Archive

iSuppli raises 2010 foundry forecast; interesting lessons to learn for India from China's story!

“During the first three quarters of 2010, foundries were under intense pressure to meet customer demand,” said Len Jelinek, director and chief analyst for semiconductor manufacturing at iSuppli. “The pressure is leading to increased revenue, as consumer spending has come back with a vengeance following a dramatic downturn in the fourth quarter of 2008 and for all of 2009.”

By 2014, total pure-play foundry revenue will reach $45.9 billion, managing a CAGR of 9.4 percent from $26.8 billion in 2008. Pure-play foundries are contract manufacturers whose business consists of producing semiconductors on behalf of other chip companies.

Enhancing foundry forecast

I started by asking Jelinek what were the chief reasons for enhancing the foundry forecast. Jelinek said: “The forecast increase is based on the anticipated strength in demand for products in Q2 and beyond. Additionally, it is also simple math. The foundry market had a good Q2, and last year, Q1 and Q2 were quite challenging. So, by having a good first half of the year, the percentage must increase.”

Also, given that there has been renewed demand for consumer electronics products, what are the specific CE products, besides netbooks, mobile phones, that have been seeing renewed demand, and why?

Indian chip industry dead? You've got to be kidding me!

I was recently chatting with a friend at LSI, who asked my opinion on the Indian semiconductor industry. Interestingly, in one of my groups on LinkedIn, a member has started a discussion on ‘whether it is ripe for India to get a silicon IC fab’!

Complete contrast — an industry friend recently narrated an incident where this friend was asked by someone else — whether the Indian chip industry was dead! Wow!! Someone’s got to be kidding!

First, I can’t really determine what’s the expectation level among people regarding India’s semiconductor industry. It seems that the interest is starting to build up, at a very slow pace.

However, folks need to understand that the semiconductor industry is extremely complex. You can’t get away by making some sort of statement about this industry! There is much more to semiconductors than someone merely writing a headline — “recovery is in sight” or “recession hits semicon” or 32nm is a great process node”!

Why aren’t more headlines like “overcoming ASIC design productivity roadblocks,” or “What lithography tools are doing for the photoresist market” doing the rounds? Or even: “Are designers as conscious of yield as they should be?” If you can spot the difference, you can make some comment on the semicon industry!

Two, the Indian chip industry CANNOT BE DEAD! It never was, never has been and never will be! Most people would find it tough to answer when Texas Instruments first started operations in India! Why did it choose to start so early? Simply because it backed India as a center! Naturally, the Indian semiconductor goes back that early!

Some folks perhaps relate more to the semiconductor industry with the advent of the India Semiconductor Association. The Association is an industry body, fulfilling its need. However, a lot of work has been going on in semiconductors before ISA came into being. I wonder whether folks have really cared to track this industry in India. I do remember when I first starting covering semiconductors in India, in the early 2000s, there were lot of curious glances from others! 🙂

Coming back to the Indian semiconductor industry, from ‘Made for India’, it has moved on to ‘Made In India’. Isn’t that a significant shift?

As for silicon IC wafer fabs in India, or for that matter, any fab in India — yes, it is still a good time to have one! Perhaps, the last time around, patience seemed to run out! And that’s a hard lesson to learn for those looking to invest in fabs — there is NO quick turnaround time in semiconductors!

Moshe Gavrielov, Xilinx’s President and CEO, recently said in EE Times that venture capital would not return to the semiconductor industry, even after this recession. If this does happen, it would be very unfair! Where would all the start-ups go?

Again, this statement brings clarity to the subject of semiconductors — this is a very complex industry, and definitely unlike IT/ITeS. We in India are so much into services that we fail to see the wood from the trees!

People love to compare China with India. Friends, do visit China or even Taiwan! Try to find out how they went about building their semiconductor industry, and manufacturing and R&D ecosystems. There are several lessons to learn, numerous role models to follow.

I strongly believe India can very well go the same route! We need some good startups in India as well. If and when those happen, please do not expect fast turnaround times. Please believe in India, and believe in its semiconductor industry. It needs your support.

Nearly 60pc of China chip manufacturing goes unused in Q1: iSuppli

EL SEGUNDO, USA: Once the world’s fastest-growing chip-manufacturing region, China hit an all-time low in the first quarter of 2009, with nearly 60 percent of the nation’s semiconductor manufacturing capacity unused, according to iSuppli Corp.

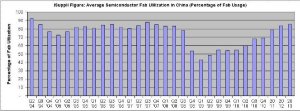

Semiconductor manufacturing capacity utilization in China fell to 43 percent in the first quarter, the lowest level since iSuppli began tracking the market in 2000, and a massive drop from a recent high of 92 percent in the second quarter of 2004. This rock-bottom utilization rate comes as a direct result of low demand spurred by the global economic downturn. However, the utilization plunge indicates that China’s long-nurtured goal of establishing a vibrant domestic semiconductor production industry is in serious jeopardy.

