Archive

Nearly 60pc of China chip manufacturing goes unused in Q1: iSuppli

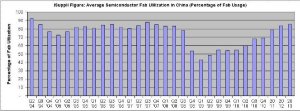

EL SEGUNDO, USA: Once the world’s fastest-growing chip-manufacturing region, China hit an all-time low in the first quarter of 2009, with nearly 60 percent of the nation’s semiconductor manufacturing capacity unused, according to iSuppli Corp.

Semiconductor manufacturing capacity utilization in China fell to 43 percent in the first quarter, the lowest level since iSuppli began tracking the market in 2000, and a massive drop from a recent high of 92 percent in the second quarter of 2004. This rock-bottom utilization rate comes as a direct result of low demand spurred by the global economic downturn. However, the utilization plunge indicates that China’s long-nurtured goal of establishing a vibrant domestic semiconductor production industry is in serious jeopardy.

“During the last 10 years, the Chinese government has worked to develop a domestic economy that would provide the nation with economic independence,” said Len Jelinek, director and chief analyst for semiconductor manufacturing at iSuppli. “The establishment of a technologically strong Chinese semiconductor industry was considered an essential element of China’s long-term domestic economic and technological independence. Unfortunately for China, the plan collapsed as global sales dried up before demand generated from internal sources was able to grow to match demand generated from the rest of the world. Once viewed by China’s government as a pillar of growth, semiconductor manufacturing has turned out to be a financial burden.”

China’s investments in capacity and technology in the semiconductor sector have not provided the financial returns that were forecast for investors, Jelinek added. Adding to China’s dilemma is the overestimation of capacity, which was expected to be shuttered in other regions in favor of lower-cost, more efficient Chinese manufacturing.

“With the addition of the current global economic recession, China’s focus has shifted from establishing semiconductor manufacturing independence to restructuring its entire chip industry before it simply collapses.”

China’s utilization is expected to rise moderately through the rest of the year, but will remain very low at 54 percent in the fourth quarter of 2009. Over the longer term, utilization will rebound to 84 and 85 percent in 2012 and 2013. However, when utilization recovers to these levels, China’s semiconductor industry will look very different from how it has in the past, with the number of competitors in the industry likely to be dramatically reduced due to consolidation.

The figure presents iSuppli’s quarterly and annual estimate and forecast of semiconductor utilization in China.

Looking ahead

What will China’s semiconductor industry look like when utilization recovers?

“Since Chinese semiconductor manufacturers do not possess a technological differentiation from their competitors, they are at a disadvantage, since there is simply far too much of the same kind of capacity in the world chasing after the same opportunities,” Jelinek said.

“This will lead to mergers and consolidations. However, even if suppliers with similar technologies merge, will they create anything but larger companies with bigger cash-flow problems?”

At first glance, such a scenario is most likely what will happen. Nonetheless, there will be one ancillary effect that will significantly impact the landscape of companies in China: The bigger company will be viewed as the most likely survivor.

This perception will transform into reality as customers assure themselves of a strong supply source by aligning with the largest, most cost-effective semiconductor maker. In the end, the smaller company simply will be forced out because it is uncompetitive in technology and price.

No recovery until 2012

With iSuppli not forecasting a recovery for Chinese manufacturers until 2012, it is unlikely that weak companies can survive two years in the face of a negative cash flow.

iSuppli anticipates the first merger in China’s semiconductor industry will be finalized in the second quarter of 2009. This will signal that time is of the essence if a company or a group of companies is going to be able to weather the storm. iSuppli anticipates that by the second half of 2010, a smaller—yet stronger—semiconductor industry will emerge in China.

Time for Indian semicon to step up! Yes or No?

I was really happy to see a comment on my blog post: “What India now offers to the global semicon industry,” left by Tom Morrow, author of the SEMISpice blog, and Vice President of Global Expositions and Marketing, SEMI. Thanks for visiting and commenting, Tom.

You said: Your description of India’s Special Incentives Package Schemes for setting up and operating semiconductor fabrication as a “debacle” is off the mark. Is it really wise for the country to join an already crowded semiconductor manufacturing ecosystem when it can apply its scarce resources to join 30-50 year boom in solar, something the country desperately needs for both domestic and export development?”

“The move to solar is the right one. India had nine manufacturers of solar cells and about twice as many module makers. Most of these proposals have been in response to the Government’s announcement of a Special Incentives Package Scheme under the 2007 Semiconductor Policy.

“About 70 percent of India’s solar cell and PV module production has been exported. This is likely to change in the near future as government policy provides the push for PV deployment and following the recent release of guidelines for grid connected solar generation. Several states in India, including Andhra Pradesh, Gujarat, Karnataka, Punjab, Rajasthan and West Bengal have also announced their own solar policies, plans and incentive packages in recent months.

“ISA and SEMI has recognized the great opportunities in solar and have taken supportive leadership positions. While both organizations would love to see a domestic semi fab industry emerge in India, given the overcapcity in the industry today, the transition to solar has been swift, thoughtful, and right on the mark.”

