Archive

Clearly, mixed signals in OEM semiconductor design activities!

Friends, here is the full report on iSuppli’s recent activity titled “Mixed Signals in OEM Design Activities”.

Min-Sun Moon, senior analyst, Semiconductor Spend and Design, iSuppli, discussed how the “values” of design activities are discerned globally and how design decisions are made by a given country.

This report should be of particular interest to the Indian semiconductor design industry as it is apparent there is considerable scope for growth and development.

It is very well documented that everyone has been hit hard by the economic downturn. The electronic OEMs are no exception. They have also reduced shipments. The average selling prices (ASPs) of semiconductor devices have dropped dramatically as well.

Top six design influencing countries

As per iSuppli’s Design Activity Tool, the top six countries leading in the design influence are as follow: USA, Japan, China/Hong Kong, Taiwan, South Korea and Germany. The United States retains the no. 1 position, followed by Japan and China.

The dramatic changes in ASPs of chips and products meant an almost about 5 percent drop in semiconductor spend in 2008, and above 21 percent drop in semiconductor spend by the top OEMs in 2009. Hence, design activities by top OEMs dropped significantly.

The USA apparently has been going through a tough period, and it does not seem to have a bright future in 2009-10 due to drop in design spends. However, in 2010, it should post about 9-10 percent growth. The top design influencers in the USA include HP, Dell, Apple and Motorola.

China seizes opportunity

According to Moon, Japan retained the second position. However, China has seized the opportunity during the recession. It has some growth compared to other countries who have had negative growth this year.

China still remains one of the most attractive markets for OEMs to enter. Many top OEM have either opened or expanded R&D centers in China in the last few years.

However, because of the recession, the expansion by OEMs slowed down in China during 2009. Nevertheless, the Chinese market continues to grow. In the next few years, China will grow and the other countries will have some positive growth as well, but their growth will be slower than that of China.

China has also been showing interesting signs. Some Chinese companies are trying to enter new markets, such as automotive.

China is currently the third largest country in terms of design influence. The design share is about 10 percent in 2009. China could get close to Japan and the USA, but it will not happen in the near future though.

Top five countries in 2009

In 2009, the top five countries by design influence spend share are as follows: USA — 31 percent, Japan — 25 percent, China/Hong Kong — 10 percent, Taiwan — 8 percent, South Korea — 7 percent, and the Rest of the World — 19 percent.

Mixed signals are apparent in the design activities by country. For instance, this year, the USA has been losing market share. A large percent of design activities are moving to the Asia Pacific region. Some business in the USA is being continued or reduced — and being moved to other regions — in order to maintain the business and lower the cost of operations.

Japan’s design spend share increased from 22 percent (approximately $40 bn in 2008) to 25 percent in 2009. Japan is bringing a lot of design activities back home.

Taiwan used to be third largest in the design influence, but has now dropped to the fourth position, with share in design spend reaching 8 percent in 2009. China also contributed to the changes here. However, it is still better than others as some OEMs are still outsourcing to some ODMs located in Taiwan.

Identifying targets by regions

iSuppli gave examples of designing with sensors and actuators, and LEDs, as these are very popular currently.

According to Moon, designs using sensors and actuators have been more than 30 percent in the USA, while Japan has more than 25 percent. It is over 20 percent in Europe, while such designs have been less in Asia Pacific — above 15 percent.

The biggest influencers for sensors and actuators in the USA are said to be Apple, HP and TRW Automotive.

For LEDs, more use has been happening in Japan — over 30 percent. As an example, there are more LED TV design activities in Japan. The biggest influencers for LEDs in Japan are Canon and Sony.

Changes due to M&A

Another trend visible in the design spend share has been the changes due to mergers and acquisitions.

As an example, we have the Mitac Group, which acquired Magellan’s consumer products division. In 2008, Mitac Group had 78 percent spend in Taiwan, and 18 percent in the USA. After acquiring Magellan, Taiwan’s design spend share became 57 percent and USA’s became 13 percent. On the other hand, France’s share grew to 17 percent and Russia’s to 7 percent. This indicates that country-wise, budgets do get changed. This is just one example.

These are indeed very interesting numbers and facts, and as mentioned earlier, India has a considerable opportunity as an influencer in the semiconductor design spend going forward.

Will solar downturn lead to more mature PV industry?

