Archive

ST intros STM32L ultra-low-power Cortex‑M3 devices

STMicroelectronics has introduced the STM32L advanced ultra-low-power Cortex-M3 based MCU platform.

Built on cutting-edge proprietary process – robustness, it is part of a wide 32-bit product portfolio. The MCU platform is based on the just-enough energy concept and has an all inclusive package applications.

STM32L 32- to 128-Kbyte products are entering full production in the second half of March 2011. It is part of the industry’s largest ARM Cortex-M 32-bit microcontroller family with six STM32 families. STMicroelectronics is developing the STM32L portfolio up to 384 Kbytes of embedded memory. The STM32L is also Continua ready for its USB peripheral driver.

STM32L’s robustness has been derived from an automotive qualified process. It is all inclusive for ultra-low-power applications, and comes with hardware integrated features and software library packages. STM32L also has a ‘just-enough energy concept’, which includes undervolting, user controlled and an innovative architecture, all of this for less than 1 µA.

ST’s ultra-low-power EnergyLite platform features ST’s 130nm ultra-low-leakage process technology. It makes use of shared technology, architecture and peripherals. The company’s ultra-low-power portfolio for 2011 will be in production second half of March 2011. Many others will also be in production in the second half of April 2011. In fact, there will be over 100 part numbers from 4- to 384-Kbyte flash, and from 20 to 144 pins.

STM32L is based on ultra-low-power architecture, which is all inclusive for ultra low power applications. It also features ultra-low voltage, with power supply down to 1.8 V with BOR and also down to 1.65 V without BOR.The analog functional can be down to 1.8 V and the reprogramming capability can be down to 1.65 V.

STM32L is also flexible and secure, featuring +/- 0.5 percent internal clock accuracy when trimmed by RTC oscillator. It has up to five clock sources and has the MSI to achieve very low power consumption at seven low frequencies.

It also feattures dynamic voltage scaling in Run mode. The voltage scaling optimizes the product efficiency. User selects a mode (voltage scaling) according to external VDD supply, DMIPS performance required and maximum power consumption. It features the energy saving mode as well, down to 171 µA/DMIPS from Flash in Run mode. Read more…

Reshaping the embedded world: Vivek Sharma, ST

Vivek Sharma, regional VP, Greater China & South Asia region -- India Operations and Director, India Design Center, STMicroelectronics.

It was a pleasure to catch up with Vivek Sharma, regional VP, Greater China & South Asia region — India Operations and Director, India Design Center, STMicroelectronics, on the sidelines of the 4th Embedded Systems Conference (ESC) 2010 in Bangalore. We had a wonderful discussion on the trends that are reshaping today’s embedded world.

Sharma said: “Moore’s Law has governed many new things. In fact, it has ruled the roost. The industry has been able to push up complexity within a chip and also bring down costs.” As an example, during the last two decades, cost and complexity have combined to create the mobile device — which has turned out to be a disruptive application. The world recently added its 5 billionth mobile subscriber in July 2010. There is likely to be a whopping 50 billion connected devices by 2020!

SiP reshaping embedded world

Borrowing from wikipedia, for those interested, a system-in-a-package or system in package (SiP), also known as a chip stack MCM, is a number of ICs enclosed in a single package or module, and performs all or most of the functions of an electronic system.

3D heterogenous integration and TSV

MEMS key segment

“Accelerometers and gyroscopes are two key segments with substantial growth. MEMS takes advantage of the electrical and mechanical properties of the silicon.’ Sharma added that all MEMS gyroscopes take advantage of Coriolis effect. In 2009, ST introduced over 30 multi-axis gyroscopes.

For the statistically inclined, earlier this year, Dr. Robert Castellano of the Information Network said in their report 3-D TSV: Insight On Critical Issues And Market Analysis, that while the overall equipment market will grow at a CAGR of nearly 60 percent between 2008-2013, the metrology/inspection sector is expected to grow nearly 80 percent. On the device side, TSVs for MEMS is expected to grow nearly 100 percent in this time frame. Read more…

ST intros STM32L EnergyLite ultra-low-power MCUs for portable and very low power apps

STMicroelectronics recently launched the STM32L EnergyLite ultra-low-power MCUs. I caught up with Vinay Thapiyal, technical marketing manager, MCU’s, ST India, to learn more.

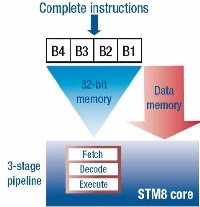

The highlights of this series of MCUs include a commitment for ultra-low power — the EnergyLite platform is common for 8-bit (STM8L) and 32-bit (STM32L) MCUs. Also, it is strong on pure energy efficiency, with high performance combined with ultra low power, i.e., high high energy saving. Finally, the ultra low power member in STM32 portfolio enriches both the STM32 ultra-low-power EnergyLite platform and the STM32 portfolio.

