Archive

Round-up 2009: Best of solar photovoltaics

Part III in the series ‘Round-up 2009’ features the top posts in solar photovoltaics during the year gone by. Some friends and readers have spent hours searching for blog posts. Hope this list will help them to easily find the blog post they are looking for. Here you go!

SOLAR PHOTOVOLTAICS

Dramatic price forecast to reshape PV industry: iSuppli

Opportunities in India’s solar/PV landscape: SEMI India

More mature PV industry likely post solar downturn: iSuppli

How is PV industry reacting to oversupply conditions?

Dr. Robert Castellano on how to make solar a ‘hot’ sector again – 1

Dr. Robert Castellano on how to make solar a ‘hot’ sector again – 2

Consolidation likely in solar cell manufacturing to control oversupply, and, lessons for India!

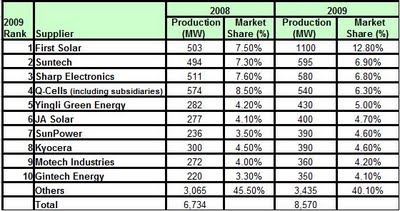

Top-10 solar cell suppliers in 2009: iSuppli — This was also a top read article during 2009!

Solar PV industry scenario in India!

Rising opportunities in India’s solar PV space

Highest efficiency Si solar cells realised with n-Si — Prof. Weber, Fraunhofer ISE

Solar Semiconductor’s Hari Surapaneni on why solar is good for India!

India major destination for solar/PV investments!

Dynamics of the global PV industry

Prof. Eicke R. Weber, Fraunhofer Institute on future of PV

Solar PV and Utility 2.0: Making the grid smarter!

Union Cabinet approves National Solar Mission; 20 GW by 2022 (not 2020)! — The day and event everyone’s waited so very patiently for long in the Indian solar/PV industry!

Indian government unveils National Solar Mission Plan document!

What’s next in PV equipment?

Again, it is extremely difficult for me to list the Top 10. If you can decide, that’ll be great.

Best wishes to my dear friends, well-wishers and everyone for a happy and prosperous 2010!

Dynamics of the global PV industry

It was a pleasure to finally meet up with Dr. Henning Wicht, Senior Director & Principal Analyst iSuppli, at the recently held Solarcon India 2009 event in Hyderabad, India.

He was also a speaker in the session: “Government policies shaping the growth of the industry.” Here are some of the highlights from his presentation.

According to Dr. Wicht, the global PV installation is likely to be around 8.3 GW in 2010. “However, it is too early to say whether this is good news. We will also see a 30 GW likely happening in 2013.” Italy, Spain, California (USA), France, Greece, Blugaria, Czech Republic, China and the USA are likely to witness aboive 60 percent CAGR during this period.

Touching on solar module production, he said that total PV modules is likely to grow from 14,52 GW in 2010 to 20,85 GW in 2013. During this period, production of crystalline modules will likely increase from 11 GW in 2010 to 13,97 GW in 2013, while production of thin film modules will likely increase from 3,53 GW to 6,87 GW in 2013.

The total crystalline cell production roadmap from is likely to expand from 11.679 GW in 2010 to 16.985 GW in 2013. The solar polysilicon production roadmap (2010-2013) is likely to expand from 22,79 GW in 2010 to 48,68 GW in 2013. According to Dr. Wicht, the dynamics of supply and demand determine the future price levels . Supply and demand for modules will likely balance in 2010. Also, polysilicon price will likely drop next year.

According to iSuppli‘s view at the end of Q3-2009 (source: PV Market tracker):

* German market picks up from July. In 2009 2,5 GW of PV system installations is possible in Germany (compared to 1,5 GW in 2008).

* Module oversupply peaked in middle of 2009.

* Installations in 2010 are estimated to grow by 60 percent reaching 8,343 GW.

* It will depend on Q4-2009 if supply and demand will be more outbalanced in 2010, or if the oversupply will continue next year.

It has now been indicated in Europe that “12 percent of EU 27 electricity shall be provided by PV”. About 462 TWh corresponds to 12 percent in 2020. Also, the insolation average: 1200 kWh/kWp installed. This would indicate 390 GW has to be installed in Europe by 2020. In 2008, only 10 GW are installed. The PV industry in Europe is likely to grow at a CAGR of 35 percent over the next 12 years.

