Archive

Top 20 semicon rankings Q2-09 — TSMC climbs up, AMD slips down!

Very interesting, isn’t it? And I am not surprised! TSMC deserves to move up the top 20 semiconductor companies rankings!! It seems that AMD especially needs to really get its act together.

First, to the rankings. Recently, IC Insights released the list of the top 20 semiconductor sales leaders during Q2-09.![]() Source: IC Insights

Source: IC Insights

In this list, there are four fabless semiconductor companies — Qualcomm, Broadcom, MediaTek and Nvidia in the top 20, and one foundry — TSMC, perhaps, emphasizing the growing influence of TSMC as well as the fabless semiconductor companies.

AMD slips! Again?

I had written a couple of posts some time back on AMD and Intel, where the former had commented on the EC ruling on Intel, and also how both were at each other’s throats, and had asked the question — how will all of this help the market?

Well, one hopes that AMD will come back very much stronger in the next quarter, despite its uninspiring guidance for 3Q09, saying that it expects its sales to be “up slightly” from 2Q09.

TSMC, Hynix, MediaTek shine

Coming back to the table, the clear movers are TSMC, and no surprises there, as well as Hynix and MediaTek. In fact, with a little better Q3 performance, TSMC could well move up to the third position, overtaking both Texas Instruments and Toshiba.

Look at the last column — the 2Q09/1Q09 percentage change — TSMC has grown by a whopping 93 percent! One other thing! TSMC is reportedly eyeing business opportunities in solar photovoltaics and LEDs in a bid to diversify its revenue channels. Should these happen, expect TSMC to move up higher!

The closest to TSMC in terms of growth are Hynix at 40 percent and Qualcomm at 36 percent, respectively. MediaTek, another impressive mover, grew by 20 percent. Of course, there is Samsung as well, with 29 percent growth.

ST, Micron, Nvidia and NXP have done well too! According to IC Insights, Nvidia replaced Fujitsu in the Q2-09 top 20 rankings. And that brings us to the shakers or those who fared poorly.

Fujitsu, AMD, Freescale slide!

I’ve already touched upon AMD. Fujitsu cited flash memory and automotive device sales to have suffered immensely this quarter. However, it hopes Q3 will be better and said that customer demand was picking up. So, it could well be back in the Top 20 during Q3.

Yet another slip was in store for Freescale. It slipped from 16th position in 2008 to 18th position during Q1-09, and slid further to 20th position in Q2-09. Perhaps, overdependance on automotives has been its undoing.

An interesting statistic from IC Insights — Fujitsu, with -9 percent and Freescale, with -2 percent growth, were the only two top-20 companies from Q1-09 to register a 2Q09/1Q09 sales decline!

Wonderful industry guidance

It is heartening to see 19 of the 20 companies registering positive growth this quarter. It won’t be improper here to commend IC Insights on its wonderful industry guidance!

In an IC Insights study from late December 2008, it was very vocal in advising firms to adopt a quarterly outlook! It also forecast a significant rebound in the IC market beginning in the third quarter of the year!

IC Insights also stood out by pointing out in early July that H2-09 is likely to usher in strong seasonal strength for electronic system sales, a period of IC inventory replenishment, which began in 2Q09, and positive worldwide GDP growth.

IC Insights had marked 4Q08 as the beginning of the downturn/collapse and Q1-09 as the bottom of the cycle. This quarter (Q2) has largely been a replenishment phase for the inventories. Going by that count, Q3 could well see a true seasonal increase in demand. IC Insights also said that during Q4-09, market growth will mirror the health of the worldwide economy and electronic system sales.

There is light, after all, at the end of the tunnel! Wonder why are the industry folks continue to tell each other — we still aren’t having a good time! Maybe, it is time for them to shed their pessimism and from holding back on investments, and move on to show steely optimism, and indulge in really aggressive buying and selling! After all, work and progress will happen ONLY if you work!!

Global semicon mid-year review: Chip market revival or blip on stats radar screen?

