Archive

Cowan LRA model: Global semicon sales forecast based on Oct. 2010 actual sales

This is a continuation of my coverage of the fortunes of the global semiconductor industry. I would like to acknowledge and thank Mike Cowan, an independent semiconductor analyst and developer of the Cowan LRA model, who has provided me the latest numbers.

Cowan has provided the latest monthly sales forecast update. Note that the latest sales forecast results capture not only the last quarter of 2010, but also provide the model’s “take” on 2011. On Sunday, 12-05-10, the WSTS posted the October 2010’s global semiconductor sales report (Historical Billings Report, HBR) on its website.

Therefore, with the WSTS having released its actual Oct. 2010 global semiconductor sales number, Cowan is sharing the latest monthly update to the Cowan LRA Model’s derived forecast numbers. The latest sales forecast estimates for 4Q and 2010 “decreased” from last month’s forecast estimates as summarized and discussed below.

Additionally, Cowan has extended the model in order to provide a “first look” at sales and sales growth estimates for each of the four quarters (and full year) of 2011.

October semicon sales

The actual Oct. 2010 global semiconductor sales released by the WSTS came in at $24.550 billion which is:

* 10.7 percent higher than last year’s (2009) actual October sales of $22.181 billion;

* Down 15.3 percent from last month’s (September) actual sales of $28.981 billion (Note – revised downward by $0.391 billion from last month’s WSTS published sales number of $29.372 billion for September);

* And lower (by $0.593 billion, or down 2.4 percent) compared to last month’s (September’s projection) sales forecast estimate for Oct., that is, $25.143 billion;

* Thus, the Cowan LRA Model’s Momentum Indicator, MI, went less negative (rose to -2.4 percent) compared to last month’s more negative posture (at -6.5 percent).

Note: November 2010’s Sales Forecast Estimate is projected to be $25.566 billion. Read more…

Look ahead to Oct. 2010 global semicon sales: Cowan LRA model

This is a continuation of my coverage of the fortunes of the global semiconductor industry. I would like to acknowledge and thank Mike Cowan, an independent semiconductor analyst and developer of the Cowan LRA model, who has provided me the latest numbers.

October 2010’s “actual” global semiconductor sales is scheduled to be released by the WSTS, via its monthly HBR (Historical Billings Report), on or about December 3rd.

(Note: The WSTS will supposedly publish its annual Autumn forecast numbers on Nov 30th. This is a deviation from its past, normal practice when it had been typically released during the middle of November. The SIA’s Fall annual forecast announcement was published earlier, on Nov. 4, 2010).

It should be highlighted that October’s “actual” sales result will play a role in whether the overall year 2010 sales reaches at least $300 billion, thereby achieving a global yearly semiconductor industry sales breakthrough (historical high).

Anticipating the upcoming October sales release by the WSTS, Cowan wants to demonstrate an analysis feature of the Cowan LRA Model for forecasting worldwide semi sales; namely, the ability to provide a “look ahead” scenario analysis for 2010’s global semi sales forecast as a function of next month’s (in this case October’s) “actual” global semi sales estimate in order to carry out a sensitivity assessment on attaining the $300 billion sales milestone.

The specifics of the scenario analysis are discussed in the following paragraphs and summarized in the scenario analysis matrix table. Read more…

Rankings of various semicon market watchers' sales growth expectations 2010

This is a continuation of my coverage of the fortunes of the global semiconductor industry. I would like to acknowledge and thank Mike Cowan, an independent semiconductor analyst and developer of the Cowan LRA model, who has provided me the latest numbers.

Mike routinely tracks how the Cowan LRA Model sales growth forecast (each month) compares to a wide range of major semiconductor industry market watchers in order to monitor how the model’s latest monthly update result “stacks up” against the competition, that is, 15 other prognosticators he routinely monitors.

The table given here summarizes the latest sales growth forecast expectations of these 15 other semiconductor industry forecasters, thus comparing Cowan’s forecast number to the rest of the crowd.

Cowan routinely updates his forecast numbers each month immediately following the WSTS release of its monthly actual sales numbers in order to “dynamically” predict the industry’s sales posture. Consequently, the sales and sales growth output of the monthly model run does NOT “sit still” as highlighted below.

Cowan LRA model for forecasting global semicon sales –– ‘divining’ (mathematically) future from past

* It should be emphasized that each month’s actual global sales number published by the WSTS is a ‘lagging indicator’ since it is released a full month after the fact.

* The Cowan LRA Model, however, “turns” this lagging actual monthly sales into a “leading indicator” by virtue of its near-term forecasting capability looking out over the next five quarters.

