Archive

TSMC leads 2009 foundry rankings; GlobalFoundries top challenger!

Recently, IC Insights released the rankings for the world’s top pure-play and IDM foundries. No surprises, as TSMC continues to lead! The surprise entrant is of course GlobalFoundries, which ranked fourth, after having started operations in March 2009.

However, all of the foundries, barring Tower Semiconductor, registered negative growth during 2009. Tower, which acquired Jazz Semiconductor in 2008, was the only foundry to post positive growth during 2009.

IC Insights further stated that if the revenues of Chartered Semiconductors, which was purchased by GlobalFoundries recently, were combined with GlobalFoundries, their combined sales would have amounted to over $2.6 billion in 2009. That’s not very far from UMC, which is ranked no. 2!

Now, I am not an expert to comment on which foundry has done really well, despite the recession, or whether GlobalFoundries can really challenge and overtake TSMC in the future. However, I followed with great interest a discussion on one of my groups on LinkedIIn on this topic.

Daniel Nenni, a critically acclaimed blogger, and an industry colleague, had recently blogged on this subject. There were some interesting comments following that post. I sought the permission of Malcolm Penn, chairman and CEO, Future Horizons, to use some of his remarks for my blog post.

Penn said that there is a reason why TSMC is the no. 1 foundry in the world. However, as competition breeds innovation, hence, the foundry business will be much more interesting to watch with GlobalFoundries challenging TSMC.

He added: “There was also no reason why Intel is #1 in PC MPUs or Microsoft #1 in PC OS except for one key factor. Once a competitor gets to be a certain size, no amount of innovation will help swing the balance of power.” The real question therefore is: “Has TSMC now passed this tipping point?” I fear it already has.”

Fact of the matter is in the foundry business capacity is king and TSMC already outguns all of the other competitors combined. Given the minimum two to three year lead time to build and ramp new capacity, TSMC has incredibly clear visibility to see any competitive threat coming.

Very interesting! Some other observations later!

Indian semicon industry starting to make a noise and be heard!

Another anecdote! “Did I not instruct, that box 5 was to be kept empty?” boomed Gerard Butler as the angry Phantom of the Opera, in the movie featuring him and Emmy Rossum. The Phantom really made his statement. He made noise!! Deafening noise, that was hard to close your ears to!

Now, what’s the relationship between Cirque du Soleil’s Alegría and The Phantom of the Opera? Well, nothing really! However, both are fantastic, distinct examples of how to create a noise — and be heard!

Why am I saying all of this? Well, here’s a wonderful comment left by a reader, Sanjay Agarwal, president and CEO, Zelig Semiconductors, to one of my earlier blog posts titled Indian semicon industry: Time for paradigm shift!

He says: “I have worked with India-based semiconductor design houses since 2001. The quality of work has steadily improved. I am sure that India will have more of semiconductor design development including whole product development in few years.”

That’s great to hear! The Indian semiconductor industry is really starting to make a lot of noise and be heard, globally, irrespective of having or not having a fab! I sincerely hope that this momentum gained by the Indian semiconductor industry continues in the years to come!

The forthcoming India Semiconductor Association (ISA) Vision Summiit 2010 — on Feb. 1-2 in Bangalore — will provide even opportunities for the Indian semiconductor industry to really make a lot of noise, and be heard, globally.

In the meantime, here’s a photograph from Oct. 28th, 2004 — the day, the ISA was born in Bangalore.

Notice the stalwarts? From left: Dr. Ananda, Dr. Madhu Atre, S. Uma Mahesh, Rajendra Khare, Dr. Sridhar Mitta, Dr. Anand Anandkumar, V. Veerappan, S. Janakiraman and Dr. Satya Gupta.

The ISA, and indeed, the Indian semiconductor industry have come a long way since! Both have made a lot of noise during this journey. Back in those days, it was a bit difficult for me to explain to folks in India that I wrote about semiconductors! Or, for that matter, EDA. Never mind. That was the ‘age of innocence’ for the Indian semiconductor industry!

