Archive

Busy period ahead for Indian semicon, solar! While, TI bids for Qimonda's tools!!

Yes, looks like it!

First, on August 31, the India Semiconductor Association and the UK-TI would be signing an MoU. The next day, September 1, there is a presentation by Ministry of New and Renewable Energy and key officials on the government of India’s policies to the industry!

Next, on September 4, the DIT Secretary R. Chandrasekhar and the Additional Secretary, will be interacting with semiconductor companies in Bangalore.

Further on, September 16 is the day when the Union Minister for New and Renewable Energy, Dr Farooq Abdullah, will be interacting with a small group of industry leaders at a solar PV conclave in Hyderabad!

That’s quite a lot, within a span of 15-odd days! Must say, this augurs well for the Indian semicon and solar/photovoltaics industry.

Interestingly, a lot of the big events are focusing on solar. So, my hunch is that the Indian solar industry may have some serious announcements to make in the coming weeks. Should that happen, I hope to bring those to you, time permitting.

TI bids for Qimonda’s tools

Oh, by the way, there’s news all over the Internet about Texas Instruments (TI) placing a bid of $172.5 million for Qimonda’s 300mm production tools from its closed DRAM fab. While this highlights TI’s focus on building the world’s first 300mm analog fab, I can’t stop wondering, what would have happened had an Indian investor really bought Qimonda!

TI's 14-bit ADC unites speed and efficiency

BANGALORE, INDIA: Texas Instruments Inc. (TI) recently introduced a dual, 14-bit analog-to-digital converter (ADC), the ADS62P49, at 250MSPS to deliver a premier combination of wide signal bandwidth, high dynamic performance and low power consumption.

The ADS62P49 achieves 73-dBFS signal-to-noise (S/N) ratio and 85-dBc spurious-free dynamic range (SFDR) at an input frequency of 60 MHz. I was able to catch up with Apoorva Awasthy, Business Development Manager, High Performance Analog, Texas Instruments India, to find out more about this new 14-bit ADC.

Chief features of TI 14-bit ADC

Texas Instruments (TI) has united speed and efficiency with the industry’s fastest dual, 14-bit ADC at 250 MSPS. Key features of this device include:

* It delivers a premier combination of wide signal bandwidth, high dynamic performance and low power consumption;

* Fastest dual, 14-bit ADC at 250MSPS enables multi-channel, wide-bandwidth sampling without sacrificing dynamic performance, for enhanced accuracy in portable test equipment;

* Low power of 625 mW per channel reduces thermal footprint for increased system efficiency in high-density, multi-antenna base station receivers and software defined radios;

* Programmable gain and other user-selectable settings maximizes design flexibility;

* Complete signal chain with comprehensive evaluation tools suite speeds time to market; and

* It is first in a series of four 12- and 14-bit dual channel ADCs with sample rates of 210MSPS and 250MSPS, respectively.

TI also says that the 250-MSPS data converter provides 66 percent greater bandwidth than competing dual ADCs. Has this been based on any on-field performance? Awasthy said that this is the performance specified in the data sheet and was tested in a lab.

Naturally, the key application areas would be interesting to look at! Awasthy said, “The ADS62P49 is suitable for applications such as communications and defense imaging systems, and wide-band test and measurement equipment. The block diagram given here shows an application area. Source: TI

Source: TI

Again, when TI says that the ADS62P49 has the “the industry’s fastest sample rate”, what’s the benchmark? Awasthy said, “We have done comparisons between our device and others in the industry. We are the only one to offer a dual, 14-bit device that achieves 250MSPS.”

Solving customer challenges

What are the main customer challenges solved by the new ADC? Awasthy said:  “Communications, defense and test design engineers are constantly challenged to create signal and data acquisition receivers with increasingly wide signal bandwidths that do not compromise overall system performance. Another key feature in demand is the low power capabilities without bargaining on performance.

“Communications, defense and test design engineers are constantly challenged to create signal and data acquisition receivers with increasingly wide signal bandwidths that do not compromise overall system performance. Another key feature in demand is the low power capabilities without bargaining on performance.

“TI addresses these challenges with the ADS62P49, which delivers high-performance, compact, power-efficient designs, and enables rapid deployment of 3G and 4G systems, software defined radios and spectrum analyzers.”

What if the competition brings out such a device or a better one soon? TI is not in a position to speculate on what the competition is planning. “The data converter market offers tremendous opportunities to TI. We will continue to offer leading edge data converters that address our customers’ challenges and advance next generation system design,” he added.

This is the first in a series of four 12- and 14-bit dual channel ADCs. Awasthy said that TI expects more of such devices to be released in the second half of this year.

