Archive

Round-up 2010: Best of semiconductors

Right then, folks! This is my last post for 2010, on my favorite topic – semiconductors. If 2009 was one of the worst, if not, the worst year ever for semiconductors, 2010 seems to be the best year for this industry, what with the analyst community forecasting that the global semicon industry will surpass the $300 billion mark for the first time in its history!

Well, here’s a look at the good, the bad and the ugly, if available for otherwise what has been an excellent year, which is in its last hours, for semiconductors. Presenting a list of posts on semiconductors that mattered in 2010.

Top semiconductor and EDA trends to watch out for in 2010!

Delivering 10X design improvements: Dr. Walden C. Rhines, Mentor Graphics @ VLSID 2010

Future research directions in EDA: Dr. Prith Banerjee @ VLSID 2010 — This was quite an entertaining presentation!

Global semicon industry on rapid recovery curve: Dr. Wally Rhines

Indian semicon industry: Time for paradigm shift! — When will that shift actually happen?

Qualcomm, AMD head top 25 fabless IC suppliers for 2009; Taiwan firms finish strong!

TSMC leads 2009 foundry rankings; GlobalFoundries top challenger!

ISA Vision Summit 2010: Karnataka Semicon Policy 2010 unveiled; great opportunity for India to show we mean business! — So far, the Karnataka semicon policy has flattered to deceive! I’m not surprised, though!

Dongbu HiTek comes India calling! Raises hopes for foundry services!!

Indian electronics and semiconductor industries: Time to answer tough questions and find solutions — Reminds me of the popular song from U2 titled — “I still haven’t found what I’m looking for”!

What should the Indian semicon/electronics industry do now? — Seriously, easy to say, difficult to manage (ESDM)! 😉 Read more…

NXP driving automotive electronics toward energy efficiency

According to him, the key macro growth drivers in electronics include energy efficiency, connected mobile devices, securty and health. He also highlighted how HPMS or high-performance mixed signal is driving innovation at NXP.

NXP provides HPMS and standard product solutions that leverage its leading RF, analog, power management, interface, security and digital processing expertise.

Commenting on the BRIC market for automotives, he said that the BRIC market has been projected to grow at a CAGR of 6.1 percent vs. total market of 5 percent for the period 2010-17. Also, BRIC’s share of the global car production has been estimated to grow from 31 percent in 2010 to 34 percent by 2017.

Motivation in India has been the the fast growing automotive market and the increasing electronic content in automotives.

Chandak also highlighted five examples that are driving significant fuel efficiency improvement. These include: electric power steering, eco telematics, body networks, transmission, and start/stop systems. Again, NXP provides dedicated solutions that are driving efficiency in conventional, as well as hybrid and electric cars.

He also touched upon some of NXP’s innovations. These include — electric power steering, which saves fuel consumption and CO2 emission 10g/km; dual clutch transmission, which saves fuel consumption and CO2 emission up to 10 percent; start/stop systems, which are micro-hybrid and also save fuel consumption and CO2 emission by 4-10 percent.

Body electronics is yet another NXP innovation. Partial networking is enabled since the ECUs are only active when a function is needed. This also extends the range of an electric car. The potential energy saving is up to 70W. NXP has also enabled eco-telematics by way of a telematics on-board unit. A feature includes intelligent traffic management, which saves fuel consumption and CO2 emission up to 16 percent.

Chandak added that ‘electrification’ is a technical mega trend. Vehicle efficiency is driving electrification. Innovations in electronics are driving the car toward energy efficiency.

Electronics for energy efficient powertrain

The Auto Expo is the premium event for auto sector in India with global participants.

Session 1 of the conference focused on electronics for energy efficient powertrain.

Environmental concerns and driver comforts are major factors for deciding on next generation automotive power-train electronics. Most countries are championing cleaner and greener automobiles. Today’s high-end ECUs (Electronic Control Units) are combining these demands to create efficient engine management systems that would be driving tomorrow’s people’s cars.

