Archive

Make unique fashion statements with E Ink!

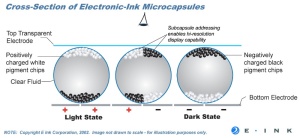

This is a continuation of my conversation with E Ink. An Electrophoretic Display (EPD) company and headquartered in Boston, the company makes rolls of EPD film that are later shipped to partners.

Founded in 1997 based on research started at the MIT Media Lab, E Ink Corp. is a leading supplier of electronic paper display (EPD) technologies. Products made with E Ink’s revolutionary electronic ink possess a paper-like high contrast appearance, ultra-low power consumption and a thin, light form.

Recently, the company achieved a number of design wins in Japan. Throwing light on these developments, Sriram Peruvemba, Vice President of Marketing, E Ink Corp., said that the company’s customers in Japan include Sony (for eBooks), Casio (for mobile phone the GzOne, most rugged version), Citizen (for signage products), Seiko (for wrist watches), Hitachi (for mobile phone, case art display), Teraoka (for Ink In Motion signs), Toppan (for train station arrival/departure information signs).

Recently, the company achieved a number of design wins in Japan. Throwing light on these developments, Sriram Peruvemba, Vice President of Marketing, E Ink Corp., said that the company’s customers in Japan include Sony (for eBooks), Casio (for mobile phone the GzOne, most rugged version), Citizen (for signage products), Seiko (for wrist watches), Hitachi (for mobile phone, case art display), Teraoka (for Ink In Motion signs), Toppan (for train station arrival/departure information signs).

Based on E Ink’s design wins in Japan, is there are a possibility that there will be more mobile phones using film-based displays?

Peruvemba said: “We see sub-segments of the mobile phone market that is disatisfied with the amount of use per battery charge with current LCD technology. We see opportunities for customers to make a unique fashion statement with their products by using our displays. Our displays are slightly thicker than a sheet of paper, so, it is easy to incorporate them as the outside skin of a mobile phone.”

The display can be cut to any shape. The company encourage designers to “think outside the rectangle”, the rectangle representing traditional display technologies, and there is no glass to break making E Ink’s displays the most rugged.

Smart design trends

Given E Ink’s vision of having a presence on every smart surface, it would be interesting to find out the company’s views on the design trends among displays, and in semiconductors.

For starters, customers used to 30 hours of continuous operation on their eBooks will no longer accept two hours on their laptop battery or just a few hours on their cell phone battery, as the demand for lower power consuming displays will increase.

Peruvemba added: “Designers that hitherto designed their product to accommodate a rectangular display will seek displays that will work around their design, displays that offer unique shapes and sizes such as what is available with technologies like E Ink’s EPD. Adoption of reflective display technologies into mobile phones, GPS, PDA’s and laptop computers, will allow us to read the display outdoors without having to squint, shield the screen or seek shade.”

This spring E Ink had announced new product advancements, like its next generation segmented display cells (SDC) and a new controller for active matrix displays that allows for menu options and pen-input. E Ink is offering a prototyping kit for each product line.

Elaborating on these developments, Peruvemba said that the segmented displays were relaunched with three major changes. They are now more flexible/bendable, they can tolerate a wider temperature range (-10 to +60 deg Centigrade)and are thinner (less than 400 micro meters).

“These features allowed E Ink to win designs with smart card makers, penetrate industrial market segments for battery indicators, and go where no display has gone before,” he concluded.

Top 20 global semicon companies — DRAM, Flash suppliers drop out

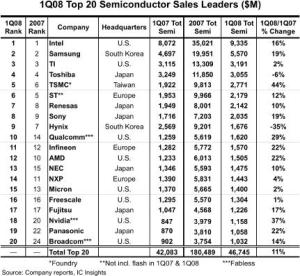

IC Insights recently published the May update to The McClean Report, featuring the Top 20 global semiconductor companies. Not surprisingly, there have been some significant movers and shakers. The most telling — quite a few of the major DRAM and Flash suppliers have dropped out of the Top 20 list!

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

TSMC, the leading foundry, moved up one position, registering the highest — 44 percent — year-over-year Q1-08 growth rate, besides being ranked 5th. Nvidia, the second largest fabless supplier, was another company registering a high YoY growth rate of 37 percent, and moved into the 18th position. Some others like Infineon, Sony and Renesas also climbed a place higher each, respectively. The top four retained their positions — Intel, Samsung, TI and Toshiba.

And now, the shakers! The volatile DRAM and Flash markets have ensured the exit of several well known names such as Qimonda, Elpida, Spansion, Powerchip, Nanya, etc., from the list of the top 20 global semiconductor companies, at least for now.

Among the others in the list, the biggest drops were registered by NXP, which dropped to 14th from 11th last year, and AMD, which dropped two places, from 10th to 12th. Two memory suppliers — Hynix and Micron — also slipped two places, to 9th and 15th places, respectively. STMicroelectronics also slipped from 5th to 6th. IBM too slipped out of the top 20 list.

The top 20 global semiconductor firms comprises of eight US companies (including three fabless suppliers), six Japanese, three European, two South Korean, and one Taiwanese foundry (TSMC). Also, looking at the realities of the foundry market, TSMC’s lead is now unassailable. If TSMC was an IDM, it would be No. 2, challenging Intel and passing Samsung, said one analyst, recently, a thought shared by many.

IC Insights has reported that since the Euro and the Yen are strong against the dollar, this effect will impact global semiconductor market figures when reported in US dollars this year.

There are some other things to watch out for. Following a miserable 2007, the global DRAM module market is likely to rebound gradually in 2008 due to the projected recovery in the overall memory industry, according to an iSuppli report. That remains to be seen.

Some new DRAM camps — such as Elpida-Qimonda, and Micron-Nanya — have been formed. It will be interesting to see how these perform, as will be the performance of ST-backed Numonyx.

Further, the oversupply of NAND Flash worsened in Q1-08, impacted by the effect of the US sub-prime mortgage loan and a slow season, according to DRAMeXchange. The NAND Flash ASP fell about 35 percent compared to Q4-07. Although the overall bit shipment grew about 30 percent compared to Q4-07, the total Q1-08 sales of branded NAND Flash makers fell 15.8 percent QoQ to US$3.24bn. Will the NAND Flash market recover and by when?

Shifts in top 20 global semicon rankings

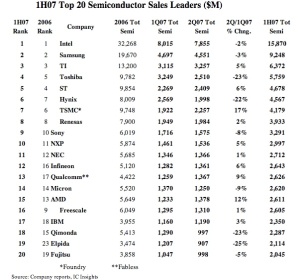

If the recent preliminary results released by IC Insights is anything to go by, there have been some movements among the top 20 semiconductor companies of the world during H1-2007. This is best illustrated by the table below.

While the top three — Intel, Samsung and TI, retain their positions, ST and Toshiba have exchanged the next two positions, as have Hynix and TSMC, while Renesas remains at no. 8!

Freescale has taken a big drop from no. 9 to no. 16, while Sony, NXP and NEC gained one place each. Infineon has climbed back up to no. 12, from no. 16, while Qualcomm occupies the no. 13 position, up from no. 17. AMD dropped two positions, from no. 13 to no. 15.

Will the semicon industry see a tight year ahead? As per reports, IC Insights said that there should be a “noticeable seasonal rebound” in overall IC demand beginning in September 2007, which may cause “significant changes” in the top 20 semiconductor ranking in the second half of 2007. Wait and watch this space!