

- N.K. Goyal

- Nader Tadros

- Nam Hyung Kim

- NAND

- NAND flash

- NAND Flash memory

- Nanomanufacturing

- nanoscience

- Nanotechnology

- nanotubes

- Nanya

- National Semiconductor

- Near Field Communication

- NEC

- Neeraj Varma

- Nehalem

- Nehalem-EX

- net-tops

- netbooks

- Netscape

- nettops

- Networking

- NewEra

- next-generation data centers

- NFC

- NI

- NI. LabVIEW 8.5

- NIIT

- Nikon

- Nile

- Nimish Modi

- Ning

- Nintendo Wii

- Nios II processor

- Nishant Sarawgi

- NMI

- Nokia

- NOR

- notebook market

- notebooks

- NTT DoCoMo

- Nuance

- Numonyx

- nVidia

- NXP India

- OEM semiconductor design

- OEMs

- oil prices

- OLED

- OLED driver ICs

- OLEDs

- Open Handset Alliance

- Open Platforms

- Open Silicon

- Open Source

- OpenOffice

- Opera

- optical networking

- optos

- Outlook 2009

- OZ

- PA Semi

- packaging

- PADS 9.0

- Pagemaker

- Palm

- Panasonic

- Parallel computing

- parallel programming

- parallelism

- passives

- Patrice Hamard

- PCB industry

- PCB services

- PCBs

- PCI

- PDAs

- PDPs

- Perry LaForge

- PFI

- pharma

- Philips

- Philips Consumer Lifestyle

- Phoenix Solar

- phonons

- photonics

- Photonics in Asia

- Photonics Society of India

- photovoltaics

- physical designers

- Piketown

- Pine Trail

- place-and-route technology

- Playstation 3

- PLD

- PMPs

- PNDs

- polysilicon

- Poornima Shenoy

- power

- Power Forward Initiative

- power management

- Power MOSFETs

- Powerchip

- PowerPC

- PR firms

- Pradeep Chakraborty

- Pradeep Chakraborty's Blog

- Premier Farnell

- probe cards

- processors

- Procys

- product development ecosystem

- programmable devices

- ProMOS

- PTT

- PTT-over-cellular

- PTT/PoC

- PULLNANO

- push-to-talk

- PV

- Q-Cells

- Qimonda

- QorIQ multicore platform

- quad core

- Qualcomm

- Quark Express

- Quartus II software v8.0

- Quasar

- QuickPath

- Raghu Panicker

- Rahul Deokar

- Rajeev Madhavan

- Rajeev Mehtani

- Rajiv C. Mody

- Rajiv Jain

- Raju Pudota

- Raman Research Institute

- Ramkumar Subramanian

- Ramprasad Ananthaswamy

- Randy Lawson

- Ranga Prasad

- Ranjan Das

- Ravinder Gujral

- RCG

- REACH

- Real Player

- recession

- Red Hat

- Reliance

- Renasas

- Renesas

- renewable energy

- repairs

- Research Infrastructure

- retail

- retail POS kiosk

- Rev. A

- REVA

- RF

- RF CMOS

- RF MEMS switches

- RF surveillance

- RFMD

- Rich Beyer

- RISCs

- Riverbed

- roaming

- Robert Bosch

- RoHS

- RTL

- RV Colege of Engineering

- RVCE

- S. Janakiraman

- S. Uma Mahesh

- Sachin Pilot

- Samsung Electronics

- Samsung Semiconductor

- Sandeep Mehndiratta

- Sandisk

- Sanjay Deshmukh

- Sanyo

- SAP

- SAP BusinessObjects Explorer

- Sasken

- Sathya Prasad

- Saxony

- Science

- Scott Apeland

- Scott Grant

- screens

- SDR

- search engines

- Security

- security MCUs

- Seiko

- SEMATECH

- semconductors

- SEMI

- SEMI India

- Semico

- Semico Research

- Semicon

- semicon blogs

- semicon capex

- semicon fabs

- semiconductor

- semiconductor equipment

- semiconductor equipment industry

- semiconductor equipment market

- semiconductor industry

- Semiconductor Industry Association

- semiconductor IPs

- semiconductor jobs

- semiconductor manufacturing

- Semiconductor market for PMPs

- semiconductor materials

- semiconductor policy

- Semiconductors

- semiconductors and ICs update

- Semicondutors

- SemiconWorld

- SemIndia

- Sentaurus

