Archive

Dexcel on growth drivers for Indian embedded design industry

It is my endeavor to write about semiconductors, solar/PV, EDA. FPGAs, embedded, etc., and related companies and solutions via this blog. One of the pleasures of writing a semicon blog is in being able to connect with and make a whole lot of friends from different countries, cultures, and companies, as well as bloggers.

One such gentleman is Ravinder Gujral or Ravi, as he’s popularly called, Director – Business Development, Dexcel Electronics Designs Pvt. Ltd. Dexcel, based very much in Bangalore, India, is among one of the emerging companies in the embedded space in the country. Ravi contacted me, like several others, via my blog! Likewise, I was elated to find myself a new friend and reader! Later, we met during Altera’s SOPC event, where Dexcel was exhibiting as well.

One such gentleman is Ravinder Gujral or Ravi, as he’s popularly called, Director – Business Development, Dexcel Electronics Designs Pvt. Ltd. Dexcel, based very much in Bangalore, India, is among one of the emerging companies in the embedded space in the country. Ravi contacted me, like several others, via my blog! Likewise, I was elated to find myself a new friend and reader! Later, we met during Altera’s SOPC event, where Dexcel was exhibiting as well.

Dexcel is an electronics design house with capabilities in embedded systems development, firmware Designs and development, DSP processors based designs, imaging software, device drivers, Linux porting, system level designs and development, application and automation software, development of audio and video codec, telecom related stacks, board designs and FPGA based digital designs services, and providing end-to-end solutions to customers.

Dexcel has an alliance and partnership with Altera (ACAP and DSP partner), and with Analog Devices (DSP collaborator), Texas Instruments (DSP third party Network Member), Actel (solution partner), Atmel (AVR 8-Bit RISC Consultants), Montavista Linux developer, etc. Quite impressive!

Estimate of Indian embedded industry

Naturally, our discussion veered toward embedded. Providing his estimate of the embedded design industry in India, Gujral said as per the survey conducted by the India Semiconductor Association (ISA) and Frost & Sullivan, the projected Indian semiconductor and embedded design industry will grow from $3.25 billion in 2005 to $14.42 billion in 2010 and to $43.07 billion in 2015. The Indian design organizations are moving beyond simple labor-cost arbitrage to become true contributors to product innovation.

Going forward, it is important to keep an eye on the drivers for embedded design. The main growth drivers for embedded software in the coming period will be mobile communications, military applications, networking devices and providing more intelligence and connectivity to consumer devices.

Gujral said: “The explosion of embedded devices is made possible mainly due to the rapid growth of semiconductor chips each year, and semiconductor devices becoming faster, cheaper and less power hungry. As the Indian domestic market is growing rapidly, this growth trend will continue. Simultaneously, there are technical challenges to design such products and services, and the availability of technical qualified resources has become more important.”

Localizing product designs and manufacturing

Given that India’s strength has been in embedded, would the biggest growth factor for embedded come from the localization of product design and manufacturing from India?

Indeed, it is! Gujral noted: “The growth factor for embedded companies will come from localization of product design and manufacturing from India. However, we should be doing well in localization of product design, rather than in manufacturing. Indian design engineers are strong in product innovation and design processes, while on the other hand, our manufacturing ecosystem is not as competitive as China.”

Going forward, India should be focused on fine tuning its design processes and best practices to become more efficient and productive, compared to counterpart in the US and Europe. “We have to develop strong domain technical knowledge to bring more innovation in product development,” added Gujral.

NI LabView solves embedded and multicore problems!

Some time ago, National Instruments (NI) introduced LabView 8.6. LabVIEW is a very data flow programming tool! And inherently, it has always been parallel processing!

Take note folks, as parallel is now increasingly becoming regular! And your multi-core problems could well be solved by NI’s LabView.

Given the ongoing recession, interestingly, NI projects double digit growth in 2009 for the region comprising India, Arabia and Russia. Jayaram Pillai, MD, India, Russia & Arabia, NI, says that these places have been traditionally strong in localization. The key is: what can NI’s technology bring in for indigenization!

Given the ongoing recession, interestingly, NI projects double digit growth in 2009 for the region comprising India, Arabia and Russia. Jayaram Pillai, MD, India, Russia & Arabia, NI, says that these places have been traditionally strong in localization. The key is: what can NI’s technology bring in for indigenization!

Pillai notes: “We have always talked about virtual instrumentation. How can you bring the local content into the system?” NI’s LabView’s ability has generally been to create a program out of a non-program. “Images are your natural language. We feel engineers can express themselves using graphical language,” he adds.

LabView inherently meant for parallel programming

Most embedded systems provide quick and easy solutions. NI is trying to put electronics into every problem that it confronts. About 98 percent of the processing environments are used elsewhere, other than the PCs. What embedded can do today is tremendous! NI’s LabView is inherently meant for parallel programming.

Pillai says: “When you are running two cores, it is important how you share the data between the cores. We have multi-core for Windows. We can do multi-core programming for embedded as well.” NI’s tools perform multi-core programming, which itself is a software program.

Besides targeting particular silicon and other resources, there are other problems or areas to deal with, such as test maths, state chart and data flow programming, etc. NI has built all of these components into LabView 8.6 — things such as programming MCUs, FPGAs, Power PCs, etc., can be handled.

Solve embedded problems by developing simpler systems!

Coming back to embedded systems, there are two requisite steps — programming the electronics and programming the system. “We see ourselves getting into the space of solving multi-core problems,” adds Pillai. “Everything today is software enabled. We intend doing for T&M what spreadsheet has done for financial analysis.”

Definitely, software is the instrument in virtual instrumentation. “It means, to solve 98 percent problems of the embedded applications, there is a need to make the development of embedded systems even simpler,” he contends, and rightly so!

“As we went higher in abstraction, we found that we were able to solve more problems. You’ve got to get into a high level of abstraction, which can be done by LabView, called system design platform. LabView today, is the platform for test and embedded,” notes Pillai.

In grahical system design, there is a need to leverage and collaborate in parallel. Graphical programming harnesses multi-core processors. LabView has also been the runaway software tool for DAQ and instrument control. As a result, more and more people can now do embedded programming.

Pillai advices: “If you want to build systems, you need to integrate NI design tools with third-party design tools to share the data. The integration of data has to be seamless.”

Benefits of graphical system design

Graphical system design should do for embedded what PCs did for desktops. “We are a graphical design company and are now building systems,” he adds. The concepts of graphical system design include design, prototype and deploy.

So, what are the product lifecycle benefits of graphical system design? There are multiple hardware systems priced at different cost points based on performance. A LabView user can install the software into an expensive system for testing purposes, and later, deploy on to a lower platform.

Legacy problem and major paradigm shift

Sharing of data between cores is key! Parallel programming in sequential does not make sense. Rather, data flow programming makes a lot of sense. However, there is a legacy problem as far as multi-core programming is concerned. That is: how do you shift so much of the sequential programming knowledge into data flow? This will require a major paradigm shift.

Besides, there are a lot of sequential tools as well. There is a need to integrate all of that into multi-core. So far, multi-core problems have been addressed in test and embedded systems. It is still on in gaming, though! Maybe, this too will be cracked in a matter of time!

To all of my Chinese friends, Kung Hei Fat Choy!

Seeking jobs in embedded! Can anyone help?

