Archive

What's happening with Indian solar/PV industry?

I’ve just returned after attending the Renewtech India 2011 show in Mumbai, on behalf of Trafalgar Media. I am very pleased to report that there were two sessions that I was able to attend — one on “Financing of Renewable Energy Projects” and the other on “Solar Energy & Hybrids.” Besides, I made a new friend in Sarita, my associate at the show.

To read more, you’d need to go to the website titled Global Solar Technology! I will, meanwhile, attempt to put down some of my own thoughts here!

First, the show itself! I am told there were many more exhibitors in the previous edition than this year’s edition. Now, I don’t know whether that is correct, but one got the feeling that this show was small! Two, the sessions were really lively! At least, that’s what I thought! Three, there was a strong German presence at the show. Four, on a lighter note, Yingli came to the show with a large booth, but also ended up doing a raffle draw on day 2! 😉

As for the conference, there were ‘moderate’ attendances for both the sessions mentioned above. ‘Moderate’, because I felt that the venue, or the room that showcased the conference, was too small! Now, I may be wrong in my assessment.

However, these odd things did not have any negative impact on the sessions themselves. All speakers went full blast at their topics, as did the audience, which, for a change, asked several interesting questions.

What was my impression about the show? It so appears that the Indian solar PV industry is well on track to perform well. However, there are some reports that not all licensees have managed a start, post the granting of 37-odd licenses by the NVVN. What’s being done to support or help the guys who have won the NVVN licenses?

Also, there seemed to be a lot of discussions focused on solar thermal, rather than on solar PV technology. Now, why is that so? Perhaps, Solar Thermal Federation of India (STFI) has a larger role to play here!

By the way, there was a Bangalore-based supplier of LEDs, which had quite a few visitors at its booth.

And now, I am looking forward to attending the ISA Vision Summit, to be held on Feb. 21st and 22nd. Let’s see if something good comes out of this edition. Not to worry, you’ll hear from me, right here! 😉

Round-up 2010: Best of solar photovoltaics

Solar photovoltaics (PV) constantly reminds me of the early days of the telecom industry. Perhaps, the similarity lies in practically anyone and everyone wants to enter the solar/PV industry as well, just like it happened in telecom — before the industry consolidation started to happen.

In India, a lot more talk has happened since the Jawaharlal Nehru National Solar Mission (JN-NSM) was unveiled. With 2010 now drawing to an end, here’s presenting the top posts for solar PV from the year that is about to leave all of us!

Want to enter solar off-grid business? Build your own solar LED lanterns and emergency lights! — This was a smashing superhit! So many folks have accessed this post and quite a few commented! Definitely, my no. 1 post for the year and among my top 10 posts for 2010!

Union budget 2010: Solar, UIDs all the way!

NI DAQ workshop: Sun tracker suitable for Indian (and global) solar/PV industry

India to miss NSM target? No, it’s likely a mistake (in reporting)! — The faux pas of the year! 😉

SEMI India benchmarks India’s NSM on global FIT best practices — Goes on to show why SEMI continues to be a top notch industry association!

RoseStreet Labs develops breakthrough multiband solar cell technology! — I enjoyed writing this post a lot!

Solar PV heats up in India — NVVN signs MoU with 16 developers; new guidelines for solar projects — First clear signs that India is indeed hot, as a solar market.

Unique solution required for grid-tie inverters in India!

Solarcon India 2010: Timely implementation of phase 1 critical to success of JN-NSM

Need to develop indigenous manufacturing capacity in solar: Deepak Gupta

Is there a case for polysilicon manufacturing in India?

India has bright future in solar PV, other RE: Stan Meyers, SEMI

Pressing need to address solar project financing in India: D. Majumdar, IREDA

TÜV Rheinland opens South Asia’s largest PV testing lab in Bangalore

Need to look at smart grid standards from an Indian context: Venkat Rajaraman, Su-Kam

Bluetooth set as short range wireless standard for smart energy! — This should be interesting, as and when it happens!