ISA Vision Summit 2009: Indian design influence, ideas to volume

This post is slightly delayed given the fact that I’ve been travelling! Here it is: Session 2 of Day 1, ISA Vision Summit 2009!!

The still quite young, Indian semiconductor industry has come a long way! Making his opening remarks during the session: Indian Design Influence, Ideas to Volume, Jaswinder Ahuja, Corporate Vice President & MD, Cadence Design Systems India, and chairman, pointed out that earlier, it used to be ‘made by the world, FOR India.’ However, globalization of design has now put India on the world semiconductor map. Today, it is ‘made by the world, IN India.’

The picture here shows Ahuja making a point, while Freescale’s Ganesh Guruswamy, TI’s Dr. Bobby Mitra and Intel’s Praveen Vishakantaiah are all attention.

The picture here shows Ahuja making a point, while Freescale’s Ganesh Guruswamy, TI’s Dr. Bobby Mitra and Intel’s Praveen Vishakantaiah are all attention.

The electronics systems production is clearly moving eastward. Even though the chip fabs may not happen in India, systems manufacturing is certainly happening. The emerging markets today offer a $5 trillion opportunity. However, the transformative challenge is: how to marry low cost, good quality, sustainability and profitability simultaneously!

Fantastic opportunity for investing in technology

Praveen Vishakantaiah, President, Intel, added that India has a fantastic opportunity ahead for investing in technology. He cited Intel’s examples, such as: products designed in India for global market — Intel Xeon 7400 processor; designed in India for India and emerging markets — Classmate PC, which was prototyped in India; and designed in India and customized for the local market — PoS retail kiosk solution.

Internal factors related to volume development include: unique market needs, designing for reliability, enabling customers — standard globally but varied in India. External factors include: access to customers — which can be challenging in a varied market such as India, access to employable talent, predictable supply chain, robust infrastructure — digital infrastructure should scale simultaneously with design and development, and proactive policies and regulations.

According to Vishakantaiah, there is a need for a call to action and seize opportunities. This means, capitalizing on opportunities for local and global product designs, increase the impact and build end-to-end competencies, and to continue to move up the value chain. There is a need to address the internal factors. This would enable increasing the quality of products and extend local products into global markets. There is also a need to focus on the enabling the local market for global product companies.

As far as the external factors are concerned, there is a need to be proactive to remove barriers. There is a need to also encourage research, faculty development and new curriculum. India also needs to build energy efficient power, logistics and manufacturing capabilities, and also reduce e-waste and think green for all product designs.

Downturn creates huge opportunities

Ganesh Guruswamy, Director and Country Manager, Freescale Semiconductor India, remarked that even the deepest downturns can create huge opportunities for companies and countries. “Continuing to innovate during the downturn is important,” he added. It is therefore, time for India to step up, put the right innovations in place and grow.

He stressed upon several custom solutions for emerging markets, such as two-wheelers, which dominate, e-bikes, which are said to be the future, LED lamps, power inverters, irrigation pumpset powered by solar, smart energy meters, and solar/PV base station and carrier based equipment for telecom.

Medical tourism is an emerging focus area for India, as it is growing by 30 percent each year. Medical tourism is likely to bring $1-2 billion to India by 2012. In this context, Guruswamy highlighted Freescale’s ECG-on-a-chip solution. According to him, the way forward would involve moving away from a design mindset to a product mindset!

Don’t be dwarfed by glamorous industries!

Dr Bobby Mitra, MD, Texas Instruments India, said that India is witnessing a change in its semiconductors agenda — from R&D to R&D + market growth. If followed properly, it can become a game changing agenda. “India has nearly 2,000 OEMs designing electronics products. That’s the untapped potential,” he said.

Most of the customers are smaller companies — the proverbial long tail. They know semiconductors and electronics very well. Such companies need to be measured by the firebrand innovation going on at those places.

Dr. Mitra said: “The products have to be the right kind of products. If they are complex, it is incidental.” He cited defense and aerospace as very strong spaces, while industrial is also an equally strong opportunity area. “We should not be dwarfed by glamorous industries,” he cautioned.

In the near term, the Indian semiconductor industry needs to develop two new stripes. These are: a high degree of customer centricity so it can be brought into the R&D engineer’s minds, and have an application mindset — India is very good in design work; it now needs to develop applications in the current context.

Dr. Mitra also called upon having research as an agenda for the industry. This can be done in areas that would assume importance in future. “By working with customers, we can make products more intelligent, by adding electronics and semiconductors,” he advised. “All of us have a key role to play in this transformation.”