Ever since I have blogged about embedded companies in India, I’ve received a few messages, regarding jobs in the embedded segment in India. Some others have dropped hints about companies who haven’t made my list!

It seems the companies are not hiring, or they’ve put hiring on freeze. Does it mean that not many projects are going on currently? Or, is there a way for freshers to make a start somewhere? For starters, those who want their companies listed in any top 10 list, are they even trying to help freshers or those looking for better jobs in the embedded space? What is their policy for hiring?

Or, are they too dependent on design services, so much that they do not have enough products to work on or develop! Or, maybe, they don’t have many ongoing projects? I have had so many people tell me “India should do product development in semiconductors!” So, is that really happening? Or, is it merely a statement?

I did come across this web site called Dev Seeker, which is said to list jobs in embedded. DevSeeker also has a page that lists some of the embedded companies in India.

I also came across a blog on Monster, which lists several posts from some freshers, as well as some others who have actually asked folks to send in their resumes.

There is another web site from KBS Consultants, which has listed some jobs in the embedded segment. Another site, called GotAChance, also has links to jobs in the embedded space. Another search led me to a site called ITJobs.

By the way, I’ve no way of knowing whether any of the sites are updated, or, if they are, how frequently are those getting updated with the latest information. Sincerely hope that all of these sites are getting updated frequently!

Whenever I speak with semiconductor professionals, they don’t stop raving about India’s might in embedded. If that’s the case, why are so many talented people not being able to find jobs? Or even worse, how do freshers get to make a start? I am not sure if companies offer freelance work for embedded software engineers. However, it is an option that could be considered.

There are several companies in China and Japan who are seeking fresh and good talent in the embedded space. A Japanese delegation visited India last August for the India-Fukuoka (Japan) IT, Embedded Software and Semiconductor Business Workshop 2008. Some of companies are:

* Daichi Institution Industry Co. Ltd

* DISCO (Dai Ichi Seitosho Co. Ltd) Corp.

* Inoueki Co. Ltd

* JETRO (Japan External Trade Organization)

* Kyushu Economic Research Center

* CLAIR (The Japan Council of Local Authorities for International Relations), Singapore

Prior to that, last May, the India Semiconductor Association (ISA) and the UK Trade & Investment and Science & Innovation Network launched a study titled “Scope for collaboration between India and the UK in semiconductor driven industry 2008.

I am also aware that China and Taiwan require lot of talent in embedded software and systems. They can surely make use of the talent available in India.

I am sure that all of these folks would be able to help out at least some of those looking to make a career in embedded systems and software. Otherwise, what’s the end result of making such trips to India and talking about India’s talent in embedded! Freshers need to make a start somewhere, so please help as many as possible.

To all of those freshers starting out to make a career, try and get the relevant experience, and the money will follow. Do not pursue it the other way round.

This is a request to the global embedded systems and software fraternity — there are quite a lot of talented and fresh engineers in India in the embedded systems and software segment, who are also seeking jobs. Give them, or at least, some of them, a chance! Can you kindly help them?

Top 10 embedded companies in India

Right then! This topic should be of interest to several folks in India as well as overseas! Especially, those who are looking to tap the renowned Indian talent in embedded systems and software.

It is very well known that all the leading MNCs are present in India, and well, do great work in embedded systems and software. Definitely, any top 10 list of such companies would include the likes of:

* Intel

* Texas Instruments

* Freescale

* Philips

* Samsung

* LG Electronics

* And some of the other leading multinational companies.

However, my exercise is NOT to look for the leading MNCs in this domain, but to find out who are the leading Indian companies ‘working’ in the embedded systems and software space.

Some immediate ones that would spring to mind could be the likes of Ittiam, Sasken, Mistral, KPIT, Symphony, Mphasis, eInfochips, Infosys, TCS, HCL Technologies, Wipro, etc., perhaps.

There are so many others, including Yindusoft, Dexcel Designs, Ample Communications. Ibex, EmLabs, eSpark Infotech, i Micro System, Adamya Computing, etc.

However, I am not very sure how all of these companies are currently performing, nor is it possible for me to find out in a short time. Nevertheless, having been in close touch with some of these companies, it is quite possible that the downturn could be hitting some of the smaller companies, and maybe, even the bigger ones. Well, it is a downturn after all, and spends are not that high!

It is widely hoped that the very strong Indian embedded industry will overcome these problems and shine brightly in the new year.

In my list of the leading Indian companies in the embedded space, I am clubbing some of the larger companies, which are also into other activities, such as IT and outsourcing services.

In no particular order, my top 10 companies in the embedded systems and software space in India would be:

1. Tata Elxsi/Sasken

2. Ittiam Systems

3. Infosys/TCS

4. HCL Technologies/Wipro

5. KPIT Cummins Infosystems

5. Mphasis/BFL

6. Symphony

7. Sonata Software

8. Mistral/eInfochips

9. Dexcel Designs

10. Robosoft/Yindusoft

Yes, do feel free to disagree, friends! 🙂 Again, I know this may not be a perfect list!

There are several companies in the embedded space within India who have been really doing outstanding work. I will try my best to contact as many of these companies and find out what these folks are presently working on!

I will also TRY and revise this list, IF I am able to round up as many companies, and am able to rank them, based on the solidity of their current projects, and NOT on the revenue gained in 2008. Again, I agree, this criteria may not appeal to all, but then it is my list 🙂

Therefore, feel free to disagree, folks… and please add several names of these great Indian companies in the embedded systems and software space, along with their email IDs, so I can easily touch base with them!

PS: One reader has mentioned about whether these companies have great products! Well, would be great if the companies could come up and say how great their products are!!

Thanks for the feedback, Mr. Nair, and good to have new names… 🙂

Another reader had mentioned ProcSys! Many thanks for those names, friends!

Time for parallel to get regular!

Given the major global developments in multi-core, it is obvious that the chip design industry is moving toward this technology platform.

However, as with any new development, multi-core platforms bring their own sets of challenges that need to be addressed as easily and skilfully as possible.

It is in this context that Intel has started its Intel Academic Community Program. This program is focused on preparing the next generation of software professionals for multi-core platforms. Excellent! Time for parallel to get regular!!

The Intel program aims at expanding the computer science curriculum to include multi-threading software for multi-core platforms. It already had tie ups with 45 universities globally, delivering curriculum in 2006, and 400+ in 2007. Intel is also contributing expertise, educational course materials, dual-core PC platforms, software development tools and funding.

Intel has already invested over $1 billion in education. Intel has programs right across the board. This year, about 90 faculty members attended the 2008 Asia Academic Forum.

Multi-core focus area

According to Scott Apeland, Director, Developer Network for Intel, at the sidelines of IDF 2008, Taipei, the company’s has always been stressing on innovation and technologies. One of the key focus areas has been multi-core. He says: “Multi-core has created significant changes in the industry. It has to be parallel, rather than sequential.We have provided tools to make it easier to develop, test, debug and optimize multi-core software.”

Two years ago, Intel had partnered with 40 universities to provide multi-core information into the curriculum. These universities were extremely receptive. Today, Intel has partnered with over 850+ universities globally.

“In India, we started with the tier 1 institutes. So, they are also training their partners. The engineers who would be coming out of these institutes with the training will definitely have the competitive edge. There is a new pipeline for the new talent coming out from all of these universities,” says Apeland.