The severe downturn in the global Photovoltaic (PV) market in 2009 actually could have a positive outcome for the worldwide solar industry, yielding a more mature and orderly supply chain when growth returns, according to iSuppli Corp.

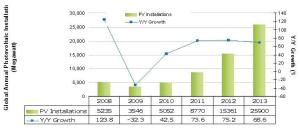

Worldwide installations of PV systems will decline to 3.5 Gigawatts (GW) in 2009, down 32 percent from 5.2GW in 2008. With the average price per solar watt declining by 12 percent in 2009, global revenue generated by PV system installations will plunge by 40.2 percent to $18.2 billion, down from $30.5 billion in 2008.

The figures present iSuppli’s forecasts of global PV installations in terms of gigawatts and revenue.

Fig 1: Global Photovoltaic System Installation Forecast in Megawatts, 2008-2013 Source: iSuppli, April 2009

Source: iSuppli, April 2009

“For years, the PV industry enjoyed vigorous double-digit annual growth in the 40 percent range, spurring a wild-west mentality among market participants,” said Dr. Henning Wicht, senior director and principal analyst for iSuppli. “An ever-rising flood of market participants attempted to capitalize on this growth, all hoping to claim a 10 percent share of market revenue by throwing more production capacity into the market. This overproduction situation, along with a decline in demand, will lead to the sharp, unprecedented fall in PV industry revenue in 2009.”

However, the 2009 PV downturn, like the PC shakeout of the mid 1980s, is likely to change the current market paradigm, cutting down on industry excesses and leading to a more mature market in 2010 and beyond.

Fig 2: Global Revenues Generated by Photovoltaic Installations 2008-2013 in Millions of US Dollars Source: iSuppli, April 2009

Source: iSuppli, April 2009

“The number of new suppliers entering and competing in the PV supply chain will decelerate and the rate of new capacity additions will slow, bringing a better balance between supply and demand in the future,” Wicht said.

Blame it on Spain

The single event most responsible for the 2009 PV market slowdown was a sharp decline in expected PV installations in Spain. Spain accounted for 50 percent of worldwide installations in 2008. An artificial demand surge had been created in Spain as the time approached when the country’s feed-in-tariff rate was set to drop and a new cap of 500 Megawatts (MW) loomed for projects qualifying for the above-market tariff. This set a well-defined deadline for growth in the Spanish market in 2009 and 2010.

While the Spanish situation is spurring a surge in excess inventory and falling prices for solar cells and systems, this will not stimulate sufficient demand to compensate for the lost sales in 2009. Even new and upgraded incentives for solar installations from nations including the United States and Japan—and attractive investment conditions in France, Italy, the Czech Republic, Greece and other countries—cannot compensate for the Spanish whiplash in 2009.

The Spanish impact will continue into 2010, restraining global revenue growth to 29.2 percent for the year. Beyond Spain, the PV market is being adversely impacted by the credit crunch.

“Power production investors and commercial entities are at least partially dependent upon debt financing,” Wicht noted. “Starting in the first quarter of 2009, many large and medium solar-installation projects went on hold as they awaited a thaw in bank credit flows.”

After the fall

After 2010, the fundamental drivers of PV demand will reassert themselves, bringing a 57.8 percent increase in revenue in 2011 and similar growth rates in 2012 and 2013.

“PV remains attractive because it continues to demonstrate a favorable Return on Investment (RoI),” Wicht said. “Furthermore, government incentives in the form of above-market feed-in-tariffs and tax breaks will remain in place, making the RoI equations viable through 2012. Cost reductions will lead to attractive RoI and payback periods even without governmental help after 2012.”

Furthermore, lower system prices will open up new markets by lowering incentives and subvention costs. The lower the PV system prices are, the lower the incentives will have to be. Developing regions will be big the beneficiaries of these lower prices and thus will grow faster than the global average, Wicht said.

Source: iSuppli, USA

No semicon recovery before mid 2010: Europartners

Connecting with new friends from all over the world is one of the best things that I have experienced while writing a semicon and electronics blog. One such gentleman is Ingo Guertler from Europartners Consultants. He is based in Munich, Germany — a city I have frequented several times.

Guertler has been part of my LinkedIn network as well. He has spent 30 years in leading positions in the electronic components market, mostly with semiconductors, at General Instrument, QT Optoelectronics and Vishay. Since 2005, he has been the senior partner at Europartners Consultants, a network of independent consultants, mostly located in Europe.