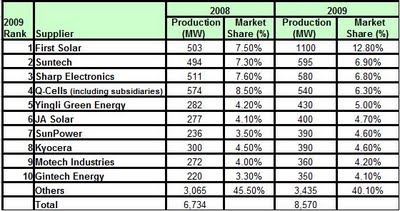

Top 15 producers of c-Si and thin film solar PV modules, and outlook 2011

There’s more to come in the new year, now that NVVN has released a list of projects under the JN-NSM. I am more keen to see how JN-NSM takes off in the new year, and am sure, so are you!

Here’s wishing everyone a very happy, joyous and prosperous 2011! 🙂

Solar PV likely showstopper at electronica India 2010 and productronica India 2010

For those interested, since its debut in 2009, this show has been split into two sections – productronica India — devoted to production technologies, SMT and EMS/contract manufacturers, PCB, solar and PV, laser, etc., and electronica India – focused on components, semiconductors, assemblies, LEDs and materials.This year, there are going to be three added attractions or special exhibit areas, namely:

* Solar pavilion.

* LED pavilion.

* Laser pavilion.

Solar PV main attraction

A report on the ‘Solar PV Industry 2010: Contemporary Scenario and Emerging Trends’ released by the India Semiconductor Association (ISA) with the support of the Office of the Principal Scientific Advisor (PSA), lays out the strengths and challenges of the Indian solar PV market:

* Even though the industry operates at a smaller scale as compared to other solar PV producing nations, production in India is very cost effective as compared to global standards.

* With Government initiatives such as the SIPS scheme and JN-NSM in place to promote application of solar PV in domestic market, the Indian solar PV industry is likely to gain further edge over other solar PV producing nations.

* There is no manufacturing base in India for the basic raw material, that is, silicon wafers.

* Over the last five years, China has emerged as the largest producer of solar cells in the world. The country currently has about 2,500 MW of production capacity for solar PV as compared to India’s 400 MW. Taiwan, with annual capacity of 800 MW, is also emerging as a major threat to the Indian industry.

* Price reduction is another major challenge for the industry as this would have greatly impact the future growth of the market.

The recently concluded Solarcon India 2010 threw up several interesting points as well. Industry observers agreed that the timely implementation of phase 1 of the historic Jawaharlal Nehru National Solar Mission (JN-NSM) is going to be critical for the success of this Mission.

The MNRE stressed on the need to develop an indigenous solar PV manufacturing capacity in solar, and build a service infrastructure. Strong emphasis is also being placed on R&D, and quite rightly. Notably, the Indian government is working toward tackling issues involved with project financing as well.

All the right steps and noises are currently being taken and made in the Indian solar PV industry. If these weren’t enough, the TÜV Rheinland recently opened South Asia’s largest PV testing lab in Bangalore!

This year, an exhibitor forum on PV and solar will also take place at the Solar PV pavilion during electronica India 2010 and productronica India 2010.

Read more…

Pressing need to address solar project financing in India: D. Majumdar, IREDA

He touched upon the three schemes that Dr. Bharat Bhargava of the MNRE had spoken about earlier. These are — NVVN scheme — typically 5MW/100MW schemes, rooftop component, and off-grid component.

Majumdar said that each one of these schemes has to be looked at differently. Two things will be important — generation and tariff. Tariff is derisked. All are going to look at the prediction and the forecast of generation. You will need good data to forecast for your project.

Power purchase agreements (PPAs) are signed in terms of MW. A change in mindset is also required. There are areas we often neglect. For example, the quality of water at site can create a lot of distortion in forecast generation. Or, how do you decide one module is better than the other?

On the 100MW scheme on power projects, Majumdar added that the entire history of what the distribution center becomes at downtime will be important. On the off grid component, Majumdar said that today, it looks small. However, it has the largest significance. Its impact is tremendous.

