Archive

Top 20 semicon rankings Q2-09 — TSMC climbs up, AMD slips down!

Very interesting, isn’t it? And I am not surprised! TSMC deserves to move up the top 20 semiconductor companies rankings!! It seems that AMD especially needs to really get its act together.

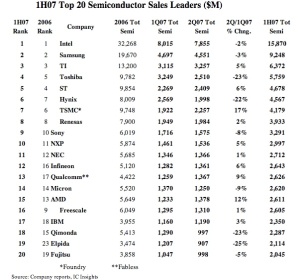

First, to the rankings. Recently, IC Insights released the list of the top 20 semiconductor sales leaders during Q2-09.![]() Source: IC Insights

Source: IC Insights

In this list, there are four fabless semiconductor companies — Qualcomm, Broadcom, MediaTek and Nvidia in the top 20, and one foundry — TSMC, perhaps, emphasizing the growing influence of TSMC as well as the fabless semiconductor companies.

AMD slips! Again?

I had written a couple of posts some time back on AMD and Intel, where the former had commented on the EC ruling on Intel, and also how both were at each other’s throats, and had asked the question — how will all of this help the market?

Well, one hopes that AMD will come back very much stronger in the next quarter, despite its uninspiring guidance for 3Q09, saying that it expects its sales to be “up slightly” from 2Q09.

TSMC, Hynix, MediaTek shine

Coming back to the table, the clear movers are TSMC, and no surprises there, as well as Hynix and MediaTek. In fact, with a little better Q3 performance, TSMC could well move up to the third position, overtaking both Texas Instruments and Toshiba.

Look at the last column — the 2Q09/1Q09 percentage change — TSMC has grown by a whopping 93 percent! One other thing! TSMC is reportedly eyeing business opportunities in solar photovoltaics and LEDs in a bid to diversify its revenue channels. Should these happen, expect TSMC to move up higher!

The closest to TSMC in terms of growth are Hynix at 40 percent and Qualcomm at 36 percent, respectively. MediaTek, another impressive mover, grew by 20 percent. Of course, there is Samsung as well, with 29 percent growth.

ST, Micron, Nvidia and NXP have done well too! According to IC Insights, Nvidia replaced Fujitsu in the Q2-09 top 20 rankings. And that brings us to the shakers or those who fared poorly.

Fujitsu, AMD, Freescale slide!

I’ve already touched upon AMD. Fujitsu cited flash memory and automotive device sales to have suffered immensely this quarter. However, it hopes Q3 will be better and said that customer demand was picking up. So, it could well be back in the Top 20 during Q3.

Yet another slip was in store for Freescale. It slipped from 16th position in 2008 to 18th position during Q1-09, and slid further to 20th position in Q2-09. Perhaps, overdependance on automotives has been its undoing.

An interesting statistic from IC Insights — Fujitsu, with -9 percent and Freescale, with -2 percent growth, were the only two top-20 companies from Q1-09 to register a 2Q09/1Q09 sales decline!

Wonderful industry guidance

It is heartening to see 19 of the 20 companies registering positive growth this quarter. It won’t be improper here to commend IC Insights on its wonderful industry guidance!

In an IC Insights study from late December 2008, it was very vocal in advising firms to adopt a quarterly outlook! It also forecast a significant rebound in the IC market beginning in the third quarter of the year!

IC Insights also stood out by pointing out in early July that H2-09 is likely to usher in strong seasonal strength for electronic system sales, a period of IC inventory replenishment, which began in 2Q09, and positive worldwide GDP growth.

IC Insights had marked 4Q08 as the beginning of the downturn/collapse and Q1-09 as the bottom of the cycle. This quarter (Q2) has largely been a replenishment phase for the inventories. Going by that count, Q3 could well see a true seasonal increase in demand. IC Insights also said that during Q4-09, market growth will mirror the health of the worldwide economy and electronic system sales.

There is light, after all, at the end of the tunnel! Wonder why are the industry folks continue to tell each other — we still aren’t having a good time! Maybe, it is time for them to shed their pessimism and from holding back on investments, and move on to show steely optimism, and indulge in really aggressive buying and selling! After all, work and progress will happen ONLY if you work!!

ISA Vision Summit 2009: Indian design influence, ideas to volume

This post is slightly delayed given the fact that I’ve been travelling! Here it is: Session 2 of Day 1, ISA Vision Summit 2009!!

The still quite young, Indian semiconductor industry has come a long way! Making his opening remarks during the session: Indian Design Influence, Ideas to Volume, Jaswinder Ahuja, Corporate Vice President & MD, Cadence Design Systems India, and chairman, pointed out that earlier, it used to be ‘made by the world, FOR India.’ However, globalization of design has now put India on the world semiconductor map. Today, it is ‘made by the world, IN India.’

