Archive

Clearly, mixed signals in OEM semiconductor design activities!

Friends, here is the full report on iSuppli’s recent activity titled “Mixed Signals in OEM Design Activities”.

Min-Sun Moon, senior analyst, Semiconductor Spend and Design, iSuppli, discussed how the “values” of design activities are discerned globally and how design decisions are made by a given country.

This report should be of particular interest to the Indian semiconductor design industry as it is apparent there is considerable scope for growth and development.

It is very well documented that everyone has been hit hard by the economic downturn. The electronic OEMs are no exception. They have also reduced shipments. The average selling prices (ASPs) of semiconductor devices have dropped dramatically as well.

Top six design influencing countries

As per iSuppli’s Design Activity Tool, the top six countries leading in the design influence are as follow: USA, Japan, China/Hong Kong, Taiwan, South Korea and Germany. The United States retains the no. 1 position, followed by Japan and China.

The dramatic changes in ASPs of chips and products meant an almost about 5 percent drop in semiconductor spend in 2008, and above 21 percent drop in semiconductor spend by the top OEMs in 2009. Hence, design activities by top OEMs dropped significantly.

The USA apparently has been going through a tough period, and it does not seem to have a bright future in 2009-10 due to drop in design spends. However, in 2010, it should post about 9-10 percent growth. The top design influencers in the USA include HP, Dell, Apple and Motorola.

China seizes opportunity

According to Moon, Japan retained the second position. However, China has seized the opportunity during the recession. It has some growth compared to other countries who have had negative growth this year.

China still remains one of the most attractive markets for OEMs to enter. Many top OEM have either opened or expanded R&D centers in China in the last few years.

However, because of the recession, the expansion by OEMs slowed down in China during 2009. Nevertheless, the Chinese market continues to grow. In the next few years, China will grow and the other countries will have some positive growth as well, but their growth will be slower than that of China.

China has also been showing interesting signs. Some Chinese companies are trying to enter new markets, such as automotive.

China is currently the third largest country in terms of design influence. The design share is about 10 percent in 2009. China could get close to Japan and the USA, but it will not happen in the near future though.

Top five countries in 2009

In 2009, the top five countries by design influence spend share are as follows: USA — 31 percent, Japan — 25 percent, China/Hong Kong — 10 percent, Taiwan — 8 percent, South Korea — 7 percent, and the Rest of the World — 19 percent.

Mixed signals are apparent in the design activities by country. For instance, this year, the USA has been losing market share. A large percent of design activities are moving to the Asia Pacific region. Some business in the USA is being continued or reduced — and being moved to other regions — in order to maintain the business and lower the cost of operations.

Japan’s design spend share increased from 22 percent (approximately $40 bn in 2008) to 25 percent in 2009. Japan is bringing a lot of design activities back home.

Taiwan used to be third largest in the design influence, but has now dropped to the fourth position, with share in design spend reaching 8 percent in 2009. China also contributed to the changes here. However, it is still better than others as some OEMs are still outsourcing to some ODMs located in Taiwan.

Identifying targets by regions

iSuppli gave examples of designing with sensors and actuators, and LEDs, as these are very popular currently.

According to Moon, designs using sensors and actuators have been more than 30 percent in the USA, while Japan has more than 25 percent. It is over 20 percent in Europe, while such designs have been less in Asia Pacific — above 15 percent.

The biggest influencers for sensors and actuators in the USA are said to be Apple, HP and TRW Automotive.

For LEDs, more use has been happening in Japan — over 30 percent. As an example, there are more LED TV design activities in Japan. The biggest influencers for LEDs in Japan are Canon and Sony.

Changes due to M&A

Another trend visible in the design spend share has been the changes due to mergers and acquisitions.

As an example, we have the Mitac Group, which acquired Magellan’s consumer products division. In 2008, Mitac Group had 78 percent spend in Taiwan, and 18 percent in the USA. After acquiring Magellan, Taiwan’s design spend share became 57 percent and USA’s became 13 percent. On the other hand, France’s share grew to 17 percent and Russia’s to 7 percent. This indicates that country-wise, budgets do get changed. This is just one example.

These are indeed very interesting numbers and facts, and as mentioned earlier, India has a considerable opportunity as an influencer in the semiconductor design spend going forward.