Beside individual projects, Europartners analyze the worldwide distribution market for electronic components each year and publish the results in its Worldwide Distribution Report.

Additionally, the company also organizes a two-day conference in Paris every two years, with high-level speakers out of the electronic component industry, discussing actual topics with top managers from component manufacturer and distributors.

This year, the headline will cover the world economy crisis, its effect on the electronics industry, and how companies can successful manage the crisis.

Naturally, our conversation revolved around the global semiconductor market, the memory market turmoil, and how European companies view the Indian semiconductor industry.

Semicon to decline 20 percent in 2009

Ingo Guertler expects a decrease in the global semiconductors market of approximately a minimum of 20 percent. Europartners does not see a recovery before the middle of 2010.

Guertler said: “Maybe, there can be a light recovery in the second quarter 2010 in some regions. Everything will depend on how fast the funds of the governments to the industry will draw. We have to specifically watch, the American and Chinese markets.”

Regarding the memory market, he added that everybody had expected that Vista will stimulate the markets. However, that did not happen. “For the time being, the industry has no direct killer application for memories available or in the design stage. I expect a further price erosion on memories, especially on DRAMs,” he cautioned.

Europe’s interest in Indian semicon

Again, it was natural for me to query Ingo on how European companies view the Indian semiconductor industry.

According to him, for the time being, collaboration between the European and Indian companies is limited in the most cases, or on a one-way service base, using the excellent skills and resources of the Indian software companies and engineers that also includes EDA. “I don’t think that will change in the near future,” he added.

Guertler said: “Personally, I see India as a new market challenge in the next 10 years or more for the European companies, because the local demand will grow faster in India, than we today see in China. Also, I believe and have seen it already, that a lot of companies will likely shift their production bases from China to India the next time, simply because of lower costs, availability of good, graduate engineers and a more Western orientated politics of the Indian government.”

However there is one handicap for the Indian continent! That is: the current infrastructure and the political situation between India and Pakistan.

According to Guertler, India has to set up huge investment programs to invite more investors in the country. Very importantly, is there any feeling that overseas companies’ interest in India is slowing down?

“Definitely not, as far as the European companies are concerned. If India meets the industry’s requirements, I believe their preference will be for India in comparison to China,” he said.

That indeed, is great to hear! The Indian interest is very much intact, in Europe and elsewhere. Now, it is time for India to get some work started on semiconductor product development companies.

DRAM makers being offered lifelines via bail out plans!

Browsing the Web these past days has brought me to various stories, mostly discussing the various bail out plans being provided for some leading DRAM makers.

It all started with Germany based Qimonda announcing that it has arranged a Euro 325 million financing package for the ramp up of its innovative Buried Wordline technology.

Yesterday, Hynix, the Korean DRAM maker, received a bail out of $597 million, according to reports on Fabtech. The story also reports that Powerchip Semiconductor, Taiwan’s largest DRAM maker, is also seeking new funding.

Then, DigiTimes, a very good technology news Web site from Taiwan, reported yesterday that Taiwan’s Ministry of Economic Affairs (MoEA) had reportedly developed an NT$200 billion (US $6.5 billion) bail out plan for Taiwan’s hard-hit DRAM makers.

Sitting in India makes it a little difficult to speak with global companies based in Taiwan, Korea and Germany. I sometimes wish I could get some help from reliable sources as to what’s the actual ground situation.

Having said that, it is good to see various national governments showing their deep concern about the state of the global DRAM industry and about technologies. And, let us keep all criticisms aside, as to who performed and who didn’t! Here’s a lesson for India to learn from, as closer home, it has a semiconductor industry really in its infancy!

Right now, the global semiconductor industry is facing a downturn and memory is the hardest hit! Hence, if any measures are being taken to somehow bring DRAM back on track, it should be welcomed.

Qimonda, Hynix, Powerchip, etc., are not small names in the global industry. Poor performance from memory players saw them dropping out of the top 20 global semiconductor players’ rankings in 2008.

All the lifelines being provided to these major players now means that these companies need to pull it off, somehow, and extricate themselves from the depths they have fallen into. If they fail, they will perish! And, they all know that!!

I’d be very keen to see the responses of DRAMeXchange and iSuppli on these bail out plans.

Merry X’mas everyone, and hope you all have a great time!

PS: I have iSuppli’s feedback!