The picture here shows Ahuja making a point, while Freescale’s Ganesh Guruswamy, TI’s Dr. Bobby Mitra and Intel’s Praveen Vishakantaiah are all attention.

The picture here shows Ahuja making a point, while Freescale’s Ganesh Guruswamy, TI’s Dr. Bobby Mitra and Intel’s Praveen Vishakantaiah are all attention.

The electronics systems production is clearly moving eastward. Even though the chip fabs may not happen in India, systems manufacturing is certainly happening. The emerging markets today offer a $5 trillion opportunity. However, the transformative challenge is: how to marry low cost, good quality, sustainability and profitability simultaneously!

Fantastic opportunity for investing in technology

Praveen Vishakantaiah, President, Intel, added that India has a fantastic opportunity ahead for investing in technology. He cited Intel’s examples, such as: products designed in India for global market — Intel Xeon 7400 processor; designed in India for India and emerging markets — Classmate PC, which was prototyped in India; and designed in India and customized for the local market — PoS retail kiosk solution.

Internal factors related to volume development include: unique market needs, designing for reliability, enabling customers — standard globally but varied in India. External factors include: access to customers — which can be challenging in a varied market such as India, access to employable talent, predictable supply chain, robust infrastructure — digital infrastructure should scale simultaneously with design and development, and proactive policies and regulations.

According to Vishakantaiah, there is a need for a call to action and seize opportunities. This means, capitalizing on opportunities for local and global product designs, increase the impact and build end-to-end competencies, and to continue to move up the value chain. There is a need to address the internal factors. This would enable increasing the quality of products and extend local products into global markets. There is also a need to focus on the enabling the local market for global product companies.

As far as the external factors are concerned, there is a need to be proactive to remove barriers. There is a need to also encourage research, faculty development and new curriculum. India also needs to build energy efficient power, logistics and manufacturing capabilities, and also reduce e-waste and think green for all product designs.

Downturn creates huge opportunities

Ganesh Guruswamy, Director and Country Manager, Freescale Semiconductor India, remarked that even the deepest downturns can create huge opportunities for companies and countries. “Continuing to innovate during the downturn is important,” he added. It is therefore, time for India to step up, put the right innovations in place and grow.

He stressed upon several custom solutions for emerging markets, such as two-wheelers, which dominate, e-bikes, which are said to be the future, LED lamps, power inverters, irrigation pumpset powered by solar, smart energy meters, and solar/PV base station and carrier based equipment for telecom.

Medical tourism is an emerging focus area for India, as it is growing by 30 percent each year. Medical tourism is likely to bring $1-2 billion to India by 2012. In this context, Guruswamy highlighted Freescale’s ECG-on-a-chip solution. According to him, the way forward would involve moving away from a design mindset to a product mindset!

Don’t be dwarfed by glamorous industries!

Dr Bobby Mitra, MD, Texas Instruments India, said that India is witnessing a change in its semiconductors agenda — from R&D to R&D + market growth. If followed properly, it can become a game changing agenda. “India has nearly 2,000 OEMs designing electronics products. That’s the untapped potential,” he said.

Most of the customers are smaller companies — the proverbial long tail. They know semiconductors and electronics very well. Such companies need to be measured by the firebrand innovation going on at those places.

Dr. Mitra said: “The products have to be the right kind of products. If they are complex, it is incidental.” He cited defense and aerospace as very strong spaces, while industrial is also an equally strong opportunity area. “We should not be dwarfed by glamorous industries,” he cautioned.

In the near term, the Indian semiconductor industry needs to develop two new stripes. These are: a high degree of customer centricity so it can be brought into the R&D engineer’s minds, and have an application mindset — India is very good in design work; it now needs to develop applications in the current context.

Dr. Mitra also called upon having research as an agenda for the industry. This can be done in areas that would assume importance in future. “By working with customers, we can make products more intelligent, by adding electronics and semiconductors,” he advised. “All of us have a key role to play in this transformation.”

SMEs, in particular, have a major role to play. Intel’s Vishakantaiah said that MNCs would need to mentor and coach such companies. Freescale’s Guruswamy added that MNCs can either help them grow or buy them out.

Dr. Mitra advised that even if customers didn’t provide business, it would pay to remain close to them. He also referred to TI’s Beagle Board, an open and low-cost platform, which enables development of applications. However, he advised the industry to be realistic about mass customization.