“Solar financing is tough. However, we will try to make it easier and show the financial institutions that it is possible to de-risk projects. We will get the lending community to activate itself,” he added.

Earlier, Dr. Bharat Bhargava, director, solar PV, MNRE, mentioned that the JN-NSM offers opportunities to invest in grid power projects, off grid projects and manufacturing. He added that the enabling polciy and framework is in place. Aggressive R&D and local manufacturing are necessary to achieve grid parity. He also outlined the R&D strategy. It includes:

* Research at academic/research institures on materials and devices.

* Applied research on the existing processes and developing new technologies.

* Development of CoEs on different aspects of solar energy.

* International collaborations.

Dr. Bhargava also mentioned the HRD strategy. It includes:

* Develop specialized curriculum for teaching solar energy at B.Tech, M.Tech and IIT levels.

* Announce fellowship for education and research.

* Provide training in grid and off-grid power projects.

* International training via bilatera programs.

* Testing and training institute.

Solarcon India 2010 kicks off in Hyderabad!

Honourable Union Minister for New and Renewable Energy, Dr Farooq Abdullah, along with Honourable Chief Minister of Andhra Pradesh, K. Rosaiah, and Honourable Union Minister for Urban Development, Jaipal Reddy, inaugurating Solarcon India 2010.

Solarcon India 2010, the second edition of India’s largest solar-energy-focused event organized by SEMI India, the premier trade body of the Indian solar/PV industry, kicked off at HICC, Hyderabad today.

Honourable Union Minister for New and Renewable Energy, Dr Farooq Abdullah, inaugurated the three day exposition and conference. Honourable Chief Minister of Andhra Pradesh, K. Rosaiah presided over the event. Honourable Union Minister for Urban Development, Jaipal Reddy, was the Guest of Honour.

The conference keynote was delivered by Dr Winfried Hoffmann, President, European Photovoltaic Industry Association.

India’s first solar industry directory, published by SEMI India was released on the occasion.

More details later… am still at the conference! 😉

Wlhat's next in PV equipment?

Thanks to David Jourdan at Yole Développement, Lyon, France, I recently participated in a presentation made by Arnaud Duteil, market analyst, photovoltaic technologies, Yole, titled: PV Equipment – What’s Next? According to Yole’s analyst:

• Until the end of 2008, optimistic demand has pushed industrials to expand their fabsquickly and has thus disconnected capacity from the real market.

• Low average utilization rates are affecting cash flow of numerous players. Initial expansion plans are delayed and cell/module makers are focusing on selling stocks.

• Equipment market has been growing very fast and is now being impacted by this industry slow down. The market will be pushed again in 2010 by a strong restart of PV installations

• Equipment makers have been running after the market for several years. 2009 being a difficult period, they have turn the slowdown into an opportunity to increase their customer support and strengthen their knowledge directly on site.

• The focus is now on process optimization and innovation to continuously drive production costs down.

What’s the current situation?

There has been strong demand in 2007 and 2008, which triggered several fab extensions projects. Also, there were large investment plans across all the value chain — polysilicon, ingot and wafer, cell and module. As a result, at the end of 2008, the industry was big enough to supply:

– 12GWp of solar modules,

– 11GWp of wafers,

– 9 GWP of polysilicon

The equipment market reached 2.7 billion Euros in 2008 and will be down by 30 percent at 1.9 billion Euros. However, two key events changed the market in 2008 — the capping of Spanish incentive program and the global financial crisis.

Yole expects that module demand will reach 6.5GWp at the end of this year and about 5GWp of connected installations assuming 7gr of polysilicon per Wpand 14,5 percent efficiency at the module level.

In 2008, the policy forecast and market reality were not quite matching. There was also strong interest into FIT (feed-in tariffs) and a sturdy demand from the Spanish market led to high module prices. A flat growth has been expected in 2009 mainly because of the 500MW cap on Spanish installations, as well as due to the strong price adjustment.

