Archive

LCD monitor panel prices rising despite downturn: iSuppli

iSuppli Corp.’s LCD PriceTrak Service recently reported that prices for LCD monitor panels are rising, despite the weak economic situation and cuts in consumer spending. Isn’t this quite unusual, and on surface, really spectacular, given the recessionary conditions.

Thanks to my good friend, Jon Cassell, I was able to get into a conversation with Ms. Sweta Dash, director of LCD research at iSuppli. I started by trying to find out the reasons for LCD monitor panel prices to be doing reasonably well in these times.

China’s program driving demand

Sweta Dash said panel demand has been strong due to ‘China’s rural consumer stimulus program’, which increased sales of small-size TVs that uses monitor panels. Also, the panel demand was strong from branded manufacturers due to inventory adjustments.

She added: “Monitor brand manufacturers and retail channel orders mostly stem from the demand for inventory replenishment because they have kept their stockpiles at lower-than-normal levels since the end of 2008. Now, factory demand is strong as they need to buy panels for inventory adjustments.”

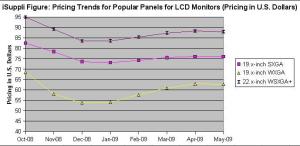

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

In that case, is China’s rural customer stimulus program the only major factor behind this rise in prices of LCD monitor panels?

According to Dash, the other factor is the inventory adjustment by brand manufacturers. TV sales in the US were also better than expected due to the very aggressive prices by brand manufacturers.

“Some retailers reported that they could not meet their demand due to low inventories level. Now, they are trying to adjust the inventory level. Besides better than expected demand for TV and monitor panel, severe cut in factory utilization rates (severe cut in panel production) also contributed to the tight supply for the monitor panel and small-size TV panel, which resulted in panel price increase,” she noted.

Is there any specific reason behind the retailers placing higher orders during recession? Or is it only due to the very low prices?

Dash clarified that it is mostly inventory adjustments. “In March, the inventory levels for monitors at the brand and channel levels were below three weeks level; and some were at two weeks level, which is considered low for this time of the year. Also, once the panel price starts increasing, buyers try to buy more in order to take advantage of the very low price.”

Situation regarding component shortages

There was also a note in iSuppli’ report regarding component shortages. I was keen to find out the exact situation with component shortages, and which specific ones!

Dash said that there is tight supply for PCBs and driver ICs. The lead time for PCBs is extending from two to three weeks to four to six weeks; and the lead time for certain driver ICs is extending to about six to eight weeks.

No recovery soon!

Interestingly, iSuppli cannot declare that monitor end-market demand is headed for a sustainable recovery at this point.

Dash added: “In the absence of a strong rebound in end-market demand, rush orders are not likely to be sustained in May with component shortages being resolved by then. And, the forecast for panel demand is most likely to remain conservative at that time. Also, panel prices are still below cost level. Therefore, in spite of the increasing panel demand, suppliers are still losing money. Further, panel suppliers are rushing to increase their utilization rates and production.”

Koreans doing better than Taiwanese

Evidently, the Korean suppliers seem to be doing better than the Taiwanese, as of now. What would be the key reasons for this?

According to Dash, the Korean suppliers were able to provide more competitive prices due to weaker Won rates.

She added: “Also, the Korean suppliers have higher generation fabs, and they have more in-house or regional component production, which gives them the cost structure compared to Taiwan suppliers. They also have more internal customers (for example, Samsung LCD’s internal customer is Samsung TV and monitor brand).

Year ahead for LCD monitor panels

Finally, how does the year ahead look like for LCD monitor panels?

Monitor panel demand may face some softness after the inventory adjustment in Q209. That is the reason why panel suppliers have to expand their production cautiously.

“Otherwise, it has the danger of pushing the market back to over supply. We still expect real end-user demand to recover in the second half of 2009 especially by Q4-09. If panel manufacturers act cautiously and expand rationally in the first half of 2009, they can see real demand recovery in the second half of 2009,” noted Dash.

Top NAND suppliers of the world: DRAMeXchange

DRAMeXchange has recently released its rankings for the top NAND suppliers of the world. I am producing bits of that report here, for the benefit of those interested in NAND and the memory market.

Be aware, that this segment has been hit particularly bad. We have heard of Qimonda’s problems, as well as Spansion’s. They are trying to battle it out, gamefully, and best wishes to them.

The global semiconductor industry needs the flash memory segment to recover, and fast, to bring the health back in the industry, as well as the missing buzz!

