Archive

Top NAND suppliers of the world: DRAMeXchange

DRAMeXchange has recently released its rankings for the top NAND suppliers of the world. I am producing bits of that report here, for the benefit of those interested in NAND and the memory market.

Be aware, that this segment has been hit particularly bad. We have heard of Qimonda’s problems, as well as Spansion’s. They are trying to battle it out, gamefully, and best wishes to them.

The global semiconductor industry needs the flash memory segment to recover, and fast, to bring the health back in the industry, as well as the missing buzz!

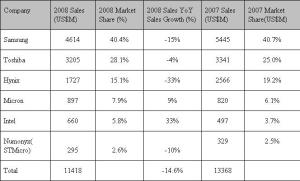

Getting back to DRAMeXchange’s report, NAND Flash brand companies released their total revenue of 2008. Samsung’s annual revenue was $4.614 billion and it gained 40.4 percent market share, to maintain the number 1. position.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

Hynix’s annual revenue was $1.727 billion, with 15.1 percent market share. Though it stayed at the number 3 position, its market share declined 4.1 percent, compared to 2007.

Micron’s annual revenue was $897 million. It had a 7.9 percent market share, which enjoyed a 1.8 percent increase when compared to 2007. Micron was number 4. Intel was at number 5. Its annual revenue was $660 million with 5.8 percent market share, which increased 2.1 percent, compared to 2007.

Numonyx’s (STMicro) 2008 annual revenue was $295 million. It was at number 6 position with the market share of 2.6 percent, which remained the same as 2007.

According to DRAMeXchange, the 4Q08 total revenue of worldwide NAND Flash brand companies was $2.227 billion, which dropped 19.3 percent from $2.761 billion in 3Q08. Under the continuing impact of global recession and the influence of declining worldwide consumer confidence, the 4Q08 revenue of NAND Flash brand companies showed signs of decreasing.

The overall demand and expenditure for consumer electronics declined. Although bit growth in 4Q08 increased 18 percent QoQ, the overall average selling price (ASP) dropped 32 percent QoQ, says DRAMeXchange. A big thanks to DRAMeXchange.

DRAM makers being offered lifelines via bail out plans!

Browsing the Web these past days has brought me to various stories, mostly discussing the various bail out plans being provided for some leading DRAM makers.

It all started with Germany based Qimonda announcing that it has arranged a Euro 325 million financing package for the ramp up of its innovative Buried Wordline technology.

Yesterday, Hynix, the Korean DRAM maker, received a bail out of $597 million, according to reports on Fabtech. The story also reports that Powerchip Semiconductor, Taiwan’s largest DRAM maker, is also seeking new funding.

Then, DigiTimes, a very good technology news Web site from Taiwan, reported yesterday that Taiwan’s Ministry of Economic Affairs (MoEA) had reportedly developed an NT$200 billion (US $6.5 billion) bail out plan for Taiwan’s hard-hit DRAM makers.

Sitting in India makes it a little difficult to speak with global companies based in Taiwan, Korea and Germany. I sometimes wish I could get some help from reliable sources as to what’s the actual ground situation.

Having said that, it is good to see various national governments showing their deep concern about the state of the global DRAM industry and about technologies. And, let us keep all criticisms aside, as to who performed and who didn’t! Here’s a lesson for India to learn from, as closer home, it has a semiconductor industry really in its infancy!

Right now, the global semiconductor industry is facing a downturn and memory is the hardest hit! Hence, if any measures are being taken to somehow bring DRAM back on track, it should be welcomed.

Qimonda, Hynix, Powerchip, etc., are not small names in the global industry. Poor performance from memory players saw them dropping out of the top 20 global semiconductor players’ rankings in 2008.

All the lifelines being provided to these major players now means that these companies need to pull it off, somehow, and extricate themselves from the depths they have fallen into. If they fail, they will perish! And, they all know that!!

I’d be very keen to see the responses of DRAMeXchange and iSuppli on these bail out plans.

Merry X’mas everyone, and hope you all have a great time!

PS: I have iSuppli’s feedback!

