Archive

Infineon's wireless strategy focuses on low cost solutions and smartphones

However, post the meeting, to my horror, I misplaced my notes and only managed to locate them last week. My apologies to Infineon for being late with this blog post.

I was able to discuss Infineon’s wireless strategy with Dr Ludwig and also managed a peek at Infineon’s range of microcontrollers during my discussion with Peter Schaefer. First, let’s have a look at the company’s wireless strategy.

Dr Matthias Ludwig said: “We are good in RF and baseband. There are about 1.5 billion RF transceivers out there globally, from Infineon.” He added that one third of the market falls in the low cost mobile phone segment.

Infineon’s wireless strategy is two fold — low cost solutions and the smartphone platform — where the company is focusing on the modem and the RF side, respectively. Infineon’s Android based smartphone platform uses an ARM 11 baseband. “Customers can come up with their own application processor,” Dr Ludwig said. “Our strategy gives us a lot of flexibility.”

He mentioned that Infineon receives a lot of requests from customers for smartphones at $100 solutions. “We believe that we can manage our single core Android platform in the $100 segment.”

Thanks to Dr Ludwig, I had a first hand experience of some of the smartphones that Infineon is currently working on. Actually, think about it! A $100 dollar (and even sub $100) smartphone may be just the thing Indians would love to have.

As for Infineon’s India strategy — part of the focus is on low cost. “We know that there is tough competition out there,” noted Dr. Ludwig. One other aspect that Infineon is focusing on is: how to develop and build an ecosystem in the country.

Of course, Infineon is also looking beyond the Indian market when it is developing solutions. In that respect, Dr Ludwig added that one of Infineon’s focus is to find the sweet spots that are not only of interest to India. “There is a certain drive to have low end products. Safety and reliability of the products are also important,” he concluded.

I will add a separate post on the conversation with Peter Schaefer, VP & GM, Head Microcontrollers, Infineon.

Round-up 2009: Best of semiconductors

Right folks! We’ve now come down to the last day of what has been one of the worst years, or the worst year ever, in the history of the global semiconductor industry!

After a very tough first half of 2009, things did start looking up in the second half, and that trend has continued right up to the end of the year. It is a sincere wish that this trend continues well into 2010 and 2011, thereby allowing the industry to scale great heights again.

Presenting a list of leading semiconductor industry related posts that mattered in 2009. Here you go!

SEMICONDUCTORS

Reviewing global/Indian semicon industry in 2008 — top posts

Consumer MEMS shine amid gloom: iSuppli

Global semi to dip by 28pc in 2009; Indian semi to grow at 13.4pc by 2010! Don’t get carried away!!

What the semiconductor industry should do in 2009!

Indian semiconductor market to reach $7.59bn by 2010!

Global semiconductor industry could well see revival in 2010?

Can the Indian semicon industry dream big? (And even buy Qimonda?)

Indian silicon wafer fab story seems dead and buried! Should we revive it? — A topic everyone loves to talk about, but do very little!

ISA Vision Summit 2009 lacks the punch!

What India now offers to global semicon industry! — Need to look beyond embedded and design services! Top read!!

ISA Vision Summit 2009: Indian design influence, ideas to volume

Definite need for rethink on India’s fab strategy!

Time for Indian semicon to step up! Yes or No?

Infineon on India’s e-passport and semicon industry

Indian chip industry dead? You’ve got to be kidding me!

How semicon firms can achieve high performance by simplifying business!

How semicon firms can achieve high performance — Part II

ISA’s BV Naidu on India’s way forward in semiconductors

Clearly, mixed signals in OEM semiconductor design activities!

What needs to be done to boost chip designing activities in India?

Freescale’s Rich Beyer on semicon and industry trends

Cypress on Indian semicon industry trends; launches PSoC 3 and PSoC 5 architectures

Chip market outlook: Back to normal abnormality? — Malcolm Penn @ IEF2009, Geneva

Excerpts from Future Horizons’ International Electronics Forum 2009 @ Geneva

Excerpts from Future Horizons’ IEF 2009 — II

Strong semicon industry recovery likely in 2010! — The first signs of recovery for an industry in trouble!

