Archive

NXP India's Rajeev Mehtani on top trends in global/Indian electronics and semicon!

When a new year approaches, we start analyzing the year gone by and try to gauge what could happen in the coming year. This really holds true, as far as the technology industry is concerned.

When a new year approaches, we start analyzing the year gone by and try to gauge what could happen in the coming year. This really holds true, as far as the technology industry is concerned.

It’s been a week since I’ve been mulling over these myself, especially, pondering over developments in the global semiconductor and electronics industries, as well as what could happen in India during 2009. Well, lots will happen, and I can’t wait for the new year to start!

I caught up with Rajeev Mehtani, vice president and managing director, NXP Semiconductors, India, and discussed in depth about the trends for 2009. Here’s a look at that discussion.

INDIA — ELECTRONICS & SEMICONDUCTORS

1. The DTH story will continue to increase in India with companies such as Tata Sky, DISH TV, BIG TV, etc., gaining market share. Owing to these challenges, there would be significant consolidation among the cable operators. Digitalization will also be seen in 2009.

2. The slowdown will affect growth across all sectors. Our view is that LCD TVs as well as STBs will continue to grow.

3. The year 2009 will witness e-commerce revolution and the RFID sector will grow at a 40-50 percent clip. The government has been sponsoring a lot of projects, which include RFID in the metros, e-passport cards and national ID cards. By mid-2009, we can expect a mass deployment of these projects as well as micro payments.

4. Manufacturing in India will continue to grow; EMS or OEMs, such as Samsung, Nokia, Flextronics, etc.

5. There could be a move from services to products in electronics and semiconductor spaces. The number of funded startups has grown significantly over the last years and more and more ideas are coming on the table.

6. The solar/PV sector will grow in India. High entry cost of capital for panels will be a barrier for this sector. Government enhancement is necessary. India will be different than other countries as people won’t push energy back into the grid; it will be used more for household consumption. The India grid is unstable. Tracking it requires a lot of expensive electronic switching. Solar deployment could be at the micro level, and also community level, where it makes more sense.

7. The startups in India are mostly Web 2.0 based, although there aren’t many hardware startups.

GLOBAL — ELECTRONICS & SEMICONDUCTORS

1. The semiconductor industry is truly global, That is mostly because it is a very expensive industry.

2. Things are a bit murky in the semiconductor industry. It would probably be dipping 10-15 percent next year.

3. Globally, energy management and home automation will start to take off in 2009. Satellite broadcasters will also continue to gain more strength.

4. On a worldwide scale, 3G will win. You will have 3G phones, and you’d add LTE to those. India is slightly different. Only 20 percent of Indian households are ready for broadband access. In India, WiMAX could be a way to have wireless broadband at home.

5. Industries moving to 300mm fabs will be making up only 20-25pc of the market. Not many need 45nm or 40nm chips. People will question any major capex, until there’s a big return and wait for recession to end. The bright spot is solar!

6. The fabless strategy would be the only way to go forward. While MNCs with fabless strategy are present in India, Indian startups in this space are quite few.

India's growing might in global semicon

It is no longer a secret that India is fast becoming the world’s destination, and increasingly the source too, for semiconductors. India also shows the most rapid growth potential among the BRIC countries.

Speaking at the recently held International Electronics Forum (IEF) 2008 at Dubai, organized by Future Horizons, S.Janakiraman, the outgoing Chairman – India Semiconductor Association, and President & CEO – R&D services, MindTree Ltd, touched upon India’s growing might as a being the third largest country in terms of purchasing power parity, as well as its growing presence in the global semiconductor industry.

It is no surprise that the current market drivers in India happen to be mobile phone services, IT services/BPO, automobiles and IT hardware. Add to these are the facts that India is very strong in design tools, system architecture and VLSI design, has quite strong IP protection laws, and is quite strong in concept/innovation as far as the semiconductor industry is concerned.

Testing and packaging are in the nascent stage. While India lacks a semicon wafer fab, as of now, there have been several announcements regarding solar fabs by leading firms such as Videocon, Moser Baer, Reliance, etc.

In the electronics manufacturing domain, India’s strength lies in hardware, embedded software and industrial design, OEMs, component distribution (includes semiconductor and box build), and end user/distribution channel, as well as more than moderate strength in product design and manufacturing (ODM, EMS).