Consumer MEMS shine amid gloom: iSuppli

I was fortunate enough to attend a webinar on MEMS organized recently by iSuppli. The webinar looked at the growth potential of this segment, especially during the downturn, as well as some top MEMS suppliers.

According to Jeremie Bouchaud, director & principal analyst, both consumer and mobile MEMS supply has been exploding. The overall MEMS market is likely to grow from $1 billion in 2006 to $2.5 billion in 2012! There will be strong acceleration due to growth of cell phones — a hotbed for MEMS, he said.

According to Jeremie Bouchaud, director & principal analyst, both consumer and mobile MEMS supply has been exploding. The overall MEMS market is likely to grow from $1 billion in 2006 to $2.5 billion in 2012! There will be strong acceleration due to growth of cell phones — a hotbed for MEMS, he said.

However, the share of MEMS for rear projection TV is vanishing. A market worth $300 million in 2006 is slowly disappearing, and will, in fact, disappear by 2012. Among other growth areas, personal navigation devices (PNDs) and remote controllers will also see growth.

Consumer and mobile market by MEMS device

The main segments include accelerometers, as well as gyroscopes, RF MEMS switches and capacitors, microphones, etc. The penetration of MEMS devices in CE products is said to increase quite fast.

MEMS growth in cell phones will be faster. It will grow from 3 percent in 2007 to 10 percent in 2008. All of the new, best selling smartphones, such as the iPhone, Nokia N95 and N96, Samsung Omnia, HTC Diamond, Google G1, Blackberry Storm, new Palm OS, etc., have accelerometers. A number of mid range phones also have accelerometers, eg. Sony Ericsson’s models.

MEMS usage is also growing in gaming. From 1998-2005, there was technology push with limited success. However, in 2006, Nintendo showed the way with its Wii, as did the Sony PS3. Microsoft did not enter this field back then!

Interestingly, 2006-08, motion sensing unveiled new, untapped target groups for gaming — the so called casual gamers. In Xmas 2008, Microsoft also embraced motion sensors with accessories. Hence, the penetration of motion sensors has really improved. The next third generation platform will include accelerometers and gyroscopes.

Top 15 MEMS suppliers

The key question: who all are shipping these products? According to iSuppli,The top 15 MEMS suppleirs for CE and mobile phones are: STMicroelectronics, Texas Instruments, Avago Technologies, Knowles, Analog Devices, Murata, Kionix, Epson Toyocom, Invensense, Panasonic, Bosch Sensortec, Freescale, Hokoriku, VTI and Memsic.

Some other companies to watch are:

Accelerometers and gyroscopes: Qualtre, Oki, Wacon, Alps, Virtus, Ricoh.

Pressure sensors: Intersema (MEAS), Metrodyne.

Microphones: Infineon, Wolfson, Memstech, Yamaha, Omron, Panasonic, MEMSensing, AAC, Goertek.

Pico-projectors and other MEMS displays: Microvision, Nippon Signal, Samsung, Konica Minolta, Scanlight, Qualcomm, Pixtronix, Unipixel

RF MEMS switches and capacitors: Wispry, Epcos, RFMD, Baolab.

MEMS oscillators: SiTime, Discera, NXP, Seiko, Intel.

BAW filters: Triquint, Skyworks, MEMS Solutions.

MEMS actuators for autofocus and zoom: Simpel, Sony.

Micro-fuel cells: Angstrom, Tekion, Medis.

It is understood well that not all of these companies will be successful. However, they all need to be monitored carefully.

Commenting on cell phones as a hotbed for inertial and magnetic sensors, Dr. Richard Dixon, senior analyst MEMS, iSuppli, said that the market for accelerometers, gyroscopes and magnetometers is in cell phones. This market will reach $730 million in 2012. Gyroscopes are not in the market yet, and are likely to enter by 2010. The total growth rate is very fast. In units, the annual growth rate is said to be 97 percent.

Interestingly, Apple has contributed significantly to growth of MEMS. The iPhone had a great application. Other vendors followed suite with a ‘me too” strategy. Apple also had sustainable business model with downloads on the Apple Store. The chicken and egg issue of price was solved. Also, with the iPhone, there was a free field test of motion sensing based applications.

Major suppliers of accelerometers for cell phones today, include STMicroelectronics, Bosch Sensortec, Analog Devices, Hokuriku, Kionix, MEMSIC, Freescale, Oki. Of these, ST has really been very impressive, while Bosch saw impressive growth in 2008. MEMSIC dropped share in 2008.