Speaking on the Taiwan government’s bail-out plan as well as Hynix’s rescue package from banks, John Lei, Analyst, memory, iSuppli Corp., said: “In general, Hynix’s package is much like a short-term relief for their near-term debt, while the Taiwan government aims at the possible consolidation of five suppliers.”

“All these packages could bring more uncertainties to the maket, however, based on iSuppli’s assumption and forecasts. The industry operation profit margin will hit bottom in Q4-08, but profitability of the industry will not occur until Q4-09,” he added.

Memory market to witness another negative sales growth in 2009

This is a continuation from my previous blog on the outlook for the global semiconductor industry, and iSuppli’s ranking of the Top 20 global semiconductor companies.

Thanks to Jon Cassell at iSuppli, I also got into a conversation with Nam Hyung Kim, Director & Chief Analyst, iSuppli. Kim touched upon the outlook for DRAM and the memory market as a whole.

Thanks to Jon Cassell at iSuppli, I also got into a conversation with Nam Hyung Kim, Director & Chief Analyst, iSuppli. Kim touched upon the outlook for DRAM and the memory market as a whole.

Further analyzing iSuppli’s top 20 rankings, among the leading memory makers, Hynix has performed the worst. On this aspect, Kim says that DRAM sales is likely to decline by 20 percent in 2008. Thus, Hynix’s performance is not far from overall challenging status considering it also scaled NAND flash business back dramatically.

On another note, Qimonda is also among the strugglers, and there have been whispers about its possible bankruptcy. However, iSuppli did not comment on this topic.

So, how much longer will it take before the memory market can come out of its current woes? Kim adds: “The memory industry inevitably will experience another negative sales growth in 2009. However, the rate of sales decline will be much lower than that of 2008.

“The year 2009 will be the third year of the memory market downturn. Therefore, supply growth reduction will take place fast, resulting in lower price drop compared to 2008.”

Finally, what’s the way forward for DRAM, NOR and SRAM? Kim asserts that iSuppli expect the following sales growth in 2009 (preliminary):

* DRAM: single digit percentage sales decline; and

* NAND, NOR, SRAM will experience mid to high teens sales decline.

Semicon to grow 4-8pc in 2008; ASPs trending up

It has really been a tumultuous year for semiconductors, which has held up very well, despite the memory market turmoils, so far.

Just a day ago, Future Horizons reported on the June sales for semiconductors. According to Malcolm Penn, chairman and CEO, June’s WSTS results brought both good and bad news! The good news being that the recovery momentum strengthened, with Q2 sales up 3 percent on Q1.

Just a day ago, Future Horizons reported on the June sales for semiconductors. According to Malcolm Penn, chairman and CEO, June’s WSTS results brought both good and bad news! The good news being that the recovery momentum strengthened, with Q2 sales up 3 percent on Q1.

He says, “This was significantly better than even we dared to predict in last month’s Report, despite the fact we raised eyebrows and disbelief by suggesting a 2.3 percent quarter on quarter growth.”

The bad news was the Jan-May YTD WSTS numbers for standard logic (and thus, the total ICs and total SC) were revised downwards by a sizeable US$1.4 billion, a restatement that will knock 2 percentage points off the 2008 year on year growth number!

What were the reasons for the recovery momentum to have strengthened, with Q2 sales up 3 percent on Q1? Penn adds: “The first half year sales were much stronger than everyone (except us) believed. It has depresses, only by memories.”

Also, the Jan-May YTD WSTS numbers for standard logic (and total ICs and total SC) were revised downward by a sizeable US$1.4 billion. Why did this happen? It is interesting to note that one company mis-reported its sales for Jan-May and corrected this reporting error in June.

Penn adds: “This often happens, but not before at this magnitude. Individual company details are secret, so we do not know who the culprit was or how the ‘error’ happened.”

Forecast revised to 4-8 percent

Future Horizons further says in its report that the downward revision in standard logic numbers would knock 2 percentage points off the 2008 year on year growth number. On quizzing, Penn agrees: “Yes, our ‘revised’ forecast range is 4-8 percent. We are currently still erring on the high side of this range. More important though is the market momentum.”

