Archive

Can the Indian semicon industry dream big? (And even buy Qimonda?)

I had ended one of my previous blog posts by saying whether the Indian semiconductor industry was hitting the right notes?

In a continuation to that specific thought, it is necessary to first examine where India stands in the global industry. We are very strong in embedded design and design services — our traditional strengths. While these will hold good for a long time, these are probably not enough to really help India make a serious mark at the global level.

The Indian semiconductor industry, in its current state, needs a rethinking as far as strategy is concerned. Maybe, it cannot survive on chip design alone. Especially in times of downturn, the global semiconductor industry players would be looking for new markets and even customers, rather than low-cost production centers.

Consider these points: In the current economic environment, is the interest in developing new business relations with India really a top priority for overseas companies? Probably not, at this very point of time!

India is also seen more as a source of resource; and the extra resource is the last thing firms need at the moment, given the recessionary climate. What global firms are looking for are new markets and customers, and these points, along with its infrastructure, have been the areas of Indian weaknesses. Maybe, all of this will change, but definitely not overnight! And it needs some more planning.

That leads me to an interesting comment from a reader of my article on CIOL, who went on to suggest that an Indian investor could consider buying Qimonda!

Now that is some serious thought and vision as far as mid- or long-term planning is concerned. However, will there really be any takers for this? If this really happens, fabs can be built in India for memory production. If these fabs perform well, it just might turn out to be a good investment in the mid-term future of the Indian semiconductor industry. Definitely, it will make the world sit up and take notice. The other players would surely give India a look-in thereafter.

Quite a thought! This suggestion of investing in Qimonda is indeed a vision. Can the Indian semiconductor industry develop the courage to show and work toward making this kind of a vision a reality?

What should India do to develop products? Speaking with Anil Gupta, managing director, India Operations, ARM, is always a pleasure.

Speaking with Anil Gupta, managing director, India Operations, ARM, is always a pleasure.

I asked him: Does India have the capability to sustain or even build a product development ecosystem? What needs to be done?

He said: “We need the following for this:

* Entrepreneurs committed to product development and willing to take that risk;

* Investors willing to take risk on product development companies;

* Consumption, and this will happen as the economy improves any way, and

* Deep enough technical/technological knowledge/know-how to put reasonably competent end products together.”

According to him, all of these qualities exist in India, and he cited examples of companies such as Sukam, Tejas, etc.

Well, there you have it!

We need enterprising entrepreneurs in India who are committed toward product development and willing to take that risk, especially in semiconductors. We need investors who can believe in things like even buying Qimonda, or some other company. After all, isn’t this what everyone’s been saying: this is the time to buy!

Dream big, India!

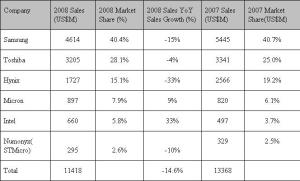

Top NAND suppliers of the world: DRAMeXchange

DRAMeXchange has recently released its rankings for the top NAND suppliers of the world. I am producing bits of that report here, for the benefit of those interested in NAND and the memory market.

Be aware, that this segment has been hit particularly bad. We have heard of Qimonda’s problems, as well as Spansion’s. They are trying to battle it out, gamefully, and best wishes to them.

The global semiconductor industry needs the flash memory segment to recover, and fast, to bring the health back in the industry, as well as the missing buzz!

Getting back to DRAMeXchange’s report, NAND Flash brand companies released their total revenue of 2008. Samsung’s annual revenue was $4.614 billion and it gained 40.4 percent market share, to maintain the number 1. position.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

According to DRAMeXchange, the annual revenue of Toshiba was $3.25 billion, and its market share was 28.1 percent at the number 2 position. Its market share increased 3.1 percent compared to 2007.

Hynix’s annual revenue was $1.727 billion, with 15.1 percent market share. Though it stayed at the number 3 position, its market share declined 4.1 percent, compared to 2007.

Micron’s annual revenue was $897 million. It had a 7.9 percent market share, which enjoyed a 1.8 percent increase when compared to 2007. Micron was number 4. Intel was at number 5. Its annual revenue was $660 million with 5.8 percent market share, which increased 2.1 percent, compared to 2007.

Numonyx’s (STMicro) 2008 annual revenue was $295 million. It was at number 6 position with the market share of 2.6 percent, which remained the same as 2007.