Whose (server) round is it anyway? Intel's or AMD's?

What a week, what a day, what a show! I am referring to the recent developments at Intel and AMD — to their respective product launches and announcements, and of course, to Computex, in Taipei, Taiwan! Oh, and to the ongoing battle between AMD and Intel in the global servers market!

First Intel… Late May, Intel previewed the Nehalem-EX, a processor that will be at the heart of the next generation of intelligent and expandable high-end Intel server platforms, which will deliver a number of new technical advancements and boost enterprise computing performance.

The Nehalem-EX is said to feature up to eight cores/16 threads, 24MB of shared cache, integrated memory controllers, four high-bandwidth QPI links, Intel Hyper-Threading, Intel Turbo Boost, and 2.3B transistors. The Nehalem-EX is said to be on track for H2-09 production.

Some time later, Intel put out an in a local news daily, about “Sponsors of Tomorrow” — a global campaign that conveys the message that gigantic advances of the digital age have been made possible by silicon — the key ingredient in microprocessors.

And guess what, AMD promptly came up with an invitation to its Istanbul launch, stating that a smarter product today would help battle the slowdown, rather than look at tomorrow!

Quite appropriately, soon after, AMD launched its Istanbul six-core Opteron processor this week, which delivers up to 34 percent more performance-per-watt.

AMD’s poking fun at Intel didn’t really quite go down well at some quarters. I have always respected and appreciated — may the best one, win, and if you really have the guts, do it yourself! And let the market decide who is the winner!!

I would surely expect the two heavyweights of the global semiconductor industry to not resort to such tactics. Instead, it would do both of them good to focus on their core businesses. Poking fun at each other will not bring in the dollars!

One AMD executive even went to the extent of highlighting the ‘today vs. tomorrow’ story on the dias, adding that when Intel comes out with an eight-core processor, AMD will come out with a 12-core processor. And, most importantly, that Intel is talking about tomorrow, but AMD is talking of today! Quite interesting!!

So, who is the winner of round one — according to me, no one!

Now, switch to Computex Taipei, Taiwan! First AMD announced a flurry of launches — such as its two new dual-core desktop processors. This was followed by a new chip for HDTV-on-the-PC reception.

Similarly, Intel made a flurry of announcements too, starting with the introduction of four new processors for ultra-thin laptops. Later, Intel’s Sean Maloney outlined the industry growth opportunities, especially, future growth throughout the computing and communications industries, particularly in mobile and wireless.

Let’s continue this in the next post, lest this grows too long! 😉

2009 DRAM CAPEX decreased by 56 percent: DRAMeXchange

The 2008 DRAM chip price dropped more than 85 percent, while the global DRAM industry has faced more than two years of cyclical downturn, and the consumer demand suddenly froze because of the global financial crisis in 2H08.

In 1Q09, the DDR2 667 MHz 1Gb chip price rebounded to an average of US$ 0.88, which fell between the material cost and cash cost level. Still, the DRAM vendors encountered huge cash outflow pressure. Not only were capacity cut conducted, the process migration schedules were also delayed in the wake of respective sharp CAPEX cuts.

In 1Q09, the DDR2 667 MHz 1Gb chip price rebounded to an average of US$ 0.88, which fell between the material cost and cash cost level. Still, the DRAM vendors encountered huge cash outflow pressure. Not only were capacity cut conducted, the process migration schedules were also delayed in the wake of respective sharp CAPEX cuts.

According to the survey of DRAMeXchange, the worldwide DRAM CAPEX of 2009 has been revised down to US$ 5.4 billion, sharply down by 56 percent, in contrast to the US$ 12.2 billion in 2008.

WW DRAM 50nm process migration schedules all deferred one to two quarters

From the roadmaps of DRAM vendors, the adoption schedule of DRAM mass production using the 50 nm process have now been delayed one to two quarters. DRAMeXchange estimates that by the end of 2009, the DDR3 will account for 30 percent of the standard DRAM.

Regarding the new DDR2 and DDR3 process migration, all DRAM vendors still own different types of strategies of density and types. For example, the Korean vendors’ 50 nm process migration schedules of DDR 3 are earlier than DDR2 and the 2 Gb DDR3 mass production schedule is earlier than the 1Gb chip.