What does it take for students to be (semiconductor) industry-ready! — a top read article, especially for students!

Building pillars of India’s tech infrastructure: Dr. Bobby Mitra, TI India

Top 20 semicon suppliers of 2009! — One of the most read articles of the year!

Future Horizons signs me as its India affiliate! — I can’t wait to do events, research reports etc. in India! 😉

2009 ending with lot of positives for global semiconductor industry

Semicon update Dec. ‘09: Q4’s off to a great start; is ‘plan B’ in your back pocket?

Nov. 09 update: -10 percent growth in 2009, +22 percent minimum for 2010, says Future Horizons

My dear friends, it has been an absolute pleasure bringing to you the trials and triumphs of the global and Indian semiconductor industry this year. Hope to carry this forward in 2010 and beyond.

In case I’ve missed out certain posts, do point out those. A list of posts related to EDA and embedded systems are presented elsewhere on this blog. Also, it is not possible for me to select the top 10 articles for the year. If anyone of you can, I’d be very delighted.

My best wishes to you, your families and loved ones for a happy and prosperous 2010. Take care, God bless, and see you all very soon next year!

Infineon on India's e-passport and semicon industry

If you have ever been a resident of Hong Kong, you’d know what an e-passport looks like! You would have even used it! For example, if you were crossing over into Shenzhen, China, from Lo Wu, which is on the borders of Luohu district within Hong Kong and the city of Shenzhen in Guangdong province, China, [having reached there via the KCR (Kowloon-Canton Railway)] — you can easily use your Hong Kong e-passport to get past the immigration point and enter China!

It is really easy! Simply drop your e-passport into the e-passport reader slot and place your finger on the fingerprint reader for it to scan and read. Once your e-passport comes out, move over to the other side to another e-passport reader, repeat the same exercise, and you’re done! All it takes is less than a minute!

All Indians could soon have e-passports!

Well, such an e-passport can become a reality in India soon! If you haven’t heard it, Infineon Technologies recently supplied contactless security microcontrollers (MCUs) for India’s electronic passport (e-passport) program! The Indian e-passport rollout started with Indian diplomats and officials being issued e-passports — around 30,000 to be issued in phase one. It is likely that by September 2009, the e-passports will be extended to the general public.

The rollout has started with the issuance of electronic passports to Indian diplomats and officials. It is expected that in this first phase, up to 30,000 electronic passports shall be issued. By September 2009, the program is likely to be expanded to include passports used by the general public. Today, around 6 million passports are being annually issued in India. I believe, the government of India has invited a new tender for interested stakeholders to bid for 20 million e-passports.

So, being a Hong Kong e-passport holder, I was interested in knowing whether the Indian version is as smart as that particular one? By the way, Hong Kong’s e-passport also doubles up as your Hong Kong ID (HKID) card. If you don’t have one, you simply cannot do business in Hong Kong! Your HKID number is unique and remains unchanged!

Dr. Rajiv Jain, Vice President and Managing Director, Infineon Technologies India Pvt Ltd, said that both Hong Kong and India are using the same product family from Infineon. “The security levels of both e-passports are based on the Common Criteria EAL 5+, the highest possible security certification for MCUs. In addition, both comply to ICAO requirements, the international standard for e-passports.”

Dr. Rajiv Jain, Vice President and Managing Director, Infineon Technologies India Pvt Ltd, said that both Hong Kong and India are using the same product family from Infineon. “The security levels of both e-passports are based on the Common Criteria EAL 5+, the highest possible security certification for MCUs. In addition, both comply to ICAO requirements, the international standard for e-passports.”

Infineon’s SLE 66CLX800PE security MCU provides advanced performance and high execution speeds, and was specifically designed for use in electronic passports, identity cards, e-government cards and payment cards. Sounds very interesting!

Highlights of Infineon’s security MCU

The security MCU features a crypto-coprocessor and can operate at very high transaction speeds of up to 848kbits/s even if the elevated encryption and decryption operations have to be calculated.