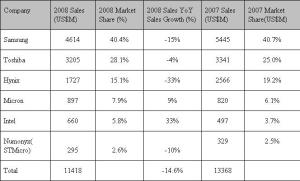

Getting back to DRAMeXchange’s report, NAND Flash brand companies released their total revenue of 2008. Samsung’s annual revenue was $4.614 billion and it gained 40.4 percent market share, to maintain the number 1. position.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

Hynix’s annual revenue was $1.727 billion, with 15.1 percent market share. Though it stayed at the number 3 position, its market share declined 4.1 percent, compared to 2007.

Micron’s annual revenue was $897 million. It had a 7.9 percent market share, which enjoyed a 1.8 percent increase when compared to 2007. Micron was number 4. Intel was at number 5. Its annual revenue was $660 million with 5.8 percent market share, which increased 2.1 percent, compared to 2007.

Numonyx’s (STMicro) 2008 annual revenue was $295 million. It was at number 6 position with the market share of 2.6 percent, which remained the same as 2007.

According to DRAMeXchange, the 4Q08 total revenue of worldwide NAND Flash brand companies was $2.227 billion, which dropped 19.3 percent from $2.761 billion in 3Q08. Under the continuing impact of global recession and the influence of declining worldwide consumer confidence, the 4Q08 revenue of NAND Flash brand companies showed signs of decreasing.

The overall demand and expenditure for consumer electronics declined. Although bit growth in 4Q08 increased 18 percent QoQ, the overall average selling price (ASP) dropped 32 percent QoQ, says DRAMeXchange. A big thanks to DRAMeXchange.

NXP India's Rajeev Mehtani on top trends in global/Indian electronics and semicon!

When a new year approaches, we start analyzing the year gone by and try to gauge what could happen in the coming year. This really holds true, as far as the technology industry is concerned.

When a new year approaches, we start analyzing the year gone by and try to gauge what could happen in the coming year. This really holds true, as far as the technology industry is concerned.

It’s been a week since I’ve been mulling over these myself, especially, pondering over developments in the global semiconductor and electronics industries, as well as what could happen in India during 2009. Well, lots will happen, and I can’t wait for the new year to start!

I caught up with Rajeev Mehtani, vice president and managing director, NXP Semiconductors, India, and discussed in depth about the trends for 2009. Here’s a look at that discussion.

INDIA — ELECTRONICS & SEMICONDUCTORS

1. The DTH story will continue to increase in India with companies such as Tata Sky, DISH TV, BIG TV, etc., gaining market share. Owing to these challenges, there would be significant consolidation among the cable operators. Digitalization will also be seen in 2009.

2. The slowdown will affect growth across all sectors. Our view is that LCD TVs as well as STBs will continue to grow.

3. The year 2009 will witness e-commerce revolution and the RFID sector will grow at a 40-50 percent clip. The government has been sponsoring a lot of projects, which include RFID in the metros, e-passport cards and national ID cards. By mid-2009, we can expect a mass deployment of these projects as well as micro payments.

4. Manufacturing in India will continue to grow; EMS or OEMs, such as Samsung, Nokia, Flextronics, etc.

5. There could be a move from services to products in electronics and semiconductor spaces. The number of funded startups has grown significantly over the last years and more and more ideas are coming on the table.

6. The solar/PV sector will grow in India. High entry cost of capital for panels will be a barrier for this sector. Government enhancement is necessary. India will be different than other countries as people won’t push energy back into the grid; it will be used more for household consumption. The India grid is unstable. Tracking it requires a lot of expensive electronic switching. Solar deployment could be at the micro level, and also community level, where it makes more sense.

7. The startups in India are mostly Web 2.0 based, although there aren’t many hardware startups.

GLOBAL — ELECTRONICS & SEMICONDUCTORS

1. The semiconductor industry is truly global, That is mostly because it is a very expensive industry.

2. Things are a bit murky in the semiconductor industry. It would probably be dipping 10-15 percent next year.

3. Globally, energy management and home automation will start to take off in 2009. Satellite broadcasters will also continue to gain more strength.

4. On a worldwide scale, 3G will win. You will have 3G phones, and you’d add LTE to those. India is slightly different. Only 20 percent of Indian households are ready for broadband access. In India, WiMAX could be a way to have wireless broadband at home.