Memory has been a constant problem this year. iSuppli has mentioned in an earlier report that NAND recovery will be likely in H2-2009.

DRAMeXchange, in another report today, indicates a new record low for DDR 1Gb. Even Penn agrees that recovery is definitely not in sight. When do we actually get to see some recovery? He adds: “There is still over capacity, however, Q3 is typically the strongest demand quarter.”

Still on memory, does Future Horizons forsee Hynix bouncing back? Penn says: “They did; in 2000-02, they were on the verge of bankruptcy. Now, they are fitter and financially strong.”

ASPs were trending up earlier, and the status quo is maintained. “ASPs are still trending up, slowly, but surely. We will be commenting more on this in September’s report,” he adds.

Fab spends trending down

Just a few days ago, a SEMI analyst highlighted the chief reasons for decline in fab spends. Christian Gregor Dieseldorff, Senior Manager of Fab Information and Analysis at SEMI, said: “Given the weaker economic conditions globally, coupled with higher energy and commodity prices and the financial crisis, the overall outlook for semiconductor growth in 2008 is for low-single digit growth in both revenues and units. As such, device makers have responded by cutting back their capital spending and pushing out fab projects or putting them on hold.”

On the status with fab spends, Penn agrees, “Those are still trending down, and will continue to do so for at least the next three quarters.”

Solar not much help

There have been lot of investments happening in solar/PV. One may imagine that all of this would be helping the global semiconductor industry. So, is the spend in solar/PV really helping the industry? Penn disagrees, saying this only helps the equipment guys.

One last query, and this is regarding the smaller IDMs, ‘fab-lite’ IDMs, and fabless semiconductor companies. Are they growing at below average? Penn concludes: “They are mostly not. The fabless firms outgrew the market 2x in the first half of 2008.”

Perhaps, here also lies a message for India!! One hopes that India does not get too carried away by all those investments in solar/PV, and focuses more on the semicon side. Semicon in India, does need concrete planning, after all!

NAND update: Market likely to recover in H2-09

iSuppli’s recently published a report on the current NAND market conditions, which highlighted that Micron had managed to buck the weak NAND market conditions, and was actually closing the gap with Hynix in Q2 2008.

To find out more about the global NAND Flash market scenario, I managed to discuss the health of the NAND market conditions, performance of certain companies, and the possible impact of SSDs on the NAND market, in depth with Nam Hyung Kim, Director & Chief Analyst, Memory, for the market research firm, iSuppli Corp., El Segundo, Calif., USA.

To find out more about the global NAND Flash market scenario, I managed to discuss the health of the NAND market conditions, performance of certain companies, and the possible impact of SSDs on the NAND market, in depth with Nam Hyung Kim, Director & Chief Analyst, Memory, for the market research firm, iSuppli Corp., El Segundo, Calif., USA.

I would also like to thank Jonathan Cassell, Editorial Director and Manager, Public Relations, iSuppli, for helping me out a lot! Without his assistance, this would not have been possible! Many thanks.

Now on to iSuppli and the NAND update. First up, NAND continues to be weak. How much longer, before we can see some sort of recovery?

Nam Hyung Kim says that the NAND market conditions will depend on the suppliers’ manufacturing capacity plans and on the global economy. The health of the NAND flash market is largely determined by consumer spending, since more than 85 percent of demand for the memory is generated by consumer-electronics-type products like digital still cameras, mobile handsets and flash storage devices.

“Market conditions won’t improve much this quarter. However, iSuppli Corp. does expect NAND prices to stabilize to some degree during the fourth quarter due to a slowdown in certain suppliers’ capacity expansion plans. A major recovery is expected in the second half of 2009,” he says.

So, what’s the reason for Micron to have done better in a weak market scenario?

According to Kim, Micron is doing well based on market share and sales growth—but not in terms of profitability. Micron has been expanding its market share by ramping up production aggressively. The company joined the flash market later than its competitors and is trying to catch up. In the memory world, a supplier needs to have critical scale. Without scale, the company won’t be competitive. Thus, Micron is increasing its scale—i.e., its volume—to be more like the size of the top-three suppliers at this moment.