SMEs, in particular, have a major role to play. Intel’s Vishakantaiah said that MNCs would need to mentor and coach such companies. Freescale’s Guruswamy added that MNCs can either help them grow or buy them out.

Dr. Mitra advised that even if customers didn’t provide business, it would pay to remain close to them. He also referred to TI’s Beagle Board, an open and low-cost platform, which enables development of applications. However, he advised the industry to be realistic about mass customization.

Consumer MEMS shine amid gloom: iSuppli

I was fortunate enough to attend a webinar on MEMS organized recently by iSuppli. The webinar looked at the growth potential of this segment, especially during the downturn, as well as some top MEMS suppliers.

According to Jeremie Bouchaud, director & principal analyst, both consumer and mobile MEMS supply has been exploding. The overall MEMS market is likely to grow from $1 billion in 2006 to $2.5 billion in 2012! There will be strong acceleration due to growth of cell phones — a hotbed for MEMS, he said.

According to Jeremie Bouchaud, director & principal analyst, both consumer and mobile MEMS supply has been exploding. The overall MEMS market is likely to grow from $1 billion in 2006 to $2.5 billion in 2012! There will be strong acceleration due to growth of cell phones — a hotbed for MEMS, he said.

However, the share of MEMS for rear projection TV is vanishing. A market worth $300 million in 2006 is slowly disappearing, and will, in fact, disappear by 2012. Among other growth areas, personal navigation devices (PNDs) and remote controllers will also see growth.

Consumer and mobile market by MEMS device

The main segments include accelerometers, as well as gyroscopes, RF MEMS switches and capacitors, microphones, etc. The penetration of MEMS devices in CE products is said to increase quite fast.

MEMS growth in cell phones will be faster. It will grow from 3 percent in 2007 to 10 percent in 2008. All of the new, best selling smartphones, such as the iPhone, Nokia N95 and N96, Samsung Omnia, HTC Diamond, Google G1, Blackberry Storm, new Palm OS, etc., have accelerometers. A number of mid range phones also have accelerometers, eg. Sony Ericsson’s models.

MEMS usage is also growing in gaming. From 1998-2005, there was technology push with limited success. However, in 2006, Nintendo showed the way with its Wii, as did the Sony PS3. Microsoft did not enter this field back then!

Interestingly, 2006-08, motion sensing unveiled new, untapped target groups for gaming — the so called casual gamers. In Xmas 2008, Microsoft also embraced motion sensors with accessories. Hence, the penetration of motion sensors has really improved. The next third generation platform will include accelerometers and gyroscopes.

Top 15 MEMS suppliers

The key question: who all are shipping these products? According to iSuppli,The top 15 MEMS suppleirs for CE and mobile phones are: STMicroelectronics, Texas Instruments, Avago Technologies, Knowles, Analog Devices, Murata, Kionix, Epson Toyocom, Invensense, Panasonic, Bosch Sensortec, Freescale, Hokoriku, VTI and Memsic.

Some other companies to watch are:

Accelerometers and gyroscopes: Qualtre, Oki, Wacon, Alps, Virtus, Ricoh.

Pressure sensors: Intersema (MEAS), Metrodyne.

Microphones: Infineon, Wolfson, Memstech, Yamaha, Omron, Panasonic, MEMSensing, AAC, Goertek.

Pico-projectors and other MEMS displays: Microvision, Nippon Signal, Samsung, Konica Minolta, Scanlight, Qualcomm, Pixtronix, Unipixel

RF MEMS switches and capacitors: Wispry, Epcos, RFMD, Baolab.

MEMS oscillators: SiTime, Discera, NXP, Seiko, Intel.

BAW filters: Triquint, Skyworks, MEMS Solutions.

MEMS actuators for autofocus and zoom: Simpel, Sony.

Micro-fuel cells: Angstrom, Tekion, Medis.

It is understood well that not all of these companies will be successful. However, they all need to be monitored carefully.

Commenting on cell phones as a hotbed for inertial and magnetic sensors, Dr. Richard Dixon, senior analyst MEMS, iSuppli, said that the market for accelerometers, gyroscopes and magnetometers is in cell phones. This market will reach $730 million in 2012. Gyroscopes are not in the market yet, and are likely to enter by 2010. The total growth rate is very fast. In units, the annual growth rate is said to be 97 percent.

Interestingly, Apple has contributed significantly to growth of MEMS. The iPhone had a great application. Other vendors followed suite with a ‘me too” strategy. Apple also had sustainable business model with downloads on the Apple Store. The chicken and egg issue of price was solved. Also, with the iPhone, there was a free field test of motion sensing based applications.