Speaking on the Taiwan government’s bail-out plan as well as Hynix’s rescue package from banks, John Lei, Analyst, memory, iSuppli Corp., said: “In general, Hynix’s package is much like a short-term relief for their near-term debt, while the Taiwan government aims at the possible consolidation of five suppliers.”

“All these packages could bring more uncertainties to the maket, however, based on iSuppli’s assumption and forecasts. The industry operation profit margin will hit bottom in Q4-08, but profitability of the industry will not occur until Q4-09,” he added.

Why 3G operators can't ignore TD-SCDMA

Come Beijing Olympics, and China will be showcasing the TD-SCDMA (Time Division-Synchronous Code-Division Multiple Access) technology. Largely unheralded, and spoken about by relatively few, TD-SCDMA may well surprise the telecom industry and pundits.

In fact, it is not even well known that the Ministry of Information Industry (MII) in China had allocated a total frequency of 155MHz for TD-SCDMA way back in Q3 of 2002. Back then, Lothar Pauly, then member of the Group Executive Management of Siemens Information and Communication Mobile had said that the allocation of frequencies for TD-SCDMA in China marked “a milestone in the standard’s development.” Siemens mobile has been developing 3G technology jointly with the China Academy of Telecommunications Technology (CATT/Datang) since 1998.

As per the TD-SCDMA Forum, China Mobile has announced its TD-SCDMA terminal timetable. Apparently, in China Mobile‘s second round of TD-SCDMA terminal bidding, ZTE has won orders for 61,000 handsets and Samsung for 20,000 handsets.

Also, the MIIT has established a 3G inter-ministerial co-ordination group. Li Yizhong, minister of the new Ministry of Industry and Information Technology (MIIT) in China, says that the ministry has established a 3G inter-ministerial co-ordination group to promote the commercial test and ensure the success of TD-SCDMA.

He says that the ministry should actively promote the commercial test of TD-SCDMA, further reform the system, and carry out the major scientific and technological projects. Relative officials are required to supervise the construction of TD-SCDMA base stations in Beijing to ensure the call quality of TD-SCDMA and ensure the trial operation of TD-SCDMA mobile phone TVs during the upcoming Olympic Games.

The minister has also issued orders to give full support to the implementation of measures and policies beneficial for the development of TD-SCDMA. The ministry should organize Chinese telecommunication units to realize better network optimization, supply special Olympic services, co-ordinate the interoperability between 2G and 3G, solve the problems in the commercial tests, and to ensure the initial success of TD-SCDMA.

All of these developments reminds and takes me back to 2000, when TD-SCDMA was just starting to make the rounds. A good friend, Shih-ying Tan from Siemens Hong Kong, called me up to discuss this technology! Subsequently, it led to visit to Munich, to see the technology first hand!

Here are excerpts from a discussion I had, back in August 2001, with Klaus Maler, who was general manager, TD-SCDMA, for Siemens Information and Mobile Communications in Munich, Germany, at that point of time (in pic). I was serving Wireless Week, US, as its Asia-Pacific editor. Some or most of this may read a bit outdated, but it is still worth a read for those keen on TD-SCDMA.

Here are excerpts from a discussion I had, back in August 2001, with Klaus Maler, who was general manager, TD-SCDMA, for Siemens Information and Mobile Communications in Munich, Germany, at that point of time (in pic). I was serving Wireless Week, US, as its Asia-Pacific editor. Some or most of this may read a bit outdated, but it is still worth a read for those keen on TD-SCDMA.

TD-SCDMA, a 3G technology co-developed by Siemens AG and the China Academy of Telecommunications Technology, is said to be the only technology suitable for TDD (time division duplex) bands. In addition to being more spectrally efficient for both symmetrical and asymmetrical data services, it is capable of dealing with hot spot scenarios. Some TDMA operators reportedly are considering it as an option for migrating to 3G, and once deployed on the mainland of China, it is likely to reach the economies of scale that would make it attractive to mobile operators worldwide.

Acceptance by carriers

What are the chances that TD-SCDMA will be accepted by carriers, given that it is a TDD technology while wideband-CDMA and CDMA2000 are FDD (frequency division duplex) technologies? Isn’t TDD in a minority here?

