Archive

Global semicon mid-year review: Chip market revival or blip on stats radar screen?

A recent report from Future Horizons suggests an 18 percent growth for the chip market in Q2-2009! So, is this a sign of the chip market recovery or a mere blip on the statistics radar screen?

It is both, said, Malcolm Penn, chairman, founder and CEO of Future Horizons, and counselled that: “The fourth quarter market collapse was far too steep — a severe over-reaction to last year’s gross financial uncertainty — culminating with the Lehman Brothers collapse in September. The first quarter saw this stabilise with the second quarter restocking, but there are other positive factors also in play.”

Examining a bit further, here’s what he further revealed. One, the memory market is seeing some signs of slow recovery. He said, “This has already started DDR3 driven!” Likewise, companies are also in the process of revising their forecasts. The reason, Penn contended, being, “The maths has changed dramatically since Jan 2009!”

According to him, factors now leading to conditions looking up in H2 2009, include the normal seasonal demand — from a tight inventory base — and tightening capacity. There is also a clear indication of the correction phase to rebalance over-depleted inventories having started. “This is what’s driving Q2’s high unit, and therefore, sales growth,” he contended.

Firms advised to stop seeing and waiting!

This isn’t all! Penn further counselled firms who are still in a wait-and-see mode to ‘stop seeing and waiting’! Next, fabs are also looking to maximize their returns. For one, they have stopped over-investing.

Do we have enough stats from others to back up what’s been happening in the global semiconductor industry? Perhaps, yes!

IC Insights stands out

First, look at IC Insights! It has stood out by pointing out in early July that H2-09 is likely to usher in strong seasonal strength for electronic system sales, a period of IC inventory replenishment, which began in 2Q09, and positive worldwide GDP growth.

IC Insights has predicted global IC market to grow +18 percent; IC foundry sales to grow +43 percent; and semiconductor capital spending to grow +28 percent in H2-09.

DDR3 driving memory recovery? Flat NAND?

Elsewhere, Converge Market Insights said that according to major DRAM manufacturers, DDR3 demand has been on the rise over the last two months and supply is limited.

This is quite in line with Future Horizons contention that there is a DDR3 driven memory recovery, albeit slow. It would be interesting to see how Q3-09 plays out.

As for NAND, according to DRAMeXchange, the NAND market may continue to show the tug-of-war status in July due to dissimilar positive and negative market factors perceived and expected by both sides. As a result, NAND Flash contract prices are likely to somewhat soften or stay flat in the short term.

Semicon equipment market to decline 52 percent in 2009!

According to SEMI, it projects 2009 semiconductor equipment sales to reach $14.14 billion as per the mid-year edition of the SEMI Capital Equipment Forecast, released by SEMI at the annual SEMICON West exposition.

The forecast indicates that, following a 31 percent market decline in 2008, the equipment market will decline another 52 percent in 2009, but will experience a rebound with annual growth of about 47 percent in 2010.

EDA cause for concern

The EDA industry still remains a cause for concern. The EDA Consortium’s Market Statistics Service (MSS) announced that the EDA industry revenue for Q1 2009 declined 10.7 percent to $1,192.1 million, compared to $1,334.2 million in Q1 2008, driven primarily by an accounting shift at one major EDA company. The four-quarter moving average declined 11.3 percent.

If you look at the last five quarters, the EDA industry has really been having it rough. Here are the numbers over the last five quarters, as per the Consortium:

* The EDA industry revenue for Q1 2008 declined 1.2 percent to $1,350.7 million compared to $1,366.8 million in Q1 2007.

* The industry revenue for Q2 2008 declined 3.7 percent to $1,357.4 million compared to $1,408.8 million in Q2 2007.

* The industry revenue for Q3 2008 declined 10.9 percent to $1,258.6 million compared to $1,412.1 million in Q3 2007.

* The industry revenue for Q4 2008 declined 17.7 percent to $1,318.7 million, compared to $1,602.7 million in Q4 2007.

Therefore, at the end of the day, what do you have? For now, the early recovery signs are more of a blip on the stats radar screen and there’s still some way to go and work to be done before the global semiconductor industry can clearly proclaim full recovery!

Before I close, a word about the Indian semiconductor industry. Perhaps, it needs to start moving a bit faster and quicker than it is doing presently. Borrowing a line from Malcolm Penn, the Indian semiconductor industry surely needs to “stop waiting and watching.”