The SLE 66CLX800PE offers all contactless proximity interfaces on a single chip: the ISO/IEC 14443 type B interface and type A interface, and both used for communication between electronics passports and the respective readers; and the ISO/IEC 18092 passive mode interface, which is used in transport and banking applications. The SLE 66CLX800PE features 80 kilobytes (kb) of EEPROM, 240kb of ROM, and 6kb of RAM.

The SLE 66PE contactless controller family, which includes the SLE 66CLX800PE, is certified according to Common Criteria EAL 5+ high (BSI-PP-0002 protection profile) security certification. Infineon’s security in MCUs used in e-passports builds on the underlying hardware-based integral security, with data encryption, memory firewall system and other security mechanisms to safeguard the privacy of data.

The SLE 66PE product family comprises a whole product portfolio designed for use in basic-security to high-security smart card systems, with the EEPROM sizes ranging from 4kb to144kb, and covering different applications including government ID, transportation and payment.

Infineon’s perception of Indian semiconductor industry

So much about the e-passport! I can’t wait to get my hands on one! Since I was in a discussion with Infineon, it naturally turned toward the Indian semiconductor industry and what needs to be done!

Dr. Jain said: “The Indian semiconductor industry has seen its share of successes and misses. The in-depth technical talent required for design and development is omni-present (TI, Intel, Infineon, Wipro, etc., to name a few). For example, we are doing critical R&D in the areas of automotive electronics, broadband, mobile communications and secured ID solutions at Infineon India, and the fact that it is one of the largest centres in Infineon’s global R&D network, is a testimony to India’s importance as the destination for cutting edge research. This has also led to creation of home-grown design houses offering services to the larger companies.

“We are also seeing in some small, but growing numbers, products and ideas for local markets. As the local markets evolve, so will the ability of these companies to deliver innovation for these local markets, which can then be taken globally.”

He added that an area of debate has been the need for semiconductor manufacturing in India. For example, having fabs, test and packaging plants, and EMS. “There have been government initiatives with a few successes. However, financial, tax-related and custom-related investment in these areas needs to come together and be centrally driven from a long-term perspective, as these institutions, which can provide a stable manufacturing base, need larger efforts to be successful.”

Hopefully, we will finally get to see some action on all of these areas post the Indian general elections due shortly.

PS: Just to let all of my friends know, I am no longer associated with either CIOL or its semiconductors web site.

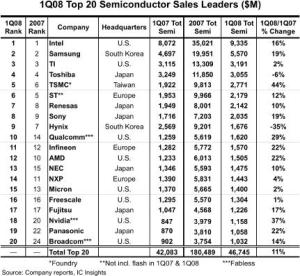

Top 20 global semicon companies — DRAM, Flash suppliers drop out

IC Insights recently published the May update to The McClean Report, featuring the Top 20 global semiconductor companies. Not surprisingly, there have been some significant movers and shakers. The most telling — quite a few of the major DRAM and Flash suppliers have dropped out of the Top 20 list!

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

First the movers! Fabless supplier Qualcomm jumped up four spots, ranking as the 10th largest semiconductor supplier in Q1-08. Next, Broadcom, the third largest fabless supplier, also moved up four positions, up to the 20th position. Panasonic (earlier, Matsushita), moved up to the 19th position, while NEC of Japan moved up to the 13th position.

TSMC, the leading foundry, moved up one position, registering the highest — 44 percent — year-over-year Q1-08 growth rate, besides being ranked 5th. Nvidia, the second largest fabless supplier, was another company registering a high YoY growth rate of 37 percent, and moved into the 18th position. Some others like Infineon, Sony and Renesas also climbed a place higher each, respectively. The top four retained their positions — Intel, Samsung, TI and Toshiba.

And now, the shakers! The volatile DRAM and Flash markets have ensured the exit of several well known names such as Qimonda, Elpida, Spansion, Powerchip, Nanya, etc., from the list of the top 20 global semiconductor companies, at least for now.

Among the others in the list, the biggest drops were registered by NXP, which dropped to 14th from 11th last year, and AMD, which dropped two places, from 10th to 12th. Two memory suppliers — Hynix and Micron — also slipped two places, to 9th and 15th places, respectively. STMicroelectronics also slipped from 5th to 6th. IBM too slipped out of the top 20 list.