India is likely to witness $363 billion of equipment consumption and $155 billion of domestic production by 2015. India’s electronic equipment consumption in 2005 was 1.8 percent. It is likely to grow to 5.5 percent in 2010 and 11 percent in 2015, as per a joint study conducted by the ISA and Frost & Sullivan.

The Indian semiconductor TAM (total available market) revenue is likely to grow by 2.5 times while the TM (total market) is likely to double revenues in 2009. The TAM is likely to grow at a CAGR of 35.8 percent and the TM is likely to grow at a CAGR of 26.7 percent, respectively, during the period 2006-09.

Telecom, and IT and office automation are currently the leading segments in both TM and TAM. Consumer segment occupies the third fastest growing area in the TM, while the industrial segment is the third fastest growing area in the TAM.

The major semiconductor categories include microprocessors, analog, memory, discrete and ASIC, while the major end use products include mobile handsets, BTS, desktops, notebooks, set-top boxes and CRT TVs.

Emerging base of EMS firms

India is also becoming an emerging base of EMS companies, thereby completing the electronics ecosystem. Five of the top 15 EMS companies globally have set up their manufacturing facilities in India. These include Celestica, Elcoteq, Flextronics, Jabil Circuit and Solectron. Two other large companies are in the process of setting up plants — Hon Hai Precision Industry and Sanmina-SCI.

Nokia has set up its manufacturing facility as well. It has invested $210 million in the plant since January 2006. The India plant has set another benchmark of achieving the fastest ramp up across all Nokia facilities worldwide. Currently, approximately 50 percent of the production from the plant is consumed domestically and the rest is exported to other countries.

Indian embedded design industry

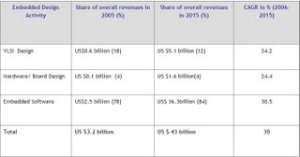

The Indian embedded design industry has been going from strength to strength. The recent IDC-ISA report puts revenues from India’s VLSI, board design and embedded software industry to grow to $10.96bn by 2010 from the current $6.08bn in 2007.

As of 2007, embedded has 81.1 percent share, hardware board design 6.3 percent; and VLSI design 12.3 percent, respectively. Source: ISA.

Source: ISA.

The challenges and focus areas for the embedded design industry include manpower — focusing on increasing productivity, creating readily deployable engineering workforce, and focusing on developing high-end skills.

Another area India is working on is moving up the semiconductor value chain. India is now focusing on end-to-end product development, investing in IP development, developing India specific products, and partnering with OEMs to understand the market needs.

The challenge is posed by the cost structure. India needs to better address cost management, i.e., increasing infrastructure and salary costs, as well as managing the dollar’s impact.

India design inside

Several global products have been now developed out of India. Some recent examples are: Harita Infoserve Ltd is developing interior parts and conducting computer tests on components for General Motors Corp.

Next, Ittiam’s videophone design will become almost entirely an India story: part of the chip, the product design, the software and, finally, the manufacturing also done here. Plexion Technologies has worked on the interior design and windows for a DaimlerChrysler (DCX) bus.

Quasar Innovations designed and developed a dual SIM card — PTL910 mobile phone for Primus, to be launched in the European market. The mobile phone allows the user to have SIM cards from Primus for two countries, with the phone automatically choosing the correct SIM depending on the user’s location.

Finally, MindTree itself has designed a feature rich satellite handset with mobile handset form factor for a European company.

Attractive semicon policy

India’s semiconductor policy is likely to attract investments of over $10bn. The government of India will bear 20 percent of the capital expenditure during the first 10 years for units located inside SEZs and 25 percent for those outside.

For semiconductor manufacturing (wafer fabs) plants, the policy proposes a minimum investment of $625mn. The same for ancillary plants would be $250mn.

The government’s participation in the projects would be limited to 26 percent of the equity portion. The key benefit here is the grant of the SEZ status.

India’s evolving ecosystem is driven by the bottom of the pyramid (BOP) opportunity. Tata Motors announced the now famous Nano — the Rs. 1 lakh (sub $2500) car -– said to be the world’s cheapest car. This has been indigenously developed in India, for India, by Tata Motors.

Nano has passed all mandatory crash tests and Euro IV norms. It is likely to be commercially launched in the second half of 2008.

All of these make India the most happening semiconductor and electronics destination. Don’t be surprised if companies not having an India strategy in place miss out on the action!

Random Posts

- Need to develop indigenous manufacturing capacity in solar: Deepak Gupta

- Want to enter solar off-grid business? Build your own solar LED lanterns and emergency lights!