First up, Tom, I did not formulate SIPS or the Indian semicon policy! I too thought India would soon build a wafer IC fab! Several delegations have visited India, in the past, with companies hoping to work with these so-called wafer IC fabs in India. I am merely a small time blogger, offering my opinions. And I love my country, no less than any other Indian!

Perhaps, you should see some of the press these ‘so-called fabs’ received! All the talk of a wafer IC fab only died down with SemIndia late last year!

If folks read my posts carefully, I’ve discussed how India has been doing fine before the semicon policy and post the policy, fab or no fab! Some knowledgeable experts have even said that fabless India shines brightly! It has shone before, and continues to do so!

Neither do I have anything against solar and the solar industry! It is a great way to trigger off manufacturing in India. Did I say otherwise?

I work closely with ISA, in fact, was present, when ISA was born, back in October 2004, and also know Sathya Prasad at SEMI India quite well. It’s a great initiative that’s going on in solar in this country. So, yes, the move to solar is a very correct one!

Still on wafer IC fabs, one expert even goes on to say that India could look at skipping the current node of technology and make an entry into the one that will be prevalent after few years.

However, my focus is essentially on semiconductor manufacturing! As many industry experts never fail to say at conferences, India needs to move up the semicon value chain! We need more semicon product start-ups!! And, that’s not happening fast enough!

Perhaps, we can just discard all of these ideas and go on being a leading player in design services (which, we already are), a much easier option.

I would still go with what Malcolm Penn of Future Horizons’ says, that India needs to re-think its semiconductor strategy! It cannot survive on chip design alone!

Even the recently held ISA Vision Summit had a session: “Indian design influence: Ideas to volume”! Speakers discussed how India should seize opportunities, especially in this downturn, and that, it is time for the Indian semiconductor industry to step up, put the right innovations in place and grow.

I am very interested in hosting an event in India on this topic — Time for India to step up: Put right innovations in place and grow! However, as I said, I am merely a small time blogger, trying to make a living. I hope I can find some support to host such an event at least once in India.

I am simply delighted that my post has drawn the interest of such a senior person at SEMI. Thank you, sir!

Definite need for rethink on India's fab strategy!

I am intrigued to see lots of great things happening in the Indian semiconductor industry, and equally frustrated to find certain things that I feel should happen, not really going the way they should!

Yes, India is very strong in the semiconductor related chip design services. However, do keep in mind folks that design services have been impacted a bit by the recession as well! There have been calls from several quarters for India to now start thinking beyond its chip design services. Therefore, are there any areas that India can look into within the semiconductor space?

Leverage strength in software

Certainly, value add in products are heavily influenced by the embedded software in addition to features of the chips, says S. Janakiraman, former chairman, India Semiconductor Association (ISA) and President and CEO-R&D Services, MindTree. “The Google Android is a great example of that. India should leverage its strength in software to enhance its value add to semiconductor companies,” he adds.

Innovation is now shifting from the development of new technologies to the creation of unique applications.

“Mobile browsers and management of remote appliances to save power at home/office are examples. We need to innovate new applications that can drive the need for more electronic gadgets, and in turn, the need for more semiconductors,” notes Jani Sir.

Rethink on Indian fab strategy?

One of my earlier posts focused on whether an Indian investor could buy Qimonda’s memory fab, and somehow kick-start the India fab story! I did find support from many quarters on this idea, but till date, I don’t think anyone from India has made a move for Qimonda. At least, I haven’t heard of any such move.

Nevertheless, some folks within the Indian semiconductor industry and elsewhere have called for India to rethink on its fab strategy.

What should it be now? Or, shall we just discard this and go on, as India has been doing fine without fabs so far? Perhaps, the last option is easier!

According to Janakiraman: “Perhaps, we should consider where semiconductor technology will be after five years from now, and prepare grounds for that through encouragement of fundamental research, as well as shuttle fabs to enable prototyping. We should skip the current node of technology and make an entry into the one that will be prevalent after few years.” Now, that’s sound advice! Will it be easy to achieve?

“That may not be as easy to achieve for the private enterprises considering the cost involved,” adds Janakiraman. “It has to be a mission of the nation to create that infrastructure and later privatize.”

According to him, it is not unique to India. “Every country, be it Taiwan or China, have done it. The only other way is to heavily subsidize and support fabs like those in Israel or Vietnam, but it will be tough to choose a partner in a democratic country like ours, wherein every investment and subsidy is seen with a colored vision,” he says.

To sum up, a fab for our country will be fundamental to gain leadership and self reliance. It cannot be ignored totally, although we can take our own time to reach there. Janakiraman adds, “We don’t have a choice other than paying a price to reach there, now or later!”

What India now offers to global semicon industry!

This semicon blog post is very timely as I keep getting a lot of questions on the topic: what does India NOW offer to the global semiconductor industry in this recession! In fact, several industry friends asked me this question during the recently held ISA Vision Summit 2009.