Strong price elasticity is likely during 2010-11. Strong investments in silicon and cell production capacities will be operational. Also, prices will continue to drop while opening up new markets. In the optimistic scenario, Italy and California could reach grid parity by 2010.

Demand will likely take off in 2012-13. Large raw material availability and factory over-capacities will again force value chain players to lower their cost and reduce margins. Grid parity will be reached in several countries and unmatched demand will emerge.

However, Duteil cautioned that technical bottlenecks are expected on systems storage and electric grid adaptability.

PV equipment market

As for the equipment market, Yole believes that the gap between capacity and demand will negatively impact the equipment market for the next two years.

Assessing the equipment market from 2007 to 2013, in 2007-08, there was strong demand for thin film solution due to expensive polysilicon. It was important for growth of equipment market to match with demand.

In the period 2008-10, there is likely to be strong over-capacity, and low utilization rates are limiting new investments in fab extensions. However companies with proprietary design continue to increase their capacity, such as First Solar. Other examples of companies investing in turnkey solutions: Best Solar, Genesis Energy, KSK Surya PV, Signet Solar, Top Green Energy, etc. From 2011-13, demand for PV installations will trigger new capacities and boost the equipment market.

If turnkey and non-turnkey fabs are compared — a-Si and a-Si/μ-Si new capacity in 2009 — the TF turnkey lines market share is bigger than its C-Si counterpart. This is mainly because the turnkey providers lower technical barriers and thus help in diffusing the technology. Non-turnkey type production capacities will grow, thanks to key companies like First Solar, Solyndra or Abound Solar.

Yole, founded in 1998, is a market research, technology evaluation and strategy consulting company. Forty of its business is in the EU countries, while Asia and North America account for 30 percent each, respectively. Yole is and involved in the following fields:

* MEMS, including microfluidics.

* Photovoltaic, from equipment and materials to cell business.

* Compound semiconductor business (SiC, GaN, AlN, ZnO) –power devices, RF devices, LED, HB LED.

* Advanced packaging (3D IC, TSV, SoC, WLP).

* Nanomaterials.

Solar PV industry scenario in India!

It is well known that India already has the advantage of being a well established, low cost producer and assembler of solar PV cells and modules.

It is also very likely that grid connected power would emerge as the major segment in India over the next few years, according to B.V. Naidu, chairman, India Semiconductor Association. He was speaking at the recently held 3rd Global Demand Conference in Hamburg, Germany.

India currently has an installed manufacturing capacity of solar cells and modules of 400 MW and 700 MW, respectively, as per the ISA chairman.

Giving an overview of the industry during 2007-08, Naidu added that India produced:

* 110 MW of solar cells and 140 MW of modules.

* Solar PV industry turnover was over $1.0 billion.

* Ninety percent of the manufacturing capacity is currently exported.

* The current grid connected capacity is less than 2 MW.

Policy initiatives from the government

The government of India has announced several incentives for manufacturing.

Manufacturing: 20-25 percent of incentive for solar PV.

Incentives for grid connected applications:

* Generation based incentives (GBI): $0.30 per unit.

* Limited upto 50 MW from the government of India.

* State governments are independently announcing their incentive programs.

Incentives are also available for off-grid applications such as home lighting systems, street lighting systems and roof top systems. Next, there is an agenda to develop 60 cities as Solar Cities, aimed at reducing the energy consumption by 10 percent through energy lighting conservation and renewable energy.

Also, the National Solar Mission aims at achieving a target of 20 GW of solar power by the year 2020.

Market opportunities in India

All of these lead to the question: what are the kinds of market opportunities that exist in India?

According to Naidu of ISA, India is already well established as a low cost producer and assembler of solar PV cells and modules. Also, it is a large market for DDG (Decentralised Distributed Generation) applications.

Next, grid connected power would emerge the major segment, as India achieves grid parity. Also, the country boasts of a large pool of talented manpower, which can serve a good resource to develop applications suited to Indian market.