The top 20 global semiconductor firms comprises of eight US companies (including three fabless suppliers), six Japanese, three European, two South Korean, and one Taiwanese foundry (TSMC). Also, looking at the realities of the foundry market, TSMC’s lead is now unassailable. If TSMC was an IDM, it would be No. 2, challenging Intel and passing Samsung, said one analyst, recently, a thought shared by many.

IC Insights has reported that since the Euro and the Yen are strong against the dollar, this effect will impact global semiconductor market figures when reported in US dollars this year.

There are some other things to watch out for. Following a miserable 2007, the global DRAM module market is likely to rebound gradually in 2008 due to the projected recovery in the overall memory industry, according to an iSuppli report. That remains to be seen.

Some new DRAM camps — such as Elpida-Qimonda, and Micron-Nanya — have been formed. It will be interesting to see how these perform, as will be the performance of ST-backed Numonyx.

Further, the oversupply of NAND Flash worsened in Q1-08, impacted by the effect of the US sub-prime mortgage loan and a slow season, according to DRAMeXchange. The NAND Flash ASP fell about 35 percent compared to Q4-07. Although the overall bit shipment grew about 30 percent compared to Q4-07, the total Q1-08 sales of branded NAND Flash makers fell 15.8 percent QoQ to US$3.24bn. Will the NAND Flash market recover and by when?

Top 10 semicon firms of 2007 by revenue

According to Gartner, the top 10 semiconductor firms for 2007 by revenue are: Intel, Samsung Electronics, Toshiba, Texas Instruments, STMicroelectronics, Infineon Technologies (including Qimonda), Hynix Semiconductor, Renesas Technology, NXP Semiconductors, and NEC Electronics.

Worldwide semiconductor revenue totaled $270.3 billion in 2007, a 2.9 percent increase from 2006, according to preliminary results from Gartner Inc.

Vendor performances were mixed with two vendors in the top 10 that experienced double-digit growth and two vendors that showed declines in revenue.

“Semiconductor vendors need to watch the performance of their end customers even closer as a major part of the industry becomes increasingly tied to consumer spending patterns,” said Andrew Norwood, research vice president at Gartner. “Loss of market share in an end-user application, such as a mobile phone, by a customer (a mobile phone manufacturer) can have a dramatic effect on a vendor’s business.”

Intel grew revenue more than twice as fast as the semiconductor market average, and it is likely to edge up its market share to 12.2 percent in 2007 from 11.6 percent in 2006.

Intel’s growth came primarily from strong shipments of mobile PCs. Armed with a strong product lineup for enthusiast desktops and servers, Intel regained lost share in those markets from AMD.

While the global market for dynamic random-access memory (DRAM) is expected to decline in 2007 due to a severe drop in prices caused by oversupply, Samsung Electronics is likely to increase its revenue by slightly higher than the overall global semiconductor market growth rate (DRAM is one the firm’s main products).

Samsung’s growth is driven by steady revenue growth in NAND flash memory and strong revenue growth in nonmemory areas such as application processors, media integrated circuits (IC), complementary metal-oxide semiconductor (CMOS) image sensor, smart card ICs and LCD driver ICs.

Toshiba’s revenue increased 27.8 percent in 2007 to $12,504 million, gaining three places in the rankings and moving into third place. The rapid gains mainly came from NAND flash memory.

Toshiba also increased production of CMOS image sensors for mobile phones and application-specific integrated circuits (ASICs)/application-specific standard products (ASSPs) revenue for digital consumer electronics, including LCD TVs, next-generation DVDs (HD DVDs) and video game consoles.

Shifts in top 20 global semicon rankings

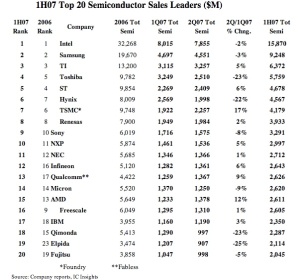

If the recent preliminary results released by IC Insights is anything to go by, there have been some movements among the top 20 semiconductor companies of the world during H1-2007. This is best illustrated by the table below.

