Archive

Cadence's focus — systems, low power, enterprise verification, mixed signal and advanced nodes

I recently had the opportunity of meeting up with Nimish Modi, Senior Vice President, Research and Development, Front-End Group, Cadence Design Systems, along with Rahul Arya, Marketing Director, Cadence Design Systems (I) Pvt. Ltd.

Modi provided a perspective on how solutions from the EDA sector help the electronic design industry improve productivity, predictability and reliability of design processes, especially verification. Design verification is the process of ensuring that a chip design meets its specifications.

Modi provided a perspective on how solutions from the EDA sector help the electronic design industry improve productivity, predictability and reliability of design processes, especially verification. Design verification is the process of ensuring that a chip design meets its specifications.

According to him, today’s product development ecosystem comprises of three driving forces — productivity, predictability and reliability. “We are clearly at the core of product development. We have a very strong breadth and depth. There is a layer of solutions we have integrated with our product offerings,” he added.

He highlighted that Cadence’s solutions consist of integrated point tools, as well as recommended use models. It also has a very strong services offering.

Focus on five key areas

Currently, Cadence is focusing on five key areas — systems, low power, enterprise verification, mixed signal and advanced nodes. “We have a solutions oriented approach across the board,” Modi said.

On systems, it is key to focus on gaining more productivity. Modi said: “This can be done by raising the level of abstraction. The technologies available to address ESL have been around for a while, each one addressing a piece of the puzzle. The need is there for seeing tremendous improvements in that. Here, Cadence’s C-to-Silicon Compiler comes in.”

“The other piece is — it has incremental synthesis capabilities. A third thing — it is connected to the downstream flow. This is the foundation of our systems strategy,” said Modi.

Coming to the systems design and verification strategy, the first component involves planning and management. “We have an enterprise manager,” he added. Cadence has been a leader in the hardware assisted verification with rich VIP/SpeedBridge portfolio. It has enabled a move to TLM driven design and verification flow. Cadence also delivers unique system power exploration, estimation and optimization flow. It provides unique hardware/software co-verification capabilities (Incisive Software eXtensions) as well.

Low power strategy

On Cadence’s low power strategy, Modi highlighted three components — implementation, verification and design. “The innovation was the ability to create a power format to capture the design intent. We are committed to providing flow operability as well. We want customers to make use of advanced power management techniques,” he added.

“We have the superior low power technology,” he claimed, referring to the Power Forward Initiative (PFI). “Look at technology — that is proven. The format is a means to the end. We are also working on providing more capabilities in the power exploration space. We are working under different aspects.

“You can do power analysis on the IP block; there’s C-to-Slicon, which has power as a function; multi-supply voltage will be a component of our synthesis solution. All of these vectors are driving the power exploration space. Seventy percent of chips’ power is determined at or before the RTL stage,” said Modi.

Cadence has a closed loop verification methodology. At each stage, you can go back and make sure you can be consistent with what’s there upfront.

Enterprise verification strategy

On enterprise verification, Cadence’s approach is plan-to-closure. Predictability — utilize executable plans and metrics that predict functional closure; productivity — effectively deploy methodolgy driven multispecialist flows. with VIP and multiproduct automation; and quality — reduce risk of functional bugs at tape-out at various project stages.

Modi added: “Our verification IP portfolio is also very critical. The depth of our portfolio is the broadest in the industry. In verfication, the actual TAM is growing. We are getting opportunities as well. Multi dimensions of enterprise verification are being taken care of by us.”

Interesting that all EDA companies have focused on verification! Why now and why not earlier? Modi said: “We’ve been in this area for a while. We have pioneered the new approaches. The goal is: how do you know it is good enough to hit the tapeout button? Our goal is to raise the confidence of customers.”

He added: “We are coming uo with a hybrid model. We are engaging with customers at this point of time. We came up with multi-language support in OVM. We have 30+ verification IP portfolios.”