A recent report from Future Horizons suggests an 18 percent growth for the chip market in Q2-2009! So, is this a sign of the chip market recovery or a mere blip on the statistics radar screen?

It is both, said, Malcolm Penn, chairman, founder and CEO of Future Horizons, and counselled that: “The fourth quarter market collapse was far too steep — a severe over-reaction to last year’s gross financial uncertainty — culminating with the Lehman Brothers collapse in September. The first quarter saw this stabilise with the second quarter restocking, but there are other positive factors also in play.”

Examining a bit further, here’s what he further revealed. One, the memory market is seeing some signs of slow recovery. He said, “This has already started DDR3 driven!” Likewise, companies are also in the process of revising their forecasts. The reason, Penn contended, being, “The maths has changed dramatically since Jan 2009!”

According to him, factors now leading to conditions looking up in H2 2009, include the normal seasonal demand — from a tight inventory base — and tightening capacity. There is also a clear indication of the correction phase to rebalance over-depleted inventories having started. “This is what’s driving Q2’s high unit, and therefore, sales growth,” he contended.

Firms advised to stop seeing and waiting!

This isn’t all! Penn further counselled firms who are still in a wait-and-see mode to ‘stop seeing and waiting’! Next, fabs are also looking to maximize their returns. For one, they have stopped over-investing.

Do we have enough stats from others to back up what’s been happening in the global semiconductor industry? Perhaps, yes!

IC Insights stands out

First, look at IC Insights! It has stood out by pointing out in early July that H2-09 is likely to usher in strong seasonal strength for electronic system sales, a period of IC inventory replenishment, which began in 2Q09, and positive worldwide GDP growth.

IC Insights has predicted global IC market to grow +18 percent; IC foundry sales to grow +43 percent; and semiconductor capital spending to grow +28 percent in H2-09.

DDR3 driving memory recovery? Flat NAND?

Elsewhere, Converge Market Insights said that according to major DRAM manufacturers, DDR3 demand has been on the rise over the last two months and supply is limited.

This is quite in line with Future Horizons contention that there is a DDR3 driven memory recovery, albeit slow. It would be interesting to see how Q3-09 plays out.

As for NAND, according to DRAMeXchange, the NAND market may continue to show the tug-of-war status in July due to dissimilar positive and negative market factors perceived and expected by both sides. As a result, NAND Flash contract prices are likely to somewhat soften or stay flat in the short term.

Semicon equipment market to decline 52 percent in 2009!

According to SEMI, it projects 2009 semiconductor equipment sales to reach $14.14 billion as per the mid-year edition of the SEMI Capital Equipment Forecast, released by SEMI at the annual SEMICON West exposition.

The forecast indicates that, following a 31 percent market decline in 2008, the equipment market will decline another 52 percent in 2009, but will experience a rebound with annual growth of about 47 percent in 2010.

EDA cause for concern

The EDA industry still remains a cause for concern. The EDA Consortium’s Market Statistics Service (MSS) announced that the EDA industry revenue for Q1 2009 declined 10.7 percent to $1,192.1 million, compared to $1,334.2 million in Q1 2008, driven primarily by an accounting shift at one major EDA company. The four-quarter moving average declined 11.3 percent.

If you look at the last five quarters, the EDA industry has really been having it rough. Here are the numbers over the last five quarters, as per the Consortium:

* The EDA industry revenue for Q1 2008 declined 1.2 percent to $1,350.7 million compared to $1,366.8 million in Q1 2007.

* The industry revenue for Q2 2008 declined 3.7 percent to $1,357.4 million compared to $1,408.8 million in Q2 2007.

* The industry revenue for Q3 2008 declined 10.9 percent to $1,258.6 million compared to $1,412.1 million in Q3 2007.

* The industry revenue for Q4 2008 declined 17.7 percent to $1,318.7 million, compared to $1,602.7 million in Q4 2007.

Therefore, at the end of the day, what do you have? For now, the early recovery signs are more of a blip on the stats radar screen and there’s still some way to go and work to be done before the global semiconductor industry can clearly proclaim full recovery!