I will be in conversation next with iSuppli on the chip and electronics industry forecasts. Keep watching this space, friends.

Reports of memory market recovery greatly exaggerated: iSuppli

EL SEGUNDO, USA: Concerned about their image as they face the specter of bankruptcy, many memory chip suppliers are attempting to paint a more optimistic picture of the business by talking up a potential market recovery.

However, while overall memory chip prices are expected to stabilize during the remaining quarters of 2009, iSuppli Corp. believes a true recovery in demand and profitability is not imminent.

After a 14.3 percent sequential decline in global revenue in the first quarter DRAM and NAND flash, the market for these products will grow throughout the rest of the year. Combined DRAM and NAND revenue will rise by 3.6 percent in the second quarter, and surge by 21.9 percent and 17.5 percent in the third and fourth quarters respectively.

“While this growth may spur some optimism among memory suppliers, the oversupply situation will continue to be acute,” said Nam Hyung Kim, director and chief analyst for memory ICs and storage at iSuppli.

“For example shipments of DRAM in the equivalent of the 1Gbit density will exceeded demand by an average of 14 percent during the first three quarters of 2009. This will prevent a strong price recovery, which will be required to achieve profitability for most memory suppliers.”

Painful oversupply

Due to a long-lasting glut of DRAM, the imbalance between supply and demand is too great for this market to recover to profitability any time soon.

“Even if all of the Taiwanese DRAM suppliers idled all their fabs, which equates to 25 percent of global DRAM megabit production, the market would remain in a state of oversupply,” Kim said. “This illustrates that the current oversupply is much more severe than many suppliers believe—or hope.”

Besides cutting capacity, which suppliers have already been doing, they presently have few options other than waiting for a fundamental demand recovery. iSuppli believes that another round of production cuts will take place in the second quarter, which will positively impact suppliers’ balance sheets late this year or early in 2010 at the earliest.

DRAM prices now amount to only one-third-level of Taiwanese suppliers’ cash costs. Unless prices increase by more than 200 percent, cash losses will persist for these Taiwanese suppliers.

While average megabit pricing for DRAM will rise during every quarter of 2009, it will not be even remotely enough to allow suppliers to generate profits in this industry. The industry needs a dramatic price recovery of a few hundred percentage points to make any kind of impact.

iSuppli is maintaining its “negative” rating of near-term market conditions for DRAM suppliers.

Confusing picture in NAND

The picture is a little more complicated in the NAND flash memory market.

Pricing for NAND since January has been better than iSuppli had expected. However, iSuppli believes this doesn’t signal a real market recovery.

Most NAND flash makers are continuing to lose money. The leading supplier, Samsung Electronics Co. Ltd., seems to be enjoying the current NAND price rally as prices have almost reached the company’s break-even costs. However, all the other NAND suppliers still are losing money.

“While the NAND market in the past has been able to achieve strong growth and solid pricing solely based on orders from Apple Computer Inc. for its popular iPod and iPhone products, this situation is not likely to recur in the future,” Kim said. “Even if Apple’s order surge, and it books most of Samsung’s capacity, it would require a commensurate increase in demand to other suppliers to generate a fundamental recovery in demand.”

However, iSuppli has not detected any substantial increase in orders from Apple to other suppliers. Furthermore, Apple’s orders, according to press reports, are not sufficient to positively impact the market as a whole.

It doesn’t make sense for major NAND suppliers Toshiba Corp. and Hynix Semiconductor Inc. to further decrease their production if there is a real fundamental market recovery. This means supply will continue to exceed demand and pricing will not rise enough to allow the NAND market as a whole to achieve profitability.

The NAND flash market is in a better situation than DRAM at least. However, the market remains challenging because fundamental demand conditions in the consumer electronics market have not improved due to the global recession.

One of the reasons why the price rally occurred is that inventory levels have been reduced in the channel and re-stocking activity has been progressing. Overall, memory suppliers will begin to announce their earnings shortly and iSuppli will remain cautious about the NAND flash market until we detect solid evidence, not just speculation, of a recovery.

iSuppli is remaining cautious about the near term rating of NAND market, holding its negative view for now, before considering upgrading it to neutral.