Web-based program

Intel has developed a Web-based program, where users can download the tools. They can license them as well, and even download the curriculum, etc. Those faculty using this program can also share ideas and experiences with the other participating faculties. Apeland adds: “Now, the institutes are also starting to communicate together. We have created the community and the people are interacting.”

Harshad Deshpande, Asia Pacific & Japan Program Manager, Intel Software & Solutions Group, elaborated that Intel works with VCs, UMs and the HRD ministry, etc., in India, and also conduct seminars. “We share information, etc., and then roll it out. The UPTU and the VTU have already started using this. Also, the NITs (formerly, RECs), have taken this up as well,” he says.

“For certain tier 1 institutes, we have the Intel Higher Education Team. Intel scholars visit these institutes, and have multiple, close engagements. Our portal is the Intel Software Network, the resource for parallel programming tools.”

Need for parallel programmers

Commenting on the growing need for parallel programmers, Apeland notes: “We are hearing from companies that they need more parallel programmers.

The whole industry is moving toward multi-core. Developers need to learn the new skills and move ahead.”

Parallel is regular

According to Apeland, this may happen in the next five to 10 years, when we have better ways to use parallel programming.

He notes: “By 2010, this may start happening. For example, Wipro, in India, has been getting customer requirements for parallelism.

Embedded computing — 15mn devices not so far away!

It has been close to three weeks since the Intel IDF @ Taipei, Taiwan. However, way too many things happened there, which still deserve a mention. One such event would be the keynote on embedded Internet by Doug Davis, Intel’s Vice President, Digital Enterprise Group and General Manager, Embedded and Communications Group.

It has been close to three weeks since the Intel IDF @ Taipei, Taiwan. However, way too many things happened there, which still deserve a mention. One such event would be the keynote on embedded Internet by Doug Davis, Intel’s Vice President, Digital Enterprise Group and General Manager, Embedded and Communications Group.

Today, there are 5 billion connected devices, and this number should likely go up to 15 billion by 2015, as per IDC. However, technology barriers need to be overcome. Davis cited these challenges as reliability and long life, software scalability, low power and low cost, privacy and data security, IPv4 addressing and open standards. As of now, the Intel architecture (IA) is said to be (due to lack of any good competition) the preferred architecture for the embedded Internet.

While on embedded products, post the Intel Atom processor, Davis said that the Menlow XL is likely for a Q1-09 introduction. The associated market segments include retail, PoS, digital signage, kiosks, vending, ATM, etc.

On digital PoS for retail markets, Davis highlighted India, and rightly so, adding that digital retail PoS would find applications, given the growing and quite affluent Indian middle class. Such a digital PoS device could improve inventory management and transaction security, allow more efficient space utilization, etc. Yet another application is digital signage for business intelligence [as informative displays].

Davis showed all of us MediaCart’s example. MediaCart is providing a unique shopping experience. It is trying to revolutionize the shopping experience with a computerized shopping cart that assists shoppers, delivers targeted communications at the point of purchase, and streamlines store operations. Incidentally, Singapore’s Venture GES was contracted by MediaCart to develop the new shopping experience cart.

Pervasive embedded computing

Davis believes that embedded computing would become more pervasive in the days ahead. “The Intel architecture has all of the unparalleled scalability to meet these needs,” he added.

Davis estimated that China could go on to become the world’s largest semiconductor market over the next five years or so. Semiconductor TAM for industrial automation is likely to grow from $13.5 billion in 2008 to $17.5 billion in 2012. India is said to be the second largest destination for industrial automation, which is interesting, and something to look forward to.

Digital factory

We have all had some visions, sometimes of how a digital factory would look like? And, who would be working at such a factory. Possibly, robots, or industrial robots would make up the attendance!

Well, if KUKA, a company that builds the world’s leading robotic and automation devices is to be believed, we are a little closer than before to this vision or dream. Bruno Geiger, managing director, Asia Pacific, KUKA, pointed out in his chat with Davis that the company makes robotic and automation devices based on Intel’s platorms. That, ‘takes us closer to the vision of a digital factory!’ This is a great example of multi-core in industrial automation.

Portal for embedded designers

Getting back to the embedded Internet, Davis said that the greatest challenge for customers is to integrate new technologies. To address this need, Intel is investing in a new Web portal for embedded designers. He announced that the Intel Architecture Embedded Design Center, a Web portal for embedded designers, will likely get launched in the spring of 2009. This is indeed something to look forward to!

Asia has all the trappings to become the largest market for embedded computing, and Taiwan, the largest market for automation. Well, don’t count India out! Embedded systems and software is India’s strength, and don’t be surprised to see and hear about lots of such activities from the country.

No fabs? So?? Fabless India shines brightly!!

This is no secret: fabs or no fabs, fabless India has been shining brightly all this while and will continue to do so for some time!

I’ve blogged on numerous occasions about India’s strength in design services, India as the embedded superstar, and well, about India’s growing might in global semicon. A fab will surely boost India’s image on the global map, but it is definitely not that essential!

It was very pleasing to hear S. Janakiraman, former chairman, India Semiconductor Association, and President and CEO-R&D Services, MindTree, also highlight this fact at Altera’s SOPC conference recently. Perhaps, India has been emphasizing on having a fab. However, if the fabless segment keeps growing as it has been up until now, that would boost industry growth as well!

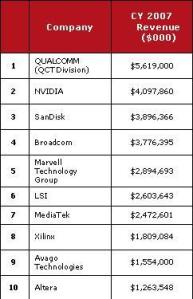

Top 10 global fabless companies For the record, here are the top 10 global fabless companies of the world, as reported by the Global Semiconductor Alliance (GSA), formerly, Fabless Semiconductor Association, USA.

For the record, here are the top 10 global fabless companies of the world, as reported by the Global Semiconductor Alliance (GSA), formerly, Fabless Semiconductor Association, USA.

According to GSA, the total fabless revenue was $27.3 billion, a 12 percent growth year-on-year during 1H 2008. I believe, quite a few, or nearly all of the companies within the GSA top 10 list, have some sort of a presence in India!

Let’s also re-visit the numbers provided by ISA-Frost & Sullivan in its study on the Indian semiconductor industry. The India semiconductor TAM (total available market) revenues will likely grow by 2.5 times, and the TM (total market) will likely double revenues in 2009. Is this not good enough?

Bear in mind that India also plays an active role in the verification and software domains, and it is increasingly covering the entire design chain. The fabs. vs. fabless debate has been going on since 2004-05. Back then, too, many industry observers were backing the fabless route. Now, this discussion is perhaps, a non-issue, with the fabless segment easily the star performer.

India has long had the expertise in chip/board design, embedded software and system engineering. Also, the product and service differentiation is being increasingly driven through software, where India already enjoys a lead over other the APAC countries.

India distinctly has a tremendous opportunity to lead the global market in both semiconductors and electronic products, with or without fabs, or even being fabless!

BV Naidu quits SemIndia; what now of Indian fab story?

There’s this report on DNA Money about BV Naidu, managing director of SemIndia Systems Pvt Ltd and SemIndia Fab Pvt Ltd having quit his job! This immediately begs the question: What now of the Indian fab story? Or, has it sunk without a trace?

There have been several questions raised in the past, as well as in the recent past, such as:

1. Is India’s fab story going astray?

2. Why have fabs in India in the first place?

3. Can an Indian based fab take on the might of established global fabs? How will it be profitable in this climate?

4. What can an Indian fab produce unique, that other fabs cannot?

5. What has the Indian semicon policy achieved, when the Indian semicon industry was doing well, prior to the announcement of the policy?