“During the last 10 years, the Chinese government has worked to develop a domestic economy that would provide the nation with economic independence,” said Len Jelinek, director and chief analyst for semiconductor manufacturing at iSuppli. “The establishment of a technologically strong Chinese semiconductor industry was considered an essential element of China’s long-term domestic economic and technological independence. Unfortunately for China, the plan collapsed as global sales dried up before demand generated from internal sources was able to grow to match demand generated from the rest of the world. Once viewed by China’s government as a pillar of growth, semiconductor manufacturing has turned out to be a financial burden.”

China’s investments in capacity and technology in the semiconductor sector have not provided the financial returns that were forecast for investors, Jelinek added. Adding to China’s dilemma is the overestimation of capacity, which was expected to be shuttered in other regions in favor of lower-cost, more efficient Chinese manufacturing.

“With the addition of the current global economic recession, China’s focus has shifted from establishing semiconductor manufacturing independence to restructuring its entire chip industry before it simply collapses.”

China’s utilization is expected to rise moderately through the rest of the year, but will remain very low at 54 percent in the fourth quarter of 2009. Over the longer term, utilization will rebound to 84 and 85 percent in 2012 and 2013. However, when utilization recovers to these levels, China’s semiconductor industry will look very different from how it has in the past, with the number of competitors in the industry likely to be dramatically reduced due to consolidation.

The figure presents iSuppli’s quarterly and annual estimate and forecast of semiconductor utilization in China.

Looking ahead

What will China’s semiconductor industry look like when utilization recovers?

“Since Chinese semiconductor manufacturers do not possess a technological differentiation from their competitors, they are at a disadvantage, since there is simply far too much of the same kind of capacity in the world chasing after the same opportunities,” Jelinek said.

“This will lead to mergers and consolidations. However, even if suppliers with similar technologies merge, will they create anything but larger companies with bigger cash-flow problems?”

At first glance, such a scenario is most likely what will happen. Nonetheless, there will be one ancillary effect that will significantly impact the landscape of companies in China: The bigger company will be viewed as the most likely survivor.

This perception will transform into reality as customers assure themselves of a strong supply source by aligning with the largest, most cost-effective semiconductor maker. In the end, the smaller company simply will be forced out because it is uncompetitive in technology and price.

No recovery until 2012

With iSuppli not forecasting a recovery for Chinese manufacturers until 2012, it is unlikely that weak companies can survive two years in the face of a negative cash flow.

iSuppli anticipates the first merger in China’s semiconductor industry will be finalized in the second quarter of 2009. This will signal that time is of the essence if a company or a group of companies is going to be able to weather the storm. iSuppli anticipates that by the second half of 2010, a smaller—yet stronger—semiconductor industry will emerge in China.

LCD monitor panel prices rising despite downturn: iSuppli

iSuppli Corp.’s LCD PriceTrak Service recently reported that prices for LCD monitor panels are rising, despite the weak economic situation and cuts in consumer spending. Isn’t this quite unusual, and on surface, really spectacular, given the recessionary conditions.

Thanks to my good friend, Jon Cassell, I was able to get into a conversation with Ms. Sweta Dash, director of LCD research at iSuppli. I started by trying to find out the reasons for LCD monitor panel prices to be doing reasonably well in these times.

China’s program driving demand

Sweta Dash said panel demand has been strong due to ‘China’s rural consumer stimulus program’, which increased sales of small-size TVs that uses monitor panels. Also, the panel demand was strong from branded manufacturers due to inventory adjustments.

She added: “Monitor brand manufacturers and retail channel orders mostly stem from the demand for inventory replenishment because they have kept their stockpiles at lower-than-normal levels since the end of 2008. Now, factory demand is strong as they need to buy panels for inventory adjustments.”

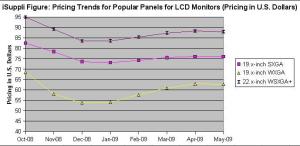

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

The figure here presents iSuppli’s estimate of pricing for various sizes of panels for LCD monitors.

In that case, is China’s rural customer stimulus program the only major factor behind this rise in prices of LCD monitor panels?

According to Dash, the other factor is the inventory adjustment by brand manufacturers. TV sales in the US were also better than expected due to the very aggressive prices by brand manufacturers.

“Some retailers reported that they could not meet their demand due to low inventories level. Now, they are trying to adjust the inventory level. Besides better than expected demand for TV and monitor panel, severe cut in factory utilization rates (severe cut in panel production) also contributed to the tight supply for the monitor panel and small-size TV panel, which resulted in panel price increase,” she noted.

