Archive

Analog and MCUs stand out: Dr. Bobby Mitra, TI

It is always a pleasure to listen to Dr. Biswadip (Bobby) Mitra, president and managing director, Texas Instruments India. Therefore, when Texas Instruments India invited me to a media roundtable today, it was an event to look forward too. However, the famous Bangalore traffic jam held me up so long that I missed out on most of Dr Mitra’s keynote! Nevertheless, I did catch some bits of it toward the end.

Dr. Mitra noted that LEDs and lighting applications are becoming a key area for growth in India. He added that the industrial segment is just right in terms of applications in electronics growth.

In telecom, analog and MCUs stand out. “Every single customer has to use analog as part of its system design. Our no. 1 position in analog gives us a unique position,” he added.

MCUs play a very important role in a huge number of areas — from consumer appliances, energy meters, lighting products etc. There is a huge customer base in India where very large application specific innovation has been happening.

In India, TI has set up a strong sales network across 14 locations, giving it a pan-India presence. Dr. Mitra added: “We want to tap the India market with sales support and applications support. You need to work hand in hand with the OEMs. We also need to get closer to our customers.” TI India supports both Indian and MNC OEMs.

“The amount of system designs being done by the MNC OEMs in India is pretty high. The third area — design houses — these OEMs are their customers. The fourth area belongs to the EMS players,” he said.

Today was virtually a walk into TI India’s ‘kitchen.’ The roundtable participants were shown demos of some really cool products and applications, especially the handheld pico projector, which also played 3D cinema!

The sessions were largely focused on analog, low power and energy efficiency, metering, solar PV/solar inverters, LEDs, medical electronics, etc. — all key areas of focus for the Indian electronics and semiconductor industries.

I will add bits from the other speakers at this event later. Stay tuned folks!

Upgrade to WiMAX 2 uncertain as TD-LTE gains in momentum!

Here’s the concluding part of the Maravedis seminar on Mobile WiMAX Deployment and Migration/Upgrade Strategies.

Robert Syputa of Maravedis focused on the evolving technology and market landscape. He said, the landscape features skyrocketing wireless broadband demand, such as the iPhone. That’s also translating into fixed broadband networks. ‘Hot’web devices would drive the industry growth. Also, the WiMAX IC vendors were the first to market with LTE.

Some other features of this landscape include multiple-mode WiMAX/LTE: extend or transition? Also, the WiMAX operators have been indicating a shift to LTE. Finally, the upgrade to WiMAX 2 was uncertain as TD-LTE was gaining in momentum. It is still early to tell what the commitments to WiMAX 2.0 would be.

Definitely, the early 4G adoption trend is exceeding many operator’s expectations due to broadband traffic demand.

Commenting on the deployment considerations, he said the fit of wireless technologies would be according to the market needs. This would take into consideration factors such as degree of mobility and roaming, build or migration to flat IP, and response to competition with 3G/LTE.

Some points to consider for device and network upgrades and migration include: how to migrate devices from WiMAX to LTE, changes in core networks, and impact of SONs, femtocell. The degree selected market is driven by mobile web devices. Maravedis also listed various candidate bands identified for IMT. Read more…

Mobile WiMAX deployment and migration/upgrade strategies

This week, I had the pleasure of attending a Maravedis seminar on Mobile WiMAX Deployment and Migration/Upgrade Strategies, sponsored by Aviat Networks. Thanks a lot to Maravedis for providing me this opportunity.

This week, I had the pleasure of attending a Maravedis seminar on Mobile WiMAX Deployment and Migration/Upgrade Strategies, sponsored by Aviat Networks. Thanks a lot to Maravedis for providing me this opportunity.

Adlane Fellah of Maravedis provided a general overview of the mobile WiMax scenario, while Robert Syputa of Maravedis touched upon the evolving technology and market landscape. Later, Jonathan Jaeger, WiMAX Solutions Marketing, at Aviat Networks discussed the mobile WiMAX deployment and migration/upgrade strategies.

Key trends in LTE and WiMAX

As for LTE chipsets, the leading chipset vendors include Qualcomm, ST-Ericsson and Nokia. The early solutions support LTE only. However, it is believed that the early suppliers may not be the long term winners.

Coming to WiMAX devices, we have seen diversified deployments of low cost CPEs, dual-mode USB dongles, and smartphones, etc. As for LTE devices, demonstrators = single-mode followed by dual-mode USB dongles. With regard to 4G equipment, WiMAX has clearly established a beachhead for technological progress, and LTE will surely benefit from it.