According to DRAMeXchange, the 4Q08 total revenue of worldwide NAND Flash brand companies was $2.227 billion, which dropped 19.3 percent from $2.761 billion in 3Q08. Under the continuing impact of global recession and the influence of declining worldwide consumer confidence, the 4Q08 revenue of NAND Flash brand companies showed signs of decreasing.

The overall demand and expenditure for consumer electronics declined. Although bit growth in 4Q08 increased 18 percent QoQ, the overall average selling price (ASP) dropped 32 percent QoQ, says DRAMeXchange. A big thanks to DRAMeXchange.

Reviewing global/Indian semicon industry in 2008 — top posts

Greetings, dear readers and friends, in the new year. May you all have all the success and prosperity in 2009!

An eventful year in semiconductors has passed by us. For me, personally, it has been a tremendous 2008, ending with Electronics Weekly of UK selecting my blog (Pradeep Chakraborty’s Blog) as the world’s best in the Electronic Hardware category.

An eventful year in semiconductors has passed by us. For me, personally, it has been a tremendous 2008, ending with Electronics Weekly of UK selecting my blog (Pradeep Chakraborty’s Blog) as the world’s best in the Electronic Hardware category.

Lot of people have asked me since, how it feels to be a world champion! Well, I do feel elated! However, one point, more of the congratulatory notes have come from overseas, than from India. Perhaps, it is an apt indicator of how semiconductors is perceived in India — though, I may be wrong.

Friends have also asked me how I’ve managed to blog on such a difficult subject sitting in India. Simply put: It has not been easy!

First, I’m just a simple person, and not some brand name. Second, my blog does not represent any large, well known media house, or a big brand semiconductor magazine. Hence, maintaining a semicon blog, with the help of contacts from all over the world has been tough, at times. Why, some folks, with whom I wished to speak with, never even responded to my emails and requests. Quite understandable!

Third, I’ve only managed to blog, when I have the time, unlike many other great bloggers who post regularly (or daily)! Fourth, there have been several instances, where my location has been my weak point. I was unable to blog on several instances simply because I had no way of reaching people whom I wished to speak with, while sitting in India. And, as I said, I did get cold snubs on several instances! 🙂 As a result, I could not present my views at specific instances, even though I dearly wanted to!

However, the unconditional and loving support and encouragement of my family, friends, well wishers, industry leaders and loyal readers such as you have helped overcome all of these deficiencies. It is only because of these people that I’ve managed to come this far! I hope each one of you continues to have faith in me. I shall try my best to provide you with the best information (hopefully) the global semiconductor industry has to offer.

To start off the new year, may I present, what I feel, are the top blog posts on semiconductors during 2008, as a review for the past year.

Being indisposed at the start of 2008, I only managed to pick up speed from April onward. As the year progressed, the Indian fab story with SemIndia started worsening, before finally disappearing, even as fabless India held on sttong, as did the fortunes of the global semiconductor industry, which incidentally, did look quite good till September last year.

I have arranged the blog posts, from January to December 2008, so they will present a better picture of how 2008 behaved! These posts are set in no particular order or preference, otherwise. Some of you may have your own favorites, so kindly let me know, in case those haven’t made the list.

JAN 2008

Power awareness critical for chip designers

LabVIEW 8.5 delivers power of multicore processors

MAR 2008

NXP India achieves RF CMOS in single chip

VLSI as a career in India

Using ‘semicon’ simulation for drug discovery

APR 2008

New camps promise exciting times ahead in memory market

Indian design services to hit $10.96bn by 2010

Staying ahead of clock a habit at Magma!

MAY 2008

Dubai — an emerging silicon oasis

Developers, go parallel, or perish, says Intel

Think AND not OR; Altera first @ 40nm FPGAs

Top 10 global semicon predictions — where are we today

Semicon to grow 12pc in 2008

India’s growing might in global semicon

JUN 2008

10-point program for Karnataka semicon policy

Has the Indian silicon wafer fab story gone astray?

Semicon half year over, what next now?

EDA as DNA of growth

JUL 2008

Semicon is no longer business as usual!

Cadence C-to-Silicon Compiler eliminates barriers to HLS adoption

Practical to take solar/PV route: Dr. Atre, Applied

AUG 2008

What India brings to the table for semicon world! And, for Japan

NAND update: Market likely to recover in H2-09

E Ink on every smart surface!