Maler had replied that TD-SCDMA, as well as W-CDMA, uses GSM MAP [manufacturing automation protocol]. This means that it is very likely to have affordable GSM/W-CDMA or GSM/TD-SCDMA dual-mode or GSM/TD-SCDMA/W-CDMA triple-mode handsets. On the other hand, an exotic GSM/CDMA2000 handset should support two different MAPs–GSM and IS-833. Dealing with such complicated and expensive handsets does not encourage GSM operators to adopt a CDMA standard.

As TD-SCDMA is TDD based, it offers optimum spectral efficiency for both symmetric and asymmetric data services. Certainly, carriers won’t ignore this aspect. On an international scale, TD-SCDMA is the only technology suitable for the TDD bands, assigned by regulators worldwide and already have been auctioned in Europe. So TD-SCDMA, being an accepted standard worldwide, approved by the ITU and standardized in the 3GPP (Third-Generation Partnership Project), is definitely not in a minority.

Were there any chances that TD-SCDMA won’t get locked in like another TDD standard, PHS, has in Japan? In response, Maler said TD-SCDMA is an accepted technology, while PHS is more of a local standard in Japan. Also, TDD frequencies have been allocated in most of the European countries. These are the two major reasons why TD-SCDMA has more potential.

Mainland China is already the largest mobile market now. TD-SCDMA will be deployed in China as a global standard, addressing all sizes of cells, [so] the necessary effects of scale will be available for operators worldwide.

“We had discussed with mainland Chinese manufacturers a few years ago the advantages of combining TDD technologies with smart antennas. We studied this issue and this evolved into continuous improvement and actual development. This happened at a time when we were looking at the mainland Chinese market as a major focus. Last year, when we realized that TD-SCDMA had good potential, we started to introduce it into the 3GPP. Now it has been accepted as a global standard,” he said.

According to him, TD-SCDMA has a very bright future, [although] operators may go for a combination of technologies. TD-SCDMA allows operators to add spectrum for voice services using their core GSM networks. The version we are talking about for the launch in mainland China is based on a GSM core network. This will later evolve into a UMTS core network. We started developing the technology three years late, [so you could] say that TD-SCDMA is three years more modern than the other technologies. Now, we are all having trials simultaneously.

Is there a compelling case for TDMA operators to go the TD-SCDMA route? At the moment [this is 2001 end, remember], most TDMA operators in United States, for example, Cingular Wireless, AT&T Wireless and VoiceStream Wireless, are embracing GSM, thereby, acknowledging it as a worldwide standard. They are also committed to adopting the following migration path–TDMA-GSM-GPRS-EDGE-UMTS– following the footsteps of European operators.

Both of the UMTS alternatives –- W-CDMA and TD-SCDMA -– are being taken into consideration by TDMA operators, either as a complementary or an alternative solution. In particular, American TDMA operators believe that TD-SCDMA, thanks to its higher data transmission rate and its capability to deal with asymmetrical traffic and hot spot scenarios, is an interesting technology. The 1.6MHz bandwidth [it uses] will certainly ease the spectrum allocation in the already crowded spectrum currently available in the United States.

Most of the TDMA operators are moving to the GSM-GPRS-EDGE-W-CDMA route. It’s not easy to get FDD spectrum in the United States and it will become even more difficult in the future. This is a very good opportunity for a TDD technology like TD-SCDMA.

TD-SCDMA in Europe

Were there any plans to implement TD-SCDMA in Europe, and especially Germany, given that Siemens has been playing an active role in developing this technology?

In Europe, TD-SCDMA will be deployed with capacity-enlargement purpose

s in W-CDMA networks in hot spot scenarios. By that time, TD-SCDMA will already be a mature technology and will have derived benefits from the mainland Chinese experience.

Most of the operators are now focusing on W-CDMA. They can consider TD-SCDMA to enhance services later on. We are speaking with several operators in Europe. They have been surprised and have actively responded [because] they can see that the chances for TD-SCDMA to succeed have improved considerably. Operators that had not chosen Siemens for some reason now have decided to take another look at us.

And why aren’t GSM operators elsewhere showing interest in this technology? Instead, they have been opting for W-CDMA? In the very beginning in Europe, around 1998, TDD was conceived as a technology only for micro and picocell coverage. Consequently, it was considered interesting only in a second phase of the UMTS deployment as a capacity enlargement. Spectrum was assigned and licenses were bought bearing this in mind.

As TD-SCDMA is also able to cover large cells, the momentum behind it is increasing considerably and we are getting quite a lot of interest from European operators of merging TDD activities into this technology.