Navigation in cell phones next big thing

According to Dixon, navigation in mobile phones is the next big thing. Leading navigation markets by platform are: mobile phone navigation, smartphone navigation, PNDs, car aftermarket and car OEM in-dash, respectively. By 2010, the mobile phone/smartphone navigation segment will account for over 60 percent of the market.

Similarly, magnetic sensors will take off in 2009 for e-Compass. There has been penetration of magnetometers in GPS phones. They have been around since 2003 in Japanese phones. These rather esoteric applications and also had technical issues.

There were successful implementations in 2008 for navigation. Eg., the G1 Street View, and the Nokia 6210. Also, 3D compass in combination with 3D accelerometers.

The leading suppliers in this space today, include AKM, Honeywell, Yamaha, Aichi Steel. In the R&D segment, the leading players are said to be Alps, Omron, Memsic, Oki, ST, Freescale, Demodulation. Growth will be steep from 2009 onward, and take off from 2010 up to 2012.

Another growth are is the multi-sensor packages and IMUs (Inertial Measurement Unit) for navigation. Today, we have six-axis e-compass combining magnetic sensors and accelerometers. In future, there will be IMU for LBS and indoor navigation also using gyroscopes.

The issue with gyroscopes is of: performance, price, size, power consumption and no availability of three-axis. Companies that need to be watched in this space are said to be Invensense, ST, Bosch Sensortec, Qualtre, Oki, Virtus.

Other opportunity areas

Later, Jeremie Bouchaud highlighted two other opportunity areas.

MEMS microphone market presents a major opportunity. It will reach close to $400 million by 2012. In 2008, already 325 million units were selling in cell phones and laptops. Leading players in this segment are said to be Knowles, Akustica, Infineon, Sonion, Memstech, AAC. Knowles has over 90 percent of the market share.

MEMS pico projectors is another growth area. Companies have made lot of progress in this segment. The pico projectors come in various varieties.

In the MEMS scanner based segment, the R&D is led by firms such as Microvison, Konica, Minolta, Scanlight, Nippon, Signal, Symbol. These solutions came first as stand alone projectors. Later, it will come on cell phones. The best opportunity is said to be at the module level.

Another sub-segnent is the DLP based projectors. First it will be in form of a pico-projector, later, followed by usage in cell phones.

Bouchaud advised watching out for non-MEMS alternatives, such as Light Blue Optics,

3M and Logic Wireless.

Coping with commoditization and price erosion

The ASP of MEMS devices for CE and mobile phones is dropping at -13 percent per year. So, what are the ways to get profitable?

To be profitable, there is a need to achieve economies of scale by combining consumer and automotive. Also, there is a need to

move wafer size to 8-inch. Next, there is a need for externalizing to foundries. ADI and TSMC have already showed the way. Now, USMC, Tower, Dongbu, Magnachip, Omron, etc., are following.

Innovation, in terms of packaging and 3D integration, test, multi-sensor packages, is another way for making profits. There is an opportunity for the equipment suppliers as well.

Consumer MEMS is currently glowing as a light in today’s dark times! It is said to grow from $1 billiom in 2006 to $2.5 billion in 2012, with 19 percent CAGR. This optimistic forecast has already started. Accelerometers are present in 10 percent of cell phones in 2008 as against 3 percent in 2007.

There exist a number of opportunities. Small companies can be successful, eg. Kionix and Invensense. There are still opportunities for newcomers. These can be large companies, fabless startups, foundries, software companies, equipment suppliers, etc. Consumer MEMS is an extremely dynamic market, having fast design cycles.

Motion sensors driving MEMS growth

In a recent report, iSuppli predicted that driven by new demand from consumer electronics (CE) and wireless applications, the global market for microelectromechanical systems (MEMS) will expand to $8.8 billion in 2012, up from $6.1 billion in 2006.

I caught up with Jérémie Bouchaud, Director and Principal Analyst, MEMS, iSuppli Corp., to find out more about the dip in the fortunes of the mainstay products and the latest trends in the MEMS market, especially, the significance of consumer electronics applications such as motion sensors for gaming, laptops and DSCs, and mobile handsets.

I caught up with Jérémie Bouchaud, Director and Principal Analyst, MEMS, iSuppli Corp., to find out more about the dip in the fortunes of the mainstay products and the latest trends in the MEMS market, especially, the significance of consumer electronics applications such as motion sensors for gaming, laptops and DSCs, and mobile handsets.

Will the mainstay products for MEMS actuators, inkjet heads and DLP chips, will lose market share? Or, is it a slight dip?