By the way, I have two good sessions from the ISA Vision Summit 2009 to blog about, and those will happen after this post! So, stay tuned folks!! 🙂

Back to the key question: What does the Indian semiconductor industry now offer to the world?

My quest for answers took me to S. Janakiraman, former chairman, India Semiconductor Association (ISA) and President and CEO-R&D Services, MindTree. Incidentally, Jani Sir, had highlighted some time ago that despite the lack of wafer IC fabs, fabless India continues to shine brightly! And, I agree with him! Even at Dubai last year, during the IEF 2008, Jani Sir had talked about India’s growing might in global semicon. I consider him to be the right person to discuss how India should frame its semicon path forward.

My quest for answers took me to S. Janakiraman, former chairman, India Semiconductor Association (ISA) and President and CEO-R&D Services, MindTree. Incidentally, Jani Sir, had highlighted some time ago that despite the lack of wafer IC fabs, fabless India continues to shine brightly! And, I agree with him! Even at Dubai last year, during the IEF 2008, Jani Sir had talked about India’s growing might in global semicon. I consider him to be the right person to discuss how India should frame its semicon path forward.

According to Jani Sir, we will remain in a tough economic scenario for some more time to come. “The cost of R&D, be it development or re-engineering or support is critical for the survival of semiconductor companies, but all of this needs to be done at lower costs. India will continue to be a cost leader to get more engineering done at the same cost or the same engineering done at a lower cost. India will continue to be a safe haven for such investments,” he contends.

India itself is a high growth market that will get sizable in the next five years for the semiconductor companies. No one can understand India and the emerging market requirements than the companies who are located here. That can be leveraged by the world to create value for many products that will serve the emerging market needs.

Janakiraman said: “Indian companies are also investing in technologies and creating intellectual properties/building blocks of technologies. These are the essential elements to create products/solutions in a shorter time-frame when the market starts recovering and builds up the appetite for consumption. Hence, Indian companies need to invest more in such areas and position themselves as value-add vendors to source technologies.”

Newer markets such as electronics in healthcare and renewable energy space provides a level-playing field since India’s maturity level is no less inferior to the western world. “We need to invest, and create solutions and products that can establish India not only as a market, but also a leading technology provider for the global market,” Janakiraman advises.

Has Indian semicon lost its way a bit?

Some folks believe that the Indian semiconductor industry has slightly lost its way since the SemIndia fab debacle late last year. I’ve mentioned earlier that hardly anyone wants to speak about having fabs in India at this point of time. Nevertheless, we’ll need to explore whether the Indian semiconductor industry is still on track!

According to Janakiraman, while the global consumption of semiconductors has seen a drastic drop in Q4 of 2008 and is likely to see a negative growth in H1 of 2009, India will be one among the few markets that will see an increasing consumption through the sales of electronic products.

He added: “The captive and design services companies serving the semiconductor market are facing a head wind, no doubt. However, the impact on them is much lesser compared to what is happening in the rest of the world.”

With the Indian semiconductor market continuing to grow, while the global market is in decline, it is possible that India may end up seeing a slower growth, but with an increased market share.

Janakiraman said: “I see the dynamics in the market will lead to India gaining way for the longer term, even though we can’t escape the short term pains. When the recovery starts, India will gather much stronger and faster momentum of growth as it will be a lucrative market for selling and the lower cost market for sourcing for any of the global semiconductor players.”

Finally, what really needs to be done to get the industry in India buzzing? For starters, don’t give up hope!

Added Janakiraman: “Look at it as an opportunity to get into a level-playing field rather than a losing ground. Consider India as a potential future market. Look at and invest in the emerging opportunities such as healthcare/security/energy, and build products like telemedicine, surveillance systems and power management systems. Invest in idea creation and product management systems, and get ready for the new model of business when recovery starts.”

I wonder why Jani Sir didn’t deliver the keynote at the ISA Vision Summit 2009! He is just the right person as far as propping up Indian semicon is concerned!!

ISA Vision Summit 2009 lacks the punch!

Yes, that’s how I felt, at the end of the opening day of India Semiconductor Association’s (ISA) Vision Summit 2009! Won’t know much about how others felt!!

Yes, that’s how I felt, at the end of the opening day of India Semiconductor Association’s (ISA) Vision Summit 2009! Won’t know much about how others felt!!

The picture here shows the ISA Vision Summit 2009 being inaugurated by the Guests of Honor, Dr. Debesh Das, Honorable Minister-in-Charge, Department of Information Technology, Government of West Bengal and Dr. Arunachalam, Chairman & Founder, Centre for Study of Science, Technology and Policy (CSTEP), Bangalore. Standing by are Jaswinder Ahuja, ISA Chairman, and Ms Poornima Shenoy, ISA President. Congrats on putting up a great show to the India Semiconductor Association, despite all the recession around us.

The opening day was largely built around sessions such as Local Products: Emerging Opportunities; Indian Design Influence: Ideas To Volumes; and Embedded Software: Its Growing Influence on the Hardware World! Yes, all of these were very interesting sessions.