Trends in complex SoCs

Today, it is largely a mixed signal world. Mixed signal IC revenue has been increasing faster than the rest of the industry. It is driven by applications, including wireless devices, consumer and DTV, and automotive.

Modi said: “There is a genuine need to support natively analog behavioral models in a digital centric verification environment. Mixed signal is a larger percentagre of area and effort.”

Coming down to advanced nodes, it is no surprise that Cadence definitely supports MCMM (multicorner and multimode). “It is part of our Encounter Digital Implementation System,” added Modi.

Xilinx rolls out ISE Design Suite 11 for targeted design platforms!

Xilinx has now started shipping its ISE Design Suite 11.1! Source: Xilinx

Source: Xilinx

This is said to be the industry’s first FPGA design solution with fully interoperable domain-specific design flows and user-specific configurations for logic, digital signal processing (DSP), embedded processing, and system-level design.

The ISE Design Suite 11.1 release is a major milestone in the delivery of targeted design platforms with simpler, smarter design methodologies for creating FPGA-based system-on-chip solutions targeting a wide variety of markets and applications.

Tom Feist, Senior Marketing Director, Xilinx Inc., said that the company has been driving the evolution of FPGA design with domain-specific development environment for targeted design platforms. The new ISE Design Suite 11.1 sets the industry standard for delivering FPGA design tools and intellectual property (IP) to embedded, DSP and logic designers.

“This is a series of announcements that Xilinx is working on. We are releasing the IC Design Suite 11, for now,” he added. “Target design platform is a focus for Xilinx right now. We are working with Vita Consortium — Vita 57.” This is the FPGA I/O Mezzanine Card (FMC) standard, which aims to bring modularity to FPGA designs.

Meeting diverse requirements of FPGA design teams

Tailored for domain-specific methodologies, Xilinx’s ISE Design Suite 11 has four configurations aligned to user-specific methodologies — logic (VHDL/Verilog), embedded, DSP, or system design. It has the FLEXnet license management to better meet the design teams’ needs.

It also delivers methodologies specific to each designer’s needs. Each configuration delivers domain specific tools and IP, and accelerates designer productivity. The Suite narrows the focus to design differentiation, and not the design flow. Besides, it leverages the robust ecosystem of third party partners.

“The goal is to build a strong foundation with the targeted deisgn platform. Each edition of the Design Suite includes all of the tools/IPs needed to create, validate and implement,” Feist added.

“We are introducing four different versions — one for the logic designers; one for the embedded designers, one for the DSP desgners; and for system integrators,” he said.

“The overall strategy is to increase designers’ productivity. To drive this to the next level, we look at the development phase of our customers. FPGA design teams face different requirements. We need to provide methodologies that are working for each one of the individuals,” Feist added. The goal being — for each new tool, provide the IP and help validate the design.

More turns/day for designers

Overall, there are improvements for all designers, leading to more turns per day. There are improvements in the place-and-route algorithms. It delivers an average of 2X faster runtimes. The second generation SmartGuide provides an additional 2X improvement. The Design Suite also supports multi-threaded place and route.

Other improvements include: XST delivers an average of 2X faster synthesis runtime; improved support for SecureIP provides faster simulation PowerPC, MGT, and PCI hard IP blocks — supports Mentor, Cadence and Synopsys simulators; 10 percent better dynamic power via place and route optimizations; and reduction of memory requirements by an average 28 of percent.

Feist clarified: “The 2X improvement in implementation is compared to 10.1, our previous release. The 2X improvement related to SmarGuide is relative to a full re-implementation. Also, the 10 percent better dynamic power via place-and-route optimizations is against the previous release.”

The Xilinx ISE Design Suite has been positioned as a key enabler for targeted design platforms. It delivers optimized tool flows for each member of the design team. Thereby, it aims to boosts user productivity, improve quality of results, accelerate time to production, and enable designers to focus on differentiation.