Will the industry be able to install 100 GW in the year 2020 in Europe? According to the PV Systems Market Tracker, by 2013, annual installations of 17 GW in Europe looks likely, and 12 GW in the rest of the world.

Dr. Wicht compared three approaches for evaluating the PV market. He advised:

* 120 to 130 GW is forecasted by bottom up approach and by top down approach. assuming that PV will provide 1 to 2 percent of total energy consumption.

* 100 GW may seem very large compared with 4 to 5 GW in 2009 but is it feasible?

* PV is still in the early stage of adoption; large solar markets, eg., US, China and India have just started.

* By 2020, it is likely that PV would contribute 1 to 2 percent to the total energy consumption of the respective region.

* Markets can grow fast, when ground installation is possible (Spain).

Hence, the annual installations of 100 GW for Europe in 2020 looks realistic!

Dr. Wicht advised pursuing CO2 emission trading and grid management. A separate grid management is recommended from traditional energy suppliers. Also, there is a need to guarantee grid access for renewables (secure investment case).

Worldwide CO2 emission trading is the next way to grow PV. Recommendations include making energy by fossil resources more expensive to trigger demand in non-PV supporting regions. Also, there’s a need to generate budgets and funds for REE as well as stimulate self-consumption of REE energy.

Those interested in reading more on Solarcon 2009 can see my articles on the India Semiconductor Association’s web site.

More mature PV industry likely post solar downturn: iSuppli

Recently, iSuppli came out with a study on whether the current solar downturn will lead to a more mature photovoltaic industry! According to iSuppli, severe downturn in the global PV market in 2009 could actually have a more positive outcome for the global solar industry, yielding a more mature and orderly supply chain when growth returns.

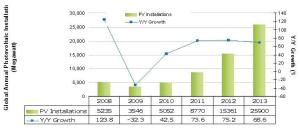

Worldwide installations of PV systems will decline to 3.5 Gigawatts (GW) in 2009, down 32 percent from 5.2GW in 2008. With the average price per solar watt declining by 12 percent in 2009, global revenue generated by PV system installations will plunge by 40.2 percent to $18.2 billion, down from $30.5 billion in 2008.

“For years, the PV industry enjoyed vigorous double-digit annual growth in the 40 percent range, spurring a wild-west mentality among market participants,” said Dr. Henning Wicht, senior director and principal analyst for iSuppli.

“For years, the PV industry enjoyed vigorous double-digit annual growth in the 40 percent range, spurring a wild-west mentality among market participants,” said Dr. Henning Wicht, senior director and principal analyst for iSuppli.

“An ever-rising flood of market participants attempted to capitalize on this growth, all hoping to claim a 10 percent share of market revenue by throwing more production capacity into the market. This overproduction situation, along with a decline in demand, will lead to the sharp, unprecedented fall in PV industry revenue in 2009,” he added.

What about new entrants?

I quizzed Dr. Wicht how this downturn would lead to a more mature PV industry and what about the new entrants?

Dr. Wicht said: “We expect that the solar industry will invest more softly. The years 2007/2008 were special. Each of the hundreds of suppliers were ready to invest to reach 10 percent market share. This is not likely to repeat.” Interesting! “Also, the new entrants will invest more modestly and closely linked to fixed customer orders,” he added.

Role of FIs in solar

Are financial institutions paying that much importance to solar, especially in places such as India? This is an issue that was also raised and discussed at the recently held SEMI India solar/PV paper launch.

According to Dr. Wicht, the financial investors are definitely looking into solar, mainly in Europe and US. “PV in India is still at the very beginning. From my experience, there is not yet much attention of financial investors for PV in India,” he noted.

Off-grid or grid connected apps?

Turning the discussion to off-grid vs. grid connected applications, I sought Dr. Wicht’s advice on the route that should be followed. Again, this topic was discussed during the SEMI India meet early this month. Hence, the interest for India in this field is significant!

Dr. Wicht highlighted: “Installations for the off-grid remains a small portion in terms of the sold modules (MW), about 5 percent. The off-grid system selling might be a good way to start in places such as India. For cell and module production, on-grid is where the volumes are needed.” Hope the Indian solar photovoltaics industry takes note of this valuable advice — and it holds good for other regions as well.