5. Industries moving to 300mm fabs will be making up only 20-25pc of the market. Not many need 45nm or 40nm chips. People will question any major capex, until there’s a big return and wait for recession to end. The bright spot is solar!

6. The fabless strategy would be the only way to go forward. While MNCs with fabless strategy are present in India, Indian startups in this space are quite few.

On possible Samsung-SanDisk deal; AMD's fab-lite path

Last week, the global semiconductor industry has been hearing and reading about two big speculative stories:

a) A possible acquisition of SanDisk by Samsung, and

b) A possible chance of AMD taking the fab-lite route.

First on Samsung’s buyout (possible) of SanDisk! There have been rumors of a possibility of Samsung acquiring SanDisk. While it is still a possibility, it also leads to several interesting questions!

Should this deal happen, what will be the possible implications for the memory market? Will this also lead to a possible easing off on the pricing pressures on the memory supply chain? And well, what happens to the Toshiba-SanDisk alliance?

A couple of weeks back, iSuppli, had highlighted how Micron had managed to buck the weak NAND market conditions, and was closing the gap with Hynix in Q2, and that NAND recovery was likely only by H2-2009.

I managed to catch up again Nam Hyung Kim, Director & Chief Analyst, iSuppli Corp., and quizzed him on the possible acquisition of SanDisk by Samsung.

A caution: Remember, all of this is merely based on speculation!

On the possibility of Samsung’s takeover of SanDisk, he says: “Samsung at least said that they consider it. Thus, it is a possible deal. But who knows!”

Kim is more forthright on the implications for the memory market, should this deal happen, and I tend to agree with him.

Consolidation inevitable; no impact on prices

The chief analyst quips: “The NAND flash market is still premature and there are too many players in flash cards, USB Flash drives, SSD, etc. The industry consolidation should be inevitable in future.”

So, will this possible buyout at least ease some pricing pressures on memory supply chain? “I don’t expect this deal to impact the prices. Prices will depend on suppliers’ capacity plans. In the memory industry, the consolidation has never impacted the prices in a long run. (maybe, just a short-term impact). As you know, Micron acquired Lexar a few years ago, but no impact,” he adds.

Is there any possibility of SanDisk delaying its production ramps and investments at two of its fabs? And, what will happen should it do so?

Nam says: “SanDisk has already said that they would delay its investment and capacity plan given difficult market condition. This is a positive sign to the market as we expect slower supply growth than expected in future. However, in a long run, consolidation won’t impact the market up and down.”

Negative impact likely for Toshiba?

Lastly, what happens to the SanDisk-Toshiba alliance, should the Samsung buyout of SanDisk does happen?

Nam adds: “It is negative to Toshiba. The company [Toshiba] not only loses its technology partner, but also loses its investment partner. It should be burden for Toshiba to keep investing themselves to grow its business.”

Well, in SEMI’s Fab Forecast Report, there is mention of how Toshiba and SanDisk are among the big spenders in fabs, in Japan. Considering that Japanese semiconductor manufacturers are more cautious, it would be interesting to see how this deal, should it happen, affects the Toshiba-SanDisk alliance.

Now, AMD goes fab-lite?

While on fabs, this brings me to the other big story of last week — of AMD going the fab-lite route, possibly!

Magma’s Rajeev Madhavan had commented some time back that fab-lite is actually good for EDA. It means more design productivity. Leading firms such as TI, NVIDIA, Broadcom, etc., are Magma’s customers.

Late last year, Anil Gupta, MD, India Operations, ARM, had also commented on some other firms going fab-lite! Gupta pointed out Infineon, NXP, etc., had announced Fab-Lite strategies. Even Texas Instruments was moving to a Fab-Lite strategy. “IDMs are going to be the fabless units of today and tomorrow,” he added.

So much for those who’ve taken the fab-lite route, and industry endorsements.

On the fab-lite subject, iSuppli’s Kim will not speculate whether AMD would actually break up into into two entities: design and manufacturing, and also prefers to wait and watch.

How does fab-lite actually benefit? He comments: “Fab-lite has not been working well in the memory industry, which requires very tight control. It works, IF two companies (an IDM and a foundry) work very closely. For example, the industry leader, Samsung, produces all of the memory alone without any foundry relationship.”

Watch this space, folks!

90pc fab investments for 300mm capacity: SEMI

Recently, SEMI (Semiconductor Equipment and Materials International) released its World Fab Forecast report. This report mentions that projected decline in world semiconductor fab equipment spending of 20 percent is likely for 2008. However, a rebound of over 20 percent in spending is expected in 2009, driven by over 70 fab projects.