Who would be the main users — power or mainstream? Feist said: “This will be useful for power users as well. Even the pushbutton users will still need to do pin layout. We have tried to make this very intuitive. You can look at the different levels.”

Big changes in probe card supplier shares due to 2008 IC market turmoil

SANTA CLARA, USA: VLSI Research Inc. has reported that the global economic downturn has had a seriously detrimental impact on the market for probe cards used for testing IC wafers during 2008, and that 2009 sales will be down even further.

Probe card revenues declined by 26.9 percent in 2008 compared to a 4.2 percent decline in IC sales. This weakness was driven largely by sharp cutbacks within the Memory sector. In 2009, sales of probe cards, including spares and service, are forecast to decline a further 24.5 percent to only US$0.77B, down from US$1.0B in 2008. This compares to nearly US$1.4B in revenues in 2007.

The 2008 probe card supplier ranking saw a number of changes, as those that rely heavily on the Memory market suffered declines. FormFactor (USA), Micronics Japan Co. (MJC – Japan), and JEM (Japan) maintained their lead at the top of the supplier ranking, while SV Probe (USA) climbed into the 4th position, up from 5th in 2007. Technoprobe (Italy) jumped to 5th place from 7th last year.

Over the coming five years probe card revenues are not expected to recover to the levels previously forecast, reflecting the lower level of IC production over this period. Additionally, the very high historic growth rate in demand for memory test probe cards is expected to remain subdued. VLSI Research projects that the probe card market will reach $1.5B by 2013.

Source: VLSI Research

More mature PV industry likely post solar downturn: iSuppli

Recently, iSuppli came out with a study on whether the current solar downturn will lead to a more mature photovoltaic industry! According to iSuppli, severe downturn in the global PV market in 2009 could actually have a more positive outcome for the global solar industry, yielding a more mature and orderly supply chain when growth returns.

Worldwide installations of PV systems will decline to 3.5 Gigawatts (GW) in 2009, down 32 percent from 5.2GW in 2008. With the average price per solar watt declining by 12 percent in 2009, global revenue generated by PV system installations will plunge by 40.2 percent to $18.2 billion, down from $30.5 billion in 2008.

“For years, the PV industry enjoyed vigorous double-digit annual growth in the 40 percent range, spurring a wild-west mentality among market participants,” said Dr. Henning Wicht, senior director and principal analyst for iSuppli.

“For years, the PV industry enjoyed vigorous double-digit annual growth in the 40 percent range, spurring a wild-west mentality among market participants,” said Dr. Henning Wicht, senior director and principal analyst for iSuppli.

“An ever-rising flood of market participants attempted to capitalize on this growth, all hoping to claim a 10 percent share of market revenue by throwing more production capacity into the market. This overproduction situation, along with a decline in demand, will lead to the sharp, unprecedented fall in PV industry revenue in 2009,” he added.

What about new entrants?

I quizzed Dr. Wicht how this downturn would lead to a more mature PV industry and what about the new entrants?

Dr. Wicht said: “We expect that the solar industry will invest more softly. The years 2007/2008 were special. Each of the hundreds of suppliers were ready to invest to reach 10 percent market share. This is not likely to repeat.” Interesting! “Also, the new entrants will invest more modestly and closely linked to fixed customer orders,” he added.

Role of FIs in solar

Are financial institutions paying that much importance to solar, especially in places such as India? This is an issue that was also raised and discussed at the recently held SEMI India solar/PV paper launch.

According to Dr. Wicht, the financial investors are definitely looking into solar, mainly in Europe and US. “PV in India is still at the very beginning. From my experience, there is not yet much attention of financial investors for PV in India,” he noted.

Off-grid or grid connected apps?

Turning the discussion to off-grid vs. grid connected applications, I sought Dr. Wicht’s advice on the route that should be followed. Again, this topic was discussed during the SEMI India meet early this month. Hence, the interest for India in this field is significant!

