Archive

Dongbu HiTek comes India calling! Raises hopes for foundry services!!

On first impression, Dongbu’s seminar on foundry services surely raises a lot of hope that India could eventually have an ‘active foundry services provider’ after all! And definitely, a player, who won’t be that expensive, one hopes, should it happen.

There’s a reason why I am using the term ‘active foundry services provider.’

While, Dongbu’s visit may not mean that India can have an actual foundry or foundry services overnight, instead, the country could well have a foundry services player, who, I felt, is quite serious about India and the Indian semiconductor industry. However, what all of this will translate into eventually, remains to be seen, as these are still very, very early days. And, Dongbu is still exploring India!

Lou N. Hutter, senior VP and GM, Analog Foundry Business and Aabid Hussain, VP of sales and marketing, Dongbu HiTek Semiconductor Business conducted a workshop on Feb 9, co-ordinated by Mandate Chips (an ISA member) and supported by the India Semiconductor Association (ISA).

Operating two world class wafer fabrication facilities — in Bucheon and Sangwoo — and leveraging key technology achievements spanning two decades, the company continues to meet the needs of fabless ventures. Its business philosophy is driven by an aggressive mission to deliver the highest quality product backed by the most responsive customer service. Overarching this mission is the vision to become the best-in-class supplier of foundry services.

To realize this vision, Dongbu HiTek pursues a “collaborate and thrive” growth strategy. Accordingly, the company continues to maintain close relations with customers and has put in place an advanced business model that adds higher value to its products and services.

Headquartered in Seoul, Dongbu has two foundries – one in Bucheon and the other in Sangwoo, both in South Korea. Fab 1 in Bucheon has a monthly capacity of 54,000 wafers in the 0.35, 0.25, 0.18 and 0.15um technology nodes. The main technologies include logic BCD, analog CMOS, HVCMOS, etc. Fab 2 in Sangwoo has a monthly capacity of 34,000 wafers in the 0.25, 0.18, 0.11um and 90nm nodes. The main technologies include logic, mixed signal, flash, RFCMOS, CIS, HVCMOS, etc. Fab 1 was acquired from Amcor in 2001 while Fab 2 has been built grounds up.

Aabid Husain said, “As we move out to higher volumes and smaller nodes, we will do new technology nodes in Fab 2.” Taiwan has been among Dongbu’s key markets and MediaTek is among its leading customers. Dongbu also has a long association with Japan. Hussain said that Toshiba has been Dongbu’s technology partner, and also draws a lot of wafers from Dongbu’s fabs. Dongbu has an office in Santa Clara, USA, and started another office in Austin last year. It plans to add another office in Boston during Q3-2010.

Husain also highlighted Dongbu’s YourFab service. An easy-to-use web based system, it facilitates real-time WIP monitoring. The service is accessible at all times from anywhere. It provides design kits and technology reports, besides PC and inline data.

Dongbu HiTek’s ShuttleChip program allows customers to share a single MultipleProject Wafer (MPW) to verify the performance of their respective prototype designs in silicon before committing to volume production. Husain said, “Indian companies can take great advantage of this program.

The ShuttleChip Program reduces the cost-burden of manufacturing chips while it also engages foundry customers at the early phase of prototype development. Accordingly, it sets the stage for close collaboration between Dongbu HiTek and its foundry customers throughout the entire manufacturing process. Read more…

LCD monitor panel prices rising despite downturn: iSuppli

iSuppli Corp.’s LCD PriceTrak Service recently reported that prices for LCD monitor panels are rising, despite the weak economic situation and cuts in consumer spending. Isn’t this quite unusual, and on surface, really spectacular, given the recessionary conditions.

Thanks to my good friend, Jon Cassell, I was able to get into a conversation with Ms. Sweta Dash, director of LCD research at iSuppli. I started by trying to find out the reasons for LCD monitor panel prices to be doing reasonably well in these times.

China’s program driving demand

Sweta Dash said panel demand has been strong due to ‘China’s rural consumer stimulus program’, which increased sales of small-size TVs that uses monitor panels. Also, the panel demand was strong from branded manufacturers due to inventory adjustments.

She added: “Monitor brand manufacturers and retail channel orders mostly stem from the demand for inventory replenishment because they have kept their stockpiles at lower-than-normal levels since the end of 2008. Now, factory demand is strong as they need to buy panels for inventory adjustments.”