“Production cuts undoubtedly will have a positive impact on the market in the future. However, it’s too early for to celebrate. iSuppli believes the surge in optimism is premature. Supplier must be rational and watch the current market conditions carefully to avoid jumping to conclusions too quickly,” Kim concluded.

2009 DRAM CAPEX decreased by 56 percent: DRAMeXchange

The 2008 DRAM chip price dropped more than 85 percent, while the global DRAM industry has faced more than two years of cyclical downturn, and the consumer demand suddenly froze because of the global financial crisis in 2H08.

In 1Q09, the DDR2 667 MHz 1Gb chip price rebounded to an average of US$ 0.88, which fell between the material cost and cash cost level. Still, the DRAM vendors encountered huge cash outflow pressure. Not only were capacity cut conducted, the process migration schedules were also delayed in the wake of respective sharp CAPEX cuts.

In 1Q09, the DDR2 667 MHz 1Gb chip price rebounded to an average of US$ 0.88, which fell between the material cost and cash cost level. Still, the DRAM vendors encountered huge cash outflow pressure. Not only were capacity cut conducted, the process migration schedules were also delayed in the wake of respective sharp CAPEX cuts.

According to the survey of DRAMeXchange, the worldwide DRAM CAPEX of 2009 has been revised down to US$ 5.4 billion, sharply down by 56 percent, in contrast to the US$ 12.2 billion in 2008.

WW DRAM 50nm process migration schedules all deferred one to two quarters

From the roadmaps of DRAM vendors, the adoption schedule of DRAM mass production using the 50 nm process have now been delayed one to two quarters. DRAMeXchange estimates that by the end of 2009, the DDR3 will account for 30 percent of the standard DRAM.

Regarding the new DDR2 and DDR3 process migration, all DRAM vendors still own different types of strategies of density and types. For example, the Korean vendors’ 50 nm process migration schedules of DDR 3 are earlier than DDR2 and the 2 Gb DDR3 mass production schedule is earlier than the 1Gb chip.

As for the US and Japanese vendors, according to their DDR3 roadmap, the 50 nm process will be introduced between 3Q09 and 4Q09, which is later than the Korean vendors, and also firstly with mass production of 2 Gb DDR3. Therefore, in the DDR3 era, the density will mainly be 2 Gb which is a lower cost driver with more stimulating incentive to the market demand of higher density chips. The Taiwanese vendors are under the high cash pressure and are falling behind in the 50 nm process race. They are mainly focused on “pilot production”.

Gross die increases 40-50 percent as 50nm process drives down cost

According to the Moore’s Law, the number of transistors on an integrated circuit doubles every 12 months. After the process shrinking became more difficult in the recent decade, it increased to 24 months. With new process migration, the closer the line distance is the larger gross die number a single wafer gets, meanwhile the cost is lower and the vendors gain more competitiveness.

The average DRAM output increased about 30 percent during the process migration from 70nm to 60nm. With improvements of process design and die shrink in the same generation of process technology, the output can once again increase 20 percent. In the 50nm generation, the output will increase almost 40-50 percent, compared to 60nm process and the number of gross die increases to 1500-1700 per 12 inch wafer with another 30 percent cost down.

Cost of immersion lithography tools major capex of 50nm process migration

The major challenge of 50nm process migration is the lithography technology. The newest immersion lithography equipment is required and the older exposure equipment at the wavelength of 193nm is no longer suitable under 65nm process, due to physical limitations.

Traditional dry lithography uses air as the medium to image through masks. However, immersion lithography uses water as the medium. Immersion lithography puts water between the light source and wafer. The wavelength of light shrinks through water so it is able to project more precise and smaller images on the wafer. This is the invention that enabled the semiconductor process technology to migrate from 65nm to 45nm.

The current major immersion equipment vendors are ASML, Nikon, and Canon. The largest vendor in the market is AMSL, which is now mainly promoting its XT1900Gi, a tool that is capable to go lower than 40nm and is the most accepted model in the industry. Nikon still promotes its NSR-S610C, which was launched in 2007 and is able to go down to 45nm process. Canon launched its FPA-7000AS7 in mid 2008 that supports the process under 45nm.

No semicon recovery before mid 2010: Europartners

Connecting with new friends from all over the world is one of the best things that I have experienced while writing a semicon and electronics blog. One such gentleman is Ingo Guertler from Europartners Consultants. He is based in Munich, Germany — a city I have frequented several times.