Students, show off your technical talent @ Mentor's University Design Contest 2010!

I really envy the students of today! They live in such lucky times!! There are so many opportunities for them to learn, grow and flourish, and so many avenues to venture!!!

Here’s one more opportunity for those brilliant students from various engineering colleges across India. Friends, you can participate and show off your techical talent by participating in Mentor Graphics’ University Design Contest 2010!

I was elated when Veeresh Shetty of Mentor Graphics informed me today about this great contest! Thanks a lot, Veeresh, and Mentor Graphics India, especially, my friend Raghu Panicker, for taking time to think about spotting talent among students.

Time to participate and win, dear students!

First, what do the students get out of this contest? Well, there’s prize money involved! The top three winners will earn a Certificate of Recognition. There will be one Winner team followed by two runner-up teams. The winning team will be awarded a cash prize of $3,000, 1st Runner-up – $2,000 and 2nd Runner-up – $1,000, respectively.

So, what’s the purpose behind this contest? Well, this is the inaugural Mentor Graphics University Design contest 2010 in India.

Xilinx intros 7 Series FPGAs

Xilinx has introduced its 7 Series FPGAs that claim to slash power consumption by 50 percent. These also reach 2 million logic cells on the industry’s first scalable architecture.

The company has introduced the Virtex-7, Kintex-7, and Artix-7 FPGA families, which promise:

– 2X more usable performance.

– 2X better price-performance with new class of FPGA.

– 2X better system-performance with Ultra High End FPGA.

– Innovative Virtex-based high volume offering.

Power is said to be the key limiting factor. At Xilinx, it is the top priority at 28nm. The Xilinx 7 Series pushes the boundaries for FPGAs. The three new families are based on a unified architecture.

The Artix 7, when compared to Spartan-6, gives 30 percent more performance, 35 percent lower cost, 50 percent less power and 50 percent smaller footprint. The Kintex 7, when compared to Virtex-6, gives comparable performance, 50 percent lower cost and 50 percent less power. Likewise, the Virtex 7, when compared to Virtex-6 is 2.5x larger, and provides up to 2M logic cells, 1.9Tbps serial bandwidth, up to 28Gbps line rate, and EasyPathcost reduction.

Users can easily scale applications with Series 7 unified architecture and design portability. Enhanced productivity is possible with Targeted Design Platforms. The foundation for Xilinx’s next generation Targeted Design Platforms are:

* Optimized ISE Design Suite.

* Expanded eco-system enabled by Plug and Play AXI based IP.

* Targeted reference designs accelerate development.

* Scalable boards using FMC Base.

Victor Peng, senior vice president, Programmable Platforms Development, Xilinx, also touched upon Programmable Foundation for Extensible Processing Platforms (EPP). It has unrivaled levels of system performance and integration, and ARM based software centric design environment.

This 7 Series will drive the next wave of FPGA adoption, thanks to:

* Increasing market demand for bandwidth coupled with flexibility.

* 2x improvement in power/performance/ capacity/price.

* Major productivity boost with Targeted Design Platforms.

* Fewer ASSPs to choose from/ASICs too risky.

Synopsys' Dr. Aart de Geus at SNUG 2010 India!

To make the ‘machine’ called SoC work, one needs to look simultaneously at economics and technology, and hence the word, techonomic.

Commenting on the global economy, he said, the industry had just come out of a very severe recession. Last year, Dr. Geus had introduced the recession compiler.

Today, there’s a clear sense of turn, and a huge shift in the global economy during the recession. According to him, China will pass Japan and become the second largest economy. China has continued to evolve quite a bit, and so has India. Dr. Geus also introduced the recovery compiler six months ago.

He added that people on one side are looking at how to minimize costs and risks. How does this impact semicon? Most semicon companies are now reporting good results. Today, there has been about 5.8-6 percent of growth, indicating a steady state. Semicon is in the center to drive growth.

In the foundry world, there has been some consolidation, and you now find some really large ones. So far, semicon has rebounded somewhat much faster. The memory folks are also feeling pretty good. It must be noted that during the last three years, they invested really nothing in capex, and some players also disappeared.