* This is the ‘beauty’ of the model and, therefore, makes it dynamic in the sense that it can be run each month utilizing the most recent actual global semiconductor sales number published by the WSTS. Thus, it allows “rigorous tracking” of the near-term sales forecast outlook for the global semiconductor industry on an “almost” real-time basis.

* Consequently, the model’s monthly sales forecast does not “sit still” but “evolves” with each succeeding month’s latest published sales number. Since conditions change rapidly and unexpectedly in the semiconductor industry, industry market forecasters are hard pressed to keep up with these changes.

How can the industry management be sure that a sales forecast issued two, three, or more months ago is still valid and relevant to what’s happening in today’s global semiconductor market?

In order to illustrate this ‘does not sit still’ principal embedded in the monthly update to Cowan’s forecasting approach, the graphic here shows the month-to-month evolution of year 2010 sales and sales growth forecast estimates as determined by the model from January to the present.

Global semicon market set for slowdown

Before I conclude, here’s a wonderful piece of information sent to me (and to several others) by Dr. Robert Castellano of The Information Network. Two months ago, I did a post with Dr. Castellano where he said that the global semicon market is set for slowdown.

The Information Network had, on September 21,issued a release similar to the report I had done with Dr. Castellano to all of its readers. This was at a time when the semiconductor market was humming along and many ‘analysts’ continued to up the ante in the market. Read more…

Cowan LRA model: Global semicon sales forecast update based on Aug. 2010's actual sales

This Monday, (10-04-10) the WSTS posted the August 2010 global semiconductor sales report (Historical Billings Report, HBR) on its website. Therefore, with the WSTS having released its actual August 2010 global semiconductor sales number, Cowan has provided the latest monthly update to the Cowan LRA Model’s derived forecast numbers.

The updated sales forecast estimates for 3Q, 4Q and 2010 decreased very slightly from the previous month’s forecast estimates as summarized below.

The actual August 2010 global semiconductor sales published by the WSTS came in at $25.358 billion which is:

* 30.8 percent higher than 2009’s August sales of $19.175 billion;

* Up 3.2 percent from last month’s (July) sales of $24.570 billion;

* And lower (by $0.090 billion, or down 0.35 percent) compared to last month’s (July’s projection) sales forecast estimate, that is, $25.448 billion;

* The Cowan LRA Model’s Momentum Indicator, MI, went slightly negative (-0.35 percent) compared to last month’s plus posture (at +5.0 percent), as discussed below.

Cowan’s momentum indicator

August 2010’s actual semiconductor sales (of $25.358 billion) came in slightly lower (by $0.090 billion) than the model’s last month’s August 2010 sales forecast estimate (of $25.448 billion) representing a minus 0.35 percent delta comparing August 2010’s actual sales number (published by the WSTS) to the projected forecast estimate “put forth” by the Cowan LRA forecasting model and reported last month. This percent delta represents the Cowan LRA Model’s MI.

The MI is defined as the percent difference between the actual sales for a given month — in this case August 2010’s just published actual global sales of $25.358 billion and the forecasted sales estimate for August 2010, that is, $25.448 billion, which was calculated and published last month.

The MI can be either positive or negative and is a measure of the percent deviation of the actual monthly sales number from the previous month’s prediction derived by the model’s linear regression analysis of the past 26 years of historical, actual monthly global “sales experience” as gathered and published, each month, by the WSTS.

Note: September 2010’s sales forecast estimate is projected to be $31.402 billion.

The latest monthly update to 2010’s global semiconductor sales forecast estimate as determined by the Cowan LRA forecasting model notched down very slightly to $305.406 billion corresponding to an updated projected 2010 year-over-year sales growth forecast estimate of 34.9 percent.

These latest forecasted 2010 sales and sales growth estimates decreased marginally from last month’s (July) reported sales and sales growth forecast estimates of $305.729 and 35.1 percent, respectively.

Thus, the full complement of the latest, updated sales and sales growth forecast estimates for 3Q, 4Q and 2010 are detailed in the table immediately below along with the 1Q’s and 2Q’s actual reported sales numbers.

The second table shows the corresponding results from last month’s model run in order to compare the sequential forecast estimate numbers, namely August versus July. Read more…

Cowan LRA model: Overview plus latest global semicon sales forecast numbers

August 2010’s ‘actual’ global semiconductor sales numbers are scheduled to be released by the WSTS, namely the August HBR (Historical Billings Report) on or about October 4.

In anticipation of the WSTS release Cowan has shared an analysis feature of the Cowan LRA Model for forecasting worldwide semiconductor sales; namely, the ability to provide a ‘look ahead’ scenario analysis for 2010’s global semiconductor sales forecast as a function of next month’s (in this case August’s) actual global semi sales estimate.

The specifics of the scenario analysis are presented in the following paragraphs and detailed in the scenario analysis matrix table provided here.