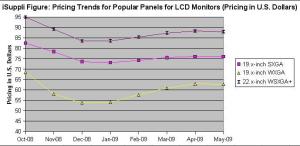

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

In that case, is China’s rural customer stimulus program the only major factor behind this rise in prices of LCD monitor panels?

According to Dash, the other factor is the inventory adjustment by brand manufacturers. TV sales in the US were also better than expected due to the very aggressive prices by brand manufacturers.

“Some retailers reported that they could not meet their demand due to low inventories level. Now, they are trying to adjust the inventory level. Besides better than expected demand for TV and monitor panel, severe cut in factory utilization rates (severe cut in panel production) also contributed to the tight supply for the monitor panel and small-size TV panel, which resulted in panel price increase,” she noted.

Is there any specific reason behind the retailers placing higher orders during recession? Or is it only due to the very low prices?

Dash clarified that it is mostly inventory adjustments. “In March, the inventory levels for monitors at the brand and channel levels were below three weeks level; and some were at two weeks level, which is considered low for this time of the year. Also, once the panel price starts increasing, buyers try to buy more in order to take advantage of the very low price.”

Situation regarding component shortages

There was also a note in iSuppli’ report regarding component shortages. I was keen to find out the exact situation with component shortages, and which specific ones!

Dash said that there is tight supply for PCBs and driver ICs. The lead time for PCBs is extending from two to three weeks to four to six weeks; and the lead time for certain driver ICs is extending to about six to eight weeks.

No recovery soon!

Interestingly, iSuppli cannot declare that monitor end-market demand is headed for a sustainable recovery at this point.

Dash added: “In the absence of a strong rebound in end-market demand, rush orders are not likely to be sustained in May with component shortages being resolved by then. And, the forecast for panel demand is most likely to remain conservative at that time. Also, panel prices are still below cost level. Therefore, in spite of the increasing panel demand, suppliers are still losing money. Further, panel suppliers are rushing to increase their utilization rates and production.”

Koreans doing better than Taiwanese

Evidently, the Korean suppliers seem to be doing better than the Taiwanese, as of now. What would be the key reasons for this?

According to Dash, the Korean suppliers were able to provide more competitive prices due to weaker Won rates.

She added: “Also, the Korean suppliers have higher generation fabs, and they have more in-house or regional component production, which gives them the cost structure compared to Taiwan suppliers. They also have more internal customers (for example, Samsung LCD’s internal customer is Samsung TV and monitor brand).

Year ahead for LCD monitor panels

Finally, how does the year ahead look like for LCD monitor panels?

Monitor panel demand may face some softness after the inventory adjustment in Q209. That is the reason why panel suppliers have to expand their production cautiously.

“Otherwise, it has the danger of pushing the market back to over supply. We still expect real end-user demand to recover in the second half of 2009 especially by Q4-09. If panel manufacturers act cautiously and expand rationally in the first half of 2009, they can see real demand recovery in the second half of 2009,” noted Dash.

DRAM makers being offered lifelines via bail out plans!

Browsing the Web these past days has brought me to various stories, mostly discussing the various bail out plans being provided for some leading DRAM makers.

It all started with Germany based Qimonda announcing that it has arranged a Euro 325 million financing package for the ramp up of its innovative Buried Wordline technology.

Yesterday, Hynix, the Korean DRAM maker, received a bail out of $597 million, according to reports on Fabtech. The story also reports that Powerchip Semiconductor, Taiwan’s largest DRAM maker, is also seeking new funding.

Then, DigiTimes, a very good technology news Web site from Taiwan, reported yesterday that Taiwan’s Ministry of Economic Affairs (MoEA) had reportedly developed an NT$200 billion (US $6.5 billion) bail out plan for Taiwan’s hard-hit DRAM makers.

Sitting in India makes it a little difficult to speak with global companies based in Taiwan, Korea and Germany. I sometimes wish I could get some help from reliable sources as to what’s the actual ground situation.

Having said that, it is good to see various national governments showing their deep concern about the state of the global DRAM industry and about technologies. And, let us keep all criticisms aside, as to who performed and who didn’t! Here’s a lesson for India to learn from, as closer home, it has a semiconductor industry really in its infancy!

Right now, the global semiconductor industry is facing a downturn and memory is the hardest hit! Hence, if any measures are being taken to somehow bring DRAM back on track, it should be welcomed.