If Micron has been aggressive, why haven’t the others? Possibly, the others could have also planned or migrate to 34nm! However, except for Samsung, all of the suppliers are losing money in their NAND businesses now.

“Each supplier has a different product mix and strategy, so being aggressive during tough times is not a suitable approach for certain firms. Others also plan to migrate their process to sub 40 nanometers. However, Micron will be the first one that produces 34nm products this year,” adds Kim.

iSuppli has now cut its 2008 NAND annual flash revenue growth forecast from 9 percent to virtually zero. When the slowdown had already been predicted during the end of last year, what was the need to cut predictions?

Kim agrees that this is indeed the second cut this year. “We cut our forecast early this year to 9 percent, which was a dramatic reduction from the more than 20 percent growth forecast previously. I believe, we were the first research firm that cut the market growth dramatically this year, followed by other research firms.

“The NAND flash market is relatively new and has lots of growth potential. However, oversupply issues, along with weak consumer spending, prompted us to cut the growth outlook further this time.”

Coming to the subject of solid-state drives, what are the chances of SSDs in helping with a turnaround in the NAND market? Or, are they (SSDs) hyped?

“I should not say SSDs (solid-state drives) are overhyped,” adds Kim. “There are lots of issues that the industry must overcome when bringing SSD technology to the real world. Hard disk drives (HDDs) have been used in PCs for more than 30 years, so the movement to SSD technology won’t be very rapid.”

iSuppli had predicted that SSDs would not impact the market this year or next year. The real prime time for SSD adoption will be in 2010. There are many optimization problems associated with SSDs, which is typical at an early stage in the technology industry. By 2011, iSuppli believes SSDs will be the number one NAND flash market driver in terms of dollar value.

iSuppli also believes that the global NAND flash per-megabit average selling price (ASP) will decline by about 60 percent in 2008, compared to its previous forecast of a 56 percent decline. On quizzing, he says, “As mentioned, the NAND flash market, even in third-quarter, holiday season, won’t have a turn around, which brings the ASP down to the 60 percent level.”

When NAND is taken out of the equation, how does the semiconductor industry look like? iSuppli believes that the 2009 global semiconductor market growth will be higher than that of this year. The semiconductor market is also cyclical, so it will be impacted by global GDP growth this year.

Finally, how does the research firm forsee Nymonyx (there was an article saying it will conquer NAND Flash)?

According to Kim, Numonyx is still a major NOR flash supplier with limited NAND flash market share. Unlike Intel, Numonyx’s focus is on mobile applications. Its joint-venture partner, Hynix, is scaling down its NAND flash production at this time and is focusing on DRAM production.

iSuppli doesn’t expect Numonyx to be a formidable competitor in the NAND flash memory market during the near term.

NAND Q108 sales falls 15.8 percent

There’s a nice report today by DRAMeXchange on the state of the NAND Flash market. It is reproduced here.

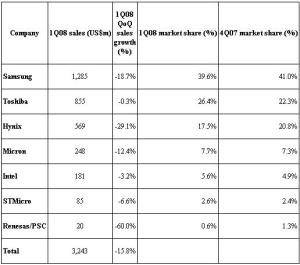

Impacted by effect of the US sub-prime mortgage loan and a slow season, oversupply of NAND Flash worsened in 1Q08. NAND Flash ASP fell about 35 percent compared to 4Q07. Although the overall bit shipment grew about 30 percent compared to 4Q07, the total 1Q08 sales of branded NAND Flash makers fell 15.8 percent QoQ to US$3.24bn.

Ranked by the overall 1Q08 sales, Samsung continues to lead. The top five NAND Flash branded makers shared 96.8 percent of the whole market share in 1Q08.

Ranked by the overall 1Q08 sales, Samsung continues to lead. The top five NAND Flash branded makers shared 96.8 percent of the whole market share in 1Q08.

Although the NAND Flash market share by sales for Samsung in 1Q08 fell to roughly 39.6 percent compared to 4Q07, Samsung continues to be the leader in branded market.

Despite the increase proportion of 51nm node production, affected by the deep decline in NAND Flash price, 1Q08 sales fell 18.7 percent QoQ to US$1.28bn.