Jérémie Bouchaud says that MEMS actuators, include inkjet and DLP, and also RF MEMS switches. While selling prices stay constant, MEMS inkjet heads are losing shipments at a rate of 6 percent per year over the forecast period, so the market grows only slightly at 0.4 percent CAGR from 2006-2012.

DLP shipments continue to grow, but price erosion is running at 10 percent CAGR, which means that the market is shrinking at close to 5 percent per year to 2012. RF MEMS switches are the one bright spot that helps the market for this type of MEMS device to recover slightly in 2012. RF MEMS switches will grow at 100 percent CAGR over this time to top $260 million in 2012.

The new wave is partly founded in the rapid rise of consumer electronics applications such as motion sensors for gaming, laptops and DSCs, and mobile handsets. How much share are these segments likely to garner?

According to the analyst, all types of sensors in wireless communications and consumer electronics (inertial, pressure, microphones, filters, oscillators etc) exceed $1,5 billion: or 17 percent of the total MEMS market.

“Specifically, the motion sensing opportunity, including accelerometers and gyroscopes, for consumer applications like MEMS accelerometers for mobile phones (e.g., image rotation such as in iPhone and Nokia phones), gaming (Nintendo Wii, Playstation 3), etc., and gyros (mostly digital still cameras and camcorders, gaming like Playstation 3) will grow at over 20 percent CAGR from 2006 to 2012 to exceed $680 million, about 8 percent of the total market,” he said.

iSuppli has also mentioned automotive as a key area for MEMS. What kind of growth does it see for automotive?

Bouchaud adds that automotive will grow at 8 percent CAGR to reach $2.1 billion in 2012, up from 1,3 billion in 2006. The market is largely driven by mandates for tire pressure monitoring, electronic stability control systems and reduced emissions, accelerating growth for pressure and inertial sensors.

So, will “new players have a chance to address a relatively open market”, and if yes, what would those markets be?

Bouchaud indicates that the consumer electronics market is more open than the automotive sector, which features established, long-term supply arrangements, and production cycles lasting five or more years.

CE applications are characterized by fast time-to-market and short product lifetimes. For example, mobile phones that change yearly or even more frequently, and supply agreements satisfied by fast manufacturing ramp-up and ability to meet seasonal demand spikes, and often several suppliers in the same product, (e.g. ST and ADI in Wii). As sensor specifications are more relaxed than automotive, price and footprint are most decisive.

Will there be a growth in dedicated mass production facilities then?

According to him, several large MEMS players, e.g., STMicroelectronics, Freescale and Bosch Sensortec, have or are now invested in upgrading to 8″ production facilities to meet the higher demand from the consumer sector. By 2011, at least 12 companies will operate at this larger wafer size.

“Some companies like Analog Devices are at the limit of their current capacity, due to its strong automotive sensor offering, and has recently decided to work with non-MEMS CMOS foundries like TSMC, a first in the industry. UMC will also join the MEMS community, partnering with Asian Pacific Microsystems,” he says.

And, how would the new entrants be investing in R&D? Will they be doing enough?

The analyst says that R&D rates run high in automotive (12-15 percent of MEMS revenues) and even higher in consumer (can be 15-20 percent). The high R&D rate is needed to sustain leading edge products in fast moving markets. Deep R&D pockets are needed, a luxury that is not available to all.

Elaborating a bit more on the market consolidation, he says: ” Today, the share of the MEM revenues in the hands of the top 30 MEMS companies grew at about the same rate as the market. The markets that drive growth in MEMS are consumer electronics and automotive sensors.

“The sensors will be increasingly commoditized due to extreme price pressure in both sectors, and iSuppli expects the production of MEMS devices for these two markets to be concentrated among fewer companies in the future. One facet is manufacturers attempting economies of scale by combining sales in automotive and consumer areas, e.g. at Bosch, and in future with Freescale and ST.

“Other companies are pioneers and hold a strong market position for a relatively long time. Examples are TI with DLP chips and Knowles with MEMS microphones. We also expect more M&As in the near future to exacerbate the consolidation.”

Karnataka semicon policy very soon!

The government of Karnataka will be announcing a semiconductor policy very soon, according to Katta Subramanya Naidu, the minister for Excise, Information, BWWB, IT and BT, government of Karnataka, while delivering the opening address at the ISA Excite organized by the India Semiconductor Association.

Over the last several years, India has been a destination favored by almost all leading global semiconductor companies for setting up their development centers for semiconductors and embedded designs.

The size of the Indian semicon design industry is currently $6 billion across VLSI and board design, and embedded software, with the potential to be around $9 billion by 2009. There are nearly 200 companies and it employs over 130,000 professionals, all over India, with the potential to employ over 180,000 by 2009. The Indian semicon design industry has a CAGR of nearly 22 percent versus the global average of 7-8 percent.