Dr. Wicht highlighted: “Installations for the off-grid remains a small portion in terms of the sold modules (MW), about 5 percent. The off-grid system selling might be a good way to start in places such as India. For cell and module production, on-grid is where the volumes are needed.” Hope the Indian solar photovoltaics industry takes note of this valuable advice — and it holds good for other regions as well.

I also asked him regarding a good low carbon growth strategy for developing countries. Dr. Wicht said that depending on the place, it could be a combination of wind, solar and biomass.

Compensating for Spanish whiplash!

According to iSuppli’s study, the single event most responsible for the PV market slowdown in 2009 was a sharp decline in expected PV installations in Spain. Also, beyond Spain, the PV market is being adversely impacted by the credit crunch.

Therefore, why won’t attractive investment conditions in other some countries compensate for the Spanish whiplash?

Dr. Wicht said: “The investigated countries start from a low level of installations and show long, administrative procedures, limits of feed-in tarifs and reduced capital access. They simply cannot compensate the 2.6GW of Spain in 2008.”

Finally, what is likely to happen after the shakeout or fall in the coming years? He added: “System demand will grow stronger from H2-2010, absorbing the inventory, which has been built up in 2009 and 2010. From 2011, demand for modules will rise. It might pick up quickly. Then, companies, which are able to supply on short notice/(flexibility) can gain market share.”

Let me see if I can convince Dr. Wicht to visit India and share his insights with the Indian solar/PV industry. Last, but not the least, thanks Jon!

Reports of memory market recovery greatly exaggerated: iSuppli

EL SEGUNDO, USA: Concerned about their image as they face the specter of bankruptcy, many memory chip suppliers are attempting to paint a more optimistic picture of the business by talking up a potential market recovery.

However, while overall memory chip prices are expected to stabilize during the remaining quarters of 2009, iSuppli Corp. believes a true recovery in demand and profitability is not imminent.

After a 14.3 percent sequential decline in global revenue in the first quarter DRAM and NAND flash, the market for these products will grow throughout the rest of the year. Combined DRAM and NAND revenue will rise by 3.6 percent in the second quarter, and surge by 21.9 percent and 17.5 percent in the third and fourth quarters respectively.

“While this growth may spur some optimism among memory suppliers, the oversupply situation will continue to be acute,” said Nam Hyung Kim, director and chief analyst for memory ICs and storage at iSuppli.

“For example shipments of DRAM in the equivalent of the 1Gbit density will exceeded demand by an average of 14 percent during the first three quarters of 2009. This will prevent a strong price recovery, which will be required to achieve profitability for most memory suppliers.”

Painful oversupply

Due to a long-lasting glut of DRAM, the imbalance between supply and demand is too great for this market to recover to profitability any time soon.

“Even if all of the Taiwanese DRAM suppliers idled all their fabs, which equates to 25 percent of global DRAM megabit production, the market would remain in a state of oversupply,” Kim said. “This illustrates that the current oversupply is much more severe than many suppliers believe—or hope.”

Besides cutting capacity, which suppliers have already been doing, they presently have few options other than waiting for a fundamental demand recovery. iSuppli believes that another round of production cuts will take place in the second quarter, which will positively impact suppliers’ balance sheets late this year or early in 2010 at the earliest.

DRAM prices now amount to only one-third-level of Taiwanese suppliers’ cash costs. Unless prices increase by more than 200 percent, cash losses will persist for these Taiwanese suppliers.

While average megabit pricing for DRAM will rise during every quarter of 2009, it will not be even remotely enough to allow suppliers to generate profits in this industry. The industry needs a dramatic price recovery of a few hundred percentage points to make any kind of impact.

iSuppli is maintaining its “negative” rating of near-term market conditions for DRAM suppliers.

Confusing picture in NAND

The picture is a little more complicated in the NAND flash memory market.