RVCE unveils Garuda super fuel-efficient car

Indian fab policy gets 12 proposals; solar dominates

SEP 2008

90pc fab investments for 300mm capacity: SEMI

Synopsys’ Dr Chi-Foon Chan on India, low power design and solar

Magma’s YieldManager could make solar ‘rock’!

Motion sensors driving MEMS growt

BV Naidu quits SemIndia; what now of Indian fab story?

OCT 2008

Top 20 global solar photovoltaic companies

IDF Taiwan: Father of the Atom an Indian!

TI Beagle Board for Indian open source developers and hobbyists

Cadence’s Virtuoso vs. Synopsys’ Galaxy Custom Designer!

Synopsys’ Galaxy Custom Designer tackles analog mixed signal (AMS) challenges

Solar, semi rocking in India; global semi recovery in 2010?

No fabs? So?? Fabless India shines brightly!!

NOV 2008

AMD’s roadmap 2009 provides lots of answers… now, to deliver!

Embedded computing — 15mn devices not so far away!

FPGAs have adopted Moore’s Law more closely!

DEC 2008

My blog is the world’s best!

Semicon outlook 2009: Global market could be down 7pc or more

Altera on FPGAs outlook for 2009

Solar sunburn likely in 2009? India, are you listening

Outlook for solar photovoltaics in 2009!

I found it difficult to select the Top 10 posts. If any one of you can draw up such a list, it’d be great!

DRAM makers being offered lifelines via bail out plans!

Browsing the Web these past days has brought me to various stories, mostly discussing the various bail out plans being provided for some leading DRAM makers.

It all started with Germany based Qimonda announcing that it has arranged a Euro 325 million financing package for the ramp up of its innovative Buried Wordline technology.

Yesterday, Hynix, the Korean DRAM maker, received a bail out of $597 million, according to reports on Fabtech. The story also reports that Powerchip Semiconductor, Taiwan’s largest DRAM maker, is also seeking new funding.

Then, DigiTimes, a very good technology news Web site from Taiwan, reported yesterday that Taiwan’s Ministry of Economic Affairs (MoEA) had reportedly developed an NT$200 billion (US $6.5 billion) bail out plan for Taiwan’s hard-hit DRAM makers.

Sitting in India makes it a little difficult to speak with global companies based in Taiwan, Korea and Germany. I sometimes wish I could get some help from reliable sources as to what’s the actual ground situation.

Having said that, it is good to see various national governments showing their deep concern about the state of the global DRAM industry and about technologies. And, let us keep all criticisms aside, as to who performed and who didn’t! Here’s a lesson for India to learn from, as closer home, it has a semiconductor industry really in its infancy!

Right now, the global semiconductor industry is facing a downturn and memory is the hardest hit! Hence, if any measures are being taken to somehow bring DRAM back on track, it should be welcomed.

Qimonda, Hynix, Powerchip, etc., are not small names in the global industry. Poor performance from memory players saw them dropping out of the top 20 global semiconductor players’ rankings in 2008.

All the lifelines being provided to these major players now means that these companies need to pull it off, somehow, and extricate themselves from the depths they have fallen into. If they fail, they will perish! And, they all know that!!

I’d be very keen to see the responses of DRAMeXchange and iSuppli on these bail out plans.

Merry X’mas everyone, and hope you all have a great time!

PS: I have iSuppli’s feedback!

Speaking on the Taiwan government’s bail-out plan as well as Hynix’s rescue package from banks, John Lei, Analyst, memory, iSuppli Corp., said: “In general, Hynix’s package is much like a short-term relief for their near-term debt, while the Taiwan government aims at the possible consolidation of five suppliers.”

“All these packages could bring more uncertainties to the maket, however, based on iSuppli’s assumption and forecasts. The industry operation profit margin will hit bottom in Q4-08, but profitability of the industry will not occur until Q4-09,” he added.

Solar sunburn likely in 2009? India, are you listening?

iSuppli’s just issued a warning that 2009 could well see the coming of a solar market eclipse!

Come to think of it! Just last week, in the Semiconductor International webcast, the analysts did mention that there could be tough times ahead for solar! In fact, Aida Jebens, Senior Economist, VLSI Research Inc., did indicate that solar/PV would pick up in the next two years and that 2009 could be a tough year.

If you look at the India situation, I have been getting the feeling all the time that all of a sudden, too many companies were entering this market segment, as though it is a land of promised gold! Perhaps, it is, and one sincerely wishes that all of those investments proposed for solar do not come unstuck.