Qimonda, Hynix, Powerchip, etc., are not small names in the global industry. Poor performance from memory players saw them dropping out of the top 20 global semiconductor players’ rankings in 2008.

All the lifelines being provided to these major players now means that these companies need to pull it off, somehow, and extricate themselves from the depths they have fallen into. If they fail, they will perish! And, they all know that!!

I’d be very keen to see the responses of DRAMeXchange and iSuppli on these bail out plans.

Merry X’mas everyone, and hope you all have a great time!

PS: I have iSuppli’s feedback!

Speaking on the Taiwan government’s bail-out plan as well as Hynix’s rescue package from banks, John Lei, Analyst, memory, iSuppli Corp., said: “In general, Hynix’s package is much like a short-term relief for their near-term debt, while the Taiwan government aims at the possible consolidation of five suppliers.”

“All these packages could bring more uncertainties to the maket, however, based on iSuppli’s assumption and forecasts. The industry operation profit margin will hit bottom in Q4-08, but profitability of the industry will not occur until Q4-09,” he added.

90pc fab investments for 300mm capacity: SEMI

Recently, SEMI (Semiconductor Equipment and Materials International) released its World Fab Forecast report. This report mentions that projected decline in world semiconductor fab equipment spending of 20 percent is likely for 2008. However, a rebound of over 20 percent in spending is expected in 2009, driven by over 70 fab projects.

The August 2008 edition of this report lists 53 fab equipping projects and up to 21 construction projects for fabs in 2009. It is sincerely hoped that at least one of the fabs likely from the Southeast Asian region is from India!

With the help of Scott Smith Senior Manager, Public Relations, SEMI, I was able to get in touch with Christian Gregor Dieseldorff, Senior Manager of Fab Information and Analysis at SEMI, in an attempt to find out more about the decline in global fab spends, these new fabs, and how these fabs can lead a turnaround in the global semiconductor industry. Thanks Scott!

So what are the chief reasons for the decline in fab spends during 2008? According to Dieseldorff, given the weaker economic conditions globally, coupled with higher energy and commodity prices and the financial crisis, the overall outlook for semiconductor growth in 2008 is for low-single digit growth in both revenues and units. As such, device makers have responded by cutting back their capital spending and pushing out fab projects or putting them on hold.

So what are the chief reasons for the decline in fab spends during 2008? According to Dieseldorff, given the weaker economic conditions globally, coupled with higher energy and commodity prices and the financial crisis, the overall outlook for semiconductor growth in 2008 is for low-single digit growth in both revenues and units. As such, device makers have responded by cutting back their capital spending and pushing out fab projects or putting them on hold.

I was keen to find out the geographic breakup of these 70 new fabs that are likely yo come up in 2009.

Dieseldorff advised that these are not 70 new fabs coming up in 2009. Rather, the numbers reflect 300mm fabs only, and is a mix of on-going and new projects for fabs equipping and fab construction projects in 2009.

For equipping 300mm fabs, SEMI expects about: Americas 8, China 5, Europe and Mideast 4, Japan 7, South Korea 11, SE Asia 3 and Taiwan 15.

For 300mm fab construction projects, SEMI expects about: Americas 3, China 2, Europe and Mideast 1, Japan 2, South Korea 3, SE Asia 2 and Taiwan 8.

What are the salient features of some of these new fabs likely to come up next year (for instance, new tech nodes)? Dieseldorff highlighted that about 90 percent of the investments are for 300mm capacity, and the amount of spending for advanced nodes, such as 65nm, is increasing.

“Also, device makers are building larger fabs, which are termed “mega fabs,” so, to potentially realize a greater return based on scales of economy,” he added.

How will these new fabs contribute to a better performance from the global semicon industry? This will be quite interesting to witness.

Dieseldorff said that over the past several years, demand for semiconductor devices has been quite strong, and so, the industry has had to bring on capacity to support this need, both in terms of needed capacity and technology. Even with the slower market growth in 2008, recent industry data shows healthy levels of fab capacity utilization, especially for the advanced technology generations and for 300mm manufacturing.

He added: “The expectation is that demand for semiconductors will strengthen once global economic conditions improve. So, the capacity addition that is coming online this year and the fab projects that are equipping and beginning construction in 2009 are necessary to meet the future demand.”