Major suppliers of accelerometers for cell phones today, include STMicroelectronics, Bosch Sensortec, Analog Devices, Hokuriku, Kionix, MEMSIC, Freescale, Oki. Of these, ST has really been very impressive, while Bosch saw impressive growth in 2008. MEMSIC dropped share in 2008.

Navigation in cell phones next big thing

According to Dixon, navigation in mobile phones is the next big thing. Leading navigation markets by platform are: mobile phone navigation, smartphone navigation, PNDs, car aftermarket and car OEM in-dash, respectively. By 2010, the mobile phone/smartphone navigation segment will account for over 60 percent of the market.

Similarly, magnetic sensors will take off in 2009 for e-Compass. There has been penetration of magnetometers in GPS phones. They have been around since 2003 in Japanese phones. These rather esoteric applications and also had technical issues.

There were successful implementations in 2008 for navigation. Eg., the G1 Street View, and the Nokia 6210. Also, 3D compass in combination with 3D accelerometers.

The leading suppliers in this space today, include AKM, Honeywell, Yamaha, Aichi Steel. In the R&D segment, the leading players are said to be Alps, Omron, Memsic, Oki, ST, Freescale, Demodulation. Growth will be steep from 2009 onward, and take off from 2010 up to 2012.

Another growth are is the multi-sensor packages and IMUs (Inertial Measurement Unit) for navigation. Today, we have six-axis e-compass combining magnetic sensors and accelerometers. In future, there will be IMU for LBS and indoor navigation also using gyroscopes.

The issue with gyroscopes is of: performance, price, size, power consumption and no availability of three-axis. Companies that need to be watched in this space are said to be Invensense, ST, Bosch Sensortec, Qualtre, Oki, Virtus.

Other opportunity areas

Later, Jeremie Bouchaud highlighted two other opportunity areas.

MEMS microphone market presents a major opportunity. It will reach close to $400 million by 2012. In 2008, already 325 million units were selling in cell phones and laptops. Leading players in this segment are said to be Knowles, Akustica, Infineon, Sonion, Memstech, AAC. Knowles has over 90 percent of the market share.

MEMS pico projectors is another growth area. Companies have made lot of progress in this segment. The pico projectors come in various varieties.

In the MEMS scanner based segment, the R&D is led by firms such as Microvison, Konica, Minolta, Scanlight, Nippon, Signal, Symbol. These solutions came first as stand alone projectors. Later, it will come on cell phones. The best opportunity is said to be at the module level.

Another sub-segnent is the DLP based projectors. First it will be in form of a pico-projector, later, followed by usage in cell phones.

Bouchaud advised watching out for non-MEMS alternatives, such as Light Blue Optics,

3M and Logic Wireless.

Coping with commoditization and price erosion

The ASP of MEMS devices for CE and mobile phones is dropping at -13 percent per year. So, what are the ways to get profitable?

To be profitable, there is a need to achieve economies of scale by combining consumer and automotive. Also, there is a need to

move wafer size to 8-inch. Next, there is a need for externalizing to foundries. ADI and TSMC have already showed the way. Now, USMC, Tower, Dongbu, Magnachip, Omron, etc., are following.

Innovation, in terms of packaging and 3D integration, test, multi-sensor packages, is another way for making profits. There is an opportunity for the equipment suppliers as well.

Consumer MEMS is currently glowing as a light in today’s dark times! It is said to grow from $1 billiom in 2006 to $2.5 billion in 2012, with 19 percent CAGR. This optimistic forecast has already started. Accelerometers are present in 10 percent of cell phones in 2008 as against 3 percent in 2007.

There exist a number of opportunities. Small companies can be successful, eg. Kionix and Invensense. There are still opportunities for newcomers. These can be large companies, fabless startups, foundries, software companies, equipment suppliers, etc. Consumer MEMS is an extremely dynamic market, having fast design cycles.

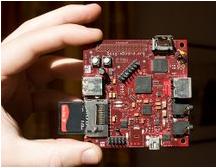

TI Beagle Board for Indian open source developers and hobbyists

Texas Instruments recently introduced the pocket-size, USB-powered Beagle Board based on TI’s OMAP3530 applications processor. It features an ARM Cortex-A8 core, 2D/3D graphics engine and high-performance TMS320C64x+ digital signal processor (DSP) core.

Texas Instruments recently introduced the pocket-size, USB-powered Beagle Board based on TI’s OMAP3530 applications processor. It features an ARM Cortex-A8 core, 2D/3D graphics engine and high-performance TMS320C64x+ digital signal processor (DSP) core.