This August, following the announcement of the national semiconductor policy (the Special Incentive Package Scheme, or SIPS), the government of India received 12 proposals amounting to a total investment of Rs. 92,915.38 crore. Ten of these proposals were for solar/PV, from: KSK Surya (Rs. 3,211 crore), Lanco Solar (Rs. 12,938 crore), PV Technologies India (Rs. 6,000 crore), Phoenix Solar India (Rs.1,200 crore), Reliance Industries (Rs.11,631 crore), Signet Solar (Rs. 9,672 crore), Solar Semiconductor (Rs.11,821 crore), TF Solar Power (Rs. 2,348 crore), Tata BP Solar India (Rs. 1,692.80 crore), and Titan Energy System (Rs. 5,880.58 crore).

Then, late September, Vavasi Telegence (Rs. 39,000 crore), EPV Solar (Rs. 4,000 crore), and Lanco Solar (Rs. 12,938 crore), also announced major investments.

Now, given the quite ruthless kind of financial crisis the world is currently engulfed in, several have raised doubts whether solar players would be able to get the credit they need. Or, would they run into rough weather?

On paper, some of these companies are big corporate houses, with several years of standing. However, reality can be quite different, and can bite! I’ve yet to hear whether all of these companies have managed to raise the requisite capital. One sure wishes that they have all been busy and will be successful!

Otherwise, all one needs to look at is iSuppli’s warning. According to iSuppli, ‘Bringing an end to eight consecutive years of growth, global revenue for photovoltaic (PV), panels is expected to plunge by nearly 20 percent in 2009, as a massive oversupply causes prices to drop.’

Will it be a case of massive oversupply in India? We haven’t exactly started. Hence, perhaps, we will come to deal with oversupply later. The key thing is to get all of these solar/PV projects off the ground!

The India Semiconductor Association (ISA), and now, SEMI India, have been promoting the solar/PV industry very aggressively. The work they’ve done so far has been commendable, and I’ve been witness to all of their activities. However, keep in mind that these are only industry associations, who can only advice, guide, debate and promote the industry, and also provide industry statistics for everyone to consume.

The real action can only happen once the proposals have been cleared by the Indian government and the players have managed to arrange for the requisite capital for their projects. The Indian fab story with SemIndia is all to familiar, and there should not be a repitition with solar/PV projects.

Therefore, the role of the government of India will be extremely critical and crucial. The good health of the Indian solar/PV industry is entirely in its hands, and not in the hands of the industry associations.

Perhaps, the Indian government could do well to look at how the Taiwan government is playing a critical role in reviving the hard hit DRAM industry and also at the German free state of Saxony, which has played a key role in financing the ailing Qimonda.

Otherwise, the Indian solar/PV industry could get hit, even before it takes off the ground! And, as a nation, we cannot afford that to happen!

India has so far has had a good story going in solar. There are hopes that solar/PV will trigger off a spate of manufacturing activities in India, besides creating lots of jobs. Don’t think we can afford to spoil all of this!

The industry in India is still very much in its infancy. Let the baby play happily in the water (solar) tub, instead of throwing the water out! This baby needs a lot of hand-holding to get stronger in the years to come.

How Taiwan government reacts to DRAM turmoil is a lesson in itself!

Taiwan based DRAMeXchange recently sent me a release, which discussed in length the steps the Taiwan government is taking in an attempt to “save one of the ‘2 trillion twin stars’, the DRAM industry”. The Taiwanese Ministry of Economic Affairs (MoEA) was designated to draft the policies, principals, strategic goals and strategic directions of the DRAM industry rescue plan.

According to DRAMeXchange: At 6 PM, December 16, the Taiwanese Ministry of Economic Affairs held a press conference about the DRAM rescue plan, emphasized in the past 10 years the investment amount of the DRAM industry surpassed NT$ 850 billion, and created a complete industry supply chain, which widely covers upstream chip makers, to downstream packaging and testing companies, and module houses. If the recession brought down the industry, the Taiwan industrial chain will be affected severely.

The Taiwanese government showed sincerity and willingness, and hoped that Taiwanese DRAM vendors can actively start to consolidate horizontally and vertically, and make joint proposing plans to the government. The government will not take the leading position, but the strategic direction is long term integration, which is not just merger but also includes cooperation of co-research, co-develop, and co-manufacturing.

The government also emphasized that it will tend to strengthen the relationship among the co-operation of Taiwanese, American, and Japanese DRAM vendors.