TD-SCDMA is quite a good alternative. Also, if an operator already has W-CDMA and adds TD-SCDMA, or it’s the other way around, it’s quite a good combination. Very soon, carriers will notice capacity shortages, especially for the more powerful applications. Facing the fact that they are wasting bandwidth, in terms of asymmetrical traffic, TDD is the technology of choice. The combination of both technologies — W-CDMA and TD-SCDMA — may apply in most countries, even here in Europe.

By the way, there used to be LinkAir’s LAS-CDMA (Large Area Synchronized Code-Division Multiple Access). LAS-CDMA was also said to offer a higher spectral efficiency and moving speed, thus providing better support for mobile applications. Its asymmetric traffic, higher throughput, and smaller delay provide also improved IP support. A LAS-CDMA TDD variant is compatible with systems such as TD-SCDMA.

I had written about LAS-CDMA back in 2000, but have been unable to find the link. Even there’s no update on this technology. Would be great if folks could update me on LAS-CDMA.

Lastly, I need to thank Chi-Foon Chan, president and COO of Synopsys, who I recently met on the sidelines of the Synopsys SNUG event. Chan discussed TD-SCDMA and LAS-CDMA briefly, while touching upon the semicon/EDA industry. But, more of that later!

New camps promise exciting times ahead in memory market

The last few weeks of this month witnessed some interesting developments in DRAM. No, there are not signs of a recovery, yet. Instead, the appearance of new DRAM camps, as well as a new memory interface working group, does generate some interest.

However, first, the stats. DRAMeXchange recently reported that the Q1-08 revenues of the branded DRAM makers, impacted by continual low DRAM prices, fell by roughly 5.8 percent compared to Q4-07. Likewise, the contract prices and the spot prices fell 19 percent and 11 percent respectively.

DRAMeXchange further reported that barring Elpida and Powerchip, all other DRAM makers experienced a decline in revenues. Both Elpida and Powerchip witnessed slight increase in their market share during Q1-08.

Categorizing the DRAM industry market share by countries, Japan only increased by 0.9 percent from 13.5 percent to 14.4 percent, as Elpida’s revenue increased in Q108. Taiwan’s share increased by only 1.1 percent from 13.6 percent to 14.7 percent, as Powerchip gained market share. Korea sustained the same market shares — 47.2 percent, as in Q4-07.

However, America and Germany lost share. America’s share slipped from 13.6 percent to 13 percent, while Germany’s share fell from 12.2 percent to 10.8 percent, respectively.

In a recent investor conference, Samsung announced it will increase its Bit Growth Rate from 70 percent to 100 percent, an indication of its desire to continue reigning as a DRAM market leader.

Now, to the really interesting developments. First, Nanya and Micron signed an agreement to create MeiYa Technology Corp., a new DRAM joint venture. One of Nanya’s 200mm facility in Taiwan will be upgraded to 300mm starting this year, with the facility going online for production in 2009. Besides MeiYa, Nanya and Micron will co-develop and share future technology.

If this wasn’t enough, close on the heels of the Micron-Nanya JV, Elpida Memory and Qimonda AG, signed a Memorandum of Understanding (MoU) for a technology partnership for jointly developing memory chips (DRAMs), and accelerate their roadmap to DRAM products featuring cell sizes of 4F2.

Analysts at DRAMeXchange believe that the Qimonda-Elpida alliance re-shuffles the DRAM competitive landscape. It is also a sign of Qimonda’s determination to develop stacked process.

Lastly, ARM, Hynix Semiconductor Inc., LG Electronics, Samsung Electronics, Silicon Image Inc., Sony Ericsson Mobile Communications AB, and STMicroelectronics announced the formation of a working group, the Serial Port Memory Technology (SPMT), which is committed to creating an open standard for next-generation memory interface technology targeting mobile devices.

SPMT, a first-of-its-kind memory standard for DRAM, is said to enable an extended battery life, bandwidth flexibility, significantly reduced pin count, lower power demand and multiple ports by using a serial interface instead of a parallel interface commonly used in today’s memory devices.

Handset vendors have joined the fray as this technology will not only extend battery life, it will allow high-performance media-rich applications as well, that are likely to be the norm on next-generation mobile phones.

Surely, these developments and the emergence of new camps promise some exciting times ahead in the memory market.