While the top three — Intel, Samsung and TI, retain their positions, ST and Toshiba have exchanged the next two positions, as have Hynix and TSMC, while Renesas remains at no. 8!

Freescale has taken a big drop from no. 9 to no. 16, while Sony, NXP and NEC gained one place each. Infineon has climbed back up to no. 12, from no. 16, while Qualcomm occupies the no. 13 position, up from no. 17. AMD dropped two positions, from no. 13 to no. 15.

Will the semicon industry see a tight year ahead? As per reports, IC Insights said that there should be a “noticeable seasonal rebound” in overall IC demand beginning in September 2007, which may cause “significant changes” in the top 20 semiconductor ranking in the second half of 2007. Wait and watch this space!

Paradigm shift indeed in semicon

Going through an article written by Dr. Wolfgang Ziebart, Member of the Management Board, President and CEO, Infineon Technologies, in Financial Times Deutschland, one cannot help but appreciate the great paradigm shift that has indeed taken place in the semiconductor industry.

The article titled: A paradigm shift in the semiconductor industry: Could this be the end of Moore’s Law? focuses on how changing technologies are indeed making life difficult for most market players to keep pace with all those changes.

The technical possibilities for shrinking chips have far from reached their limits at 65nm. There are preparations already on for 45nm and development work for 32nm has already started!

When PULLNANO announced breakthrough results for 32/22nm, did it surprise many? The PULLNANO consortium has fabricated a functional SRAM using innovative MOS transistors whose device architecture differs significantly from that of transistors used in 45nm technology node.

It talks about a compact SRAM cell that has been fabricated using FDSOI (Fully Depleted Silicon On Insulator), high-k dielectric and metal gate all together.

PULLNANO has demonstrated that the material and integration schemes used in 45nm generation can be modified to provide a robust solution at 32nm. It has also proposed an innovative new architecture that could provide even higher performance at 32nm and 22nm, using the so-called ‘air gap’ technique.

I do remember Dr Pradip Dutta of Synopsys India telling me about two months ago about 32nm, during a course of a telephonic conversation about ndia’s moves in the semicon space.

After that conversation, I was wondering how quickly semicon technology had started to move. How quickly, from a has-been all these years, India was suddenly emerging as a semicon base to reckon with. How quickly, the geometry had moved from 90nm to, now, 22nm!

Dr Dutta also added that there would be more emphasis in India on doing high-end designs. In fact, whether it is frequency, number of gates, high complexity, etc., all of those would be driven by applications. India is now ready for doing high-end complex designs.

Indian companies are now definitely excelling in the design services sector. Some of them have also grown significantly. It is believed that they have also taken a load off the international design services company. Some of these Indian companies are now also developing their own IPs — a paradigm shift in itself!

India's semicon policy takes off

Close on the heels of the historic Indian semicon policy announced earlier this year comes the news that Hindustan Semiconductor Manufacturing Corporation (HSMC) would be setting up a semicon foundry in India partnering with Infineon Technologies for CMOS licences. It’s no surprise to see Infineon among the early movers as Infineon has been present in India for quite a while now.

This is excellent news as far as the Indian semiconductor industry is concerned. I remember the day the India Semiconductor Association (ISA) was formed in Bangalore in early November 2004. The ISA is a very young industry body and all kudos to it for having taken forward the Indian industry so very well.

Congratulations are also due to Honourable minister, Dayanidhi Maran for having the foresight and for believing in the semiconductor industry.

Not only would the semicon industry boost India’s GDP in the coming years, the policy should also see India emerging as a destination of choice for manufacturing of high-tech products in the future.

This January, while attending the VLSI conference in Bangalore, I had the pleasure of learning about the various incentives some of the state governments, such as those of Karnataka, Kerala, Tamil Nadu and West Bengal have to offer to investors.

Other state governments should come forward as well and make India’s dream of becoming a semicon giant a success and help the semicon policy really take off.

Following HSMC’s announcement, we have now come to expect more such announcements in the near future. All of this really augurs well for India. It will also change the global perception that India is the destination for software and outsourcing.

We can do it. Time to show the world. Well done ISA. Well done Minister. And well done HSMC and Infineon