Guertler has been part of my LinkedIn network as well. He has spent 30 years in leading positions in the electronic components market, mostly with semiconductors, at General Instrument, QT Optoelectronics and Vishay. Since 2005, he has been the senior partner at Europartners Consultants, a network of independent consultants, mostly located in Europe.

Beside individual projects, Europartners analyze the worldwide distribution market for electronic components each year and publish the results in its Worldwide Distribution Report.

Additionally, the company also organizes a two-day conference in Paris every two years, with high-level speakers out of the electronic component industry, discussing actual topics with top managers from component manufacturer and distributors.

This year, the headline will cover the world economy crisis, its effect on the electronics industry, and how companies can successful manage the crisis.

Naturally, our conversation revolved around the global semiconductor market, the memory market turmoil, and how European companies view the Indian semiconductor industry.

Semicon to decline 20 percent in 2009

Ingo Guertler expects a decrease in the global semiconductors market of approximately a minimum of 20 percent. Europartners does not see a recovery before the middle of 2010.

Guertler said: “Maybe, there can be a light recovery in the second quarter 2010 in some regions. Everything will depend on how fast the funds of the governments to the industry will draw. We have to specifically watch, the American and Chinese markets.”

Regarding the memory market, he added that everybody had expected that Vista will stimulate the markets. However, that did not happen. “For the time being, the industry has no direct killer application for memories available or in the design stage. I expect a further price erosion on memories, especially on DRAMs,” he cautioned.

Europe’s interest in Indian semicon

Again, it was natural for me to query Ingo on how European companies view the Indian semiconductor industry.

According to him, for the time being, collaboration between the European and Indian companies is limited in the most cases, or on a one-way service base, using the excellent skills and resources of the Indian software companies and engineers that also includes EDA. “I don’t think that will change in the near future,” he added.

Guertler said: “Personally, I see India as a new market challenge in the next 10 years or more for the European companies, because the local demand will grow faster in India, than we today see in China. Also, I believe and have seen it already, that a lot of companies will likely shift their production bases from China to India the next time, simply because of lower costs, availability of good, graduate engineers and a more Western orientated politics of the Indian government.”

However there is one handicap for the Indian continent! That is: the current infrastructure and the political situation between India and Pakistan.

According to Guertler, India has to set up huge investment programs to invite more investors in the country. Very importantly, is there any feeling that overseas companies’ interest in India is slowing down?

“Definitely not, as far as the European companies are concerned. If India meets the industry’s requirements, I believe their preference will be for India in comparison to China,” he said.

That indeed, is great to hear! The Indian interest is very much intact, in Europe and elsewhere. Now, it is time for India to get some work started on semiconductor product development companies.

Can the Indian semicon industry dream big? (And even buy Qimonda?)

I had ended one of my previous blog posts by saying whether the Indian semiconductor industry was hitting the right notes?

In a continuation to that specific thought, it is necessary to first examine where India stands in the global industry. We are very strong in embedded design and design services — our traditional strengths. While these will hold good for a long time, these are probably not enough to really help India make a serious mark at the global level.

The Indian semiconductor industry, in its current state, needs a rethinking as far as strategy is concerned. Maybe, it cannot survive on chip design alone. Especially in times of downturn, the global semiconductor industry players would be looking for new markets and even customers, rather than low-cost production centers.

Consider these points: In the current economic environment, is the interest in developing new business relations with India really a top priority for overseas companies? Probably not, at this very point of time!

India is also seen more as a source of resource; and the extra resource is the last thing firms need at the moment, given the recessionary climate. What global firms are looking for are new markets and customers, and these points, along with its infrastructure, have been the areas of Indian weaknesses. Maybe, all of this will change, but definitely not overnight! And it needs some more planning.

That leads me to an interesting comment from a reader of my article on CIOL, who went on to suggest that an Indian investor could consider buying Qimonda!

Now that is some serious thought and vision as far as mid- or long-term planning is concerned. However, will there really be any takers for this? If this really happens, fabs can be built in India for memory production. If these fabs perform well, it just might turn out to be a good investment in the mid-term future of the Indian semiconductor industry. Definitely, it will make the world sit up and take notice. The other players would surely give India a look-in thereafter.