Nearly 90 percent of the VLSI design work is done out of Bangalore alone. Appropriately, the ISA is headquartered in Bangalore, the heart of India’s chip industry. The minister said: “The conducive work environment policies and high-quality talent are the important attractions for both MNCs and Indian companies to set up shop here. We value the contribution of our technology leaders and engineers to build the economy of the state and make it a global leader. Bangalore is next only to Silicon Valley, California, in terms of the work done here.”

New centers likely

In future, the government of Karnataka wants to look at Mysore, Mangalore and Hubli as important centers to be developed. “These are centers of education with high quality and quantity of engineering talent. Our government is working on improving the connectivity to these cities to help attract investment there, as well as the expansion of companies from Bangalore to other towns within Karnataka,” he added.

Welcome the ISA initiative to launch Excite, a program for the semiconductor and ecosystem companies, he noted that it was a good platform to understand the technology trends and to collaborate with the right partner.

He said: “Karnataka today is at the crossroads. We have the direction and leadership of Hon’ble chief minister Yeddyruppa. He is extremely committed to the cause of making Karnataka as the most preferred destination for the semiconductor industry and electronics hardware manufacturing. My (BJP) government would be glad to extend any support for your business plans in the state.”

Semicon policy soon

The state government plans to announce a semiconductor policy in the very near future, actually. It has also earmarked land for a hardware technology park near the new airport (in Devanahalli).

The government is also thinking in the lines of finishing schools in PPP mode as the semiconductor industry is technology driven, and demands continuous training and re-skilling of the workforce.

Initiatives in Karnataka

The minister pointed out that his government has been taking several pro-active steps for further accelerating the growth of these sectors, as well as for their expansion in tier II and III cities. For these two sectors, the government proposes to identify and set apart exclusive IT/BT zones in Mysore, Mangalore, Hubli-Dharwad, Belgaum, Shimoga and Gulbarga.

Yeddyruppa, the state chief minister, has made an announcement of a number of initiatives to boost the growth and development of IT/BT. A bio-IT park on a 100-acre plot is proposed to be developed with private participation near Bangalore. IT parks, with private participation, would be set up in tier II and III cities. A massive IT city on the lines of the Electronics City near Bangalore is under consideration. Similarly, BT parks are proposed to be set up in Mangalore, Dharwad and Bidar. KEONICS, a government of Karnataka undertaking, will play a major role in development of the IT city, IT parks and computer literacy campaigns.

He added that the state government believes in formulating initiatives and policies in consultation with the industry. The existing Mahithi IT policy is also being revised with inputs from the Vision Group on IT headed by N.R. Narayana Murthy of Infosys.

“The state government would be happy to see IT and BT developments happening in tier II and III cities. We are taking steps to improve and upgrade the infrastructure in these cities. The CM is personally reviewing the construction and upgradation of airports in Mysore, Shimoga and Gulbarga, which will provide vital air connectivity, essential for the growth of industry and business,” he noted.

The NASSCOM-Kearney report has identified 43 potential locations in the country for IT development. The report also suggests measures to be taken to make these locations attractive for IT investments. Recommendations, such as improving the quality of education, imparting employable skills to the uneducated youth, improving infrastructure, particularly, air connectivity, etc., would be taken into consideration.

The minister said: “Our government would take all the necessary steps to ensure that there is no flight of investment to other states, and to make Karnataka the most attractive region for IT/BT investments. We want the semiconductor industry to grow and flourish in the state.”

Participative semicon policy likely

Elaborating on the proposed semiconductor policy for Karnataka, Ashok Kumar C. Manoli, principal secretary to the government, said: “When you look at India, it is software, and when you look at China, it is hardware. We should make a beginning and try and become the global capital for both hardware and software. We need to design such a policy that design activities continue and also facilitate manufacturing.”

He added: “We will come up with a very participative semiconductor policy. It will also look at addressing infrastructure requirements for manufacturing setups.” According to him, the hardware industry is the foundation for the entire revolution, which the government is looking at. He requested all companies present at the ISA Excite to participate at the forthcoming BangaloreIT.com event, and added that the state government was committed and fully geared up to deliver.

Announcing the ISA Excite initiative, Sanjeev Keskar, country sales manager, Freescale Semiconductor India Pvt Ltd, said: “We need to collaborate with the right partner. The ISA felt the need to arrange an ecosystem meet. Telecom and healthcare are the two drivers of importance.” The ISA has plans to take Excite to other cities too, possibly, New Delhi, focusing on industrial and consumer.

