Archive

Where is Indian semiconductor industry headed?

It has been a pretty disappointing year for me, so far, owing to one or another family related problems. I’ve only flattered, to deceive, as one would put it! Not that I’m out of my troubles, but am sure I can ‘play my game as usual’, hopefully, without any further disruptions.

First, I have been closely following the global semiconductor industry, despite my troubles, and there’s really nothing new worth reporting, at least, so far! Hope the next month and the rest of the year are better! But first, my take on the Indian semiconductor industry, which has now started to disappoint! At least, yours truly!

Last July, I had done a post, where, Len Jelinek, director and chief analyst for semiconductor manufacturing at iSuppli, (now IHS iSuppli) had said to a question on the need for a foundry for the Indian semiconductor industry that: “If there is a foundry built in India, it will have to start at mature technology, which they will have to underprice just to get business. Financially, this makes no sense for any investor, except for the government, which can protect the foundry (their investment) through tariffs.”

It is going to be a year since the remark was made!

This February, at the ISA Vision Summit, one heard a well known personality voice concern that the manufacturing sector suffers from a confidence deficit. A part of the software successes have been due to a brand developed. He said: “We have the advantage of a great brand, and need to make use of it in the electronics manufacturing sector. The government recognizes the need to convert Indian into a global destination.”

Where is the recognition to help create Indian into a global destination happening? Does it really take so long to develop a semicon policy in the first place? It is strange that perhaps, six and a half years since it was set up (Oct. 30, 2004), the ISA has still not found any takers for a fab in India!

Elsewhere, I mentioned that the latest ISA-Frost report on the status of the Indian semiconductor industry does not sound accurate! I don’t have anything personal against the Indian arms of MNCs, but why are they made even part of the report? I don’t recall seeing a similar report from China or Japan or Taiwan, that does a similar thing!

Where are the Indian semiconductor companies in the first place? One of India’s major semicon firms, the Srini Rajam-led Ittiam Systems, recorded a growth of Rs. 52 crore in 2010, while another significant ODM player, SFO Technologies from Kochi, Kerala, was said to be achieving Rs. 750-800 crore in 2010. What about the other Indian companies? To be accurate: what’s even happening with the Karnataka Semicon Policy? And, don’t some of the other Indian states deserve similar policies?

There are certain things that the Indian semicon industry needs to do, unless it wants to be written out of reckoning in the global context.

1) Focus on the needs of the Indian semicon companies only!

2) Prepare industry reports that highlight the capabilities of Indian semicon firms only; it does not matter how small those firms are! At least, we will have correct reports presenting the right picture.

3) I mentioned 10 points the Indian semicon industry needs to focus on in a post “Long wait for Indian semicon industry?” Perhaps, some, if not all, need to be paid attention to!

I am also told that the ISA president, Ms Poornima Shenoy is leaving, to start a new business. My best wishes to her for a successful career!

Round-up 2010: Best of semiconductors

Right then, folks! This is my last post for 2010, on my favorite topic – semiconductors. If 2009 was one of the worst, if not, the worst year ever for semiconductors, 2010 seems to be the best year for this industry, what with the analyst community forecasting that the global semicon industry will surpass the $300 billion mark for the first time in its history!

Well, here’s a look at the good, the bad and the ugly, if available for otherwise what has been an excellent year, which is in its last hours, for semiconductors. Presenting a list of posts on semiconductors that mattered in 2010.

Top semiconductor and EDA trends to watch out for in 2010!

Delivering 10X design improvements: Dr. Walden C. Rhines, Mentor Graphics @ VLSID 2010

Future research directions in EDA: Dr. Prith Banerjee @ VLSID 2010 — This was quite an entertaining presentation!

Global semicon industry on rapid recovery curve: Dr. Wally Rhines

Indian semicon industry: Time for paradigm shift! — When will that shift actually happen?

Qualcomm, AMD head top 25 fabless IC suppliers for 2009; Taiwan firms finish strong!

TSMC leads 2009 foundry rankings; GlobalFoundries top challenger!