In his presentation, Praveen Acharya, vice president, Semicon Solutions, KPIT Cummins Infosystems Ltd, said that powertrain was both complex and critical. Highlighting the automotive/ECU market, he added that while this market had matured in Japan, USA and Europe, big growth was likely in BRICs.

He highlighted some industry challenges for powertrain and electronics, which include:

Dr. A. Zahir, vice president, Bosch, discussed sustainable individual mobility. He focused on the reduction of CO2 emissions as well as technologies to support CO2-reductive comportment.

He highlighted some measures to manage vehicle energy. These include: combustion engine optimization, demand-responsive energy management, stop/start, hybrid, electric vehicles, components optimization, and waste heat recovery.

Dr. Zahir said global warming and population were rising. Hence, there was a strong increase of urbanization and energy hunger in the emerging countries. All of these challenge sustainable individual mobility.

Sustainable individual mobility can be achieved by reducing CO2 emissions and by increasing fuel economy. With a system approach based on enabling technologies from the Bosch portfolio, there is an enormous potential to reduce the CO2 emissions and increase fuel economy.

All of the required functionalities require cost effective electronics running complex control algorithms and diagnostics. The proliferation of smart and highly integrated.semiconductors will continue to accelerate in the automotive domain.

Suraj Mukundrajan, director Automotive Development, Infineon Technologies India Pvt Ltd, touched upon how semiconductors can enable fuel efficiency.

He highlighted certain global CO2 targets, wherein, the European Union (EU) proposes steep fines to cut car CO2 from 2012. For cars – 120gCO2/km by 2012 +10 g coming from biofuels. Now, the law is: 35mpg CAFE (Corporate Average Fuel Economy) by 2020 for cars.

Mukundrajan advised that emission reduction could be achieved by optimizing different areas in a car. The full spectrum of semiconductor technologies would be required to achieve energy efficiency in automotive electronics Less fuel consumption and cleaner engines will happen due to better performing MCUs.

He also highlighted the advantages of automotive hybridization. For instance, plug-in hybrid saves 40 percent to 60 percent energy compared to conventional combustion engines.

Already, the 2013 annual production will likely rise to over 3 million vehicles, which is about ten times the production of 2005 with 335.000 hybrid cars. Further, the semiconductor content in hybrid cars is much higher — $525-$900 as compared to conventional combustion engine cars — $225-$300.

Mukundrajan added that the CO2 target must be achieved. Although, the customer did not clearly realize the value today, the required technologies do exist. However, they are not included in the drive cycle in a huge manner, at least not yet!

Sandip Sarkar, head – Electrical Systems, Controls & Software Engineering, General Motors – Technical Center India, highlighted the huge opportunity for smart and green automobiles. While there was 70 million sales in 2007, in 2016, it is likely to touch 95 million in sales.

According to him, the automotive DNA of the future would include: electrically driven automobiles, energized by electricity and hydrogen, powered by electric motors, controlled electronically and ‘connected.’

Sarkar highlighted the sustainability benefits as well. These include:

The vision is to have electrically driven vehicles in the future – equipped with sensors, V2V, GPS, digital maps, electronic controls and actuators, etc. This will enhance roadway safety, besides providing real-time traffic management. Smart intersections would be part of the roadway of the future. All of these together, will enhance energy efficiency and reduced emissions.

ST/Freescale intro 32-bit MCUs for safety critical applications

Early this month, STMicroelectronics and Freescale Semiconductor introduced a new dual-core microcontroller (MCU) family aimed at functional safety applications for car electronics.

These 32-bit devices help engineers address the challenge of applying sophisticated safety concepts to comply with current and future safety standards. The dual-core MCU family also includes features that help engineers focus on application design and simplify the challenges of safety concept development and certification.

Based on the industry-leading 32-bit Power Architecture technology, the dual-core MCU family, part-numbered SPC56EL at ST and MPC564xL at Freescale, is ideal for a wide range of automotive safety applications including electric power steering for improved vehicle efficiency, active suspension for improved dynamics and ride performance, anti-lock braking systems and radar for adaptive cruise control.