This will help open source developers and hobbyists in India to realize their creative design ideas without being restricted by expensive hardware development tools, lackluster performance capabilities, high power consumption or stifled design environments, according to Khasim Syed Mohammed, Lead Developer for Open Platforms, Texas Instruments India Pvt. Ltd.

He added: “It helps us in learning cutting edge technology, innovating new ideas and executing them. Beagle board should be used to explore the growing demand in areas like medical, security, infotainment, navigation, education, signal processing, mobile devices and communication.”

Important for India

This initiative is particularly important in India where students can use the board to learn, show case their efforts and global recognition for their innovations.

Innovators in India should use this opportunity to prototype their ideas using the specification software hardware openly available in a never before package. It is important for the student community to learn new technologies, explore new areas and innovate. This initiative by TI also helps startups in India who want to explore the OMAP hardware but have limited support base for their requirements.

Passionate open source developers and hobbyists in India can realize their creative design ideas without being restricted by expensive hardware development tools, lackluster performance capabilities, high power consumption or stifled design environments.

Open platform innovators have the expandability of desktop machines without the expense, bulk or noise with the Beagle board, which is a powerful, low-cost and fan-less embedded system development board smaller than the size of an index card.

Board named after Beagle

The board is named after a popular breed of dogs, Beagle. It has been designed it to be one of the shortest pocket sized OMAP3530 boards. TI is encouraging the Open community to treat this as a pet, which is easy to carry and can be USB powered so that development is made easy and can perform high end applications at very less power.

Inspired to create a small, open source development board, a small group of enthusiastic engineers worked together on the concept and realization of the Beagle board. The resulting 3×3-inch board bridges desktop and embedded development by allowing developers to use the same peripherals and usage mode for almost limitless expansion. Developers are able to design exactly according to their specifications and collaborate with the community on creative new applications.

Mohammed said: “There is a growing need for development support in the Open Community. The Open Community is capable and passionate to work on industry’s high end processors and architectures and build innovative applications and prototypes for mobile, portable infotainment, portable navigation, medical, home security and many such applications. Another important reason for this initiative was the cost implications in owning a high end platform which was restricting them in exploring many such ideas/applications.”

Beagleboard is a global initiative to address the growing needs of the Open community to help them innovate and explore new areas by providing them access to leading hardware and software, giving them a forum to present their views and thoughts, showcasing their efforts for global appreciation, maintain community’s contribution.

Developers can quickly maximize their design concepts by tapping into the expertise and support of some of the industry’s top Linux programmers already experimenting with the Beagle board. With communities hosting the latest updates and codes, live forums and chats for easy collaboration, developers have easy access to support and exchange of ideas. Users are encouraged to join active, existing communities already participating in the project.

TI's TPS62601 converter for telecom apps

This August, Texas Instruments India (TII) announced the industry’s smallest and thinnest 500-mA, step-down DC/DC converter solution, the TPS62601 converter, for space-constrained applications.

According to TI, It gives portable designers the ability to add more features and functions on a handheld device. The high-efficiency power management IC is the first 6-MHz, 500-mA converter to achieve a 13-mm2 solution size with an ultra-thin 0.6-mm total height.

I caught up with Ramprasad Ananthaswamy, Director, Power Management Products, Texas Instruments India, to find out a bit more about this so-called industry’s smallest and thinnest converter solution, and its essential design trends.

I caught up with Ramprasad Ananthaswamy, Director, Power Management Products, Texas Instruments India, to find out a bit more about this so-called industry’s smallest and thinnest converter solution, and its essential design trends.

So what exactly is the TPS62601 power converter targeted toward? According to Ananthaswamy, the TPS62601, a high-efficiency power management IC is the first 6-MHz, 500-mA converter to achieve a 13mm2 solution size with an ultra-thin 0.6-mm total height.

The TPS62601 converter achieves up to 89-percent power efficiency and only 30-uA typical operating quiescent current, all from a 0.9×1.3mm chip scale package roughly the size of a flake of pepper. The synchronous, switch-mode device’s fixed frequency of 6 MHz allows the use of only one 0.47-uH inductor with a height of 0.6 m and two low-cost ceramic capacitors, without compromising performance and efficiency.

The device supports applications, such as memory modules, GPS modules, Bluetooth and Wi-Fi modules or other wireless micro-modules used in ultra-thin smart phones, digital still cameras, portable disk drives and media players.

Applications areas of this device include: Smart and media phones; Cell phones; Media players; Mobile Internet devices; DSCs; and Other portable communications devices.

This chip will help powering sources such as: WLAN modules; WiFi modules; Bluetooth modules; Memory modules; and Generic micro modules.