The benefits that will arise by the adoption of solar photovoltaics for India are immense. One, solar energy will help the country meet its energy security requirements, reduce dependence on exhaustible fossil fuel reserves and reduce the carbon footprint.

It will also help in providing remote/rural villages faster access to electricity. Finallly, it will create several thousands of jobs — both, direct and indirect — in manufacturing, applications and R&D.

ISA’s role

Highlighting the role of the India Semiconductor Association (ISA) in demand promotion, Naidu added that it acts as an umbrella industry association for the solar PV companies in India.

Also, the ISA enjoys a strong and credible working relationship with the key concerned ministries in the government of India, and advises it on policy initiatives for demand growth.

Further, the ISA has also made some bold recommendations on demand promotion in its comprehensive report on the sector carried out with government support, which have served as a useful reference for the government in policy formation. The ISA organises industry events and delegation visits as well.

Folks, this is probably just the time to enter the Indian solar/PV market!

Dr. Robert Castellano on how to make solar a ‘hot’ sector again – 2

Dr. Robert N. Castellano, president, The Information Network

Friends, this is the concluding part of my conversation with Dr. Robert N. Castellano, president of The Information Network, based in New Tripoli, USA.

The question of adding new, additional solar capacity will always arise. Is it the certain that no new additional capacity will be brought on board in 2009?

Dr. Castellano noted: “Actually I said 2010. Solar manufacturers are already losing money this year and the capacity utilization is 27.9 percent. Also, the days of inventory are currently 122, up from 71 days in 2008. If they continue to add new capacity, things will only worsen, exasperating the recession.”

What lessons for India?

Turning our attention to India, which has lately been witnessing a lot of talks of building new capacity. According to Dr. Castellano, now is a good time to talk, as a plant will take at least a year to get into full production. By that time, prices should be stabilized and increase.

What then are the lessons to learn from all of this for the Indian solar PV industry?

He added: “What has to be weighed is the cost of making the solar panels in India versus buying the outside the country. It can take several years for a plant to be profitable. If the venture was established from money from India’s government through subsidies, it can lessen the impact of potential losses, while the plants ramp and selling prices move up to a level where production becomes profitable.”

I hope this valuable piece of advice is noted by the existing players or those looking to entering the solar photovoltaics segment in India.

Bring solar production cost per watt down

Dr. Castellano had mentioned about First Solar bringing production costs down to $0.93 per watt. How many of the others are capable of matching or bettering this?

He said, for that matter, Oerlikon, expects that its lines will deliver a cost of $0.70 cents per watt by the end of 2010 and has achieved an initial conversion efficiency of 11 percent, which comes out to about 9.5 percent of stabilized efficiency.

How can manufacturers differentiate their solar products?

Another query has been, how should solar manufacturers differentiate their products and how can they do it cheaply?

Certainly, there are new avenues of manufacturing, such as CdTe from First Solar, CIGS from half a dozen manufacturers, multi-junction cells from companies such as Uni-Solar, and building integrated photovoltaics (BIPV) from an increasing number of manufacturers, advised Dr. Castellano.

He said: “These technologies differentiate the companies’ products, but the proportion of wattage manufactured, while growing, is small compared to the majority of solar panels sold using traditional methods of production, i.e., a thin film on a glass substrate.

“Long life and low cost of ownership are of paramount importance if solar is to grow, particularly, if there is to be a large acceptance at the residential level. Manufacturing can introduce defects in solar cells that can result in low electron mobility (EM), electron traps and photo-degradation from UV light. These issues affect the efficiency and lifetime of solar cells and the importance of measuring electron mobility at the wafer and cell stage.

“The lifetime of minority carriers has been widely identified to be the key material parameter determining the conversion efficiency of pn-junctions in silicon solar cells. Defects in the crystal lattice reduce the charge carrier lifetime and thus limit the performance of the solar cells. Another major efficiency loss is due to impurities in the cell. These can be foreign atoms or molecules in the crystal lattice (including the dopant atoms), and provide sites where electrons and holes can recombine, thereby reducing the number of charged particles available to create an electrical current.