In another report, Gartner has gone as far as dubbing the DRAM industry as the wild card for the semiconductor industry in 2009! The DRAM industry has been in a downturn for the past 18 months and losses are now approaching $12 billion, it says.

How the Taiwanese DRAM industry reacts to the efforts of the Taiwan government will be visible in the coming months. Among other bail out plans, the Taiwan government has also focused on the need for the local industry to develop its own technology.

Taiwan takes great pride in having been a leader in technology and R&D for long. If the DRAM industry does not recover quickly enough, it would indeed impact the country’s industrial chain as well.

What’s interesting to note is the key role the government of Taiwan is playing in all of this. It again stresses the importance of government contribution within the semiconductor industry. And, there is also a lesson in all of this for India!

Closer home, in India, I am (and I am sure, interested readers and parties are too) still waiting to hear on what happened to the several proposals that were received for solar/PV, as well as on the various state policies, especially, Karnataka.

All believe that these would surely get pushed through in the new year. However, there is a need to show some speed in this regard as well. You cannot afford to wait for too long in the semiconductor industry. The SemIndia fab story is all to well known and hopefully, still fresh in everyone’s minds.

Memory market to witness another negative sales growth in 2009

This is a continuation from my previous blog on the outlook for the global semiconductor industry, and iSuppli’s ranking of the Top 20 global semiconductor companies.

Thanks to Jon Cassell at iSuppli, I also got into a conversation with Nam Hyung Kim, Director & Chief Analyst, iSuppli. Kim touched upon the outlook for DRAM and the memory market as a whole.

Thanks to Jon Cassell at iSuppli, I also got into a conversation with Nam Hyung Kim, Director & Chief Analyst, iSuppli. Kim touched upon the outlook for DRAM and the memory market as a whole.

Further analyzing iSuppli’s top 20 rankings, among the leading memory makers, Hynix has performed the worst. On this aspect, Kim says that DRAM sales is likely to decline by 20 percent in 2008. Thus, Hynix’s performance is not far from overall challenging status considering it also scaled NAND flash business back dramatically.

On another note, Qimonda is also among the strugglers, and there have been whispers about its possible bankruptcy. However, iSuppli did not comment on this topic.

So, how much longer will it take before the memory market can come out of its current woes? Kim adds: “The memory industry inevitably will experience another negative sales growth in 2009. However, the rate of sales decline will be much lower than that of 2008.

“The year 2009 will be the third year of the memory market downturn. Therefore, supply growth reduction will take place fast, resulting in lower price drop compared to 2008.”

Finally, what’s the way forward for DRAM, NOR and SRAM? Kim asserts that iSuppli expect the following sales growth in 2009 (preliminary):

* DRAM: single digit percentage sales decline; and

* NAND, NOR, SRAM will experience mid to high teens sales decline.

Solar, semi rocking in India; global semi recovery in 2010?

Wow! What a start for October! We have had a whole new range of activities going on! Fist, late September, the India Semiconductor Association organized a solar/PV conclave in New Delhi, where plans were laid out for India’s roadmap in the solar/PV field. the ISA-NMCC (National Manufacturing Competitiveness Council) report on the Indian solar PV market was also released at the conclave.

According to Poornima Shenoy, president, ISA, the year 2015 could be important for this industry. She said, “Around this time, the product cost of the Indian solar PV industry is likely to match the semi grid parity (peak power) globally, and also to match the grid parity within India.”

Next, AMD joined hands with Advanced Technology Investment Co. (ATIC) of Abu Dhabi to create “The Foundry Company”, a leading-edge foundry production outfit. It will also join the IBM joint development alliance for silicon-on-insulator (SOI) and bulk silicon through 22nm generation. It will be very interesting to see how AMD now takes on Intel!

Messe Munchen put out a white paper on “How China, India and Eastern Europe are changing the global electronics market.” This is not surprising at all! You can download the report by clicking on the link here, and I must say, the report is really engaging!

On the same lines, Gartner came up with its analysis that China is dominating the global semiconductor scene, and that both India and Vietnam are gaining! India’s growing might in semicon is well documented! Also, last month, I had mentioned how the lack of a fab or the exit of a top professional from an Indian semicon firm would not hamper India’s growing fortunes in this industry!

The trials and tribulations of the global semiconductor industry were already touched upon by Derek Lidow of iSuppli. Analysts such as Malcolm Penn of Future Horizons and those at Gartner have been saying similar things, more or less. Penn advises that this is the time to stop chasing fashion and get back to basics. He adds, “The good news being the industry basics are mercifully as good as they get back.”