The August 2008 edition of this report lists 53 fab equipping projects and up to 21 construction projects for fabs in 2009. It is sincerely hoped that at least one of the fabs likely from the Southeast Asian region is from India!

With the help of Scott Smith Senior Manager, Public Relations, SEMI, I was able to get in touch with Christian Gregor Dieseldorff, Senior Manager of Fab Information and Analysis at SEMI, in an attempt to find out more about the decline in global fab spends, these new fabs, and how these fabs can lead a turnaround in the global semiconductor industry. Thanks Scott!

So what are the chief reasons for the decline in fab spends during 2008? According to Dieseldorff, given the weaker economic conditions globally, coupled with higher energy and commodity prices and the financial crisis, the overall outlook for semiconductor growth in 2008 is for low-single digit growth in both revenues and units. As such, device makers have responded by cutting back their capital spending and pushing out fab projects or putting them on hold.

So what are the chief reasons for the decline in fab spends during 2008? According to Dieseldorff, given the weaker economic conditions globally, coupled with higher energy and commodity prices and the financial crisis, the overall outlook for semiconductor growth in 2008 is for low-single digit growth in both revenues and units. As such, device makers have responded by cutting back their capital spending and pushing out fab projects or putting them on hold.

I was keen to find out the geographic breakup of these 70 new fabs that are likely yo come up in 2009.

Dieseldorff advised that these are not 70 new fabs coming up in 2009. Rather, the numbers reflect 300mm fabs only, and is a mix of on-going and new projects for fabs equipping and fab construction projects in 2009.

For equipping 300mm fabs, SEMI expects about: Americas 8, China 5, Europe and Mideast 4, Japan 7, South Korea 11, SE Asia 3 and Taiwan 15.

For 300mm fab construction projects, SEMI expects about: Americas 3, China 2, Europe and Mideast 1, Japan 2, South Korea 3, SE Asia 2 and Taiwan 8.

What are the salient features of some of these new fabs likely to come up next year (for instance, new tech nodes)? Dieseldorff highlighted that about 90 percent of the investments are for 300mm capacity, and the amount of spending for advanced nodes, such as 65nm, is increasing.

“Also, device makers are building larger fabs, which are termed “mega fabs,” so, to potentially realize a greater return based on scales of economy,” he added.

How will these new fabs contribute to a better performance from the global semicon industry? This will be quite interesting to witness.

Dieseldorff said that over the past several years, demand for semiconductor devices has been quite strong, and so, the industry has had to bring on capacity to support this need, both in terms of needed capacity and technology. Even with the slower market growth in 2008, recent industry data shows healthy levels of fab capacity utilization, especially for the advanced technology generations and for 300mm manufacturing.

He added: “The expectation is that demand for semiconductors will strengthen once global economic conditions improve. So, the capacity addition that is coming online this year and the fab projects that are equipping and beginning construction in 2009 are necessary to meet the future demand.”

So how will all of this affect the overall memory market (e.g., 42pc increase in share for memory)? Dieseldorff shared his thought, a fact, known well to those in the semiconductor industry, that the memory market has been battered by declining average selling prices and a condition termed by some as “profitless prosperity.”

“Looking at demand forecasts specific to memory, tremendous growth is anticipated,” he forecasted.

However, the manufacturers in this device segment are battling it out for market share, and the general expectation is that consolidation will continue.

Also, joint-ventures and partnerships are becoming increasingly critical in the memory sector as manufacturers seek to leverage their existing resources to meet future technology and capacity requirements.

It would be interesting to find out why Taiwan and Korea are forecasted as likely to exceed Japan in fab spend?

According to Dieseldorff, in Korea, Samsung has been and is the key spender, and as a company, it will continue to invest so to have a dominant share in the memory sector.

He said: “In 2009, our expectation is for the DRAM manufacturers in Taiwan to boost spending after cutting back this year. We expect seven new 300 mm fab lines in Taiwan to come into production over the next two years.”

However, spending in Japan has been more measured and is likely to remain so. Toshiba, and its joint-venture partner, Sandisk are the big spenders in Japan, when it comes to new fab capacity. Other Japanese semiconductor manufacturers are more cautious and are focused more on technology spending.

India unlikely to become LCD TV manufacturing hub

A recent iSuppli report, dwelt on the fact that the hard economic times could actually turn out to be a boon for contract manufacturers serving the LCD-TV market. The reason given was that the leading brand names of the world are increasingly outsourcing their production to reduce risk.