Essential design trends

There is a need to understand the essential design trends of the TPS62601 that makes it unique. Ananthaswamy added that the TPS62601 can deliver DC voltage regulation accuracy of +/- 1.5 percent. In addition, its excellent load transient response, wide input voltage range of 2.3V to 5.5V and 1.8V of output allows the device to effectively support single-rail voltage requirements as designers add new features and functions.

The converter also applies energy-saving techniques to help maximize battery run-time. For example, the converter automatically enters a power save mode during light-load operating conditions via an automatic pulse frequency modulation and pulse width modulation switching feature. In shutdown mode, the device’s current consumption is reduced to less than 1 uA.

Size and high-performance are important. The converter achieves up to 89-percent power efficiency and only 30-uA typical operating quiescent current, from a small chip scale package.

A high switching frequency of 6MHz reduces the size of the external components used around this chip, thereby reducing the total size of the power solution. A low quiescent current of 30 uA also makes it very attractive for portable applications requiring long run times.

Helping portable designers

Let us understand how the TPS62601 will actually enable the portable designers to add more features and functions on to a handheld device. Ananthaswamy says: “Portable system designers continue to desire more features on their devices, which require smaller, efficient DC/DC converters to maintain long battery life and system run-times. As the size of the total power solution is small, more PCB space becomes available for additional features that need to get added on to the cell phone. The TPS62601 gives portable designers access to the smallest, thinnest 500-mA DC/DC solution, which simplifies design and reduces board space and time-to-market.”

The converter also applies energy-saving techniques to help maximize battery run-time. For example, the converter automatically enters a power save mode during light-load operating conditions via an automatic pulse frequency modulation and pulse width modulation switching feature. In shutdown mode, the device’s current consumption is reduced to less than 1uA.

Power management

How well does the TPS62601 tackle power management issues? The biggest issue inside feature rich cell phones today is thermal management. This power converter, consuming only 30uA for its own operation, manages the thermal problem through efficient power conversion. “Better efficiency means less heat,” added Ramaswamy.

Energy-saving techniques

Elaborate on the energy-saving techniques that can help maximize battery run-time, he said: “Globally, switching regulators are efficient means of power conversion. This device is a buck derived switching regulator that efficiently converts the single cell Li-ion battery voltage to the one that is required by the various multimedia rich cell phone chips, like applications processors, GPS modules, digital multimedia broadcast chips, camera engines, WiFi etc.

“It can power all of these chips, while consuming as little as 30uA for its own operation. Depending on the input to output voltage ration, the conversion efficiency can also reach close to 90 percent. Less consumption, better conversion efficiencies, etc., all of these result in longer battery run times.”

Is it then safe to say that the maximizing battery run-time problem has been tackled with the TPS62601? Not exactly!!

According to Ramaswamy, the TPS62601 addresses part of the battery run-time issue. “With this initiative, TI has gone a step ahead in making the battery last longer,” he noted.

Making power converters efficient is only a part of the battery run-time issue. Along with making power converters efficient, one also has to look at how much power is consumed by the various chips that are used in a cell phone, the operating system that runs the cell phone and the overall power saving features that are built into the cell phone system. The speaker volume settings, backlight brightness settings and the duration of the backlight and some of the other user friendly settings have an effect on the battery run times.

Xilinx on microprocessor trends, solar/PV

This semicon blog will basically examine the key trends in microprocessors, as well as whether companies such as Xilinx — a key player in FPGAs — has any kind of role to play in the solar/PV domain.

For the record, this is the concluding part of the discussion with Vincent Ratford, Senior Vice President, Solutions Development Group, Xilinx.

First, on to solar/PV! We have been reading and hearing a lot about the rapid advances being made in solar/PV. With so much investments in solar/PV happening globally, is there a role for Xilinx to play in this segment?

Ratford said: “Perhaps! Our devices are great for prototyping new ideas and often find their way into new markets. In base stations, our devices are used to reduce the power up to 50 percent. In signal processing applications, we have a decided performance/power advantage vs. discrete signal processors. Many of these ‘Green’ applications require some form of signal and embedded processing.” Interesting, and this point needs some further examination!

Another area of main concern within the global semiconductor industry is low-power design. According to Ratford, there are a variety of ways to save system power.

He added: “We are designing features in our new products that will reduce active and standby power. We also have power-estimation and optimization tools. I would say, there is a lot more to be done in this area at all levels, software, IP and silicon.”

Ratford was however, tight-lipped about Xilinx’s product roadmap beyond the Virtex V. Obviously, we need to remain very tuned toward this!