Gartner only expects a recovery for semiconductors sometime in 2010! According to Gartner, a collapse in memory spending, combined with a weak economy, is driving a major contraction in semiconductor capital equipment spending in 2008. The slowdown is likely to continue into 2009 before the industry recovers in 2010.

SEMI now has a presence in India. Sathya Prasad, formerly of Cadence, has been appointed as president of SEMI India with immediate effect. This is a further indication of India’s growing leadership in the semicon space. I will be getting into a discussion with Sathya Prasad sometime later.

Of course, we have the usual stuff like companies selling off or retiring 200mm fabs. Examples are NXP, Hynix, Renesas, etc. Also, DRAM prices continue to be weak and suppliers could likely face a credit crunch.

Interesting mix of happenings, isn’t it! While India rocks in solar and semicon, we are still speculating on a recovery for the global semiconductor industry. About time India took the lead in making that happen!

Finally, I was busy with Durga Puja, and hence, didn’t blog in a while. Will try my best and make up for my absence. I would like to take this opportunity to wish SHUBHO BIJOYA to all of my Bengali and non-Bengali friends.

What can the global semicon industry do to get back its money-making touch!

It is very well known that the global semiconductor industry has had a year full of turmoil. The ongoing global financial has been not been of any help either.

The key question: Has the semiconductor industry really lost its money making touch?

According to iSuppli, facing dwindling profits, fewer opportunities to expand by taking market share from competitors and a shrinking roster of star performers, the semiconductor industry has entered a period of lowered expectations and diminishing options, forcing chip suppliers to rethink their basic strategies for success.

Thanks to Jon Cassell at iSuppli, I caught up with Derek Lidow, president and CEO, of iSuppli, to find out more about why the global semiconductor industry has become less forgiving. He has offered a range of suggestions for the global semiconductor industry to adopt and follow. The beauty of the advice lies in its simplicity, and I hope the industry is reading!

Thanks to Jon Cassell at iSuppli, I caught up with Derek Lidow, president and CEO, of iSuppli, to find out more about why the global semiconductor industry has become less forgiving. He has offered a range of suggestions for the global semiconductor industry to adopt and follow. The beauty of the advice lies in its simplicity, and I hope the industry is reading!

Facing dwindling profits and fewer opportunities to expand by taking market share from competitors and a shrinking roster of star performer, how difficult is the market today?

According to Derek Lidow, at the moment, the makers of electronics have started slamming on the brakes as they have decided that the financial turmoil will effect Christmas spending.

In this scenario, what strategies should the players: a) fabs; b) NAND; c) DRAM; d) materials devise, to ensure some turnaround?

Lidow says that the fab players should consolidate fabs to make them more efficient.

Both the NAND players and DRAM players should push out capacity expansion plans. Makers of devices should make variations of the existing products that customer would like to have, and don’t turn down opportunities to lock in orders for specials.

If semiconductors have actually lost their money-making touch, it is really an alarming sign. However, Lidow advises that the semiconductor business is maturing and every industry, as it matures, must undergo transitions.

Leaders can’t ignore looming changes

“Often, these transitions come as a surprise and many companies go through hard times,” he says. “Semiconductor companies don’t have to go through the turmoil of the steel or automotive industries if it doesn’t want to. The leaders of the industry just can’t ignore the looming changes.”

Is there a way that semiconductor companies break out of the current market dynamics to outperform the industry?

Lidow suggests the semiconductor companies should STOP doing things that they are not good at! He adds: “Each company will have to follow a recipe that eliminates where they are mediocre and focuses on where they add real value. Next, they should change their business models so that semiconductor technology is the tool, not the objective.”

According to him, designing more total systems with system-level chips built around proprietary Intellectual Property (IP) should be enough.

He says: “The electronics industry is $1.5 trillion dollars in size, and the semiconductor industry is $270 billion in size. There is a lot more value to capture. However, the value is more complex to unlock and requires as much or more software expertise as it does semiconductor expertise. They have to get married together to succeed in developing proprietary IP.”

Areas to outspend rivals

As for the areas where companies can massively outspending rivals in areas of products and manufacturing, these would be leading edge wafer foundries, memory chips, and the most complex system-on-chips (SoCs).

Why won’t this massive outspend simply to maintain technical and scale dominances in competitive market segments be risky?