Is there any specific reason behind the retailers placing higher orders during recession? Or is it only due to the very low prices?

Dash clarified that it is mostly inventory adjustments. “In March, the inventory levels for monitors at the brand and channel levels were below three weeks level; and some were at two weeks level, which is considered low for this time of the year. Also, once the panel price starts increasing, buyers try to buy more in order to take advantage of the very low price.”

Situation regarding component shortages

There was also a note in iSuppli’ report regarding component shortages. I was keen to find out the exact situation with component shortages, and which specific ones!

Dash said that there is tight supply for PCBs and driver ICs. The lead time for PCBs is extending from two to three weeks to four to six weeks; and the lead time for certain driver ICs is extending to about six to eight weeks.

No recovery soon!

Interestingly, iSuppli cannot declare that monitor end-market demand is headed for a sustainable recovery at this point.

Dash added: “In the absence of a strong rebound in end-market demand, rush orders are not likely to be sustained in May with component shortages being resolved by then. And, the forecast for panel demand is most likely to remain conservative at that time. Also, panel prices are still below cost level. Therefore, in spite of the increasing panel demand, suppliers are still losing money. Further, panel suppliers are rushing to increase their utilization rates and production.”

Koreans doing better than Taiwanese

Evidently, the Korean suppliers seem to be doing better than the Taiwanese, as of now. What would be the key reasons for this?

According to Dash, the Korean suppliers were able to provide more competitive prices due to weaker Won rates.

She added: “Also, the Korean suppliers have higher generation fabs, and they have more in-house or regional component production, which gives them the cost structure compared to Taiwan suppliers. They also have more internal customers (for example, Samsung LCD’s internal customer is Samsung TV and monitor brand).

Year ahead for LCD monitor panels

Finally, how does the year ahead look like for LCD monitor panels?

Monitor panel demand may face some softness after the inventory adjustment in Q209. That is the reason why panel suppliers have to expand their production cautiously.

“Otherwise, it has the danger of pushing the market back to over supply. We still expect real end-user demand to recover in the second half of 2009 especially by Q4-09. If panel manufacturers act cautiously and expand rationally in the first half of 2009, they can see real demand recovery in the second half of 2009,” noted Dash.

Infineon on India's e-passport and semicon industry

If you have ever been a resident of Hong Kong, you’d know what an e-passport looks like! You would have even used it! For example, if you were crossing over into Shenzhen, China, from Lo Wu, which is on the borders of Luohu district within Hong Kong and the city of Shenzhen in Guangdong province, China, [having reached there via the KCR (Kowloon-Canton Railway)] — you can easily use your Hong Kong e-passport to get past the immigration point and enter China!

It is really easy! Simply drop your e-passport into the e-passport reader slot and place your finger on the fingerprint reader for it to scan and read. Once your e-passport comes out, move over to the other side to another e-passport reader, repeat the same exercise, and you’re done! All it takes is less than a minute!

All Indians could soon have e-passports!

Well, such an e-passport can become a reality in India soon! If you haven’t heard it, Infineon Technologies recently supplied contactless security microcontrollers (MCUs) for India’s electronic passport (e-passport) program! The Indian e-passport rollout started with Indian diplomats and officials being issued e-passports — around 30,000 to be issued in phase one. It is likely that by September 2009, the e-passports will be extended to the general public.

The rollout has started with the issuance of electronic passports to Indian diplomats and officials. It is expected that in this first phase, up to 30,000 electronic passports shall be issued. By September 2009, the program is likely to be expanded to include passports used by the general public. Today, around 6 million passports are being annually issued in India. I believe, the government of India has invited a new tender for interested stakeholders to bid for 20 million e-passports.

So, being a Hong Kong e-passport holder, I was interested in knowing whether the Indian version is as smart as that particular one? By the way, Hong Kong’s e-passport also doubles up as your Hong Kong ID (HKID) card. If you don’t have one, you simply cannot do business in Hong Kong! Your HKID number is unique and remains unchanged!

Dr. Rajiv Jain, Vice President and Managing Director, Infineon Technologies India Pvt Ltd, said that both Hong Kong and India are using the same product family from Infineon. “The security levels of both e-passports are based on the Common Criteria EAL 5+, the highest possible security certification for MCUs. In addition, both comply to ICAO requirements, the international standard for e-passports.”

Dr. Rajiv Jain, Vice President and Managing Director, Infineon Technologies India Pvt Ltd, said that both Hong Kong and India are using the same product family from Infineon. “The security levels of both e-passports are based on the Common Criteria EAL 5+, the highest possible security certification for MCUs. In addition, both comply to ICAO requirements, the international standard for e-passports.”