- Solar/PV is just right for India

- Disruptions to global electronics supply chain following Japan's quake!

- Fellow bloggers, add traffic using Widgetbox Blog Network!

Tag Cloud

3G 32nm AMD ARM China chip design DRAM DRAMeXchange EDA EDA tools embedded design embedded systems and software fabless fabs FPGAs Freescale Future Horizons global semiconductor industry global semiconductor market Hynix IC Insights India Indian semiconductor industry Indian solar/PV industry India Semiconductor Association India semiconductor market Intel iSuppli low-power design Malcolm Penn memory market mobile phones NAND Qimonda S. Janakiraman Samsung SEMI Semicon Semiconductors solar solar/PV solar cells Synopsys Taiwan TICategories

- 22nm

- 32nm

- 3G

- 3G spectrum

- 40nm

- 450mm

- 45nm

- 4G

- 65nm

- 802.11n

- 90nm

- A.Raja

- Aart De Geus

- Abhi Talwalkar

- Accellera

- Accenture

- access control

- Agilent

- Altera

- Aluminum electrolytic capacitors

- AMD

- AMS

- Analog Devices

- analog ICs

- analog mixed signal

- analog/RF

- analog/RF competency center

- Anand Chandrasekher

- Anil Gupta

- Ankush Oberai

- Apple

- Apple TV

- Applied Materials

- AqTronics

- ARIB

- ARM

- Asia

- Asiaworld Expo

- ASICs

- ASML

- ASPs

- ASSPs

- ASUS

- Atom

- Atom processor

- AUSPI

- automotive

- automotive electronics

- Bali

- bandwidth costs

- Bangalore

- Bangalore Nano 2007

- Bangalore serial blasts of July 25

- Bangkok

- Barack Obama

- Beagle Board

- Beceem

- Beijing Olympics

- Belliappa Kuttanna

- biometrics

- BIPV

- Blackberry

- Blade.org

- bloggers

- Blogging

- blogs

- board design

- Bosch Sensortec

- Brazil

- Brent Przybus

- Broadband

- Broadcom

- building integrated photovoltaics

- BV Naidu

- C++

- C-DoT

- C-to-Silicon Compiler

- Cadence

- Calpella

- carrier Ethernet

- CDG

- CDMA

- CDMA Development Group

- CDMA2000

- CDNLive

- CEA

- CEATEC

- cell phones

- Cellworks

- Charlie Hartley

- Chartered Semiconductor

- Chelsio

- Chi-Foon Chan

- Chimera

- China

- China Mobile

- China Sourcing Fair

- China Telecom

- China's IC industry

- China/Hong Kong

- Chinese semiconductor industry

- chip design

- chip designers

- Chip fabs

- chip industry

- chip makers

- chip market

- chip suppliers

- chips

- Christian Gregor Dieseldorff

- CIOL

- CIOs

- Cir-Q-Tech

- cloud computing

- CMOS

- CMOS camera modules

- CMP

- co-verification tools

- COAI

- communications

- components

- COMPUTEX

- Computex Taipei

- computing

- connectors

- consumer electronics

- Converge Market Insights

- convergence

- converter solution

- Core i7 processor

- Corporate Social Responsibility

- Cosmic Circuits

- Cowans LRA model

- CPF

- CPLD

- CPM

- cross-license dispute

- cross-licensing

- crystalline solar

- CSF

- CSR

- Cuil

- CustomSim

- CWG

- Cyclone III LS

- Cypress

- Cypress Semiconductor

- DAB

- DAB radios

- Dale Ford

- data center energy measurement

- Datang

- DAVIC

- DECT

- Deloitte

- Delphi FormFactor

- Denali

- Department of IT

- Derek Lidow

- design challenges

- design services

- design services in India

- design tools

- designers

- developers

- Dexcel Electronics Designs

- DFM

- DFT

- Diachi

- digital cameras

- digital factory

- digital president

- digital still cameras

- Digitimes

- DISCO

- Discovery 2009

- disk drive controllers

- display driver ICs

- display drivers

- displays

- DisplaySearch

- DLNA

- DLP

- Dr Farooq Abdullah

- Dr Gordon Moore

- Dr. Ashok Das

- Dr. Bobby Mitra

- Dr. Chi Foon-Chan

- Dr. Ganesh Natarajan

- Dr. Henning Wicht

- Dr. J. Gururaja

- Dr. Li Shi-he

- Dr. Madhusudan V. Atre

- Dr. Rajiv Jain