6. What does India bring to the semicon world?

7. Why move to solar, when there’s been no action of note for wafer IC fabs?

8. Why convert the Fabcity in Hyderabad, to Solarcity?

9. Solar/PV isn’t exactly semiconductors, so why this hype about solar fabs? Is this being done to hide the lack of any success in semiconductor fabs?

Right! I am not here to provide the answers to such questions, nor am I qualified enough to address these! These are questions, if they are justifiable questions, to be answered by the industry! Rather, I will try and analyze what India has done and can do in semiconductors!

May I add here that according to the India Semiconductor Association, BV Naidu remains an active member of the Executive Council. BV Naidu himself informed me that he will be continuing at the board level at SemIndia, moving away from executive responsibilities. And, he will be continuing at the ISA. So that’s good news!

Now back to the discussion!

First, yes, before and post the Indian semiconductor policy, India continues to do very well in semiconductors. Nearly every single MNC has its presence here; and no one that I know, has said that it has no plans to expand in India! Two, we have been traditionally very strong in design services and continue to remain so! Three, India is the emerging (or already emerged) embedded superstar!

Having a wafer IC fab isn’t such a big deal, is it? So many folks have already moved on to fab-lite anyway! Yes, having one wafer IC fab would surely prop up India’s image in the global semicon market, but well, not having one, won’t sully India’s image either!

If we do not get a fab, then let’s just all accept that India was not ready for one, and let’s move on! Life in semiconductors is much more than wafer fabs, as India’s brilliant design services companies keep proving day in and day out!

I’ve said before in one of my blogs that doing product development is probably not India’s strength! Design services surely is! Let’s focus on our strength!

Will the moving out of BV Naidu from SemIndia effect the Indian industry? Why should it? Actually, far from it! Some companies in IP and other embedded areas are doing very well anyway. Let’s give such companies their due credit! They’ve been present, much before the India Semiconductor Association was formed, or way long before the Indian semicon policy was born!

I interact regularly with the length and breadth of the Indian semiconductor industry. I’ve been covering this industry much before the India Semiconductor Association was even formed! If I remember correctly, I was among the three journalists present on the day the ISA was actually launched! Coming back to my point, I’ve yet to come across one person from the industry who does not understand the dynamics of this industry!

If a fab does not happen or someone leaves a company, that does not mean that there’s been a failure. Maybe, it was a wrong choice to start off with! Perhaps, it just coincided with the turbulent global semiconductor industry. Or, simply, semiconductor was mistaken to be a commodity, which it is not!

India has had several investments in solar. Two days from now, there’ll be a major solar/PV conference in New Delhi. Solar is within the ecosystem units of the Indian semicon policy, and it has attracted major investments. Yes, solar has to do with energy security, and in that regard, India could well be on the right path. However, that’s just one small part of the complete story of the semicon policy!

As to whether India should focus on semicon OR solar, I am not the right person to comment or judge! Nor am I qualified enough to comment on ‘why convert Fabcity to Solarcity’. Maybe, solar is being hyped in India right now. If yes, like any other industry, once it matures, the solar bubble will burst and consolidation will happen.

There are several other ecosystem unit definitions in the semicon policy. Some may and will happen. For those who are not aware, the “ecosystem units” have been clearly defined as units, other than a fab unit, for manufacture of semiconductors, displays including LCDs, OLEDs, PDPs, any other emerging displays; storage devices; solar cells; photovoltaics; other advanced micro and nanotechnology products; and assembly and test of all products.

The Indian semiconductor industry, as I see it, remains strong as before, fabs or no fabs! I don’t equate solar with semiconductors, and maybe I am wrong here, but I do believe the two should be treated separately. Not a single solar company will probably feature in India’s top 10 semiconductor companies! At least, not in my list! And, if a top executive leaves a company, why should it hamper the overall industry?

Frankly, it is the Ittiams, the MindTrees, the Cosmic Circuits’, the eInfochips, and the SoftJins who continue to remain India’s pride, even though they may be quite small in comparison to the global giants! At least, they have done India proud in their own way! Doesn’t matter if these companies do not make great media copy! These are among the Indian semiconductor companies that continue to matter!

The India semiconductor story is something like this: Lots of high-end designs are being done here. In fact, lot of key decisions are now being made out of India. The talent pool is very much intact and growing! We are leaders in design services and embedded, make no mistake.

Now, does all of this indicate a recession or depression in the Indian semiconductor industry? Or, is it an indication of India’s growing success — fabs or no fabs? You decide!

Yindusoft rocks embedded domain for India across Apac

India has, for long, been the acknowledged ’embedded superstar’ of the world! It is in no danger of losing that top position, especially in the near future, as several Indian firms in the embedded space continue to rock the world.

One such company is Yindusoft, established 2006, a software services company focused on the following domains: embedded software for IC design houses, OEMS/ODMS in consumer electronics; IT solutions in the semiconductor manufacturing sector; and distribute and customize higher end IT software products in the two areas.

G.K. Pramod, CEO, and a former member of Cybermedia/IDC said: “We are a two-year old company! We cover Asia Pacific especially, Taiwan and Singapore. We would like to expand into Korea and Japan, hopefully, by the end of Q4 2008.”

G.K. Pramod, CEO, and a former member of Cybermedia/IDC said: “We are a two-year old company! We cover Asia Pacific especially, Taiwan and Singapore. We would like to expand into Korea and Japan, hopefully, by the end of Q4 2008.”

Yindusoft is present in two domains: providing IT solutions to large semiconductor manufacturing companies, being the first. Pramod said: “We are working with companies like TSMC, UMC, etc. We work with them in CIM (computer-integrated manufacturing). We recently completed a project on wafer analysis in Taiwan. Our engineers developed the software to cut the wafers into precise shapes. We have onsite engineers with TSMC in Taiwan and UMC in Taiwan and Singapore. Now, we are aggressively positioned ourselves in the CIM space for semiconductors.”

The second important domain are OEMs/ODMs. Yindusoft develops embedded software for OEMs/ODMs. Pramod added: “We develop the software for these companies. In Taiwan, we have done work on digital signage systems. We worked on the UI design. We did development on the UI design itself, along with market research, and therefore, the customer received market feedback as well.”

Yindusoft has two recent design wins: designing of digital signage application for a large OEM/ODM in Taiwan. and designing of set-top box application for a large OEM/ODM in Asia Pacific.

Commenting further on Yindusoft’s design wins, he said: “We completed a large project in the area of digital signage product development with the help of an embedded product development domain expert. Our domain consultant adopted methods like market research, making global product feature list and getting the UI design development from design experts who are from art and design background (and, not IT background).”

Too early to estimate Indian semicon

Pramod added that it was quite early to estimate the strength of the Indian semiconductor industry as fabs are yet be commissioned for production. The Indian embedded design industry is estimated at $4-5 billion in 2008-09.

Commenting on the drivers for embedded design, Pramod said these could be the design capabilities of Indians and the requirement of low-cost consumer products. “Big markets like India and China would require lot of consumer devices for common man applications,” he said.

Customers expect strong domain expertise today. Definitely, and I completely agree on this,” he added. “We need domain expertise to speak the “customers’ language, make the project successful and show the differentiating factors in our service delivery.”