This invariably leads to the China factor, and whether China is dominating when iSuppli speaks about outsourcing to EMS and ODM companies.

Again, I would like to thank Jonathan Cassell, Editorial Director and Manager, Public Relations, iSuppli, for helping me out a lot with my queries! Many thanks.

Responding to my query, Jeffrey Wu, senior analyst, EMS/ODM, for iSuppli Corp., El Segundo, Calif., USA, says that the China factor consists of a few critical elements, such as cheap labor, localized supply chains, manufacturing clusters, government-planned trade zones, etc.

Responding to my query, Jeffrey Wu, senior analyst, EMS/ODM, for iSuppli Corp., El Segundo, Calif., USA, says that the China factor consists of a few critical elements, such as cheap labor, localized supply chains, manufacturing clusters, government-planned trade zones, etc.

China backlash observed

Wu adds: “In recent years, however, owing to: (a) rising labor costs (due to economic growth and the new labor laws in place), (b) increasing raw material costs (due to the price hike in crude oil), and (c) surging shipping and logistics costs (due to oil price increase), iSuppli has observed backlash in China.

“Nowadays, OEMs, EMS providers and ODMs factor in more considerations, besides the China factor, when calculating their total landed costs. For products that involve substantial tariffs (e.g. LCD TVs and mobile phones in India) and high shipping costs (industrial products such as factory automation equipment), companies tend to look beyond the China factor and set up manufacturing presences close to the end markets.

“For example, more and more companies establish new production plants in Eastern Europe to fulfill the demand in Western Europe and in India to support the demand in Southeast Asia, etc.”

It is quite well known that the so-called hard economic times may not apply to China and India. How does iSuppli forsee LCD-TV manufacturing getting outsourced to places such as India?

India unlikely to become LCD TV manufacturing hub

Wu further adds: “Localized LCD TV production involves a few critical elements, including a sizable end market, high tariffs, supply chain readiness (especially panel supply and LCD module assembly) besides other factors.

“While localized LCD TV manufacturing in India is on the rise, the activities are limited to only final assembly India for the time being such that OEMs eschew tariffs. In other words, while the demand for LCD TVs in India has been growing, it is not high enough to justify localized LCD panel and module assembly for most panel suppliers, EMS providers and OEMs.”

In short, iSuppli believes that more and more LCD TV production-related activities are taking place in India but India may not become the next LCD TV manufacturing hub in the near future.

Some leading Korean and Japanese makers have already been present in India for some time, and have been going very strong, especially, LG, Panasonic and Samsung. Would they be required to rethink on their outsourcing strategies as well?

Overall outsourcing strategies

According to Wu, Japanese and Koreans traditionally like to maintain their production in-house for they see manufacturing as one of their core competences.

“Specific to the Indian market, these companies ship in CKD or SKD parts into India and administer the final assembly in India. As of right now, their strong performances in the India market do not affect their overall outsourcing strategies.

“However, as these OEMs, especially Korean OEMs, begin to strategize their approach to outsourcing on a global level, their operations in India may be affected in the future. For instance, they may outsource finally assembly activities to their would-be EMS partners in the future,” he concludes.

NAND update: Market likely to recover in H2-09

iSuppli’s recently published a report on the current NAND market conditions, which highlighted that Micron had managed to buck the weak NAND market conditions, and was actually closing the gap with Hynix in Q2 2008.

To find out more about the global NAND Flash market scenario, I managed to discuss the health of the NAND market conditions, performance of certain companies, and the possible impact of SSDs on the NAND market, in depth with Nam Hyung Kim, Director & Chief Analyst, Memory, for the market research firm, iSuppli Corp., El Segundo, Calif., USA.

To find out more about the global NAND Flash market scenario, I managed to discuss the health of the NAND market conditions, performance of certain companies, and the possible impact of SSDs on the NAND market, in depth with Nam Hyung Kim, Director & Chief Analyst, Memory, for the market research firm, iSuppli Corp., El Segundo, Calif., USA.

I would also like to thank Jonathan Cassell, Editorial Director and Manager, Public Relations, iSuppli, for helping me out a lot! Without his assistance, this would not have been possible! Many thanks.

Now on to iSuppli and the NAND update. First up, NAND continues to be weak. How much longer, before we can see some sort of recovery?