However, there was no word on the Indian semicon policy, or even about India’s plans to have (OR not have) a fab! There was very little about how to incubate and handhold start-ups, and help them grow bigger! And, even less about how to go about building a successful product company in India!

It is in all of these areas, I felt, that the ISA Vision Summit 2009, lacked the punch! Last year, the enthusiasm was quite evident! The Indian semicon policy had been announced in late 2007, and the fab plans looked very much in line! However, it seems, this year, no one’s willing to bet on fabs, or rather, even speak about them!

One gentleman discussed my post on the possibility of an Indian investor buying Qimonda, and even cited examples of how looking at certain memory fabs in Taiwan won’t be quite out of line! Yes, this is exactly the time to invest and think really big, India!

Let me also highlight a comment left on my Qimonda article on CIOL by a reader, who calls himself/herself as “The Edge”. BTW, dear friend, I have not at all back-pedalled! Rather, I have been screaming hoarse, and loud enough to perhaps, land in the bad books of some industry folks 🙂 Well, here’s what “The Edge’ says:

“Ed, I happened to read your blog and notice that you have already back pedalled a bit (though the outrageous comment has not provided reasons as to why he/she feels that way.) I’ll provide some reasons as to why India should look to invest NOW and not two years later when the markets start to look up.

1) Fabs are shutting down or idling at the moment: In this scenario, equipment vendors will be more than happy to get rid of inventory even at huge losses so as to keep some business going.

2) Onus on product development: This is evolutionary and will come along with experience; akin to a baby crawling before it begins to walk! How about jumping into the foundry business first and playing a minor role in product development for the time being? The role and the direction of development will evolve over a period of time. Just as importantly, one has to be in total control of the full life-cycle of the product. Else, there will be that missing link/experience between optimum design and subsequent efficient manufacturing.

3) Technical know-how: Reverse brain-drain and attracting of expats to move to India is easier during the downturns, when intelligent folks might get laid off and would be available for a lot lesser (if at all) compared to the boom-times. Most importantly India has NOTHING to lose. This can be the first serious foray into the semicon manufacturing sector, if the money goes in now. NOT two years later, because by then, the set-up costs would be that much higher and personnel/partners/acquisitions would be hard and expensive to come by in a good market scenario. An early start, i.e., right away, will position the semicon manufacturing industry (along with whichever partner/acquisitions) to be ready to make full use of the next peak in the industry. That big name might well be Qimonda or maybe some other innovative company that might have been reduced to a pauper during this downturn.”

This is absolutely something I agree with and am passionate about! Even though others called my post out of line, and outrageous, it does not matter. I have high hopes for the Indian semicon industry, and as I was telling an industry friend today: I will continue to write about what I think should be done!

Coming back to the ISA Vision Summit, this morning, Nandan M. Nilekani, Co-Chairman of the Board of Directors, Infosys Technologies Ltd, in his keynote, highlighted communication, healthcare and energy as the key domains for semiconductor industry to leverage for potential business. The solutions should be scalable and low cost. Quite rightly so! Indian solutions to solve Indian (and global) problems are the need of the hour. Nilekani touched on India’s demographic dividend, which gives the country the rare advantage over the rest of the globe.

However, I wonder whether developing these solutions alone will be enough to pull the Indian semiconductor industry right to the top! A lot of people at the event wanted to hear my views, and as far as I am concerned: A lot more needs to be done!

Prof. Rajeev Gowda, IIM-Bangalore, the moderator for the opening session, Local Products: Emerging Opportunities, struck the nail on its head, when he said in his opening remarks that while Bangalore had become an IT center, it had yet to become a knowledge center. He stressed on the need to get people to think creatively and innovatively. If only, this was as simple as it seems!

Can the Indian semicon industry innovate? Or, will it find it hard to get out of the rut it seems to have run into, as far as fabs are concerned? Will it finally find some way of incubating, building and growing product companies? I am still awaiting a good answer, rather, any answer!

Indian silicon wafer fab story seems dead and buried! Should we revive it?

Now then, this will make a very interesting read! Back in October 2007, I had discussed the timing and the need for a silicon wafer fab in India, in-depth, with Anil Gupta, managing director, India Operations, ARM.

We have come a long way since then! There was all the hype last year about SemIndia’s fab, which never really did happen, and eventually, BV Naidu moved on! Then came the rush to solar fabs. Recently, when I blogged on how a Qimonda buy could be good for India, I am told that it is really outrageous. No problem, it is merely a suggestion.

We have come a long way since then! There was all the hype last year about SemIndia’s fab, which never really did happen, and eventually, BV Naidu moved on! Then came the rush to solar fabs. Recently, when I blogged on how a Qimonda buy could be good for India, I am told that it is really outrageous. No problem, it is merely a suggestion.

At times, I have got the feeling whether the Indian semiconductor industry is losing its way! However, when I see all around, it is hale and hearty, and business as usual — fabs or no fabs!

It was interesting to meet up again with Anil Gupta of ARM, and to find out what he thought about what I thought!