As mentioned, Yindusoft also works with the STB companies. “We are developing an STB (Set-top box) application. Typical applications would be PVR, email application, parental security, etc.,” he said.

Yindusoft is also trying out a model called offshore solutions center. Pramod said: “We have identified pain areas of customers, like OEMs/ODMs and semicon companies. Till such time the companies don’t develop the necessary software skills, there orders can get rejected. They can’t add value to their products. Therefore, profitability is a major issue with them. Next, they also have a language problem and cannot provide the essential technical support. Also, they cannot enter the Indian semiconductor market because of these reasons.

“Hence, we are now trying to build up a solution for them. One is the ODC, which is regular. The second factor: localization of their product for the Indian market, is an example. We also have a demo center. We conduct the market research for a particular product and then set up a demo center in India for that product. After that, there’s the technical support center.”

Way forward for embedded

Would the biggest growth factor for embedded come from localization of product design and manufacturing from India? What’s the way forward?

Pramod said that the biggest growth factor for embedded could come from the localization of product design, and it will be the driving factor. “In fact, we provide this as a value addition to our customer, he added. “Indians need to focus on designs, which is our core strength.” However, he felt that China would still lead in manufacturing.

Finally, what did the Indian semiconductor industry offer to the world, and why should the others should come here?

Pramod listed six key capabilities: Design capabilities of Indians; VLSI design, IC design capabilities; software integration capability; good software knowledge; India is also a good pilot market to launch new embedded products; and India is a strategic location for Asia Pacific markets where there is a good ecosystem for the semiconductor industry.

The company’s head office is located in Bangalore, while it has two overseas offices in Taiwan and Singapore, respectively.

Yindusoft’s vision is to be the leaders in providing software services for IC design houses, OEM/ODMS and semiconductor manufacturing companies.

The mission is to act as a software consultant in new product development by providing cost effective co-working models and establish offshore solution centers (OSC) in India. Best of luck!

What India brings to the table for semicon world! And, for Japan

This semicon blog’s title has been inspired by some queries, largely from friends in Japan, who are looking at the Indian semiconductor market. The topic of great global (and Japanese) interest is: What does India bring to the table for the semicon world to go to India!

Interesting! The world has been keenly following the Indian semiconductor and fab policy, and can gather a lot of information off my blog itself! For those who’d like to know it all again in specifics, here we go again!

Indian semicon and fab policy

Around September last year, the Department of Information Technology, Ministry of Communication and IT, Government of India, came up with the Special Incentive Package Scheme (SIPS) to encourage investments for setting up semicon fabs, and other micro and nanotechnology manufacturing industries in India!

The “ecosystem units” have been clearly defined as units, other than a fab unit, for manufacture of semiconductors, displays, including LCDs, OLEDs, PDPs, any other emerging displays; storage devices; solar cells; photovoltaics; other advanced micro and nanotechnology products; and assembly and test of all the above products.

What has happened since?

Lots! Initially, there were two major proposals from HSMC and SemIndia for setting up wafer IC fabs. While those haven’t really taken off yet, more investments have since happened in India.

Quite recently, the Indian semiconductor and fab policy attracted 12 major proposals, worth a whopping Rs. 93,000 crores! The Department of Information Technology (DIT), Government of India, has set up a panel of technical experts to evaluate these proposals.

Ten (10) of these proposals are for solar/PV. One is for a semiconductor wafer — from Reliance Industries worth Rs. 18,521 crores, and another for TFT LCD flat panels — from Videocon Industries, worth Rs. 8,000 crores.

The 10 proposals for solar/PV are from: KSK Surya (Rs. 3,211 crores), Lanco Solar (Rs. 12,938 crores), PV Technologies India (Rs. 6,000 crores), Phoenix Solar India (Rs. 1,200 crores), Reliance Industries (Rs. 11,631 crores), Signet Solar Inc. (Rs. 9,672 crores), Solar Semiconductor (Rs. 11,821 crores), TF Solar Power (Rs. 2,348 crores), Tata BP Solar India (Rs. 1,692.80 crores), and Titan Energy System (Rs. 5,880.58 crores). This is as far the latest developments are concerned!

Solar fabs have also been announced earlier by leading firms such as Videocon, Reliance and Moser Baer, etc. (Two of them are figuring here again!) There are also talks about developing solar farms in India, which is good.

What are India’s strengths?

The clear strengths of the Indian semiconductor industry are embedded and design services! We are NOT YET into product development, but one sincerely hopes that it gathers pace.

The market drivers in India are mobile phone services, IT services/BPO, automobiles and IT hardware. India is also very strong in design tools, system architecture and VLSI design, has quite strong IP protection laws, and is reasonably strong in concept/innovation in semiconductors.

Testing and packaging are in a nascent stage. India will certainly have more of ATMP facilities. Nearly every single semicon giant has an India presence! That should indicate the amount of interest the outside world has on India. In fact, I am told, some key decisions are now made out of the Bangalore based outfits!

Electronics manufacturing

In the electronics manufacturing domain, India’s strength lies in hardware, embedded software and industrial design, OEMs, component distribution (includes semiconductor and box build), and end user/distribution channel, as well as more than moderate strength in product design and manufacturing (ODM, EMS).

India is likely to witness $363 billion of equipment consumption and $155 billion of domestic production by 2015. India’s electronic equipment consumption in 2005 was 1.8 percent. It is likely to grow to 5.5 percent in 2010 and 11 percent in 2015, as per a joint study conducted by the ISA and Frost & Sullivan.

The Indian semiconductor TAM (total available market) revenue is likely to grow by 2.5 times while the TM (total market) is likely to double revenues in 2009. The TAM is likely to grow at a CAGR of 35.8 percent and the TM is likely to grow at a CAGR of 26.7 percent, respectively, during the period 2006-09.

Telecom, and IT and office automation are the leading segments in TM and TAM. Consumer segment occupies the third fastest growing area in the TM, and the industrial segment is the third fastest growing area in the TAM.

The major semiconductor categories of interest include microprocessors, analog, memory, discretes and ASICs, while the major end use products include mobile handsets, BTS, desktops, notebooks, set-top boxes and CRT TVs.

India, the embedded superstar!

India’s embedded design industry has been going from strength to strength. An IDC-ISA report forecasts the revenues from India’s VLSI, board design and embedded software industry to grow to $10.96bn by 2010 from the current $6.08bn in 2007.

India is also focusing on moving up the semiconductor value chain. It is emphasizing on end-to-end product development, investing in IP development, developing India specific products, and partnering with OEMs to understand the market needs. Also, be aware that several leading EMS firms are present in India as well.

What should investors do?

Certainly, invest in India! The Indian semicon policy clearly defines the “ecosystem units.” Global manufacturers of displays, including LCDs, OLEDs, PDPs, any other emerging displays; storage devices; including SSDs, solar cells; photovoltaics; other advanced micro and nanotechnology products, should certainly look at investing in India, and consider manufacturing here!

Lots of solar fabs are likely to come up, so there will be a great demand for solar related equipment, chemicals, testing, etc. We hope that one wafer IC fab comes up as well, so there will be opportunity for semicon equipment manufacturers. However, do be prepared to wait as things may not move as fast as some may expect.

There is lot of opportunity for fabless companies and in ATMP as well. There are several Indian firms, small ones, who may be interested in partnering. Some trading companies may find India of interest, especially in the solar/PV and ATMP segments.