Freescale/STMicroelectronics JDP

The Freescale/STMicroelectronics joint development program (JDP) is headquartered in Munich, Germany, and jointly managed by ST and Freescale.

The JDP is accelerating innovation and development of products for the automotive market. The JDP is developing 32-bit Power Architecture MCUs manufactured on 90nm technology for an array of automotive applications: a) powertrain, b) body, c) chassis and safety, and d) instrument cluster.

STMicroelectronics’ SK Yue, said: “We are developing 32-bit MCUs based on 90nm Power Architecture technology. One unique feature — it allows customer to use dual core or single core operation. The objective of this MCU is to help customers simplify design and to also reduce the overall system cost.

On the JDP, he added: “We will have more products coming out over a period of time. This JDP is targeted toward automotive products.”

Commenting on the automotive market today, he said that from June onward, the industry has been witnessing a gradual sign of recovery coming in the automotive market.

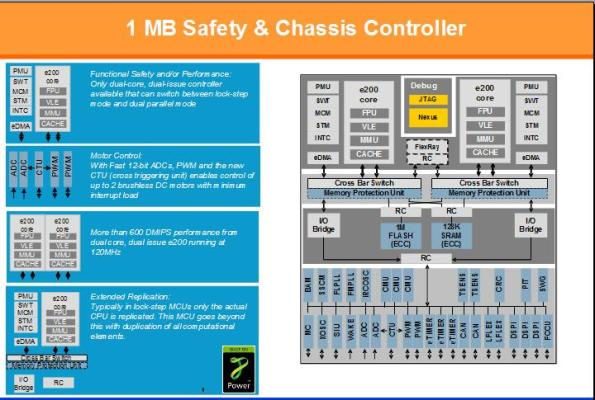

1 MB safety and chassis controller -- 32-bit MCU courtesy Freescale/STMicroelectronics joint development program (JDP)

Automotive market challenges

There has been an increasing integration and system complexity. These include:

* Increasing electrification of the vehicle (replacing traditional mechanical systems).

* Mounting costs pressure leading to integration of more functionality in a single ECU.

* Subsequent increase in use of high-performance sensor systems has driven increased MCU performance needs.

There are also increasing safety expectations. Automotive system manufacturers need to guarantee the IEC61508 (SIL3) and ISO26262 (ASILD) system-safety capability. Also, a move from passive to active safety is increasing the number of safety functions distributed in many ECUs.

Finally, there is a continued demand for quality — in form of zero defects, by which, a 10x quality improvement is expected.

MCU family addresses market challenges

The MCU family offers exceptional integration and performance. These include: high-end 32-bit dual-issue Power Architecture cores, combined with comprehensive peripheral set in 90nm non-volatile-memory technology. It also provides a cost effective solution by reducing board size, chip count and logistics/support costs.

It also solves functional safety. The Functional Safety architecture has been specifically designed to support IEC61508 (SIL3) and ISO26262 (ASILD) safety standards. The architecture provides redundancy checking of all computational elements to help endure the operation of safety related tasks. The unique, dual mode of operation allows customers to choose how best to address their safety requirements without compromising on performance.

The MCU also offers best-in-class quality. It is design for quality, aiming for zero defects. The test and manufacture have been aligned to lifetime warranty needs.

The MCU family addresses the challenges of applying sophisticated safety concepts to meet future safety standards. Yue added, “There are two safety standards — we are following those guidelines.” These are the IEC61508 (SIL3) and ISO26262 (ASILD) system-safety capabilities.

The automotive industry is also targeting for zero defects. “Therefore, all suppliers in tier 1 and 2 need to come up with stringent manuyfaturing and testing process that ensures zero defects,” he said.

32-bit dual-issue, dual-core MCU family

Finally, why dual core? Yue said that the MCU helps customers to achieve to achieve safety and motor control. Hence, dual core will definitely help deliver results.