In order to demonstrate this capability, Cowan has selected a range in possible August 2010 sales; in this particular scenario analysis, a sales range from $23.95 billion to $26.95 billion in increments of $0.5 billion was chosen as listed in the first column of the table.

This estimated range of actual sales is ‘centered around’ the actual August sales forecast estimate of $25.448 billion as determined by last month’s (July) run of the model. The corresponding August 3MMA sales forecast estimate that the model put forth is $25.723 billion.

The overall year 2010 sales forecast estimate for each assumed estimated August sales number over the selected range of August actual sales estimates is calculated by the model, and is shown in the second column of the table.

The third column reveals the resulting yr-o-yr sales growth estimates compared to year 2009’s actual sales (of $226.3 billion).

The fourth and fifth columns show the corresponding three Month Moving Average (3MMA) sales estimate and the associated year-on-year sales growth relative to August 2009’s 3MMA sales (of $19.381 billion), respectively.

Finally, the sixth column lists the associated Momentum Indicator (MI), which is defined and discussed below.

The MI is defined as the percent difference between the actual sales for a given month — in this case July 2010’s just published actual global sales of $24.568 billion and the forecasted sales estimate for July 2010, that is, $23.388 billion, which was calculated and published last month.

The MI can be either positive or negative and is a measure of the percent deviation of the actual monthly sales number from the previous month’s prediction derived by the model’s linear regression analysis of the past 26 years of historical, actual monthly global “sales experience” as gathered and published, each month, by the WSTS.

Note: August 2010’s sales forecast estimate is projected to be $25.448 billion. Read more…

Cowan LRA model's 2010 semicon sales growth forecast estimate: How does it 'stack up' against other prognosticators?

Cowan routinely tracks how the Cowan LRA Model sales growth forecast (each month) compares to a wide range of other major semiconductor market watchers in order to monitor how the model’s latest monthly result “stacks up” against the competition, that is, the 14 other prognosticators he routinely monitors.

The table below summarizes the latest sales growth forecast expectations of these 14 other semiconductor industry forecasters, thus comparing Cowan’s forecast number to the rest of the crowd.

Consequently, the sales and sales growth output of the monthly model run does NOT “sit still” as highlighted below:

* It should be emphasized that each month’s actual global sales number published by the WSTS is a “lagging indicator” since it is released a full month after the fact.

* The Cowan LRA Model, however, “turns” this lagging actual monthly sales into a “leading indicator” by virtue of its near-term forecasting capability looking out over the next five quarters.

* This is the “beauty” of the model and, therefore, makes it dynamic in the sense that it can be run each month utilizing the most recent actual global semiconductor sales number published by the WSTS. Thus, it allows “rigorous tracking” of the near-term sales forecast outlook for the global semiconductor industry on an “almost” real-time basis.

Since conditions change rapidly and unexpectedly in the semiconductor industry, industry market forecasters are hard pressed to keep up with these changes.

How can industry management be sure that a sales forecast issued two, three, or more months ago is still valid and relevant to what’s happening in today’s global semiconductor market?

Cowan's LRA model: Actual July 2010 global semicon sales $24.57bn; down 9.5 percent from last month (June)

The WSTS posted the July 2010 global semiconductor sales report (Historical Billings Report, HBR) on its website this Wednesday.

Therefore, with the WSTS having released its actual July 2010 global semiconductor sales number Cowan has provided the latest monthly update to the Cowan LRA Model’s derived forecast results. The updated forecast numbers for 3Q, 4Q and 2010 “kicked up” slightly from the previous month’s forecast estimates.

The actual July 2010 global semiconductor sales announced by the WSTS came in at $24.568 billion which is:

July 2010’s actual semiconductor sales (of $24.568 billion) came in higher (by $1.180 billion) than the model’s last month’s July 2010 sales forecast estimate (of $23.388 billion) representing a plus 5.0 percent delta comparing July 2010’s actual sales number (published by the WSTS) to the projected forecast estimate “put forth” by the Cowan LRA forecasting model and reported last month. This percent delta represents the Cowan LRA Model’s MI.

The MI is defined as the percent difference between the actual sales for a given month — in this case July 2010’s just published actual global sales of $24.568 billion and the forecasted sales estimate for July 2010, that is, $23.388 billion, which was calculated and published last month.

The MI can be either positive or negative and is a measure of the percent deviation of the actual monthly sales number from the previous month’s prediction derived by the model’s linear regression analysis of the past 26 years of historical, monthly global “sales experience.”