Nevertheless, I was there!

The journey of the ISA and the Indian semiconductor industry, post the formation of the ISA has been pleasant, so far. One, it got all leading companies under one umbrella. Two, we started seeing some India specific reports on the industry. Does not matter if the statistics presented were/are agreeable to all. Three, it led to the semicon policy. Again, it does not really matter, how much of it has succeeded as far as setting up a wafer IC fab is concerned.

What it has not achieved so far is that these events have not really led to the creation of a knowledge economy one would have liked to see. However, that will change for sure in the times ahead! Do understand: semiconductors is not an easy subject, nor easily understood by all. I’m still a student and have much more to learn about this industry!

Continuing with the journey of the ISA and the Indian semiconductor industry, starting from 2005, when the Indian semiconductor industry and the ISA were discussing design hub challenges before India and whether the country should go fabless vs. fabs, it has since led to the formation of the Indian semicon policy in 2007. That sparked off a huge debate about having fabs in India in 2008, to the falling off of fab plans by early 2009! The strength of India in embedded electronics and design services also came to the fore during this period. Last year, it led to the emergence of solar photovoltaics (PV) and solar fabs in India. How this market segment plays out in the coming years would be interesting to watch.

As of now, the Indian wafer IC fab story lies dead and buried! Will it get revived? No, for the present. Perhaps yes, in the future.

The new mantra in 2009 became Made in India, Made for India. Now, the emerging mantra in 2010 seems to be product development and product development companies, and India as a market with growth momentum.

All of these really make for very compelling reading, especially for followers of the Indian semiconductor industry. However, everyone associated with the Indian industry will agree that while a lot of noise has already been made and it has been heard globally, a lot more really needs to be done to make India a truly semicon powerhouse.

The ISA Vision Summit 2010 will, in all probability, see the light of the day of the really long awaited Karnataka Semiconductor Policy. It has been nearly 18 months in the making and waiting. Hope to hear some good stuff about it. Better late than never!

Finally, hope to see you at the ISA Vision Summit 2010. More, later!

Electronics for energy efficient powertrain

The Auto Expo is the premium event for auto sector in India with global participants.

Session 1 of the conference focused on electronics for energy efficient powertrain.

Environmental concerns and driver comforts are major factors for deciding on next generation automotive power-train electronics. Most countries are championing cleaner and greener automobiles. Today’s high-end ECUs (Electronic Control Units) are combining these demands to create efficient engine management systems that would be driving tomorrow’s people’s cars.

In his presentation, Praveen Acharya, vice president, Semicon Solutions, KPIT Cummins Infosystems Ltd, said that powertrain was both complex and critical. Highlighting the automotive/ECU market, he added that while this market had matured in Japan, USA and Europe, big growth was likely in BRICs.

He highlighted some industry challenges for powertrain and electronics, which include:

Dr. A. Zahir, vice president, Bosch, discussed sustainable individual mobility. He focused on the reduction of CO2 emissions as well as technologies to support CO2-reductive comportment.

He highlighted some measures to manage vehicle energy. These include: combustion engine optimization, demand-responsive energy management, stop/start, hybrid, electric vehicles, components optimization, and waste heat recovery.

Dr. Zahir said global warming and population were rising. Hence, there was a strong increase of urbanization and energy hunger in the emerging countries. All of these challenge sustainable individual mobility.

Sustainable individual mobility can be achieved by reducing CO2 emissions and by increasing fuel economy. With a system approach based on enabling technologies from the Bosch portfolio, there is an enormous potential to reduce the CO2 emissions and increase fuel economy.

All of the required functionalities require cost effective electronics running complex control algorithms and diagnostics. The proliferation of smart and highly integrated.semiconductors will continue to accelerate in the automotive domain.

Suraj Mukundrajan, director Automotive Development, Infineon Technologies India Pvt Ltd, touched upon how semiconductors can enable fuel efficiency.