NAND Flash market share by sales for Toshiba rose to 26.4 percent compared to 4Q07 and continued to be in the second place among the branded NAND Flash makers.

Due to Toshiba’s successful increase in 56nm node production, it was able to resist the effect of the NAND Flash price decline. However, 1Q08 sales were flat compared to 4Q07 at US$855m.

The 1Q08 market share by sales for Hynix fell to 17.5 percent, though it continued to stay at the number three spot among branded NAND Flash makers. As Hynix lowered its NAND Flash production, 1Q08 bit shipment increased only 9 percent QoQ. However, due to the fall of NAND Flash ASP at 39 percent QoQ, 1Q08 sales for Hynix fell to US$569m, or a decline of 29.1 percent QoQ.

With the ramp up of 50nm node, Micron and Intel continued to see steady growth in a bit shipment in 1Q08. However, impacted by the large decline in NAND Flash price, their 1Q08 sales fell compared to 4Q07. Micron and Intel 1Q08 sales were US$248m and US$181m, respectively, with a market share of 7.7 percent and 5.6 percent, each.

As STMicroelectronics primarily produces NAND Flash for cell phone applications, revenue for 1Q08 was not as severely impacted by the price decline. Revenue for STMicro in 1Q08 fell slightly to US$85m, or a slight decline of 6.6 percent compared to 4Q07. The 1Q08 market share by sales was 2.6 percent.

Since Renesas continued to reduce its AG-AND Flash production in 1Q08, Renesas/PSC camp sales fell roughly 60 percent compared to 4Q07 with a market share of 0.6 percent.

Top 25 semicon vendors of 2007

Here are the top 25 global suppliers of semiconductors, according to iSuppli. First up, there are no surprises in the top 5 — Intel, Samsung, Texas Instruments, Toshiba and STMicroelectronics retain their spots for this year too. The surprises occur in the second rung — or, in the next five spots.

Here are the top 25 global suppliers of semiconductors, according to iSuppli. First up, there are no surprises in the top 5 — Intel, Samsung, Texas Instruments, Toshiba and STMicroelectronics retain their spots for this year too. The surprises occur in the second rung — or, in the next five spots.

Renasas and Hynix exchanged places, with Hynix moving up from 7th position in 2006 to 6th position in 2007, and Renasas dropping from 6th last year to 7th. This is very interesting, because, despite memory market pains during 2007, South Korea’s Hynix Semiconductor and Japan’s Toshiba and Elpida Memory achieved memory-chip revenue growth of 15, 14.5 and 8.8 percent respectively in 2007, as per iSuppli.

Infineon, Sony major movers

The next three positions are the major surprises of the year. Well, the 10th position was no surprise to me — AMD, dropping from 8th in 2006 to 10th in 2007. Sony and Germany’s Infineon Technologies have been the biggest gainers of the year!

According to iSuppli, Infineon acquired TI’s DSL CPE chip business and its wireless baseband semiconductor unit, boosting its revenue. Qimonda, which spun off Infineon, dropped from 12th in 2006 to 16th this year. This split had seen Infineon go out of the top 10 last year.

As per iSuppli, logic application specific integrated circuits (application specific standard products and ASICs) enjoyed the strongest performance among all semicon segments in 2007. Sony and Toshiba were key drivers of growth in this segment due to their sales of semiconductors for the PS3.

Fabless is surely in

The presence of Qualcomm and nVidia in the top 25 list speaks volumes of the power of fabless companies. Qualcomm moved up from 16th to 13th position this year, while nVidia moved up from 25th to the 20th position this year. There is every chance that we will see a fabless company in the top 10 next year! There is an even better chance that more fabless companies will make it to the top 25 companies next year and in future.

All other key players dropped in their rankings. NXP dropped from 9th to 11th; NEC dropped from 11th to 12th; Freescale from 10th to 14th; Micron from 13th to 15th; Elpida moved up from 19th to 17th; while Matsushita and Broadcom dropped a place each.

An iSuppli release says: “Overall, the top 25 semiconductor suppliers significantly outperformed the combined performance of companies ranked lower than them in 2007. The Top-25 as a group achieved revenue growth of 4.5 percent in 2007 while the combined growth of all other semiconductor suppliers was only 0.8 percent.”