Keep an eye on the IT/semicon policies some states, especially, Karnataka have in store. A host of opportunities could become available, once Karnataka comes up with a policy. More states may follow suit!

Well, do contact me in case you need further assistance!

Random Posts

- Forging win-win industry-academia collaboration in VLSI education

- How Taiwan government reacts to DRAM turmoil is a lesson in itself!

- Embedded Vision Alliance (EVA) is born!

- Currently profitable global semicon industry needs to remember lessons of downturn!

- AqTronics-Mouser eye growth opportunities for components distribution in India!

Tag Cloud

3G 32nm AMD ARM China chip design DRAM DRAMeXchange EDA EDA tools embedded design embedded systems and software fabless fabs FPGAs Freescale Future Horizons global semiconductor industry global semiconductor market Hynix IC Insights India Indian semiconductor industry Indian solar/PV industry India Semiconductor Association India semiconductor market Intel iSuppli low-power design Malcolm Penn memory market mobile phones NAND Qimonda S. Janakiraman Samsung SEMI Semicon Semiconductors solar solar/PV solar cells Synopsys Taiwan TICategories

- 22nm

- 32nm

- 3G

- 3G spectrum

- 40nm

- 450mm

- 45nm

- 4G

- 65nm

- 802.11n

- 90nm

- A.Raja

- Aart De Geus

- Abhi Talwalkar

- Accellera

- Accenture

- access control

- Agilent

- Altera

- Aluminum electrolytic capacitors

- AMD

- AMS

- Analog Devices

- analog ICs

- analog mixed signal

- analog/RF

- analog/RF competency center

- Anand Chandrasekher

- Anil Gupta

- Ankush Oberai

- Apple

- Apple TV

- Applied Materials

- AqTronics

- ARIB

- ARM

- Asia

- Asiaworld Expo

- ASICs

- ASML

- ASPs

- ASSPs

- ASUS

- Atom

- Atom processor

- AUSPI

- automotive

- automotive electronics

- Bali

- bandwidth costs

- Bangalore

- Bangalore Nano 2007

- Bangalore serial blasts of July 25

- Bangkok

- Barack Obama

- Beagle Board

- Beceem

- Beijing Olympics

- Belliappa Kuttanna

- biometrics

- BIPV

- Blackberry

- Blade.org

- bloggers

- Blogging

- blogs

- board design

- Bosch Sensortec

- Brazil

- Brent Przybus

- Broadband

- Broadcom

- building integrated photovoltaics

- BV Naidu

- C++

- C-DoT

- C-to-Silicon Compiler

- Cadence

- Calpella

- carrier Ethernet

- CDG

- CDMA

- CDMA Development Group

- CDMA2000

- CDNLive

- CEA

- CEATEC

- cell phones

- Cellworks

- Charlie Hartley

- Chartered Semiconductor

- Chelsio

- Chi-Foon Chan

- Chimera

- China

- China Mobile

- China Sourcing Fair

- China Telecom

- China's IC industry

- China/Hong Kong

- Chinese semiconductor industry

- chip design

- chip designers

- Chip fabs

- chip industry

- chip makers

- chip market

- chip suppliers

- chips

- Christian Gregor Dieseldorff

- CIOL

- CIOs

- Cir-Q-Tech

- cloud computing

- CMOS

- CMOS camera modules

- CMP

- co-verification tools

- COAI

- communications

- components

- COMPUTEX

- Computex Taipei

- computing

- connectors

- consumer electronics

- Converge Market Insights

- convergence

- converter solution

- Core i7 processor

- Corporate Social Responsibility

- Cosmic Circuits

- Cowans LRA model

- CPF

- CPLD

- CPM

- cross-license dispute

- cross-licensing

- crystalline solar

- CSF

- CSR

- Cuil

- CustomSim

- CWG

- Cyclone III LS

- Cypress

- Cypress Semiconductor

- DAB

- DAB radios

- Dale Ford

- data center energy measurement

- Datang

- DAVIC

- DECT

- Deloitte

- Delphi FormFactor

- Denali

- Department of IT

- Derek Lidow

- design challenges

- design services

- design services in India

- design tools

- designers

- developers

- Dexcel Electronics Designs

- DFM

- DFT

- Diachi

- digital cameras

- digital factory

- digital president

- digital still cameras

- Digitimes

- DISCO

- Discovery 2009

- disk drive controllers

- display driver ICs

- display drivers

- displays

- DisplaySearch

- DLNA

- DLP

- Dr Farooq Abdullah

- Dr Gordon Moore

- Dr. Ashok Das

- Dr. Bobby Mitra

- Dr. Chi Foon-Chan

- Dr. Ganesh Natarajan

- Dr. Henning Wicht

- Dr. J. Gururaja

- Dr. Li Shi-he

- Dr. Madhusudan V. Atre

- Dr. Rajiv Jain

- Dr. Robert N. Castellano

- DRAM

- DRAM industry

- DRAM manufacturers

- DRAM market

- DRAMeXchange

- DRC/LVS

- driver ICs

- drug discovery

- DSOA

- DSPs

- DTG

- DTH

- DTV

- Dubai

- Dubai Circuit Design

- Durga Puja

- E Ink

- e-book semiconductors

- E-books

- e-passports

- ebooks

- EC

- EC ruling

- ECG-on-a-Chip

- Eclypse

- EDA

- EDA Consortium

- EDA industry

- EDA products

- EDA tools

- EDGE

- EEPROMs

- eInfochips

- Elcoteq

- Elections 2009

- electronic components

- electronic design engineers

- Electronic Design Trends

- electronic designers

- electronic equipment

- electronic paper display

- electronics

- electronics components

- Electronics Hardware

- Electronics industry

- electronics products

- electronics supply chain

- Electronics Weekly

- Electrophoretic Display

- element14

- Elpida