ISA Vision Summit 2010: Karnataka Semicon Policy 2010 unveiled; great opportunity for India to show we mean business! — So far, the Karnataka semicon policy has flattered to deceive! I’m not surprised, though!

Dongbu HiTek comes India calling! Raises hopes for foundry services!!

Indian electronics and semiconductor industries: Time to answer tough questions and find solutions — Reminds me of the popular song from U2 titled — “I still haven’t found what I’m looking for”!

What should the Indian semicon/electronics industry do now? — Seriously, easy to say, difficult to manage (ESDM)! 😉 Read more…

More 'fabless IC billionaires' in 2010, says IC Insights! Is India listening?

Brilliant! There’s no other word to describe the first part of this headline!

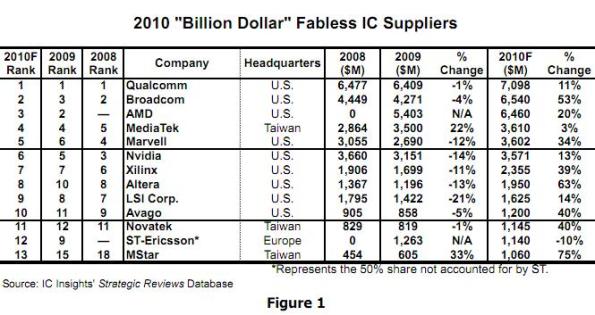

As per IC Insights’ forecast of 2010 billion-dollar fabless IC suppliers, excerpted from a ranking of top 50 fabless IC suppliers in its ‘ 2011 edition of The McClean Report’, as many as 13 fabless IC suppliers are tipped to cross the $1-billion mark in sales in 2010! As per IC Insights, this is a significant step up — from 10 companies in 2009 and eight in 2008.

Just sit back and admire this table. There are nine firms from the US — Qualcomm, Broadcom, AMD, Marvell, Nvidia, Xilinx, Altera, LSI and Avago, three from Taiwan — MediaTek, Novatek and MStar, while ST-Ericsson is Europe’s lone representation in this stellar list.

In this august club of IC billionaires, no surprises, but Qualcomm retains the top place for the third consecutive year. Broadcom moves up a place. AMD should become the world’s third largest player.

Broadcom at 53 percent, Marvell at 34 percent, Xilinx at 39 percent, Altera at 63 percent, Avago and Novatek at 40 percent each are top performers. However, MStar of Taiwan steals the show with an estimated 75 percent growth in 2010.

Qualcomm, Nvidia and LSI have performed well, especially the last two – coming pff a difficult 2009. Taiwan’s MediaTek has seen the biggest slip — down to 3 percent in 2010 from 22 percent in 2009.

There is no representation from Japan in the fabless IC billionaires club. IC Insights has indicated that the fabless/foundry hasn’t caught on in Japan and is unlikely to do so in the near future. However, Taiwan and China based firms should sooner or later find their way into this club.

I will now come to India! Read more…

Need to develop robust Indian semicon industry, led by local companies!

I came across an article titled “Global Semiconductor Companies Turn to India for Growth” published on India Knowledge@Wharton. Isn’t this reason why global semiconductor companies enter a specific market in the first place — to grow their own markets and regions? So, why should it be different with India?

India is very well known globally for its talent, chip design capabilities (especially in the Indian arms of the global semicon firms) and as the world’s embedded bastion!

This particular article is brilliantly written, and kudos the author. The clinching paragraph is tucked away at the end, starting with: “None of the global players, however, is currently looking at setting up a semiconductor fabrication plant, or “fab,” in India.”

What’s happened up until now in the Indian semicon industry? If one were to look at the Special Incentive Package Scheme (SIPS), which was introduced back in Sept. 2007 by the government of India, it was geared toward encouraging investments for setting up semicon fabs, and other micro and nanotechnology manufacturing industries in India!

It also defined the “ecosystem units” as units, other than a fab unit, for manufacture of semiconductors, displays including LCDs, OLEDs, PDPs, any other emerging displays; storage devices; solar cells; photovoltaics; other advanced micro and nanotechnology products; and assembly and test of all the above products.