“In many automotive applications, especially in safety-related applications, we want to have redundancy for safety. In the lock-step mode, two cores run the same task simultaneously, and results are then compared to each other in every computation. If the results are not matched, it indicates that there are some problems.”

This MCU family definitely simplifies design. It uses a flexible, configurable architecture that addresses both lock-step and dual parallel operation modes on a single dual-core chip. Next, it complies with safety standards.

A redundant architecture provides a compelling solution for real-time applications that require compliance with the IEC61508 SIL3 and ISO26262 ASIL-D safety standards. It also lowers the systems cost.

Dual-core architecture reduces the need for component duplication at the system level, and lowers overall system costs.

Global semicon mid-year review: Not a blip, but recovery won't be smooth, says iSuppli

According to a release from iSuppli today, following four consecutive quarters of reductions, global inventories of chips have declined to appropriate levels, clearing the way for stockpile rebuilding and higher sales in the second half of the year.

However, this particular blog post looks at a previous study from iSuppli where it trimmed the 2009 chip and electronics forecasts, but sees second-half rebound.

Thanks to my good friends, Jon Cassell and Debra Jaramilla, I was able to connect with Dale Ford, senior vice president, market intelligence services, for iSuppli, for a discussion on this particular study.

Thanks to my good friends, Jon Cassell and Debra Jaramilla, I was able to connect with Dale Ford, senior vice president, market intelligence services, for iSuppli, for a discussion on this particular study.

Given the lingering economic woes and continuing poor visibility into future demand trends, iSuppli, as mentioned, reduced its forecasts for global semiconductor and electronic equipment revenue in 2009.

Worldwide electronic equipment revenue is set to decline to $1.38 trillion in 2009, down 9.8 percent from $1.53 trillion in 2008. iSuppli’s previous forecast in April predicted a 7.6 percent decline in revenue. Global semiconductor revenue is set to fall to $198.9 billion in 2009, down 23 percent from $258.5 billion in 2008. iSuppli’s April forecast called for a 21.5 percent decline.

I quizzed Ford on how iSuppli sees the global semicon market performing over the rest of the year. He said: “We do expect sequential improvement in the second half of 2009 compared to the first half of 2009. However, the market will remain significantly below the market level of the same period in 2008.”

It is also apt to determine the behaviour of the electronic equipment segment in the same period. iSuppli expects a similar pattern in the electronics segment based on the current economic outlook and guidance from key OEMs.

According to iSuppli’s study, while all of the electronics segments are likely to suffer contractions in 2009, the automotive sector was a major culprit behind the downgrade. So, is it fair to only blame the automotive sector for the downgrade?

No, said Ford. “It should be noted that the downgrade is very minor and reflects a more broad-based impact of the economy on the electronics market.”

I mentioned about a new study from iSuppli, which talks about global chip inventories declining to appropriate levels, clearing the way for stockpile rebuilding and higher sales during H2-2009.

Prior to the release of this study, I had asked Dale Ford and iSuppli whether we would see companies revising their forecasts.

According to Ford, companies are already revising their forecasts and this has been noted in some of the earnings announcements this week. However, there is still great uncertainty in the economy and this presents the likelihood that company and industry expectations will continue to fluctuate.

As for iSuppli’s growth prediction for H2-09, its current published second half outlook calls for H2-09 to grow by over 17 percent compared to H1-09. iSuppli also is sticking to the 13.1 percent growth for the semiconductor industry in 2010.

As for the factors now leading to conditions looking up in H2, Ford said that the global economy is the dominant factor driving industry growth. All other factors are secondary in comparison.

It would also be interesting to see how the Japanese semiconductor industry is likely to hold out in H2. Ford added: “Japanese semiconductor suppliers have experienced a very difficult H1. However, with improving consumer sentiment, they have the opportunity for an improved H2.”

There is also a clear indication of the starting of the correction phase to rebalance over-depleted inventories. Ford said that a number of companies have noted that their Q2 sales are influenced both by rebalancing inventories and expectations of H2-09 demand.