He highlighted certain global CO2 targets, wherein, the European Union (EU) proposes steep fines to cut car CO2 from 2012. For cars – 120gCO2/km by 2012 +10 g coming from biofuels. Now, the law is: 35mpg CAFE (Corporate Average Fuel Economy) by 2020 for cars.

Mukundrajan advised that emission reduction could be achieved by optimizing different areas in a car. The full spectrum of semiconductor technologies would be required to achieve energy efficiency in automotive electronics Less fuel consumption and cleaner engines will happen due to better performing MCUs.

He also highlighted the advantages of automotive hybridization. For instance, plug-in hybrid saves 40 percent to 60 percent energy compared to conventional combustion engines.

Already, the 2013 annual production will likely rise to over 3 million vehicles, which is about ten times the production of 2005 with 335.000 hybrid cars. Further, the semiconductor content in hybrid cars is much higher — $525-$900 as compared to conventional combustion engine cars — $225-$300.

Mukundrajan added that the CO2 target must be achieved. Although, the customer did not clearly realize the value today, the required technologies do exist. However, they are not included in the drive cycle in a huge manner, at least not yet!

Sandip Sarkar, head – Electrical Systems, Controls & Software Engineering, General Motors – Technical Center India, highlighted the huge opportunity for smart and green automobiles. While there was 70 million sales in 2007, in 2016, it is likely to touch 95 million in sales.

According to him, the automotive DNA of the future would include: electrically driven automobiles, energized by electricity and hydrogen, powered by electric motors, controlled electronically and ‘connected.’

Sarkar highlighted the sustainability benefits as well. These include:

The vision is to have electrically driven vehicles in the future – equipped with sensors, V2V, GPS, digital maps, electronic controls and actuators, etc. This will enhance roadway safety, besides providing real-time traffic management. Smart intersections would be part of the roadway of the future. All of these together, will enhance energy efficiency and reduced emissions.

Qualcomm, AMD head top 25 fabless IC suppliers for 2009; Taiwan firms finish strong!

So, IC Insights has revealed the top 25 list of fabless IC suppliers for 2009! No surprises, Qualcomm still leads!

However, AMD is the surprise runner-up, for now. The reason being: AMD became a fabless company by including its Dresden, Germany fabs as part of GlobalFoundries spin-off. IC Insights included all of AMD’s sales for 2009 in its study.

Some other interesting points

First, as many as nine fabless IC companies — all of the top nine companies — had sales of $1 billion or more in 2009. These are: Qualcomm, AMD, Broadcom, MediaTek, nVidia, Marvell, Xilinx, LSI Corp., Altera and Avago! And you still believe there was a recession in H1-09?

Movers and shakers

So, who are the leading top movers and shakers?

The list comprises fabless IC suppliers from the USA — which has 17 representations, including nine suppliers in the top 10! Taiwan has six representations, with one — MediaTek — figuring among the top 10, well, top five actually! Europe and Japan have one representation each — in CSR and MegaChips. Read more…

Indian semicon industry: Time for paradigm shift!

First, the strengths — what really makes the Indian semiconductor industry tick and appear attractive to the overseas players!

Key strengths…

Dr. Pradip K. Dutta, corporate vice president and managing director, Synopsys India, and treasurer, ISA, said, “India’s strengths include its huge market potential, availability of good engineering talent with the ability to scale up as required; and a pretty well established IP/judicial regime.”

As per Raju Pudota, managing director, Denali Software, India defintely has a great talent pool and a lot of work has been done over the last 20-25 years. “Over a period of time, India has developed a variety of skills and capabilites. We have forayed into multiple domains. There is a variety of domain knowledge that has been developed. As captive design centers, companies are having more ownership as before,” he added.

Rahul Arya, director, Marketing & Technology Sales, Cadence Design Systems India Pvt Ltd, listed strengths from business and technology perspectives. From a business perspective, it would include an expertise built over years, scalability of operations, etc. “If you look at any other emerging country, expertise could be there, but can you scale that?” Also, cost arbitrage is still valid.