According to Thapliyal, STMicroelectronics has been involved in the MCU market for a long time. Off late, it has started focusing on the STM32 — the ARM Cortex based MCU and the STM8 — for 8-bit family. “We have started converging our old families into these two domains,” he added.

The STM32F is the foundation of the STM32 family. STM32F is a family of low power MCUs based on the 32-bit ARM Cortex M3 architecture.

The STM8 is a family of MCUs based on ST’s propritetary atchitecture. The STM32L is STMicroelectronics’ ultra low power family mainly used for portable and very low power applications.

The ultra-low-power EnergyLite platform, featuring the STM32L and the STM8L is based on STMicroelectronics’ 130 nm ultra-low-leakage process technology. They share common technology, architecture and peripherals. The STM8, which was launched in 2009, has caught on very fast. It is a high performance, low cost MCU.

He added that STMicroelectronics started with 130nm technology, and low pin count and low flash on STM8, while higher memory and high pin count is available on the STM32. Read more…

ST/Freescale intro 32-bit MCUs for safety critical applications

Early this month, STMicroelectronics and Freescale Semiconductor introduced a new dual-core microcontroller (MCU) family aimed at functional safety applications for car electronics.

These 32-bit devices help engineers address the challenge of applying sophisticated safety concepts to comply with current and future safety standards. The dual-core MCU family also includes features that help engineers focus on application design and simplify the challenges of safety concept development and certification.

Based on the industry-leading 32-bit Power Architecture technology, the dual-core MCU family, part-numbered SPC56EL at ST and MPC564xL at Freescale, is ideal for a wide range of automotive safety applications including electric power steering for improved vehicle efficiency, active suspension for improved dynamics and ride performance, anti-lock braking systems and radar for adaptive cruise control.

Freescale/STMicroelectronics JDP

The Freescale/STMicroelectronics joint development program (JDP) is headquartered in Munich, Germany, and jointly managed by ST and Freescale.

The JDP is accelerating innovation and development of products for the automotive market. The JDP is developing 32-bit Power Architecture MCUs manufactured on 90nm technology for an array of automotive applications: a) powertrain, b) body, c) chassis and safety, and d) instrument cluster.

STMicroelectronics’ SK Yue, said: “We are developing 32-bit MCUs based on 90nm Power Architecture technology. One unique feature — it allows customer to use dual core or single core operation. The objective of this MCU is to help customers simplify design and to also reduce the overall system cost.

On the JDP, he added: “We will have more products coming out over a period of time. This JDP is targeted toward automotive products.”

Commenting on the automotive market today, he said that from June onward, the industry has been witnessing a gradual sign of recovery coming in the automotive market.

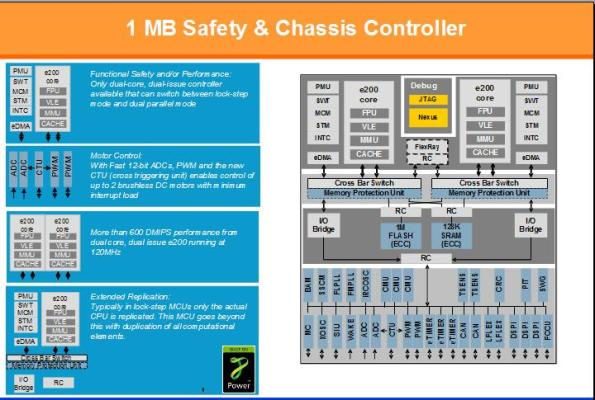

1 MB safety and chassis controller -- 32-bit MCU courtesy Freescale/STMicroelectronics joint development program (JDP)

Automotive market challenges

There has been an increasing integration and system complexity. These include:

* Increasing electrification of the vehicle (replacing traditional mechanical systems).

* Mounting costs pressure leading to integration of more functionality in a single ECU.

* Subsequent increase in use of high-performance sensor systems has driven increased MCU performance needs.

There are also increasing safety expectations. Automotive system manufacturers need to guarantee the IEC61508 (SIL3) and ISO26262 (ASILD) system-safety capability. Also, a move from passive to active safety is increasing the number of safety functions distributed in many ECUs.

Finally, there is a continued demand for quality — in form of zero defects, by which, a 10x quality improvement is expected.

MCU family addresses market challenges

The MCU family offers exceptional integration and performance. These include: high-end 32-bit dual-issue Power Architecture cores, combined with comprehensive peripheral set in 90nm non-volatile-memory technology. It also provides a cost effective solution by reducing board size, chip count and logistics/support costs.

It also solves functional safety. The Functional Safety architecture has been specifically designed to support IEC61508 (SIL3) and ISO26262 (ASILD) safety standards. The architecture provides redundancy checking of all computational elements to help endure the operation of safety related tasks. The unique, dual mode of operation allows customers to choose how best to address their safety requirements without compromising on performance.