Quite a thought! This suggestion of investing in Qimonda is indeed a vision. Can the Indian semiconductor industry develop the courage to show and work toward making this kind of a vision a reality?

What should India do to develop products? Speaking with Anil Gupta, managing director, India Operations, ARM, is always a pleasure.

Speaking with Anil Gupta, managing director, India Operations, ARM, is always a pleasure.

I asked him: Does India have the capability to sustain or even build a product development ecosystem? What needs to be done?

He said: “We need the following for this:

* Entrepreneurs committed to product development and willing to take that risk;

* Investors willing to take risk on product development companies;

* Consumption, and this will happen as the economy improves any way, and

* Deep enough technical/technological knowledge/know-how to put reasonably competent end products together.”

According to him, all of these qualities exist in India, and he cited examples of companies such as Sukam, Tejas, etc.

Well, there you have it!

We need enterprising entrepreneurs in India who are committed toward product development and willing to take that risk, especially in semiconductors. We need investors who can believe in things like even buying Qimonda, or some other company. After all, isn’t this what everyone’s been saying: this is the time to buy!

Dream big, India!

Top NAND suppliers of the world: DRAMeXchange

DRAMeXchange has recently released its rankings for the top NAND suppliers of the world. I am producing bits of that report here, for the benefit of those interested in NAND and the memory market.

Be aware, that this segment has been hit particularly bad. We have heard of Qimonda’s problems, as well as Spansion’s. They are trying to battle it out, gamefully, and best wishes to them.

The global semiconductor industry needs the flash memory segment to recover, and fast, to bring the health back in the industry, as well as the missing buzz!

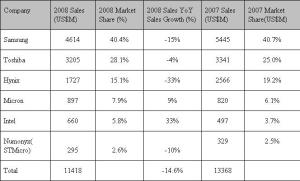

Getting back to DRAMeXchange’s report, NAND Flash brand companies released their total revenue of 2008. Samsung’s annual revenue was $4.614 billion and it gained 40.4 percent market share, to maintain the number 1. position.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

Hynix’s annual revenue was $1.727 billion, with 15.1 percent market share. Though it stayed at the number 3 position, its market share declined 4.1 percent, compared to 2007.

Micron’s annual revenue was $897 million. It had a 7.9 percent market share, which enjoyed a 1.8 percent increase when compared to 2007. Micron was number 4. Intel was at number 5. Its annual revenue was $660 million with 5.8 percent market share, which increased 2.1 percent, compared to 2007.

Numonyx’s (STMicro) 2008 annual revenue was $295 million. It was at number 6 position with the market share of 2.6 percent, which remained the same as 2007.

According to DRAMeXchange, the 4Q08 total revenue of worldwide NAND Flash brand companies was $2.227 billion, which dropped 19.3 percent from $2.761 billion in 3Q08. Under the continuing impact of global recession and the influence of declining worldwide consumer confidence, the 4Q08 revenue of NAND Flash brand companies showed signs of decreasing.

The overall demand and expenditure for consumer electronics declined. Although bit growth in 4Q08 increased 18 percent QoQ, the overall average selling price (ASP) dropped 32 percent QoQ, says DRAMeXchange. A big thanks to DRAMeXchange.

Reviewing global/Indian semicon industry in 2008 — top posts

Greetings, dear readers and friends, in the new year. May you all have all the success and prosperity in 2009!

An eventful year in semiconductors has passed by us. For me, personally, it has been a tremendous 2008, ending with Electronics Weekly of UK selecting my blog (Pradeep Chakraborty’s Blog) as the world’s best in the Electronic Hardware category.

An eventful year in semiconductors has passed by us. For me, personally, it has been a tremendous 2008, ending with Electronics Weekly of UK selecting my blog (Pradeep Chakraborty’s Blog) as the world’s best in the Electronic Hardware category.

Lot of people have asked me since, how it feels to be a world champion! Well, I do feel elated! However, one point, more of the congratulatory notes have come from overseas, than from India. Perhaps, it is an apt indicator of how semiconductors is perceived in India — though, I may be wrong.

Friends have also asked me how I’ve managed to blog on such a difficult subject sitting in India. Simply put: It has not been easy!