Pricing for NAND since January has been better than iSuppli had expected. However, iSuppli believes this doesn’t signal a real market recovery.

Most NAND flash makers are continuing to lose money. The leading supplier, Samsung Electronics Co. Ltd., seems to be enjoying the current NAND price rally as prices have almost reached the company’s break-even costs. However, all the other NAND suppliers still are losing money.

“While the NAND market in the past has been able to achieve strong growth and solid pricing solely based on orders from Apple Computer Inc. for its popular iPod and iPhone products, this situation is not likely to recur in the future,” Kim said. “Even if Apple’s order surge, and it books most of Samsung’s capacity, it would require a commensurate increase in demand to other suppliers to generate a fundamental recovery in demand.”

However, iSuppli has not detected any substantial increase in orders from Apple to other suppliers. Furthermore, Apple’s orders, according to press reports, are not sufficient to positively impact the market as a whole.

It doesn’t make sense for major NAND suppliers Toshiba Corp. and Hynix Semiconductor Inc. to further decrease their production if there is a real fundamental market recovery. This means supply will continue to exceed demand and pricing will not rise enough to allow the NAND market as a whole to achieve profitability.

The NAND flash market is in a better situation than DRAM at least. However, the market remains challenging because fundamental demand conditions in the consumer electronics market have not improved due to the global recession.

One of the reasons why the price rally occurred is that inventory levels have been reduced in the channel and re-stocking activity has been progressing. Overall, memory suppliers will begin to announce their earnings shortly and iSuppli will remain cautious about the NAND flash market until we detect solid evidence, not just speculation, of a recovery.

iSuppli is remaining cautious about the near term rating of NAND market, holding its negative view for now, before considering upgrading it to neutral.

“Production cuts undoubtedly will have a positive impact on the market in the future. However, it’s too early for to celebrate. iSuppli believes the surge in optimism is premature. Supplier must be rational and watch the current market conditions carefully to avoid jumping to conclusions too quickly,” Kim concluded.

Welcome to PC's Telecom Blog!

Welcome to PC’s Telecom Blog (http://pctelecoms.blogspot.com)!

Hi friends, I’ve been thinking about adding a telecom blog to my network for a very long time! The reason being, I started my career in electronics and telecom back in 1989.

I had the privilege of being part of Asian Sources Telecom Products — a site, which I managed and built, with the help of my team and colleagues at Asian Sources Media, and later, Global Sources. Later, I moved on to Wireless Week, USA, as Asia Pacific Editor for the Asian Edition.

Back in India, I managed Convergence Plus for a short while, before launching four sites for CIOL in 2004 — Mobility, Networking, Storage and Security.

Given this background in telecommunications, it is apt for me to start a blog on this subject as well. Telecom has been my forte, and well, it is a subject that has also won me four awards in technology journalism, while at Global Sources.

Again, this blog has been spun out off my award winning blog! That blog remains unchanged, and will continue to carry top-quality, world class content!

This blogs will now include specific blog posts related to telecommunications, as well as press releases, industry updates, new products, features, statistics, etc. It will cover wireless, wireline, broadband, networking, optical networking, Test & Measurement, etc.

Thanks for your kind support as always. Suggestions for improvements are always welcome! 🙂

Semicon recovery likely in H2-09 after sharp recession: Future Horizons

This is what I’ve received and heard a few minutes ago! If it does happen, as stated, there can’t be any better news than this for the global semiconductor industry!

According to Malcolm Penn, chairman, founder and CEO of Future Horizons, a recovery is expected in the second half of 2009 after a sharp recession!!

Future Horizons is predicting this recovery in the second half of 2009 in the Annual Semiconductor Report that was released today.

“There have so far been ten chip-market recessions and all but two have resulted in negative industry growth,” said Malcolm Penn, Chairman, founder and CEO of Future Horizons. “The year 2009 will mark the industry’s 11th recession; a further period on negative growth is inevitable at an estimated minus 28 percent, similar in magnitude to 2001.”