From a technology perspective, India’s strengths include embedded design, verification and an increasing ownership of end-to-end SoC designs, which are well known globally!

…and weaknesses!

Now, on to the weaknesses, which I’ve actually, written about a lot in the past!

Synopsys’ Dr. Dutta said: “Although we have lot of talent, it is raw talent. The industry is more services oriented and not product oriented, with very little of systems manufacturing. Maybe, the services companies became more successful, so there has been risk averseness. However, it can change overnight with some mavericks coming in. As for systems manufacturing, the govenment of India should put together a national agenda to promote electronics manufacturing.”

Denali’s Pudota agreed that the Indian semiconductor industry is still in the services center mode. “We have not yet managed to translate the talent base into product startups. Somehow, the mindset and value proposition is: how do we get margin on the work we do. Its been like that in the semiconductor industry. You don’t see many home grown startups,” he added.

Cadence’s Arya also advocated that India needs to move away from service to product mindset. According to him, some other weaknesses include — not enough basic research and not many PhDs in the fraternity, as well as a gap of new hires — the time new hires take to become productive, and third — a gap in analog and RF engineers.

NSM formally launched, but why so much focus on thermal solar?

So, the Jawaharlal Nehru National Solar Mission (NSM) has been launched! The NSM was launched by the Prime Minister of India, Dr. Manmohan Singh, at the Solar Energy Conclave organized by the MNRE at Vigyan Bhavan, New Delhi this week in the presence of Dr. Farooq Abdullah, Union Minister for New & Renewable Energy, Sharad Pawar, Minister of Agriculture and Minister of Consumer Affairs, Food and Public Distribution, Jairam Ramesh, Minister of State (Independent Charge) for Environment and Forests, and Montek Singh Ahluwalia, Deputy Chairman of the Planning Commission, Government of India.

In his address, the Prime Minister of India, Dr. Manmohan Singh, said: “Increased use of solar energy is a central component of our strategy to bring about a strategic shift from our current reliance on fossil fuels to a pattern of sustainable growth based on renewable and clean sources of energy. I sincerely hope that this solar Mission will also establish India as a global leader in solar energy, not just in terms of solar power generation but also in solar manufacturing and generation of this technology.

“The importance of this Mission is not just limited to providing large-scale grid connected power. It has the potential to provide significant multipliers in our efforts for transformation of India’s rural economy. Already, in its decentralized and distributed applications, solar energy is beginning to light the lives of tens of millions of India’s energy-poor citizens.

“The rapid spread of solar lighting systems, solar water pumps and other solar power-based rural applications can change the face of India’s rural economy. We intend to significantly expand such applications through this Mission. As a result, the movement for decentralized and disbursed industrialization will acquire an added momentum, a momentum which has not been seen before.

“I am happy that the Federation of Indian Chambers of Commerce and Industry (FICCI) has been associated with this event. The role of industry in this Mission’s success will be critical. Eventually, if the ambitious roll out of the Mission is to become a living reality, we will have to create many ‘Solar Valleys’ on the lines of the Silicon Valleys that are spurring our IT industry across the four corners of our country.

Dr. Farooq Abdullah, Union Minister, stated in his keynote: “This Mission is named after India’s first and visionary Prime Minister, Jawaharlal Nehru. For him, India’s development needed to be anchored in its mastery over cutting-edge technologies. The Solar Mission is very much in line with his vision, which has made India today, a leading nuclear and space power. He would have been equally keen and proud to see India attaining the same level of advancement in solar energy. I am confident, that under the leadership of our Hon’ble Prime Minister, Dr. Manmohan Singh, we shall make India a global solar power as well.”

The focal point, for the next three years, will be the NTPC Vidyut Vyapar Nigam (NVVN), which is the power trading arm of the NTPC. NVVN will purchase solar power at rates fixed by the Central Regulatory Electricity Commission (CERC) and for a period specified by the latter.