As for the US and Japanese vendors, according to their DDR3 roadmap, the 50 nm process will be introduced between 3Q09 and 4Q09, which is later than the Korean vendors, and also firstly with mass production of 2 Gb DDR3. Therefore, in the DDR3 era, the density will mainly be 2 Gb which is a lower cost driver with more stimulating incentive to the market demand of higher density chips. The Taiwanese vendors are under the high cash pressure and are falling behind in the 50 nm process race. They are mainly focused on “pilot production”.

Gross die increases 40-50 percent as 50nm process drives down cost

According to the Moore’s Law, the number of transistors on an integrated circuit doubles every 12 months. After the process shrinking became more difficult in the recent decade, it increased to 24 months. With new process migration, the closer the line distance is the larger gross die number a single wafer gets, meanwhile the cost is lower and the vendors gain more competitiveness.

The average DRAM output increased about 30 percent during the process migration from 70nm to 60nm. With improvements of process design and die shrink in the same generation of process technology, the output can once again increase 20 percent. In the 50nm generation, the output will increase almost 40-50 percent, compared to 60nm process and the number of gross die increases to 1500-1700 per 12 inch wafer with another 30 percent cost down.

Cost of immersion lithography tools major capex of 50nm process migration

The major challenge of 50nm process migration is the lithography technology. The newest immersion lithography equipment is required and the older exposure equipment at the wavelength of 193nm is no longer suitable under 65nm process, due to physical limitations.

Traditional dry lithography uses air as the medium to image through masks. However, immersion lithography uses water as the medium. Immersion lithography puts water between the light source and wafer. The wavelength of light shrinks through water so it is able to project more precise and smaller images on the wafer. This is the invention that enabled the semiconductor process technology to migrate from 65nm to 45nm.

The current major immersion equipment vendors are ASML, Nikon, and Canon. The largest vendor in the market is AMSL, which is now mainly promoting its XT1900Gi, a tool that is capable to go lower than 40nm and is the most accepted model in the industry. Nikon still promotes its NSR-S610C, which was launched in 2007 and is able to go down to 45nm process. Canon launched its FPA-7000AS7 in mid 2008 that supports the process under 45nm.

LCD monitor panel prices rising despite downturn: iSuppli

iSuppli Corp.’s LCD PriceTrak Service recently reported that prices for LCD monitor panels are rising, despite the weak economic situation and cuts in consumer spending. Isn’t this quite unusual, and on surface, really spectacular, given the recessionary conditions.

Thanks to my good friend, Jon Cassell, I was able to get into a conversation with Ms. Sweta Dash, director of LCD research at iSuppli. I started by trying to find out the reasons for LCD monitor panel prices to be doing reasonably well in these times.

China’s program driving demand

Sweta Dash said panel demand has been strong due to ‘China’s rural consumer stimulus program’, which increased sales of small-size TVs that uses monitor panels. Also, the panel demand was strong from branded manufacturers due to inventory adjustments.

She added: “Monitor brand manufacturers and retail channel orders mostly stem from the demand for inventory replenishment because they have kept their stockpiles at lower-than-normal levels since the end of 2008. Now, factory demand is strong as they need to buy panels for inventory adjustments.”

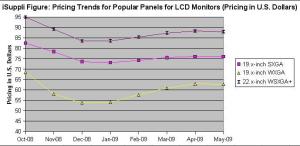

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

In that case, is China’s rural customer stimulus program the only major factor behind this rise in prices of LCD monitor panels?

According to Dash, the other factor is the inventory adjustment by brand manufacturers. TV sales in the US were also better than expected due to the very aggressive prices by brand manufacturers.

“Some retailers reported that they could not meet their demand due to low inventories level. Now, they are trying to adjust the inventory level. Besides better than expected demand for TV and monitor panel, severe cut in factory utilization rates (severe cut in panel production) also contributed to the tight supply for the monitor panel and small-size TV panel, which resulted in panel price increase,” she noted.

Is there any specific reason behind the retailers placing higher orders during recession? Or is it only due to the very low prices?

Dash clarified that it is mostly inventory adjustments. “In March, the inventory levels for monitors at the brand and channel levels were below three weeks level; and some were at two weeks level, which is considered low for this time of the year. Also, once the panel price starts increasing, buyers try to buy more in order to take advantage of the very low price.”