- Dr. Robert N. Castellano

- DRAM

- DRAM industry

- DRAM manufacturers

- DRAM market

- DRAMeXchange

- DRC/LVS

- driver ICs

- drug discovery

- DSOA

- DSPs

- DTG

- DTH

- DTV

- Dubai

- Dubai Circuit Design

- Durga Puja

- E Ink

- e-book semiconductors

- E-books

- e-passports

- ebooks

- EC

- EC ruling

- ECG-on-a-Chip

- Eclypse

- EDA

- EDA Consortium

- EDA industry

- EDA products

- EDA tools

- EDGE

- EEPROMs

- eInfochips

- Elcoteq

- Elections 2009

- electronic components

- electronic design engineers

- Electronic Design Trends

- electronic designers

- electronic equipment

- electronic paper display

- electronics

- electronics components

- Electronics Hardware

- Electronics industry

- electronics products

- electronics supply chain

- Electronics Weekly

- Electrophoretic Display

- element14

- Elpida

- embedded

- embedded applications

- embedded computing

- embedded design

- embedded designers

- embedded devices

- embedded Internet

- Embedded Internet devices

- embedded jobs

- embedded Linux

- embedded processor

- embedded software

- embedded systems

- embedded systems and software

- EmSys

- emulator

- Encounter

- Encounter Digital Implementation

- energy

- energy efficiency

- Enterprise

- enterprise technologies

- enterprise verification

- Enterprises

- epaper

- EPD

- Epson Toyocom

- EPSRC

- ESL

- Ethernet

- EU

- Europartners

- European Commission

- EV-DO Rev. A

- EVE

- Extreme Networks

- fab capacities

- fab policy

- fab spends

- Fab-Lite

- FabCity

- fabless

- fabless companies

- Fabless Semiconductor Association

- fabs

- Fabtech

- Farnell

- FDSOI

- femtocells

- First Solar

- fixed-mobile convergence

- flash memory

- flexible displays

- flexible substrates

- Flextronics

- FMC

- FOMA

- Forward Concepts

- foundries

- foundry semiconductor market

- FPDs

- FPGA

- FPGA Central

- FPGA design

- FPGA design software

- FPGA market

- FPGA Seek

- FPGAs

- France

- Freescale

- Freescale Technology Forum

- Frost

- FTF 2008

- Fujicon

- Fujitsu

- Fukuoka

- Fully Depleted Silicon On Insulator

- Future Horizons

- G1

- Galaxy Custom Designer

- Gartner

- Garuda

- Gary Shapiro

- GateRocket

- GE Healthcare

- Germany

- Gigabyte

- GK Pramod

- global chip market

- global DRAM market

- global EDA industry

- global MEMS market

- global semiconductor industry

- global semiconductor inventory

- global semiconductor manufacturing industry. global semiconductor industry

- Global semiconductor manufacturing utilization

- global semiconductor market

- Global silicon photonics market

- global solar industry

- Global Sources

- global telecom industry

- GlobalFoundries

- Google phone

- Gordon Moore

- GPS

- graphical programming

- graphical system design

- green data centers

- green electronics

- GSA

- GSM

- Gurdas Kamat

- Hanns Windele

- HardCopy IV ASICs

- hardware

- hardware policy

- hardware/software co-verification

- hardware/software co-verification solutions

- Harriet Green

- Harshad Deshpande

- HDDs

- HDMI

- healthcare

- High-definition

- high-K gate dielectric

- high-K metal gates

- high-level synthesis

- Hitachi

- HKMG

- HLS

- Hokoriku

- Hon Hai

- HSMC

- HSPA

- HTC

- Huawei

- hybrid car

- Hynix

- i-mode phones

- i-phones

- IBM

- IBM Research Labs

- IC ASPs

- IC industry

- IC Insights

- IC market

- IC Validator

- ICICI Ventures

- ICs

- IDC

- Idea Cellular

- IDF

- IDF Taiwan

- IDM

- iDTV

- IEF 2009

- IIM-Bangalore

- IISc. Bangalore

- IIT Bombay

- IIT Kharagpur

- IIT Madras

- IIT-Kanpur

- iMac

- IMS

- IMT

- InCyte Chip Estimator

- India

- India Inc.