If one were to look at cool killer applications today, there’s certainly a theme around video more and more on mobile apps, HD, 3D, etc. All of this is leading to the fact that bandwidth and storgae will grow even more. Smart grids are also clearly becoming more important In future. The word ‘smart’ will be critical. “Eveything around us will commmunicate in some form or another, in future,” Dr. Geus added. Read more…

Growing Indian power electronics market provides host of opportunities

The India Power Electronics Market Report – 2010 has been developed by Dhaval Dalal and Ram Kumar, on behalf of Innovatech Switching Power India Pvt Ltd in Bangalore, India. I was delighted on being contacted by Ram Kumar, MD, who was kind enough to share some bits of this report.

The unprecedented growth in the Indian electronics demand (estimated at $50 billion for 2009), has spawned a corresponding spurt in the domestic power electronics industry. While this growth has been acknowledged in industry circles, no specific data exist to understand this phenomenon – this report aims to fulfill this gap.

The report highlights the peculiarities of Indian industry by identifying unique areas of growth which require special attention from industry participants. It also highlights the gap between the domestic demand and supply which is currently fulfilled by imports. Conversely, areas where the Indian industry contributes to the global demand by exporting products/services are also highlighted.

Coming from technology/strategic marketing background and with an unmatched access to the decision makers and trendsetters in Indian electronics industry, the authors are able to provide a highly credible and comprehensive account of the market that goes well beyond the surface data and helps identify actionable agenda for the reader.

So, here’s an opportunity for folks to enter the Indian power electronics segment, which offers a host of opportunities.

Some excerpts from the report are reproduced here. Read more…

Indian semicon market grows 15.6 percent in 2009, but don't rejoice yet!

The India Semiconductor Association (ISA) today released the ISA-Frost & Sullivan India Semiconductor Market 2009-2011 update. It was released in New Delhi by Dr. M.M. Pallam Raju, Minister of State for Defense, Government of India.

• India semiconductor market grew 15.6 percent in 2009 in contrast to the global market that shrunk by 11 percent from 2008.

Key findings:

Poornima Shenoy, president, ISA said: “The semiconductor industry in India is growing at a CAGR of nearly 22 percent. This points to the rapidly growing domestic market which necessitates the need to have electronics as a national agenda. It can contribute substantially to the GDP in the years to come.”

While this growth looks phenomenal when compared to what has happened in the global semiconductor market during 2009, it is still too early to rejoice! It is well known that the size of the Indian semiconductor industry is not too large at the moment. So, any growth will be positive!

As per the report, the TM revenues for semiconductors in India during 2009 were $5.39 billion. End user segments of wireless handsets, communications and IT segments have played a key role in the expansion of overall semiconductor revenues in 2009. Mobile handsets, communication infrastructure and drive to extend IT are likely to be the growth drivers till 2011. Registering a CAGR of 22.2 percent, TM revenues for the Indian semiconductor industry are likely to touch $8.04 billion during this forecast period.

That brings me to ESDM!

There has been a lot of talk about Electronics Systems Design and Manufacturing (ESDM) over the past six months or so. Instead of “easier to say, but difficult to manage”, the ESDM should reflect the message — “Electrifying start to dreams of many (in India)” with suitable action! The real test for ESDM starts now! A clear roadmap has to be in place to achieve the growth ahead.

Friends, I will try and review the entire report, time permitting!

What needs to be done to build an Indian electronics ecosystem!

A raging debate has been going on for long within the Indian semiconductor industry — what really needs to be done here to build a robust electronics ecosystem. Well, a highly engaging panel discussion, titled: “The electronics ecosystem: Plans and strategies for innovation and growth, organized by the India Semiconductor Association (ISA) was held today.

L-R: Gaurav K. Punjabi, senior manager - Events & Alliances, ISA, Aabid Hussain, VP of Sales & Marketing, DongBu HiTek, Lou Hutter, senior VP and GM of Analog Foundry Business unit, Dongbu HiTek, Arnob Roy, president-engineering, Tejas Networks, Poornima Shenoy, president, ISA, Felicia James, Analog strategy director, Dongbu HiTek, Rahul Arya, director, marketing and technology sales, Cadence, D. Rajakumar, GM, 3MTS, Ganapathy Subramaniam, president and CEO, Cosmic Circuits, and N. Ramakrishnan, president and CEO, Mandate Chips & Circuits.