On a personal note, I would love to see names like SemIndia and HSMC making it to the list. If not now, then at least sometime in the near future. However, it seems from certain published reports that the Indian fab story has gone all wrong. I’ll take up this topic in a future blog for sure!

Top 10 semicon firms of 2007 by revenue

According to Gartner, the top 10 semiconductor firms for 2007 by revenue are: Intel, Samsung Electronics, Toshiba, Texas Instruments, STMicroelectronics, Infineon Technologies (including Qimonda), Hynix Semiconductor, Renesas Technology, NXP Semiconductors, and NEC Electronics.

Worldwide semiconductor revenue totaled $270.3 billion in 2007, a 2.9 percent increase from 2006, according to preliminary results from Gartner Inc.

Vendor performances were mixed with two vendors in the top 10 that experienced double-digit growth and two vendors that showed declines in revenue.

“Semiconductor vendors need to watch the performance of their end customers even closer as a major part of the industry becomes increasingly tied to consumer spending patterns,” said Andrew Norwood, research vice president at Gartner. “Loss of market share in an end-user application, such as a mobile phone, by a customer (a mobile phone manufacturer) can have a dramatic effect on a vendor’s business.”

Intel grew revenue more than twice as fast as the semiconductor market average, and it is likely to edge up its market share to 12.2 percent in 2007 from 11.6 percent in 2006.

Intel’s growth came primarily from strong shipments of mobile PCs. Armed with a strong product lineup for enthusiast desktops and servers, Intel regained lost share in those markets from AMD.

While the global market for dynamic random-access memory (DRAM) is expected to decline in 2007 due to a severe drop in prices caused by oversupply, Samsung Electronics is likely to increase its revenue by slightly higher than the overall global semiconductor market growth rate (DRAM is one the firm’s main products).

Samsung’s growth is driven by steady revenue growth in NAND flash memory and strong revenue growth in nonmemory areas such as application processors, media integrated circuits (IC), complementary metal-oxide semiconductor (CMOS) image sensor, smart card ICs and LCD driver ICs.

Toshiba’s revenue increased 27.8 percent in 2007 to $12,504 million, gaining three places in the rankings and moving into third place. The rapid gains mainly came from NAND flash memory.

Toshiba also increased production of CMOS image sensors for mobile phones and application-specific integrated circuits (ASICs)/application-specific standard products (ASSPs) revenue for digital consumer electronics, including LCD TVs, next-generation DVDs (HD DVDs) and video game consoles.

Major shakeups in top 10 semiconductor supplier rankings

According to the latest report from IC Insights, there have been major shakeups in the global top 10 rankings among suppliers of semiconductors.

Here’s what IC Insights has to say regarding some of the changes that took place in 3Q07:

* Toshiba rode the coat-tails of a 46 percent 3Q07/2Q07 NAND flash memory market surge to post an amazing 40 percent 3Q07/2Q07 semiconductor sales increase. This increase helped propel Toshiba to a third place ranking, its highest since being ranked as the second largest semiconductor supplier in 2000.

* AMD continues to display a nice recovery this year with its 3Q07 sales increasing 18 percent over 2Q07, which follows a 12 percent sequential increase in 2Q07/1Q07. As part of its continuing MPU marketshare battle with Intel, AMD is expected to announce a major manufacturing/foundry deal in the second half of 2007.

* The largest pure-play foundry in the world, TSMC, jumped one spot in 3Q07 as compared to the full-year 2006 ranking as the company recorded a strong 3Q07/2Q07 sales increase of 21 percent. It should be noted that after operating at only 83 percent capacity utilization in 1Q07, TSMC surpassed its “company-defined” 100 percent capacity utilization level in 3Q07!

* If pure-play foundry TSMC were excluded from the ranking, NXP would have been in the tenth position.

* In spite of 3Q07 DRAM pricing weakness, Hynix took advantage of its strong NAND flash marketshare to move from seventh to sixth place in the ranking.