“Lehighton Electronics (Lehighton, PA) is an example of a company that has developed a variety of tools to test and measure solar wafers. One tool can measure sheet resistance and resistivity to see if there is any subsurface damage. Another system can measure minority carrier lifetimes, while a third model can find traps in solar wafers.” Read more…

Time for Indian semicon to step up! Yes or No?

I was really happy to see a comment on my blog post: “What India now offers to the global semicon industry,” left by Tom Morrow, author of the SEMISpice blog, and Vice President of Global Expositions and Marketing, SEMI. Thanks for visiting and commenting, Tom.

You said: Your description of India’s Special Incentives Package Schemes for setting up and operating semiconductor fabrication as a “debacle” is off the mark. Is it really wise for the country to join an already crowded semiconductor manufacturing ecosystem when it can apply its scarce resources to join 30-50 year boom in solar, something the country desperately needs for both domestic and export development?”

“The move to solar is the right one. India had nine manufacturers of solar cells and about twice as many module makers. Most of these proposals have been in response to the Government’s announcement of a Special Incentives Package Scheme under the 2007 Semiconductor Policy.

“About 70 percent of India’s solar cell and PV module production has been exported. This is likely to change in the near future as government policy provides the push for PV deployment and following the recent release of guidelines for grid connected solar generation. Several states in India, including Andhra Pradesh, Gujarat, Karnataka, Punjab, Rajasthan and West Bengal have also announced their own solar policies, plans and incentive packages in recent months.

“ISA and SEMI has recognized the great opportunities in solar and have taken supportive leadership positions. While both organizations would love to see a domestic semi fab industry emerge in India, given the overcapcity in the industry today, the transition to solar has been swift, thoughtful, and right on the mark.”

First up, Tom, I did not formulate SIPS or the Indian semicon policy! I too thought India would soon build a wafer IC fab! Several delegations have visited India, in the past, with companies hoping to work with these so-called wafer IC fabs in India. I am merely a small time blogger, offering my opinions. And I love my country, no less than any other Indian!

Perhaps, you should see some of the press these ‘so-called fabs’ received! All the talk of a wafer IC fab only died down with SemIndia late last year!

If folks read my posts carefully, I’ve discussed how India has been doing fine before the semicon policy and post the policy, fab or no fab! Some knowledgeable experts have even said that fabless India shines brightly! It has shone before, and continues to do so!

Neither do I have anything against solar and the solar industry! It is a great way to trigger off manufacturing in India. Did I say otherwise?

I work closely with ISA, in fact, was present, when ISA was born, back in October 2004, and also know Sathya Prasad at SEMI India quite well. It’s a great initiative that’s going on in solar in this country. So, yes, the move to solar is a very correct one!

Still on wafer IC fabs, one expert even goes on to say that India could look at skipping the current node of technology and make an entry into the one that will be prevalent after few years.

However, my focus is essentially on semiconductor manufacturing! As many industry experts never fail to say at conferences, India needs to move up the semicon value chain! We need more semicon product start-ups!! And, that’s not happening fast enough!

Perhaps, we can just discard all of these ideas and go on being a leading player in design services (which, we already are), a much easier option.

I would still go with what Malcolm Penn of Future Horizons’ says, that India needs to re-think its semiconductor strategy! It cannot survive on chip design alone!

Even the recently held ISA Vision Summit had a session: “Indian design influence: Ideas to volume”! Speakers discussed how India should seize opportunities, especially in this downturn, and that, it is time for the Indian semiconductor industry to step up, put the right innovations in place and grow.

I am very interested in hosting an event in India on this topic — Time for India to step up: Put right innovations in place and grow! However, as I said, I am merely a small time blogger, trying to make a living. I hope I can find some support to host such an event at least once in India.

I am simply delighted that my post has drawn the interest of such a senior person at SEMI. Thank you, sir!