Moderated by Rahul Arya, director, marketing and technology sales, Cadence Design Systems (I) Pvt Ltd, the panelists included:

Indian electronics product industry provides biggest opportunity for semicon

According to Tejas Networks’ Arnob Roy, product companies addressing a large local market have the potential to trigger an ecosystem. He added that the Indian electronics products industry is the biggest opportunity for Indian semiconductor industry.

Presenting an overview of the Indian electronics product market, which stands at $45 billion today, inclusive of $18-20 billion in telecom, $20 billion in consumer, industrial, automotive, etc., actually presented a great opportunity for the semiconductor industry. The Indian electronics product market represents close to 10 percent of the global electronics products market, which has been growing at approximately 22 percent year-on-year compared to 3-4 percent globally.

The Indian electronics product market is likely to grow to $120 billion by 2015. Roy added that domestic products for this market can be the biggest trigger for the semiconductor ecosystem. India consumes semiconductors worth $8 billion today, which would grow to $30 billion by 2015.

India has all the key ingredients — such as a large, growing domestic industry, a large talent pool of technical and managerial resources, and tremendous leverage of “cost of innovation”. However, the Indian market has its own innovation needs. Domestic systems companies need to drive the innovation requirements for the semiconductor market.

The Indian electronics industry can contribute significantly to the GDP as well and reduce the trade deficit. Its contribution today is negligible, as compared to the USA – 40 percent, Israel – 22 percent, and Korea and China – 15 percent, respectively.

Roy said that there is a need to nurture the Indian industry to meet domestic and strategic needs. There is also a need to create a ‘market pull’ for “made in India” products. In this regard, it would be wise to adopt a similar approach as China, while it was creating companies such as Huawei, ZTE, Haeir, etc. There is also the need to make available risk capital, and develop skills in product conceptualization, product management, marketing, branding, etc.

Dongbu HiTek’s Lou Hutter stated, “We believe in the Indian industry and we would like to be part of and help drive growth.” He added that Dongbu HiTek has been visiting India with the goal to establish something here! This is the first clear sign of a global foundry having shown keen interest to be a major player in India, which is excellent news.

He pointed out that the global analog/power market has been growing at a CAGR of 2x times the semiconductor market. While India has advantages such as a world-class education system, vibrant emerging market and proven engineering strengths, it also needs to address major challenges such as trying to build up market presence, lack of or presence of few ‘Indian’ global brands, developing marketing and business knowledge, and have access to manufacturing.

On the subject of how Dongbu HiTek can help the progression of the Indian semiconductor industry, he said that the company works with IDMs, engineering services companies, fabless and systems companies, and it could do the same in India. “Collaboration is really the essence in an ecosystem,” he added. Read more…

Evolution of various semicon analysts growth forecasts for 2010

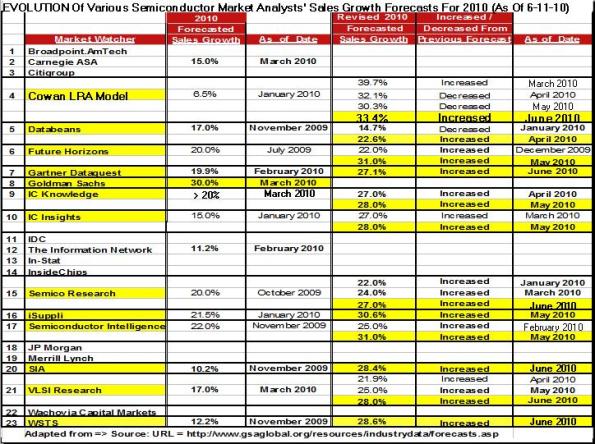

As a follow-on to his April 2010 global semiconductor forecast numbers, Mike Cowan constructed (and updated) a table (sourced from the GSA website in order to compare the latest 2010 sales growth forecasts from a large number of leading market researchers to his latest sales growth forecast estimate of 33.4 percent.

Notice that for the thirteen (13) yellow-highlighted market researchers shown in the attached table (including mine), 12 of the market watchers have increased their most recent forecast year-over-year sales growths to a range of 22.6 percent to 33.4 percent with a mean sales growth forecast of 28.7 percent (28.4 percent without Cowan’s forecast number).

As revealed in the table, Cowan’s most recent 2010 sales growth forecast estimate is the most bullish of the bunch (at least for this month; stay tuned for my monthly forecast numbers as the year plays out!).

Also note that the just published (last week – June 8 and 10, respectively), WSTS and SIA Spring 2010 forecast sales growth results for 2010 are included in the table.