The MCU also offers best-in-class quality. It is design for quality, aiming for zero defects. The test and manufacture have been aligned to lifetime warranty needs.

The MCU family addresses the challenges of applying sophisticated safety concepts to meet future safety standards. Yue added, “There are two safety standards — we are following those guidelines.” These are the IEC61508 (SIL3) and ISO26262 (ASILD) system-safety capabilities.

The automotive industry is also targeting for zero defects. “Therefore, all suppliers in tier 1 and 2 need to come up with stringent manuyfaturing and testing process that ensures zero defects,” he said.

32-bit dual-issue, dual-core MCU family

Finally, why dual core? Yue said that the MCU helps customers to achieve to achieve safety and motor control. Hence, dual core will definitely help deliver results.

“In many automotive applications, especially in safety-related applications, we want to have redundancy for safety. In the lock-step mode, two cores run the same task simultaneously, and results are then compared to each other in every computation. If the results are not matched, it indicates that there are some problems.”

This MCU family definitely simplifies design. It uses a flexible, configurable architecture that addresses both lock-step and dual parallel operation modes on a single dual-core chip. Next, it complies with safety standards.

A redundant architecture provides a compelling solution for real-time applications that require compliance with the IEC61508 SIL3 and ISO26262 ASIL-D safety standards. It also lowers the systems cost.

Dual-core architecture reduces the need for component duplication at the system level, and lowers overall system costs.

Consumer MEMS shine amid gloom: iSuppli

I was fortunate enough to attend a webinar on MEMS organized recently by iSuppli. The webinar looked at the growth potential of this segment, especially during the downturn, as well as some top MEMS suppliers.

According to Jeremie Bouchaud, director & principal analyst, both consumer and mobile MEMS supply has been exploding. The overall MEMS market is likely to grow from $1 billion in 2006 to $2.5 billion in 2012! There will be strong acceleration due to growth of cell phones — a hotbed for MEMS, he said.

According to Jeremie Bouchaud, director & principal analyst, both consumer and mobile MEMS supply has been exploding. The overall MEMS market is likely to grow from $1 billion in 2006 to $2.5 billion in 2012! There will be strong acceleration due to growth of cell phones — a hotbed for MEMS, he said.

However, the share of MEMS for rear projection TV is vanishing. A market worth $300 million in 2006 is slowly disappearing, and will, in fact, disappear by 2012. Among other growth areas, personal navigation devices (PNDs) and remote controllers will also see growth.

Consumer and mobile market by MEMS device

The main segments include accelerometers, as well as gyroscopes, RF MEMS switches and capacitors, microphones, etc. The penetration of MEMS devices in CE products is said to increase quite fast.

MEMS growth in cell phones will be faster. It will grow from 3 percent in 2007 to 10 percent in 2008. All of the new, best selling smartphones, such as the iPhone, Nokia N95 and N96, Samsung Omnia, HTC Diamond, Google G1, Blackberry Storm, new Palm OS, etc., have accelerometers. A number of mid range phones also have accelerometers, eg. Sony Ericsson’s models.

MEMS usage is also growing in gaming. From 1998-2005, there was technology push with limited success. However, in 2006, Nintendo showed the way with its Wii, as did the Sony PS3. Microsoft did not enter this field back then!

Interestingly, 2006-08, motion sensing unveiled new, untapped target groups for gaming — the so called casual gamers. In Xmas 2008, Microsoft also embraced motion sensors with accessories. Hence, the penetration of motion sensors has really improved. The next third generation platform will include accelerometers and gyroscopes.

Top 15 MEMS suppliers

The key question: who all are shipping these products? According to iSuppli,The top 15 MEMS suppleirs for CE and mobile phones are: STMicroelectronics, Texas Instruments, Avago Technologies, Knowles, Analog Devices, Murata, Kionix, Epson Toyocom, Invensense, Panasonic, Bosch Sensortec, Freescale, Hokoriku, VTI and Memsic.

Some other companies to watch are:

Accelerometers and gyroscopes: Qualtre, Oki, Wacon, Alps, Virtus, Ricoh.

Pressure sensors: Intersema (MEAS), Metrodyne.

Microphones: Infineon, Wolfson, Memstech, Yamaha, Omron, Panasonic, MEMSensing, AAC, Goertek.

Pico-projectors and other MEMS displays: Microvision, Nippon Signal, Samsung, Konica Minolta, Scanlight, Qualcomm, Pixtronix, Unipixel

RF MEMS switches and capacitors: Wispry, Epcos, RFMD, Baolab.

MEMS oscillators: SiTime, Discera, NXP, Seiko, Intel.

BAW filters: Triquint, Skyworks, MEMS Solutions.