Global semicon industry on rapid recovery curve: Dr. Wally Rhines

Thanks to Mentor’s Raghu Panicker and Veeresh Shetty, I had the pleasure of an exclusive meeting with Dr. Walden (Wally) Rhines, chairman and CEO, Mentor Graphics, post his technical keynote at the recently held VLSID 2010.

We discussed a range of issues, such as the global semiconductor and EDA industries, as well as the Indian industry.

Global semicon industry

According to Dr. Rhines, the global semiconductor industry is currently on a rapid recovery curve. However, that the semiconductor total available market (TAM) would decline in 2009 due to the weakness of H1-09.

He added that the global semiconductor industry’s growth could even be as much as 22 percent during 2010, as also advised by Malcolm Penn of Future Horizons. This number can definitely change, rather than remain so optimistically high, as the year goes by. (Yes, Malcolm’s an optimist!)

Dr. Rhines said, “If you look at the major semiconductor companies, most of them will have an opportunity to grow — after the Q4 results are in.”

On the global EDA industry

So how will all of this contribute to the well being of the global EDA industry?

According to Dr. Rhines, the EDA industry has been a little different. Mentor and Synopsys have probably had more growth and stability. “Mentor could be the only company to grow. Bookings in Q3-09 have grown by 15 percent and revenue by 3 percent. We are perhaps the only major EDA company that has grown,” he said. In the long term, EDA tends to trend with semiconductor R&D. Semiconductor R&D was flat in 2008, down in 2009, and will probably grow in 2010. So, EDA will probably lag in 2010.”

Advise for Indian semicon industry

I also requested Dr. Rhines to advise the Indian semiconductor industry.

He said: “The Indian semiconductor industry needs to look at more of systems and IC design, as well as embedded software development. India should also have more product start-ups. What makes India unique is its talent, education, etc. India is now producing its own electronic design architecture and embedded software, and it also has the systems infrastructure. India can greatly advance what it already does so well.”

Commenting on the industry’s weaknesses, he added that the Indian semiconductor industry needs to increase the infrastructure for its local start-ups. That infrastructure would require things such as VCs and especially, a cultural acceptance of failure. Also, if India does not have the intrinsic semiconductor manufacturing capability, then it needs to stay current on the evolving technologies.

Does India need a fab?

On being asked this question, Dr. Rhines’ reply was immediate: “I don’t think India ever needed a fab! You can easily have closer relationships with other fabs. The highest paying jobs are design and innovation, etc.. The recession has been driving down costs and innovation has been happening. There are big growing markets — in India and Asia.”

Global semiconductor sales forecast: Cowan's LRA model (based on Nov. 2009 sales data)

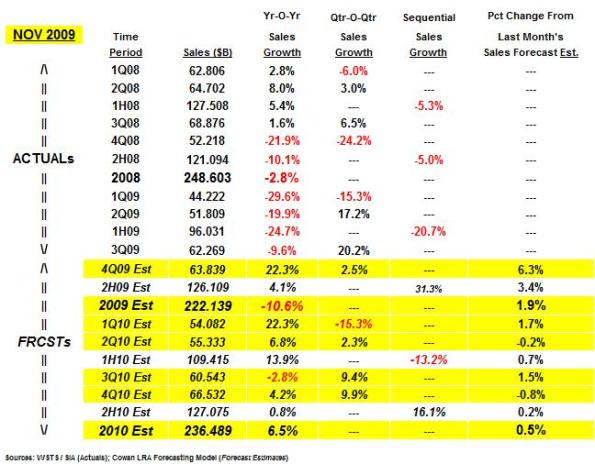

Here are the latest forecast results for 2009 and 2010 global semiconductor sales estimates associated with the forecasting model — the Cowan LRA model for predicting worldwide semiconductor sales.

The presently updated global semiconductor sales forecast estimates are based upon the recently published November 2009 actual sales numbers released by the WSTS (posted on its website on Jan 4, 2010).

The table below details the latest, updated forecast numbers covering the next five quarters, that is, from 4Q09 through 4Q10, respectively, as well as for the full years of 2009 (including 4Q09) and 2010.