- India Semiconductor Association

- India semiconductor market

- India's first plug-in hybrid car

- Indian 3G policy

- Indian aerospace and defense markets

- Indian branded memory market

- Indian EDA industry

- Indian electronics industry

- Indian embedded industry

- Indian fab story

- Indian IT industry

- Indian semicon policy

- Indian semiconductor industry

- Indian solar industry

- Indian solar/PV industry

- Indian telecom

- Indian telecom industry

- Indrion

- industrial segments

- Infineon

- Infineon Asiaworld Expo

- Infosys

- Ingo Guertler

- innovators

- InnovLite

- Inoueki

- integrated access devices

- Intel

- Intel Atom processor

- Intel Core 2 Duo

- Intel Developer Forum

- intelligent video surveillance system

- International Electronics Forum (IEF)

- Internet

- Internet radio stations

- Internet radios

- intranets

- Invensense

- IP creation

- IP re-use

- iPad

- iPDK

- iPhone

- iPhone 3G

- iPod

- IPs

- IPSec

- IPTV

- ISA

- ISA Excite

- ISA Vision Summit 2009

- ISE Design Suite 11

- ISI Calcutta

- Israel

- Istanbul

- iSuppli

- IT

- IT processes

- IT/OA

- Ittiam

- Ittiam Systems

- ITU

- ITU Telecom Asia

- iTV

- IVSS

- James Reinders

- Japan

- Japan chip industry

- Japan's microelectronics industry

- Jaswinder Ahuja

- Jayamahal

- Jayaram Pillai

- Jérémie Bouchaud

- JEM

- Jennifer Lo

- JETRO

- JMCC

- JNCASR

- Jobs in FPGAs and CPLDs

- Jon Cassell

- Jonney Shih

- Jordan Plofsky

- Joseph Sawicki

- K. Subramanya

- Karnataka

- KCR

- Kexin

- Khasim Syed Mohammed

- Kionix

- Kirk Skaugen

- Kishor Patil

- Klaus Maler

- Knowles

- Kochi

- Kodiak Networks

- Korea

- Korea Electronics Show

- KPIT Cummins

- KUKA

- Kyushu

- LabView

- LabView 8.6

- Lanco Solar

- Lara Chamness

- LAS-CDMA

- last mile problem

- Laurin Publishing

- LCD

- LCD monitor panels

- LCD monitors

- LCD panels

- LCD TVs

- LCDs

- LED driver ICs

- LED lighting devices

- LED lights

- LEDs

- Lexmark

- LG

- LG Telecom

- life sciences

- LinkAir

- Linux

- lithography

- Lo Wu

- logic IC market

- logic synthesis

- low power

- low-cost handsets

- low-power design

- LSI Corp.