Nam Hyung Kim says that the NAND market conditions will depend on the suppliers’ manufacturing capacity plans and on the global economy. The health of the NAND flash market is largely determined by consumer spending, since more than 85 percent of demand for the memory is generated by consumer-electronics-type products like digital still cameras, mobile handsets and flash storage devices.

“Market conditions won’t improve much this quarter. However, iSuppli Corp. does expect NAND prices to stabilize to some degree during the fourth quarter due to a slowdown in certain suppliers’ capacity expansion plans. A major recovery is expected in the second half of 2009,” he says.

So, what’s the reason for Micron to have done better in a weak market scenario?

According to Kim, Micron is doing well based on market share and sales growth—but not in terms of profitability. Micron has been expanding its market share by ramping up production aggressively. The company joined the flash market later than its competitors and is trying to catch up. In the memory world, a supplier needs to have critical scale. Without scale, the company won’t be competitive. Thus, Micron is increasing its scale—i.e., its volume—to be more like the size of the top-three suppliers at this moment.

If Micron has been aggressive, why haven’t the others? Possibly, the others could have also planned or migrate to 34nm! However, except for Samsung, all of the suppliers are losing money in their NAND businesses now.

“Each supplier has a different product mix and strategy, so being aggressive during tough times is not a suitable approach for certain firms. Others also plan to migrate their process to sub 40 nanometers. However, Micron will be the first one that produces 34nm products this year,” adds Kim.

iSuppli has now cut its 2008 NAND annual flash revenue growth forecast from 9 percent to virtually zero. When the slowdown had already been predicted during the end of last year, what was the need to cut predictions?

Kim agrees that this is indeed the second cut this year. “We cut our forecast early this year to 9 percent, which was a dramatic reduction from the more than 20 percent growth forecast previously. I believe, we were the first research firm that cut the market growth dramatically this year, followed by other research firms.

“The NAND flash market is relatively new and has lots of growth potential. However, oversupply issues, along with weak consumer spending, prompted us to cut the growth outlook further this time.”

Coming to the subject of solid-state drives, what are the chances of SSDs in helping with a turnaround in the NAND market? Or, are they (SSDs) hyped?

“I should not say SSDs (solid-state drives) are overhyped,” adds Kim. “There are lots of issues that the industry must overcome when bringing SSD technology to the real world. Hard disk drives (HDDs) have been used in PCs for more than 30 years, so the movement to SSD technology won’t be very rapid.”

iSuppli had predicted that SSDs would not impact the market this year or next year. The real prime time for SSD adoption will be in 2010. There are many optimization problems associated with SSDs, which is typical at an early stage in the technology industry. By 2011, iSuppli believes SSDs will be the number one NAND flash market driver in terms of dollar value.

iSuppli also believes that the global NAND flash per-megabit average selling price (ASP) will decline by about 60 percent in 2008, compared to its previous forecast of a 56 percent decline. On quizzing, he says, “As mentioned, the NAND flash market, even in third-quarter, holiday season, won’t have a turn around, which brings the ASP down to the 60 percent level.”

When NAND is taken out of the equation, how does the semiconductor industry look like? iSuppli believes that the 2009 global semiconductor market growth will be higher than that of this year. The semiconductor market is also cyclical, so it will be impacted by global GDP growth this year.

Finally, how does the research firm forsee Nymonyx (there was an article saying it will conquer NAND Flash)?

According to Kim, Numonyx is still a major NOR flash supplier with limited NAND flash market share. Unlike Intel, Numonyx’s focus is on mobile applications. Its joint-venture partner, Hynix, is scaling down its NAND flash production at this time and is focusing on DRAM production.

iSuppli doesn’t expect Numonyx to be a formidable competitor in the NAND flash memory market during the near term.

Top 10 global semicon predictions — where are we today

It is always interesting to write semicon blogs! Lots of people come up to me with their own comments, insights, requests, etc. One such request came from a friend in Taiwan, who’s involved with the semiconductor industry.

It is always interesting to write semicon blogs! Lots of people come up to me with their own comments, insights, requests, etc. One such request came from a friend in Taiwan, who’s involved with the semiconductor industry.

I was asked forthrightly what I thought of the top 10 global predictions, which I had blogged/written about some time back late last year.

Top 10 semicon predictions

For those who came in late, here are the 10 global predictions on semiconductors made at that time (late December 2007.