Before I close, a word about the Indian semiconductor industry. Perhaps, it needs to start moving a bit faster and quicker than it is doing presently. Borrowing a line from Malcolm Penn, the Indian semiconductor industry surely needs to “stop waiting and watching.”

I will be in conversation next with iSuppli on the chip and electronics industry forecasts. Keep watching this space, friends.

Rebounding IC ASPs and Intel-AMD dispute! Two contrasting sides of semicon!!

Friends, I’d like to draw your attention to two completely contrasting sides of the the global semiconductor industry!

First, there was a significant piece of information last week, where IC Insights highlighted that the IC ASP prices were across several product segments. In fact, IC Insights further goes on to say that while it is unsure whether IC ASPs had reached their low points, IC Insights firmly believes that the IC ASPs will rebound throughout 2009 and well into 2010.

I am reminded of another IC Insights study of late December 2008 where it advised adopting a quarterly outlook! It also forecast a significant rebound in the IC market beginning in the third quarter of the year! Is it already upon us? Too early to say.

Consider this: are these two projections bringing some good tidings for the global semiconductor industry? Perhaps, yes!

Now, a change of scene! Time — early this week!

Intel notified Advanced Micro Devices (AMD) that it believes AMD has breached a 2001 patent cross-license agreement with Intel. According to its release, Intel believes that Global Foundries is not a subsidiary under terms of the agreement and is therefore not licensed under the 2001 patent cross-license agreement. Intel also said the structure of the deal between AMD and ATIC breaches a confidential portion of that agreement.

Intel has asked AMD to make the relevant portion of the agreement public, but so far AMD has declined to do so. AMD’s breach could result in the loss of licenses and rights granted to AMD by Intel under the agreement.

Knowing my soft corner for semiconductors, I received a mail carrying AMD’s comment on Intel’s claim. And, it was a counter claim of sorts!

According to Ramkumar Subramanian, VP Sales & Marketing India, AMD: “Intel’s action is an attempt to distract the world from the global anti-trust scrutiny it faces. Should this matter proceed to litigation, we will prove that Intel fabricated this claim to interfere with our commercial relationships and thus, has violated the cross-license.”

I really don’t know what’s happening! Who’s right and who’s wrong? All I understand is that this Intel vs. AMD dispute is simply NOT good news for the global industry.

Both Intel and AMD are companies admired globally. I’ve interacted with executives from both companies, and they are all really exceptionally talented people.

It is important for Intel and AMD to not get drawn into controversies of this stature, especially at a time when the industry is going through a rough patch. I have asked this question of both companies and expect their replies sometime next week, hopefully. And I wish they don’t send me standard replies.

Both of you are sticking to you lines and stands! Can you please take your gloves off and clear this up folks? The industry does not need such things right now!

Global semiconductor industry could well see revival in 2010?

“Let’s start from the very beginning! A very good place to start!!”

Hope you all remember this lovely song sung by Julie Andrews in The Sound of Music!! So, what’s the connection?

Right! Last week, I blogged about how the global semiconductor industry is likely to drop by 28 percent in 2009, while the Indian industry should grow by 13.4 percent during the same period, and that, we should not get carried away by these statistics!

A moment to ponder: isn’t this drop of 28 percent too high for the global semicon industry? Or, is the situation really that bad? So, let’s start from the very beginning, and go straight to the source — Malcolm Penn!

Revival likely by 2010?  Here’s what Malcolm Penn, CEO and founder of Future Horizons, had to say: “Fraid not! It could even be lower, but remember that this is a year on year number. It is based on the following assumptions: Q4-08 down 22.5 percent vs. Q3-08; Q1-09 down 20 percent vs Q4-08; Q2 down 2 percent vs Q1; and Q3 up 12 percent vs Q2, and Q4 up 3 percent vs Q3! And, if this pattern runs true, 2010 will be up 28 percent vs 2009!”