Starting with an old question, whether India has the capability to sustain or even build a product development ecosystem? Gupta said: “We need the following for this:

* Entrepreneurs committed to product development and willing to take that risk.

* Investors willing to take risk on product development companies.

* Consumption (this will happen as the economy improves any way).

* Deep enough technical/technological knowledge/know-how to put reasonably competent end products together (It exists. Examples like Sukam, Tejas and other are there).

Indian fab story dead and buried

Turning focus on fabs, is the Indian silicon wafer fab story completely dead and buried now? Gupta notes: “When TSMC says they are running at only 38 percent capacity, one can imagine what the rest of the fabs must be going through. In any case, the Indian fab story was a longer term story and the current economic climate actually makes it further and further remote. So yes, it is dead and buried now!”

Wow! India probably flattered to deceive! However, I am an optimist, and hope that one day, India will have its own silicon wafer fabs!

Gupta adds: “What worries me now is the glut of the solar/PV fabs. By the industry estimates, solar/PV is a viable option only when the price of oil is >$100 per barrel (oil is at $40 per barrel now). This means, there would be challenges for the solar cell industry too! One can only hope that the economy picks up growth soon enough and sends the price of oil higher so that solar becomes a viable option.”

Again, this is a concern I have as well. The rush toward solar is good, but then, is this what the Indian semiconductor industry really needs? Where’s all that talk of developing silicon and product companies? You simply cannot equate the two — semicon and solar! You can’t have a policy, and then ignore the main crux either, and simply go for the ones that are easily attainable! It does not project a good impression, or maybe, I am somehow wrong in my assessment. Hence, my feeling that the industry could be losing its way somewhere!

However, Gupta feels that’s not really the case! What has been working until now, still continues to work!! “Our strengths are design and verification. We will continue to be in demand for that. The other pastures we explore, there are a lot of uncertainties,” he adds.

“The challenge is to pick the right pasture where the grass remains green even in the summer. This is not easy to find and does require that we bet on some of them and learn through the experience,” he advises.

How can India really buzz?

What now needs to be done to get the semiconductor industry in India really buzzing? Surely, local consumption is key. Local consumption would hopefully foster electronic product innovation just like products by two-wheeler manufacturers and the Tata Nano.

“The current initiatives in the industry for rural applications are also quite interesting. I am optimistic that some good offerings will come out of this. While these may not be specifically from a “semiconductor” perspective, at least at the “system” level these would make sense,” says Gupta.

What India NOW offers to semicon world?

What does India NOW offer to the semicon world, in these times of a global recession?

The Indian economy is still mostly internal consumption oriented, as opposed to exports oriented. This is very different from the economies of island nations like Taiwan, Korea, and Japan, which are very heavily export oriented.

In a recession like the current one, these predominantly export-oriented economies experience a far greater crunch than the others. Thus, as long as products are being sold in Indian markets at the right price points, there would be consumption.

Gupta says, “This time around, the world would come out of recession mainly driven by Asian countries, India being one. People in the industry that I talk to tell me that as the worst is over in this crisis, and as things begin to pick up, India will once again be the beneficiary of a lot of work moving here. However, my personal view is somewhat different.

“I believe that the last round did witness this phenomenon mainly because it was the honeymoon period. But by now, the honeymoon period is over and the India centres of these companies are working hard to reach a level where they become “mission critical” to the businesses of their companies.

“The journey hasn’t been very easy for multiple reasons. And by now, the cost differentials also do not look as attractive as they did before. Hence, what work comes here would come only after a careful assessment and very selectively (not by leap of faith).”

I did blog about how Qimonda could be a good buy for starting a memory fab in India. You have all the facts in front of you! My question to the Indian semiconductor industry is: should we revive the call for having a silicon wafer fab in India, post SemIndia and post recession?

Can the Indian semicon industry dream big? (And even buy Qimonda?)

I had ended one of my previous blog posts by saying whether the Indian semiconductor industry was hitting the right notes?

In a continuation to that specific thought, it is necessary to first examine where India stands in the global industry. We are very strong in embedded design and design services — our traditional strengths. While these will hold good for a long time, these are probably not enough to really help India make a serious mark at the global level.

The Indian semiconductor industry, in its current state, needs a rethinking as far as strategy is concerned. Maybe, it cannot survive on chip design alone. Especially in times of downturn, the global semiconductor industry players would be looking for new markets and even customers, rather than low-cost production centers.

Consider these points: In the current economic environment, is the interest in developing new business relations with India really a top priority for overseas companies? Probably not, at this very point of time!

India is also seen more as a source of resource; and the extra resource is the last thing firms need at the moment, given the recessionary climate. What global firms are looking for are new markets and customers, and these points, along with its infrastructure, have been the areas of Indian weaknesses. Maybe, all of this will change, but definitely not overnight! And it needs some more planning.

That leads me to an interesting comment from a reader of my article on CIOL, who went on to suggest that an Indian investor could consider buying Qimonda!