- LSI Logic

- LTE

- LUT

- Mac OS

- Magma Design Automation

- Malcolm Penn

- malware

- Man Yue

- Manoj Gandhi

- manufacturing hub

- Marco Principato

- Market for key system semiconductors

- Marnello

- material devices

- McAfee

- MCMM

- MCUs

- MEAS

- Measurement Specialties

- Mediacart

- MediaTek

- mega fabs

- MelZoo

- memory

- memory fabs

- memory market

- MEMS

- MEMS accelerometers

- MEMS devices

- MEMS foundries

- MEMS gyroscopes

- MEMS industry

- MEMS oscillators

- MEMS sensors

- Memsic

- Mentor Graphics

- Messe Munchen

- metro area networks

- MHEG-5

- Michael J. Fister

- micro fuel cells

- microcontrollers

- Micron

- Micronics Japan

- microprocessors

- Microsoft

- MIDs

- MII

- MIII

- Mike Cowan

- Mike Splinter

- military

- military market

- Min-Sun Moon

- Minalogic

- mini fabs

- Ministry of Communication and IT

- mixed signal

- ML-PCBs

- MNRE

- Mobile

- Mobile application operating systems

- mobile broadband

- mobile computing

- mobile CPUs

- mobile devices

- mobile handheld devices

- mobile handsets

- mobile Internet

- mobile Internet devices

- mobile phone semiconductor market

- mobile phones

- mobile TV

- mobile VAS

- Mobile WiMAX

- Mobility

- Moblin

- modeling and photomask correction

- monitor panels

- Monolithic Power Systems

- monster fabs

- Moore’s Law

- Moorestown

- MosChip

- Moser Baer

- Moshe Handelsman

- Motorola

- Mouser

- MP3 players

- MPUs

- multi-core platforms

- multi-cores

- multicore programming

- multilayer PCBs

- Mumbaikars

- Munich

- Murata

- N.K. Goyal

- Nader Tadros

- Nam Hyung Kim

- NAND

- NAND flash

- NAND Flash memory

- Nanomanufacturing

- nanoscience

- Nanotechnology

- nanotubes

- Nanya

- National Semiconductor

- Near Field Communication

- NEC

- Neeraj Varma

- Nehalem

- Nehalem-EX

- net-tops

- netbooks

- Netscape

- nettops

- Networking

- NewEra

- next-generation data centers

- NFC

- NI

- NI. LabVIEW 8.5

- NIIT

- Nikon

- Nile

- Nimish Modi

- Ning

- Nintendo Wii

- Nios II processor

- Nishant Sarawgi

- NMI

- Nokia

- NOR

- notebook market

- notebooks

- NTT DoCoMo

- Nuance

- Numonyx

- nVidia

- NXP India

- OEM semiconductor design

- OEMs

- oil prices

- OLED

- OLED driver ICs

- OLEDs

- Open Handset Alliance

- Open Platforms

- Open Silicon

- Open Source

- OpenOffice

- Opera

- optical networking

- optos

- Outlook 2009

- OZ

- PA Semi

- packaging

- PADS 9.0

- Pagemaker

- Palm

- Panasonic

- Parallel computing

- parallel programming

- parallelism

- passives

- Patrice Hamard

- PCB industry

- PCB services

- PCBs

- PCI

- PDAs

- PDPs

- Perry LaForge

- PFI

- pharma

- Philips

- Philips Consumer Lifestyle

- Phoenix Solar

- phonons

- photonics

- Photonics in Asia

- Photonics Society of India

- photovoltaics

- physical designers

- Piketown

- Pine Trail

- place-and-route technology

- Playstation 3

- PLD

- PMPs

- PNDs

- polysilicon

- Poornima Shenoy

- power

- Power Forward Initiative

- power management

- Power MOSFETs

- Powerchip

- PowerPC

- PR firms

- Pradeep Chakraborty

- Pradeep Chakraborty's Blog

- Premier Farnell

- probe cards

- processors

- Procys

- product development ecosystem

- programmable devices

- ProMOS

- PTT

- PTT-over-cellular

- PTT/PoC

- PULLNANO

- push-to-talk

- PV

- Q-Cells

- Qimonda

- QorIQ multicore platform

- quad core

- Qualcomm

- Quark Express

- Quartus II software v8.0

- Quasar

- QuickPath

- Raghu Panicker

- Rahul Deokar

- Rajeev Madhavan

- Rajeev Mehtani

- Rajiv C. Mody

- Rajiv Jain

- Raju Pudota

- Raman Research Institute

- Ramkumar Subramanian

- Ramprasad Ananthaswamy

- Randy Lawson

- Ranga Prasad

- Ranjan Das

- Ravinder Gujral

- RCG

- REACH

- Real Player

- recession

- Red Hat

- Reliance

- Renasas

- Renesas

- renewable energy

- repairs

- Research Infrastructure

- retail

- retail POS kiosk

- Rev. A

- REVA

- RF

- RF CMOS

- RF MEMS switches

- RF surveillance

- RFMD

- Rich Beyer

- RISCs

- Riverbed

- roaming

- Robert Bosch

- RoHS

- RTL

- RV Colege of Engineering

- RVCE

- S. Janakiraman

- S. Uma Mahesh

- Sachin Pilot

- Samsung Electronics

- Samsung Semiconductor

- Sandeep Mehndiratta

- Sandisk

- Sanjay Deshmukh