Here’s what Malcolm Penn, CEO and founder of Future Horizons, had to say: “Fraid not! It could even be lower, but remember that this is a year on year number. It is based on the following assumptions: Q4-08 down 22.5 percent vs. Q3-08; Q1-09 down 20 percent vs Q4-08; Q2 down 2 percent vs Q1; and Q3 up 12 percent vs Q2, and Q4 up 3 percent vs Q3! And, if this pattern runs true, 2010 will be up 28 percent vs 2009!”

Voila! The global semiconductor industry could well be in for a major revival next year itself! Why, even Bill McClean, president of IC Insights, took a more optimistic look at the state of the industry in light of the current global economic situation at the recently concluded SEMI ISS 2009 conference!!

Continues Penn, “The actual Q4 results (released this Sunday) were down 24.2 percent, slightly worse than our estimate.”

How to get the buzz back in semicon?

It has been said that the current situation the global semiconductor industry finds itself in was fueled by greed and short-term business goals. So, who were the culprits? Weren’t they warned earlier?

Adds Penn: “It was more complex that that! The woeful state-of-the-world economy was a consequence of debt, greed and irresponsibility; political self interests and short-term business goals, aided and abetted by compliant governments; ineffective regulators; imprudent institutions; incompetent management; irrational self delusion and vested self-interests! No one is blameless for this crisis! Concerns were raised, but the human nature is often irrational, and the ‘easy option’ always the one of choice.”

So true! Perhaps, the ‘easy option’ factor seems to be affecting the Indian semiconductor industry as well, but more of that later!

The key issue today is: what needs to be done to get the buzz back in the global semiconductor industry? The answer probably lies in the following: in the short-term, it involves rebuilding the industry confidence, and in longer term, it involves a radical return to ‘old fashioned’ business and political values.

On another note, I was curious to know how the EDA segment is doing? Penn said, “No better, no worse than normal, technology marches on, new designs accelerate in a downturn.”

Tricky memory!

Memory is another segment that’s been hit hard. In fact, the other day, someone asked me why Qimonda’s story was so important!

Another could not understand what Spansion really did, and why it had announced this January 15 that the company was exploring strategic alternatives for a sale or a merger! Doesn’t matter! Memory is a very tricky business, and semiconductors is the mother of all such tricky businesses! Perhaps, isn’t that why they once said in jest: “Real men have fabs!” Anyhow!

Coming back to memory, when can the industry expect some recovery in NAND? More importantly, will the various government interventions help? Qimonda also recently petitioned for the opening of the insolvency proceedings.

Penn is clear: “NAND will recover when the excess capacity abates, and that will take several more quarters. The government intervention won’t help, rather the opposite, and it will exacerbate the excess capacity issue.”

Fab spends to move up only by Q1-2010

Earlier, Penn predicted a recovery in 2010 with the resumption of growth in Q3 2009. What will make this happen? He says, “A recovering world GDP growth, plus a return in business confidence.”

However, those keen on fabs, do not expect the fab spends to look up any time soon! In fact, Penn estimates fab spends to start moving north not until Q1-2010 at the earliest.

The Chinese impact!

Interestingly, China is set to see negative growth of 5.8 percent during 2009. It will be worth noting how much of this this impact the global semiconductor industry.

Point one, compared to a global semicon fall of 28 percent in 2009, Penn considers a fall in China’s semicon fortunes of 5.8 percent to be ‘darned sight better!’ So, China should still be a high growth market (relatively speaking).

And India?

Like I mentioned earlier, the Indian semiconductor industry is perhaps getting affected by the ‘easy option.’ Design services continue to do well, hopefully, but when it comes to real semiconductor product companies, those are far and few.

And, I haven’t seen any real activity in the recent past that could tell me more such initiatives are in the pipeline. Nor do I think there are many attempts to even incubate such companies. On the contrary, there’s a mad rush toward solar!

No harm there! Solar is great for India and the need of the hour. However, India should not forget its semiconductor priorities as well! Indian simply cannot bank on chip design services and solar gains, and then proclaim that it has a very successful semiconductor industry! Real action is still quite far away.