I also asked him regarding a good low carbon growth strategy for developing countries. Dr. Wicht said that depending on the place, it could be a combination of wind, solar and biomass.

Compensating for Spanish whiplash!

According to iSuppli’s study, the single event most responsible for the PV market slowdown in 2009 was a sharp decline in expected PV installations in Spain. Also, beyond Spain, the PV market is being adversely impacted by the credit crunch.

Therefore, why won’t attractive investment conditions in other some countries compensate for the Spanish whiplash?

Dr. Wicht said: “The investigated countries start from a low level of installations and show long, administrative procedures, limits of feed-in tarifs and reduced capital access. They simply cannot compensate the 2.6GW of Spain in 2008.”

Finally, what is likely to happen after the shakeout or fall in the coming years? He added: “System demand will grow stronger from H2-2010, absorbing the inventory, which has been built up in 2009 and 2010. From 2011, demand for modules will rise. It might pick up quickly. Then, companies, which are able to supply on short notice/(flexibility) can gain market share.”

Let me see if I can convince Dr. Wicht to visit India and share his insights with the Indian solar/PV industry. Last, but not the least, thanks Jon!

Will solar downturn lead to more mature PV industry?

The severe downturn in the global Photovoltaic (PV) market in 2009 actually could have a positive outcome for the worldwide solar industry, yielding a more mature and orderly supply chain when growth returns, according to iSuppli Corp.

Worldwide installations of PV systems will decline to 3.5 Gigawatts (GW) in 2009, down 32 percent from 5.2GW in 2008. With the average price per solar watt declining by 12 percent in 2009, global revenue generated by PV system installations will plunge by 40.2 percent to $18.2 billion, down from $30.5 billion in 2008.

The figures present iSuppli’s forecasts of global PV installations in terms of gigawatts and revenue.

Fig 1: Global Photovoltaic System Installation Forecast in Megawatts, 2008-2013 Source: iSuppli, April 2009

Source: iSuppli, April 2009

“For years, the PV industry enjoyed vigorous double-digit annual growth in the 40 percent range, spurring a wild-west mentality among market participants,” said Dr. Henning Wicht, senior director and principal analyst for iSuppli. “An ever-rising flood of market participants attempted to capitalize on this growth, all hoping to claim a 10 percent share of market revenue by throwing more production capacity into the market. This overproduction situation, along with a decline in demand, will lead to the sharp, unprecedented fall in PV industry revenue in 2009.”

However, the 2009 PV downturn, like the PC shakeout of the mid 1980s, is likely to change the current market paradigm, cutting down on industry excesses and leading to a more mature market in 2010 and beyond.

Fig 2: Global Revenues Generated by Photovoltaic Installations 2008-2013 in Millions of US Dollars Source: iSuppli, April 2009

Source: iSuppli, April 2009

“The number of new suppliers entering and competing in the PV supply chain will decelerate and the rate of new capacity additions will slow, bringing a better balance between supply and demand in the future,” Wicht said.

Blame it on Spain

The single event most responsible for the 2009 PV market slowdown was a sharp decline in expected PV installations in Spain. Spain accounted for 50 percent of worldwide installations in 2008. An artificial demand surge had been created in Spain as the time approached when the country’s feed-in-tariff rate was set to drop and a new cap of 500 Megawatts (MW) loomed for projects qualifying for the above-market tariff. This set a well-defined deadline for growth in the Spanish market in 2009 and 2010.

While the Spanish situation is spurring a surge in excess inventory and falling prices for solar cells and systems, this will not stimulate sufficient demand to compensate for the lost sales in 2009. Even new and upgraded incentives for solar installations from nations including the United States and Japan—and attractive investment conditions in France, Italy, the Czech Republic, Greece and other countries—cannot compensate for the Spanish whiplash in 2009.

The Spanish impact will continue into 2010, restraining global revenue growth to 29.2 percent for the year. Beyond Spain, the PV market is being adversely impacted by the credit crunch.

“Power production investors and commercial entities are at least partially dependent upon debt financing,” Wicht noted. “Starting in the first quarter of 2009, many large and medium solar-installation projects went on hold as they awaited a thaw in bank credit flows.”