He added: “This semiconductor recession is unlike previous recessions and is directly attributable to the worldwide financial problems; it is not a structural problem of the industry itself. This factor will help to mitigate the global recession’s impact on the industry. On the other hand, all markets and all regions were impacted quickly and at the same time. This leads us to predict a minus 28 percent negative growth in dollars for the global semiconductor market over 2008.”

Future Horizons believes that the industry is in structurally good shape to enter a recession. This should make the 2009 downturn shorter than it might otherwise have been, depending on when the confidence in the global economy stops falling and that is expected to be during 2010.

Today, businesses prefer the ‘stop everything/do nothing’ approach, resulting in the dramatic fall in Q4 semiconductor demand, but this cannot continue forever. Future Horizons expects a gradual return to ‘business as usual’ — whatever the new ‘usual’ turns out to be — in Q2 2009, once a degree of confidence returns to the markets.

It is impossible to predict when the recovery will start, but it eventually will and, given the extent and abruptness of the Q4-08 decline, an overshoot is inevitable making the recovery process faster coming, possibly as early as the second half of this year.

I will be in conversation with Malcolm Penn later today, hopefully, and will carry another post on this subject, should that happen. Stay tuned, folks! 🙂

Indian chip industry dead? You've got to be kidding me!

I was recently chatting with a friend at LSI, who asked my opinion on the Indian semiconductor industry. Interestingly, in one of my groups on LinkedIn, a member has started a discussion on ‘whether it is ripe for India to get a silicon IC fab’!

Complete contrast — an industry friend recently narrated an incident where this friend was asked by someone else — whether the Indian chip industry was dead! Wow!! Someone’s got to be kidding!

First, I can’t really determine what’s the expectation level among people regarding India’s semiconductor industry. It seems that the interest is starting to build up, at a very slow pace.

However, folks need to understand that the semiconductor industry is extremely complex. You can’t get away by making some sort of statement about this industry! There is much more to semiconductors than someone merely writing a headline — “recovery is in sight” or “recession hits semicon” or 32nm is a great process node”!

Why aren’t more headlines like “overcoming ASIC design productivity roadblocks,” or “What lithography tools are doing for the photoresist market” doing the rounds? Or even: “Are designers as conscious of yield as they should be?” If you can spot the difference, you can make some comment on the semicon industry!

Two, the Indian chip industry CANNOT BE DEAD! It never was, never has been and never will be! Most people would find it tough to answer when Texas Instruments first started operations in India! Why did it choose to start so early? Simply because it backed India as a center! Naturally, the Indian semiconductor goes back that early!

Some folks perhaps relate more to the semiconductor industry with the advent of the India Semiconductor Association. The Association is an industry body, fulfilling its need. However, a lot of work has been going on in semiconductors before ISA came into being. I wonder whether folks have really cared to track this industry in India. I do remember when I first starting covering semiconductors in India, in the early 2000s, there were lot of curious glances from others! 🙂

Coming back to the Indian semiconductor industry, from ‘Made for India’, it has moved on to ‘Made In India’. Isn’t that a significant shift?

As for silicon IC wafer fabs in India, or for that matter, any fab in India — yes, it is still a good time to have one! Perhaps, the last time around, patience seemed to run out! And that’s a hard lesson to learn for those looking to invest in fabs — there is NO quick turnaround time in semiconductors!

Moshe Gavrielov, Xilinx’s President and CEO, recently said in EE Times that venture capital would not return to the semiconductor industry, even after this recession. If this does happen, it would be very unfair! Where would all the start-ups go?

Again, this statement brings clarity to the subject of semiconductors — this is a very complex industry, and definitely unlike IT/ITeS. We in India are so much into services that we fail to see the wood from the trees!

People love to compare China with India. Friends, do visit China or even Taiwan! Try to find out how they went about building their semiconductor industry, and manufacturing and R&D ecosystems. There are several lessons to learn, numerous role models to follow.