I think, India needs to rethink its semiconductor strategy! It cannot survive on chip design alone.

“When you know the notes to sing, you can sing most anything,” concludes the song from The Sound of Music!

So, is the Indian semiconductor industry hitting the right notes? That’s going to be my next blog post, friends.

IC shipments likely to grow 3.8pc in 2008

The latest wireless/DSP bulletin from Forward Concepts has highlighted an improved shipments of DSP and RISC chips for cell phones as well as DSP shipments for wireless infrastructure.

I had the privilege of interacting directly with Will Strauss, President & Principal Analyst, Forward Concepts, author of this particular bulletin.

On being quizzed about the improvement in shipments of DSP and RISC chips for cell phones, Strauss indicated that new cellular subscribers in China and India are continuing to grow, even as Europe and the US are reaching saturation.

“Since most people here have cell phones, the market is mostly driven by the replacement devices. In the US, handsets are also subsidized by the carriers under a subscription plan that ties the subscriber to a handset for two years,” he says.

An interesting point in the wireless/DSP bulletin is the fact that although DSP shipments for wireless infrastructure were down 14 percent in May compared to April, it was still 30 percent higher than May of 2007. What are the reasons for this peculiar trend?

Citing that the reasons were not yet clear, Strauss adds that in infrastructure, more so than for cellphones, the quarterly shipments are all that really matter. Forward Concepts hopes to have better calibration when June shipments are reported at the end of July.

Going forward, how are DSPs likely to perform? Well, it is to be noted that DSP chips, as devices with that specific nomenclature, are now becoming a decreasing percentage of the DSP silicon market. That’s because DSPs as cores are becoming just part of SoCs in everything multimedia, in VoIP, in cell phones, etc., adds Strauss.

Similarly, RISCs, like DSPs, are simply part of the SoCs, and often in lock step with DSP. That’s because every cell phone chip has at least one DSP core and one RISC core inside.

Another point noticeable in the bulletin is that automotive, wired communications and storage (disk drive controllers) sectors have seen a slowdown.

On this, Strauss clarifies that the automotive market has seen a drastic slowdown because of high fuel prices. Telecom companies have been slow to invest in infrastructure as wireless is taking over their traditional wireline market.

As for the disk drive controllers, their prices are akin to those of DRAM memory, subject to big swings in selling prices, lowering revenue even when production is strong.

Mobile Internet devices or MIDs are devices people are looking forward to. It is hoped they would bring some cheer to the IC market. This remains to be seen as the MID market doesn’t begin until late in Q3 2008.

Finally, the key question: what’s the industry outlook likely to be for the rest of the year? Strauss says: “The semiconductor industry is also subject to world economic changes. The outlook is for minimal world economic growth in 2008, mostly because of high oil prices and the weak US dollar. We are forecasting only 3.8 percent revenue growth in worldwide IC shipments for 2008, down from its traditional annual growth rate of about 7 percent.”

Collision course ahead?

On another note, the IC Insights reported that current spending plans by IC manufacturers worldwide will lower total semiconductor capital expenditures by 18 percent to $49.7 billion in 2008 from $60.3 billion in 2007, according to new data collected by IC Insights.

A growing number of large IC firms are now outsourcing more products to foundries. Also, major pure-play wafer foundries are aiming to increase their profitability by controlling capital spending. As such, IC Insights believes that the IC industry continues on a “collision course” with respect to supply, demand, and average selling prices or ASPs!

Top 20 global semicon companies — DRAM, Flash suppliers drop out

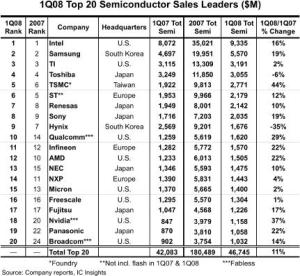

IC Insights recently published the May update to The McClean Report, featuring the Top 20 global semiconductor companies. Not surprisingly, there have been some significant movers and shakers. The most telling — quite a few of the major DRAM and Flash suppliers have dropped out of the Top 20 list!