Now that is some serious thought and vision as far as mid- or long-term planning is concerned. However, will there really be any takers for this? If this really happens, fabs can be built in India for memory production. If these fabs perform well, it just might turn out to be a good investment in the mid-term future of the Indian semiconductor industry. Definitely, it will make the world sit up and take notice. The other players would surely give India a look-in thereafter.

Quite a thought! This suggestion of investing in Qimonda is indeed a vision. Can the Indian semiconductor industry develop the courage to show and work toward making this kind of a vision a reality?

What should India do to develop products? Speaking with Anil Gupta, managing director, India Operations, ARM, is always a pleasure.

Speaking with Anil Gupta, managing director, India Operations, ARM, is always a pleasure.

I asked him: Does India have the capability to sustain or even build a product development ecosystem? What needs to be done?

He said: “We need the following for this:

* Entrepreneurs committed to product development and willing to take that risk;

* Investors willing to take risk on product development companies;

* Consumption, and this will happen as the economy improves any way, and

* Deep enough technical/technological knowledge/know-how to put reasonably competent end products together.”

According to him, all of these qualities exist in India, and he cited examples of companies such as Sukam, Tejas, etc.

Well, there you have it!

We need enterprising entrepreneurs in India who are committed toward product development and willing to take that risk, especially in semiconductors. We need investors who can believe in things like even buying Qimonda, or some other company. After all, isn’t this what everyone’s been saying: this is the time to buy!

Dream big, India!

Global semiconductor industry could well see revival in 2010?

“Let’s start from the very beginning! A very good place to start!!”

Hope you all remember this lovely song sung by Julie Andrews in The Sound of Music!! So, what’s the connection?

Right! Last week, I blogged about how the global semiconductor industry is likely to drop by 28 percent in 2009, while the Indian industry should grow by 13.4 percent during the same period, and that, we should not get carried away by these statistics!

A moment to ponder: isn’t this drop of 28 percent too high for the global semicon industry? Or, is the situation really that bad? So, let’s start from the very beginning, and go straight to the source — Malcolm Penn!

Revival likely by 2010?  Here’s what Malcolm Penn, CEO and founder of Future Horizons, had to say: “Fraid not! It could even be lower, but remember that this is a year on year number. It is based on the following assumptions: Q4-08 down 22.5 percent vs. Q3-08; Q1-09 down 20 percent vs Q4-08; Q2 down 2 percent vs Q1; and Q3 up 12 percent vs Q2, and Q4 up 3 percent vs Q3! And, if this pattern runs true, 2010 will be up 28 percent vs 2009!”

Here’s what Malcolm Penn, CEO and founder of Future Horizons, had to say: “Fraid not! It could even be lower, but remember that this is a year on year number. It is based on the following assumptions: Q4-08 down 22.5 percent vs. Q3-08; Q1-09 down 20 percent vs Q4-08; Q2 down 2 percent vs Q1; and Q3 up 12 percent vs Q2, and Q4 up 3 percent vs Q3! And, if this pattern runs true, 2010 will be up 28 percent vs 2009!”

Voila! The global semiconductor industry could well be in for a major revival next year itself! Why, even Bill McClean, president of IC Insights, took a more optimistic look at the state of the industry in light of the current global economic situation at the recently concluded SEMI ISS 2009 conference!!

Continues Penn, “The actual Q4 results (released this Sunday) were down 24.2 percent, slightly worse than our estimate.”

How to get the buzz back in semicon?

It has been said that the current situation the global semiconductor industry finds itself in was fueled by greed and short-term business goals. So, who were the culprits? Weren’t they warned earlier?

Adds Penn: “It was more complex that that! The woeful state-of-the-world economy was a consequence of debt, greed and irresponsibility; political self interests and short-term business goals, aided and abetted by compliant governments; ineffective regulators; imprudent institutions; incompetent management; irrational self delusion and vested self-interests! No one is blameless for this crisis! Concerns were raised, but the human nature is often irrational, and the ‘easy option’ always the one of choice.”

So true! Perhaps, the ‘easy option’ factor seems to be affecting the Indian semiconductor industry as well, but more of that later!

The key issue today is: what needs to be done to get the buzz back in the global semiconductor industry? The answer probably lies in the following: in the short-term, it involves rebuilding the industry confidence, and in longer term, it involves a radical return to ‘old fashioned’ business and political values.

On another note, I was curious to know how the EDA segment is doing? Penn said, “No better, no worse than normal, technology marches on, new designs accelerate in a downturn.”

Tricky memory!

Memory is another segment that’s been hit hard. In fact, the other day, someone asked me why Qimonda’s story was so important!

Another could not understand what Spansion really did, and why it had announced this January 15 that the company was exploring strategic alternatives for a sale or a merger! Doesn’t matter! Memory is a very tricky business, and semiconductors is the mother of all such tricky businesses! Perhaps, isn’t that why they once said in jest: “Real men have fabs!” Anyhow!

Coming back to memory, when can the industry expect some recovery in NAND? More importantly, will the various government interventions help? Qimonda also recently petitioned for the opening of the insolvency proceedings.