Infineon’s SLE 66CLX800PE security MCU provides advanced performance and high execution speeds, and was specifically designed for use in electronic passports, identity cards, e-government cards and payment cards. Sounds very interesting!

Highlights of Infineon’s security MCU

The security MCU features a crypto-coprocessor and can operate at very high transaction speeds of up to 848kbits/s even if the elevated encryption and decryption operations have to be calculated.

The SLE 66CLX800PE offers all contactless proximity interfaces on a single chip: the ISO/IEC 14443 type B interface and type A interface, and both used for communication between electronics passports and the respective readers; and the ISO/IEC 18092 passive mode interface, which is used in transport and banking applications. The SLE 66CLX800PE features 80 kilobytes (kb) of EEPROM, 240kb of ROM, and 6kb of RAM.

The SLE 66PE contactless controller family, which includes the SLE 66CLX800PE, is certified according to Common Criteria EAL 5+ high (BSI-PP-0002 protection profile) security certification. Infineon’s security in MCUs used in e-passports builds on the underlying hardware-based integral security, with data encryption, memory firewall system and other security mechanisms to safeguard the privacy of data.

The SLE 66PE product family comprises a whole product portfolio designed for use in basic-security to high-security smart card systems, with the EEPROM sizes ranging from 4kb to144kb, and covering different applications including government ID, transportation and payment.

Infineon’s perception of Indian semiconductor industry

So much about the e-passport! I can’t wait to get my hands on one! Since I was in a discussion with Infineon, it naturally turned toward the Indian semiconductor industry and what needs to be done!

Dr. Jain said: “The Indian semiconductor industry has seen its share of successes and misses. The in-depth technical talent required for design and development is omni-present (TI, Intel, Infineon, Wipro, etc., to name a few). For example, we are doing critical R&D in the areas of automotive electronics, broadband, mobile communications and secured ID solutions at Infineon India, and the fact that it is one of the largest centres in Infineon’s global R&D network, is a testimony to India’s importance as the destination for cutting edge research. This has also led to creation of home-grown design houses offering services to the larger companies.

“We are also seeing in some small, but growing numbers, products and ideas for local markets. As the local markets evolve, so will the ability of these companies to deliver innovation for these local markets, which can then be taken globally.”

He added that an area of debate has been the need for semiconductor manufacturing in India. For example, having fabs, test and packaging plants, and EMS. “There have been government initiatives with a few successes. However, financial, tax-related and custom-related investment in these areas needs to come together and be centrally driven from a long-term perspective, as these institutions, which can provide a stable manufacturing base, need larger efforts to be successful.”

Hopefully, we will finally get to see some action on all of these areas post the Indian general elections due shortly.

PS: Just to let all of my friends know, I am no longer associated with either CIOL or its semiconductors web site.

Definite need for rethink on India's fab strategy!

I am intrigued to see lots of great things happening in the Indian semiconductor industry, and equally frustrated to find certain things that I feel should happen, not really going the way they should!

Yes, India is very strong in the semiconductor related chip design services. However, do keep in mind folks that design services have been impacted a bit by the recession as well! There have been calls from several quarters for India to now start thinking beyond its chip design services. Therefore, are there any areas that India can look into within the semiconductor space?

Leverage strength in software

Certainly, value add in products are heavily influenced by the embedded software in addition to features of the chips, says S. Janakiraman, former chairman, India Semiconductor Association (ISA) and President and CEO-R&D Services, MindTree. “The Google Android is a great example of that. India should leverage its strength in software to enhance its value add to semiconductor companies,” he adds.

Innovation is now shifting from the development of new technologies to the creation of unique applications.

“Mobile browsers and management of remote appliances to save power at home/office are examples. We need to innovate new applications that can drive the need for more electronic gadgets, and in turn, the need for more semiconductors,” notes Jani Sir.

Rethink on Indian fab strategy?

One of my earlier posts focused on whether an Indian investor could buy Qimonda’s memory fab, and somehow kick-start the India fab story! I did find support from many quarters on this idea, but till date, I don’t think anyone from India has made a move for Qimonda. At least, I haven’t heard of any such move.

Nevertheless, some folks within the Indian semiconductor industry and elsewhere have called for India to rethink on its fab strategy.

What should it be now? Or, shall we just discard this and go on, as India has been doing fine without fabs so far? Perhaps, the last option is easier!

According to Janakiraman: “Perhaps, we should consider where semiconductor technology will be after five years from now, and prepare grounds for that through encouragement of fundamental research, as well as shuttle fabs to enable prototyping. We should skip the current node of technology and make an entry into the one that will be prevalent after few years.” Now, that’s sound advice! Will it be easy to achieve?

“That may not be as easy to achieve for the private enterprises considering the cost involved,” adds Janakiraman. “It has to be a mission of the nation to create that infrastructure and later privatize.”