Situation regarding component shortages

There was also a note in iSuppli’ report regarding component shortages. I was keen to find out the exact situation with component shortages, and which specific ones!

Dash said that there is tight supply for PCBs and driver ICs. The lead time for PCBs is extending from two to three weeks to four to six weeks; and the lead time for certain driver ICs is extending to about six to eight weeks.

No recovery soon!

Interestingly, iSuppli cannot declare that monitor end-market demand is headed for a sustainable recovery at this point.

Dash added: “In the absence of a strong rebound in end-market demand, rush orders are not likely to be sustained in May with component shortages being resolved by then. And, the forecast for panel demand is most likely to remain conservative at that time. Also, panel prices are still below cost level. Therefore, in spite of the increasing panel demand, suppliers are still losing money. Further, panel suppliers are rushing to increase their utilization rates and production.”

Koreans doing better than Taiwanese

Evidently, the Korean suppliers seem to be doing better than the Taiwanese, as of now. What would be the key reasons for this?

According to Dash, the Korean suppliers were able to provide more competitive prices due to weaker Won rates.

She added: “Also, the Korean suppliers have higher generation fabs, and they have more in-house or regional component production, which gives them the cost structure compared to Taiwan suppliers. They also have more internal customers (for example, Samsung LCD’s internal customer is Samsung TV and monitor brand).

Year ahead for LCD monitor panels

Finally, how does the year ahead look like for LCD monitor panels?

Monitor panel demand may face some softness after the inventory adjustment in Q209. That is the reason why panel suppliers have to expand their production cautiously.

“Otherwise, it has the danger of pushing the market back to over supply. We still expect real end-user demand to recover in the second half of 2009 especially by Q4-09. If panel manufacturers act cautiously and expand rationally in the first half of 2009, they can see real demand recovery in the second half of 2009,” noted Dash.

Definite need for rethink on India's fab strategy!

I am intrigued to see lots of great things happening in the Indian semiconductor industry, and equally frustrated to find certain things that I feel should happen, not really going the way they should!

Yes, India is very strong in the semiconductor related chip design services. However, do keep in mind folks that design services have been impacted a bit by the recession as well! There have been calls from several quarters for India to now start thinking beyond its chip design services. Therefore, are there any areas that India can look into within the semiconductor space?

Leverage strength in software

Certainly, value add in products are heavily influenced by the embedded software in addition to features of the chips, says S. Janakiraman, former chairman, India Semiconductor Association (ISA) and President and CEO-R&D Services, MindTree. “The Google Android is a great example of that. India should leverage its strength in software to enhance its value add to semiconductor companies,” he adds.

Innovation is now shifting from the development of new technologies to the creation of unique applications.

“Mobile browsers and management of remote appliances to save power at home/office are examples. We need to innovate new applications that can drive the need for more electronic gadgets, and in turn, the need for more semiconductors,” notes Jani Sir.

Rethink on Indian fab strategy?

One of my earlier posts focused on whether an Indian investor could buy Qimonda’s memory fab, and somehow kick-start the India fab story! I did find support from many quarters on this idea, but till date, I don’t think anyone from India has made a move for Qimonda. At least, I haven’t heard of any such move.

Nevertheless, some folks within the Indian semiconductor industry and elsewhere have called for India to rethink on its fab strategy.

What should it be now? Or, shall we just discard this and go on, as India has been doing fine without fabs so far? Perhaps, the last option is easier!

According to Janakiraman: “Perhaps, we should consider where semiconductor technology will be after five years from now, and prepare grounds for that through encouragement of fundamental research, as well as shuttle fabs to enable prototyping. We should skip the current node of technology and make an entry into the one that will be prevalent after few years.” Now, that’s sound advice! Will it be easy to achieve?

“That may not be as easy to achieve for the private enterprises considering the cost involved,” adds Janakiraman. “It has to be a mission of the nation to create that infrastructure and later privatize.”

According to him, it is not unique to India. “Every country, be it Taiwan or China, have done it. The only other way is to heavily subsidize and support fabs like those in Israel or Vietnam, but it will be tough to choose a partner in a democratic country like ours, wherein every investment and subsidy is seen with a colored vision,” he says.