Penn is clear: “NAND will recover when the excess capacity abates, and that will take several more quarters. The government intervention won’t help, rather the opposite, and it will exacerbate the excess capacity issue.”

Fab spends to move up only by Q1-2010

Earlier, Penn predicted a recovery in 2010 with the resumption of growth in Q3 2009. What will make this happen? He says, “A recovering world GDP growth, plus a return in business confidence.”

However, those keen on fabs, do not expect the fab spends to look up any time soon! In fact, Penn estimates fab spends to start moving north not until Q1-2010 at the earliest.

The Chinese impact!

Interestingly, China is set to see negative growth of 5.8 percent during 2009. It will be worth noting how much of this this impact the global semiconductor industry.

Point one, compared to a global semicon fall of 28 percent in 2009, Penn considers a fall in China’s semicon fortunes of 5.8 percent to be ‘darned sight better!’ So, China should still be a high growth market (relatively speaking).

And India?

Like I mentioned earlier, the Indian semiconductor industry is perhaps getting affected by the ‘easy option.’ Design services continue to do well, hopefully, but when it comes to real semiconductor product companies, those are far and few.

And, I haven’t seen any real activity in the recent past that could tell me more such initiatives are in the pipeline. Nor do I think there are many attempts to even incubate such companies. On the contrary, there’s a mad rush toward solar!

No harm there! Solar is great for India and the need of the hour. However, India should not forget its semiconductor priorities as well! Indian simply cannot bank on chip design services and solar gains, and then proclaim that it has a very successful semiconductor industry! Real action is still quite far away.

I think, India needs to rethink its semiconductor strategy! It cannot survive on chip design alone.

“When you know the notes to sing, you can sing most anything,” concludes the song from The Sound of Music!

So, is the Indian semiconductor industry hitting the right notes? That’s going to be my next blog post, friends.

Reviewing global/Indian semicon industry in 2008 — top posts

Greetings, dear readers and friends, in the new year. May you all have all the success and prosperity in 2009!

An eventful year in semiconductors has passed by us. For me, personally, it has been a tremendous 2008, ending with Electronics Weekly of UK selecting my blog (Pradeep Chakraborty’s Blog) as the world’s best in the Electronic Hardware category.

An eventful year in semiconductors has passed by us. For me, personally, it has been a tremendous 2008, ending with Electronics Weekly of UK selecting my blog (Pradeep Chakraborty’s Blog) as the world’s best in the Electronic Hardware category.

Lot of people have asked me since, how it feels to be a world champion! Well, I do feel elated! However, one point, more of the congratulatory notes have come from overseas, than from India. Perhaps, it is an apt indicator of how semiconductors is perceived in India — though, I may be wrong.

Friends have also asked me how I’ve managed to blog on such a difficult subject sitting in India. Simply put: It has not been easy!

First, I’m just a simple person, and not some brand name. Second, my blog does not represent any large, well known media house, or a big brand semiconductor magazine. Hence, maintaining a semicon blog, with the help of contacts from all over the world has been tough, at times. Why, some folks, with whom I wished to speak with, never even responded to my emails and requests. Quite understandable!

Third, I’ve only managed to blog, when I have the time, unlike many other great bloggers who post regularly (or daily)! Fourth, there have been several instances, where my location has been my weak point. I was unable to blog on several instances simply because I had no way of reaching people whom I wished to speak with, while sitting in India. And, as I said, I did get cold snubs on several instances! 🙂 As a result, I could not present my views at specific instances, even though I dearly wanted to!

However, the unconditional and loving support and encouragement of my family, friends, well wishers, industry leaders and loyal readers such as you have helped overcome all of these deficiencies. It is only because of these people that I’ve managed to come this far! I hope each one of you continues to have faith in me. I shall try my best to provide you with the best information (hopefully) the global semiconductor industry has to offer.

To start off the new year, may I present, what I feel, are the top blog posts on semiconductors during 2008, as a review for the past year.

Being indisposed at the start of 2008, I only managed to pick up speed from April onward. As the year progressed, the Indian fab story with SemIndia started worsening, before finally disappearing, even as fabless India held on sttong, as did the fortunes of the global semiconductor industry, which incidentally, did look quite good till September last year.

I have arranged the blog posts, from January to December 2008, so they will present a better picture of how 2008 behaved! These posts are set in no particular order or preference, otherwise. Some of you may have your own favorites, so kindly let me know, in case those haven’t made the list.

JAN 2008

Power awareness critical for chip designers

LabVIEW 8.5 delivers power of multicore processors

MAR 2008

NXP India achieves RF CMOS in single chip

VLSI as a career in India

Using ‘semicon’ simulation for drug discovery

APR 2008

New camps promise exciting times ahead in memory market

Indian design services to hit $10.96bn by 2010

Staying ahead of clock a habit at Magma!

MAY 2008

Dubai — an emerging silicon oasis

Developers, go parallel, or perish, says Intel

Think AND not OR; Altera first @ 40nm FPGAs

Top 10 global semicon predictions — where are we today

Semicon to grow 12pc in 2008

India’s growing might in global semicon

JUN 2008

10-point program for Karnataka semicon policy

Has the Indian silicon wafer fab story gone astray?