Key microprocessor trends

Now this is another interesting area. A few weeks ago, I had received a great article from Texas Instruments, which mentioned about five key microprocessor trends today.

Microprocessors have always been among the key areas of interest for semiconductor design and development. On being quizzed on what could be the five major trends for microprocessors, Xilinx’s Ratford said: “For our embedded customers it is:

* Rising adoption of Linux.

* Increasing use of multi-core and some multi-processing.

* Accelerating trend to increase the connectivity, bandwidth and reduce the latency between the processor and the FPGA.

* Improve the OOBE (Out of the Box Experience) for non-FPGA developers.

* Reduce power.

Before signing off, my thoughts also veered toward LTE and TD-SCDMA, one 4G and the other, a 3G technology. Both these technologies have been very much in the news lately, especially, TD-SCDMA, which is currently in use at the Beijing Olympics.

As expected, Xilinx has also forayed into both LTE and TD-SCDMA spaces!

Ratford said: “Yes, we have complete reference designs for LTE and TD-SCDMA and have secured most of the prototype sockets for these air interface standards with Virtex-5. We have a very strong IP portfolio for the radio shelf and baseband and our Sytem Generator and AccelDSP tools are used extensively.”

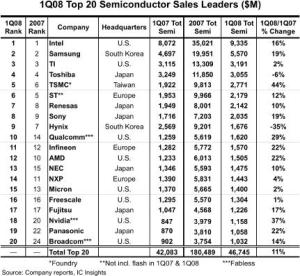

Top 20 global semicon companies — DRAM, Flash suppliers drop out

IC Insights recently published the May update to The McClean Report, featuring the Top 20 global semiconductor companies. Not surprisingly, there have been some significant movers and shakers. The most telling — quite a few of the major DRAM and Flash suppliers have dropped out of the Top 20 list!

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

TSMC, the leading foundry, moved up one position, registering the highest — 44 percent — year-over-year Q1-08 growth rate, besides being ranked 5th. Nvidia, the second largest fabless supplier, was another company registering a high YoY growth rate of 37 percent, and moved into the 18th position. Some others like Infineon, Sony and Renesas also climbed a place higher each, respectively. The top four retained their positions — Intel, Samsung, TI and Toshiba.

And now, the shakers! The volatile DRAM and Flash markets have ensured the exit of several well known names such as Qimonda, Elpida, Spansion, Powerchip, Nanya, etc., from the list of the top 20 global semiconductor companies, at least for now.

Among the others in the list, the biggest drops were registered by NXP, which dropped to 14th from 11th last year, and AMD, which dropped two places, from 10th to 12th. Two memory suppliers — Hynix and Micron — also slipped two places, to 9th and 15th places, respectively. STMicroelectronics also slipped from 5th to 6th. IBM too slipped out of the top 20 list.

The top 20 global semiconductor firms comprises of eight US companies (including three fabless suppliers), six Japanese, three European, two South Korean, and one Taiwanese foundry (TSMC). Also, looking at the realities of the foundry market, TSMC’s lead is now unassailable. If TSMC was an IDM, it would be No. 2, challenging Intel and passing Samsung, said one analyst, recently, a thought shared by many.

IC Insights has reported that since the Euro and the Yen are strong against the dollar, this effect will impact global semiconductor market figures when reported in US dollars this year.

There are some other things to watch out for. Following a miserable 2007, the global DRAM module market is likely to rebound gradually in 2008 due to the projected recovery in the overall memory industry, according to an iSuppli report. That remains to be seen.

Some new DRAM camps — such as Elpida-Qimonda, and Micron-Nanya — have been formed. It will be interesting to see how these perform, as will be the performance of ST-backed Numonyx.

Further, the oversupply of NAND Flash worsened in Q1-08, impacted by the effect of the US sub-prime mortgage loan and a slow season, according to DRAMeXchange. The NAND Flash ASP fell about 35 percent compared to Q4-07. Although the overall bit shipment grew about 30 percent compared to Q4-07, the total Q1-08 sales of branded NAND Flash makers fell 15.8 percent QoQ to US$3.24bn. Will the NAND Flash market recover and by when?

Google phone beckons as industry leaders announce open platform for mobile devices

Is the Google Phone finally going to see the light of the day? Well, the following release (below) has all the makings of a mega telecom happening. Read on!

A broad alliance of leading technology and wireless companies today joined forces to announce the development of Android, the first truly open and comprehensive platform for mobile devices. Google Inc., T-Mobile, HTC, Qualcomm, Motorola and others have collaborated on the development of Android through the Open Handset Alliance, a multinational alliance of technology and mobile industry leaders.