After the fall

After 2010, the fundamental drivers of PV demand will reassert themselves, bringing a 57.8 percent increase in revenue in 2011 and similar growth rates in 2012 and 2013.

“PV remains attractive because it continues to demonstrate a favorable Return on Investment (RoI),” Wicht said. “Furthermore, government incentives in the form of above-market feed-in-tariffs and tax breaks will remain in place, making the RoI equations viable through 2012. Cost reductions will lead to attractive RoI and payback periods even without governmental help after 2012.”

Furthermore, lower system prices will open up new markets by lowering incentives and subvention costs. The lower the PV system prices are, the lower the incentives will have to be. Developing regions will be big the beneficiaries of these lower prices and thus will grow faster than the global average, Wicht said.

Source: iSuppli, USA

Dramatic price forecast to reshape PV industry: iSuppli

I was very fortunate to attend a webinar on solar PV a couple of days back, thanks to iSuppli, USA. The webinar looked at:

* Polysilicon — what is going on in the market?

* Cells and modules — where will the prices go?

Dr. Henning Wicht, senior director and principal analyst, iSuppli, made it clear that the intention was to show what’s coming out of primary industry research.

Dr. Henning Wicht, senior director and principal analyst, iSuppli, made it clear that the intention was to show what’s coming out of primary industry research.

He said: “We believe that solar is a fantastic market. It has been growing over the last four years by revenue. It will continue to grow! There are not many industries with a growth path like that! However, in last the 18 months, the supply has been disconnected from demand.”

This is exactly the point iSuppli addressed in its webinar. Dr. Wicht was accompanied by Stefan de Haan, senior analyst, photovoltaics, iSuppli.

iSuppli’s recent findings are:

* Severe supply chain imbalances exist at polysilicon/wafer and cell/module levels.

* Short term polysilicon and module prices will decrease significantly.

Polysilicon: What’s going on with supply and pricing?

If you looked at the global solar PV industry, many plants are under construction, and there are huge capacity expansion plans. There has been a dramatic decrease in production. In 2008, iSuppli estimated total production of solar PV at 60,000 metric tons. In 2009, about 100,000 metric tons will be produced!

What are the reasons for this supply situation? In 2005-06, the high margins of this industry attracted several newcomers. The cycle time to ramp up a polysilicon plant is 24-36 months, and including another 12 months to get finance, it takes about four years.

He said: “The decisions taken in year 2005-06 are coming to the market now. This is also why we see the big ramp in 2009-10. This is also the reason why the industry will have big difficulties to react on a short term notice. The polysilicon industry is a big super tanker, which has difficulties to maneuver on short term.”

Looking at the demand side of things, iSuppli showed a graph where the two curves — polysilicon supply and polysilicon demand meet, or rather cross, in early 2010. From that point on, the supply line passes the demand line. “That means, from that time onward, we definitely see prices for polysilicon decreasing,” he said.

What will happen in 2009?

The key point to note is that the ramping rates of polysilicon and solar cells are completely different! The ramping rate of polysilicon is much steeper, than on the cell side. Polysilicon is more than doubling, while the cell industry is growing at 34 percent.

According to Dr. Wicht, the gap between demand and supply is already shrinking fast in 2009, which will lead to a price decrease in 2009.

Coming to prices, the polysilicon market boasts two kinds of prices — long term and spot market. According to Dr. Wicht, the long term prices are already decreasing from around $100/kg in 2008, and it is expected to be around $80/kg in 2009.

On the other hand, the spot market price peaked in 2008 at around $400/kg. Now, it has already dropped. It will continue to drop, far beyond today’s long term contract price, which will then, from 2010 onward, make up another round of discussion. This is because companies might tend to get out of their long term contracts to secure their silicon on the spot!

Summarizing, he said that polysilicon production will increase heavily. Next, supply will pass demand from 2010 onward, and then the industry will enter the oversupply situation for the next three to four years. The polysilicon industry will also react. In fact, iSuppli anticipates a recent announcement from a solar PV company to expand production capacity would be the last for quite a while!

What about projects on the way? These projects have to come on to the market and many of those will! This is precisely the reason why the industry will see silicon passing solar cells in capacity over the next few years.