1. Semiconductor firms may have to face a recession year in an election year.

2. DRAM market looks weak in 2008.

3. NAND market will remain hot.

4. Power will remain a major issue.

5. EDA has to catch up.

6. Need to solve embedded (software crisis?) dilemma.

7. Consolidation in the fab space.

8. Capital equipment guys will continue to move to other market.

9. Spend on capital equipment to drop.

10. Mini fabs in developing countries.

Well, lot of water has flowed since those predictions were made. Let’s see how things stand, as of now. The updated predictions would look something like these:

1. There have been signs of recession, but the industry has faced it well, so far. In fact, Future Horizons feels that if there is going to be a global economic recession, the chip industry (but not all companies) is in the best shape possible to weather the ensuing storm.

2. Memory market is changing slightly as well, though people are very cautious. According to Converge, memory market prices appear to be stabilizing. iSuppli has predicted a poor year for DRAM though!

3. NAND Flash could show some recovery later this year. Yes, Q1-08 QoQ sales seems to have slipped, but the market remains hopeful of a recovery. Even iSuppli warned of NAND Flash slowdown in 2008, while Apple slashed its NAND order forecast significantly for 2008! Keep those fingers crossed!!

4. Power remains a big issue, and will continue to be so. This will remain as we move up newer technology process nodes.

5. EDA is seemingly catching up with 45nm designs. Magma, Synopsys, and the other leading EDA vendors are said to be playing big roles in 45nm designs.

6. Fabless companies are gaining in strength. No doubt about it! The 2007 semicon rankings show that. Also, Qualcomm is now the leader in the top wireless semicon suppliers, displacing Texas Instruments.

7. There have been consilidations (or long term alliances) in: a) fab space b) DRAM space. In the fab space, Intel, Samsung and TSMC have combined to go with 450mm wafer fab line by 2012. And in the DRAM space, there have been new camps, such as Elpida-Qimonda, and Nanya-Micron partnering to take on Samsung. With the global semiconductor market seeing steady decline in growth rate, which would continue, look forward to more consolidations.

8. Investments in photovoltaics (PV) have eased the pressure on capital equipment makers and spend somewhat. In fact, 2007 will be remembered as the year when the PV industry emerged as a key opportunity for subsystems suppliers and provided a timely boost in sales for those companies actively addressing this market. Perhaps, here lies an opportunity for India.

9. Mini fabs — these are yet to happen; so far talks only. In India, a single silicon wafer fab has yet to start functioning, even though it has been quite a while since the semicon policy was announced. Conversely, some feel that India should focus on design, rather than go after something as mature as having wafer fabs. However, several solar fabs — from Moser Baer, Videocon, Reliance, etc., are quite likely.

10. Moving to 45nm from 32nm is posing more design challenges than thought. This is largely due to the use of new materials. Well, 45nm will herald a totally different structure — metal gate/high-k/thin FET/deep trench design, etc. It will herald a new way of system design as well.

Now, I am not a semicon expert by any long distance, and welcome comments, suggestions, improvements from you all.

Top 20 global semicon companies — DRAM, Flash suppliers drop out

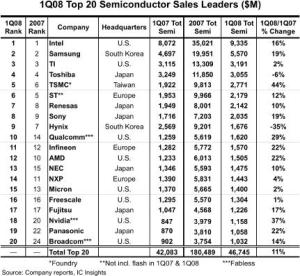

IC Insights recently published the May update to The McClean Report, featuring the Top 20 global semiconductor companies. Not surprisingly, there have been some significant movers and shakers. The most telling — quite a few of the major DRAM and Flash suppliers have dropped out of the Top 20 list!

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

TSMC, the leading foundry, moved up one position, registering the highest — 44 percent — year-over-year Q1-08 growth rate, besides being ranked 5th. Nvidia, the second largest fabless supplier, was another company registering a high YoY growth rate of 37 percent, and moved into the 18th position. Some others like Infineon, Sony and Renesas also climbed a place higher each, respectively. The top four retained their positions — Intel, Samsung, TI and Toshiba.

And now, the shakers! The volatile DRAM and Flash markets have ensured the exit of several well known names such as Qimonda, Elpida, Spansion, Powerchip, Nanya, etc., from the list of the top 20 global semiconductor companies, at least for now.

Among the others in the list, the biggest drops were registered by NXP, which dropped to 14th from 11th last year, and AMD, which dropped two places, from 10th to 12th. Two memory suppliers — Hynix and Micron — also slipped two places, to 9th and 15th places, respectively. STMicroelectronics also slipped from 5th to 6th. IBM too slipped out of the top 20 list.