To sum up, a fab for our country will be fundamental to gain leadership and self reliance. It cannot be ignored totally, although we can take our own time to reach there. Janakiraman adds, “We don’t have a choice other than paying a price to reach there, now or later!”

DRAM makers being offered lifelines via bail out plans!

Browsing the Web these past days has brought me to various stories, mostly discussing the various bail out plans being provided for some leading DRAM makers.

It all started with Germany based Qimonda announcing that it has arranged a Euro 325 million financing package for the ramp up of its innovative Buried Wordline technology.

Yesterday, Hynix, the Korean DRAM maker, received a bail out of $597 million, according to reports on Fabtech. The story also reports that Powerchip Semiconductor, Taiwan’s largest DRAM maker, is also seeking new funding.

Then, DigiTimes, a very good technology news Web site from Taiwan, reported yesterday that Taiwan’s Ministry of Economic Affairs (MoEA) had reportedly developed an NT$200 billion (US $6.5 billion) bail out plan for Taiwan’s hard-hit DRAM makers.

Sitting in India makes it a little difficult to speak with global companies based in Taiwan, Korea and Germany. I sometimes wish I could get some help from reliable sources as to what’s the actual ground situation.

Having said that, it is good to see various national governments showing their deep concern about the state of the global DRAM industry and about technologies. And, let us keep all criticisms aside, as to who performed and who didn’t! Here’s a lesson for India to learn from, as closer home, it has a semiconductor industry really in its infancy!

Right now, the global semiconductor industry is facing a downturn and memory is the hardest hit! Hence, if any measures are being taken to somehow bring DRAM back on track, it should be welcomed.

Qimonda, Hynix, Powerchip, etc., are not small names in the global industry. Poor performance from memory players saw them dropping out of the top 20 global semiconductor players’ rankings in 2008.

All the lifelines being provided to these major players now means that these companies need to pull it off, somehow, and extricate themselves from the depths they have fallen into. If they fail, they will perish! And, they all know that!!

I’d be very keen to see the responses of DRAMeXchange and iSuppli on these bail out plans.

Merry X’mas everyone, and hope you all have a great time!

PS: I have iSuppli’s feedback!

Speaking on the Taiwan government’s bail-out plan as well as Hynix’s rescue package from banks, John Lei, Analyst, memory, iSuppli Corp., said: “In general, Hynix’s package is much like a short-term relief for their near-term debt, while the Taiwan government aims at the possible consolidation of five suppliers.”

“All these packages could bring more uncertainties to the maket, however, based on iSuppli’s assumption and forecasts. The industry operation profit margin will hit bottom in Q4-08, but profitability of the industry will not occur until Q4-09,” he added.

Solar sunburn likely in 2009? India, are you listening?

iSuppli’s just issued a warning that 2009 could well see the coming of a solar market eclipse!

Come to think of it! Just last week, in the Semiconductor International webcast, the analysts did mention that there could be tough times ahead for solar! In fact, Aida Jebens, Senior Economist, VLSI Research Inc., did indicate that solar/PV would pick up in the next two years and that 2009 could be a tough year.

If you look at the India situation, I have been getting the feeling all the time that all of a sudden, too many companies were entering this market segment, as though it is a land of promised gold! Perhaps, it is, and one sincerely wishes that all of those investments proposed for solar do not come unstuck.

This August, following the announcement of the national semiconductor policy (the Special Incentive Package Scheme, or SIPS), the government of India received 12 proposals amounting to a total investment of Rs. 92,915.38 crore. Ten of these proposals were for solar/PV, from: KSK Surya (Rs. 3,211 crore), Lanco Solar (Rs. 12,938 crore), PV Technologies India (Rs. 6,000 crore), Phoenix Solar India (Rs.1,200 crore), Reliance Industries (Rs.11,631 crore), Signet Solar (Rs. 9,672 crore), Solar Semiconductor (Rs.11,821 crore), TF Solar Power (Rs. 2,348 crore), Tata BP Solar India (Rs. 1,692.80 crore), and Titan Energy System (Rs. 5,880.58 crore).