According to Engadget Mobile, Google will be holding a conference call at noon eastern (November 5) to unveil the details of its long-rumored Android mobile operating system. Joining CEO Eric Schmidt will be other members of the 34-member Open Handset Alliance, including the chief executives of Deutche Telekom, HTC, Qualcomm, and Motorola. So keep watching this space!

According to the release, this alliance shares a common goal of fostering innovation on mobile devices and giving consumers a far better user experience than much of what is available on today’s mobile platforms. By providing developers a new level of openness that enables them to work more collaboratively, Android will accelerate the pace at which new and compelling mobile services are made available to consumers.

With nearly 3 billion users worldwide, the mobile phone has become the most personal and ubiquitous communications device. However, the lack of a collaborative effort has made it a challenge for developers, wireless operators and handset manufacturers to respond as quickly as possible to the ever-changing needs of savvy mobile consumers. Through Android, developers, wireless operators and handset manufacturers will be better positioned to bring to market innovative new products faster and at a much lower cost. The end result will be an unprecedented mobile platform that will enable wireless operators and manufacturers to give their customers better, more personal and more flexible mobile experiences.

Fully integrated Android platform

Thirty-four companies have formed the Open Handset Alliance, which aims to develop technologies that will significantly lower the cost of developing and distributing mobile devices and services. The Android platform is the first step in this direction — a fully integrated mobile “software stack” that consists of an operating system, middleware, user-friendly interface and applications. Consumers should expect the first phones based on Android to be available in the second half of 2008.

The Android platform will be made available under one of the most progressive, developer-friendly open-source licenses, which gives mobile operators and device manufacturers significant freedom and flexibility to design products. Next week the Alliance will release an early access software development kit to provide developers with the tools necessary to create innovative and compelling applications for the platform.

Android holds the promise of unprecedented benefits for consumers, developers and manufacturers of mobile services and devices. Handset manufacturers and wireless operators will be free to customize Android in order to bring to market innovative new products faster and at a much lower cost. Developers will have complete access to handset capabilities and tools that will enable them to build more compelling and user-friendly services, bringing the Internet developer model to the mobile space. And consumers worldwide will have access to less expensive mobile devices that feature more compelling services, rich Internet applications and easier-to-use interfaces — ultimately creating a superior mobile experience.

Open Software, Open Device, Open Ecosystem

“This partnership will help unleash the potential of mobile technology for billions of users around the world. A fresh approach to fostering innovation in the mobile industry will help shape a new computing environment that will change the way people access and share information in the future,” said Google Chairman and CEO Eric Schmidt. “Today’s announcement is more ambitious than any single ‘Google Phone’ that the press has been speculating about over the past few weeks. Our vision is that the powerful platform we’re unveiling will power thousands of different phone models.”

“As a founding member of the Open Handset Alliance, T-Mobile is committed to innovation and fostering an open platform for wireless services to meet the rapidly evolving and emerging needs of wireless customers,” said René Obermann, Chief Executive Officer, Deutsche Telekom, parent company of T-Mobile. “Google has been an established partner for T-Mobile’s groundbreaking approach to bring the mobile open Internet to the mass market. We see the Android platform as an exciting opportunity to launch robust wireless Internet and Web 2.0 services for T-Mobile customers in the US and Europe in 2008.”

“HTC’s trademark on the mobile industry has been its ability to drive cutting-edge innovation into a wide variety of mobile devices to create the perfect match for individuals,” said Peter Chou, Chief Executive Officer, HTC Corp. “Our participation in the Open Handset Alliance and integration of the Android platform in the second half of 2008 enables us to expand our device portfolio into a new category of connected mobile phones that will change the complexion of the mobile industry and re-create user expectations of the mobile phone experience.”

“The convergence of the wireless and Internet industries is creating new partnerships, evolving business models and driving innovation,” said Dr. Paul E. Jacobs, Chief Executive Officer of Qualcomm. “We are extremely pleased to be participating in the Open Handset Alliance, whose mission is to help build the leading open-source application platform for 3G networks. The proliferation of open-standards-based handsets will provide an exciting new opportunity to create compelling services and devices. As a result, we are committing research and development resources to enable the Android platform and to create the best always-connected consumer experience on our chipsets.”

“Motorola has long been an advocate of open software for mobile platforms. Today, we’re excited to continue this support by joining Google and others in the announcement of the Open Handset Alliance and Android platform. Motorola plans to leverage the Android platform to enable seamless, connected services and rich consumer experiences in future Motorola products,” said Ed Zander, Chairman and CEO of Motorola, Inc.