The top 20 global semiconductor firms comprises of eight US companies (including three fabless suppliers), six Japanese, three European, two South Korean, and one Taiwanese foundry (TSMC). Also, looking at the realities of the foundry market, TSMC’s lead is now unassailable. If TSMC was an IDM, it would be No. 2, challenging Intel and passing Samsung, said one analyst, recently, a thought shared by many.

IC Insights has reported that since the Euro and the Yen are strong against the dollar, this effect will impact global semiconductor market figures when reported in US dollars this year.

There are some other things to watch out for. Following a miserable 2007, the global DRAM module market is likely to rebound gradually in 2008 due to the projected recovery in the overall memory industry, according to an iSuppli report. That remains to be seen.

Some new DRAM camps — such as Elpida-Qimonda, and Micron-Nanya — have been formed. It will be interesting to see how these perform, as will be the performance of ST-backed Numonyx.

Further, the oversupply of NAND Flash worsened in Q1-08, impacted by the effect of the US sub-prime mortgage loan and a slow season, according to DRAMeXchange. The NAND Flash ASP fell about 35 percent compared to Q4-07. Although the overall bit shipment grew about 30 percent compared to Q4-07, the total Q1-08 sales of branded NAND Flash makers fell 15.8 percent QoQ to US$3.24bn. Will the NAND Flash market recover and by when?

NAND Q108 sales falls 15.8 percent

There’s a nice report today by DRAMeXchange on the state of the NAND Flash market. It is reproduced here.

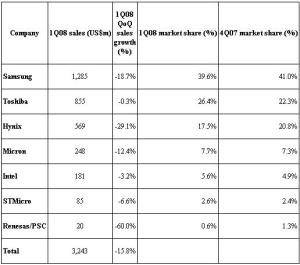

Impacted by effect of the US sub-prime mortgage loan and a slow season, oversupply of NAND Flash worsened in 1Q08. NAND Flash ASP fell about 35 percent compared to 4Q07. Although the overall bit shipment grew about 30 percent compared to 4Q07, the total 1Q08 sales of branded NAND Flash makers fell 15.8 percent QoQ to US$3.24bn.

Ranked by the overall 1Q08 sales, Samsung continues to lead. The top five NAND Flash branded makers shared 96.8 percent of the whole market share in 1Q08.

Ranked by the overall 1Q08 sales, Samsung continues to lead. The top five NAND Flash branded makers shared 96.8 percent of the whole market share in 1Q08.

Although the NAND Flash market share by sales for Samsung in 1Q08 fell to roughly 39.6 percent compared to 4Q07, Samsung continues to be the leader in branded market.

Despite the increase proportion of 51nm node production, affected by the deep decline in NAND Flash price, 1Q08 sales fell 18.7 percent QoQ to US$1.28bn.

NAND Flash market share by sales for Toshiba rose to 26.4 percent compared to 4Q07 and continued to be in the second place among the branded NAND Flash makers.

Due to Toshiba’s successful increase in 56nm node production, it was able to resist the effect of the NAND Flash price decline. However, 1Q08 sales were flat compared to 4Q07 at US$855m.

The 1Q08 market share by sales for Hynix fell to 17.5 percent, though it continued to stay at the number three spot among branded NAND Flash makers. As Hynix lowered its NAND Flash production, 1Q08 bit shipment increased only 9 percent QoQ. However, due to the fall of NAND Flash ASP at 39 percent QoQ, 1Q08 sales for Hynix fell to US$569m, or a decline of 29.1 percent QoQ.

With the ramp up of 50nm node, Micron and Intel continued to see steady growth in a bit shipment in 1Q08. However, impacted by the large decline in NAND Flash price, their 1Q08 sales fell compared to 4Q07. Micron and Intel 1Q08 sales were US$248m and US$181m, respectively, with a market share of 7.7 percent and 5.6 percent, each.

As STMicroelectronics primarily produces NAND Flash for cell phone applications, revenue for 1Q08 was not as severely impacted by the price decline. Revenue for STMicro in 1Q08 fell slightly to US$85m, or a slight decline of 6.6 percent compared to 4Q07. The 1Q08 market share by sales was 2.6 percent.

Since Renesas continued to reduce its AG-AND Flash production in 1Q08, Renesas/PSC camp sales fell roughly 60 percent compared to 4Q07 with a market share of 0.6 percent.