Lidow says you can only use this strategy if you know you can outspend your rival! “We see the problems of a spending race in the memory market where many companies are trying to keep up with Samsung’s massive investments and it is hurting everyone,” he points out.

iSuppli has also advised adopting a scalable acquisition process that would allow a semiconductor company to grow by buying other companies or selected parts of companies.

Lidow says: “I think the point of my article was that there haven’t been any success stories to date. So, this strategy is unproven, but very tantalizing, considering the state of the maturing industry.”

On possible Samsung-SanDisk deal; AMD's fab-lite path

Last week, the global semiconductor industry has been hearing and reading about two big speculative stories:

a) A possible acquisition of SanDisk by Samsung, and

b) A possible chance of AMD taking the fab-lite route.

First on Samsung’s buyout (possible) of SanDisk! There have been rumors of a possibility of Samsung acquiring SanDisk. While it is still a possibility, it also leads to several interesting questions!

Should this deal happen, what will be the possible implications for the memory market? Will this also lead to a possible easing off on the pricing pressures on the memory supply chain? And well, what happens to the Toshiba-SanDisk alliance?

A couple of weeks back, iSuppli, had highlighted how Micron had managed to buck the weak NAND market conditions, and was closing the gap with Hynix in Q2, and that NAND recovery was likely only by H2-2009.

I managed to catch up again Nam Hyung Kim, Director & Chief Analyst, iSuppli Corp., and quizzed him on the possible acquisition of SanDisk by Samsung.

A caution: Remember, all of this is merely based on speculation!

On the possibility of Samsung’s takeover of SanDisk, he says: “Samsung at least said that they consider it. Thus, it is a possible deal. But who knows!”

Kim is more forthright on the implications for the memory market, should this deal happen, and I tend to agree with him.

Consolidation inevitable; no impact on prices

The chief analyst quips: “The NAND flash market is still premature and there are too many players in flash cards, USB Flash drives, SSD, etc. The industry consolidation should be inevitable in future.”

So, will this possible buyout at least ease some pricing pressures on memory supply chain? “I don’t expect this deal to impact the prices. Prices will depend on suppliers’ capacity plans. In the memory industry, the consolidation has never impacted the prices in a long run. (maybe, just a short-term impact). As you know, Micron acquired Lexar a few years ago, but no impact,” he adds.

Is there any possibility of SanDisk delaying its production ramps and investments at two of its fabs? And, what will happen should it do so?

Nam says: “SanDisk has already said that they would delay its investment and capacity plan given difficult market condition. This is a positive sign to the market as we expect slower supply growth than expected in future. However, in a long run, consolidation won’t impact the market up and down.”

Negative impact likely for Toshiba?

Lastly, what happens to the SanDisk-Toshiba alliance, should the Samsung buyout of SanDisk does happen?

Nam adds: “It is negative to Toshiba. The company [Toshiba] not only loses its technology partner, but also loses its investment partner. It should be burden for Toshiba to keep investing themselves to grow its business.”

Well, in SEMI’s Fab Forecast Report, there is mention of how Toshiba and SanDisk are among the big spenders in fabs, in Japan. Considering that Japanese semiconductor manufacturers are more cautious, it would be interesting to see how this deal, should it happen, affects the Toshiba-SanDisk alliance.

Now, AMD goes fab-lite?

While on fabs, this brings me to the other big story of last week — of AMD going the fab-lite route, possibly!

Magma’s Rajeev Madhavan had commented some time back that fab-lite is actually good for EDA. It means more design productivity. Leading firms such as TI, NVIDIA, Broadcom, etc., are Magma’s customers.

Late last year, Anil Gupta, MD, India Operations, ARM, had also commented on some other firms going fab-lite! Gupta pointed out Infineon, NXP, etc., had announced Fab-Lite strategies. Even Texas Instruments was moving to a Fab-Lite strategy. “IDMs are going to be the fabless units of today and tomorrow,” he added.

So much for those who’ve taken the fab-lite route, and industry endorsements.

On the fab-lite subject, iSuppli’s Kim will not speculate whether AMD would actually break up into into two entities: design and manufacturing, and also prefers to wait and watch.

How does fab-lite actually benefit? He comments: “Fab-lite has not been working well in the memory industry, which requires very tight control. It works, IF two companies (an IDM and a foundry) work very closely. For example, the industry leader, Samsung, produces all of the memory alone without any foundry relationship.”

Watch this space, folks!