Stefan de Haan added that the output of the PV modules industry will grow. The total module prod will likely grow to 11GW this year and to 20GW in 2012. Thin film modules will continuously gain market share and it probably account for 1/3rd of the total market by 2012. Production of crystalline cells will run in parallel. It is likely to reach 9GW for 2009 and 18GW for 2012.

Commenting on the competitive landscape, he added that many new players would be entering production in 2009, especially in the thin film business. “However, the current leaders — QCells, Suntech and First Solar — will increase their edge over the competition in terms of absolute production volumes,” he said.

In general, it is a good thing that the industry is growing and that all of this capacity is coming online. However, this raises the question: can demand can keep up with the supply?

According to iSuppli, in 2009, the installation market will be flattening. In the sense, iSuppli projects that 4.2GW will be installed this year, or about 10 percent growth. However, this growth is much smaller in comparison to the previous years. Some of the reasons for slower growth in 2009 include changes in sustained feed-in tariffs and the global economic slowdown.

Hann added, “In H2-2010, module demand will probably return to the previous growth rates, of more than 20 percent per year.”

Combining demand and supply, there is a massive oversupply of modules that has already been building up since early 2008. Back in 2008, this did not impact on the module prices as there was short term heavy demand from countries like Germany and Spain, from project developers and installation companies, etc. So, this was not noticeable earlier. However, in 2009, the oversupply situation is quite serious!

As a consequence, many suppliers will not be able to react to this situation in the short term. They will still need to run their factories to try and generate some revenue and satisfy the industry. Many had bet on some strong demand coming from USA and also China.

This year, the module prices will decline. Consequently, the declining prices will also create some additional demand. However, for the next two years, this fundamental oversupply situation will not change.

How far will prices drop?

So, what are the message for 2009? First, crystalline module prices will drop to about $2.50 per watt, and second, cost is going to be the differentiating factor! This was a point emphasized strongly by the iSuppli analysts.

Further, how should companies manage this situation, where supply is disconnected by demand? According to Dr. Wicht, there is 11.1GW of module supply vs. 4.2GW of installations. “We do not see that the demand is elastic and that everything will be good after the end of 2009. The gap is too large between demand and supply, and will last till end of 2010.”

Installation capacity will surely become a bottleneck. There will be falling prices for silicon, as well as solar cells and modules. Also, the demand is not that elastic enough to absorb all modules produced.

Therefore, given this situation, what are the options for success, rather, what are the ideas to re-orient the solar PV business?

The first option could be to shut down 50 percent of production till price recovers. However, this is not a realistic option. Another could be to put expansion plans on hold. Yet another option for producers would be to become the best in class in production cost, an option, which is excellent, but difficult!

Probably, the best option would be for mak

ers to integrate downstream. This includes new demand simulation in established markets as well as developing new markets.

Dr. Wicht said: “Anticipating bottlenecks are key for solar. The next bottlenecks are the bureaucracy and installation capacity. The production capacity would not be influential. Production cost and downstream integration are key.” He advised solar PV producers to monitor their PV market demand and supply situation regularly.

Outlook for solar photovoltaics in 2009!

Friends and dear readers, this is my last blog post for 2008! Indeed, what a year this has been!!

Let me bid this year goodbye with a general outlook on the global solar photovoltaics industry for 2009.

iSuppli had recently put out a report on solar eclipse coming in 2009! I had blogged about the possible solar sunburn ahead, as well, earlier last week!

Another point that has interested me is: what happens to the top 20 global solar photovoltaic companies, based on iSuppli’s analysis! This blog post has perhaps been the most popular in recent times.

I was very lucky to re-associate with Dr. Henning Wicht, Senior Director, Principal Analyst, iSuppli Deutschland GmbH, in Munich, Germany, for this discussion, thanks to the efforts of Jon Cassell and Debra Jaramilla!

I was very lucky to re-associate with Dr. Henning Wicht, Senior Director, Principal Analyst, iSuppli Deutschland GmbH, in Munich, Germany, for this discussion, thanks to the efforts of Jon Cassell and Debra Jaramilla!

How bad is solar?

The first and the most obvious question: how bad is the global solar market right now and why?

According to iSuppli, bringing an end to eight consecutive years of growth, global revenue for photovoltaic (PV), panels is likely to plunge by nearly 20 percent in 2009, as a massive oversupply causes prices to drop!