'Look ahead' scenario for global semicon sales forecast: Cowan LRA model update

In advance of this release Mike Cowan wishes to again share an additional feature of the Cowan LRA Model for forecasting worldwide semiconductor sales; namely, the ability to provide a ‘look ahead’ scenario analysis for 2010’s global semiconductor sales forecast update as a function of next month’s (in this case July’s) actual global semiconductor sales estimate.

The specifics of the scenario analysis are presented in the following paragraphs and detailed in the scenario matrix table.

Table 1: Semicon forecast — Cowan LRA model

This estimated range of actual sales is ‘centered around’ the actual July sales forecast estimate of $23.388 billion as determined by last month’s June run of the model. The corresponding July 3MMA (three-month moving average) sales forecast estimate is $24.849 billion.

The overall year 2010 sales forecast estimate for each assumed estimated sales number over the selected range of July actual sales is calculated by the model, and is shown in the second column of the table.

The fourth and fifth columns show the corresponding 3MMA, sales estimate and the associated year-on-year sales growth relative to July 2009’s 3MMA sales (of $18.423 billion), respectively.

June 2010’s actual semiconductor sales (of $27.153 billion) came in lower (by $1.138 billion) than the model’s last month’s June 2010 sales forecast estimate (of $28.291 billion) representing a minus 4 percent delta comparing June 2010’s actual sales number (published by the WSTS) to the projected forecast estimate “put forth” by the Cowan LRA forecasting model and reported last month.

This percent delta represents Cowan LRA model’s MI. See tables 2 and 3 for this indicator’s short-term (last 15 months) and long-term (past 8+ years) historical trend, respectively.

Semicon industry sales have peaked, growth to stabilize for rest of 2010 at 32-34 percent: Cowan's LRA model

Here is the latest update to the Cowan LRA model-derived forecast results reflecting the just released “actual” June sales.

The actual June 2010 global semiconductor sales announced by the WSTS came in at $27.153 billion which is:

* 38.6 percent higher than 2009’s June sales of $19.586 billion;

* Up 13.1 percent from last month’s (non-revised) sales of $24.007 billion;

* And lower (by $1.138 billion, or down 4.0 percent) compared to last month’s (May’s projection) sales forecast estimate for June, that is, $28.291 billion.

It should be highlighted that June’s sales report exhibited relatively large upward revisions for each of the months of Jan., Feb., Mar. and Apr., — resulting in a cumulative upward revision of $0.888 billion to the June year-to-date global semiconductor sales number (that is, $144.647 billion) as detailed in Table 1 below.

Table 1

Table 2

Therefore, taking into account these upward revisions, the latest monthly update to 2010’s global semiconductor sales forecast estimate as determined by the Cowan LRA forecasting model becomes $303.914 billion corresponding to a projected 2010 year-over-year sales growth forecast estimate of 34.3 percent.

These latest forecasted 2010 sales and sales growth estimates decreased very slightly from last month’s reported sales and sales growth forecast estimates of $304.696 and 34.6 percent, respectively. Read more…

Cowan LRA model: Time to "think about" June 2010 global semicon sales (and 2Q10 also)!

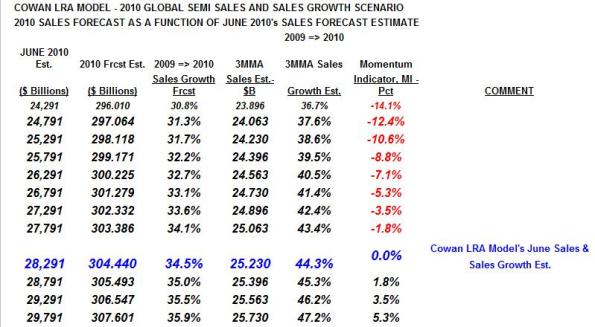

Mike Cowan has shared with us an additional feature of the Cowan LRA Model for forecasting worldwide semi sales; namely, the capability to provide a “look ahead” scenario analysis for 2010’s global semi sales forecast update as a function of next month’s (in this case June’s) actual sales normally published by the WSTS (expected on Thursday, August 5, 2010).

The specifics of the scenario analysis are discussed in the following paragraphs and detailed in the tables.

This chosen range of actual sales is “centered around” the actual June sales forecast estimate of $28.291 billion as determined by last month’s May run of the model. The corresponding June 3MMA sales forecast estimate is $25.230 billion.

The overall year 2010 sales forecast estimate for each assumed, estimated sales number of the selected range of June actual sales is calculated by the model, and is shown in the second column of the table.

The third column reveals the resulting yr-o-yr sales growth estimates compared to year 2009 actual sales (of $226.3 billion).

Finally, the fourth and fifth columns show the corresponding 3MMA, three Month Moving Average, sales estimate and the associated yr-o-yr sales growth relative to June 2009’s 3MMA sales (of $17.483 billion), respectively.