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

TSMC, the leading foundry, moved up one position, registering the highest — 44 percent — year-over-year Q1-08 growth rate, besides being ranked 5th. Nvidia, the second largest fabless supplier, was another company registering a high YoY growth rate of 37 percent, and moved into the 18th position. Some others like Infineon, Sony and Renesas also climbed a place higher each, respectively. The top four retained their positions — Intel, Samsung, TI and Toshiba.

And now, the shakers! The volatile DRAM and Flash markets have ensured the exit of several well known names such as Qimonda, Elpida, Spansion, Powerchip, Nanya, etc., from the list of the top 20 global semiconductor companies, at least for now.

Among the others in the list, the biggest drops were registered by NXP, which dropped to 14th from 11th last year, and AMD, which dropped two places, from 10th to 12th. Two memory suppliers — Hynix and Micron — also slipped two places, to 9th and 15th places, respectively. STMicroelectronics also slipped from 5th to 6th. IBM too slipped out of the top 20 list.

The top 20 global semiconductor firms comprises of eight US companies (including three fabless suppliers), six Japanese, three European, two South Korean, and one Taiwanese foundry (TSMC). Also, looking at the realities of the foundry market, TSMC’s lead is now unassailable. If TSMC was an IDM, it would be No. 2, challenging Intel and passing Samsung, said one analyst, recently, a thought shared by many.

IC Insights has reported that since the Euro and the Yen are strong against the dollar, this effect will impact global semiconductor market figures when reported in US dollars this year.

There are some other things to watch out for. Following a miserable 2007, the global DRAM module market is likely to rebound gradually in 2008 due to the projected recovery in the overall memory industry, according to an iSuppli report. That remains to be seen.

Some new DRAM camps — such as Elpida-Qimonda, and Micron-Nanya — have been formed. It will be interesting to see how these perform, as will be the performance of ST-backed Numonyx.

Further, the oversupply of NAND Flash worsened in Q1-08, impacted by the effect of the US sub-prime mortgage loan and a slow season, according to DRAMeXchange. The NAND Flash ASP fell about 35 percent compared to Q4-07. Although the overall bit shipment grew about 30 percent compared to Q4-07, the total Q1-08 sales of branded NAND Flash makers fell 15.8 percent QoQ to US$3.24bn. Will the NAND Flash market recover and by when?

Major shakeups in top 10 semiconductor supplier rankings

According to the latest report from IC Insights, there have been major shakeups in the global top 10 rankings among suppliers of semiconductors.

Here’s what IC Insights has to say regarding some of the changes that took place in 3Q07:

* Toshiba rode the coat-tails of a 46 percent 3Q07/2Q07 NAND flash memory market surge to post an amazing 40 percent 3Q07/2Q07 semiconductor sales increase. This increase helped propel Toshiba to a third place ranking, its highest since being ranked as the second largest semiconductor supplier in 2000.

* AMD continues to display a nice recovery this year with its 3Q07 sales increasing 18 percent over 2Q07, which follows a 12 percent sequential increase in 2Q07/1Q07. As part of its continuing MPU marketshare battle with Intel, AMD is expected to announce a major manufacturing/foundry deal in the second half of 2007.

* The largest pure-play foundry in the world, TSMC, jumped one spot in 3Q07 as compared to the full-year 2006 ranking as the company recorded a strong 3Q07/2Q07 sales increase of 21 percent. It should be noted that after operating at only 83 percent capacity utilization in 1Q07, TSMC surpassed its “company-defined” 100 percent capacity utilization level in 3Q07!

* If pure-play foundry TSMC were excluded from the ranking, NXP would have been in the tenth position.

* In spite of 3Q07 DRAM pricing weakness, Hynix took advantage of its strong NAND flash marketshare to move from seventh to sixth place in the ranking.