According to him, it is not unique to India. “Every country, be it Taiwan or China, have done it. The only other way is to heavily subsidize and support fabs like those in Israel or Vietnam, but it will be tough to choose a partner in a democratic country like ours, wherein every investment and subsidy is seen with a colored vision,” he says.

To sum up, a fab for our country will be fundamental to gain leadership and self reliance. It cannot be ignored totally, although we can take our own time to reach there. Janakiraman adds, “We don’t have a choice other than paying a price to reach there, now or later!”

Global semiconductor industry could well see revival in 2010?

“Let’s start from the very beginning! A very good place to start!!”

Hope you all remember this lovely song sung by Julie Andrews in The Sound of Music!! So, what’s the connection?

Right! Last week, I blogged about how the global semiconductor industry is likely to drop by 28 percent in 2009, while the Indian industry should grow by 13.4 percent during the same period, and that, we should not get carried away by these statistics!

A moment to ponder: isn’t this drop of 28 percent too high for the global semicon industry? Or, is the situation really that bad? So, let’s start from the very beginning, and go straight to the source — Malcolm Penn!

Revival likely by 2010?  Here’s what Malcolm Penn, CEO and founder of Future Horizons, had to say: “Fraid not! It could even be lower, but remember that this is a year on year number. It is based on the following assumptions: Q4-08 down 22.5 percent vs. Q3-08; Q1-09 down 20 percent vs Q4-08; Q2 down 2 percent vs Q1; and Q3 up 12 percent vs Q2, and Q4 up 3 percent vs Q3! And, if this pattern runs true, 2010 will be up 28 percent vs 2009!”

Here’s what Malcolm Penn, CEO and founder of Future Horizons, had to say: “Fraid not! It could even be lower, but remember that this is a year on year number. It is based on the following assumptions: Q4-08 down 22.5 percent vs. Q3-08; Q1-09 down 20 percent vs Q4-08; Q2 down 2 percent vs Q1; and Q3 up 12 percent vs Q2, and Q4 up 3 percent vs Q3! And, if this pattern runs true, 2010 will be up 28 percent vs 2009!”

Voila! The global semiconductor industry could well be in for a major revival next year itself! Why, even Bill McClean, president of IC Insights, took a more optimistic look at the state of the industry in light of the current global economic situation at the recently concluded SEMI ISS 2009 conference!!

Continues Penn, “The actual Q4 results (released this Sunday) were down 24.2 percent, slightly worse than our estimate.”

How to get the buzz back in semicon?

It has been said that the current situation the global semiconductor industry finds itself in was fueled by greed and short-term business goals. So, who were the culprits? Weren’t they warned earlier?

Adds Penn: “It was more complex that that! The woeful state-of-the-world economy was a consequence of debt, greed and irresponsibility; political self interests and short-term business goals, aided and abetted by compliant governments; ineffective regulators; imprudent institutions; incompetent management; irrational self delusion and vested self-interests! No one is blameless for this crisis! Concerns were raised, but the human nature is often irrational, and the ‘easy option’ always the one of choice.”

So true! Perhaps, the ‘easy option’ factor seems to be affecting the Indian semiconductor industry as well, but more of that later!

The key issue today is: what needs to be done to get the buzz back in the global semiconductor industry? The answer probably lies in the following: in the short-term, it involves rebuilding the industry confidence, and in longer term, it involves a radical return to ‘old fashioned’ business and political values.

On another note, I was curious to know how the EDA segment is doing? Penn said, “No better, no worse than normal, technology marches on, new designs accelerate in a downturn.”

Tricky memory!

Memory is another segment that’s been hit hard. In fact, the other day, someone asked me why Qimonda’s story was so important!

Another could not understand what Spansion really did, and why it had announced this January 15 that the company was exploring strategic alternatives for a sale or a merger! Doesn’t matter! Memory is a very tricky business, and semiconductors is the mother of all such tricky businesses! Perhaps, isn’t that why they once said in jest: “Real men have fabs!” Anyhow!

Coming back to memory, when can the industry expect some recovery in NAND? More importantly, will the various government interventions help? Qimonda also recently petitioned for the opening of the insolvency proceedings.

Penn is clear: “NAND will recover when the excess capacity abates, and that will take several more quarters. The government intervention won’t help, rather the opposite, and it will exacerbate the excess capacity issue.”

Fab spends to move up only by Q1-2010

Earlier, Penn predicted a recovery in 2010 with the resumption of growth in Q3 2009. What will make this happen? He says, “A recovering world GDP growth, plus a return in business confidence.”

However, those keen on fabs, do not expect the fab spends to look up any time soon! In fact, Penn estimates fab spends to start moving north not until Q1-2010 at the earliest.

The Chinese impact!