So how will all of this affect the overall memory market (e.g., 42pc increase in share for memory)? Dieseldorff shared his thought, a fact, known well to those in the semiconductor industry, that the memory market has been battered by declining average selling prices and a condition termed by some as “profitless prosperity.”

“Looking at demand forecasts specific to memory, tremendous growth is anticipated,” he forecasted.

However, the manufacturers in this device segment are battling it out for market share, and the general expectation is that consolidation will continue.

Also, joint-ventures and partnerships are becoming increasingly critical in the memory sector as manufacturers seek to leverage their existing resources to meet future technology and capacity requirements.

It would be interesting to find out why Taiwan and Korea are forecasted as likely to exceed Japan in fab spend?

According to Dieseldorff, in Korea, Samsung has been and is the key spender, and as a company, it will continue to invest so to have a dominant share in the memory sector.

He said: “In 2009, our expectation is for the DRAM manufacturers in Taiwan to boost spending after cutting back this year. We expect seven new 300 mm fab lines in Taiwan to come into production over the next two years.”

However, spending in Japan has been more measured and is likely to remain so. Toshiba, and its joint-venture partner, Sandisk are the big spenders in Japan, when it comes to new fab capacity. Other Japanese semiconductor manufacturers are more cautious and are focused more on technology spending.

New camps promise exciting times ahead in memory market

The last few weeks of this month witnessed some interesting developments in DRAM. No, there are not signs of a recovery, yet. Instead, the appearance of new DRAM camps, as well as a new memory interface working group, does generate some interest.

However, first, the stats. DRAMeXchange recently reported that the Q1-08 revenues of the branded DRAM makers, impacted by continual low DRAM prices, fell by roughly 5.8 percent compared to Q4-07. Likewise, the contract prices and the spot prices fell 19 percent and 11 percent respectively.

DRAMeXchange further reported that barring Elpida and Powerchip, all other DRAM makers experienced a decline in revenues. Both Elpida and Powerchip witnessed slight increase in their market share during Q1-08.

Categorizing the DRAM industry market share by countries, Japan only increased by 0.9 percent from 13.5 percent to 14.4 percent, as Elpida’s revenue increased in Q108. Taiwan’s share increased by only 1.1 percent from 13.6 percent to 14.7 percent, as Powerchip gained market share. Korea sustained the same market shares — 47.2 percent, as in Q4-07.

However, America and Germany lost share. America’s share slipped from 13.6 percent to 13 percent, while Germany’s share fell from 12.2 percent to 10.8 percent, respectively.

In a recent investor conference, Samsung announced it will increase its Bit Growth Rate from 70 percent to 100 percent, an indication of its desire to continue reigning as a DRAM market leader.

Now, to the really interesting developments. First, Nanya and Micron signed an agreement to create MeiYa Technology Corp., a new DRAM joint venture. One of Nanya’s 200mm facility in Taiwan will be upgraded to 300mm starting this year, with the facility going online for production in 2009. Besides MeiYa, Nanya and Micron will co-develop and share future technology.

If this wasn’t enough, close on the heels of the Micron-Nanya JV, Elpida Memory and Qimonda AG, signed a Memorandum of Understanding (MoU) for a technology partnership for jointly developing memory chips (DRAMs), and accelerate their roadmap to DRAM products featuring cell sizes of 4F2.

Analysts at DRAMeXchange believe that the Qimonda-Elpida alliance re-shuffles the DRAM competitive landscape. It is also a sign of Qimonda’s determination to develop stacked process.

Lastly, ARM, Hynix Semiconductor Inc., LG Electronics, Samsung Electronics, Silicon Image Inc., Sony Ericsson Mobile Communications AB, and STMicroelectronics announced the formation of a working group, the Serial Port Memory Technology (SPMT), which is committed to creating an open standard for next-generation memory interface technology targeting mobile devices.

SPMT, a first-of-its-kind memory standard for DRAM, is said to enable an extended battery life, bandwidth flexibility, significantly reduced pin count, lower power demand and multiple ports by using a serial interface instead of a parallel interface commonly used in today’s memory devices.

Handset vendors have joined the fray as this technology will not only extend battery life, it will allow high-performance media-rich applications as well, that are likely to be the norm on next-generation mobile phones.

Surely, these developments and the emergence of new camps promise some exciting times ahead in the memory market.