* Freescale continues to feel the pain of its biggest customer, Motorola, as the company went from being ranked as the ninth largest semiconductor supplier in the world in 2006 to sixteenth in 3Q07. Unfortunately for Freescale, Motorola has gone from holding a 22 percent share of cellular phone unit shipments in 3Q06 (53.7 million) to securing only a 13 percent share in 3Q07 (37.2 million).

* TI, ST, and Renesas were the only top 10 companies to register less than double-digit 3Q07/2Q07 sequential sales growth rates. Each one of these companies is a top-10 supplier to the currently slow-growing analog IC market.

* The top 10 listing consists of three U.S., three Japanese, two Korean, one European, and one Taiwanese company.

Through the end of 2007, IC Insights expects to see pricing stability return to the DRAM memory market, surging IC demand for PCs and high-end cellular phones, and a continuation of the seasonal rebound in overall semiconductor demand that began in August.

IDC's semicon predictions and top 10 vendors

Looks like a season of predictions in semiconductors. Just a few weeks back, I was looking at IC Insights’ top 20 global semicon rankings by sales. And now, we have IDC’s list of the top 10 vendors by revenue, along with predictions of its own. Let’s look at the table.

According to IDC’s table, Intel, Samsung and Texas Instruments held on to the number 1, 2 and 3 positions respectively, with TI showing the highest growth percentage in revenue among the top three leaders.

With the exception of Intel, Renesas, and NXP, all other vendors in IDC’s 2006 top 10 ranking showed positive growth. Hynix grew at an amazing rate of 43 percent over the same period thanks to the company’s growing position in DRAM and NAND.

Now, if we look back at IC Insights’ ranking from a few weeks ago, I find some differences. First, the similarity — The top three — Intel, Samsung and TI, retain their positions in both tables!

However, in IC Insights’ table, ST and Toshiba exchanged the next two positions, as did Hynix and TSMC, while Renesas was at no. 8! Freescale dropped from no. 9 to no. 16, while Sony, NXP and NEC gained one place each. Infineon climbed back up to no. 12, from no. 16, while Qualcomm occupied the no. 13 position, up from no. 17. AMD dropped two positions, from no. 13 to no. 15.

In IDC’s table (by semicon revenue), STMicroelectronics, Toshiba, Renesas, Hynix, AMD, Freescale and NXP occupied positions 4th to 10th, respectively. IDC has made some predictions as well. These include:

Outlook for 2007

* Demand for semiconductors is centered on the big three segments: PC and mobile phone unit volume is steady, led by emerging regions and low-end products. Consumer demand is lackluster, but excess inventory has subsided and IDC expects the design momentum to lead to healthy volume growth during the holiday season.

* DRAM and NAND are experiencing much lower revenue outlook this year following the severe price correction in the first half of 2007.

* Microprocessor market remains flat this year.

Long-term trends

* Emerging regions will boost semiconductor volume growth.

* Multimedia-rich mobile phones continue to drive semiconductor content and demand for processing, memory consumption, and power management.

* Personal computing further migrates toward mobility and low-priced form factors.

* Video processing proliferates across multiple consumer electronic segments, resulting in strong growth for semiconductor suppliers.

* Semiconductor connectivity technologies drive new usage models across device segments.

* Growth in personal content implies increasing need for storage, including NAND.

By the way, IDC’s Worldwide Semiconductor Market Forecaster predicts that the 2007 revenue slowdown in the worldwide semiconductor market will make way to a healthier 2008!

The worldwide semiconductor market will grow at a conservative rate of 4.8 percent in 2007, compared to 8.8 percent in 2006. IDC expects growth to resume at 8.1 percent in 2008 based on the current outlook. Interesting days ahead in semicon!

Will Z-RAM lead DRAM rebound?

Most of us have and use swanky mobile phones with enough memory to store videos, songs, clips, images, etc. And we certainly love playing with those wonderful devices. However, have we ever wondered where is all that memory coming from? There’s DRAM, and then, there’s Z-RAM.

Another news! It was reported recently that record sales of NAND-based iPhones and iPods were using up serious flash memory. Apple’s two biggest hits are likely to consume 25 percent of the global flash output! This could drive up prices of memory in the not too distant future. Now this is good news for memory makers.