NOTE – This is the last forecast for 2009 since next month’s sales data from WSTS, namely for Dec 2009, will “wrap up” the year (2009 will become history!) and the model will “shift focus” to 2010 forecast expectations and beyond!

As the table below shows, the latest updates for years 2009 and 2010 chip sales forecast estimates increased by +1.9 percent and +0.5 percent, respectively, to $222.1 billion and $236.5 billion compared to last month’s sales forecast estimates of $217.9 billion and $234.0 billion, respectively.

The updated 2009 and 2010 chip sales forecast estimates correspond to yr-o-yr sales growth forecast estimates of -10.6 percent and +6.5 percent, respectively, which represent a continuing improvement compared to last month’s sales growth prediction of -12.6 percent for 2009 but, however, no change from last month’s same sales growth forecast estimate of +6.5 percent for 2010.

Additionally, the model also projects a sales forecast estimate for next month, namely for December 2009. Thus December’s (actual) sales forecast estimate is projected to be $20.023 billion, which corresponds to a 3MMA (three Month Moving Average) sales forecast estimate of $21.28 billion as is normally published by the SIA. Read more…

Future research directions in EDA: Dr. Prith Banerjee @ VLSID 2010

Dr. Prith Banerjee, senior VP of research at HP and director of HP Labs, discussed some promising areas for research while delivering his keynote on future research directions in EDA at the ongoing VLSID 2010.

He highlighted eight areas that HP Labs is currently working on. These are:

— Digital commercial print

— Content transformation

— Immersive interaction

— Information management

— Analytics

— Cloud

— Intelligent infrastructure

— Sustainability

EDA challenges

So, what are the EDA challenges? According to Dr. Banerjee:

* Today, EDA develops automated tools for designing ICs. However, there is a need to address automation for electronic systems at higher levels.

* There is a proliferation of new modes for communication and collaboration has resulted in the explosion of digital information.

* An intelligent IT infrastructure, which can deliver extremely high performance, adaptability and security — will be the backbone of these developments.

* In future, you need to look at design automation for entire systems.

— networks and data centers

— electronics and photonics

— performance and sustainability

Growth of new modes of communication and collaboration has led to an explosion of digital information. The IT industry would need to develop novel ways to acquire, store, process, and deliver information to customers. An intelligent IT infrastructure, which can deliver extremely high performance, adaptability and security, will be the backbone of these developments.

Intelligent infrastructure

This is required to capture more value via dramatic computing performance and cost improvement. HP Labs’ contribution has been on three big bet projects, namely, next generation data centers, networking and next generation scalable storage. HP Labs’ research contribution has been:

* Exascale

An Exascale data center that will provide 1000X performance while enhancing availability, manageability and reliability and reducing the power and cooling costs. HP Labs is working on the design of a sustainable data center that reduces total cost of operation (TCO) and carbon footprint, while meeting the current quality of service goals.

— Designed across components, interconnects, power and cooling, virtualization, management and software delivery.

* Photonics

— Replace copper with light to transmit data

* 1000X gain in performance

Dr. Banerjee said that there is a need to create brand new optical technologies that can work in exascale. Photonics interconnects make use of light for data communications. The transmit or receive optical bus is a simple modular system in four elements — transmitter media, optical tap, optical source, and optical receiver.

Non volatile memory and storage is another area that HP Labs is working on. Dr. Banerjee highlighted the memristor or a resistor with memory. In future, it has the potential to replace DRAM, hard drives and Flash memory.

“The memristor has the potential to revolutionize electronics,” he added. It is structurally simple and easy to fabricate. Also, it switches in nanoseconds and has many year lifetimes. HP Labs is said to be in discussions with leading memory makers for further.developing and licensing this technology.

Next-generation displays is yet another key research area at HP Labs. These are said to be unbreakable, conformable, ultra-thin and lightweight displays. Such displays have paper like qualities + video capabilities.