I strongly believe India can very well go the same route! We need some good startups in India as well. If and when those happen, please do not expect fast turnaround times. Please believe in India, and believe in its semiconductor industry. It needs your support.

Nearly 60pc of China chip manufacturing goes unused in Q1: iSuppli

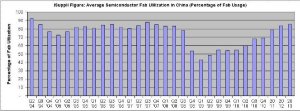

EL SEGUNDO, USA: Once the world’s fastest-growing chip-manufacturing region, China hit an all-time low in the first quarter of 2009, with nearly 60 percent of the nation’s semiconductor manufacturing capacity unused, according to iSuppli Corp.

Semiconductor manufacturing capacity utilization in China fell to 43 percent in the first quarter, the lowest level since iSuppli began tracking the market in 2000, and a massive drop from a recent high of 92 percent in the second quarter of 2004. This rock-bottom utilization rate comes as a direct result of low demand spurred by the global economic downturn. However, the utilization plunge indicates that China’s long-nurtured goal of establishing a vibrant domestic semiconductor production industry is in serious jeopardy.

“During the last 10 years, the Chinese government has worked to develop a domestic economy that would provide the nation with economic independence,” said Len Jelinek, director and chief analyst for semiconductor manufacturing at iSuppli. “The establishment of a technologically strong Chinese semiconductor industry was considered an essential element of China’s long-term domestic economic and technological independence. Unfortunately for China, the plan collapsed as global sales dried up before demand generated from internal sources was able to grow to match demand generated from the rest of the world. Once viewed by China’s government as a pillar of growth, semiconductor manufacturing has turned out to be a financial burden.”

China’s investments in capacity and technology in the semiconductor sector have not provided the financial returns that were forecast for investors, Jelinek added. Adding to China’s dilemma is the overestimation of capacity, which was expected to be shuttered in other regions in favor of lower-cost, more efficient Chinese manufacturing.

“With the addition of the current global economic recession, China’s focus has shifted from establishing semiconductor manufacturing independence to restructuring its entire chip industry before it simply collapses.”

China’s utilization is expected to rise moderately through the rest of the year, but will remain very low at 54 percent in the fourth quarter of 2009. Over the longer term, utilization will rebound to 84 and 85 percent in 2012 and 2013. However, when utilization recovers to these levels, China’s semiconductor industry will look very different from how it has in the past, with the number of competitors in the industry likely to be dramatically reduced due to consolidation.

The figure presents iSuppli’s quarterly and annual estimate and forecast of semiconductor utilization in China.

Looking ahead

What will China’s semiconductor industry look like when utilization recovers?

“Since Chinese semiconductor manufacturers do not possess a technological differentiation from their competitors, they are at a disadvantage, since there is simply far too much of the same kind of capacity in the world chasing after the same opportunities,” Jelinek said.

“This will lead to mergers and consolidations. However, even if suppliers with similar technologies merge, will they create anything but larger companies with bigger cash-flow problems?”

At first glance, such a scenario is most likely what will happen. Nonetheless, there will be one ancillary effect that will significantly impact the landscape of companies in China: The bigger company will be viewed as the most likely survivor.

This perception will transform into reality as customers assure themselves of a strong supply source by aligning with the largest, most cost-effective semiconductor maker. In the end, the smaller company simply will be forced out because it is uncompetitive in technology and price.

No recovery until 2012

With iSuppli not forecasting a recovery for Chinese manufacturers until 2012, it is unlikely that weak companies can survive two years in the face of a negative cash flow.

iSuppli anticipates the first merger in China’s semiconductor industry will be finalized in the second quarter of 2009. This will signal that time is of the essence if a company or a group of companies is going to be able to weather the storm. iSuppli anticipates that by the second half of 2010, a smaller—yet stronger—semiconductor industry will emerge in China.