Then, late September, Vavasi Telegence (Rs. 39,000 crore), EPV Solar (Rs. 4,000 crore), and Lanco Solar (Rs. 12,938 crore), also announced major investments.

Now, given the quite ruthless kind of financial crisis the world is currently engulfed in, several have raised doubts whether solar players would be able to get the credit they need. Or, would they run into rough weather?

On paper, some of these companies are big corporate houses, with several years of standing. However, reality can be quite different, and can bite! I’ve yet to hear whether all of these companies have managed to raise the requisite capital. One sure wishes that they have all been busy and will be successful!

Otherwise, all one needs to look at is iSuppli’s warning. According to iSuppli, ‘Bringing an end to eight consecutive years of growth, global revenue for photovoltaic (PV), panels is expected to plunge by nearly 20 percent in 2009, as a massive oversupply causes prices to drop.’

Will it be a case of massive oversupply in India? We haven’t exactly started. Hence, perhaps, we will come to deal with oversupply later. The key thing is to get all of these solar/PV projects off the ground!

The India Semiconductor Association (ISA), and now, SEMI India, have been promoting the solar/PV industry very aggressively. The work they’ve done so far has been commendable, and I’ve been witness to all of their activities. However, keep in mind that these are only industry associations, who can only advice, guide, debate and promote the industry, and also provide industry statistics for everyone to consume.

The real action can only happen once the proposals have been cleared by the Indian government and the players have managed to arrange for the requisite capital for their projects. The Indian fab story with SemIndia is all to familiar, and there should not be a repitition with solar/PV projects.

Therefore, the role of the government of India will be extremely critical and crucial. The good health of the Indian solar/PV industry is entirely in its hands, and not in the hands of the industry associations.

Perhaps, the Indian government could do well to look at how the Taiwan government is playing a critical role in reviving the hard hit DRAM industry and also at the German free state of Saxony, which has played a key role in financing the ailing Qimonda.

Otherwise, the Indian solar/PV industry could get hit, even before it takes off the ground! And, as a nation, we cannot afford that to happen!

India has so far has had a good story going in solar. There are hopes that solar/PV will trigger off a spate of manufacturing activities in India, besides creating lots of jobs. Don’t think we can afford to spoil all of this!

The industry in India is still very much in its infancy. Let the baby play happily in the water (solar) tub, instead of throwing the water out! This baby needs a lot of hand-holding to get stronger in the years to come.

How Taiwan government reacts to DRAM turmoil is a lesson in itself!

Taiwan based DRAMeXchange recently sent me a release, which discussed in length the steps the Taiwan government is taking in an attempt to “save one of the ‘2 trillion twin stars’, the DRAM industry”. The Taiwanese Ministry of Economic Affairs (MoEA) was designated to draft the policies, principals, strategic goals and strategic directions of the DRAM industry rescue plan.

According to DRAMeXchange: At 6 PM, December 16, the Taiwanese Ministry of Economic Affairs held a press conference about the DRAM rescue plan, emphasized in the past 10 years the investment amount of the DRAM industry surpassed NT$ 850 billion, and created a complete industry supply chain, which widely covers upstream chip makers, to downstream packaging and testing companies, and module houses. If the recession brought down the industry, the Taiwan industrial chain will be affected severely.

The Taiwanese government showed sincerity and willingness, and hoped that Taiwanese DRAM vendors can actively start to consolidate horizontally and vertically, and make joint proposing plans to the government. The government will not take the leading position, but the strategic direction is long term integration, which is not just merger but also includes cooperation of co-research, co-develop, and co-manufacturing.

The government also emphasized that it will tend to strengthen the relationship among the co-operation of Taiwanese, American, and Japanese DRAM vendors.

In another report, Gartner has gone as far as dubbing the DRAM industry as the wild card for the semiconductor industry in 2009! The DRAM industry has been in a downturn for the past 18 months and losses are now approaching $12 billion, it says.

How the Taiwanese DRAM industry reacts to the efforts of the Taiwan government will be visible in the coming months. Among other bail out plans, the Taiwan government has also focused on the need for the local industry to develop its own technology.

Taiwan takes great pride in having been a leader in technology and R&D for long. If the DRAM industry does not recover quickly enough, it would indeed impact the country’s industrial chain as well.