If firms still continue in a wait-and-see mode, won’t this serve to make the market dynamics worse as firms are then faced with a massive catch-up problem? What should they do?

Ford advised: “There is the potential for companies to miss opportunities in the market if they are too passive. Companies need to aggressively communicate with their partners and clients to obtain the best visibility possible in planning their tactics and strategies for meeting market demand.”

Recovery or blip?

Finally, is this really the start of the chip market recovery or a blip on the statistics radar screen?

He said: “While we do not consider this to be a ‘blip’, we do expect that the ‘recovery’ will not be smooth. Ongoing uncertainty and volatility in the economy will impact the progress of the market moving forward.”

Farnell looking to convert 3,500 prospects this year in India!

Now that’s what I call aggression!

Last July, I had the pleasure of meeting Ms Harriet Green, CEO, Farnell Electronics, a part of the Premier Farnell group of companies. It is soon going to be a year since the company set up presence in India. Farnell has aggressive plans for India, with the company likely to look at converting at least 3,500 prospects this year.

I met up with Nader Tadros, Commercial Marketing Director APAC, Premier Farnell (see picture here), and Navin Honnavar, marketing manager, Farnell Electronics India Pvt. Ltd to get an update on Farnell.

I met up with Nader Tadros, Commercial Marketing Director APAC, Premier Farnell (see picture here), and Navin Honnavar, marketing manager, Farnell Electronics India Pvt. Ltd to get an update on Farnell.

According to Tadros, Farnell is said to be the number 1 small-order high service multi-channel distributor in the world. “We carry obver 3,500 leading suppliers and 450,000 product stocks globally. We have 36 transactional websites in 23 languages,” he added.

Farnell currently has six warehouses — one in America, and two in Europe and three in Asia — Sydney, Shanghai and Singapore. In India, it now has nine branch offices, and one contact center and one global tech center (GTC) — in Bangalore. The GTC provides live chat and board level support, which also translates into global support.

Tadros said that Farnell is aggressively are supporting the EDE (electronic design engineers) community and MRO (maintenance, repair, operatoinal) marketplace. “We have taken particular focus on developing the EDE space, providing support, services and relevant products. We want to make sure the value proposition is mapped on to the EDE needs,” he said. Elaborating on the value proposition, he cited an example of x-ray machine manufacturers.

Global business strategy

Farnell has a four-pronged global business strategy. This includes:

* Focusing on global EDE customer segment.

* Increase business via the Web.

* Internationalization

* Continue to develop profitable MRO business.

Tadros believes that the power of the Web is tremendous. “It is very useful for customers to search and transact. Another area is customer demand. They are looking for efficiencies,” he added. “An important aspect that can help us is that we are able to understand customers; needs. The data that the web search is able to provide gives us the critical information. If a customer searches for a part, and we track that, we are able to service their needs better.”

Hasn’t Farnell been affected by the recession? Tadros said: “We are not immune to the recession. The volatlity is higher, and it is also at the customer level.” Honnavar added: “Our strategy seems to be working for us. We are maintaining our base in the MRO space. We are still pulling in customer requests and still growing.”

So, what else is Farnell doing, besides these activities? Well, it has adopted a multichannel approach for the Asia Pacific region. It has 154 staff in eight call centers, besides being involved in direct and e-marketing. The company has nine local websites — simplified chinese for China, thai for Thailand, and English for India, Malaysia, Singapore, Hong Kong, Philippines, Australia and New Zealand. Besides, it has 103 field sales engineers in 29 sales offices.

Aggressive plans

I started this post by saying I liked Farnell’s aggressive plans. It currently has 2,500 active customers and 9,000 prospects in India alone. The company has a target to reach $25 mn by 2010. It is also a walue added distributor offering products to leading suppliers such as Texas Instruments, Molex, and 3,500 other leading brands.

Touching on Farnell’s clients in India, Honnavar said: “We have independent design houses, resellers, R&D centers, educational centers, government organizations (such as BEL, HAL), etc., among our customers. The prospects includes a huge list of people. We have touched the top layers in tier 2 cities — such as Coimbatore and Ahmedabad. We are looking at converting 3,500 prospects this year.”