First, I’m just a simple person, and not some brand name. Second, my blog does not represent any large, well known media house, or a big brand semiconductor magazine. Hence, maintaining a semicon blog, with the help of contacts from all over the world has been tough, at times. Why, some folks, with whom I wished to speak with, never even responded to my emails and requests. Quite understandable!

Third, I’ve only managed to blog, when I have the time, unlike many other great bloggers who post regularly (or daily)! Fourth, there have been several instances, where my location has been my weak point. I was unable to blog on several instances simply because I had no way of reaching people whom I wished to speak with, while sitting in India. And, as I said, I did get cold snubs on several instances! 🙂 As a result, I could not present my views at specific instances, even though I dearly wanted to!

However, the unconditional and loving support and encouragement of my family, friends, well wishers, industry leaders and loyal readers such as you have helped overcome all of these deficiencies. It is only because of these people that I’ve managed to come this far! I hope each one of you continues to have faith in me. I shall try my best to provide you with the best information (hopefully) the global semiconductor industry has to offer.

To start off the new year, may I present, what I feel, are the top blog posts on semiconductors during 2008, as a review for the past year.

Being indisposed at the start of 2008, I only managed to pick up speed from April onward. As the year progressed, the Indian fab story with SemIndia started worsening, before finally disappearing, even as fabless India held on sttong, as did the fortunes of the global semiconductor industry, which incidentally, did look quite good till September last year.

I have arranged the blog posts, from January to December 2008, so they will present a better picture of how 2008 behaved! These posts are set in no particular order or preference, otherwise. Some of you may have your own favorites, so kindly let me know, in case those haven’t made the list.

JAN 2008

Power awareness critical for chip designers

LabVIEW 8.5 delivers power of multicore processors

MAR 2008

NXP India achieves RF CMOS in single chip

VLSI as a career in India

Using ‘semicon’ simulation for drug discovery

APR 2008

New camps promise exciting times ahead in memory market

Indian design services to hit $10.96bn by 2010

Staying ahead of clock a habit at Magma!

MAY 2008

Dubai — an emerging silicon oasis

Developers, go parallel, or perish, says Intel

Think AND not OR; Altera first @ 40nm FPGAs

Top 10 global semicon predictions — where are we today

Semicon to grow 12pc in 2008

India’s growing might in global semicon

JUN 2008

10-point program for Karnataka semicon policy

Has the Indian silicon wafer fab story gone astray?

Semicon half year over, what next now?

EDA as DNA of growth

JUL 2008

Semicon is no longer business as usual!

Cadence C-to-Silicon Compiler eliminates barriers to HLS adoption

Practical to take solar/PV route: Dr. Atre, Applied

AUG 2008

What India brings to the table for semicon world! And, for Japan

NAND update: Market likely to recover in H2-09

E Ink on every smart surface!

RVCE unveils Garuda super fuel-efficient car

Indian fab policy gets 12 proposals; solar dominates

SEP 2008

90pc fab investments for 300mm capacity: SEMI

Synopsys’ Dr Chi-Foon Chan on India, low power design and solar

Magma’s YieldManager could make solar ‘rock’!

Motion sensors driving MEMS growt

BV Naidu quits SemIndia; what now of Indian fab story?

OCT 2008

Top 20 global solar photovoltaic companies

IDF Taiwan: Father of the Atom an Indian!

TI Beagle Board for Indian open source developers and hobbyists

Cadence’s Virtuoso vs. Synopsys’ Galaxy Custom Designer!

Synopsys’ Galaxy Custom Designer tackles analog mixed signal (AMS) challenges

Solar, semi rocking in India; global semi recovery in 2010?

No fabs? So?? Fabless India shines brightly!!

NOV 2008

AMD’s roadmap 2009 provides lots of answers… now, to deliver!

Embedded computing — 15mn devices not so far away!

FPGAs have adopted Moore’s Law more closely!

DEC 2008

My blog is the world’s best!

Semicon outlook 2009: Global market could be down 7pc or more

Altera on FPGAs outlook for 2009

Solar sunburn likely in 2009? India, are you listening

Outlook for solar photovoltaics in 2009!

I found it difficult to select the Top 10 posts. If any one of you can draw up such a list, it’d be great!

DRAM makers being offered lifelines via bail out plans!

Browsing the Web these past days has brought me to various stories, mostly discussing the various bail out plans being provided for some leading DRAM makers.