What’s interesting to note is the key role the government of Taiwan is playing in all of this. It again stresses the importance of government contribution within the semiconductor industry. And, there is also a lesson in all of this for India!

Closer home, in India, I am (and I am sure, interested readers and parties are too) still waiting to hear on what happened to the several proposals that were received for solar/PV, as well as on the various state policies, especially, Karnataka.

All believe that these would surely get pushed through in the new year. However, there is a need to show some speed in this regard as well. You cannot afford to wait for too long in the semiconductor industry. The SemIndia fab story is all to well known and hopefully, still fresh in everyone’s minds.

Intel showcases world's first Moorestown platform at IDF Taiwan

Intel showcased the world’s first Moorestown platform at the recently held Intel Developer Forum in Taipei, Taiwan.

In his opening keynote on Day 1 at the IDF: Innovating a New Reality, Anand Chandrasekher, Senior Vice President, General Manager, Ultra Mobility Group, Intel Corp., said: “It is a world in transformation. There have been 3 billion new entrants in the global economy. The resilience of the global economy has been incredibly strong. The Internet has equalized the level-playing field.”

In his opening keynote on Day 1 at the IDF: Innovating a New Reality, Anand Chandrasekher, Senior Vice President, General Manager, Ultra Mobility Group, Intel Corp., said: “It is a world in transformation. There have been 3 billion new entrants in the global economy. The resilience of the global economy has been incredibly strong. The Internet has equalized the level-playing field.”

He added how technology innovation and strong industry collaboration have driven the digital economy over the past 40 years, and the universal impact that the Internet and mobile Web has had in people’s lives.

“Technology innovation is the catalyst for new user experiences, industry collaborations and business models that together will shape the next 40 years,” said Chandrasekher. “As the next billion people connect to and experience the Internet, significant opportunities lie in the power of technology and the development of purpose-built devices that deliver more targeted computing needs and experiences.”

Asia’s growing might

Chandrasekher added: “IT is more important today, than it has ever been over the last 20 years. Asia has been playing a dramatic role.” In fact, in 2007, Asia accounted for over 25 percent of Intel’s revenue. “Look at the PC companies. ASUS, Acer, Lenovo, etc., are now in the top 10. The number of PCs in China exceeds the US’s population. There are more handsets in Taiwan than the people in Taiwan,” he highlighted. As for the Internet, Asia is now the fastest growing region online.

The foundation of the Internet is silicon, whose foundation is the Intel architecture (IA). Chandrasekher said: “It is the ecosystem for growth, tomorrow. If you don’t have the tools to drive the Internet ecosystem, you have fallen behind.” As a comparison, during 1971, the 4004 processor had 2,250 transistors. In 2008, the Core 2 Quad processor has 820 million transistors. It also consumes 93 percent less power. “Process is one piece of the foundation. Architecture is the other,” he added.

Welcome Nehalem!

Chandrasekher next focused on the upcoming Nehalem microarchitecture, which, he said, has an extremely energy efficient design. “We have introduced the turbo mode and dynamic power management. We have hyper-threading technology as well.” He pointed out that Intel has a 32nm version of the Nehalem, which should be out soon. “There has been a huge performance increase, almost 2X, with Nehalem.”

According to him, developers love parallel programming and the Intel IA. “We are giving the Larabee. It increases the throughput performance and the programmability.”

World’s first working Moorestown platform

The event’s showstopper: a live video from a Moorestown lab in Taiwan, which also demonstrated the world’s first working Moorestown platform! The Moorestown platform is scheduled for 2009-2010 timeframe.

Moorestown comprises of an SoC, codenamed “Lincroft,” which integrates the 45nm processor, graphics, memory controller and video encode/decode onto a single chip and an I/O hub codenamed “Langwell”, which supports a range of I/O ports to connect with wireless, storage, and display components in addition to incorporating several board level functions.

Chandrasekher showed off a ”Moorestown” wafer to the delegates.

In the next blog, I will introduce you to the Father of the Atom!

90pc fab investments for 300mm capacity: SEMI

Recently, SEMI (Semiconductor Equipment and Materials International) released its World Fab Forecast report. This report mentions that projected decline in world semiconductor fab equipment spending of 20 percent is likely for 2008. However, a rebound of over 20 percent in spending is expected in 2009, driven by over 70 fab projects.