More focus on components, SMEs

The components industry isn’t exactly in the pink of health right now. Giving his views on the electronics and components space, Tadros said: “Customers themselves are not able to anticipate the demand for the next quarter or periods. We are seeing that there is still growth in the EDE space and inquiries are still coming in. During a recession, you have an opportunity to distinguish yourself from competition. There is pressure on teams as they have to continually innovate. Customers require more even support, more technical documentation, and look for faster turnaround times.”

Farnell is in a position to help those SMEs who are in the electronics and components spaces. Tadros said that the company can support such SMEs by helping them to build their markets in a timely fashion.

Honnavar added that Farnell is focusing on building a product and purchasing team, sitting out of Singapore and Hong Kong. “Moving forward, you will probably get to see more buying happening in the Asia Pacific region. Going ahead, a lot of sourcing will also be done from India.” The company intends to be extremely close to suppliers, especially in the Greater China region.

ISA Vision Summit 2009: Local products, emerging opportunities!

The first session on day 1 of the ISA Vision Summit 2009 focused on local products and emerging opportunities in India, especially in healthcare, automotive electronics and mobility. It was great to see companies present solutions developed for India, by Indians. If earlier, it used to be “made by the world for India,” today, it has changed to “made by the world, in India.” This focuses highly on India’s well known strength in design services.

In the picture, you can see Ajay Vasudeva, Head R&D, Nokia India, making a point, with Prof. Rajeev Gowda, IIM-Bangalore, Ashish Shah, GM, GE Healthcare, and Dr. Aravind S. Bharadwaj, CEO, Automotive Infotronics, listening very attentively.

In the picture, you can see Ajay Vasudeva, Head R&D, Nokia India, making a point, with Prof. Rajeev Gowda, IIM-Bangalore, Ashish Shah, GM, GE Healthcare, and Dr. Aravind S. Bharadwaj, CEO, Automotive Infotronics, listening very attentively.

In his opening remarks, Prof. Rajeev Gowda, IIM-Bangalore, said: “As the world is in recession, we are still cheerful, and we are still growing.” He called upon the industry to focus on healthcare, which is an area where work is going on. Agriculture is yet another area to look at! According to him, Bangalore had become an IT center, it had yet to become a knowledge center. “As an industry, think about reaching out to colleges, and get people to think innovatively and creatively,” he added.

Dr. Aravind S. Bharadwaj, CEO, Automotive Infotronics Pvt Ltd, a a joint venture between Ashok Leyland and Continental AG, in his presentation, highlighted that infotronics for automotives is an opportunity for India. He added that the infotronics content in automotives was growing, and is likely to touch around 40 percent by 2010. In India, the auto industry was growing at a CAGR of 11.4 percent, and auto electronics was growing at a CAGR of 21 percent.

What is the India advantage here? “We definitely have a high level of expertise. India can also become an automotive embedded powerhouse,” he said.

Dwelling on the current trends in automotive electronics in India, he said that there has been an increase in demand by customers for technically advanced in vehicles. Also, there are strict emission and safety regulations in place. Some other trends include the increase in automotive exports, and fuel economy in Indian driving conditions.

Dr. Bharadwaj cited the example of the fleet management telematics solution at the Koyambedu bus terminus in Chennai. He added that embedded automotive applications will dominate the future automotive applications.

Healthcare market to explode!

Ashish Shah, General Manager, GE Healthcare Global Technology Organization, India, said that two sectors will undergo tremendous growth in India: healthcare and energy, and added that the country is now ready for growth. He highlighted the fact that about 20 percent of GE’s engineers were Indians, thereby indicating a huge talent pool within the country itself.

The drivers for Indian healtcare market include: medical tourism: About 175,000 foreign nationals; up 25 percent; huge investments: government spending up 1-2 percent of GDP; disease patterns: such as lifestyle diseases; and increased spending in healthcare.