Interestingly, China is set to see negative growth of 5.8 percent during 2009. It will be worth noting how much of this this impact the global semiconductor industry.

Point one, compared to a global semicon fall of 28 percent in 2009, Penn considers a fall in China’s semicon fortunes of 5.8 percent to be ‘darned sight better!’ So, China should still be a high growth market (relatively speaking).

And India?

Like I mentioned earlier, the Indian semiconductor industry is perhaps getting affected by the ‘easy option.’ Design services continue to do well, hopefully, but when it comes to real semiconductor product companies, those are far and few.

And, I haven’t seen any real activity in the recent past that could tell me more such initiatives are in the pipeline. Nor do I think there are many attempts to even incubate such companies. On the contrary, there’s a mad rush toward solar!

No harm there! Solar is great for India and the need of the hour. However, India should not forget its semiconductor priorities as well! Indian simply cannot bank on chip design services and solar gains, and then proclaim that it has a very successful semiconductor industry! Real action is still quite far away.

I think, India needs to rethink its semiconductor strategy! It cannot survive on chip design alone.

“When you know the notes to sing, you can sing most anything,” concludes the song from The Sound of Music!

So, is the Indian semiconductor industry hitting the right notes? That’s going to be my next blog post, friends.

Outlook for solar photovoltaics in 2009!

Friends and dear readers, this is my last blog post for 2008! Indeed, what a year this has been!!

Let me bid this year goodbye with a general outlook on the global solar photovoltaics industry for 2009.

iSuppli had recently put out a report on solar eclipse coming in 2009! I had blogged about the possible solar sunburn ahead, as well, earlier last week!

Another point that has interested me is: what happens to the top 20 global solar photovoltaic companies, based on iSuppli’s analysis! This blog post has perhaps been the most popular in recent times.

I was very lucky to re-associate with Dr. Henning Wicht, Senior Director, Principal Analyst, iSuppli Deutschland GmbH, in Munich, Germany, for this discussion, thanks to the efforts of Jon Cassell and Debra Jaramilla!

I was very lucky to re-associate with Dr. Henning Wicht, Senior Director, Principal Analyst, iSuppli Deutschland GmbH, in Munich, Germany, for this discussion, thanks to the efforts of Jon Cassell and Debra Jaramilla!

How bad is solar?

The first and the most obvious question: how bad is the global solar market right now and why?

According to iSuppli, bringing an end to eight consecutive years of growth, global revenue for photovoltaic (PV), panels is likely to plunge by nearly 20 percent in 2009, as a massive oversupply causes prices to drop!

Worldwide revenue from shipments of panels will decline to $12.9 billion in 2009, down 19.1 percent from $15.9 billion in 2008. A drop of this magnitude has not occurred in the last 10 years and likely has not happened in the entire history of the solar industry.

Dr. Henning Wicht says that the upstream part of the solar business (cell, module, etc.) will suffer from price decline due to strong oversupply. The downstream side will benefit (installation, end-user, investor, etc.) by lower system prices.

Therefore, what can the solar players do to get over this coming bad phase in 2009? Well, three things: improve the cost structure, improve the sales side, and diversify downstream… These points hold strong for all fully integrated and non-integrated solar panel suppliers as well. By the way, fully integrated solar panel suppliers are likely to suffer less severe losses than non-integrated competitors.

There must be some way around to to bring about some balance within the current imbalance in the demand and supply situation. While Dr. Wicht agrees this is a difficult one to answer this early, he adds that supply and demand are diverging heavily. “With the current trajectories even in 2012, 100 percent more modules are produced than installed,” he says. I promise to discuss this question again with the good Dr. in another six months time.

Word of wisdom

There are various support programs in place, and it is important to know whether they will continue to remain beneficial, both to support markets to become independent sustainable and to develop the regional industry.

Dr. Wicht believes the support programs are still required and beneficial. “If China, India, Mexico and other sunny regions would start to support solar installations, that could change the picture drastically,” he notes.

A note of warning for new entrants in the solar photovoltaic space! Be aware that this warning has been earlier highlighted in the global semiconductor outlook for 2009! In tune with what the various analysts have maintained earlier, iSuppli also forsees newcomers in the solar photovoltaic line having problems in getting the required credit for their projects.

What next for Europe, emerging regions?

According to iSuppli, the short-term boost in demand from Spain and Germany has kept the installation companies busy, and solar orders and module prices high. But this boom is over. So, what’s next for European players?

According to Dr. Wicht, Germany and Spain should continue their leading role as solar installation regions, even after the boom. France, Italy and Czech Republic are attractive, but still much smaller markets, he maintains.

iSuppli has also mentioned that the race to larger manufacturing scale comes to an end when the production is not sold anymore! In that case, what’s the case for the emerging nations, like China and India? Aren’t there buyers in such places?