* Freescale continues to feel the pain of its biggest customer, Motorola, as the company went from being ranked as the ninth largest semiconductor supplier in the world in 2006 to sixteenth in 3Q07. Unfortunately for Freescale, Motorola has gone from holding a 22 percent share of cellular phone unit shipments in 3Q06 (53.7 million) to securing only a 13 percent share in 3Q07 (37.2 million).

* TI, ST, and Renesas were the only top 10 companies to register less than double-digit 3Q07/2Q07 sequential sales growth rates. Each one of these companies is a top-10 supplier to the currently slow-growing analog IC market.

* The top 10 listing consists of three U.S., three Japanese, two Korean, one European, and one Taiwanese company.

Through the end of 2007, IC Insights expects to see pricing stability return to the DRAM memory market, surging IC demand for PCs and high-end cellular phones, and a continuation of the seasonal rebound in overall semiconductor demand that began in August.

Will Z-RAM lead DRAM rebound?

Most of us have and use swanky mobile phones with enough memory to store videos, songs, clips, images, etc. And we certainly love playing with those wonderful devices. However, have we ever wondered where is all that memory coming from? There’s DRAM, and then, there’s Z-RAM.

Another news! It was reported recently that record sales of NAND-based iPhones and iPods were using up serious flash memory. Apple’s two biggest hits are likely to consume 25 percent of the global flash output! This could drive up prices of memory in the not too distant future. Now this is good news for memory makers.

Now let’s start with DRAM, which just got over a very difficult first half of the year. Evidence now suggests that the market, and free-falling ASPs, turned the corner in July and will begin an upward climb resulting in increases in quarterly growth through the balance of 2007, according to IC Insights. It reports that second-half optimism can be linked to the typical back-to-school and seasonal holiday demand, but other specific reasons include:

PC shipments are forecast to increase 12 percent in 2007, with the average PC forecast to contain 1.4GB of DRAM, an increase of 75 percent over 2006, when memory per PC averaged 800MB. The average system memory per PC is expected to grow from 1.3GB in 2Q07, to 1.4GB in 3Q07 and 1.6GB in 4Q07. Some DRAM vendors believe as many as 45 percent of PCs shipped in 4Q07 will contain 2GB of DRAM, the amount required for optimal performance using the Vista OS.

Strong specialty DRAM demand driven by handsets and game consoles will also help boost DRAM demand in H2-07. The Xbox 360 (512MB GDDR3 DRAM), PlayStation 3 (256MB XDR DRAM), and the Nintendo Wii (64MB GDDR3 DRAM) — require significant amount of memory. Meanwhile, increased DRAM content in new-generation handsets and other personal mobile products will generate more growth opportunities for DRAM suppliers. IC Insights forecasts an average 28MB of DRAM per cellular phone handset in 2007.

On the other side, a significant piece of news hit headlines recently. Hynix Semiconductor Inc. agreed to license Innovative Silicon Inc.’s (ISi), Z-RAM high-density memory intellectual property (IP) for use in its DRAM chips.

According to a release, Z-RAM-based DRAMs will use a singletransistor bitcell — rather than a combination of transistors and capacitor elements — representing the first fundamental DRAM bitcell change since the invention of the DRAM in the early 1970s. Hynix has received the first-mover opportunity to bring Z-RAM to the DRAM market. To ensure this advantage,the two companies have committed considerable engineering resources to work side-by-side on the program.

Z-RAM was initially developed as the world’s lowest-cost embedded memory technology for logic-based ICs such as mobile chipsets, microprocessors, networking and other consumer applications The technology was first licensed, in December 2005, by AMD for upcoming microprocessor designs. Now, the engagement with Hynix positions Z-RAM to become the lowest-cost memory technology in the greater than $30bn memory market. This is surely good news for the memory segment.

So, is supply-demand balance appears to be returning to the DRAM market in the second half of the year? And will Z-RAM lead a rebound? Time will tell!

End note: Recently, there was this power outage in Seoul, Korea, which knocked off quite a few chip production lines at Samsung. As I press this blog, I’ve come across the news that Samsung will likely deliver only 85 percent of promised NAND flash to its major customers. Is the pain going to extend?