- embedded

- embedded applications

- embedded computing

- embedded design

- embedded designers

- embedded devices

- embedded Internet

- Embedded Internet devices

- embedded jobs

- embedded Linux

- embedded processor

- embedded software

- embedded systems

- embedded systems and software

- EmSys

- emulator

- Encounter

- Encounter Digital Implementation

- energy

- energy efficiency

- Enterprise

- enterprise technologies

- enterprise verification

- Enterprises

- epaper

- EPD

- Epson Toyocom

- EPSRC

- ESL

- Ethernet

- EU

- Europartners

- European Commission

- EV-DO Rev. A

- EVE

- Extreme Networks

- fab capacities

- fab policy

- fab spends

- Fab-Lite

- FabCity

- fabless

- fabless companies

- Fabless Semiconductor Association

- fabs

- Fabtech

- Farnell

- FDSOI

- femtocells

- First Solar

- fixed-mobile convergence

- flash memory

- flexible displays

- flexible substrates

- Flextronics

- FMC

- FOMA

- Forward Concepts

- foundries

- foundry semiconductor market

- FPDs

- FPGA

- FPGA Central

- FPGA design

- FPGA design software

- FPGA market

- FPGA Seek

- FPGAs

- France

- Freescale

- Freescale Technology Forum

- Frost

- FTF 2008

- Fujicon

- Fujitsu

- Fukuoka

- Fully Depleted Silicon On Insulator

- Future Horizons

- G1

- Galaxy Custom Designer

- Gartner

- Garuda

- Gary Shapiro

- GateRocket

- GE Healthcare

- Germany

- Gigabyte

- GK Pramod

- global chip market

- global DRAM market

- global EDA industry

- global MEMS market

- global semiconductor industry

- global semiconductor inventory

- global semiconductor manufacturing industry. global semiconductor industry

- Global semiconductor manufacturing utilization

- global semiconductor market

- Global silicon photonics market

- global solar industry

- Global Sources

- global telecom industry

- GlobalFoundries

- Google phone

- Gordon Moore

- GPS

- graphical programming

- graphical system design

- green data centers

- green electronics

- GSA

- GSM

- Gurdas Kamat

- Hanns Windele

- HardCopy IV ASICs

- hardware

- hardware policy

- hardware/software co-verification

- hardware/software co-verification solutions

- Harriet Green

- Harshad Deshpande

- HDDs

- HDMI

- healthcare

- High-definition

- high-K gate dielectric

- high-K metal gates

- high-level synthesis

- Hitachi

- HKMG

- HLS

- Hokoriku

- Hon Hai

- HSMC

- HSPA

- HTC

- Huawei

- hybrid car

- Hynix

- i-mode phones

- i-phones

- IBM

- IBM Research Labs

- IC ASPs

- IC industry

- IC Insights

- IC market

- IC Validator

- ICICI Ventures

- ICs

- IDC

- Idea Cellular

- IDF

- IDF Taiwan

- IDM

- iDTV

- IEF 2009

- IIM-Bangalore

- IISc. Bangalore

- IIT Bombay

- IIT Kharagpur

- IIT Madras

- IIT-Kanpur

- iMac

- IMS

- IMT

- InCyte Chip Estimator

- India

- India Inc.

- India Semiconductor Association

- India semiconductor market

- India's first plug-in hybrid car

- Indian 3G policy

- Indian aerospace and defense markets

- Indian branded memory market

- Indian EDA industry

- Indian electronics industry

- Indian embedded industry

- Indian fab story

- Indian IT industry

- Indian semicon policy

- Indian semiconductor industry

- Indian solar industry

- Indian solar/PV industry

- Indian telecom

- Indian telecom industry

- Indrion

- industrial segments

- Infineon

- Infineon Asiaworld Expo

- Infosys

- Ingo Guertler

- innovators

- InnovLite

- Inoueki

- integrated access devices

- Intel

- Intel Atom processor

- Intel Core 2 Duo

- Intel Developer Forum

- intelligent video surveillance system

- International Electronics Forum (IEF)

- Internet

- Internet radio stations

- Internet radios

- intranets

- Invensense

- IP creation

- IP re-use

- iPad

- iPDK

- iPhone

- iPhone 3G

- iPod

- IPs

- IPSec

- IPTV

- ISA

- ISA Excite

- ISA Vision Summit 2009

- ISE Design Suite 11

- ISI Calcutta

- Israel

- Istanbul

- iSuppli

- IT

- IT processes

- IT/OA

- Ittiam

- Ittiam Systems

- ITU

- ITU Telecom Asia

- iTV

- IVSS

- James Reinders

- Japan

- Japan chip industry

- Japan's microelectronics industry

- Jaswinder Ahuja

- Jayamahal

- Jayaram Pillai

- Jérémie Bouchaud

- JEM

- Jennifer Lo

- JETRO

- JMCC

- JNCASR

- Jobs in FPGAs and CPLDs

- Jon Cassell

- Jonney Shih

- Jordan Plofsky

- Joseph Sawicki

- K. Subramanya

- Karnataka

- KCR

- Kexin

- Khasim Syed Mohammed

- Kionix

- Kirk Skaugen

- Kishor Patil

- Klaus Maler

- Knowles

- Kochi

- Kodiak Networks

- Korea

- Korea Electronics Show

- KPIT Cummins

- KUKA

- Kyushu

- LabView

- LabView 8.6

- Lanco Solar

- Lara Chamness

- LAS-CDMA

- last mile problem

- Laurin Publishing

- LCD

- LCD monitor panels

- LCD monitors

- LCD panels

- LCD TVs

- LCDs

- LED driver ICs

- LED lighting devices

- LED lights

- LEDs

- Lexmark

- LG

- LG Telecom

- life sciences

- LinkAir

- Linux

- lithography

- Lo Wu

- logic IC market

- logic synthesis

- low power

- low-cost handsets

- low-power design

- LSI Corp.