Dr. Wicht says: “Demand in the traditional solar markets is not elastic enough to absorb all of the solar production. Potential new markets, for example, China and India, do not yet have installation capacities and administration to significantly change the global solar demand short term.”

iSuppli also feels that the newer Chinese and Taiwanese suppliers will be hit particularly hard during 2009. The reason being, many suppliers have expanded their production capacities heavily without securing equally the sales/downstream part.

Global top 20 rankings to change?

Now to the most interesting part! Most of you have read about the top 20 global solar photovoltaic suppliers. Following the iSuppli warning of a ‘solar eclipse’ in 2009, there is every likelihood that there will be changes in that table!

Dr. Wicht adds, “However, the top 10 companies are typically better placed than the competition regarding their cost structures, downstream integration and vertical integration.”

Obama’s solar plans!

Now on to yet other interesting point! The US President-elect, Barack Obama’s, New Energy for America plan could well have a significant impact on the US solar industry.

The plan’s provisions include:

• A federal renewable portfolio standard (RPS) that requires 10 percent of electricity consumed in the US to come from renewable sources by 2012.

• A $150 billion investment over 10 years in research, technology demonstration and commercial deployment of clean energy technology.

• Extension of production tax credits for five years to encourage renewable energy production.

• A cap-and-trade system of carbon credits to provide an incentive for businesses to reduce greenhouse gas emissions.

Dr. Wicht says: “We all know that Obama is in favor of renewable energy. However, he will not change a 160 percent oversupply of solar panels in 2009.”

Bumpy ride to grid parity?

On another note, and a pretty favorite one: Is it going to be a “bumpy road” to grid parity? How will the subsidies be kept going?

Dr. Wicht notes: “Subsidies will continue. It will always be a bumby road because the ramping cycles differ heavily among silicon, cells, modules and the installation capacity. Please remember that the installation business will now benefit from low module prices. It will recover some of the margins it has lost in the last years due to high module prices.”

Also, up to when will polysilicon constraints last? iSuppli had earlier indicated PV strategy changes. According to Dr. Wicht, the polysilicon prices are coming down already. “Our indication from October 2008 seems to be fairly good,” he says.

Lastly, will iSuppli be still sticking by solar, semicon investments being equal by 2010?

Dr. Wicht says: “Please let me cite again our interview in October: The investments for solar production raising up to several hundreds of Mio USD, up to 1 Bio $ per production site. That is coming close to a semiconductor fab. The total capex of semiconductor is still 10 times larger than PV. However, PV is rising much faster.”

That will be all for this year, folks!

Look forward to sharing much more captivating moments in semiconductors, electronics, solar photovoltaics, telecom, etc., in 2009!

Wishing all of you a very happy, prospe

rous and successful 2009. Be safe and look after yourself! See you next year!! 🙂

Solar, semi rocking in India; global semi recovery in 2010?

Wow! What a start for October! We have had a whole new range of activities going on! Fist, late September, the India Semiconductor Association organized a solar/PV conclave in New Delhi, where plans were laid out for India’s roadmap in the solar/PV field. the ISA-NMCC (National Manufacturing Competitiveness Council) report on the Indian solar PV market was also released at the conclave.

According to Poornima Shenoy, president, ISA, the year 2015 could be important for this industry. She said, “Around this time, the product cost of the Indian solar PV industry is likely to match the semi grid parity (peak power) globally, and also to match the grid parity within India.”

Next, AMD joined hands with Advanced Technology Investment Co. (ATIC) of Abu Dhabi to create “The Foundry Company”, a leading-edge foundry production outfit. It will also join the IBM joint development alliance for silicon-on-insulator (SOI) and bulk silicon through 22nm generation. It will be very interesting to see how AMD now takes on Intel!

Messe Munchen put out a white paper on “How China, India and Eastern Europe are changing the global electronics market.” This is not surprising at all! You can download the report by clicking on the link here, and I must say, the report is really engaging!

On the same lines, Gartner came up with its analysis that China is dominating the global semiconductor scene, and that both India and Vietnam are gaining! India’s growing might in semicon is well documented! Also, last month, I had mentioned how the lack of a fab or the exit of a top professional from an Indian semicon firm would not hamper India’s growing fortunes in this industry!

The trials and tribulations of the global semiconductor industry were already touched upon by Derek Lidow of iSuppli. Analysts such as Malcolm Penn of Future Horizons and those at Gartner have been saying similar things, more or less. Penn advises that this is the time to stop chasing fashion and get back to basics. He adds, “The good news being the industry basics are mercifully as good as they get back.”