The one-day ISA Excite event had an exhibition running simultaneously, featuring about 40 companies. These included ARM, Farnell, Ittiam Systems, Broadcom, Cosmic Circuits, Windriver, Wipro, HCL, AMDL, LSI Logic, TI, NXP, Cisco, Synopsys, SemIndia, Freescale, Open Silicon, MindTree, AMD, Analog Devices, RFMD, Cir-Q-Tech, NewEra, STPI, etc.

Top 25 semicon vendors of 2007

Here are the top 25 global suppliers of semiconductors, according to iSuppli. First up, there are no surprises in the top 5 — Intel, Samsung, Texas Instruments, Toshiba and STMicroelectronics retain their spots for this year too. The surprises occur in the second rung — or, in the next five spots.

Here are the top 25 global suppliers of semiconductors, according to iSuppli. First up, there are no surprises in the top 5 — Intel, Samsung, Texas Instruments, Toshiba and STMicroelectronics retain their spots for this year too. The surprises occur in the second rung — or, in the next five spots.

Renasas and Hynix exchanged places, with Hynix moving up from 7th position in 2006 to 6th position in 2007, and Renasas dropping from 6th last year to 7th. This is very interesting, because, despite memory market pains during 2007, South Korea’s Hynix Semiconductor and Japan’s Toshiba and Elpida Memory achieved memory-chip revenue growth of 15, 14.5 and 8.8 percent respectively in 2007, as per iSuppli.

Infineon, Sony major movers

The next three positions are the major surprises of the year. Well, the 10th position was no surprise to me — AMD, dropping from 8th in 2006 to 10th in 2007. Sony and Germany’s Infineon Technologies have been the biggest gainers of the year!

According to iSuppli, Infineon acquired TI’s DSL CPE chip business and its wireless baseband semiconductor unit, boosting its revenue. Qimonda, which spun off Infineon, dropped from 12th in 2006 to 16th this year. This split had seen Infineon go out of the top 10 last year.

As per iSuppli, logic application specific integrated circuits (application specific standard products and ASICs) enjoyed the strongest performance among all semicon segments in 2007. Sony and Toshiba were key drivers of growth in this segment due to their sales of semiconductors for the PS3.

Fabless is surely in

The presence of Qualcomm and nVidia in the top 25 list speaks volumes of the power of fabless companies. Qualcomm moved up from 16th to 13th position this year, while nVidia moved up from 25th to the 20th position this year. There is every chance that we will see a fabless company in the top 10 next year! There is an even better chance that more fabless companies will make it to the top 25 companies next year and in future.

All other key players dropped in their rankings. NXP dropped from 9th to 11th; NEC dropped from 11th to 12th; Freescale from 10th to 14th; Micron from 13th to 15th; Elpida moved up from 19th to 17th; while Matsushita and Broadcom dropped a place each.

An iSuppli release says: “Overall, the top 25 semiconductor suppliers significantly outperformed the combined performance of companies ranked lower than them in 2007. The Top-25 as a group achieved revenue growth of 4.5 percent in 2007 while the combined growth of all other semiconductor suppliers was only 0.8 percent.”

On a personal note, I would love to see names like SemIndia and HSMC making it to the list. If not now, then at least sometime in the near future. However, it seems from certain published reports that the Indian fab story has gone all wrong. I’ll take up this topic in a future blog for sure!

Power awareness critical for chip designers

The holy grail of electronics — low-power design, or having the requisite power awareness is extremely critical for chip designers working on both high-performance applications and portable applications. For one, it determines the battery lifetime of a device, besides determining the cooling and energy costs. It is said that several of today’s chip designs are limited in terms of power and still require maximum performance.

Touching on the global factors, S.N. Padmanabhan, Senior Vice President, Mindtree Consulting, said the Kyoto Protocol mandates energy conservation efforts.

Low-power design challenges

Asia, as we all know, has been emerging as a major energy consuming society. Shortage of electricity is becoming a major concern. There is a huge strain on nations to meet the rising needs/halt rise. There is also a rapid increase in all types of electronic goods in growing economies. As a result, increased efficiencies and reduced consumption should be beneficial as a whole!

In the Indian context, the country has around 125 million televisions sets, 5 million automatic washing machines, 10 million white goods, 200+ million other electronics, over 90 million cell phones and 50 million land lines, etc. A 1W reduction in white goods and TVs would lead to a saving of 140 Mi Watts of power! And, a 10 mW reduction in phones will save 1.4 Mi Watts!! Therefore, it makes even more sense to go low power!