MEMS actuators for autofocus and zoom: Simpel, Sony.

Micro-fuel cells: Angstrom, Tekion, Medis.

It is understood well that not all of these companies will be successful. However, they all need to be monitored carefully.

Commenting on cell phones as a hotbed for inertial and magnetic sensors, Dr. Richard Dixon, senior analyst MEMS, iSuppli, said that the market for accelerometers, gyroscopes and magnetometers is in cell phones. This market will reach $730 million in 2012. Gyroscopes are not in the market yet, and are likely to enter by 2010. The total growth rate is very fast. In units, the annual growth rate is said to be 97 percent.

Interestingly, Apple has contributed significantly to growth of MEMS. The iPhone had a great application. Other vendors followed suite with a ‘me too” strategy. Apple also had sustainable business model with downloads on the Apple Store. The chicken and egg issue of price was solved. Also, with the iPhone, there was a free field test of motion sensing based applications.

Major suppliers of accelerometers for cell phones today, include STMicroelectronics, Bosch Sensortec, Analog Devices, Hokuriku, Kionix, MEMSIC, Freescale, Oki. Of these, ST has really been very impressive, while Bosch saw impressive growth in 2008. MEMSIC dropped share in 2008.

Navigation in cell phones next big thing

According to Dixon, navigation in mobile phones is the next big thing. Leading navigation markets by platform are: mobile phone navigation, smartphone navigation, PNDs, car aftermarket and car OEM in-dash, respectively. By 2010, the mobile phone/smartphone navigation segment will account for over 60 percent of the market.

Similarly, magnetic sensors will take off in 2009 for e-Compass. There has been penetration of magnetometers in GPS phones. They have been around since 2003 in Japanese phones. These rather esoteric applications and also had technical issues.

There were successful implementations in 2008 for navigation. Eg., the G1 Street View, and the Nokia 6210. Also, 3D compass in combination with 3D accelerometers.

The leading suppliers in this space today, include AKM, Honeywell, Yamaha, Aichi Steel. In the R&D segment, the leading players are said to be Alps, Omron, Memsic, Oki, ST, Freescale, Demodulation. Growth will be steep from 2009 onward, and take off from 2010 up to 2012.

Another growth are is the multi-sensor packages and IMUs (Inertial Measurement Unit) for navigation. Today, we have six-axis e-compass combining magnetic sensors and accelerometers. In future, there will be IMU for LBS and indoor navigation also using gyroscopes.

The issue with gyroscopes is of: performance, price, size, power consumption and no availability of three-axis. Companies that need to be watched in this space are said to be Invensense, ST, Bosch Sensortec, Qualtre, Oki, Virtus.

Other opportunity areas

Later, Jeremie Bouchaud highlighted two other opportunity areas.

MEMS microphone market presents a major opportunity. It will reach close to $400 million by 2012. In 2008, already 325 million units were selling in cell phones and laptops. Leading players in this segment are said to be Knowles, Akustica, Infineon, Sonion, Memstech, AAC. Knowles has over 90 percent of the market share.

MEMS pico projectors is another growth area. Companies have made lot of progress in this segment. The pico projectors come in various varieties.

In the MEMS scanner based segment, the R&D is led by firms such as Microvison, Konica, Minolta, Scanlight, Nippon, Signal, Symbol. These solutions came first as stand alone projectors. Later, it will come on cell phones. The best opportunity is said to be at the module level.

Another sub-segnent is the DLP based projectors. First it will be in form of a pico-projector, later, followed by usage in cell phones.

Bouchaud advised watching out for non-MEMS alternatives, such as Light Blue Optics,

3M and Logic Wireless.

Coping with commoditization and price erosion

The ASP of MEMS devices for CE and mobile phones is dropping at -13 percent per year. So, what are the ways to get profitable?

To be profitable, there is a need to achieve economies of scale by combining consumer and automotive. Also, there is a need to

move wafer size to 8-inch. Next, there is a need for externalizing to foundries. ADI and TSMC have already showed the way. Now, USMC, Tower, Dongbu, Magnachip, Omron, etc., are following.

Innovation, in terms of packaging and 3D integration, test, multi-sensor packages, is another way for making profits. There is an opportunity for the equipment suppliers as well.

Consumer MEMS is currently glowing as a light in today’s dark times! It is said to grow from $1 billiom in 2006 to $2.5 billion in 2012, with 19 percent CAGR. This optimistic forecast has already started. Accelerometers are present in 10 percent of cell phones in 2008 as against 3 percent in 2007.

There exist a number of opportunities. Small companies can be successful, eg. Kionix and Invensense. There are still opportunities for newcomers. These can be large companies, fabless startups, foundries, software companies, equipment suppliers, etc. Consumer MEMS is an extremely dynamic market, having fast design cycles.