Worldwide revenue from shipments of panels will decline to $12.9 billion in 2009, down 19.1 percent from $15.9 billion in 2008. A drop of this magnitude has not occurred in the last 10 years and likely has not happened in the entire history of the solar industry.

Dr. Henning Wicht says that the upstream part of the solar business (cell, module, etc.) will suffer from price decline due to strong oversupply. The downstream side will benefit (installation, end-user, investor, etc.) by lower system prices.

Therefore, what can the solar players do to get over this coming bad phase in 2009? Well, three things: improve the cost structure, improve the sales side, and diversify downstream… These points hold strong for all fully integrated and non-integrated solar panel suppliers as well. By the way, fully integrated solar panel suppliers are likely to suffer less severe losses than non-integrated competitors.

There must be some way around to to bring about some balance within the current imbalance in the demand and supply situation. While Dr. Wicht agrees this is a difficult one to answer this early, he adds that supply and demand are diverging heavily. “With the current trajectories even in 2012, 100 percent more modules are produced than installed,” he says. I promise to discuss this question again with the good Dr. in another six months time.

Word of wisdom

There are various support programs in place, and it is important to know whether they will continue to remain beneficial, both to support markets to become independent sustainable and to develop the regional industry.

Dr. Wicht believes the support programs are still required and beneficial. “If China, India, Mexico and other sunny regions would start to support solar installations, that could change the picture drastically,” he notes.

A note of warning for new entrants in the solar photovoltaic space! Be aware that this warning has been earlier highlighted in the global semiconductor outlook for 2009! In tune with what the various analysts have maintained earlier, iSuppli also forsees newcomers in the solar photovoltaic line having problems in getting the required credit for their projects.

What next for Europe, emerging regions?

According to iSuppli, the short-term boost in demand from Spain and Germany has kept the installation companies busy, and solar orders and module prices high. But this boom is over. So, what’s next for European players?

According to Dr. Wicht, Germany and Spain should continue their leading role as solar installation regions, even after the boom. France, Italy and Czech Republic are attractive, but still much smaller markets, he maintains.

iSuppli has also mentioned that the race to larger manufacturing scale comes to an end when the production is not sold anymore! In that case, what’s the case for the emerging nations, like China and India? Aren’t there buyers in such places?

Dr. Wicht says: “Demand in the traditional solar markets is not elastic enough to absorb all of the solar production. Potential new markets, for example, China and India, do not yet have installation capacities and administration to significantly change the global solar demand short term.”

iSuppli also feels that the newer Chinese and Taiwanese suppliers will be hit particularly hard during 2009. The reason being, many suppliers have expanded their production capacities heavily without securing equally the sales/downstream part.

Global top 20 rankings to change?

Now to the most interesting part! Most of you have read about the top 20 global solar photovoltaic suppliers. Following the iSuppli warning of a ‘solar eclipse’ in 2009, there is every likelihood that there will be changes in that table!

Dr. Wicht adds, “However, the top 10 companies are typically better placed than the competition regarding their cost structures, downstream integration and vertical integration.”

Obama’s solar plans!

Now on to yet other interesting point! The US President-elect, Barack Obama’s, New Energy for America plan could well have a significant impact on the US solar industry.

The plan’s provisions include:

• A federal renewable portfolio standard (RPS) that requires 10 percent of electricity consumed in the US to come from renewable sources by 2012.

• A $150 billion investment over 10 years in research, technology demonstration and commercial deployment of clean energy technology.

• Extension of production tax credits for five years to encourage renewable energy production.

• A cap-and-trade system of carbon credits to provide an incentive for businesses to reduce greenhouse gas emissions.

Dr. Wicht says: “We all know that Obama is in favor of renewable energy. However, he will not change a 160 percent oversupply of solar panels in 2009.”

Bumpy ride to grid parity?

On another note, and a pretty favorite one: Is it going to be a “bumpy road” to grid parity? How will the subsidies be kept going?

Dr. Wicht notes: “Subsidies will continue. It will always be a bumby road because the ramping cycles differ heavily among silicon, cells, modules and the installation capacity. Please remember that the installation business will now benefit from low module prices. It will recover some of the margins it has lost in the last years due to high module prices.”