Semicon half year over, what next now?

EDA as DNA of growth

JUL 2008

Semicon is no longer business as usual!

Cadence C-to-Silicon Compiler eliminates barriers to HLS adoption

Practical to take solar/PV route: Dr. Atre, Applied

AUG 2008

What India brings to the table for semicon world! And, for Japan

NAND update: Market likely to recover in H2-09

E Ink on every smart surface!

RVCE unveils Garuda super fuel-efficient car

Indian fab policy gets 12 proposals; solar dominates

SEP 2008

90pc fab investments for 300mm capacity: SEMI

Synopsys’ Dr Chi-Foon Chan on India, low power design and solar

Magma’s YieldManager could make solar ‘rock’!

Motion sensors driving MEMS growt

BV Naidu quits SemIndia; what now of Indian fab story?

OCT 2008

Top 20 global solar photovoltaic companies

IDF Taiwan: Father of the Atom an Indian!

TI Beagle Board for Indian open source developers and hobbyists

Cadence’s Virtuoso vs. Synopsys’ Galaxy Custom Designer!

Synopsys’ Galaxy Custom Designer tackles analog mixed signal (AMS) challenges

Solar, semi rocking in India; global semi recovery in 2010?

No fabs? So?? Fabless India shines brightly!!

NOV 2008

AMD’s roadmap 2009 provides lots of answers… now, to deliver!

Embedded computing — 15mn devices not so far away!

FPGAs have adopted Moore’s Law more closely!

DEC 2008

My blog is the world’s best!

Semicon outlook 2009: Global market could be down 7pc or more

Altera on FPGAs outlook for 2009

Solar sunburn likely in 2009? India, are you listening

Outlook for solar photovoltaics in 2009!

I found it difficult to select the Top 10 posts. If any one of you can draw up such a list, it’d be great!

NXP India's Rajeev Mehtani on top trends in global/Indian electronics and semicon!

When a new year approaches, we start analyzing the year gone by and try to gauge what could happen in the coming year. This really holds true, as far as the technology industry is concerned.

When a new year approaches, we start analyzing the year gone by and try to gauge what could happen in the coming year. This really holds true, as far as the technology industry is concerned.

It’s been a week since I’ve been mulling over these myself, especially, pondering over developments in the global semiconductor and electronics industries, as well as what could happen in India during 2009. Well, lots will happen, and I can’t wait for the new year to start!

I caught up with Rajeev Mehtani, vice president and managing director, NXP Semiconductors, India, and discussed in depth about the trends for 2009. Here’s a look at that discussion.

INDIA — ELECTRONICS & SEMICONDUCTORS

1. The DTH story will continue to increase in India with companies such as Tata Sky, DISH TV, BIG TV, etc., gaining market share. Owing to these challenges, there would be significant consolidation among the cable operators. Digitalization will also be seen in 2009.

2. The slowdown will affect growth across all sectors. Our view is that LCD TVs as well as STBs will continue to grow.

3. The year 2009 will witness e-commerce revolution and the RFID sector will grow at a 40-50 percent clip. The government has been sponsoring a lot of projects, which include RFID in the metros, e-passport cards and national ID cards. By mid-2009, we can expect a mass deployment of these projects as well as micro payments.

4. Manufacturing in India will continue to grow; EMS or OEMs, such as Samsung, Nokia, Flextronics, etc.

5. There could be a move from services to products in electronics and semiconductor spaces. The number of funded startups has grown significantly over the last years and more and more ideas are coming on the table.

6. The solar/PV sector will grow in India. High entry cost of capital for panels will be a barrier for this sector. Government enhancement is necessary. India will be different than other countries as people won’t push energy back into the grid; it will be used more for household consumption. The India grid is unstable. Tracking it requires a lot of expensive electronic switching. Solar deployment could be at the micro level, and also community level, where it makes more sense.

7. The startups in India are mostly Web 2.0 based, although there aren’t many hardware startups.

GLOBAL — ELECTRONICS & SEMICONDUCTORS

1. The semiconductor industry is truly global, That is mostly because it is a very expensive industry.

2. Things are a bit murky in the semiconductor industry. It would probably be dipping 10-15 percent next year.

3. Globally, energy management and home automation will start to take off in 2009. Satellite broadcasters will also continue to gain more strength.

4. On a worldwide scale, 3G will win. You will have 3G phones, and you’d add LTE to those. India is slightly different. Only 20 percent of Indian households are ready for broadband access. In India, WiMAX could be a way to have wireless broadband at home.

5. Industries moving to 300mm fabs will be making up only 20-25pc of the market. Not many need 45nm or 40nm chips. People will question any major capex, until there’s a big return and wait for recession to end. The bright spot is solar!

6. The fabless strategy would be the only way to go forward. While MNCs with fabless strategy are present in India, Indian startups in this space are quite few.