Next, the government of India’s thrust on solar/PV, via the Jawaharlal Nehru National Solar Mission (JN-NSM), has at least ensured the country’s solar/PV future.

What has happened since all of these policies? Really, nothing much, at least from the perspective of the Indian semicon industry. If it has, at least, I am unaware, and my apologies for this ignorance.

Of course, solar/PV seems to be going from strength to strength! Recently, NTPC Vidyut Vyapar Nigam Ltd (NVVN) put out the list of selected solar projects under the JN-NSM Phase 1, Batch 1. But that’s another story!

On this very blog, there are several posts that speak of India’s ability or inability to build a fab. At first, folks said that semicon fabs were on their way in India, and that the story isn’t disappearing. However, somewhere along the line, that particular vision took a beating and fabs simply disappeared from the Indian semicon radar! Read more…

Indian medical electronics equipment industry to grow at 17 percent CAGR over next five years: ISA

The India Semiconductor Association (ISA) has released a sector report on the opportunities in the Indian medical electronics field, titled: “Current status and potential for medical electronics in India”, 2010, at the Narayana Hrudayalaya campus in Bangalore.

The Indian healthcare market (FY ’09) has been valued at Rs. 300,000 crores ($63 billion). Of this, healthcare delivery makes up 72 percent, pharmaceutical industry 20 percent, health insurance 5 percent, medical equipment 1.4 percent, medical consumables 1.1 percent, and medical IT 0.2 percent, respectively.

Medical electronics has been valued at Rs. 3,850 crores ($820 million) of the overall Indian healthcare market of Rs. 300,000 crores. The Indian medical equipment market is estimated to grow at around 17 percent CAGR over the next five years and reach about Rs. 9,735 crores ($2.075 billion).

As per the ISA report, the Indian healthcare industry currently contributes to 5.6 percent of GDP, which is estimated to increase to 8-8.5 percent in FY 13.

The domestic market for medical equipment currently stands at Rs. 3,850 crores ($820 million). Annually, medical equipment worth Rs. 2,450 crores ($520 million) is manufactured in India, out of which Rs. 350 crore ($75 million) is exported.

Growth of the medical equipment market is directly proportionate to growth of healthcare delivery, which was Rs. 216,000 crores ($45.36 billion) in 2009 Siemens, Wipro GE and Philips are leaders in the space with 18 percent, 17 percent and 10 percent share, respectively. However, 45 percent of the market is addressed by smaller, niche domestic players.

The report was released by Dr. Devi Prasad Shetty, CMD, Narayana Hrudayalaya, in the presence of Dr. Bobby Mitra, ISA chairman, Poornima Shenoy, ISA president and Vivek Sharma, convener of the ISA Medical Electronics Segment. Read more…

Solar PV likely showstopper at electronica India 2010 and productronica India 2010

For those interested, since its debut in 2009, this show has been split into two sections – productronica India — devoted to production technologies, SMT and EMS/contract manufacturers, PCB, solar and PV, laser, etc., and electronica India – focused on components, semiconductors, assemblies, LEDs and materials.This year, there are going to be three added attractions or special exhibit areas, namely:

* Solar pavilion.

* LED pavilion.

* Laser pavilion.

Solar PV main attraction

A report on the ‘Solar PV Industry 2010: Contemporary Scenario and Emerging Trends’ released by the India Semiconductor Association (ISA) with the support of the Office of the Principal Scientific Advisor (PSA), lays out the strengths and challenges of the Indian solar PV market:

* Even though the industry operates at a smaller scale as compared to other solar PV producing nations, production in India is very cost effective as compared to global standards.

* With Government initiatives such as the SIPS scheme and JN-NSM in place to promote application of solar PV in domestic market, the Indian solar PV industry is likely to gain further edge over other solar PV producing nations.

* There is no manufacturing base in India for the basic raw material, that is, silicon wafers.

