Archive

LCD monitor panel prices rising despite downturn: iSuppli

iSuppli Corp.’s LCD PriceTrak Service recently reported that prices for LCD monitor panels are rising, despite the weak economic situation and cuts in consumer spending. Isn’t this quite unusual, and on surface, really spectacular, given the recessionary conditions.

Thanks to my good friend, Jon Cassell, I was able to get into a conversation with Ms. Sweta Dash, director of LCD research at iSuppli. I started by trying to find out the reasons for LCD monitor panel prices to be doing reasonably well in these times.

China’s program driving demand

Sweta Dash said panel demand has been strong due to ‘China’s rural consumer stimulus program’, which increased sales of small-size TVs that uses monitor panels. Also, the panel demand was strong from branded manufacturers due to inventory adjustments.

She added: “Monitor brand manufacturers and retail channel orders mostly stem from the demand for inventory replenishment because they have kept their stockpiles at lower-than-normal levels since the end of 2008. Now, factory demand is strong as they need to buy panels for inventory adjustments.”

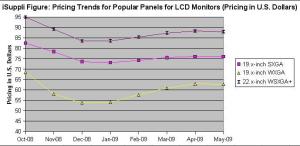

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

In that case, is China’s rural customer stimulus program the only major factor behind this rise in prices of LCD monitor panels?

According to Dash, the other factor is the inventory adjustment by brand manufacturers. TV sales in the US were also better than expected due to the very aggressive prices by brand manufacturers.

“Some retailers reported that they could not meet their demand due to low inventories level. Now, they are trying to adjust the inventory level. Besides better than expected demand for TV and monitor panel, severe cut in factory utilization rates (severe cut in panel production) also contributed to the tight supply for the monitor panel and small-size TV panel, which resulted in panel price increase,” she noted.

Is there any specific reason behind the retailers placing higher orders during recession? Or is it only due to the very low prices?

Dash clarified that it is mostly inventory adjustments. “In March, the inventory levels for monitors at the brand and channel levels were below three weeks level; and some were at two weeks level, which is considered low for this time of the year. Also, once the panel price starts increasing, buyers try to buy more in order to take advantage of the very low price.”

Situation regarding component shortages

There was also a note in iSuppli’ report regarding component shortages. I was keen to find out the exact situation with component shortages, and which specific ones!

Dash said that there is tight supply for PCBs and driver ICs. The lead time for PCBs is extending from two to three weeks to four to six weeks; and the lead time for certain driver ICs is extending to about six to eight weeks.

No recovery soon!

Interestingly, iSuppli cannot declare that monitor end-market demand is headed for a sustainable recovery at this point.

Dash added: “In the absence of a strong rebound in end-market demand, rush orders are not likely to be sustained in May with component shortages being resolved by then. And, the forecast for panel demand is most likely to remain conservative at that time. Also, panel prices are still below cost level. Therefore, in spite of the increasing panel demand, suppliers are still losing money. Further, panel suppliers are rushing to increase their utilization rates and production.”

Koreans doing better than Taiwanese

Evidently, the Korean suppliers seem to be doing better than the Taiwanese, as of now. What would be the key reasons for this?

According to Dash, the Korean suppliers were able to provide more competitive prices due to weaker Won rates.

She added: “Also, the Korean suppliers have higher generation fabs, and they have more in-house or regional component production, which gives them the cost structure compared to Taiwan suppliers. They also have more internal customers (for example, Samsung LCD’s internal customer is Samsung TV and monitor brand).

Year ahead for LCD monitor panels

Finally, how does the year ahead look like for LCD monitor panels?

Monitor panel demand may face some softness after the inventory adjustment in Q209. That is the reason why panel suppliers have to expand their production cautiously.

“Otherwise, it has the danger of pushing the market back to over supply. We still expect real end-user demand to recover in the second half of 2009 especially by Q4-09. If panel manufacturers act cautiously and expand rationally in the first half of 2009, they can see real demand recovery in the second half of 2009,” noted Dash.

India unlikely to become LCD TV manufacturing hub

A recent iSuppli report, dwelt on the fact that the hard economic times could actually turn out to be a boon for contract manufacturers serving the LCD-TV market. The reason given was that the leading brand names of the world are increasingly outsourcing their production to reduce risk.

This invariably leads to the China factor, and whether China is dominating when iSuppli speaks about outsourcing to EMS and ODM companies.

Again, I would like to thank Jonathan Cassell, Editorial Director and Manager, Public Relations, iSuppli, for helping me out a lot with my queries! Many thanks.

Responding to my query, Jeffrey Wu, senior analyst, EMS/ODM, for iSuppli Corp., El Segundo, Calif., USA, says that the China factor consists of a few critical elements, such as cheap labor, localized supply chains, manufacturing clusters, government-planned trade zones, etc.

Responding to my query, Jeffrey Wu, senior analyst, EMS/ODM, for iSuppli Corp., El Segundo, Calif., USA, says that the China factor consists of a few critical elements, such as cheap labor, localized supply chains, manufacturing clusters, government-planned trade zones, etc.

China backlash observed

Wu adds: “In recent years, however, owing to: (a) rising labor costs (due to economic growth and the new labor laws in place), (b) increasing raw material costs (due to the price hike in crude oil), and (c) surging shipping and logistics costs (due to oil price increase), iSuppli has observed backlash in China.

“Nowadays, OEMs, EMS providers and ODMs factor in more considerations, besides the China factor, when calculating their total landed costs. For products that involve substantial tariffs (e.g. LCD TVs and mobile phones in India) and high shipping costs (industrial products such as factory automation equipment), companies tend to look beyond the China factor and set up manufacturing presences close to the end markets.

“For example, more and more companies establish new production plants in Eastern Europe to fulfill the demand in Western Europe and in India to support the demand in Southeast Asia, etc.”

It is quite well known that the so-called hard economic times may not apply to China and India. How does iSuppli forsee LCD-TV manufacturing getting outsourced to places such as India?

India unlikely to become LCD TV manufacturing hub

Wu further adds: “Localized LCD TV production involves a few critical elements, including a sizable end market, high tariffs, supply chain readiness (especially panel supply and LCD module assembly) besides other factors.

“While localized LCD TV manufacturing in India is on the rise, the activities are limited to only final assembly India for the time being such that OEMs eschew tariffs. In other words, while the demand for LCD TVs in India has been growing, it is not high enough to justify localized LCD panel and module assembly for most panel suppliers, EMS providers and OEMs.”

In short, iSuppli believes that more and more LCD TV production-related activities are taking place in India but India may not become the next LCD TV manufacturing hub in the near future.

Some leading Korean and Japanese makers have already been present in India for some time, and have been going very strong, especially, LG, Panasonic and Samsung. Would they be required to rethink on their outsourcing strategies as well?

Overall outsourcing strategies

According to Wu, Japanese and Koreans traditionally like to maintain their production in-house for they see manufacturing as one of their core competences.

“Specific to the Indian market, these companies ship in CKD or SKD parts into India and administer the final assembly in India. As of right now, their strong performances in the India market do not affect their overall outsourcing strategies.

“However, as these OEMs, especially Korean OEMs, begin to strategize their approach to outsourcing on a global level, their operations in India may be affected in the future. For instance, they may outsource finally assembly activities to their would-be EMS partners in the future,” he concludes.