- Sanyo

- SAP

- SAP BusinessObjects Explorer

- Sasken

- Sathya Prasad

- Saxony

- Science

- Scott Apeland

- Scott Grant

- screens

- SDR

- search engines

- Security

- security MCUs

- Seiko

- SEMATECH

- semconductors

- SEMI

- SEMI India

- Semico

- Semico Research

- Semicon

- semicon blogs

- semicon capex

- semicon fabs

- semiconductor

- semiconductor equipment

- semiconductor equipment industry

- semiconductor equipment market

- semiconductor industry

- Semiconductor Industry Association

- semiconductor IPs

- semiconductor jobs

- semiconductor manufacturing

- Semiconductor market for PMPs

- semiconductor materials

- semiconductor policy

- Semiconductors

- semiconductors and ICs update

- Semicondutors

- SemiconWorld

- SemIndia

- Sentaurus

- Shanghai

- Shanghai processor

- Sharp

- short-range wireless

- Shweta Dash

- Si-Quest

- SIA

- Siemens

- Signet Solar

- silicon photonics

- Silicon Sensing

- silicon wafers

- simulation

- single-chip design

- SK Telecom

- Skyway Software

- smart grid

- smart meters

- smartphones

- SMB strategies

- SMEs

- SoC

- social networking

- social networking for semicon professionals

- SoCs

- SoftJin

- software developers

- solar

- solar cells

- solar ecsystem

- solar energy ecosystem

- solar fabs

- solar manufacturers

- solar modules

- solar panels

- solar photovoltaics

- solar power products

- solar/PV

- Solar; Lux Research

- Solid polymer capacitors

- solid-state hard drives

- Sony

- Sony Ericsson

- South Korea

- Spain

- Spansion

- Spartan

- spectrum

- speech-recognition

- SPIRIT

- SPMT

- SRAM

- Sriram Peruvemba

- SSDs

- SSI

- ST

- ST Micro

- ST-Ericsson

- Stanley T. Myers

- StarOffice

- STBs

- Stefan de Haan

- Stephan de Haan

- Steve Svoboda

- STM

- STM8S

- STM8S105

- STM8S207

- STMicroelectronics

- storage

- STPI

- Strategic Marketing Associates

- Stratix IV FPGAs

- Subhash Bal

- Sun

- SunFab

- Suntech

- super fuel-efficient car

- SV Probe

- Symantec

- Synopsys

- System-in-Package (SiP) solutions

- system-level chips

- systems

- Systron Donner

- Taitronics

- Taiwan

- targeted design platforms

- Tata BP Solar

- Tata Teleservices

- TCAD

- TCS

- TD-SCDMA

- TD-SCDMA Forum

- TDD

- Technology

- Technopole

- Technoprobe

- Technovation 2008

- Tejas

- Telecom

- Telecom and IT

- telecom OEMs

- telecom operators

- telecommunications

- Telefonica

- telisma

- teliSpeech 10 Indian languages

- terror attack on Mumbai

- test and measurement

- Texas Instruments India

- Text 100

- TFPV

- TFTs

- Thailand

- The Information Network

- thin film

- thin film solar

- TI

- timing analysis

- Tipping Point

- Tom Feist

- Top 10

- top 10 embedded companies in India

- TPS62601

- traffic

- TRAI

- Transport

- Trilliant

- TSIA

- TSMC

- TV panels

- TwitterJobSearch

- TwitterJobSearch.com

- UIDAI

- UK

- UK-TI

- ultra mobile broadband

- UMB

- UMC

- unified power format

- union budget

- UPA

- Upendra Patel

- UPF

- USA

- USB

- V. Srikumar

- V.R. Venkatesh

- VC funding

- VCS2009

- VDAT 2010

- Venkatesh Valluri

- Venture GES

- verification

- Verilog

- VHDL

- Vic Mahadevan

- video roaming

- Videocon

- Vietman

- Vincent Ratford

- Virtex

- Virtex-5

- virtual instrumentation

- virtualization

- Virtuoso

- Vista

- Vivek Sharma

- VLSI

- VLSI conference

- VLSI Research

- VLSI Society of India

- voice

- vPro

- VSI

- VTI

- VTU

- W-CDMA

- wafer fabs

- wafer processing equipment

- Walden C. Rhines

- WAP

- WDS

- Web 2.0

- Webdesign International Festival

- WEEE

- West Bengal

- Wi-Fi

- Widgetbox

- widgets

- WIF 2008

- WIF 2010

- WiLL

- Will Strauss

- WiMAX

- WinCE

- Wind River

- wind solutions

- Wipro

- Wipro Technologies

- wired communications

- Wireless

- wireless devices

- wireless handsets

- Wireless USB

- Wireless Week

- wireless/DSP bulletin

- WirelessHART

- wireline

- WiTECK

- Workhound

- World Cup Cricket 2011

- WSTS

- WUSB

- X-Con

- Xeon 5500

- Xilinx

- yield management

- YieldManager

- Yindusoft

- Yole

- Yole Developpement

- Yukon

- Z-RAM

- ZeBu

- ZeBu-Server

- Zetex

- ZigBee

- ZTE

Blogroll

Archives

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007