* Over the last five years, China has emerged as the largest producer of solar cells in the world. The country currently has about 2,500 MW of production capacity for solar PV as compared to India’s 400 MW. Taiwan, with annual capacity of 800 MW, is also emerging as a major threat to the Indian industry.

* Price reduction is another major challenge for the industry as this would have greatly impact the future growth of the market.

The recently concluded Solarcon India 2010 threw up several interesting points as well. Industry observers agreed that the timely implementation of phase 1 of the historic Jawaharlal Nehru National Solar Mission (JN-NSM) is going to be critical for the success of this Mission.

The MNRE stressed on the need to develop an indigenous solar PV manufacturing capacity in solar, and build a service infrastructure. Strong emphasis is also being placed on R&D, and quite rightly. Notably, the Indian government is working toward tackling issues involved with project financing as well.

All the right steps and noises are currently being taken and made in the Indian solar PV industry. If these weren’t enough, the TÜV Rheinland recently opened South Asia’s largest PV testing lab in Bangalore!

This year, an exhibitor forum on PV and solar will also take place at the Solar PV pavilion during electronica India 2010 and productronica India 2010.

Read more…

Unique solution required for grid-tie inverters in India!

He was speaking during a workshop on solar inverters, organized by the India Semiconductor Association (ISA) on 23 July, 2010, in Kolkata, India.

Further, the inverters (solar/otherwise) are still designed with chips designed for motor control application. There is a need for inverter specific solution input PFC, battery monitoring/algorithms, charge current/mains sense, power device drivers, etc).

As and when these challenges be met, which should happen, hopefully, in the long run, the Indian opportunity is immense! For instance, the goal of the Jawaharlal Nehru National Solar Mission (JN-NSM) is already well known — to set up a capacity of solar power generation of 20,000 MW by 2022 in India.

Solar should be seen as a long term solution to solving India’s power deficit situation. The total capital outlay at today’s prices for adding 20,000MW capacity is estimated at Rs. 4 lakh crores ($90 billion)! Further, the share of electronics (balance of system) alone will likely be Rs 80,000 crores ($20 billion). Read more…

Need to overcome solar inverter challenges and issues in India

According to Dr. J. N. Roy, vice president (R&D/Engineering), Solar Semiconductor Pvt Ltd, while Indian made inverters could be mostly installed indoors, the foreign ones could be deployed both indoors and outdoors. In terms of durability, Indian inverters are expected to last at least 20 years, while foreign inverters had already proved that they can last this distance!

These limitations or challenges facing Indian made inverters were highlighted by Dr. Roy during a workshop on solar inverters, organized by the India Semiconductor Association (ISA) on 23 July, 2010, in Kolkata, India.

In terms of control, Indian inverters did not support wireless features as yet, while it is already available on foreign inverters. In terms of design and support, while Indian inverters were generally custom made, the foreign inverters were standardized and had simulation support. As for efficiency, while Indian inverters had efficiency less than 94 percent, their foreign counterparts boast efficiency higher than 97 percent — a telling differentiator.

In terms of battery voltage, Indian made inverters were available supporting 24V, 48V, 96V, 120V and 240V, respectively. Foreign made inverters support 24V and 48V as fixed. They are light and compact, as compared to large and heavy for locally made inverters. While Indian inverters are generally EC and TUV approved, the foreign inverters are EC and TUV approved and UL listed, respectively.

Dr. Roy also highlighted the challenges faced by power control units (PCUs) in India and touched upon the desired features of inverters.

Roy said that inverters today have a mean time between failure (MTBF) of less than 10 years. The computed MTBF above 100 years has already been achieved in recent modular solar inverters. Incidentally, solar PV panels easily meet the 25 years life requirement.

He provided case studies, such as off-grid DC couple system, off-grid AC couple system, and off-grid pump systems. In the off-grid pump systems, there were no batteries/grid as buffer. Power consumption can be matched with power generation by controlling speed of the pump. He advised making power generation as close as possible to maximum power.

Dr. Roy provided several examples of inverters. While multi string inverter and central inverter were examples of classification based on installations, solar inverters with and without transformer were examples of classification based on topology. Read more…