- LSI Logic

- LTE

- LUT

- Mac OS

- Magma Design Automation

- Malcolm Penn

- malware

- Man Yue

- Manoj Gandhi

- manufacturing hub

- Marco Principato

- Market for key system semiconductors

- Marnello

- material devices

- McAfee

- MCMM

- MCUs

- MEAS

- Measurement Specialties

- Mediacart

- MediaTek

- mega fabs

- MelZoo

- memory

- memory fabs

- memory market

- MEMS

- MEMS accelerometers

- MEMS devices

- MEMS foundries

- MEMS gyroscopes

- MEMS industry

- MEMS oscillators

- MEMS sensors

- Memsic

- Mentor Graphics

- Messe Munchen

- metro area networks

- MHEG-5

- Michael J. Fister

- micro fuel cells

- microcontrollers

- Micron

- Micronics Japan

- microprocessors

- Microsoft

- MIDs

- MII

- MIII

- Mike Cowan

- Mike Splinter

- military

- military market

- Min-Sun Moon

- Minalogic

- mini fabs

- Ministry of Communication and IT

- mixed signal

- ML-PCBs

- MNRE

- Mobile

- Mobile application operating systems

- mobile broadband

- mobile computing

- mobile CPUs

- mobile devices

- mobile handheld devices

- mobile handsets

- mobile Internet

- mobile Internet devices

- mobile phone semiconductor market

- mobile phones

- mobile TV

- mobile VAS

- Mobile WiMAX

- Mobility

- Moblin

- modeling and photomask correction

- monitor panels

- Monolithic Power Systems

- monster fabs

- Moore’s Law

- Moorestown

- MosChip

- Moser Baer

- Moshe Handelsman

- Motorola

- Mouser

- MP3 players

- MPUs

- multi-core platforms

- multi-cores

- multicore programming

- multilayer PCBs

- Mumbaikars

- Munich

- Murata

- N.K. Goyal

- Nader Tadros

- Nam Hyung Kim

- NAND

- NAND flash

- NAND Flash memory

- Nanomanufacturing

- nanoscience

- Nanotechnology

- nanotubes

- Nanya

- National Semiconductor

- Near Field Communication

- NEC

- Neeraj Varma

- Nehalem

- Nehalem-EX

- net-tops

- netbooks

- Netscape

- nettops

- Networking

- NewEra

- next-generation data centers

- NFC

- NI

- NI. LabVIEW 8.5

- NIIT

- Nikon

- Nile

- Nimish Modi

- Ning

- Nintendo Wii

- Nios II processor

- Nishant Sarawgi

- NMI

- Nokia

- NOR

- notebook market

- notebooks

- NTT DoCoMo

- Nuance

- Numonyx

- nVidia

- NXP India

- OEM semiconductor design

- OEMs

- oil prices

- OLED

- OLED driver ICs

- OLEDs

- Open Handset Alliance

- Open Platforms

- Open Silicon

- Open Source

- OpenOffice

- Opera

- optical networking

- optos

- Outlook 2009

- OZ

- PA Semi

- packaging

- PADS 9.0

- Pagemaker

- Palm

- Panasonic

- Parallel computing

- parallel programming

- parallelism

- passives

- Patrice Hamard

- PCB industry

- PCB services

- PCBs

- PCI

- PDAs

- PDPs

- Perry LaForge

- PFI

- pharma

- Philips

- Philips Consumer Lifestyle

- Phoenix Solar

- phonons

- photonics

- Photonics in Asia

- Photonics Society of India

- photovoltaics

- physical designers

- Piketown

- Pine Trail

- place-and-route technology

- Playstation 3

- PLD

- PMPs

- PNDs

- polysilicon

- Poornima Shenoy

- power

- Power Forward Initiative

- power management

- Power MOSFETs

- Powerchip

- PowerPC

- PR firms

- Pradeep Chakraborty

- Pradeep Chakraborty's Blog

- Premier Farnell

- probe cards

- processors

- Procys

- product development ecosystem

- programmable devices

- ProMOS

- PTT

- PTT-over-cellular

- PTT/PoC

- PULLNANO

- push-to-talk

- PV

- Q-Cells

- Qimonda

- QorIQ multicore platform

- quad core

- Qualcomm

- Quark Express

- Quartus II software v8.0

- Quasar

- QuickPath

- Raghu Panicker

- Rahul Deokar

- Rajeev Madhavan

- Rajeev Mehtani

- Rajiv C. Mody

- Rajiv Jain

- Raju Pudota

- Raman Research Institute

- Ramkumar Subramanian

- Ramprasad Ananthaswamy

- Randy Lawson

- Ranga Prasad

- Ranjan Das

- Ravinder Gujral

- RCG

- REACH

- Real Player

- recession

- Red Hat

- Reliance

- Renasas

- Renesas

- renewable energy

- repairs

- Research Infrastructure

- retail

- retail POS kiosk

- Rev. A

- REVA

- RF

- RF CMOS

- RF MEMS switches

- RF surveillance

- RFMD

- Rich Beyer

- RISCs

- Riverbed

- roaming

- Robert Bosch

- RoHS

- RTL

- RV Colege of Engineering

- RVCE

- S. Janakiraman

- S. Uma Mahesh

- Sachin Pilot

- Samsung Electronics

- Samsung Semiconductor

- Sandeep Mehndiratta

- Sandisk

- Sanjay Deshmukh

- Sanyo

- SAP

- SAP BusinessObjects Explorer

- Sasken

- Sathya Prasad

- Saxony

- Science

- Scott Apeland

- Scott Grant

- screens

- SDR

- search engines

- Security

- security MCUs

- Seiko

- SEMATECH

- semconductors

- SEMI

- SEMI India

- Semico

- Semico Research

- Semicon

- semicon blogs

- semicon capex

- semicon fabs

- semiconductor

- semiconductor equipment

- semiconductor equipment industry

- semiconductor equipment market

- semiconductor industry

- Semiconductor Industry Association

- semiconductor IPs

- semiconductor jobs

- semiconductor manufacturing

- Semiconductor market for PMPs

- semiconductor materials

- semiconductor policy

- Semiconductors

- semiconductors and ICs update

- Semicondutors

- SemiconWorld

- SemIndia

- Sentaurus

- Shanghai

- Shanghai processor

- Sharp

- short-range wireless

- Shweta Dash

- Si-Quest

- SIA

- Siemens

- Signet Solar

- silicon photonics

- Silicon Sensing

- silicon wafers

- simulation

- single-chip design

- SK Telecom

- Skyway Software

- smart grid

- smart meters

- smartphones

- SMB strategies

- SMEs

- SoC

- social networking

- social networking for semicon professionals

- SoCs

- SoftJin

- software developers

- solar

- solar cells

- solar ecsystem

- solar energy ecosystem

- solar fabs

- solar manufacturers

- solar modules

- solar panels

- solar photovoltaics

- solar power products

- solar/PV

- Solar; Lux Research

- Solid polymer capacitors

- solid-state hard drives

- Sony

- Sony Ericsson

- South Korea

- Spain

- Spansion

- Spartan

- spectrum

- speech-recognition

- SPIRIT

- SPMT

- SRAM

- Sriram Peruvemba

- SSDs

- SSI

- ST

- ST Micro

- ST-Ericsson

- Stanley T. Myers

- StarOffice

- STBs

- Stefan de Haan

- Stephan de Haan

- Steve Svoboda

- STM

- STM8S

- STM8S105

- STM8S207

- STMicroelectronics

- storage

- STPI

- Strategic Marketing Associates

- Stratix IV FPGAs

- Subhash Bal

- Sun

- SunFab

- Suntech

- super fuel-efficient car

- SV Probe

- Symantec

- Synopsys

- System-in-Package (SiP) solutions

- system-level chips

- systems

- Systron Donner

- Taitronics

- Taiwan

- targeted design platforms

- Tata BP Solar

- Tata Teleservices

- TCAD

- TCS

- TD-SCDMA

- TD-SCDMA Forum

- TDD

- Technology

- Technopole

- Technoprobe

- Technovation 2008

- Tejas

- Telecom

- Telecom and IT

- telecom OEMs

- telecom operators

- telecommunications

- Telefonica

- telisma

- teliSpeech 10 Indian languages

- terror attack on Mumbai

- test and measurement

- Texas Instruments India

- Text 100

- TFPV

- TFTs

- Thailand

- The Information Network

- thin film

- thin film solar

- TI

- timing analysis

- Tipping Point

- Tom Feist

- Top 10

- top 10 embedded companies in India

- TPS62601

- traffic

- TRAI

- Transport

- Trilliant

- TSIA

- TSMC

- TV panels

- TwitterJobSearch

- TwitterJobSearch.com

- UIDAI

- UK

- UK-TI

- ultra mobile broadband

- UMB

- UMC

- unified power format

- union budget

- UPA

- Upendra Patel

- UPF

- USA

- USB

- V. Srikumar

- V.R. Venkatesh

- VC funding

- VCS2009

- VDAT 2010

- Venkatesh Valluri

- Venture GES

- verification

- Verilog

- VHDL

- Vic Mahadevan

- video roaming

- Videocon

- Vietman

- Vincent Ratford

- Virtex

- Virtex-5

- virtual instrumentation

- virtualization

- Virtuoso

- Vista

- Vivek Sharma

- VLSI

- VLSI conference

- VLSI Research

- VLSI Society of India

- voice

- vPro

- VSI

- VTI

- VTU

- W-CDMA

- wafer fabs

- wafer processing equipment

- Walden C. Rhines

- WAP

- WDS

- Web 2.0

- Webdesign International Festival

- WEEE

- West Bengal

- Wi-Fi

- Widgetbox

- widgets

- WIF 2008

- WIF 2010

- WiLL

- Will Strauss

- WiMAX

- WinCE

- Wind River

- wind solutions

- Wipro

- Wipro Technologies

- wired communications

- Wireless

- wireless devices

- wireless handsets

- Wireless USB

- Wireless Week

- wireless/DSP bulletin

- WirelessHART

- wireline

- WiTECK

- Workhound

- World Cup Cricket 2011

- WSTS

- WUSB

- X-Con

- Xeon 5500

- Xilinx

- yield management

- YieldManager

- Yindusoft

- Yole

- Yole Developpement

- Yukon

- Z-RAM

- ZeBu

- ZeBu-Server

- Zetex

- ZigBee

- ZTE

Blogroll

Archives

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007