- Shanghai

- Shanghai processor

- Sharp

- short-range wireless

- Shweta Dash

- Si-Quest

- SIA

- Siemens

- Signet Solar

- silicon photonics

- Silicon Sensing

- silicon wafers

- simulation

- single-chip design

- SK Telecom

- Skyway Software

- smart grid

- smart meters

- smartphones

- SMB strategies

- SMEs

- SoC

- social networking

- social networking for semicon professionals

- SoCs

- SoftJin

- software developers

- solar

- solar cells

- solar ecsystem

- solar energy ecosystem

- solar fabs

- solar manufacturers

- solar modules

- solar panels

- solar photovoltaics

- solar power products

- solar/PV

- Solar; Lux Research

- Solid polymer capacitors

- solid-state hard drives

- Sony

- Sony Ericsson

- South Korea

- Spain

- Spansion

- Spartan

- spectrum

- speech-recognition

- SPIRIT

- SPMT

- SRAM

- Sriram Peruvemba

- SSDs

- SSI

- ST

- ST Micro

- ST-Ericsson

- Stanley T. Myers

- StarOffice

- STBs

- Stefan de Haan

- Stephan de Haan

- Steve Svoboda

- STM

- STM8S

- STM8S105

- STM8S207

- STMicroelectronics

- storage

- STPI

- Strategic Marketing Associates

- Stratix IV FPGAs

- Subhash Bal

- Sun

- SunFab

- Suntech

- super fuel-efficient car

- SV Probe

- Symantec

- Synopsys

- System-in-Package (SiP) solutions

- system-level chips

- systems

- Systron Donner

- Taitronics

- Taiwan

- targeted design platforms

- Tata BP Solar

- Tata Teleservices

- TCAD

- TCS

- TD-SCDMA

- TD-SCDMA Forum

- TDD

- Technology

- Technopole

- Technoprobe

- Technovation 2008

- Tejas

- Telecom

- Telecom and IT

- telecom OEMs

- telecom operators

- telecommunications

- Telefonica

- telisma

- teliSpeech 10 Indian languages

- terror attack on Mumbai

- test and measurement

- Texas Instruments India

- Text 100

- TFPV

- TFTs

- Thailand

- The Information Network

- thin film

- thin film solar

- TI

- timing analysis

- Tipping Point

- Tom Feist

- Top 10

- top 10 embedded companies in India

- TPS62601

- traffic

- TRAI

- Transport

- Trilliant

- TSIA

- TSMC

- TV panels

- TwitterJobSearch

- TwitterJobSearch.com

- UIDAI

- UK

- UK-TI

- ultra mobile broadband

- UMB

- UMC

- unified power format

- union budget

- UPA

- Upendra Patel

- UPF

- USA

- USB

- V. Srikumar

- V.R. Venkatesh

- VC funding

- VCS2009

- VDAT 2010

- Venkatesh Valluri

- Venture GES

- verification

- Verilog

- VHDL

- Vic Mahadevan

- video roaming

- Videocon

- Vietman

- Vincent Ratford

- Virtex

- Virtex-5

- virtual instrumentation

- virtualization

- Virtuoso

- Vista

- Vivek Sharma

- VLSI

- VLSI conference

- VLSI Research

- VLSI Society of India

- voice

- vPro

- VSI

- VTI

- VTU

- W-CDMA

- wafer fabs

- wafer processing equipment

- Walden C. Rhines

- WAP

- WDS

- Web 2.0

- Webdesign International Festival

- WEEE

- West Bengal

- Wi-Fi

- Widgetbox

- widgets

- WIF 2008

- WIF 2010

- WiLL

- Will Strauss

- WiMAX

- WinCE

- Wind River

- wind solutions

- Wipro

- Wipro Technologies

- wired communications

- Wireless

- wireless devices

- wireless handsets

- Wireless USB

- Wireless Week

- wireless/DSP bulletin

- WirelessHART

- wireline

- WiTECK

- Workhound

- World Cup Cricket 2011

- WSTS

- WUSB

- X-Con

- Xeon 5500

- Xilinx

- yield management

- YieldManager

- Yindusoft

- Yole

- Yole Developpement

- Yukon

- Z-RAM

- ZeBu

- ZeBu-Server

- Zetex

- ZigBee

- ZTE

Blogroll

Archives

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007