It all started with Germany based Qimonda announcing that it has arranged a Euro 325 million financing package for the ramp up of its innovative Buried Wordline technology.

Yesterday, Hynix, the Korean DRAM maker, received a bail out of $597 million, according to reports on Fabtech. The story also reports that Powerchip Semiconductor, Taiwan’s largest DRAM maker, is also seeking new funding.

Then, DigiTimes, a very good technology news Web site from Taiwan, reported yesterday that Taiwan’s Ministry of Economic Affairs (MoEA) had reportedly developed an NT$200 billion (US $6.5 billion) bail out plan for Taiwan’s hard-hit DRAM makers.

Sitting in India makes it a little difficult to speak with global companies based in Taiwan, Korea and Germany. I sometimes wish I could get some help from reliable sources as to what’s the actual ground situation.

Having said that, it is good to see various national governments showing their deep concern about the state of the global DRAM industry and about technologies. And, let us keep all criticisms aside, as to who performed and who didn’t! Here’s a lesson for India to learn from, as closer home, it has a semiconductor industry really in its infancy!

Right now, the global semiconductor industry is facing a downturn and memory is the hardest hit! Hence, if any measures are being taken to somehow bring DRAM back on track, it should be welcomed.

Qimonda, Hynix, Powerchip, etc., are not small names in the global industry. Poor performance from memory players saw them dropping out of the top 20 global semiconductor players’ rankings in 2008.

All the lifelines being provided to these major players now means that these companies need to pull it off, somehow, and extricate themselves from the depths they have fallen into. If they fail, they will perish! And, they all know that!!

I’d be very keen to see the responses of DRAMeXchange and iSuppli on these bail out plans.

Merry X’mas everyone, and hope you all have a great time!

PS: I have iSuppli’s feedback!

Speaking on the Taiwan government’s bail-out plan as well as Hynix’s rescue package from banks, John Lei, Analyst, memory, iSuppli Corp., said: “In general, Hynix’s package is much like a short-term relief for their near-term debt, while the Taiwan government aims at the possible consolidation of five suppliers.”

“All these packages could bring more uncertainties to the maket, however, based on iSuppli’s assumption and forecasts. The industry operation profit margin will hit bottom in Q4-08, but profitability of the industry will not occur until Q4-09,” he added.

Solar sunburn likely in 2009? India, are you listening?

iSuppli’s just issued a warning that 2009 could well see the coming of a solar market eclipse!

Come to think of it! Just last week, in the Semiconductor International webcast, the analysts did mention that there could be tough times ahead for solar! In fact, Aida Jebens, Senior Economist, VLSI Research Inc., did indicate that solar/PV would pick up in the next two years and that 2009 could be a tough year.

If you look at the India situation, I have been getting the feeling all the time that all of a sudden, too many companies were entering this market segment, as though it is a land of promised gold! Perhaps, it is, and one sincerely wishes that all of those investments proposed for solar do not come unstuck.

This August, following the announcement of the national semiconductor policy (the Special Incentive Package Scheme, or SIPS), the government of India received 12 proposals amounting to a total investment of Rs. 92,915.38 crore. Ten of these proposals were for solar/PV, from: KSK Surya (Rs. 3,211 crore), Lanco Solar (Rs. 12,938 crore), PV Technologies India (Rs. 6,000 crore), Phoenix Solar India (Rs.1,200 crore), Reliance Industries (Rs.11,631 crore), Signet Solar (Rs. 9,672 crore), Solar Semiconductor (Rs.11,821 crore), TF Solar Power (Rs. 2,348 crore), Tata BP Solar India (Rs. 1,692.80 crore), and Titan Energy System (Rs. 5,880.58 crore).

Then, late September, Vavasi Telegence (Rs. 39,000 crore), EPV Solar (Rs. 4,000 crore), and Lanco Solar (Rs. 12,938 crore), also announced major investments.

Now, given the quite ruthless kind of financial crisis the world is currently engulfed in, several have raised doubts whether solar players would be able to get the credit they need. Or, would they run into rough weather?

On paper, some of these companies are big corporate houses, with several years of standing. However, reality can be quite different, and can bite! I’ve yet to hear whether all of these companies have managed to raise the requisite capital. One sure wishes that they have all been busy and will be successful!