The bottom line is that growth is for real! The Indian healthcare market is about to explode,” said Shah.

Shah displayed an ECG, the MAC 400, which has been developed for India. While the company shipped 3,600 units last year, and of these, about 500 units in India, GE projects selling 10,000 units during this year. The selling price of this device is an affordable $700. GE is also making maternal infant products, as well as x-ray programs. It is also developing an MRI application, which would not require the injecting of a contrast agent, thereby, leading to 50 percent savings!

In his presentation, Ajay Vasudeva, Head R&D, Nokia India, focused on the tipping point for mobility today. More people have access to a mobile phone than a PC, and most use it to access the Internet.

He highlighted some of the applications Nokia is developing, such as those for mobile rural/irrigation applications, mobile banking and NFC (near fied communications), and mobile healthcare and diabetes checking — all using the mobile phone! Livelihood, such as agriculture, and life improvement, such as education, services are highly relevant in India. Of course, entertainment has the widest appeal!

Vasudeva concluded by remarking, “Together, let’s create devices, products, services and solutions, that can change peoples’ lives.”

In his concluding remarks, Prof. Rajeev Gowda, session moderator, called upon India to devise policies on e-waste, and to think about how can we convert semiconductor waste into energy.

NXP India's Rajeev Mehtani on top trends in global/Indian electronics and semicon!

When a new year approaches, we start analyzing the year gone by and try to gauge what could happen in the coming year. This really holds true, as far as the technology industry is concerned.

When a new year approaches, we start analyzing the year gone by and try to gauge what could happen in the coming year. This really holds true, as far as the technology industry is concerned.

It’s been a week since I’ve been mulling over these myself, especially, pondering over developments in the global semiconductor and electronics industries, as well as what could happen in India during 2009. Well, lots will happen, and I can’t wait for the new year to start!

I caught up with Rajeev Mehtani, vice president and managing director, NXP Semiconductors, India, and discussed in depth about the trends for 2009. Here’s a look at that discussion.

INDIA — ELECTRONICS & SEMICONDUCTORS

1. The DTH story will continue to increase in India with companies such as Tata Sky, DISH TV, BIG TV, etc., gaining market share. Owing to these challenges, there would be significant consolidation among the cable operators. Digitalization will also be seen in 2009.

2. The slowdown will affect growth across all sectors. Our view is that LCD TVs as well as STBs will continue to grow.

3. The year 2009 will witness e-commerce revolution and the RFID sector will grow at a 40-50 percent clip. The government has been sponsoring a lot of projects, which include RFID in the metros, e-passport cards and national ID cards. By mid-2009, we can expect a mass deployment of these projects as well as micro payments.

4. Manufacturing in India will continue to grow; EMS or OEMs, such as Samsung, Nokia, Flextronics, etc.

5. There could be a move from services to products in electronics and semiconductor spaces. The number of funded startups has grown significantly over the last years and more and more ideas are coming on the table.

6. The solar/PV sector will grow in India. High entry cost of capital for panels will be a barrier for this sector. Government enhancement is necessary. India will be different than other countries as people won’t push energy back into the grid; it will be used more for household consumption. The India grid is unstable. Tracking it requires a lot of expensive electronic switching. Solar deployment could be at the micro level, and also community level, where it makes more sense.

7. The startups in India are mostly Web 2.0 based, although there aren’t many hardware startups.

GLOBAL — ELECTRONICS & SEMICONDUCTORS

1. The semiconductor industry is truly global, That is mostly because it is a very expensive industry.

2. Things are a bit murky in the semiconductor industry. It would probably be dipping 10-15 percent next year.

3. Globally, energy management and home automation will start to take off in 2009. Satellite broadcasters will also continue to gain more strength.

4. On a worldwide scale, 3G will win. You will have 3G phones, and you’d add LTE to those. India is slightly different. Only 20 percent of Indian households are ready for broadband access. In India, WiMAX could be a way to have wireless broadband at home.