Mindtree’s Padmanabhan said IC power budgets have come down drastically. It is <2W for four out of five chips designed. There has also been a simultaneous manipulation of multiple parameters (P=CV2f). Next, there are several leakage issues in 65nm and smaller geometries, which can no longer be ignored.

Add to all of these are factors that there is a lack of availability of comprehensive tools and techniques, as well as analog designs. In such a scenario, designers need to be very clear about their objectives — is it achieving lowering average power, lowering the maximum peak power or lowering energy.

Jayanta Kumar Lahiri, Director, ARM, pointed out challenges associated with batteries. Battery storage has been a limiting factor. Battery energy doubles in a decade and surely, does not follow the Moore’s law. Next, there have hardly been major changes in the basic battery technology. The energy density/size safe handling are limiting factors as well for batteries.

He added that the low-power challenge is four-fold in the VLSI domain. These are — leakiness; more integration means more W/cm^2; EDA tools not that good in low power domain and does not co-relate sometimes with the silicon, and variability of device parameters make things worse.

Toshiyuki Saito, Senior Manager, Design Engineering Division NEC Electronics Japan, said low power is necessary for customer’s success — in form of heat suppress for wired systems and improved battery life time for mobile systems. It also brings cost competitiveness for SoC suppliers in terms of packaging cost, and development cost and turnaround time. Finally, it would contribute to preserving the global environment.

Addressing low power challenges

What are semiconductor and EDA companies doing to address the low-power design challenges? Padmanabhan said several techniques were being employed at the circuit level. However, each one of those had limitations.

These include AVS — which provides maximum savings, reduces speed, but may need compensation; clock gating — which does not help to reduce leakage and needs additional gates; and adaptive clock scaling — which needs sophistication and is not very simple; and finally, the use of multi threshold cells for selective trade-off.

Emerging techniques include efficient RTL synthesis techniques, which is fast, but leaky, vs. slow and low power; power aware resource sharing, which is planning to be done at the architectural level and synthesis, but is not as widely used as other techniques; and power gating methodology — which makes use of sleep transistors, has coarse and fine grained methods, reduces dynamic and leakage power, and also exploits idle times of the circuit.

He added that power optimization should start at the architecture and design stages. Maximum optimization can be achieved at the system level. Also, the evolving power optimization tools and methodologies required collaborative approaches.

Power Forward Initiative

Pankaj Mayor, Group Director, Industry Alliances, Cadence Design Systems, said low power imperative is driving the semiconductor and EDA industries. He said, “design-based low power solution is the only answer!” Traditional design-based solutions are fragmented. Basic low power design techniques, such as area optimization, multi-Vt optimization and clock gating were automated in the 1990s.

There has since been an impact of advanced low-power techniques. These advanced techniques include multi-supply voltage (MSV), power shut-off (PSO), dynamic and adaptive voltage frequency scaling (DVFS and AVS), and substrate biasing. Cadence’s low-power solution uses advanced techniques.

According to Mayor, the Power Forward Initiative (PFI) has created an ecosystem as well. The Power Forward Initiative includes Cadence and 23 other companies across the design chain, as of the end of December 2007.

The year 2007 also saw a continued Power Forward industry momentum. In Q1-07, Common Power Format or CPF became the Si2 [Silicon Integration Initiative] standard. The Cadence Low Power Solution production released V 1.0 in this quarter as well. In H2-07, the industry has seen over 100 customers adopting CPF-based advanced low power solution as well as ~50 tapeouts.

CPF allows holistic automation and validation at every design step. Arijit Dutta, Manager, Design Methodology, Freescale Semiconductor exhibited the advantages of using the CPF in wireless, networking and automotive verticals at Freescale.

Shifts in top 20 global semicon rankings

If the recent preliminary results released by IC Insights is anything to go by, there have been some movements among the top 20 semiconductor companies of the world during H1-2007. This is best illustrated by the table below.

While the top three — Intel, Samsung and TI, retain their positions, ST and Toshiba have exchanged the next two positions, as have Hynix and TSMC, while Renesas remains at no. 8!

Freescale has taken a big drop from no. 9 to no. 16, while Sony, NXP and NEC gained one place each. Infineon has climbed back up to no. 12, from no. 16, while Qualcomm occupies the no. 13 position, up from no. 17. AMD dropped two positions, from no. 13 to no. 15.

Will the semicon industry see a tight year ahead? As per reports, IC Insights said that there should be a “noticeable seasonal rebound” in overall IC demand beginning in September 2007, which may cause “significant changes” in the top 20 semiconductor ranking in the second half of 2007. Wait and watch this space!