Otherwise, all one needs to look at is iSuppli’s warning. According to iSuppli, ‘Bringing an end to eight consecutive years of growth, global revenue for photovoltaic (PV), panels is expected to plunge by nearly 20 percent in 2009, as a massive oversupply causes prices to drop.’

Will it be a case of massive oversupply in India? We haven’t exactly started. Hence, perhaps, we will come to deal with oversupply later. The key thing is to get all of these solar/PV projects off the ground!

The India Semiconductor Association (ISA), and now, SEMI India, have been promoting the solar/PV industry very aggressively. The work they’ve done so far has been commendable, and I’ve been witness to all of their activities. However, keep in mind that these are only industry associations, who can only advice, guide, debate and promote the industry, and also provide industry statistics for everyone to consume.

The real action can only happen once the proposals have been cleared by the Indian government and the players have managed to arrange for the requisite capital for their projects. The Indian fab story with SemIndia is all to familiar, and there should not be a repitition with solar/PV projects.

Therefore, the role of the government of India will be extremely critical and crucial. The good health of the Indian solar/PV industry is entirely in its hands, and not in the hands of the industry associations.

Perhaps, the Indian government could do well to look at how the Taiwan government is playing a critical role in reviving the hard hit DRAM industry and also at the German free state of Saxony, which has played a key role in financing the ailing Qimonda.

Otherwise, the Indian solar/PV industry could get hit, even before it takes off the ground! And, as a nation, we cannot afford that to happen!

India has so far has had a good story going in solar. There are hopes that solar/PV will trigger off a spate of manufacturing activities in India, besides creating lots of jobs. Don’t think we can afford to spoil all of this!

The industry in India is still very much in its infancy. Let the baby play happily in the water (solar) tub, instead of throwing the water out! This baby needs a lot of hand-holding to get stronger in the years to come.

How Taiwan government reacts to DRAM turmoil is a lesson in itself!

Taiwan based DRAMeXchange recently sent me a release, which discussed in length the steps the Taiwan government is taking in an attempt to “save one of the ‘2 trillion twin stars’, the DRAM industry”. The Taiwanese Ministry of Economic Affairs (MoEA) was designated to draft the policies, principals, strategic goals and strategic directions of the DRAM industry rescue plan.

According to DRAMeXchange: At 6 PM, December 16, the Taiwanese Ministry of Economic Affairs held a press conference about the DRAM rescue plan, emphasized in the past 10 years the investment amount of the DRAM industry surpassed NT$ 850 billion, and created a complete industry supply chain, which widely covers upstream chip makers, to downstream packaging and testing companies, and module houses. If the recession brought down the industry, the Taiwan industrial chain will be affected severely.

The Taiwanese government showed sincerity and willingness, and hoped that Taiwanese DRAM vendors can actively start to consolidate horizontally and vertically, and make joint proposing plans to the government. The government will not take the leading position, but the strategic direction is long term integration, which is not just merger but also includes cooperation of co-research, co-develop, and co-manufacturing.

The government also emphasized that it will tend to strengthen the relationship among the co-operation of Taiwanese, American, and Japanese DRAM vendors.

In another report, Gartner has gone as far as dubbing the DRAM industry as the wild card for the semiconductor industry in 2009! The DRAM industry has been in a downturn for the past 18 months and losses are now approaching $12 billion, it says.

How the Taiwanese DRAM industry reacts to the efforts of the Taiwan government will be visible in the coming months. Among other bail out plans, the Taiwan government has also focused on the need for the local industry to develop its own technology.

Taiwan takes great pride in having been a leader in technology and R&D for long. If the DRAM industry does not recover quickly enough, it would indeed impact the country’s industrial chain as well.

What’s interesting to note is the key role the government of Taiwan is playing in all of this. It again stresses the importance of government contribution within the semiconductor industry. And, there is also a lesson in all of this for India!

Closer home, in India, I am (and I am sure, interested readers and parties are too) still waiting to hear on what happened to the several proposals that were received for solar/PV, as well as on the various state policies, especially, Karnataka.

All believe that these would surely get pushed through in the new year. However, there is a need to show some speed in this regard as well. You cannot afford to wait for too long in the semiconductor industry. The SemIndia fab story is all to well known and hopefully, still fresh in everyone’s minds.