Now let’s start with DRAM, which just got over a very difficult first half of the year. Evidence now suggests that the market, and free-falling ASPs, turned the corner in July and will begin an upward climb resulting in increases in quarterly growth through the balance of 2007, according to IC Insights. It reports that second-half optimism can be linked to the typical back-to-school and seasonal holiday demand, but other specific reasons include:

PC shipments are forecast to increase 12 percent in 2007, with the average PC forecast to contain 1.4GB of DRAM, an increase of 75 percent over 2006, when memory per PC averaged 800MB. The average system memory per PC is expected to grow from 1.3GB in 2Q07, to 1.4GB in 3Q07 and 1.6GB in 4Q07. Some DRAM vendors believe as many as 45 percent of PCs shipped in 4Q07 will contain 2GB of DRAM, the amount required for optimal performance using the Vista OS.

Strong specialty DRAM demand driven by handsets and game consoles will also help boost DRAM demand in H2-07. The Xbox 360 (512MB GDDR3 DRAM), PlayStation 3 (256MB XDR DRAM), and the Nintendo Wii (64MB GDDR3 DRAM) — require significant amount of memory. Meanwhile, increased DRAM content in new-generation handsets and other personal mobile products will generate more growth opportunities for DRAM suppliers. IC Insights forecasts an average 28MB of DRAM per cellular phone handset in 2007.

On the other side, a significant piece of news hit headlines recently. Hynix Semiconductor Inc. agreed to license Innovative Silicon Inc.’s (ISi), Z-RAM high-density memory intellectual property (IP) for use in its DRAM chips.

According to a release, Z-RAM-based DRAMs will use a singletransistor bitcell — rather than a combination of transistors and capacitor elements — representing the first fundamental DRAM bitcell change since the invention of the DRAM in the early 1970s. Hynix has received the first-mover opportunity to bring Z-RAM to the DRAM market. To ensure this advantage,the two companies have committed considerable engineering resources to work side-by-side on the program.

Z-RAM was initially developed as the world’s lowest-cost embedded memory technology for logic-based ICs such as mobile chipsets, microprocessors, networking and other consumer applications The technology was first licensed, in December 2005, by AMD for upcoming microprocessor designs. Now, the engagement with Hynix positions Z-RAM to become the lowest-cost memory technology in the greater than $30bn memory market. This is surely good news for the memory segment.

So, is supply-demand balance appears to be returning to the DRAM market in the second half of the year? And will Z-RAM lead a rebound? Time will tell!

End note: Recently, there was this power outage in Seoul, Korea, which knocked off quite a few chip production lines at Samsung. As I press this blog, I’ve come across the news that Samsung will likely deliver only 85 percent of promised NAND flash to its major customers. Is the pain going to extend?

Shifts in top 20 global semicon rankings

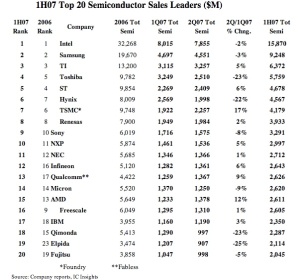

If the recent preliminary results released by IC Insights is anything to go by, there have been some movements among the top 20 semiconductor companies of the world during H1-2007. This is best illustrated by the table below.

While the top three — Intel, Samsung and TI, retain their positions, ST and Toshiba have exchanged the next two positions, as have Hynix and TSMC, while Renesas remains at no. 8!

Freescale has taken a big drop from no. 9 to no. 16, while Sony, NXP and NEC gained one place each. Infineon has climbed back up to no. 12, from no. 16, while Qualcomm occupies the no. 13 position, up from no. 17. AMD dropped two positions, from no. 13 to no. 15.

Will the semicon industry see a tight year ahead? As per reports, IC Insights said that there should be a “noticeable seasonal rebound” in overall IC demand beginning in September 2007, which may cause “significant changes” in the top 20 semiconductor ranking in the second half of 2007. Wait and watch this space!