5. Industries moving to 300mm fabs will be making up only 20-25pc of the market. Not many need 45nm or 40nm chips. People will question any major capex, until there’s a big return and wait for recession to end. The bright spot is solar!

6. The fabless strategy would be the only way to go forward. While MNCs with fabless strategy are present in India, Indian startups in this space are quite few.

What can the global semicon industry do to get back its money-making touch!

It is very well known that the global semiconductor industry has had a year full of turmoil. The ongoing global financial has been not been of any help either.

The key question: Has the semiconductor industry really lost its money making touch?

According to iSuppli, facing dwindling profits, fewer opportunities to expand by taking market share from competitors and a shrinking roster of star performers, the semiconductor industry has entered a period of lowered expectations and diminishing options, forcing chip suppliers to rethink their basic strategies for success.

Thanks to Jon Cassell at iSuppli, I caught up with Derek Lidow, president and CEO, of iSuppli, to find out more about why the global semiconductor industry has become less forgiving. He has offered a range of suggestions for the global semiconductor industry to adopt and follow. The beauty of the advice lies in its simplicity, and I hope the industry is reading!

Thanks to Jon Cassell at iSuppli, I caught up with Derek Lidow, president and CEO, of iSuppli, to find out more about why the global semiconductor industry has become less forgiving. He has offered a range of suggestions for the global semiconductor industry to adopt and follow. The beauty of the advice lies in its simplicity, and I hope the industry is reading!

Facing dwindling profits and fewer opportunities to expand by taking market share from competitors and a shrinking roster of star performer, how difficult is the market today?

According to Derek Lidow, at the moment, the makers of electronics have started slamming on the brakes as they have decided that the financial turmoil will effect Christmas spending.

In this scenario, what strategies should the players: a) fabs; b) NAND; c) DRAM; d) materials devise, to ensure some turnaround?

Lidow says that the fab players should consolidate fabs to make them more efficient.

Both the NAND players and DRAM players should push out capacity expansion plans. Makers of devices should make variations of the existing products that customer would like to have, and don’t turn down opportunities to lock in orders for specials.

If semiconductors have actually lost their money-making touch, it is really an alarming sign. However, Lidow advises that the semiconductor business is maturing and every industry, as it matures, must undergo transitions.

Leaders can’t ignore looming changes

“Often, these transitions come as a surprise and many companies go through hard times,” he says. “Semiconductor companies don’t have to go through the turmoil of the steel or automotive industries if it doesn’t want to. The leaders of the industry just can’t ignore the looming changes.”

Is there a way that semiconductor companies break out of the current market dynamics to outperform the industry?

Lidow suggests the semiconductor companies should STOP doing things that they are not good at! He adds: “Each company will have to follow a recipe that eliminates where they are mediocre and focuses on where they add real value. Next, they should change their business models so that semiconductor technology is the tool, not the objective.”

According to him, designing more total systems with system-level chips built around proprietary Intellectual Property (IP) should be enough.

He says: “The electronics industry is $1.5 trillion dollars in size, and the semiconductor industry is $270 billion in size. There is a lot more value to capture. However, the value is more complex to unlock and requires as much or more software expertise as it does semiconductor expertise. They have to get married together to succeed in developing proprietary IP.”

Areas to outspend rivals

As for the areas where companies can massively outspending rivals in areas of products and manufacturing, these would be leading edge wafer foundries, memory chips, and the most complex system-on-chips (SoCs).

Why won’t this massive outspend simply to maintain technical and scale dominances in competitive market segments be risky?

Lidow says you can only use this strategy if you know you can outspend your rival! “We see the problems of a spending race in the memory market where many companies are trying to keep up with Samsung’s massive investments and it is hurting everyone,” he points out.

iSuppli has also advised adopting a scalable acquisition process that would allow a semiconductor company to grow by buying other companies or selected parts of companies.

Lidow says: “I think the point of my article was that there haven’t been any success stories to date. So, this strategy is unproven, but very tantalizing, considering the state of the maturing industry.”