The August 2008 edition of this report lists 53 fab equipping projects and up to 21 construction projects for fabs in 2009. It is sincerely hoped that at least one of the fabs likely from the Southeast Asian region is from India!

With the help of Scott Smith Senior Manager, Public Relations, SEMI, I was able to get in touch with Christian Gregor Dieseldorff, Senior Manager of Fab Information and Analysis at SEMI, in an attempt to find out more about the decline in global fab spends, these new fabs, and how these fabs can lead a turnaround in the global semiconductor industry. Thanks Scott!

So what are the chief reasons for the decline in fab spends during 2008? According to Dieseldorff, given the weaker economic conditions globally, coupled with higher energy and commodity prices and the financial crisis, the overall outlook for semiconductor growth in 2008 is for low-single digit growth in both revenues and units. As such, device makers have responded by cutting back their capital spending and pushing out fab projects or putting them on hold.

So what are the chief reasons for the decline in fab spends during 2008? According to Dieseldorff, given the weaker economic conditions globally, coupled with higher energy and commodity prices and the financial crisis, the overall outlook for semiconductor growth in 2008 is for low-single digit growth in both revenues and units. As such, device makers have responded by cutting back their capital spending and pushing out fab projects or putting them on hold.

I was keen to find out the geographic breakup of these 70 new fabs that are likely yo come up in 2009.

Dieseldorff advised that these are not 70 new fabs coming up in 2009. Rather, the numbers reflect 300mm fabs only, and is a mix of on-going and new projects for fabs equipping and fab construction projects in 2009.

For equipping 300mm fabs, SEMI expects about: Americas 8, China 5, Europe and Mideast 4, Japan 7, South Korea 11, SE Asia 3 and Taiwan 15.

For 300mm fab construction projects, SEMI expects about: Americas 3, China 2, Europe and Mideast 1, Japan 2, South Korea 3, SE Asia 2 and Taiwan 8.

What are the salient features of some of these new fabs likely to come up next year (for instance, new tech nodes)? Dieseldorff highlighted that about 90 percent of the investments are for 300mm capacity, and the amount of spending for advanced nodes, such as 65nm, is increasing.

“Also, device makers are building larger fabs, which are termed “mega fabs,” so, to potentially realize a greater return based on scales of economy,” he added.

How will these new fabs contribute to a better performance from the global semicon industry? This will be quite interesting to witness.

Dieseldorff said that over the past several years, demand for semiconductor devices has been quite strong, and so, the industry has had to bring on capacity to support this need, both in terms of needed capacity and technology. Even with the slower market growth in 2008, recent industry data shows healthy levels of fab capacity utilization, especially for the advanced technology generations and for 300mm manufacturing.

He added: “The expectation is that demand for semiconductors will strengthen once global economic conditions improve. So, the capacity addition that is coming online this year and the fab projects that are equipping and beginning construction in 2009 are necessary to meet the future demand.”

So how will all of this affect the overall memory market (e.g., 42pc increase in share for memory)? Dieseldorff shared his thought, a fact, known well to those in the semiconductor industry, that the memory market has been battered by declining average selling prices and a condition termed by some as “profitless prosperity.”

“Looking at demand forecasts specific to memory, tremendous growth is anticipated,” he forecasted.

However, the manufacturers in this device segment are battling it out for market share, and the general expectation is that consolidation will continue.

Also, joint-ventures and partnerships are becoming increasingly critical in the memory sector as manufacturers seek to leverage their existing resources to meet future technology and capacity requirements.

It would be interesting to find out why Taiwan and Korea are forecasted as likely to exceed Japan in fab spend?

According to Dieseldorff, in Korea, Samsung has been and is the key spender, and as a company, it will continue to invest so to have a dominant share in the memory sector.

He said: “In 2009, our expectation is for the DRAM manufacturers in Taiwan to boost spending after cutting back this year. We expect seven new 300 mm fab lines in Taiwan to come into production over the next two years.”

However, spending in Japan has been more measured and is likely to remain so. Toshiba, and its joint-venture partner, Sandisk are the big spenders in Japan, when it comes to new fab capacity. Other Japanese semiconductor manufacturers are more cautious and are focused more on technology spending.