Gartner only expects a recovery for semiconductors sometime in 2010! According to Gartner, a collapse in memory spending, combined with a weak economy, is driving a major contraction in semiconductor capital equipment spending in 2008. The slowdown is likely to continue into 2009 before the industry recovers in 2010.

SEMI now has a presence in India. Sathya Prasad, formerly of Cadence, has been appointed as president of SEMI India with immediate effect. This is a further indication of India’s growing leadership in the semicon space. I will be getting into a discussion with Sathya Prasad sometime later.

Of course, we have the usual stuff like companies selling off or retiring 200mm fabs. Examples are NXP, Hynix, Renesas, etc. Also, DRAM prices continue to be weak and suppliers could likely face a credit crunch.

Interesting mix of happenings, isn’t it! While India rocks in solar and semicon, we are still speculating on a recovery for the global semiconductor industry. About time India took the lead in making that happen!

Finally, I was busy with Durga Puja, and hence, didn’t blog in a while. Will try my best and make up for my absence. I would like to take this opportunity to wish SHUBHO BIJOYA to all of my Bengali and non-Bengali friends.

Semicon to grow 10pc during 2008: Future Horizons

Hold on to your horses, folks. The year 2008 may not be so bad after all for the global semiconductor industry, according to Malcolm Penn, CEO, Future Horizons.

While presenting the mid-term semiconductor industry outlook in London this week, he said that the overall semiconductor outlook for 2008 was somewhere between 7-10 perfect. This includes 5-8 percent unit growth plus 2 percent ASP growth.

In his presentation, he ruled out any changes in forecast, saying that the industry could grow at about 10 percent this year, though 12 percent growth was still possible.

In his presentation, he ruled out any changes in forecast, saying that the industry could grow at about 10 percent this year, though 12 percent growth was still possible.

Will unit sales will hold up then? This is one of the great unknown answers! Unit visibility is bad, very bad, he adds. The inventory excesses/adjustments can always catch you out, but the underlying 10 percent pa annual unit growth will continue.

When put together with increasing ASPs, will it start to deliver strong overall chip market growth? Penn assumes that this may happen either second half of this year at best, or second half of next year at worst.

How has the memory market been doing among all of this? Well, it has really been lousy, and it is this that is holding back the overall market numbers!

There have been concerns over the lack of investment in the overall semiconductor manufacturing capacity. This trend will likely continue. Penn says: “Yes, this was the whole theme for the capacity section. It’s been going on for a year and will continue that way for most of this year. That earliest correction will come in Q4-08, i.e., capacity in Q4-09.”

In the midst of all of this, it seems that the Asian giants such as China and India, as well as the other emerging markets have been compensating adequately for the recessionary tendencies elsewhere.

Finally, are the Intels, Samsungs and the foundries of this world spending the required billions of dollars to bring on production at the leading-edge? Penn says: “Intel yes, but Samsung is slowing, but the foundries, no! The reason? To put up their prices; the industry is fed up with four successive years of decreasing revenues per wafer start, despite all of the billions spent on new investment.”

So what’s Future Horizon’s overall outlook for 2008? One, no change to IFS2008-09 analysis. If anything, the fundamentals are stronger! Also, the global economic outlook has strengthened. However, fab capacity expansion rate has slowed. The inventory is as controlled as it gets. PC and mobile phone markets remain robust.

However, there is weakening consumer demand in the US and the UK/Eurozone. The memory markets are continuing to be plagued with price wars. As a result, the YoY maths has been slightly impacted (down). The balance still leans to the upside, depending on the ASPs.

Danger signs to watch?

Multiple, he says! Capacity: It’s hard to see how this can spoil 2008-09, provided unit growth holds up (need to watch capex). Next, demand — the current IC unit demand is sustainable provided the economy holds up (need to watch inventory). On the economy itself, the current outlook continues good, but risks still on the downside (if it does tank, run for the life boats).

And finally, ASPs, which are always the industry’s first line of defence (ASPs can still derail Q3/Q4, but they are improving, memories aside).

Chip industry in perspective

Technology marches on, new markets open, old ones expand, enhancing our lives. The fall out at the macro level affects the entire world economy. Next, the electronic market was traditionally Japan, North America and Western Europe. It now encompasses the whole Asian Rim, China, Eastern Europe and India. There has been a middle class market growth from 500 million to 3 billion people.

Large chip markets have become larger, niches have become commodities, and new niches have arisen. Far from maturing, the industry is still in its volatile high growth phase, says Penn, with at least a further 20 years of strong growth in prospect.

Third digital wave leaders will be different from today. The shakeout has started. The underlying growth drivers for chips continues good. The market’s not maturing nor slowing, and neither have the industry dynamics / psyche (globally competitive / intensely competitive).

As Penn says, he who dares may not necessarily win, but the feint-hearted will definitely lose! Aptly sums up the state of the global semiconductor industry.