Technologies such as memristors, photonic interconnects, and sensors will likely revolutionize the way data is collected, stored and transmitted.

Sustainable data centers is another key research area. Among HP Labs’ research contribution, it is aiming to reduce TCO by 50 percent and carbon footprint by 75 percent.

Highlighting another industry challenge, Dr. Banerjee pointed out that the IT industry is only responsible for 2 percent of total carbon emissions. The global economny contributes the remaining 98 percent of total carbon emissions from other industries such as aviation, transportation, retail, etc. IT has a significant role to play here.

Naturally, all of the research areas would require sophisticated system-level design automation tools. Dr. Banerjee said: “In the past, the EDA research focused on chips. In the future, we need to look at entire systems.”

Delivering 10X design improvements: Dr. Walden C. Rhines, Mentor Graphics @ VLSID 2010

Today, the exponential rise in complexity has quickened its pace as the industry moves toward adoption of 28 nm and below. Dr. Rhines discussed how over the next five years, 10X improvements in design methodologies are required in four areas: high-level system design, verification, embedded software development, and back-end physical design and test. According to Dr. Rhines:

* Reduced cost per function will continue on a predictable learning curve – long after Moore’s Law is obsolete.

~ 40 billion transistor (5-10 billion gate) ASIC designs in 2018.

* EDA tools for 40 billion transistor designs are available today:

— Design abstraction.

— Advanced verification methodology changes.

— Merging of physical verification with new router architectures.

— Parallelization.

* Embedded software automation (ESA) will automate software development and verification

— Just as EDA did for hardware design.

So, why has Moore’s Law been a useful approximation for 40 years? It is based upon a basic ‘Law’ of nature – the learning curve. Moore’s Law is a special case of the learning curve when two things are true:

1. Cumulative transistors produced increase exponentially with time (e.g. 2x cum volume => fixed percentage cost decrease).

2. Almost all cost reduction has come from shrinking feature sizes (and growing wafer diameter).

Learning curves

* Cost per unit decreases by a fixed percent every time total cumulative volume doubles.

* Applies to all free market products and services (over centuries) when measured in constant currency.

* Used to predict future costs.

— Aircraft industry

— Semiconductor industry

* Also true for subsystem or component costs and improvements in reliability, quality, yield, etc.

A non-linearity of growth in transistor consumption led to Moore’s Law adjustments.

Can Moore’s Law support 10X complexity?

Going forward, Moore’s Law doesn’t matter! The innovative assembly and packaging of multiple chips will drive lowest cost. The cost per function will continue to decline long after Moore’s Law is obsolete.

Growth in unit volume distinguishes semiconductors from other industries (see graph). The question is: Will transistor unit volume continue to grow at 49 percent annually for the next 10 years?

There has been constant or increasing IC unit growth. There have been only three years of negative growth in history. There has also been constant transistor unit growth. An order of magnitude increase in complexity Is likely by 2018. Therefore, what are the applications that will require 10X more transistors (per package) by 2018?

Now, computers and cell phones account for over 70 percent of semiconductor revenue. Also, semiconductor recessions are typically followed by the rapid growth of new semiconductor applications.

The economic cycle provides a boost to new DRAM intensive applications. Further, new NAND Flash applications will be accelerated by price decreases beyond Moore’s Law. The affordability of memory enables new applications and re-ignites the old appetites. The reduced memory cost drives new architectures and applications.

Dr. Rhines gave examples of how digital cameras achieved high volumes as falling prices ignited volume sales. Low prices generally tend to open up whole new markets. ASICs have even enabled sub $20 mobile handsets. The integration of new functionality also ignites demand in both new and old applications — an example being products and applications incorporating GPS.

As another example, the desktop PC market growth is slowing after 30 years. However, notebook/netbook/smartbook market appears to be headed for many years of growth ahead! Similarly, while the Internet penetration as well as mobile phone adoption are saturated in mature economies, both of them are in a high-growth mode in the emerging economies. Read more…