Also, up to when will polysilicon constraints last? iSuppli had earlier indicated PV strategy changes. According to Dr. Wicht, the polysilicon prices are coming down already. “Our indication from October 2008 seems to be fairly good,” he says.

Lastly, will iSuppli be still sticking by solar, semicon investments being equal by 2010?

Dr. Wicht says: “Please let me cite again our interview in October: The investments for solar production raising up to several hundreds of Mio USD, up to 1 Bio $ per production site. That is coming close to a semiconductor fab. The total capex of semiconductor is still 10 times larger than PV. However, PV is rising much faster.”

That will be all for this year, folks!

Look forward to sharing much more captivating moments in semiconductors, electronics, solar photovoltaics, telecom, etc., in 2009!

Wishing all of you a very happy, prospe

rous and successful 2009. Be safe and look after yourself! See you next year!! 🙂

Top 20 global solar photovoltaic companies

Alright folks! This has taken some time coming, but it is worth the wait! Presenting the Top 20 solar photovoltaic companies during Q1-2008. May I add here that I am extremely grateful to iSuppli’s Jon Cassell for giving me this opportunity.

I was also fortunate enough to discuss this table with Dr. Henning Wicht, Senior Director, Principal Analyst, iSuppli Deutschland GmbH, in Munich, Germany.

I was also fortunate enough to discuss this table with Dr. Henning Wicht, Senior Director, Principal Analyst, iSuppli Deutschland GmbH, in Munich, Germany.

Parameters for rankings

Parameters for rankings

First up, what were the parameters used by iSuppli to determine the top 20? According to Dr. Wicht, the top 20 cell-companies have been ranked by production in 2007 and by announced production capacity 2010. He clarified, “Ranking by revenue is not applicable because many integrated manufactures publish compound revenues for cells, modules and systems.”

Yes, there have been several announcements in the solar/PV space, in India, and globally, and some names could be missing here. However, the new cell manufacturing projects will be included as soon as they are announced.

Coming back to the topic, it is necessary to examine the role of subsidies. While photovoltaics have been getting cheaper, Dr. Wicht said that subsidies were still necessary to support the PV markets. “It shows that the time grid parity shortens faster than expected earlier. As an example, for Germany, the grid parity might be achieved in 2015, which is two years earlier than expected in 2007.”

That is to say, the support programs are benefical, both to support markets to become independent sustainable and to develop the regional industry.

Global interest in solar/PV

Critically, there seems to have developed a sudden interest in solar/PV, starting late 2007, when this (solar) has been around for some time. How has this happened?

According to Dr. Wicht, raising CO2 levels generated through fossil energy, CO2 certificates, rising prices of fossil fuels, political dependency from oil exporting countries drove the Kyoto protocol to reduce CO2.

“Renewable energy is a major pillar to achieve that goal. European governments have been frontrunners to implement and execute that goal. That said, solar has been around for a while. Japan was the first significant market. However, on a global basis, it took off in Europe from 2005 onward,” he noted.

With the spate of initiatives in solar/PV, can it not turn out to be a case of too many folks entering the same line?

Sure, over and undersupply happens along the supply chain! The iSuppli market research figures out imbalances, which drive prices/margins up and down.

Also, isn’t there a chance of solar/PV getting commoditized, or has it already become one? Well, PV modules are a commodity product, said the analyst. The market is still in its infancy and it will continue to grow for the next 10 years and further. The overall saturation will come, but still some years to go.

Is solar helping semicon?

Some industry folks have been saying that the solar/PV initiatives are not really helping the overall semicon industry, a statement I agree with as well. Also, it may only be benefitting some of the equipment makers.

Dr. Wicht said: “Indeed, semicon fabs are not able to produce competitively solar cells and the solar need for semiconductor devices is rather low. The semiconductor companies, however diversify into PV, e.g., Qimonda with a new cell production. Intel is investing in several PV companies, LG is investing in Conergy, etc., or supplying devices for power conversion, e.g, National Semiconductor. However, the overall impact on the semicon devices market is rather low!

Solar, semicon on par?

iSuppli made a forecast some time back regarding investments in solar and semiconductors being on par by 2010.

The investments for solar cell production raising up to several hundreds of Mio USD, up to 1 Bio $ per production site. That is coming close to a semiconductor fab. The total capex of semiconductor is still 10 times larger than PV. However, PV is rising much faster.